Understanding Role Of Decentralized Finance Defi In A Digital Economy BCT CD

Check out our professionally designed Understanding Role of Decentralized Finance DeFi in a Digital Economy PPT that explores the role of Decentralized Finance DeFi in the digital economy. This Decentralized Finance presentation elucidates the pivotal role of blockchain in facilitating DeFi, offering a comparative analysis between DeFi and traditional financing methods and contrasting centralized finance CeFi with DeFi. Moreover, the Digital Economy Template sheds light on leveraging decentralized financing methods while key elements of the DeFi ecosystem are meticulously outlined. Lastly, the Crypto Investments presentation covers determining and exploring top DeFi platforms, including Aave, Compound, Coinbase, Uniswap, and Curve Finance. Download this PowerPoint presentation to provide detailed insights and actionable strategies across various DeFi applications and platforms.

Check out our professionally designed Understanding Role of Decentralized Finance DeFi in a Digital Economy PPT that explor..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Enthrall your audience with this Understanding Role Of Decentralized Finance Defi In A Digital Economy BCT CD. Increase your presentation threshold by deploying this well-crafted template. It acts as a great communication tool due to its well-researched content. It also contains stylized icons, graphics, visuals etc, which make it an immediate attention-grabber. Comprising ninety six slides, this complete deck is all you need to get noticed. All the slides and their content can be altered to suit your unique business setting. Not only that, other components and graphics can also be modified to add personal touches to this prefabricated set.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: The slide introduces Understanding role of Decentralized Finance (DeFi) in a Digital Economy. State Your company name.

Slide 2: This is an Agenda slide. State your agendas here.

Slide 3: The slide renders Table of contents for the presentation.

Slide 4: The slide displays Table of contents further.

Slide 5: The slide again renders Table of contents.

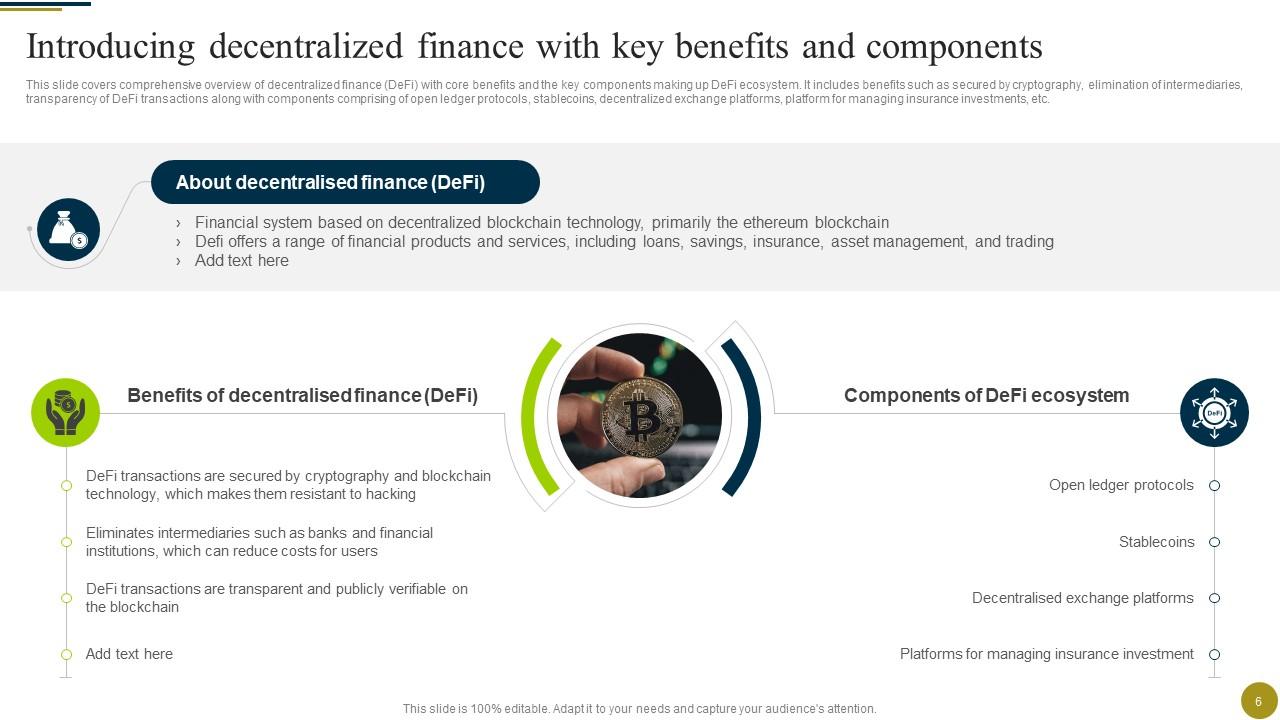

Slide 6: This slide covers comprehensive overview of decentralized finance (DeFi) with core benefits and the key components making up DeFi ecosystem.

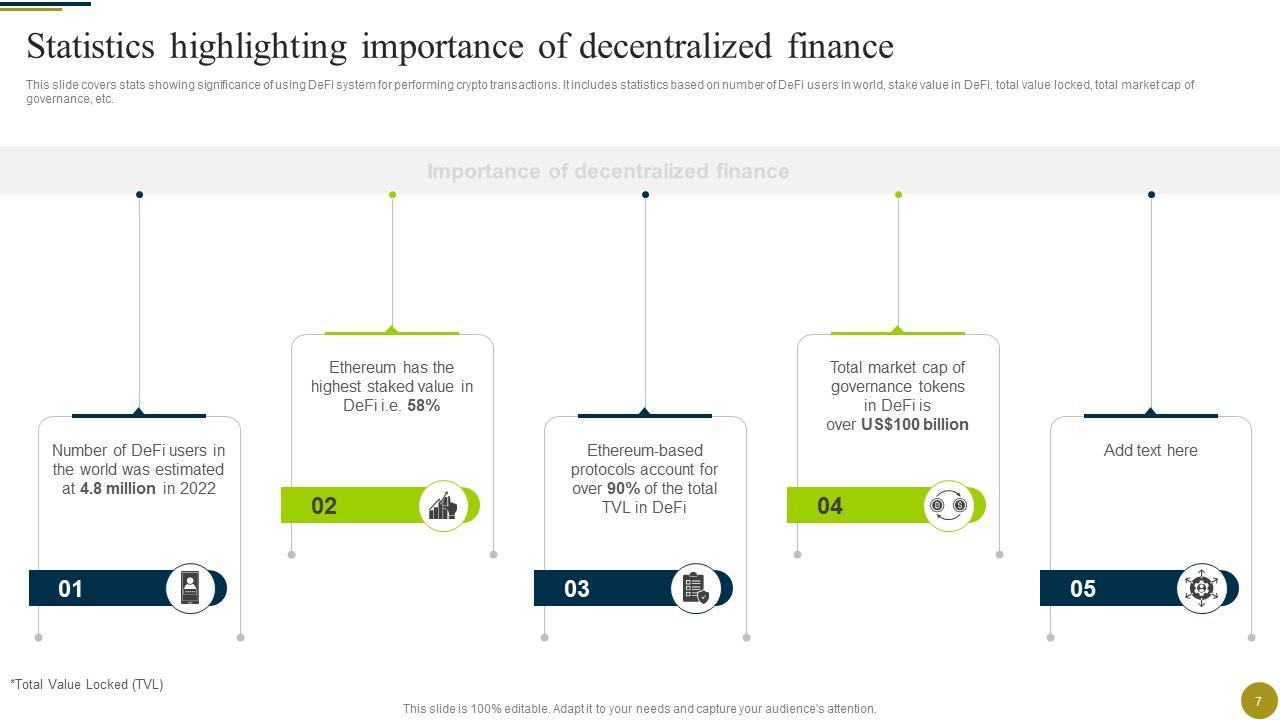

Slide 7: This slide highlights stats showing significance of using DeFi system for performing crypto transactions.

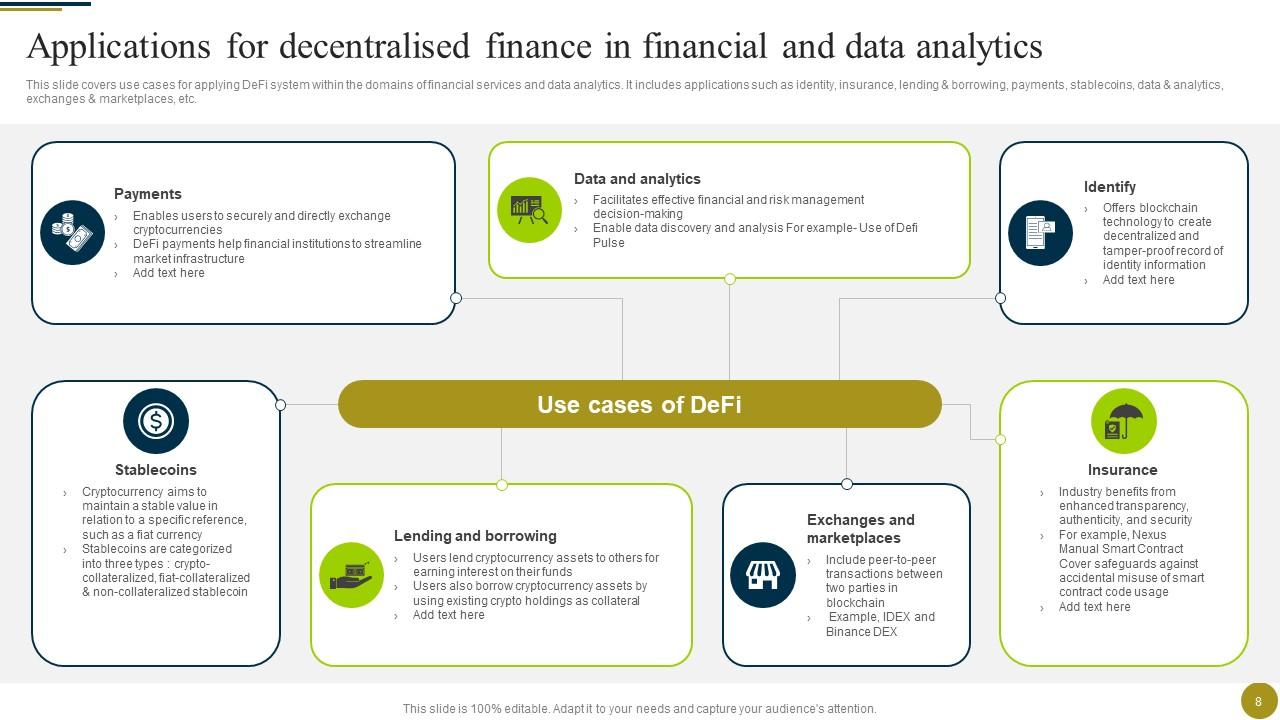

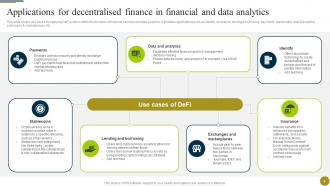

Slide 8: This slide shows use cases for applying DeFi system within the domains of financial services and data analytics.

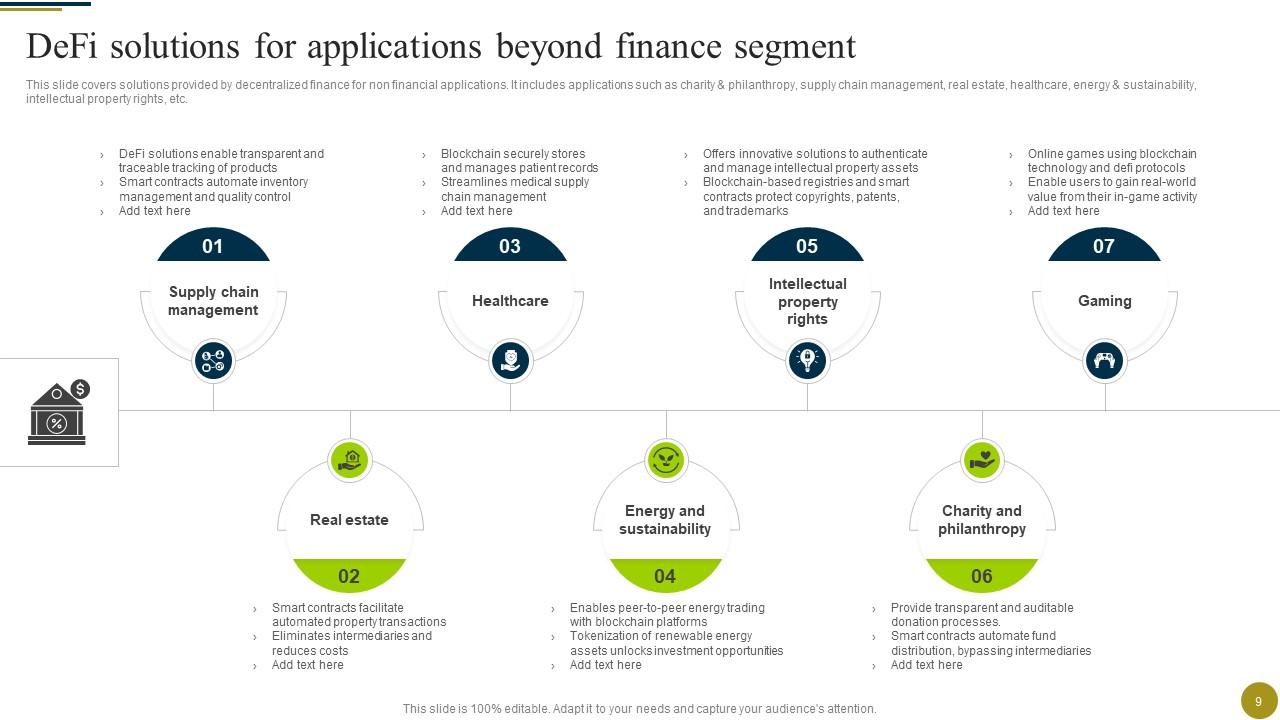

Slide 9: This slide contain solutions provided by decentralized finance for non financial applications.

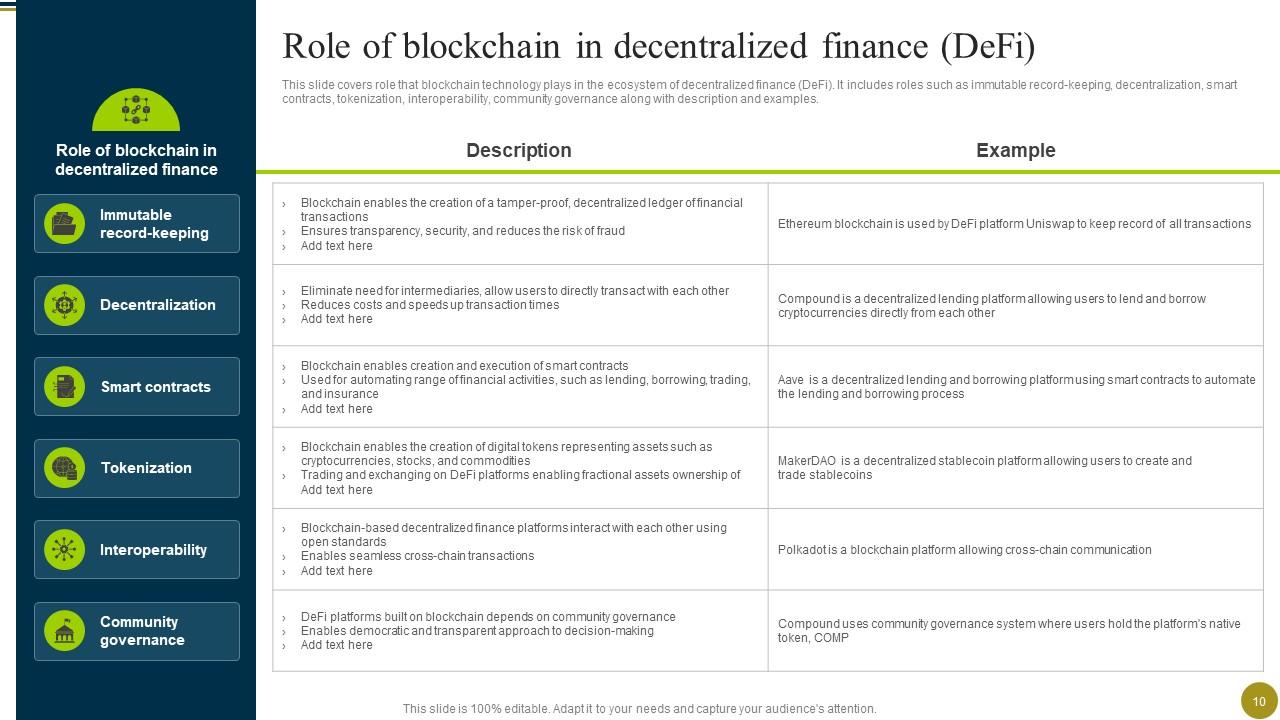

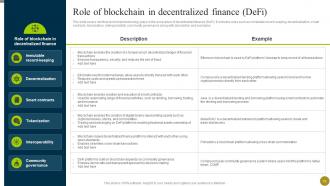

Slide 10: This slide represents role that blockchain technology plays in the ecosystem of decentralized finance (DeFi).

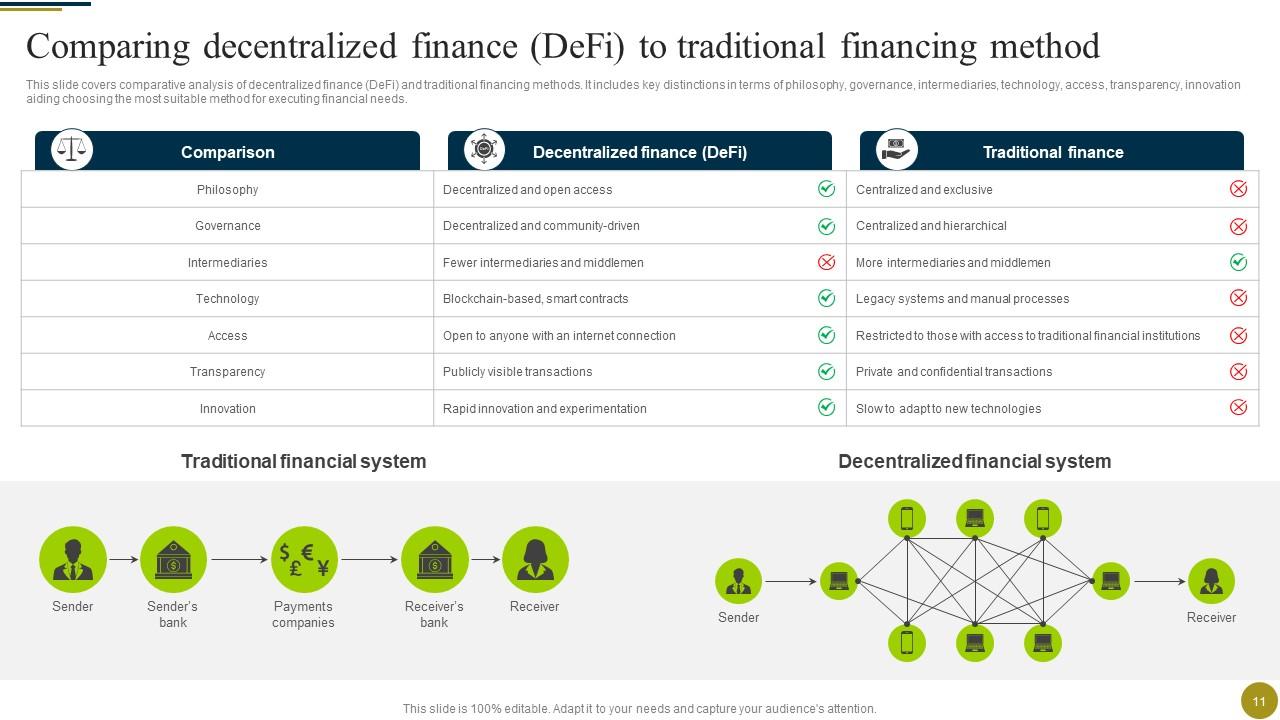

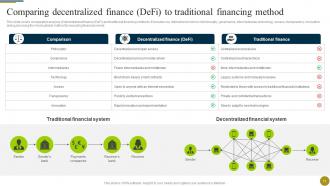

Slide 11: This slide covers comparative analysis of decentralized finance (DeFi) and traditional financing methods.

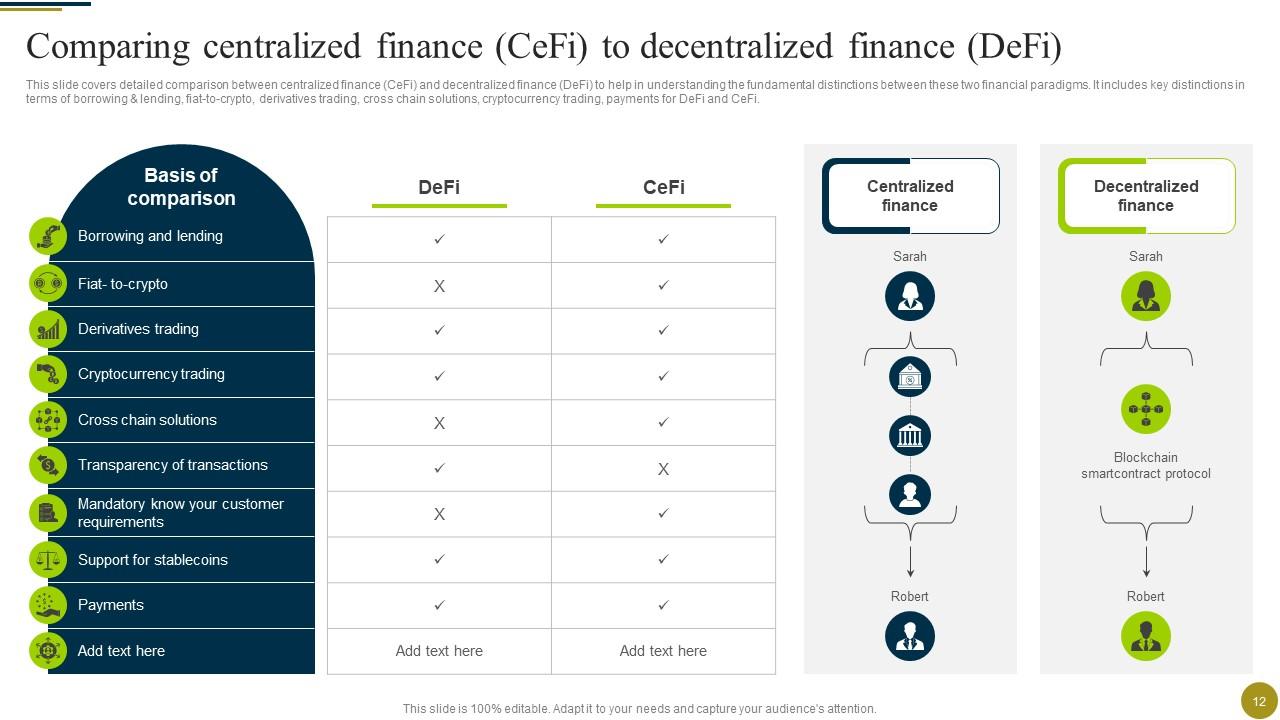

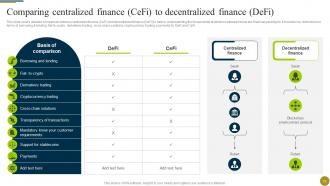

Slide 12: This slide gives detailed comparison between centralized finance (CeFi) and decentralized finance (DeFi).

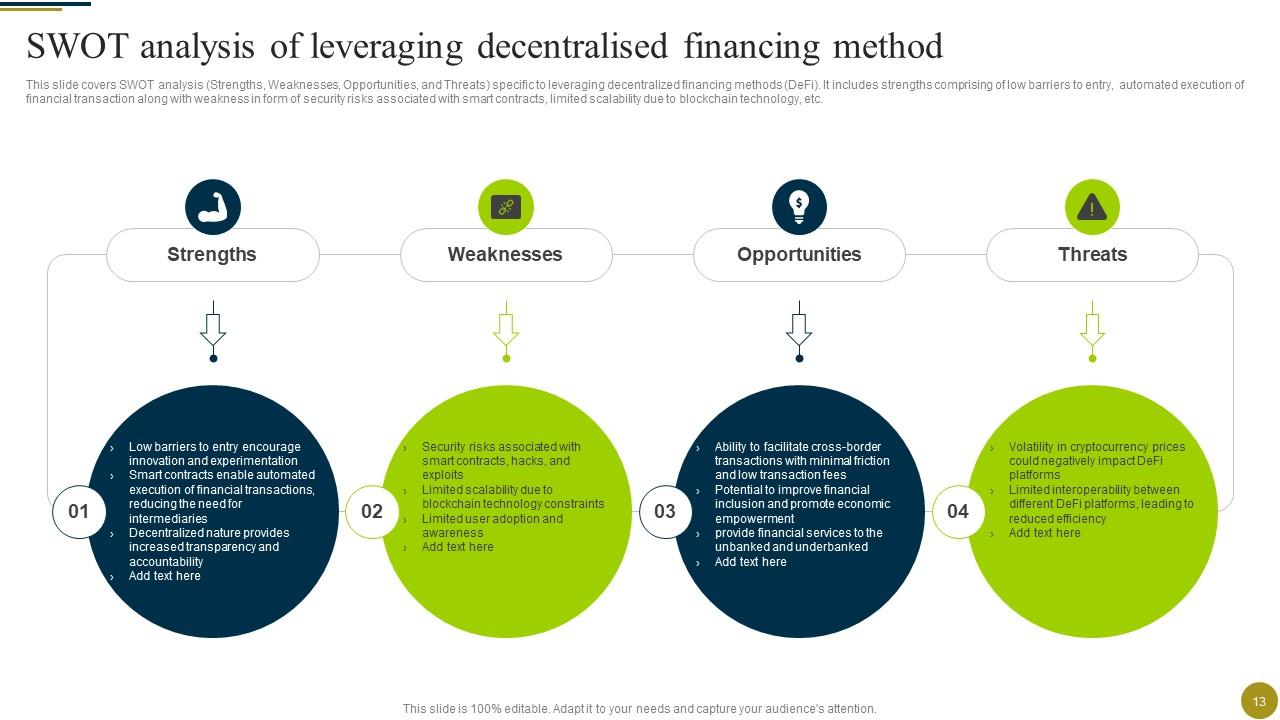

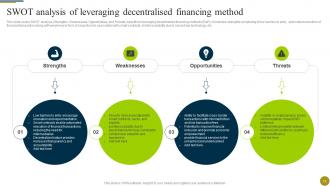

Slide 13: This slide shows SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats) specific to leveraging decentralized financing methods (DeFi).

Slide 14: This slide contains key components that constitute the decentralized finance (DeFi) landscape.

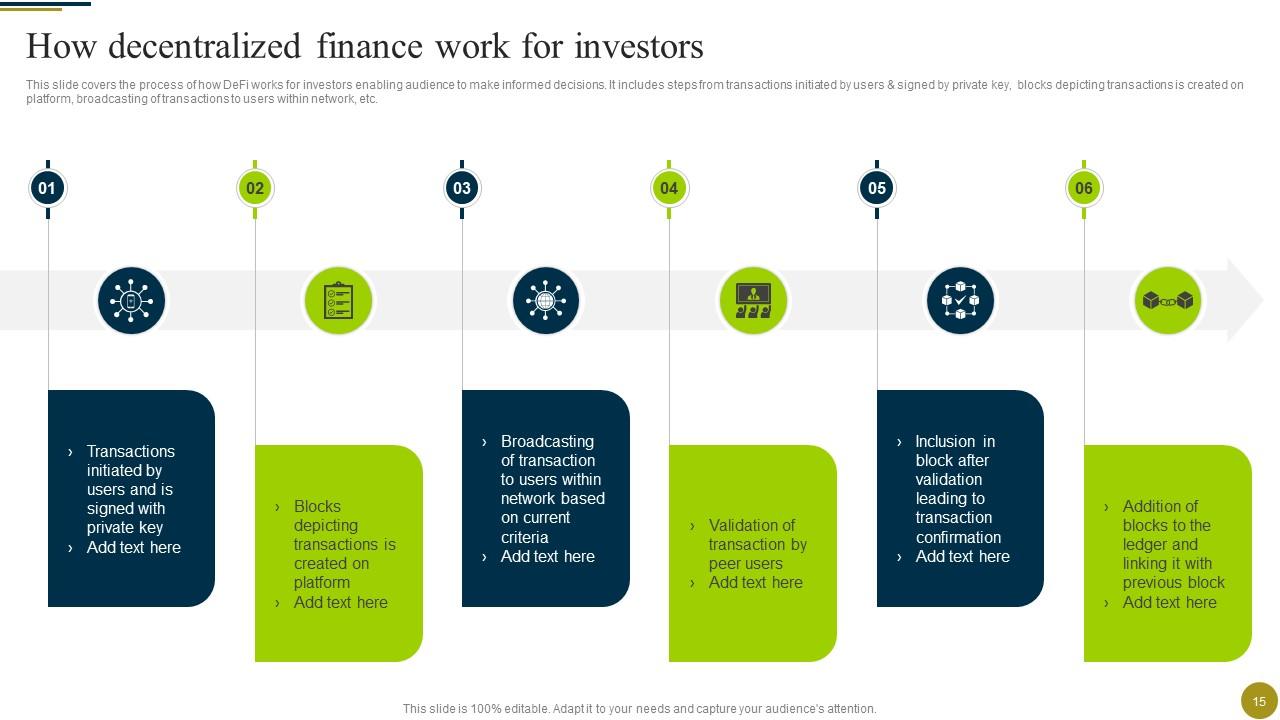

Slide 15: This slide covers the process of how DeFi works for investors enabling audience to make informed decisions.

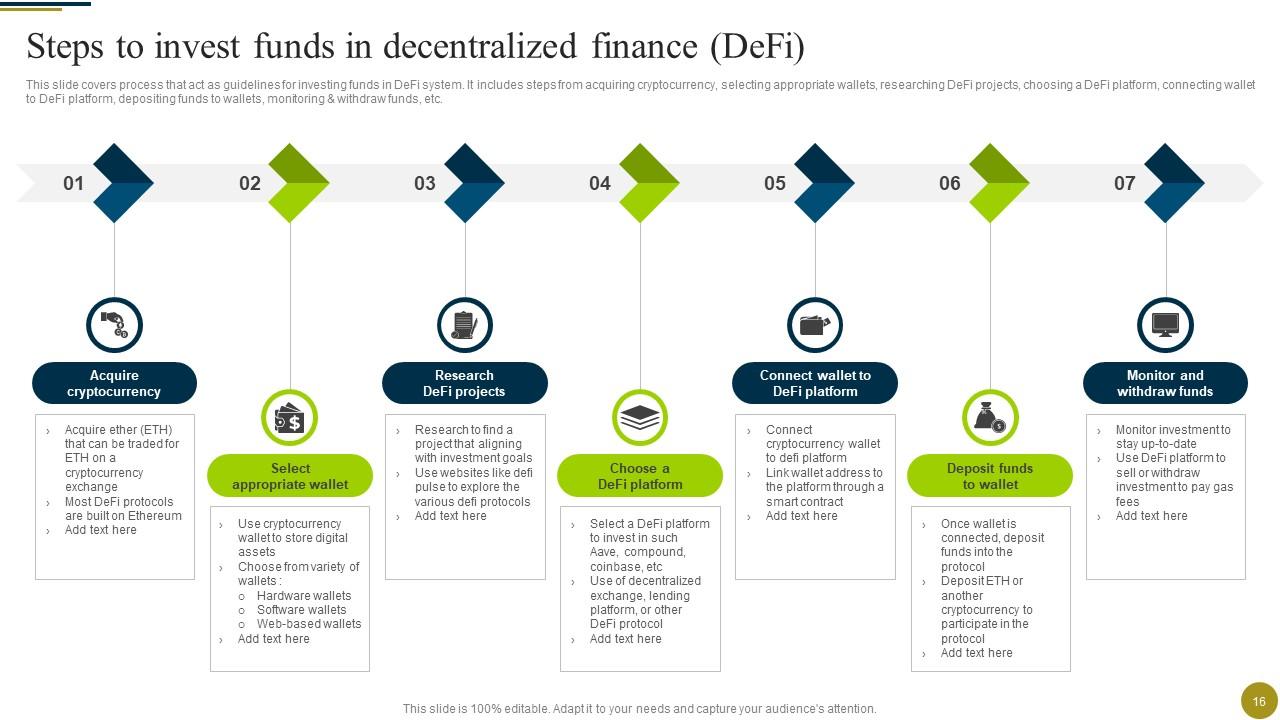

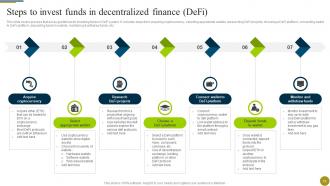

Slide 16: This slide shows process that act as guidelines for investing funds in DeFi system.

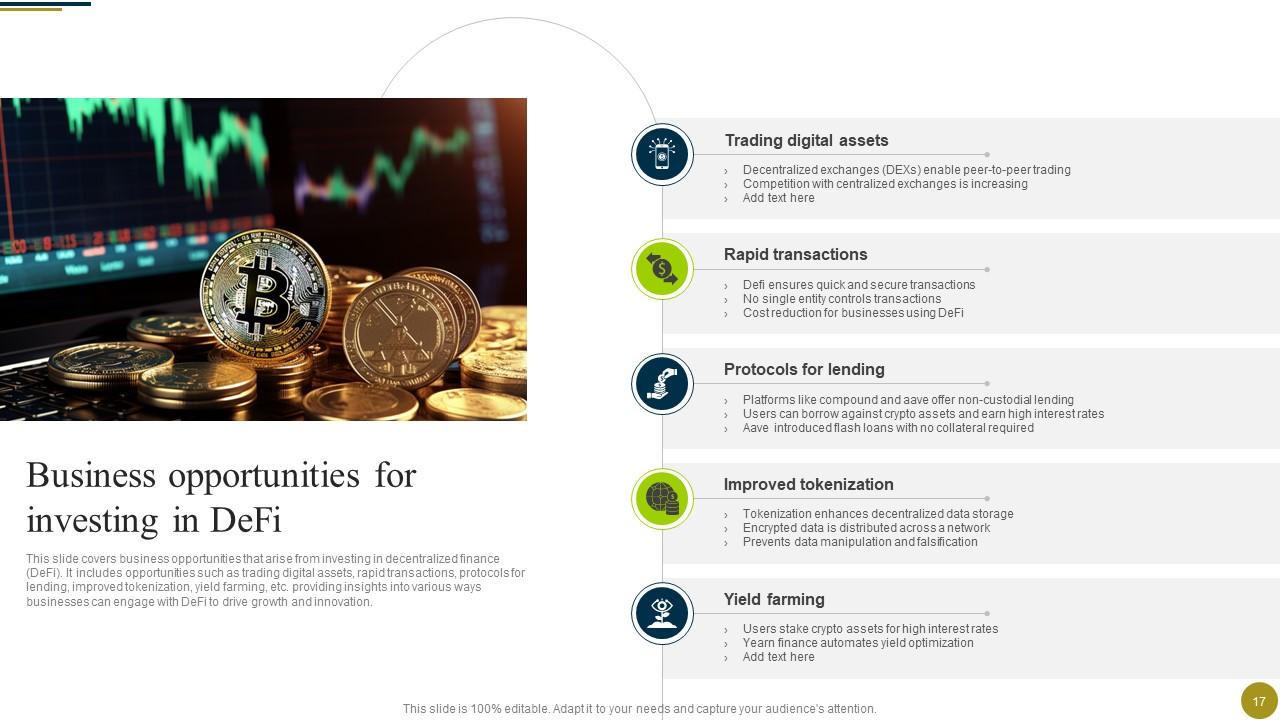

Slide 17: This slide covers business opportunities that arise from investing in decentralized finance (DeFi).

Slide 18: This slide presents risks and challenges that investors may encounter when engaging with decentralized finance (DeFi).

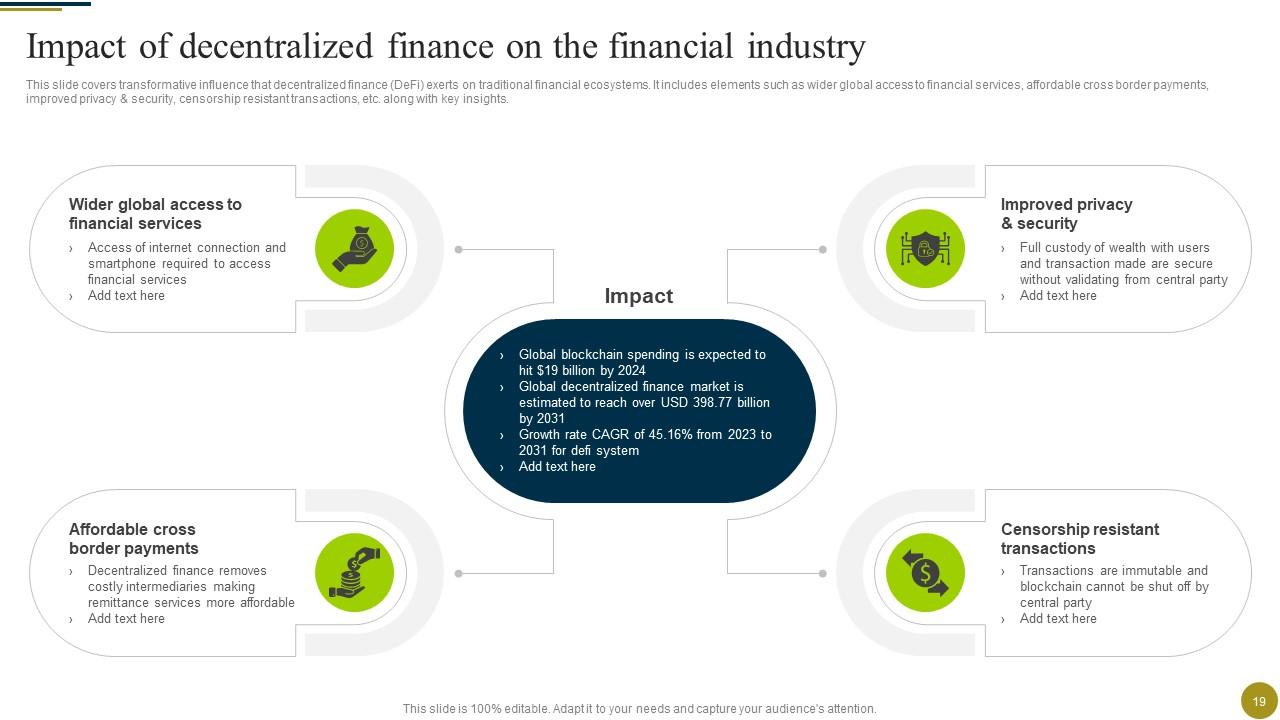

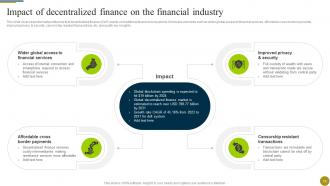

Slide 19: This slide covers transformative influence that decentralized finance (DeFi) exerts on traditional financial ecosystems.

Slide 20: The slide depicts Title of contents further.

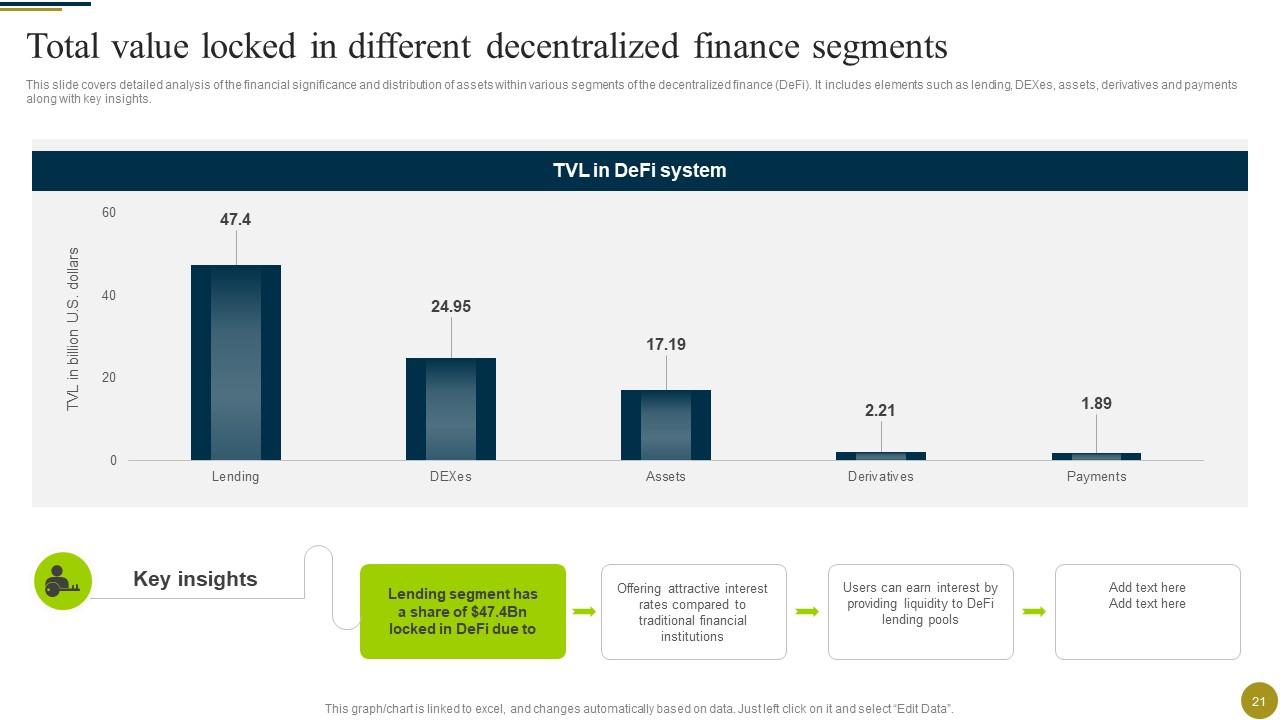

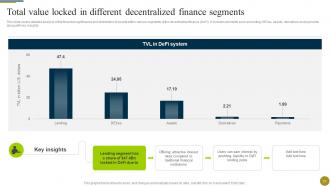

Slide 21: This slide covers detailed analysis of the financial significance and distribution of assets within various segments of the decentralized finance (DeFi).

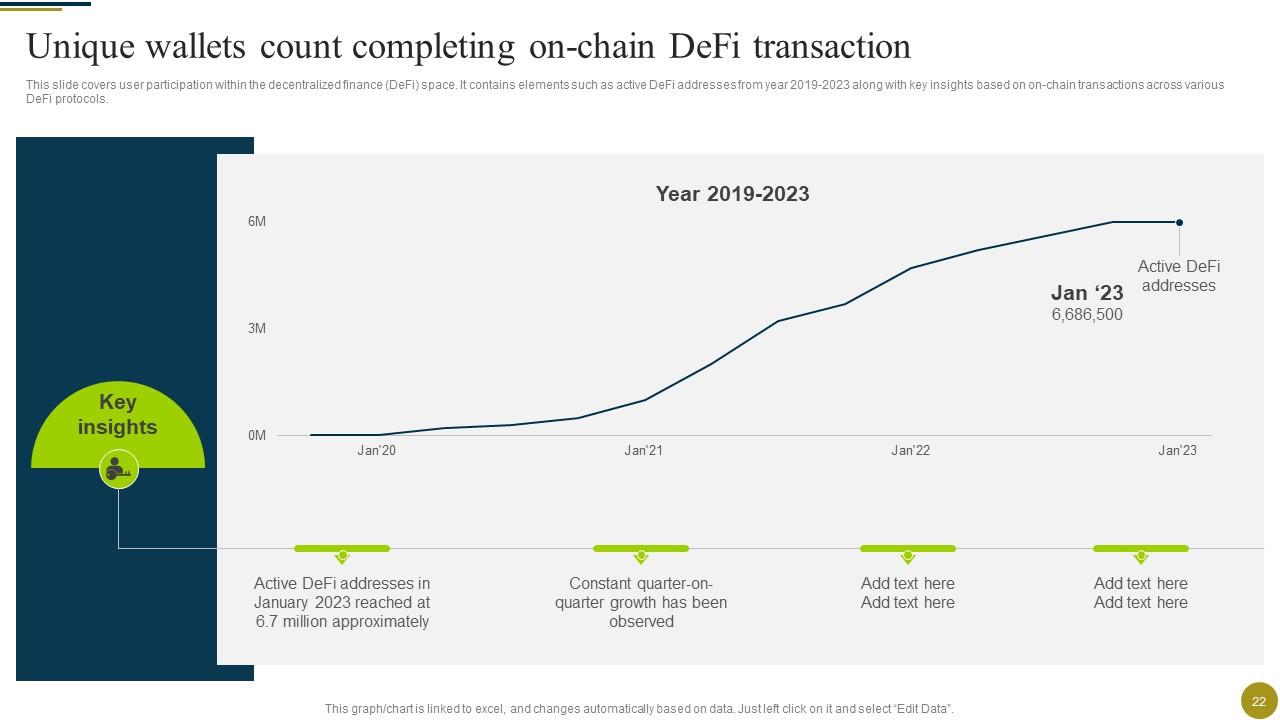

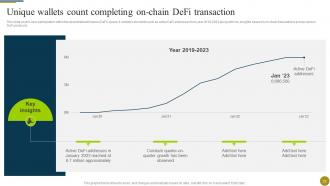

Slide 22: This slide renders user participation within the decentralized finance (DeFi) space.

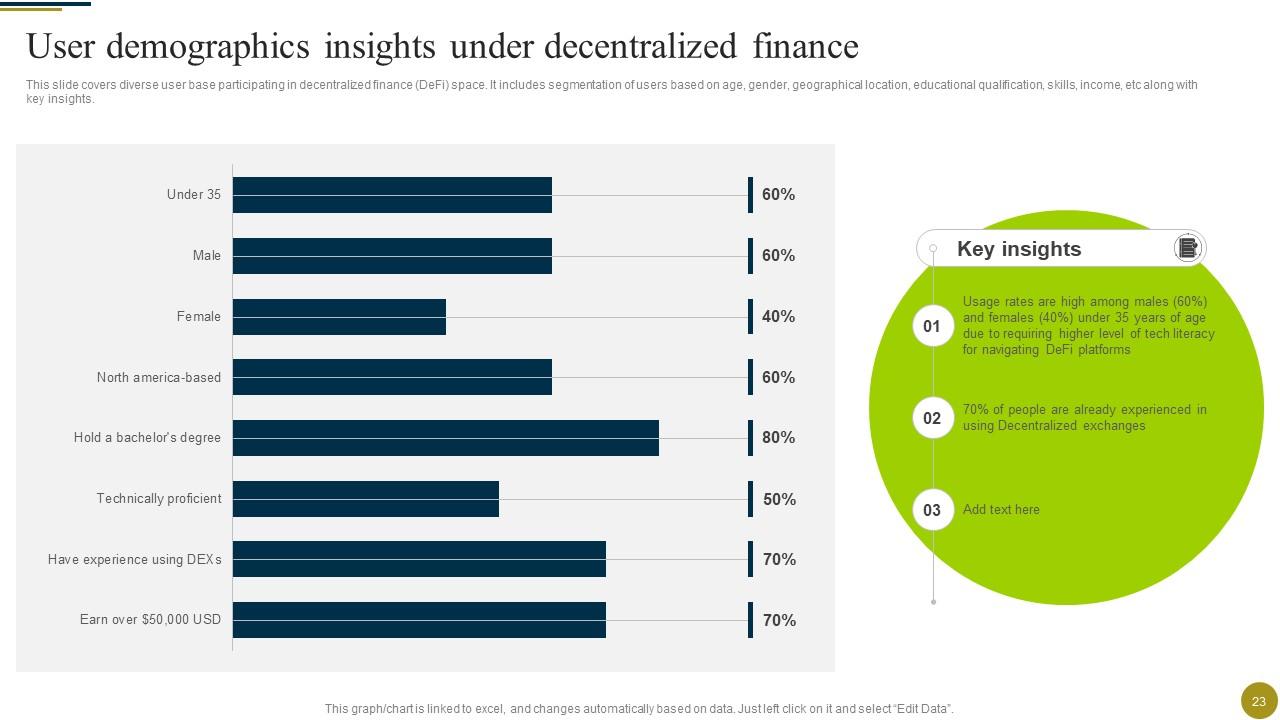

Slide 23: This slide contains diverse user base participating in decentralized finance (DeFi) space.

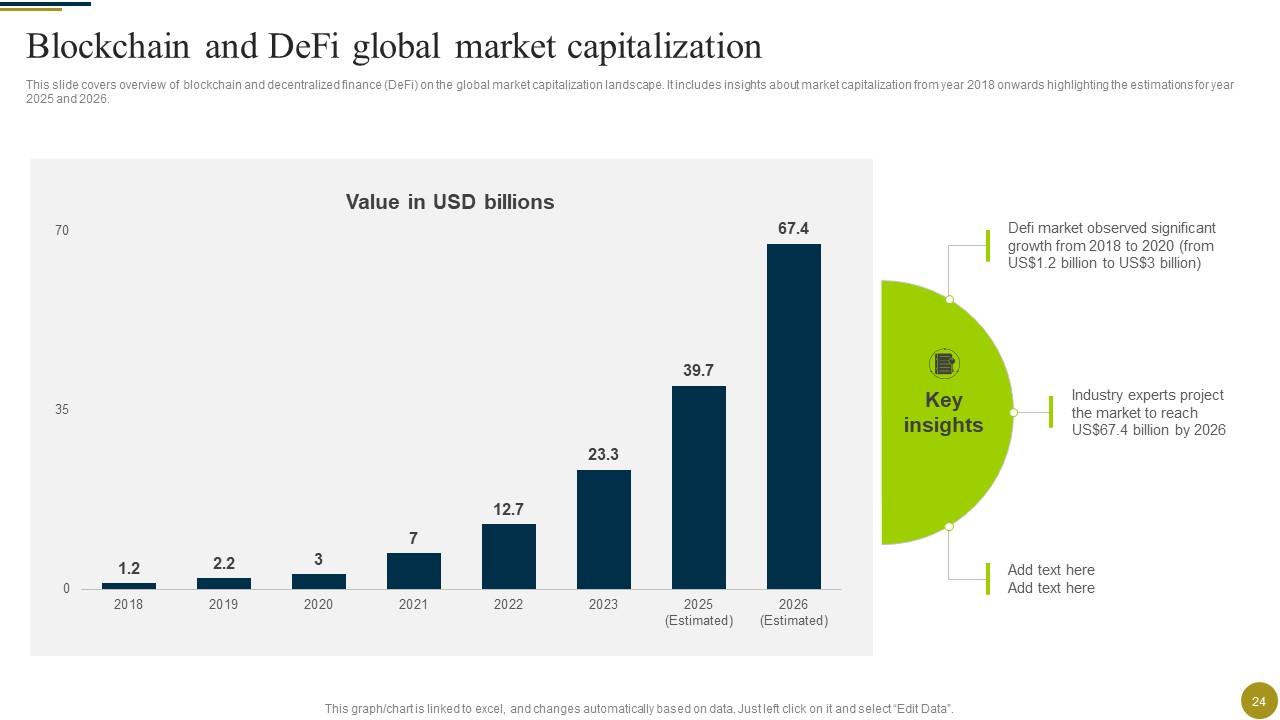

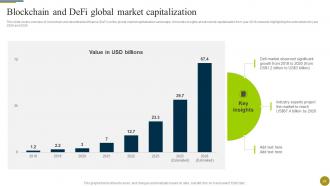

Slide 24: This slide highlights overview of blockchain and decentralized finance (DeFi) on the global market capitalization landscape.

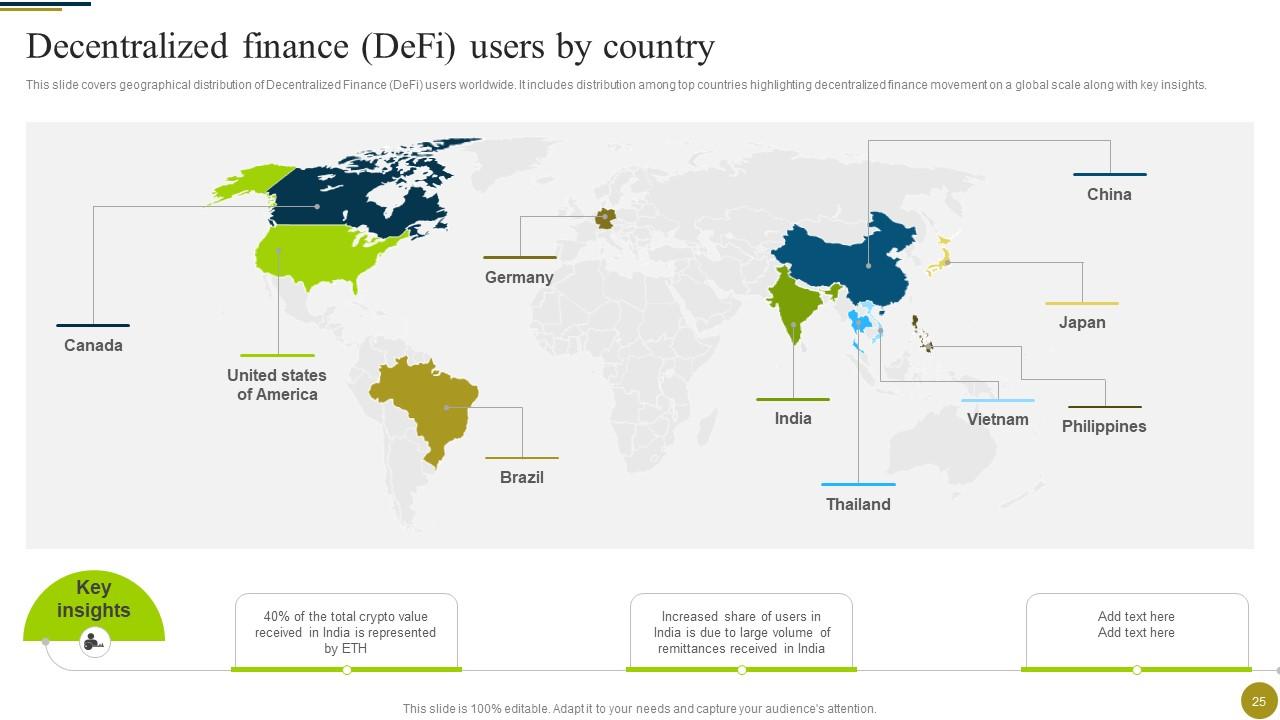

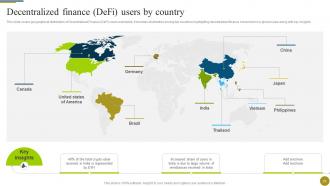

Slide 25: This slide covers geographical distribution of Decentralized Finance (DeFi) users worldwide.

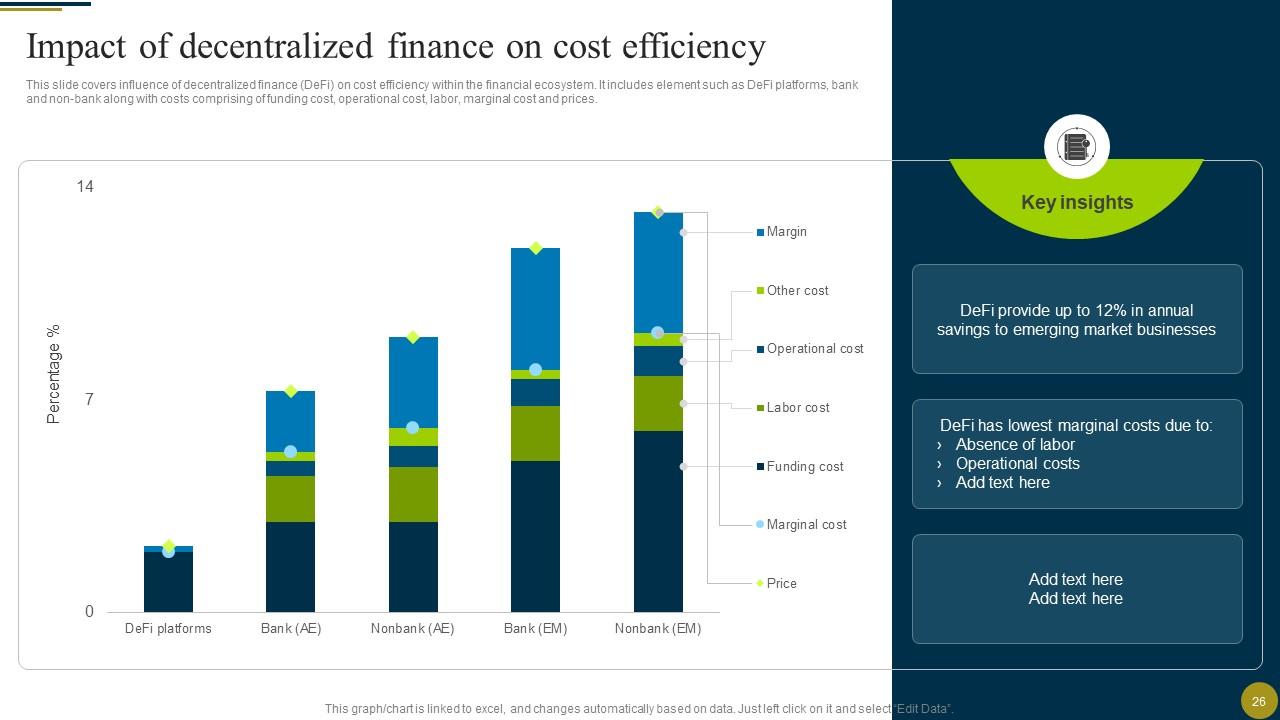

Slide 26: This slide shows influence of decentralized finance (DeFi) on cost efficiency within the financial ecosystem.

Slide 27: The slide contains Title of contents further.

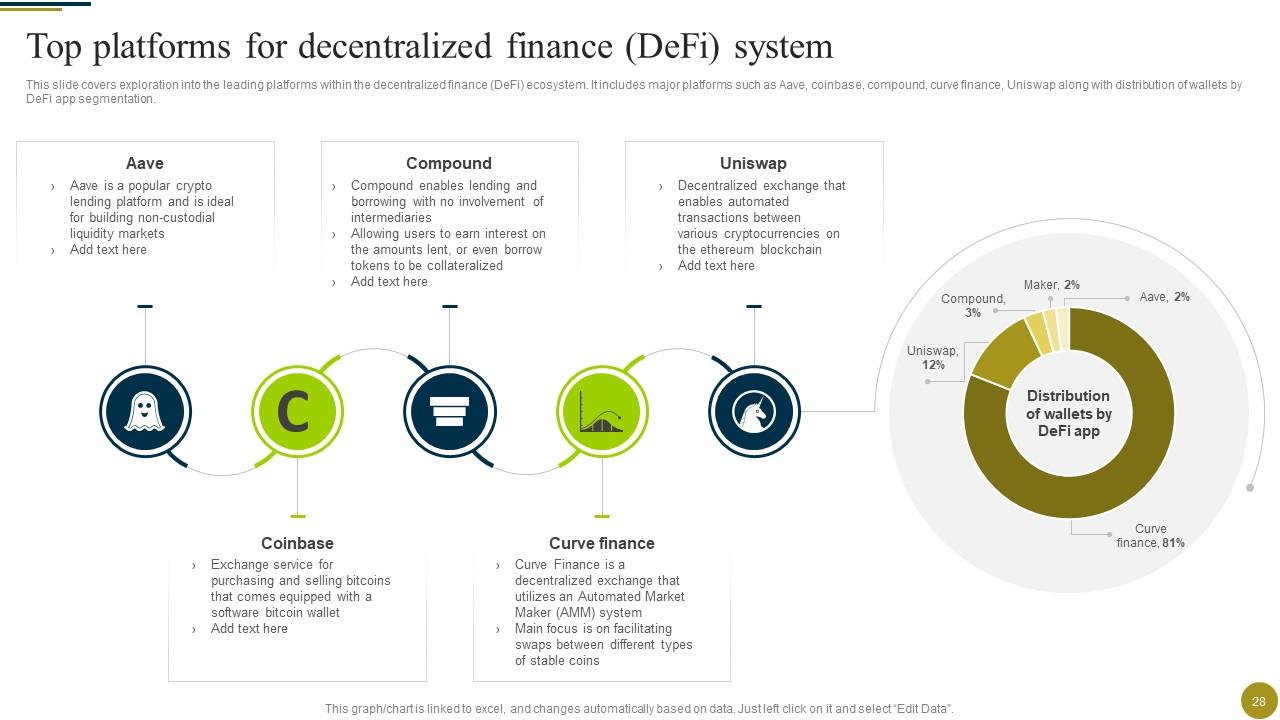

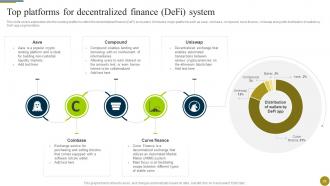

Slide 28: This slide covers exploration into the leading platforms within the decentralized finance (DeFi) ecosystem.

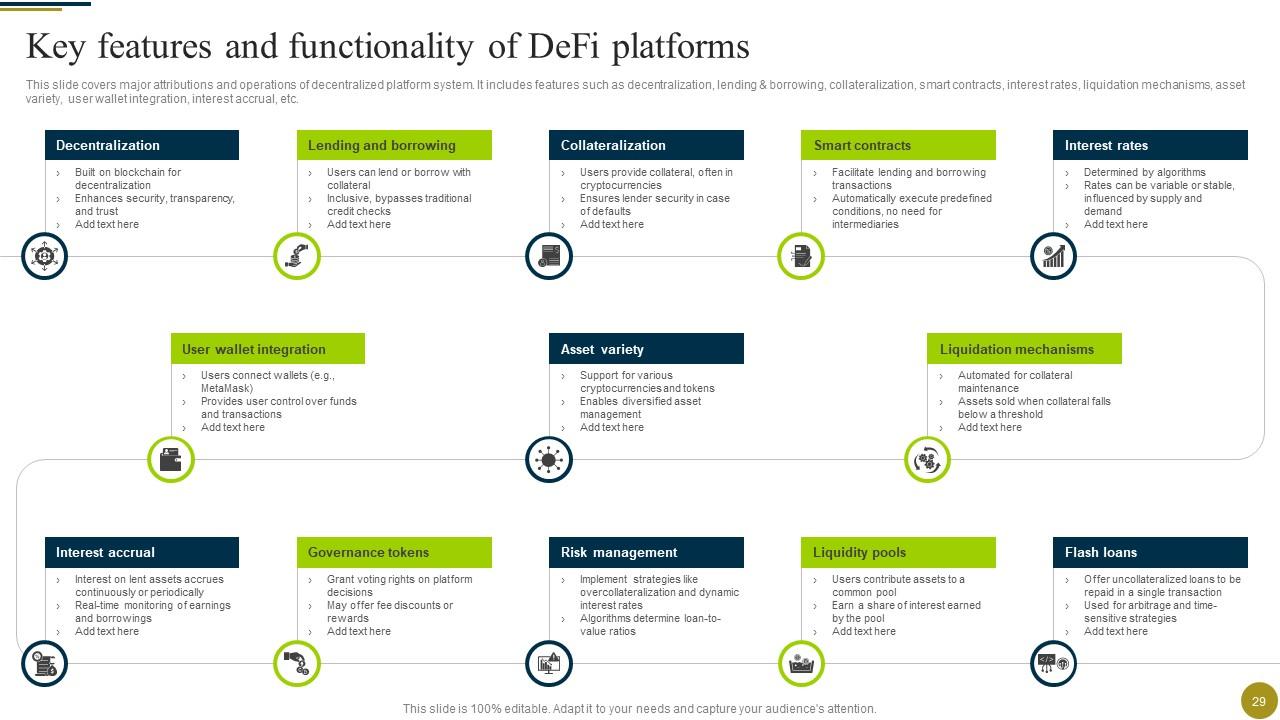

Slide 29: This slide presents major attributions and operations of decentralized platform system.

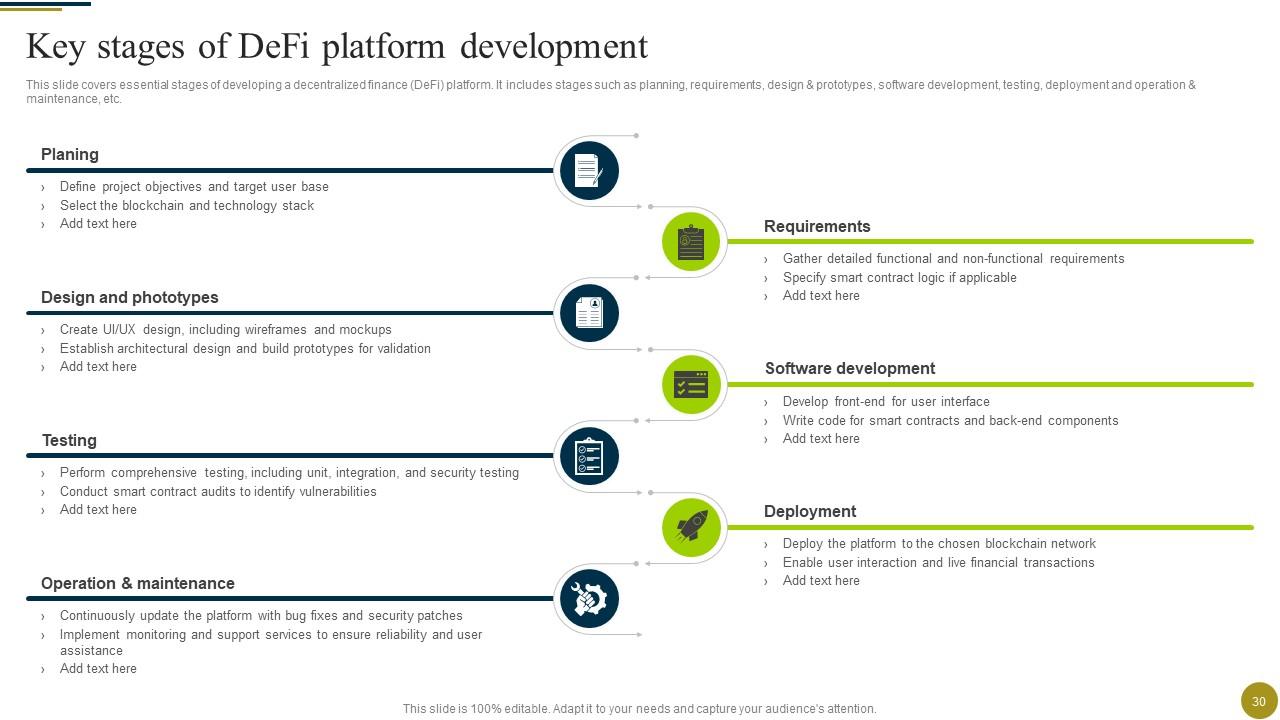

Slide 30: This slide covers essential stages of developing a decentralized finance (DeFi) platform.

Slide 31: The slide displays Title of contents further.

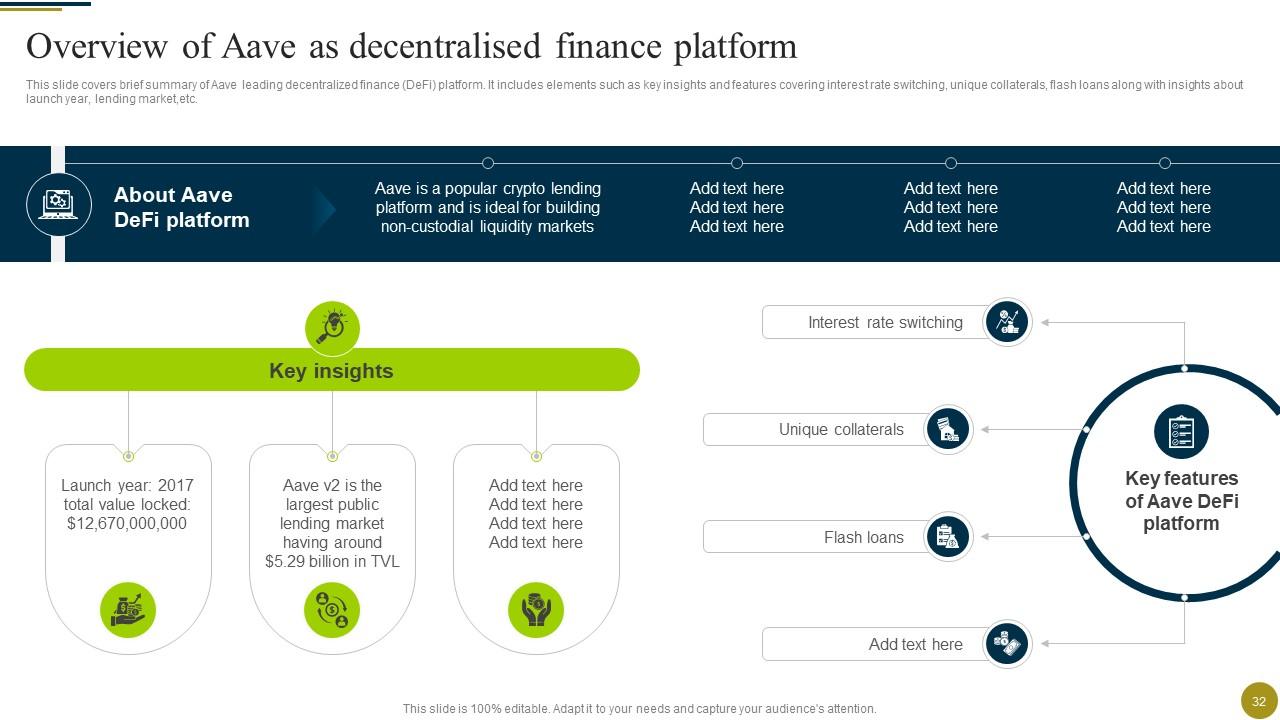

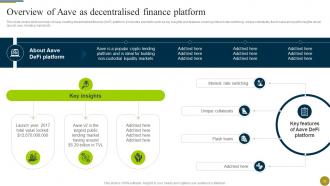

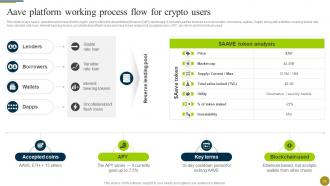

Slide 32: This slide contains brief summary of Aave leading decentralized finance (DeFi) platform.

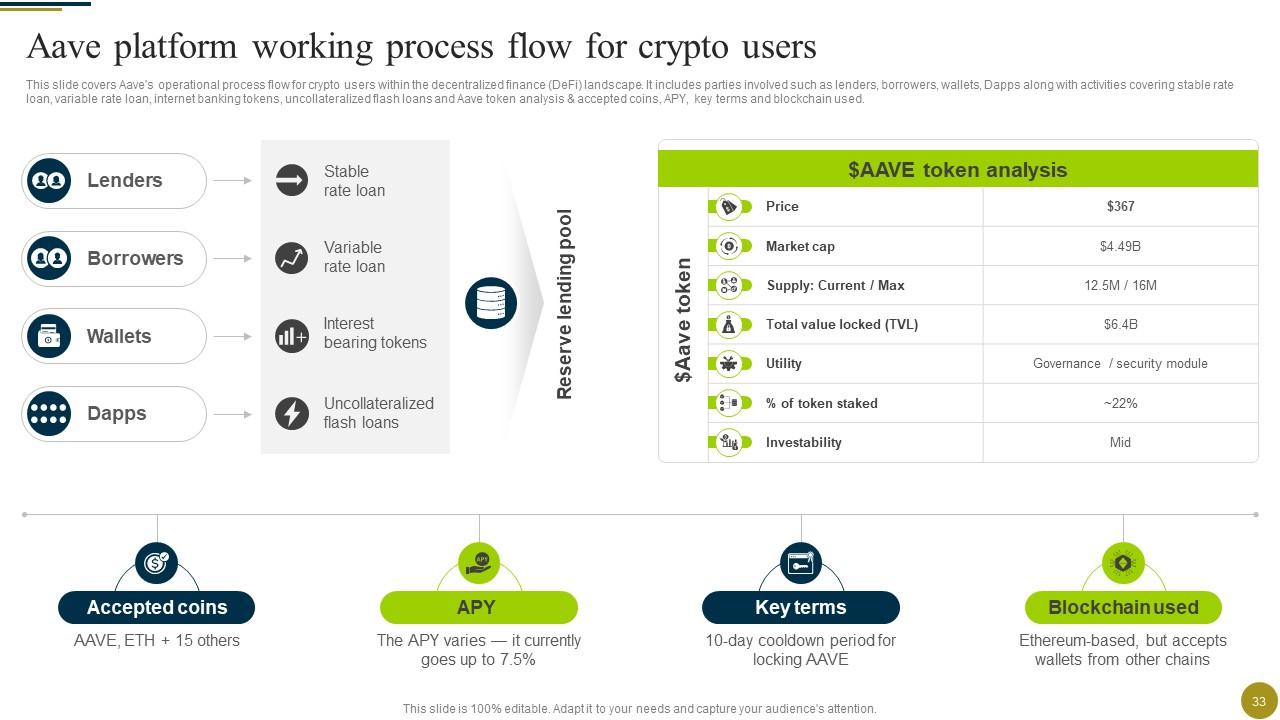

Slide 33: This slide covers Aave's operational process flow for crypto users within the decentralized finance (DeFi) landscape.

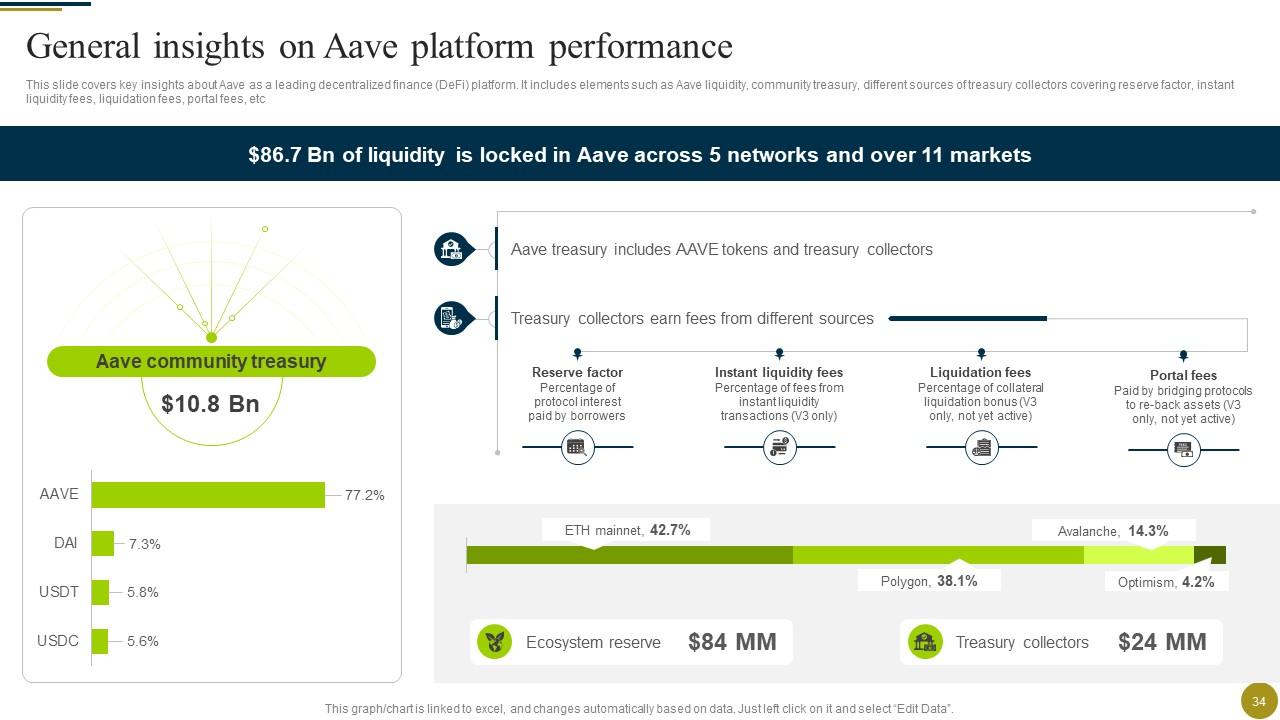

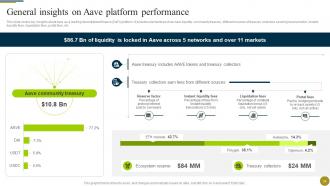

Slide 34: This slide represents key insights about Aave as a leading decentralized finance (DeFi) platform.

Slide 35: The slide renders another Title of contents.

Slide 36: This slide briefs summary of Compound as a leading decentralized finance (DeFi) platform.

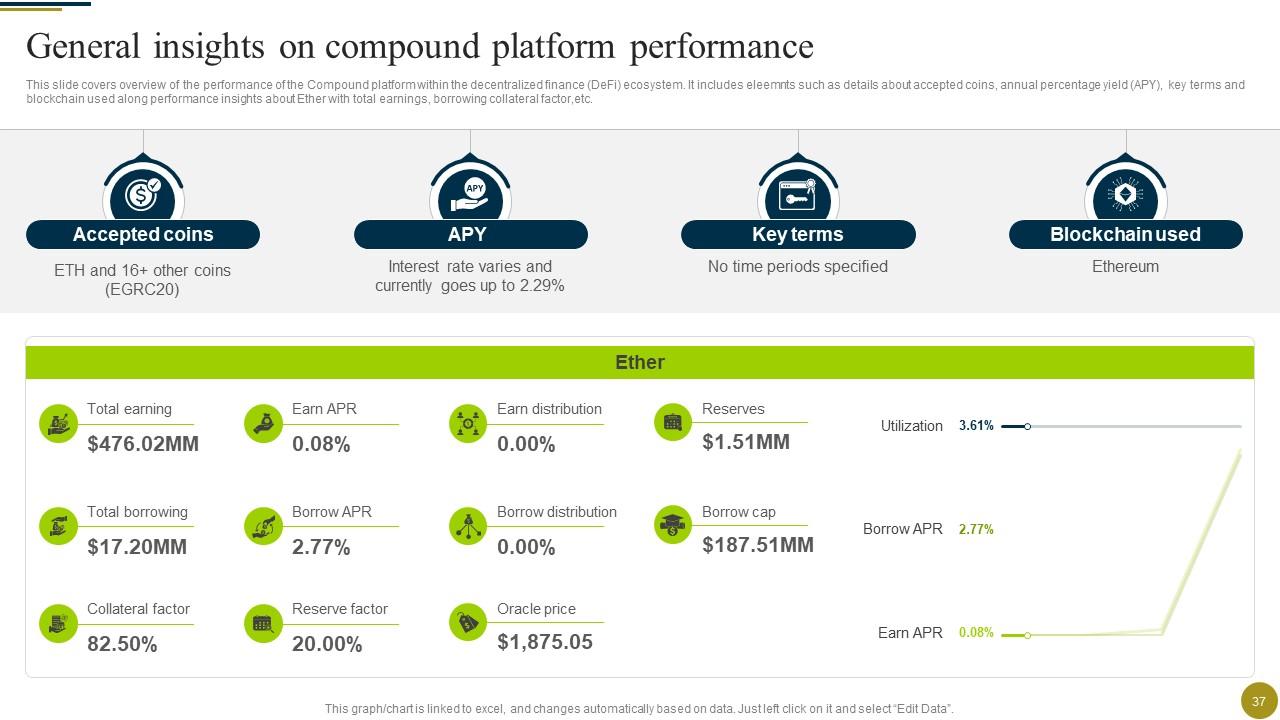

Slide 37: This slide highlights overview of the performance of the Compound platform within the decentralized finance (DeFi) ecosystem.

Slide 38: The slide displays Title of contents further.

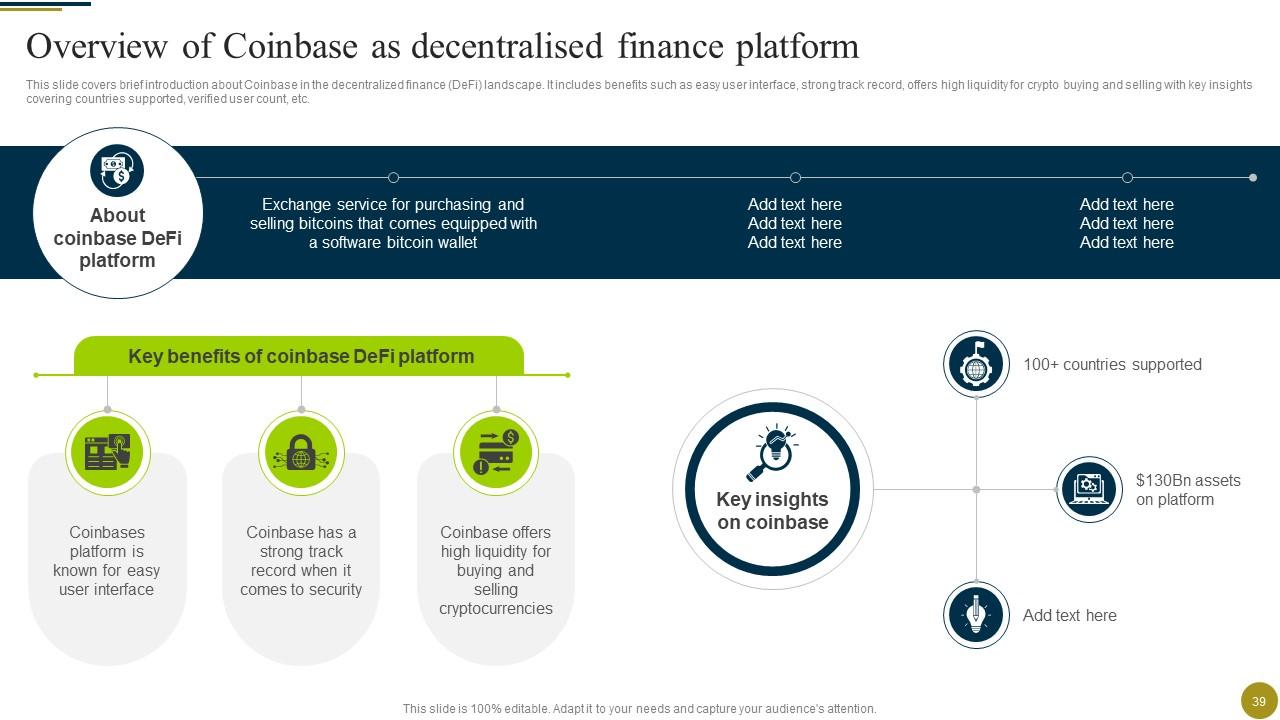

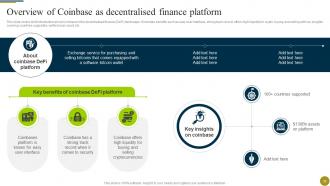

Slide 39: This slide provides brief introduction about Coinbase in the decentralized finance (DeFi) landscape.

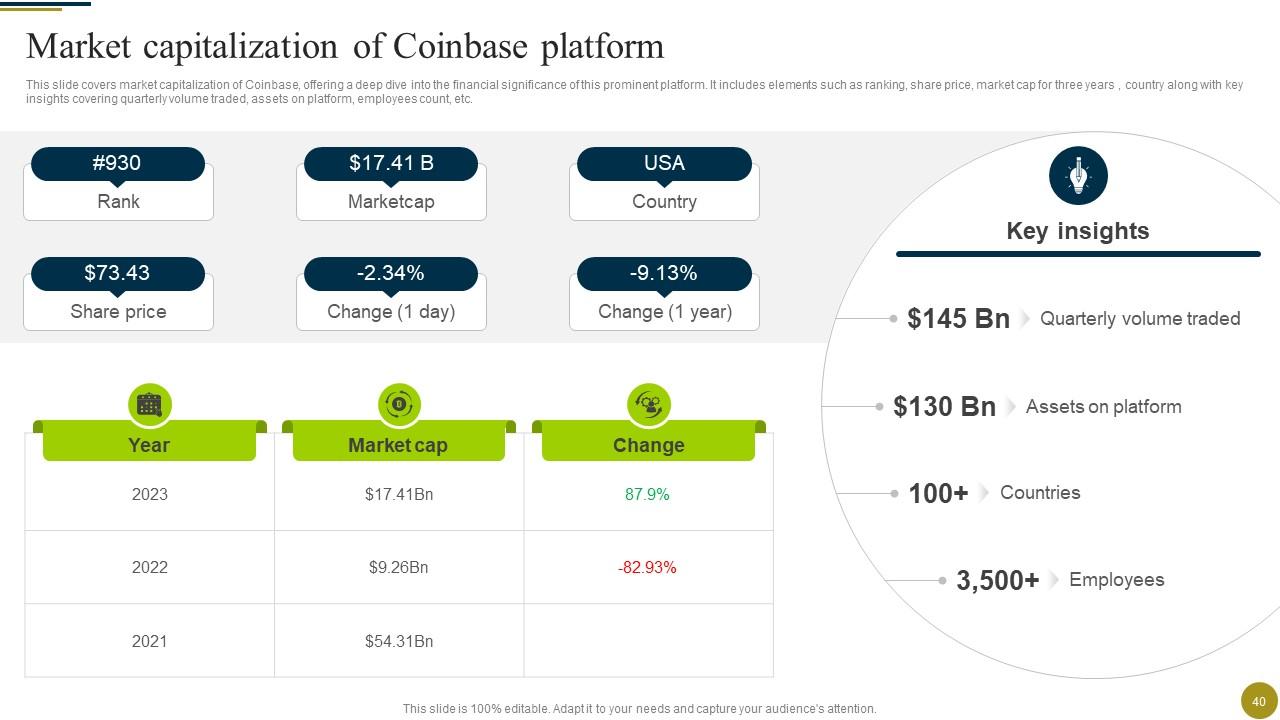

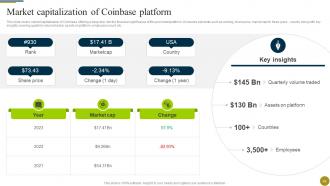

Slide 40: This slide covers market capitalization of Coinbase, offering a deep dive into the financial significance of this prominent platform.

Slide 41: The slide renders Title of contents which is to be discussed further.

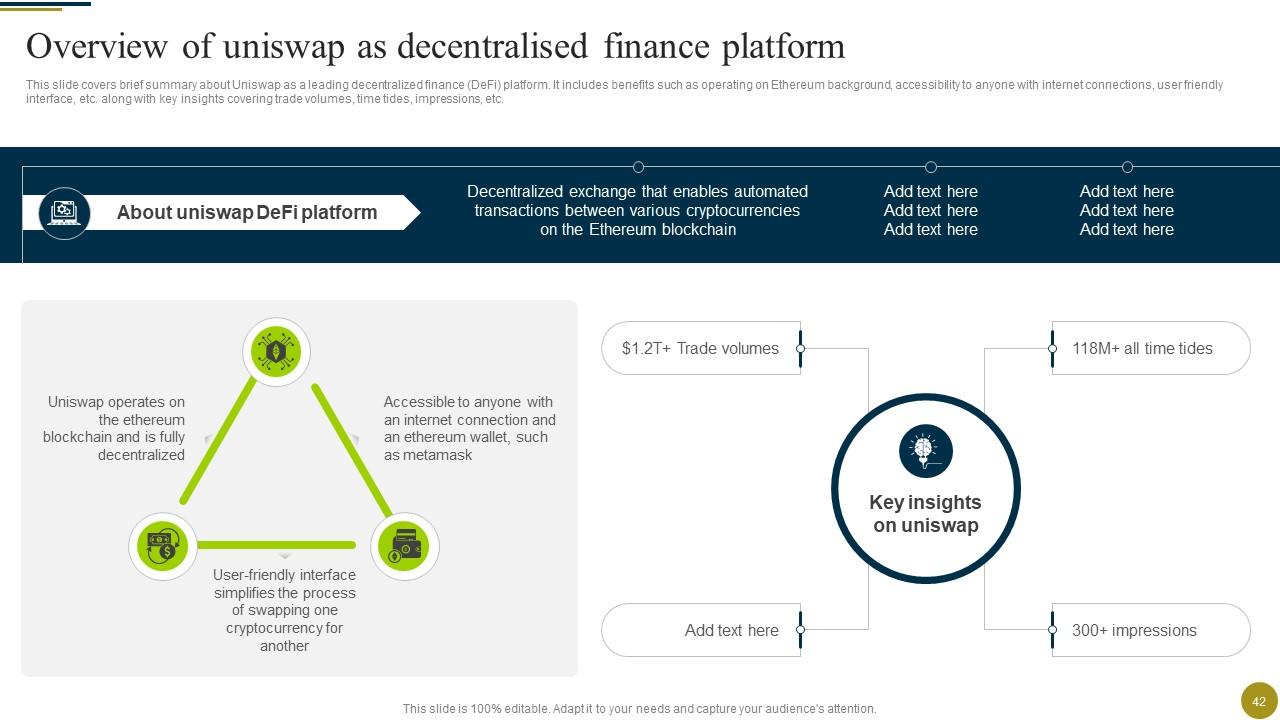

Slide 42: This slide renders brief summary about Uniswap as a leading decentralized finance (DeFi) platform.

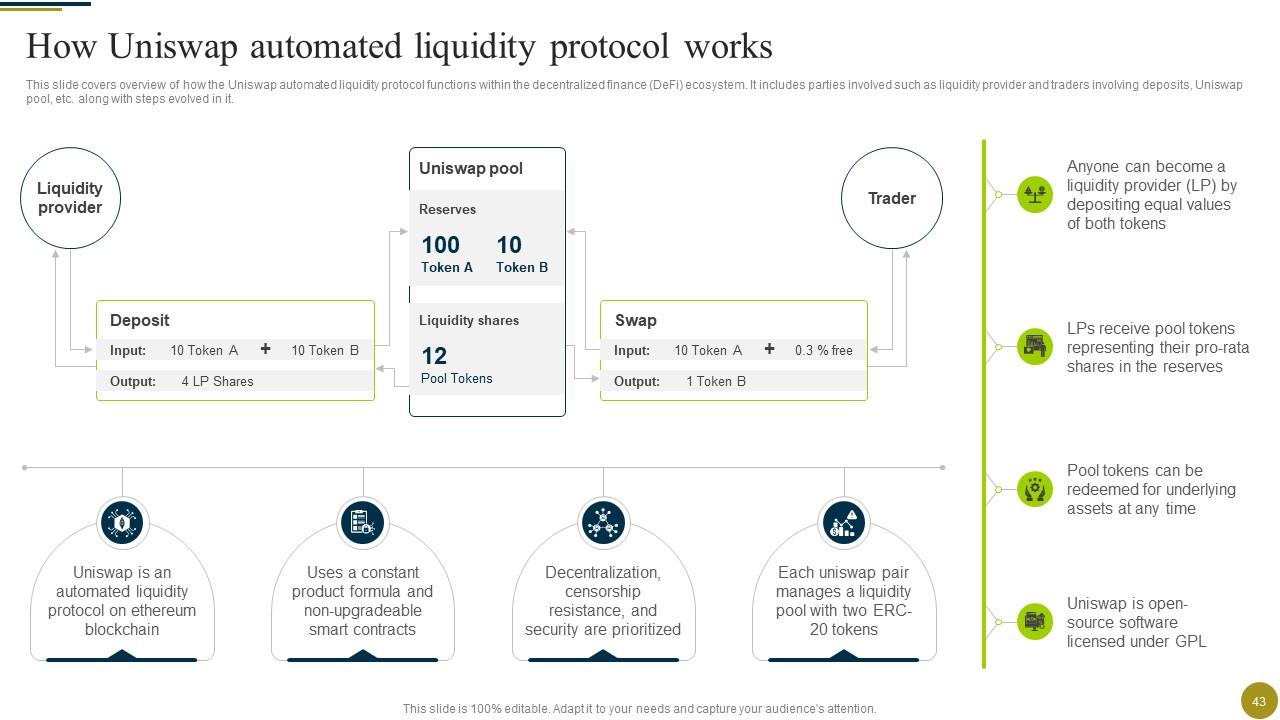

Slide 43: This slide covers overview of how the Uniswap automated liquidity protocol functions within the decentralized finance (DeFi) ecosystem.

Slide 44: The slide displays Title of contents further.

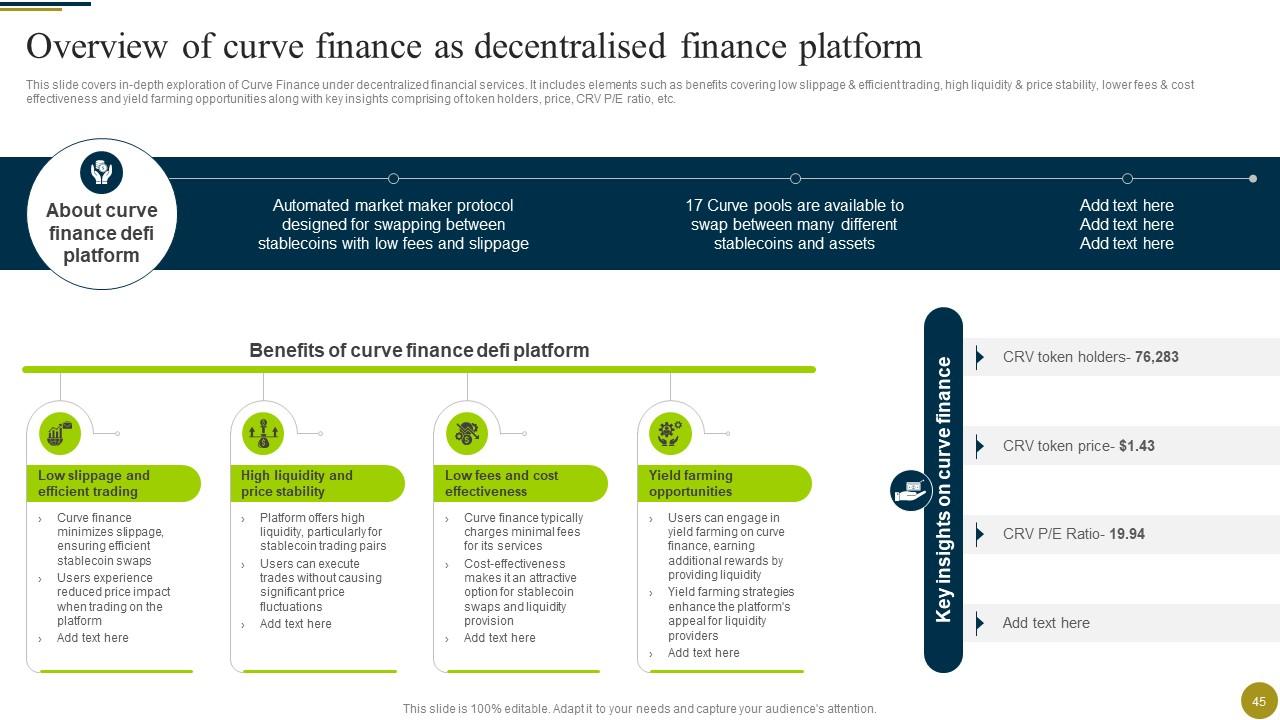

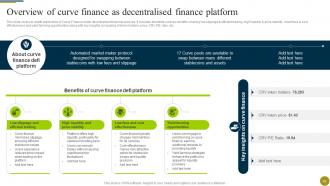

Slide 45: This slide covers in-depth exploration of Curve Finance under decentralized financial services.

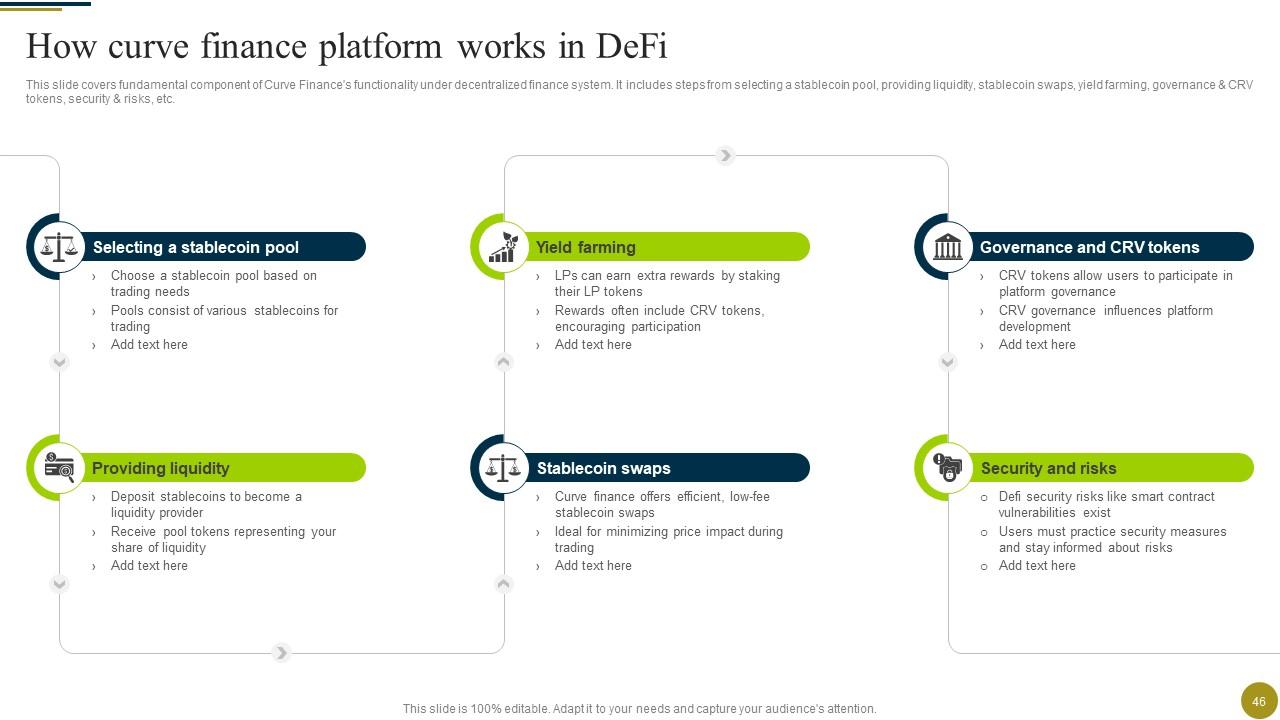

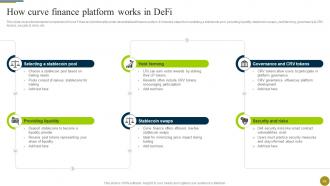

Slide 46: This slide shows fundamental component of Curve Finance's functionality under decentralized finance system.

Slide 47: The slide desvribes Title of contents further.

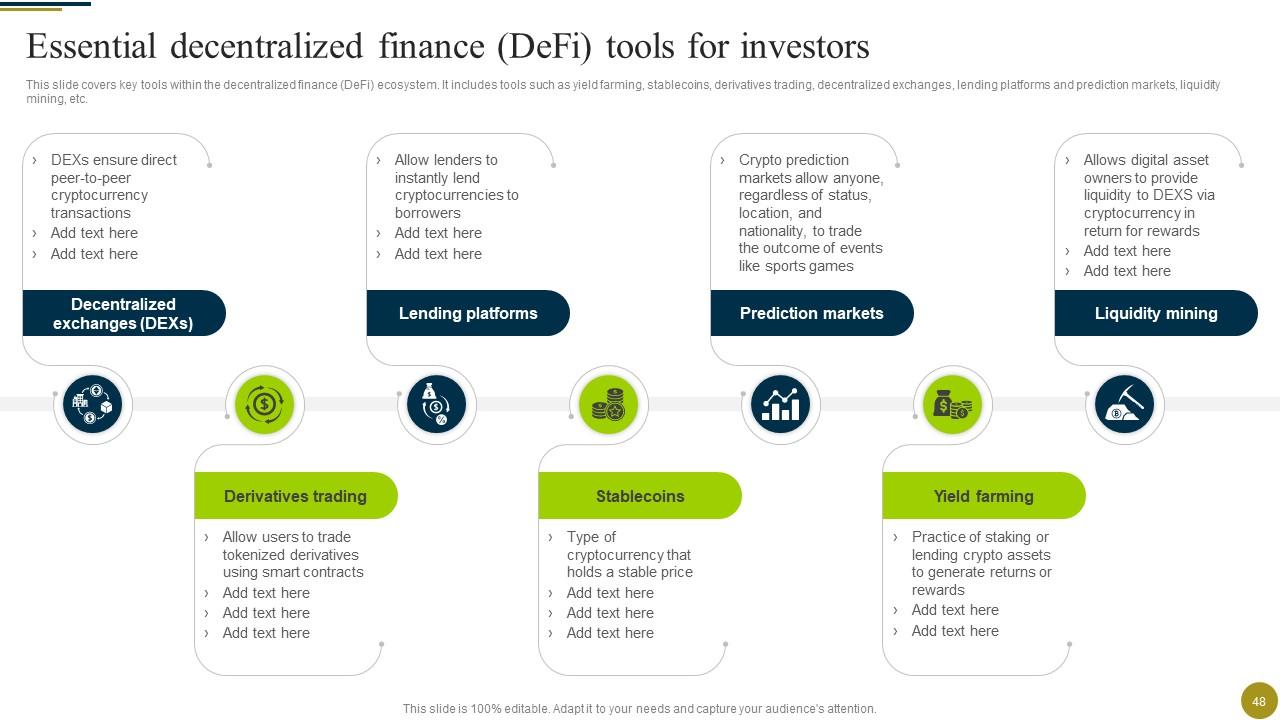

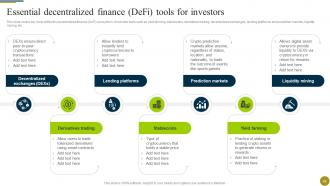

Slide 48: This slide covers key tools within the decentralized finance (DeFi) ecosystem.

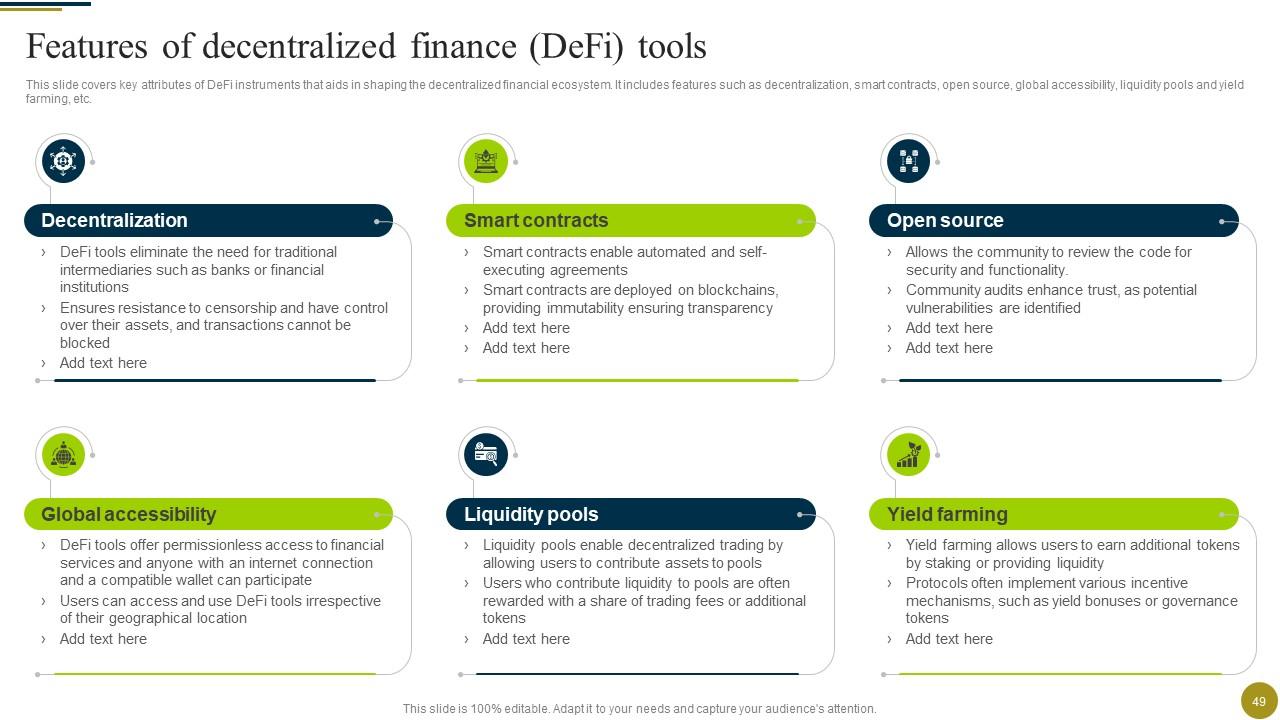

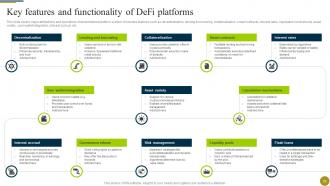

Slide 49: This slide contains key attributes of DeFi instruments that aids in shaping the decentralized financial ecosystem.

Slide 50: The slide displays another Title of contents.

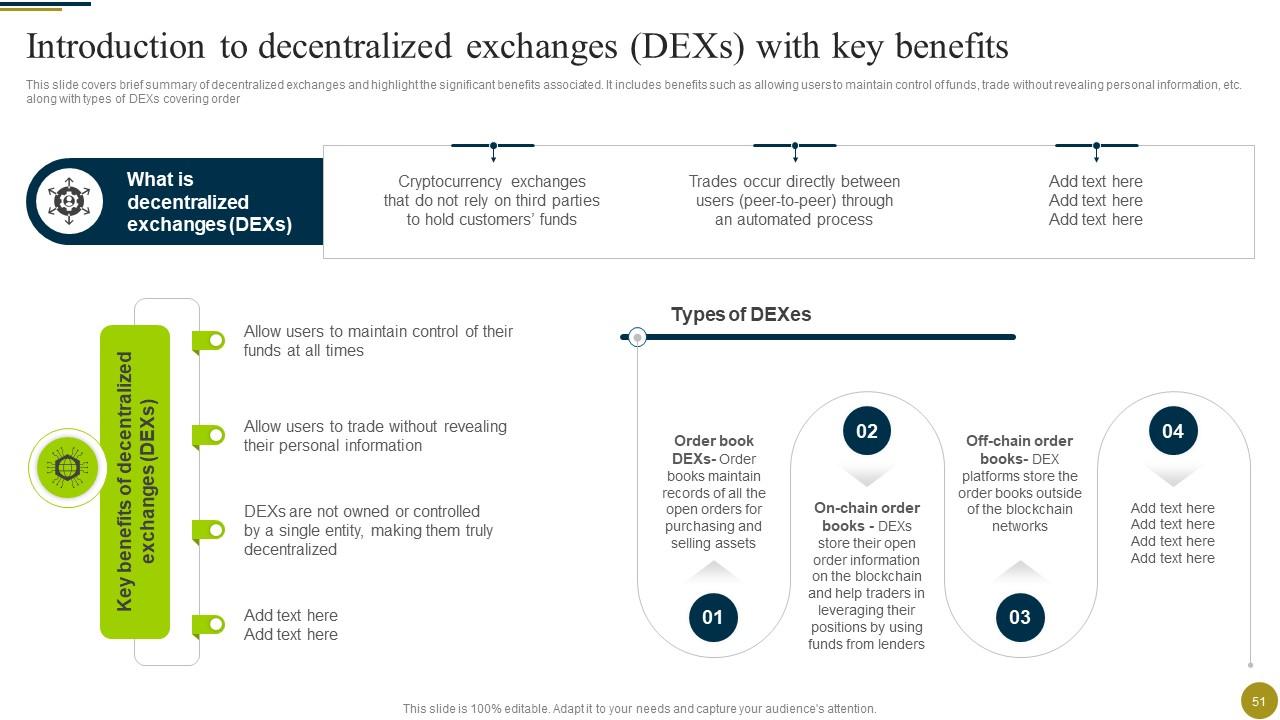

Slide 51: This slide provides brief summary of decentralized exchanges and highlight the significant benefits associated.

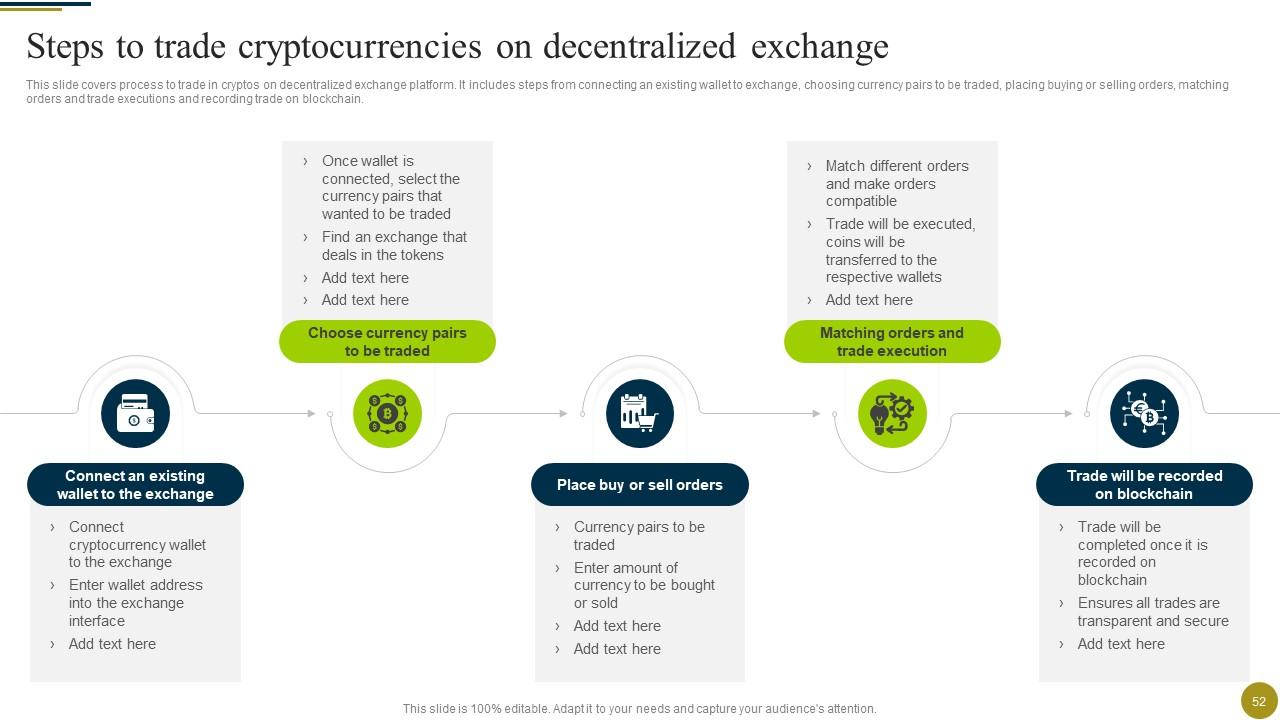

Slide 52: This slide covers process to trade in cryptos on decentralized exchange platform.

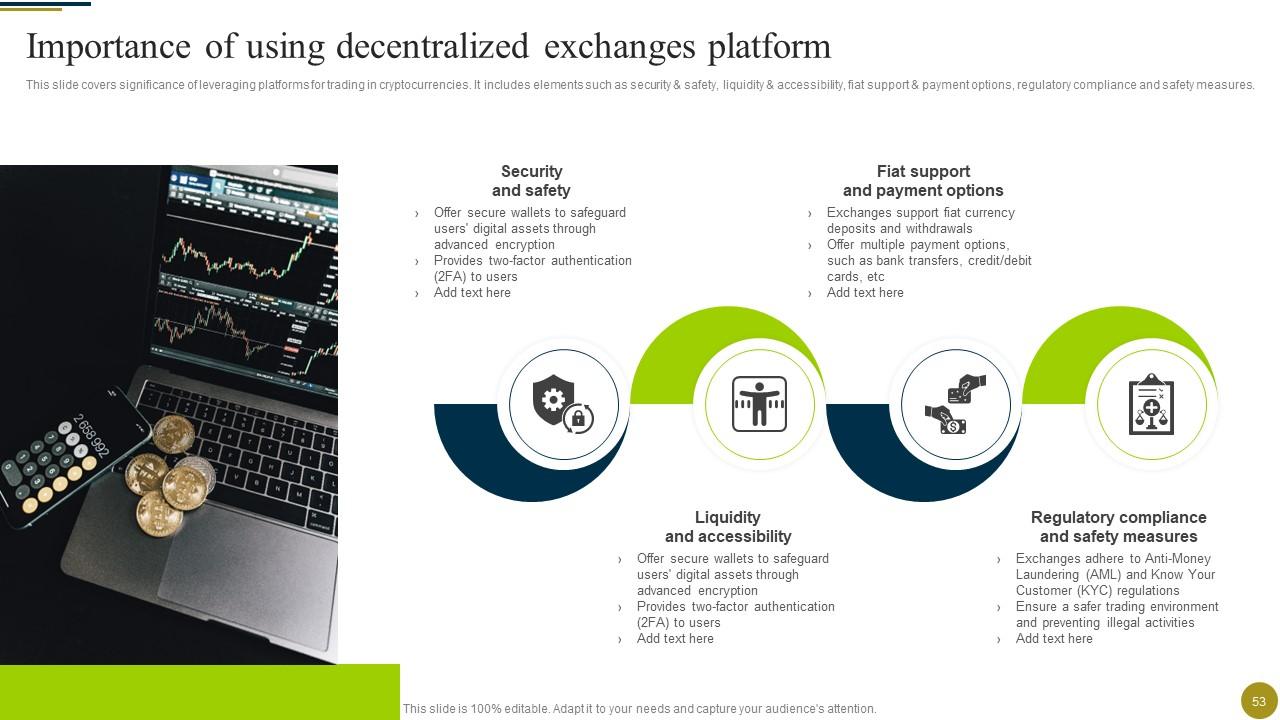

Slide 53: This slide highlights significance of leveraging platforms for trading in cryptocurrencies.

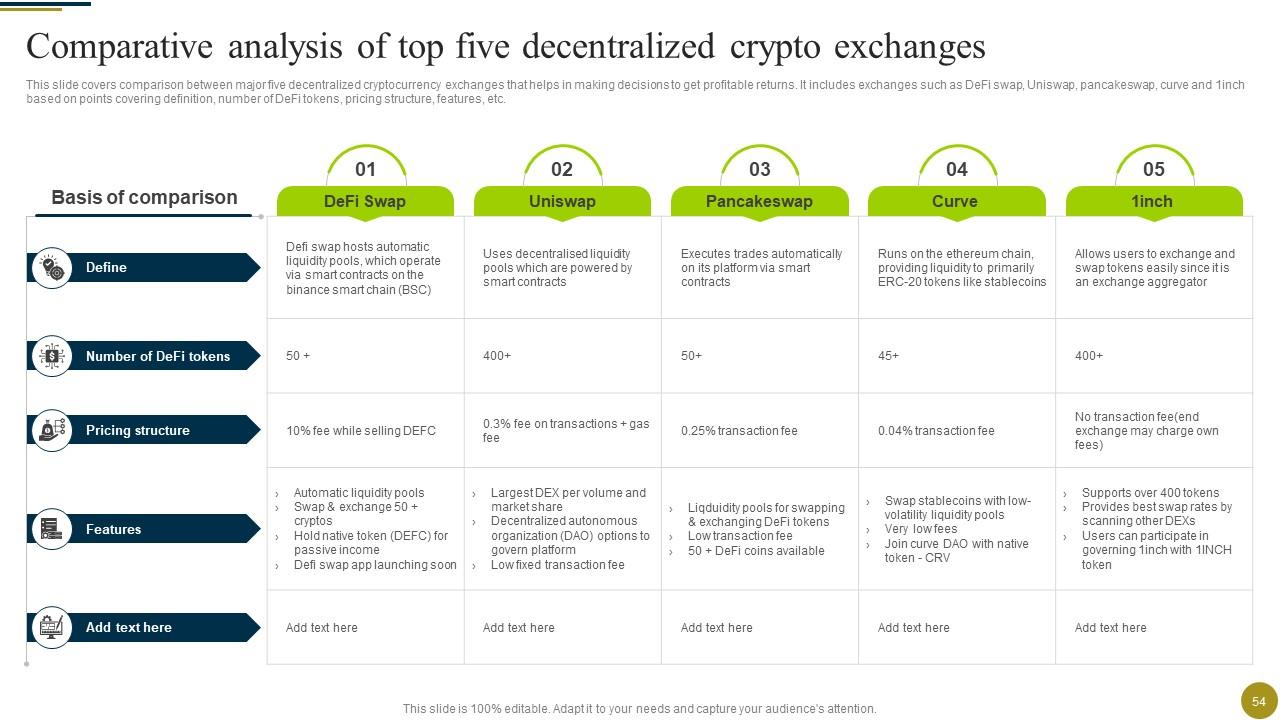

Slide 54: This slide covers comparison between major five decentralized cryptocurrency exchanges that helps in making decisions to get profitable returns.

Slide 55: The slide displays Title of contents further.

Slide 56: This slide contains fundamental concepts and highlighting the key benefits associated with engaging in derivative markets.

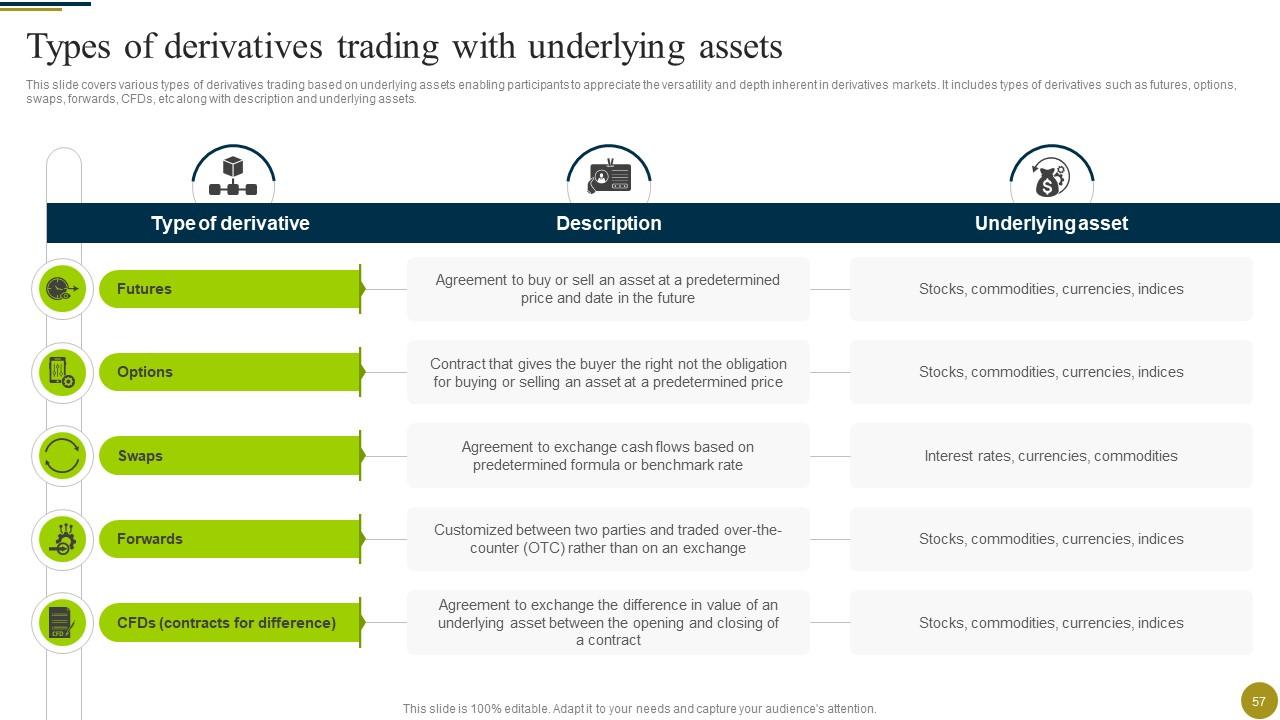

Slide 57: This slide covers various types of derivatives trading based on underlying assets enabling participants.

Slide 58: This slide contains process to initiate derivatives trading for global investors.

Slide 59: This slide represents important elements used for derivatives trading under DeFi landscape.

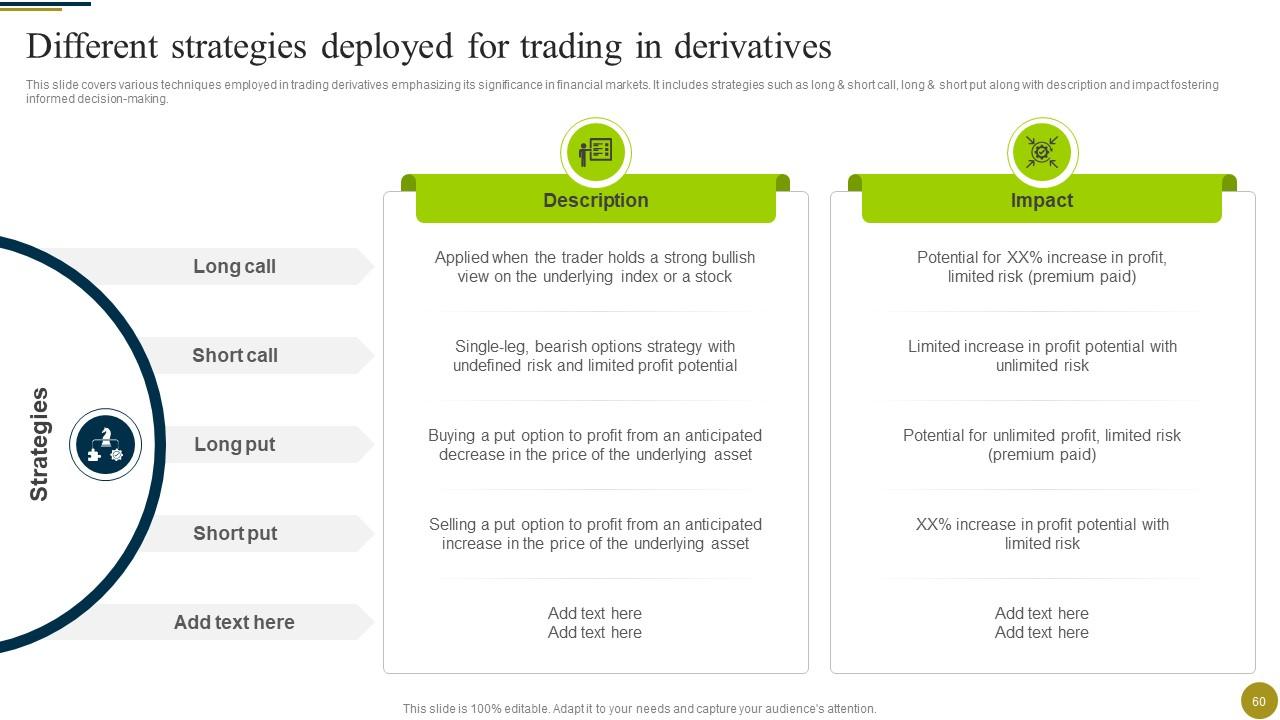

Slide 60: This slide covers various techniques employed in trading derivatives emphasizing its significance in financial markets.

Slide 61: The slide displays Title of contents further.

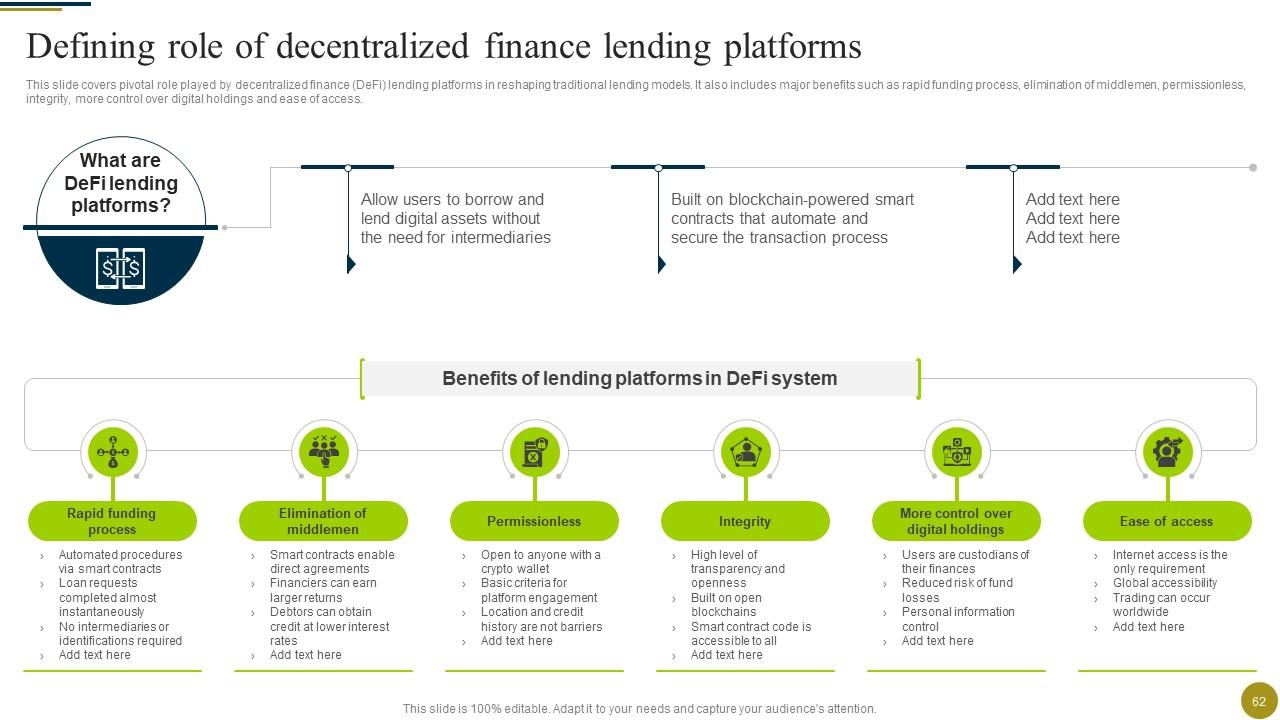

Slide 62: This slide presents pivotal role played by decentralized finance (DeFi) lending platforms in reshaping traditional lending models.

Slide 63: This slide covers different ways through which lending and borrowing under decentralized finance system works.

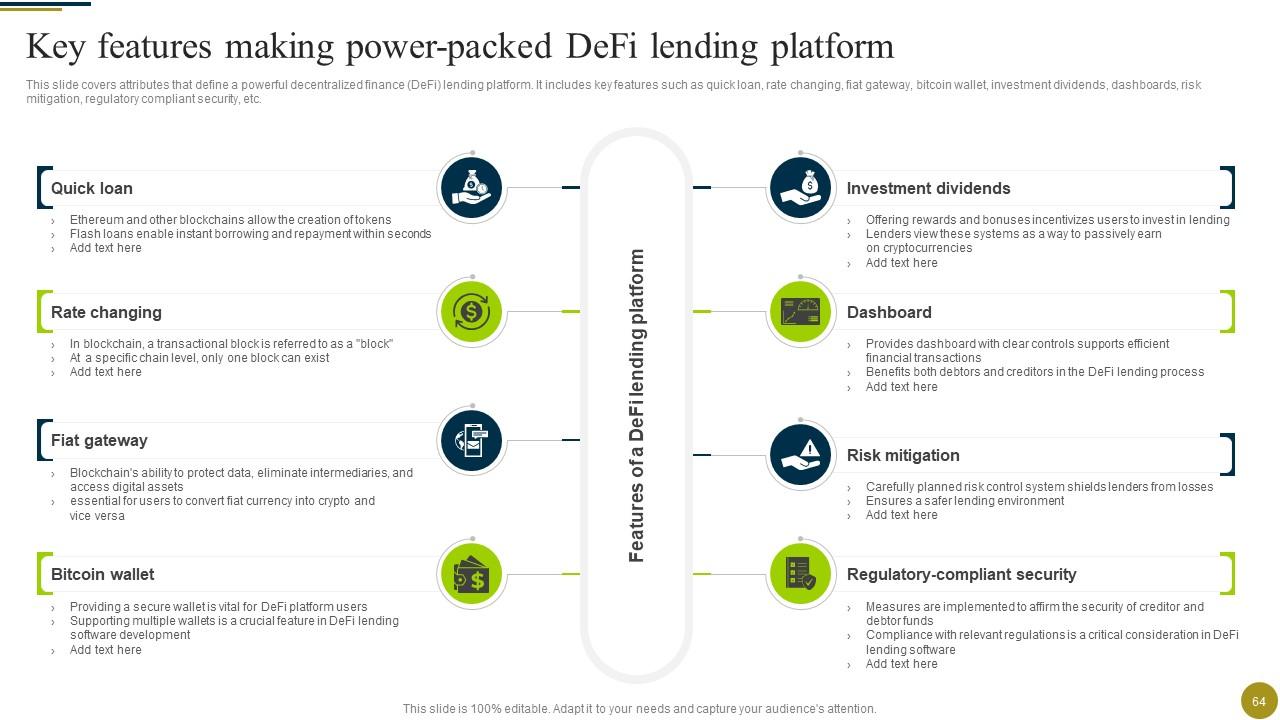

Slide 64: This slide covers attributes that define a powerful decentralized finance (DeFi) lending platform.

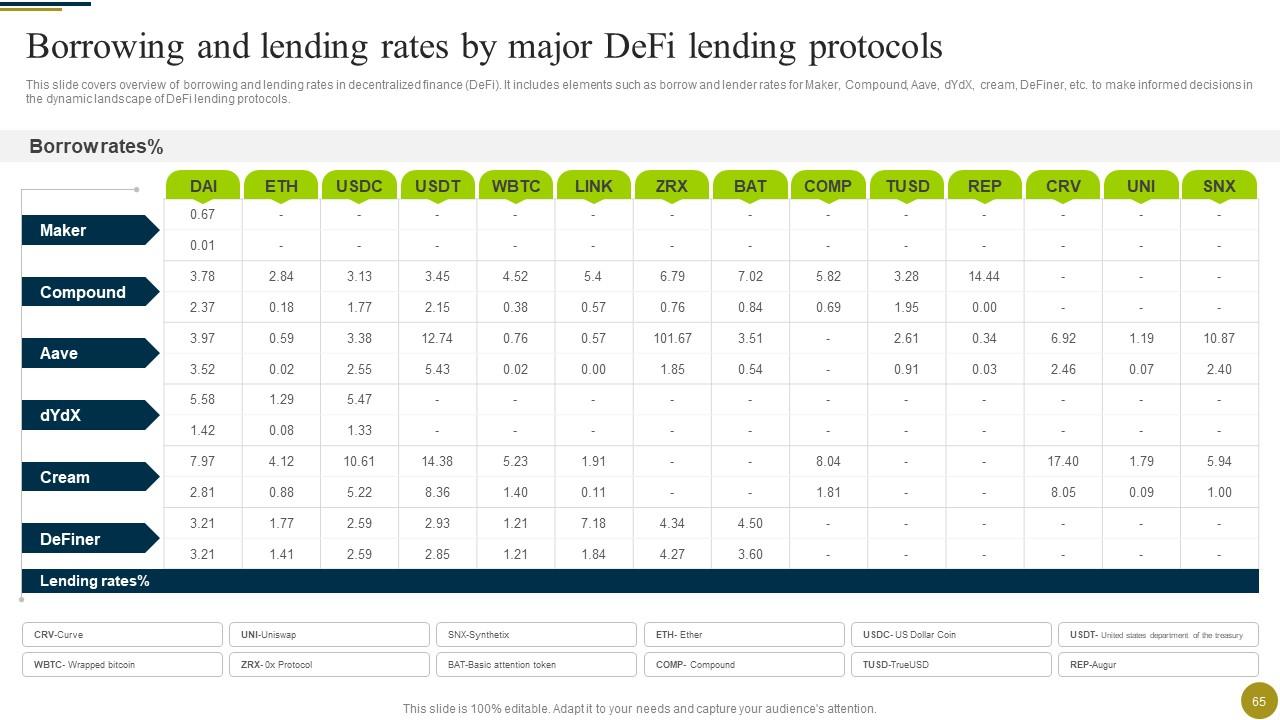

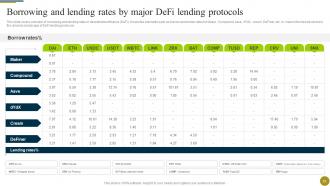

Slide 65: This slide highlights overview of borrowing and lending rates in decentralized finance (DeFi).

Slide 66: The slide describes another Title of contents.

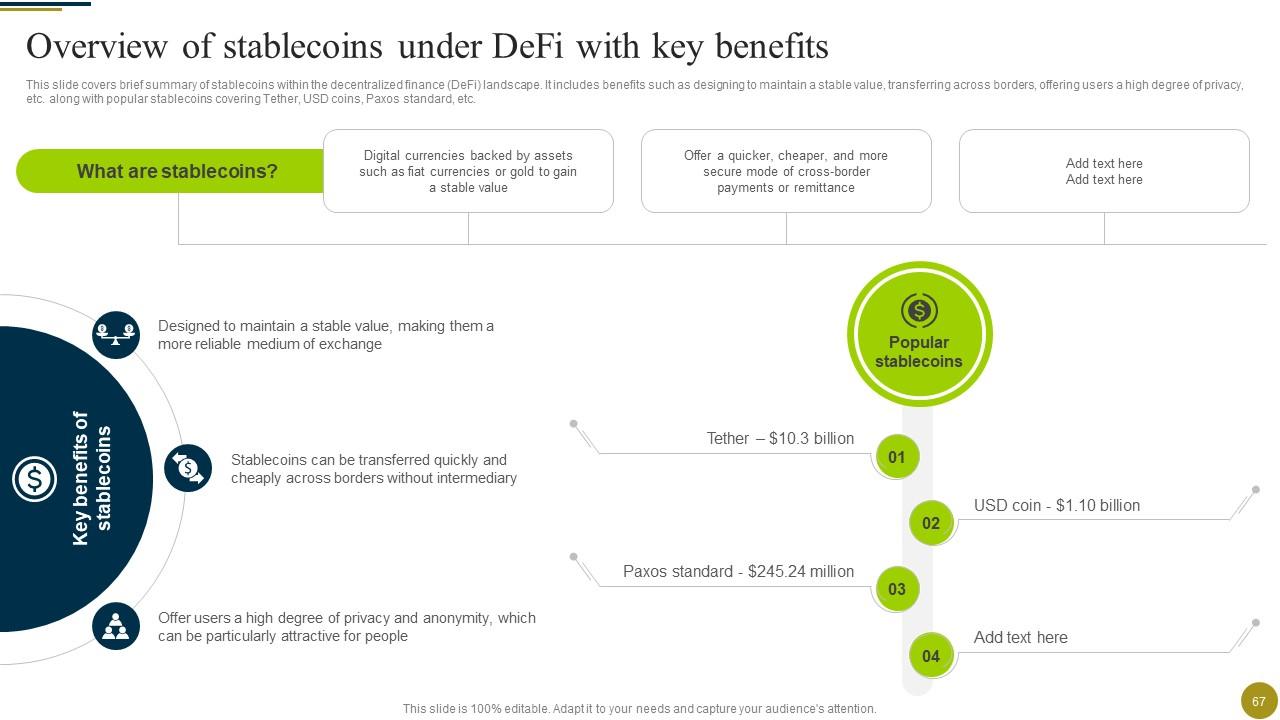

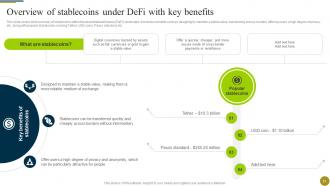

Slide 67: This slide briefs summary of stablecoins within the decentralized finance (DeFi) landscape.

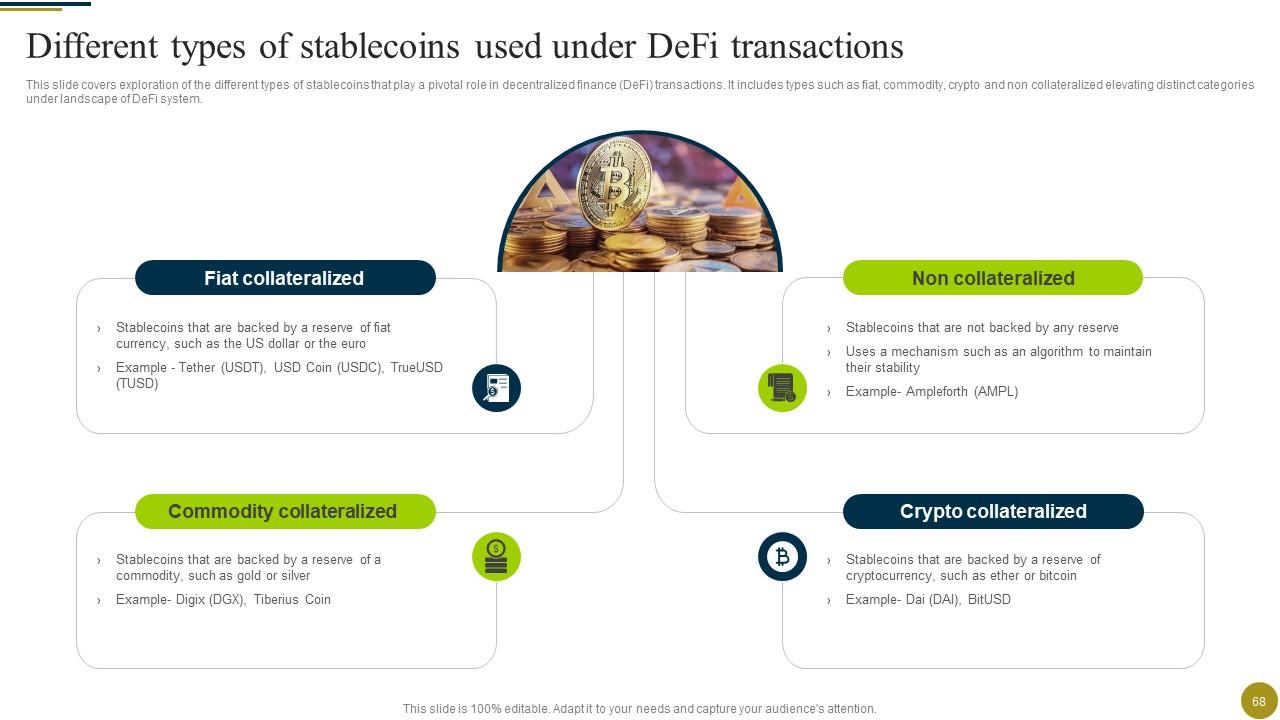

Slide 68: This slide covers exploration of the different types of stablecoins that play a pivotal role in decentralized finance (DeFi) transactions.

Slide 69: This slide covers process involved in investing in stablecoins to maximize returns.

Slide 70: This slide presents identifying the most stable cryptocurrency for investment based on market capitalization.

Slide 71: The slide depicts Title of contents for presentation.

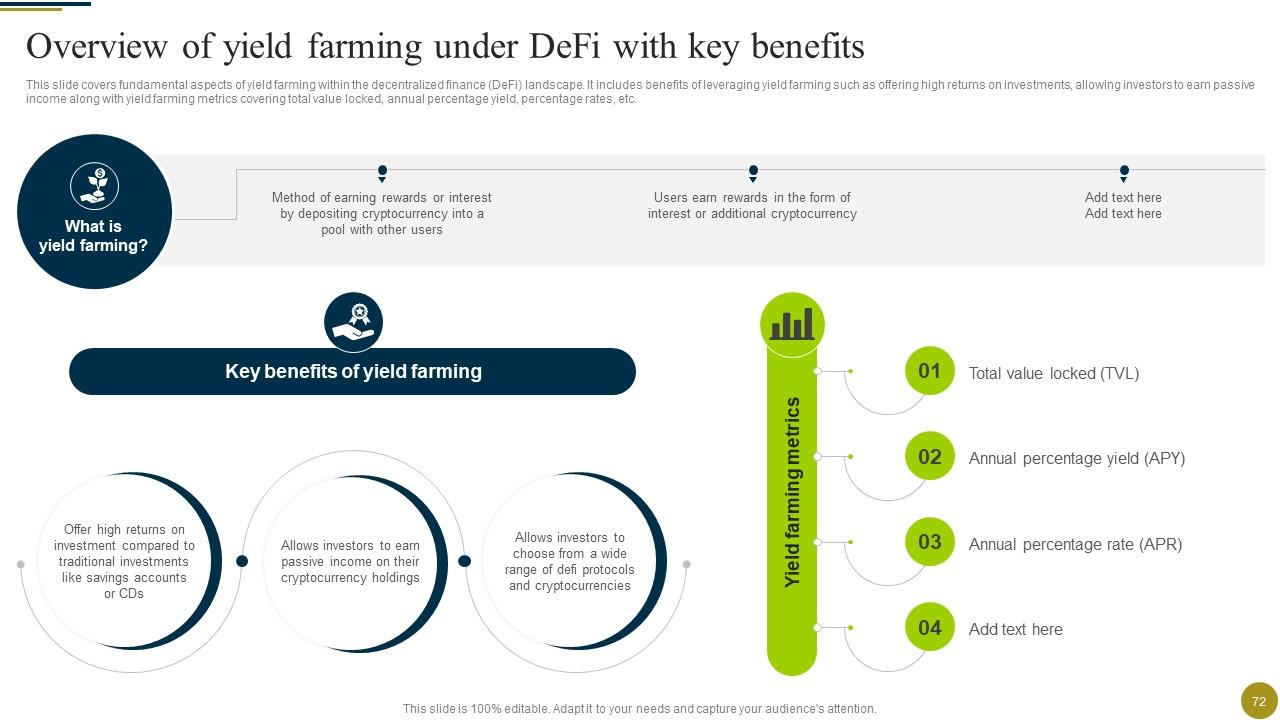

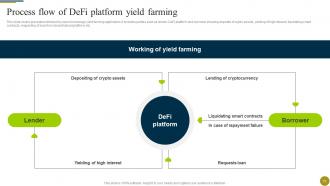

Slide 72: This slide covers fundamental aspects of yield farming within the decentralized finance (DeFi) landscape.

Slide 73: This slide covers significance of investor yield farming strategies within the decentralized finance (DeFi) landscape.

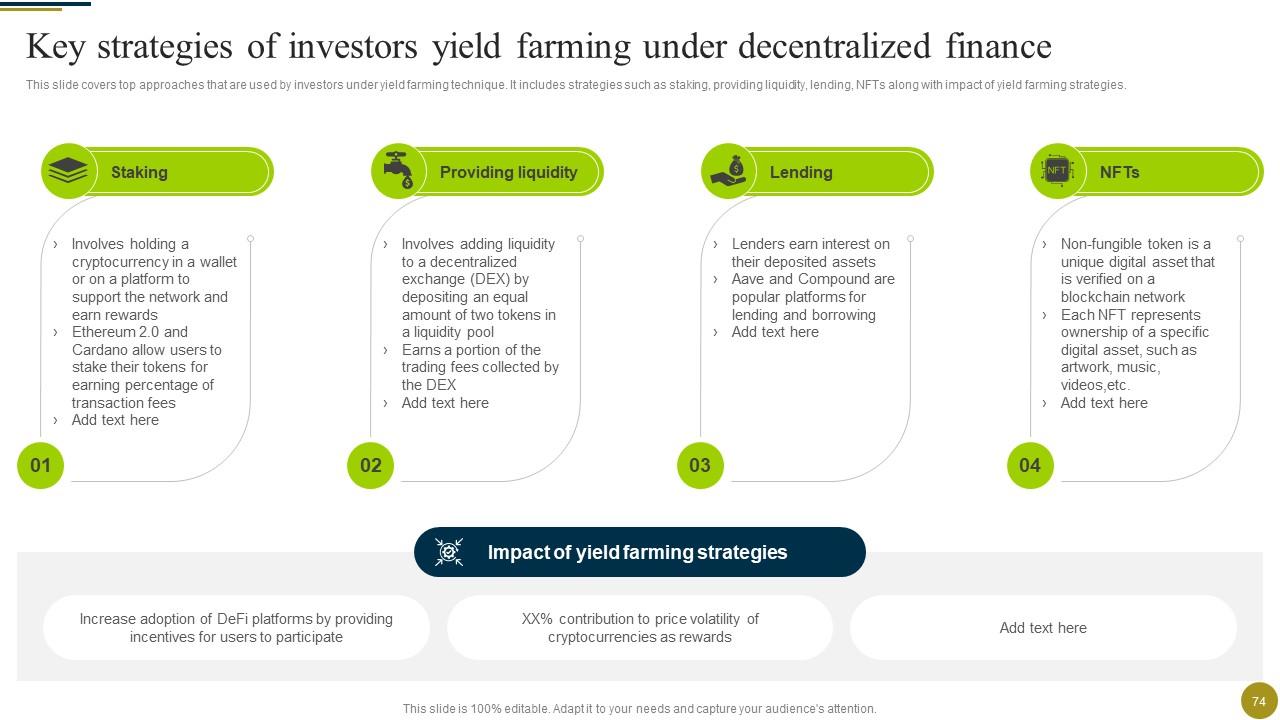

Slide 74: This slide contains top approaches that are used by investors under yield farming technique.

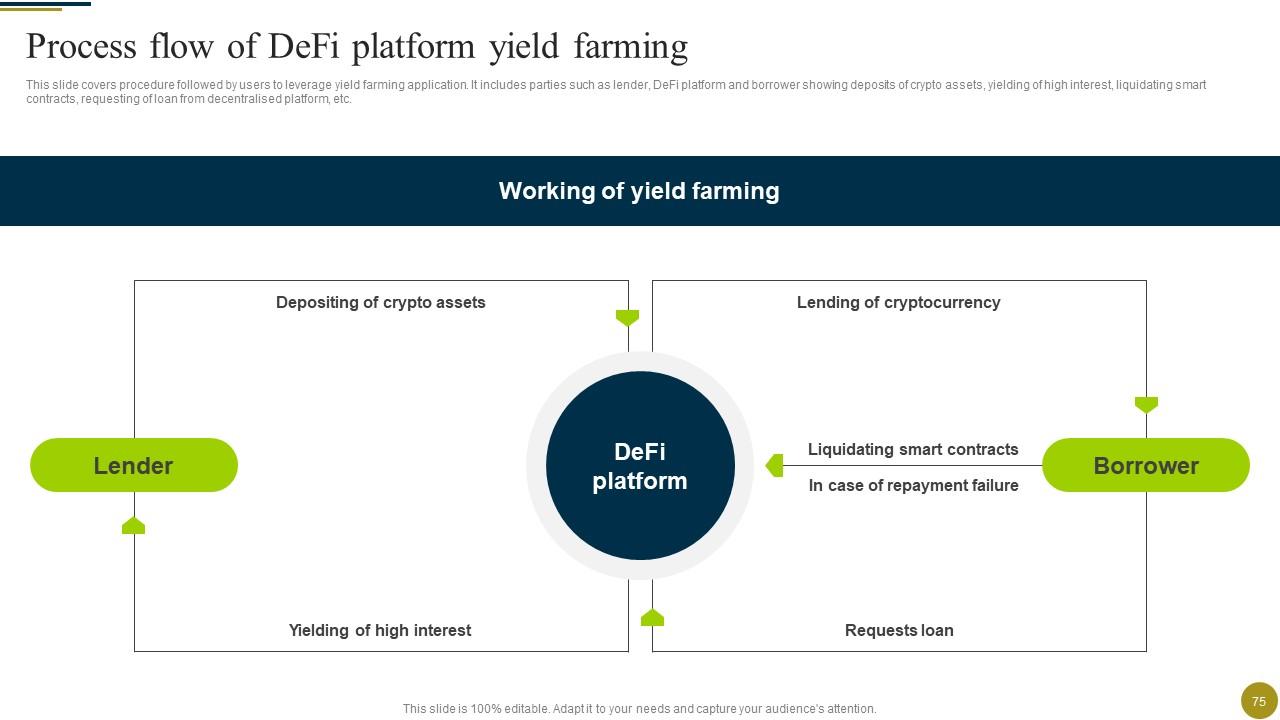

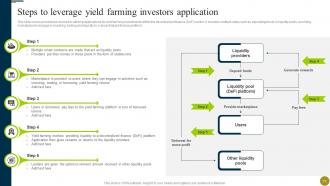

Slide 75: This slide represents procedure followed by users to leverage yield farming application.

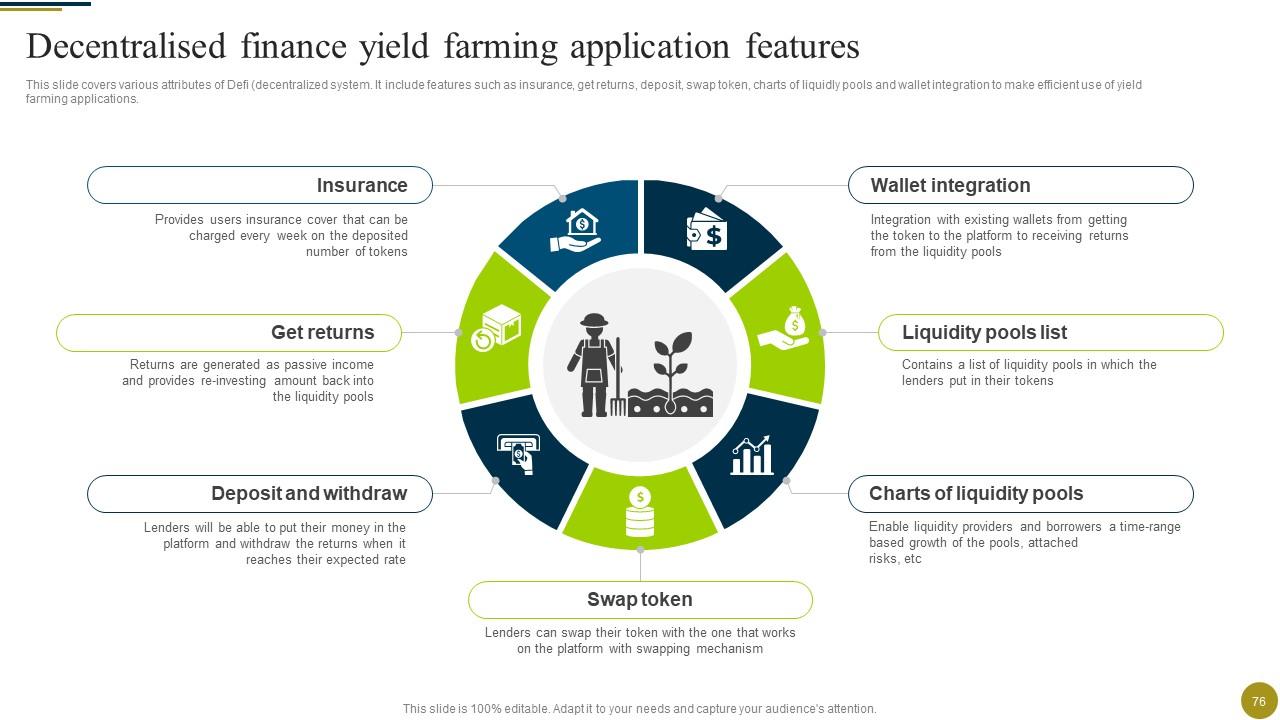

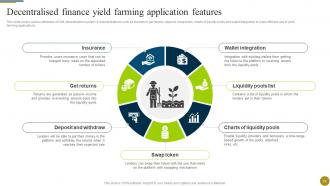

Slide 76: This slide describes various attributes of Defi (decentralized system).

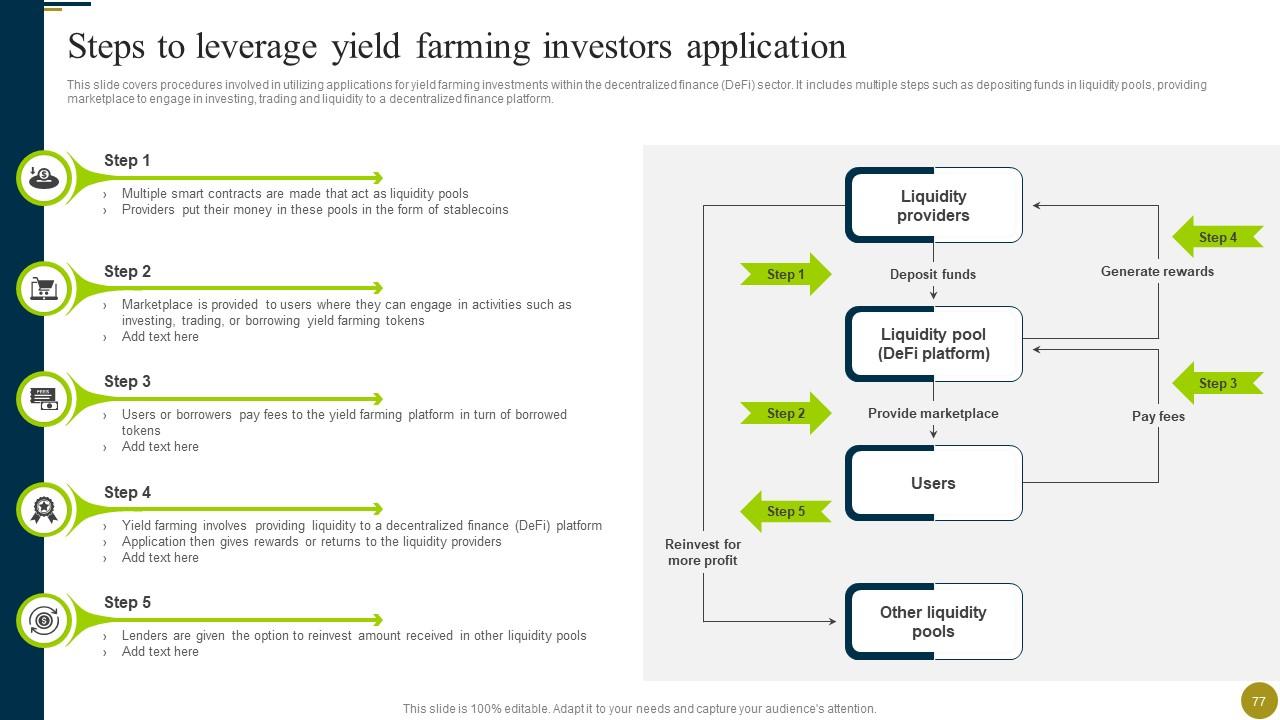

Slide 77: This slide covers procedures involved in utilizing applications for yield farming investments within the decentralized finance (DeFi) sector.

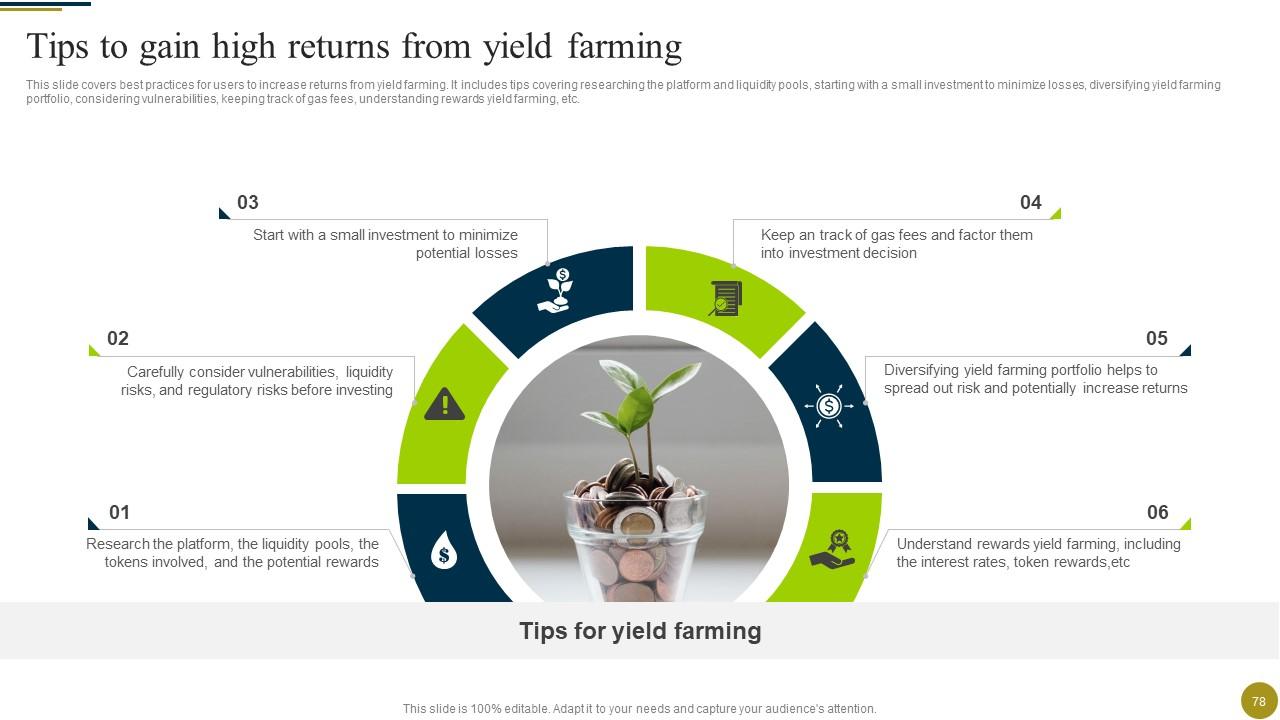

Slide 78: This slide highlights best practices for users to increase returns from yield farming.

Slide 79: This slide covers list of the top-performing yield farming projects, ranking them based on criteria.

Slide 80: The slide depicts Title of contents further.

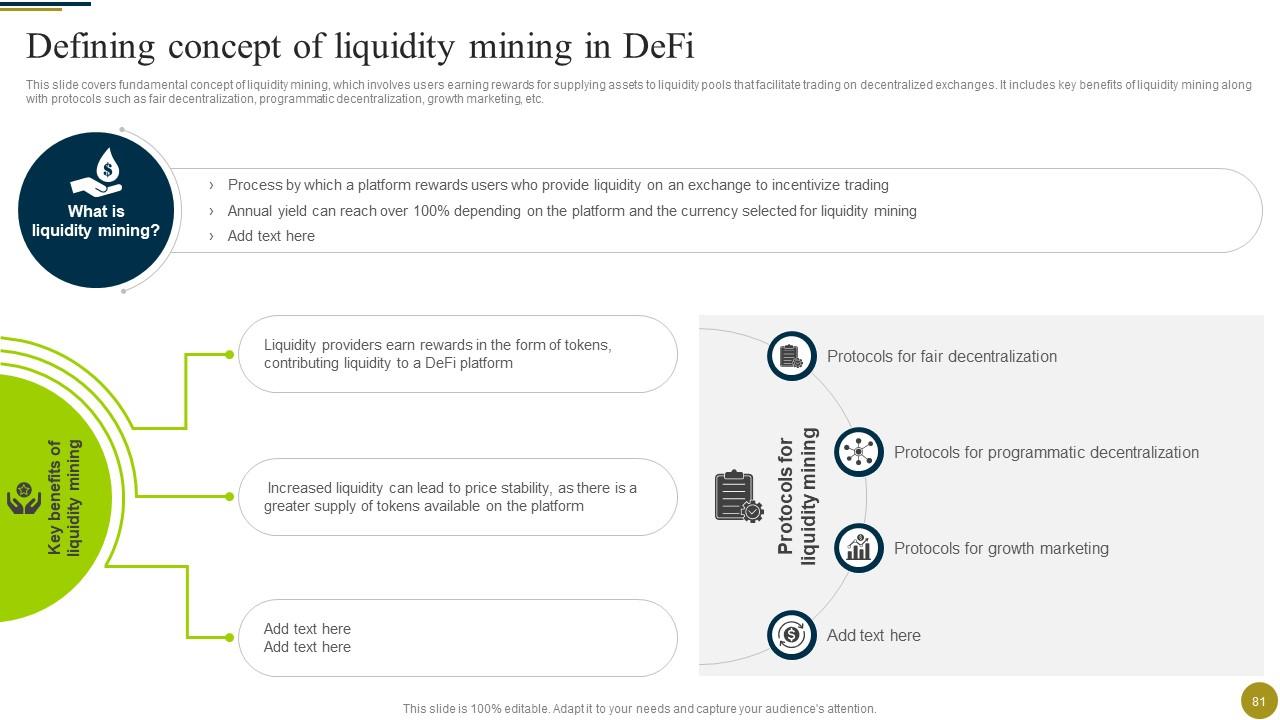

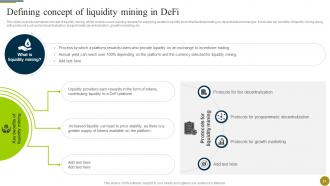

Slide 81: This slide covers fundamental concept of liquidity mining, which involves users earning rewards for supplying assets to liquidity pools.

Slide 82: This slide contains process of participating in liquidity mining within decentralized finance (DeFi).

Slide 83: The slide displays Title of contents which is to be discussed further.

Slide 84: This slide covers brief summary of DeFi predictive markets helping individuals and organizations understand its mechanism.

Slide 85: This slide highlights internal workings of decentralized predictive markets.

Slide 86: This slide covers complexities and risks of decentralized prediction markets.

Slide 87: The slide displays Title of contents further.

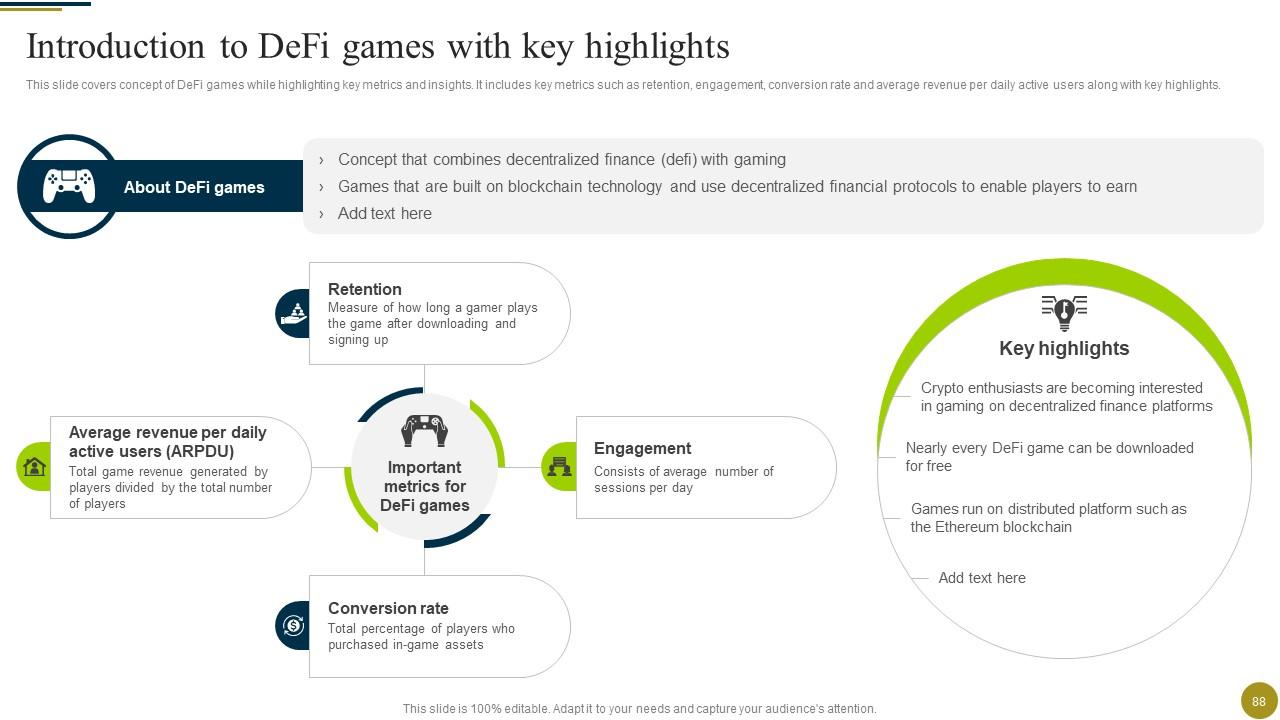

Slide 88: This slide covers concept of DeFi games while highlighting key metrics and insights.

Slide 89: This slide highlights essential role that decentralized finance (DeFi) plays within the gaming industry.

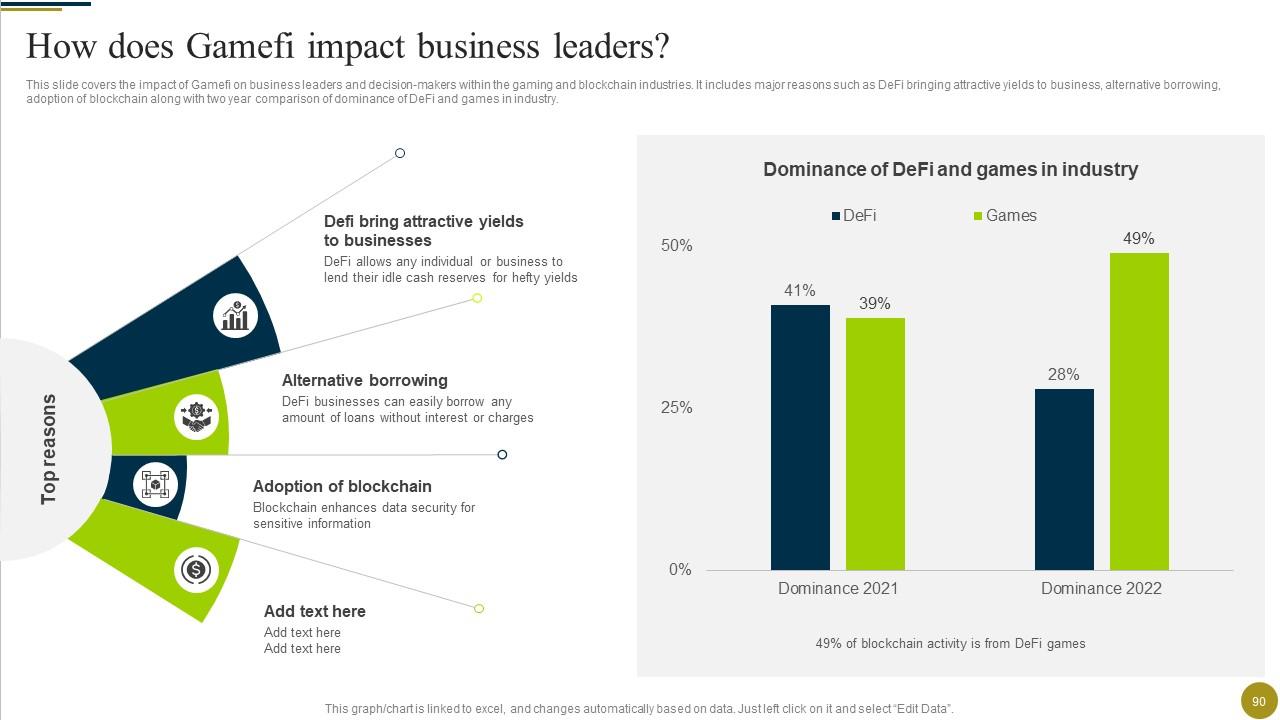

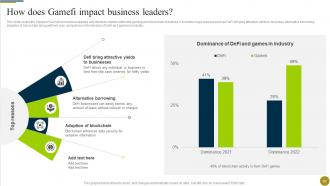

Slide 90: This slide presents the impact of Gamefi on business leaders and decision-makers within the gaming and blockchain industries.

Slide 91: This slide covers various methods through which individuals can generate income by playing decentralized finance (DeFi) games.

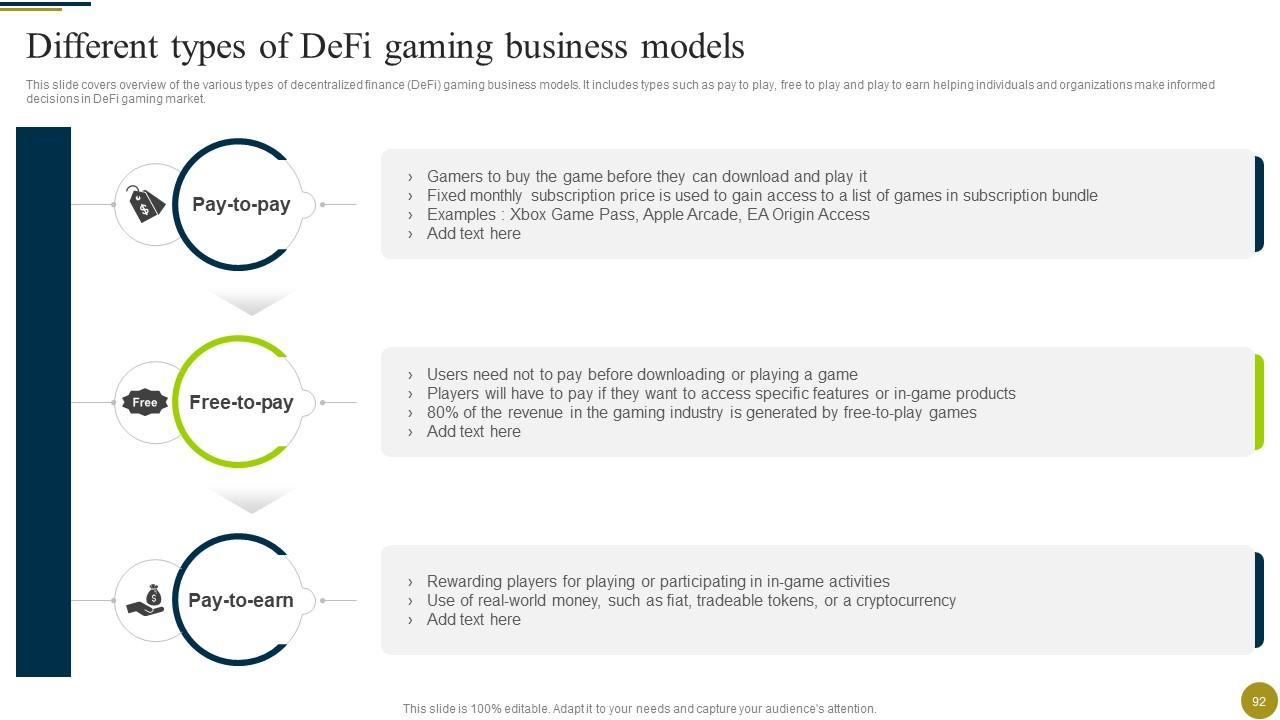

Slide 92: This slide gives an overview of the various types of decentralized finance (DeFi) gaming business models.

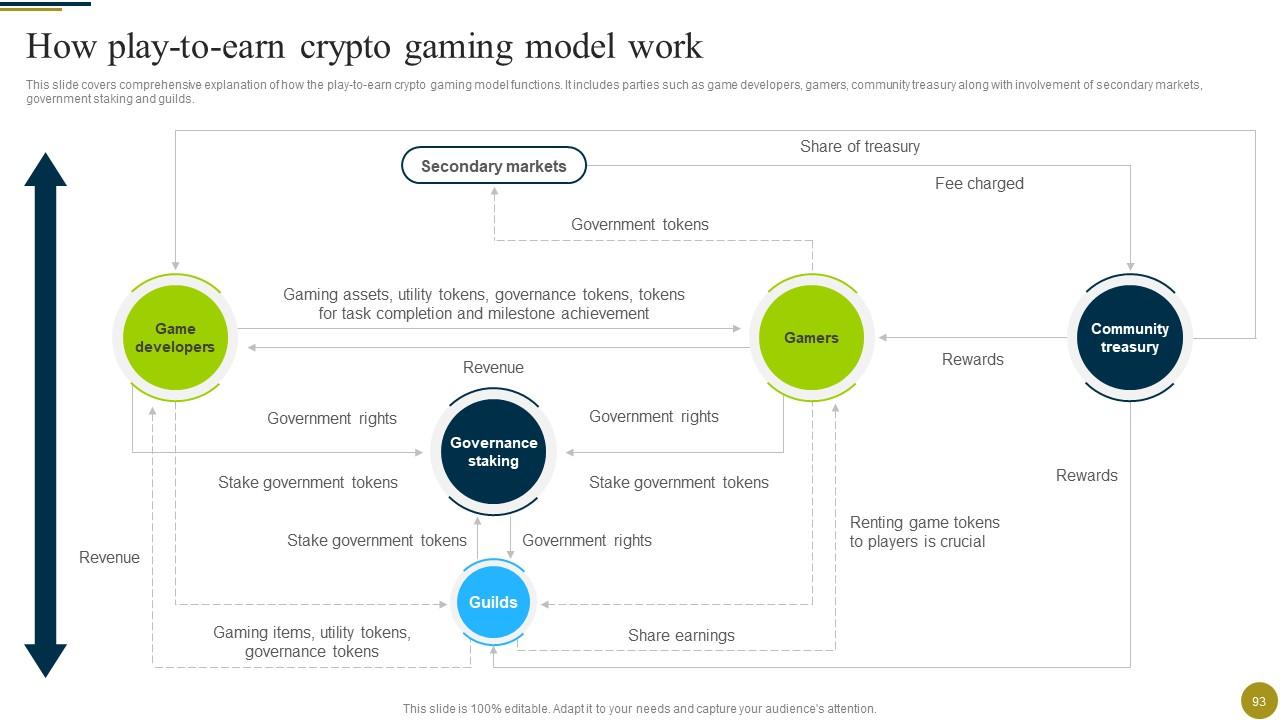

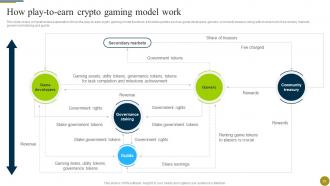

Slide 93: This slide contains comprehensive explanation of how the play-to-earn crypto gaming model functions.

Slide 94: This slide shows specific use case within the world of decentralized finance (DeFi) related to the popular blockchain-based game, AXIE INFINITY.

Slide 95: This slide shows all the icons included in the presentation.

Slide 96: This is a Thank You slide with address, contact numbers and email address.

Understanding Role Of Decentralized Finance Defi In A Digital Economy BCT CD with all 105 slides:

Use our Understanding Role Of Decentralized Finance Defi In A Digital Economy BCT CD to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Fantastic and innovative graphics with useful content. The templates are the best and latest in the industry.

-

The slides are remarkable with creative designs and interesting information. I am pleased to see how functional and adaptive the design is. Would highly recommend this purchase!