Bank mortgage procedure powerpoint presentation slides

Introducing Bank Mortgage Procedure PowerPoint Presentation Slides. Showcase the company overview with mission, vision, values, products, and services offered, client testimonials, etc. with this effective PowerPoint presentation. Take the assistance of this ready-to-use PowerPoint visual, to mention the need for a business loan in the organization such as to purchase real estate, equipment, inventory, increase working capital, etc. the With the use of our readily available PowerPoint slideshow, you can discuss the types of business loans offered with advantages and disadvantages of each type of loan. Describe features and benefits of loan which constitutes financial flexibility, easy availability, convenient tenure, tax benefits. By utilizing this business loan PowerPoint graphic, you can present the competitive landscape of business loans. Provide an overview of the loan process by describing the mortgage program and rates, application, processing, required documents, credit reports, appraisal basics with these visually appealing PPT themes. The steps required for processing the loan can be easily displayed using this PowerPoint slide deck.

Introducing Bank Mortgage Procedure PowerPoint Presentation Slides. Showcase the company overview with mission, vision, val..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Bank Mortgage Procedure Powerpoint Presentation Slides.This PPT is compatible with Google Slides, which is an added advantage. The presentation is completely customizable in PowerPoint and other related software. You can easily modify the font style, font color, and other components with ease. Transform this PPT into numerous documents or image formats like PDF or JPEG. High-quality graphics ensure that the picture quality is maintained.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This title slide introduces the Bank Mortgage Procedure. Add the name of your company here.

Slide 2: This is the Agenda slide of the Loan Process. It includes - Educate clients and potential customers about the company and its loan offerings, Evaluate the borrower's ability and willingness to repay a loan, etc.

Slide 3: This slide contains the Table of Contents. It includes - Company Overview, Need of Business Loan in the Organization, Types of Business Loans Offered, etc.

Slide 4: This is a table of content slide showing the Company Overview.

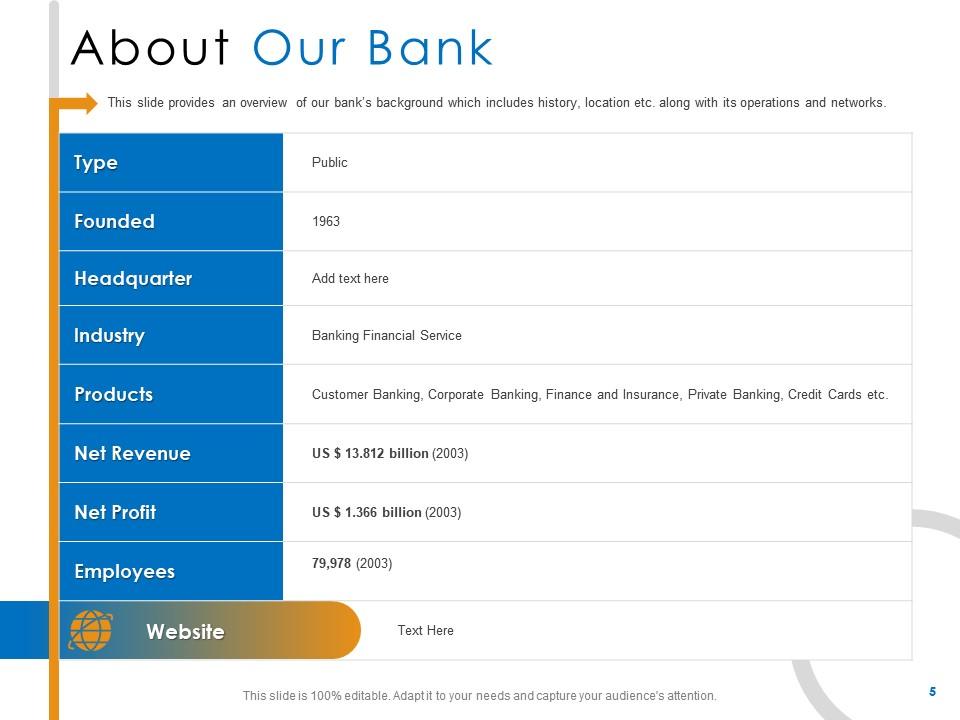

Slide 5: This slide presents About Our Bank. It provides an overview of our bank’s background which includes history, location, etc. along with its operations and networks.

Slide 6: This slide presents Our Bank Team Members. It provides a glimpse of the bank’s important people who will help to make the business successful.

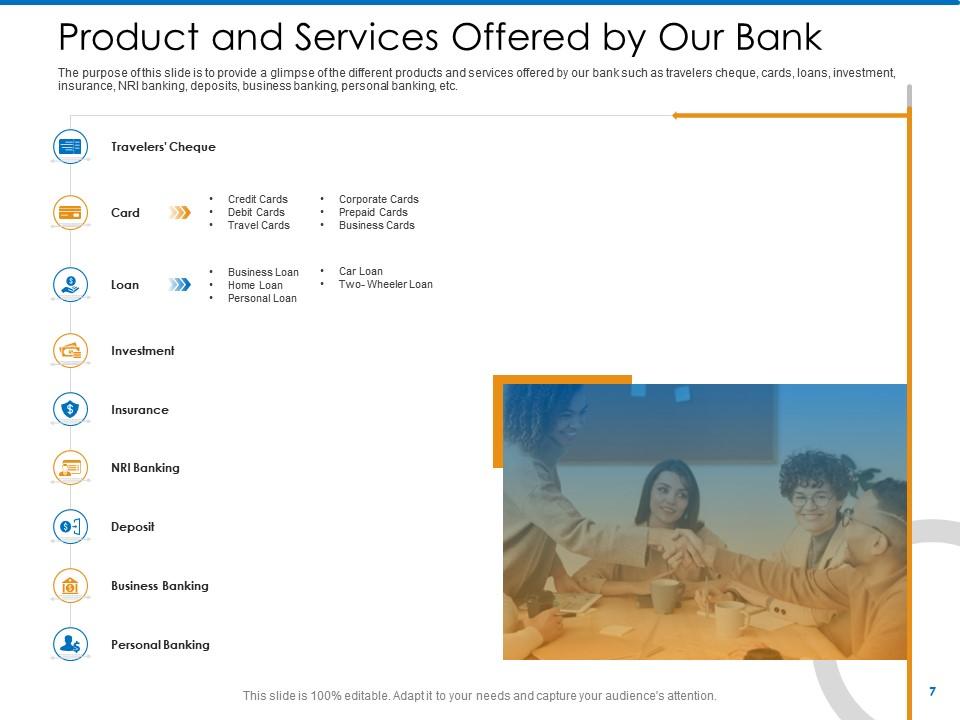

Slide 7: This slide presents the Product and Services Offered by Our Bank. It provides a glimpse of the different products and services offered by our bank.

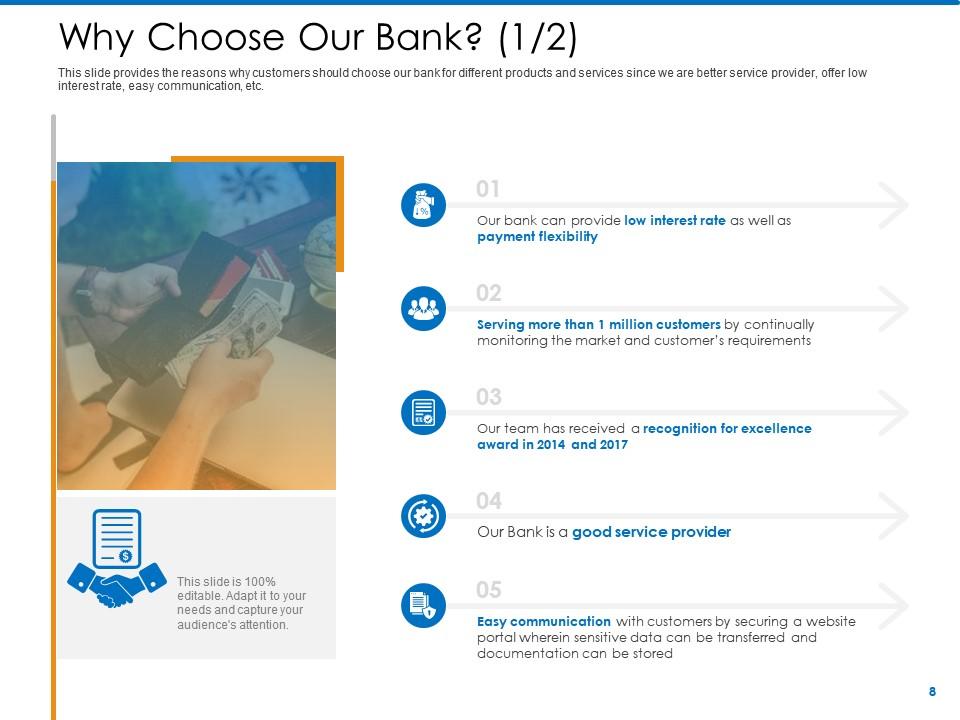

Slide 8: This slide presents Why Choose Our Bank? (1/2). It provides the reasons why customers should choose our bank for different products and services since we are a better service provider, offer low-interest rates, easy communication, etc.

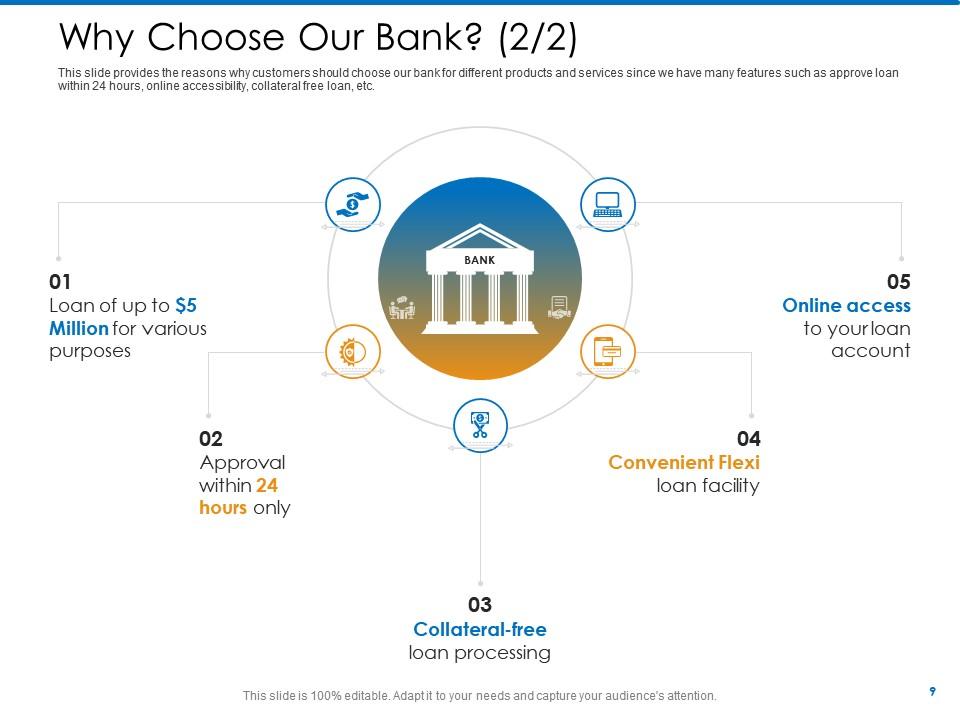

Slide 9: This slide presents Why Choose Our Bank? (2/2). It provides the reasons why customers should choose our bank for different products and services since we have many features such as approve loans within 24 hours, online accessibility, collateral-free loan, etc.

Slide 10: This slide presents Client Testimonials (1/20. It provides the testimonials of some of our clients to share their reviews and stories with our new customers.

Slide 11: This slide presents Client Testimonials (2/2).

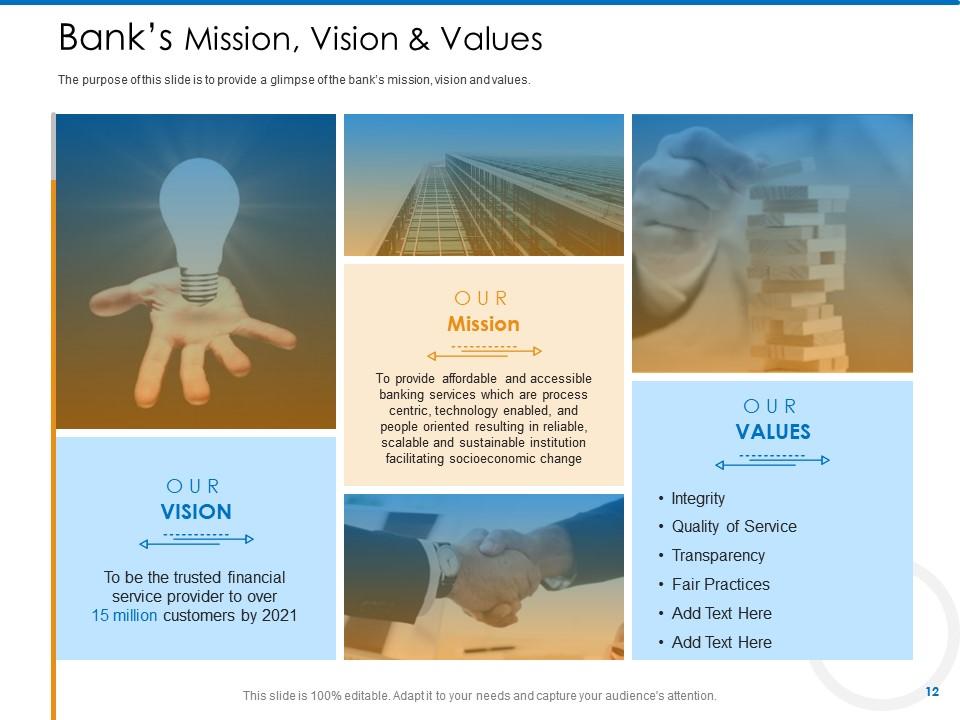

Slide 12: This slide presents Bank’s Mission, Vision & Values.

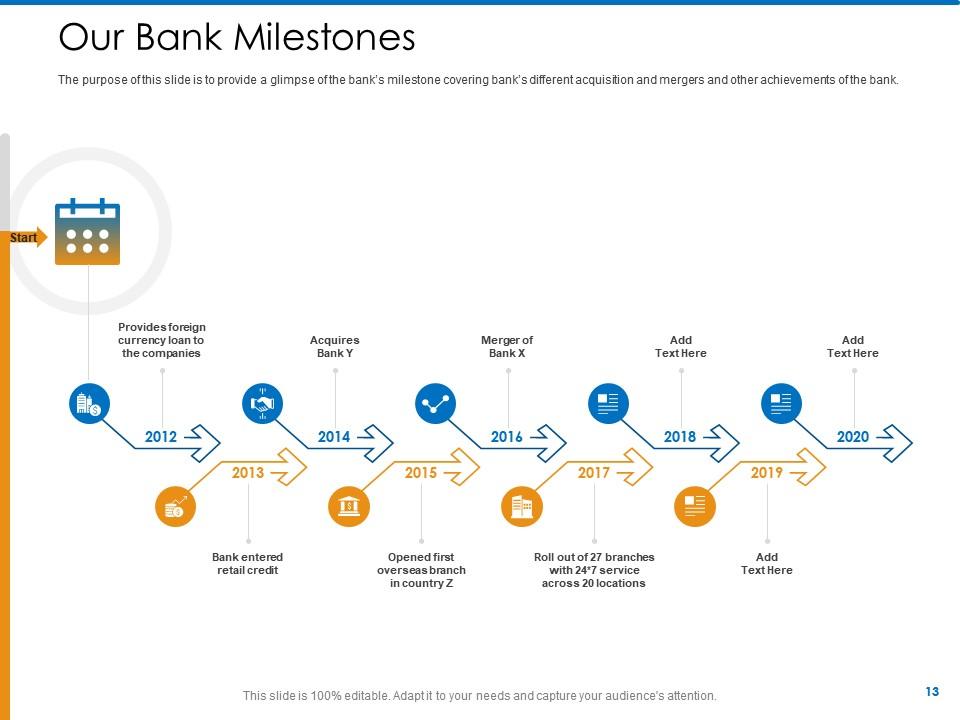

Slide 13: This slide presents Our Bank Milestones. It provides a glimpse of the bank’s milestones covering the bank’s different acquisitions and mergers and other achievements of the bank.

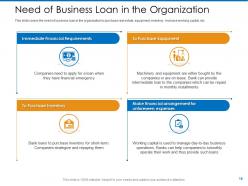

Slide 14: This is a table of content slide showing the Need for a Business Loan in the Organization.

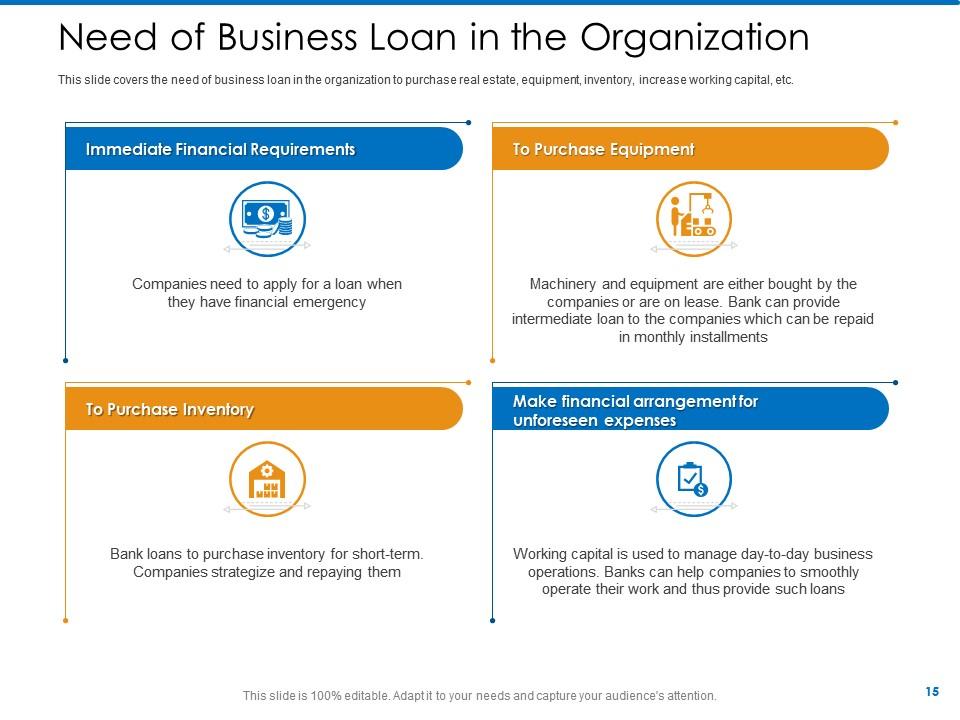

Slide 15: This slide presents the Need for a Business Loan in the Organization. It covers the need for business loans in the organization to purchase real estate, equipment, inventory, increase working capital, etc.

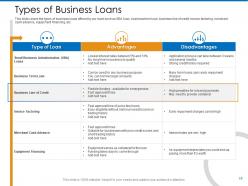

Slide 16: This is a table of content slide showing the Types of Business Loans Offered.

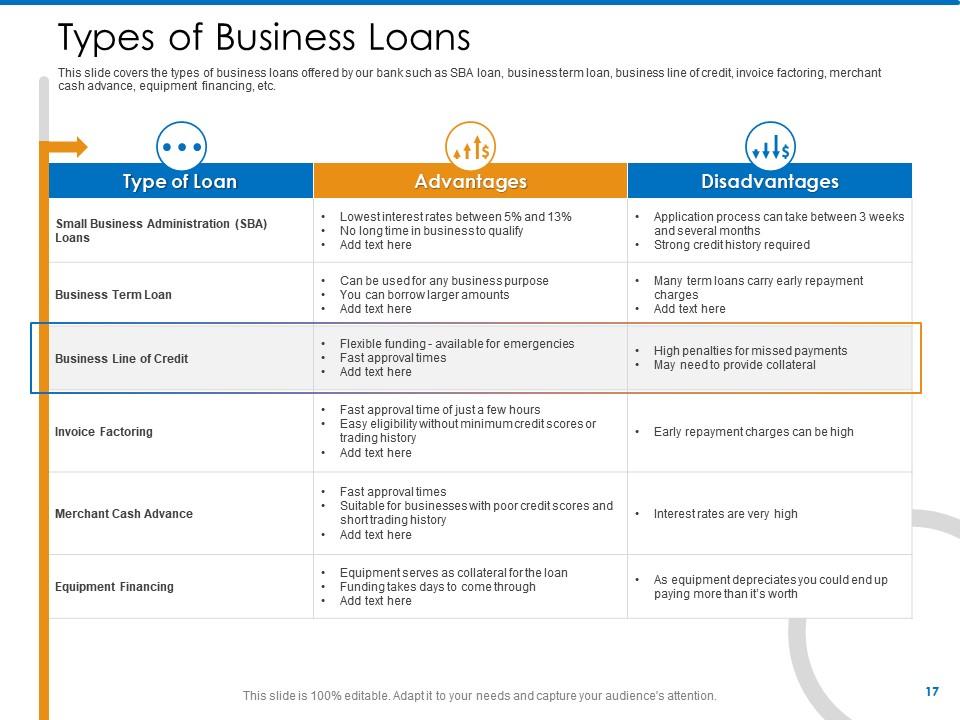

Slide 17: This slide presents the Types of Business Loans. It covers the types of business loans offered by our bank.

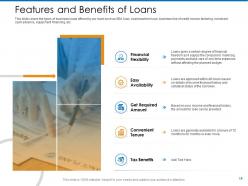

Slide 18: This is a table of content slide showing the Features & Benefits of Loans.

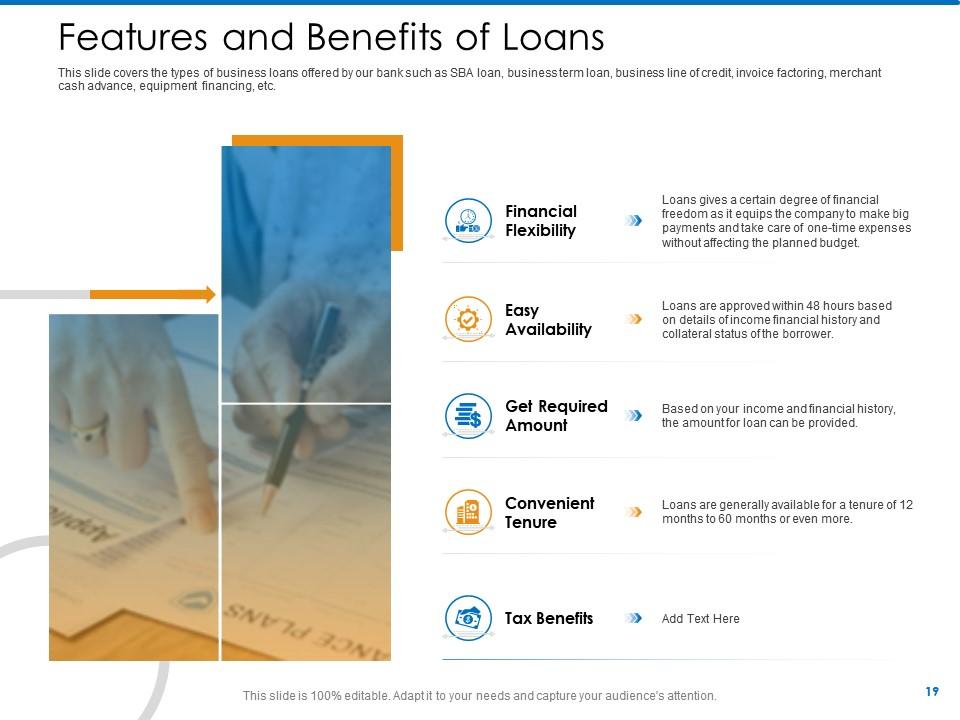

Slide 19: This slide presents the Features and Benefits of Loans. It covers the types of business loans offered by our bank.

Slide 20: This is a table of content slide showing the Competitive Landscape of Business Loans.

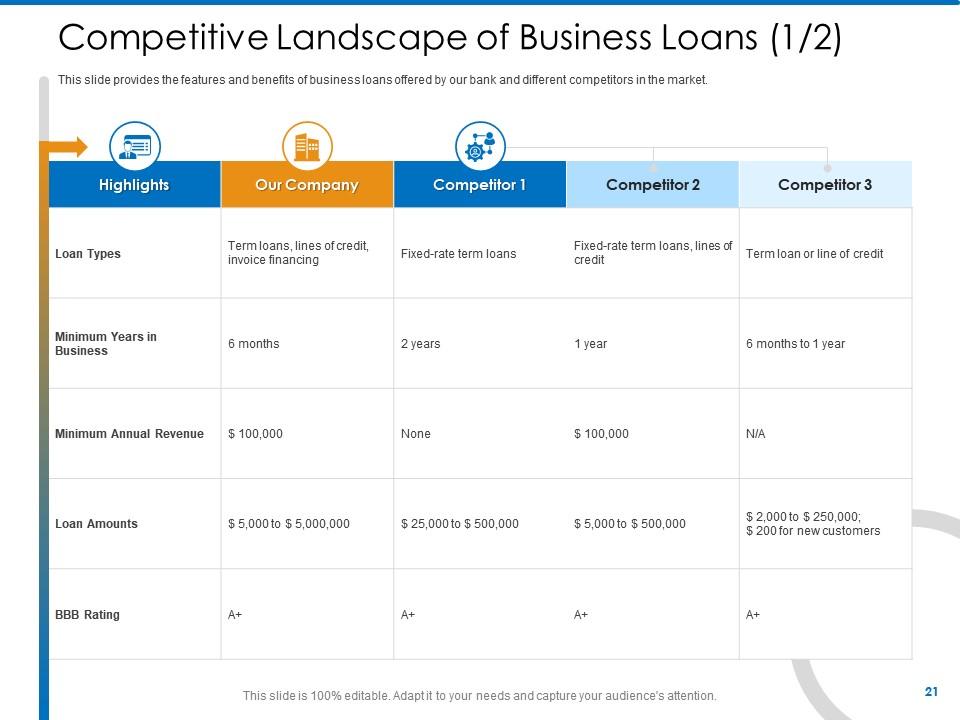

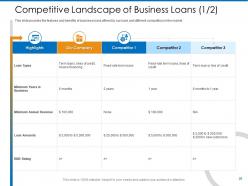

Slide 21: This slide presents the Competitive Landscape of Business Loans (1/2). It provides the features and benefits of business loans offered by our bank and different competitors in the market.

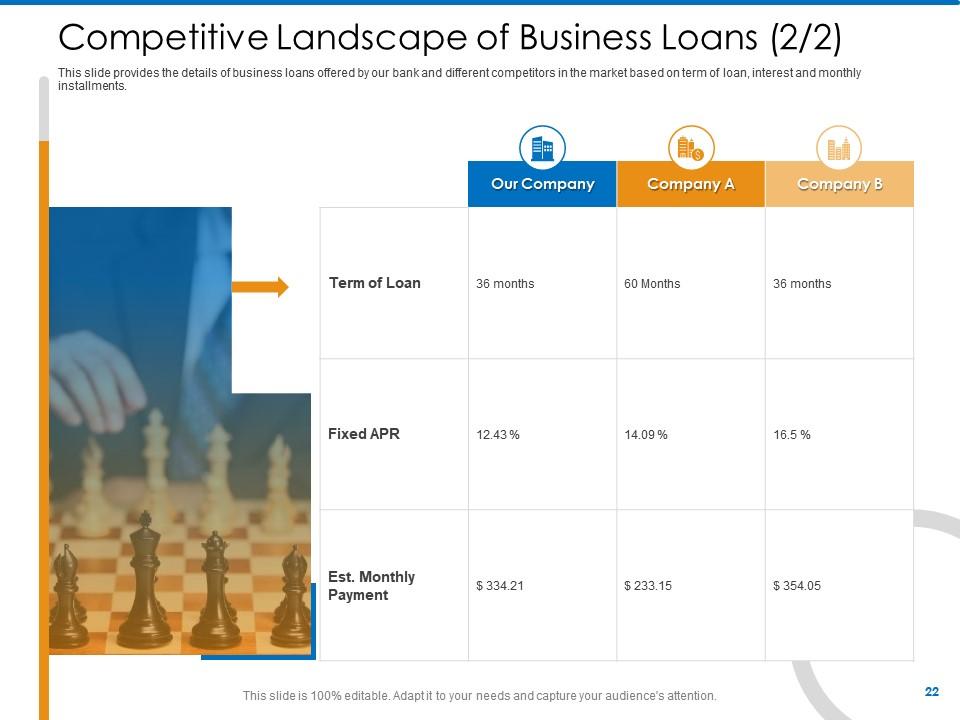

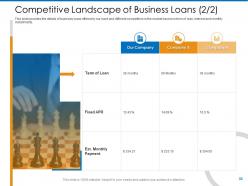

Slide 22: This slide presents the Competitive Landscape of Business Loans (2/2).

Slide 23: This is a table of content slide showing the Loan Process.

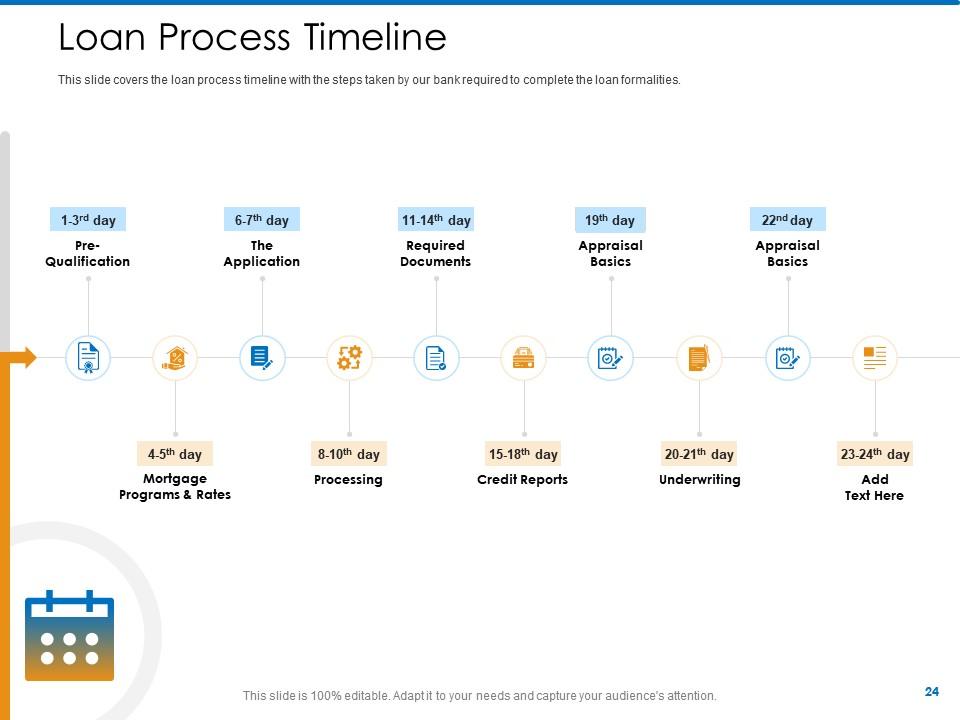

Slide 24: This slide presents the Loan Process Timeline. It covers the loan process timeline with the steps taken by our bank required to complete the loan formalities.

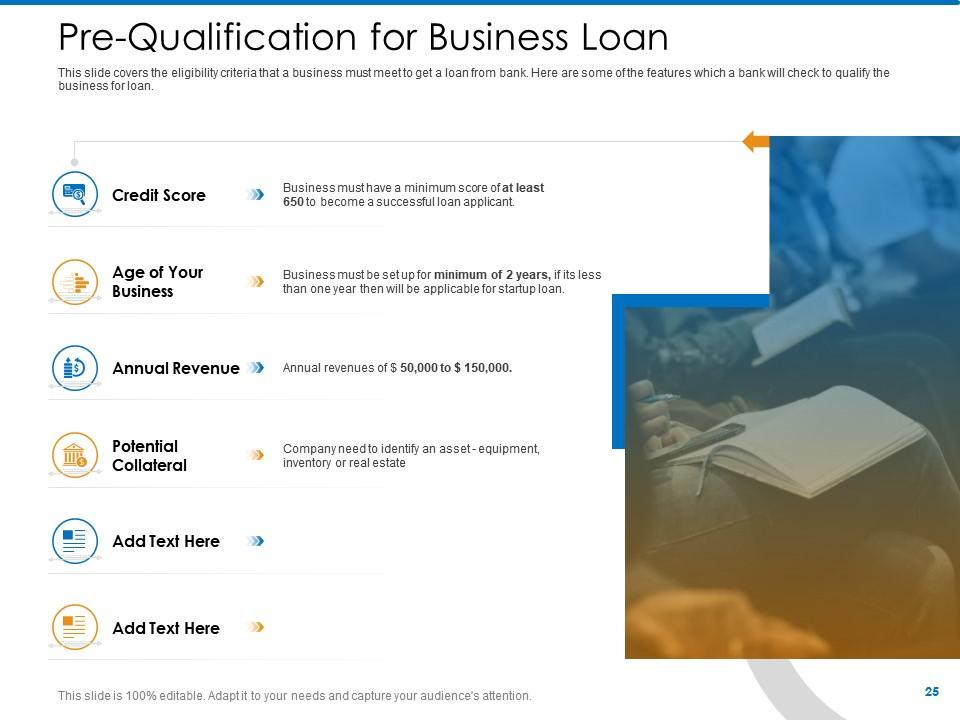

Slide 25: This slide presents the Pre-Qualification for Business Loan. It covers the eligibility criteria that a business must meet to get a loan from a bank.

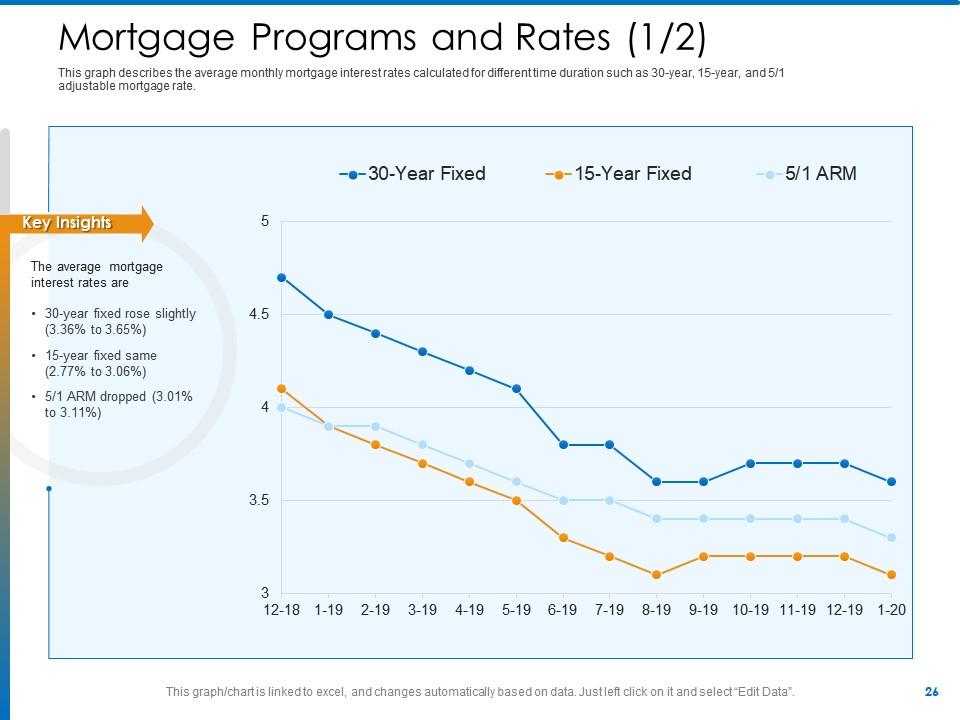

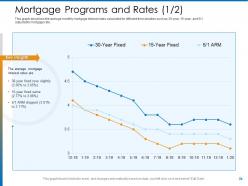

Slide 26: This slide presents the Mortgage Programs and Rates (1/2).

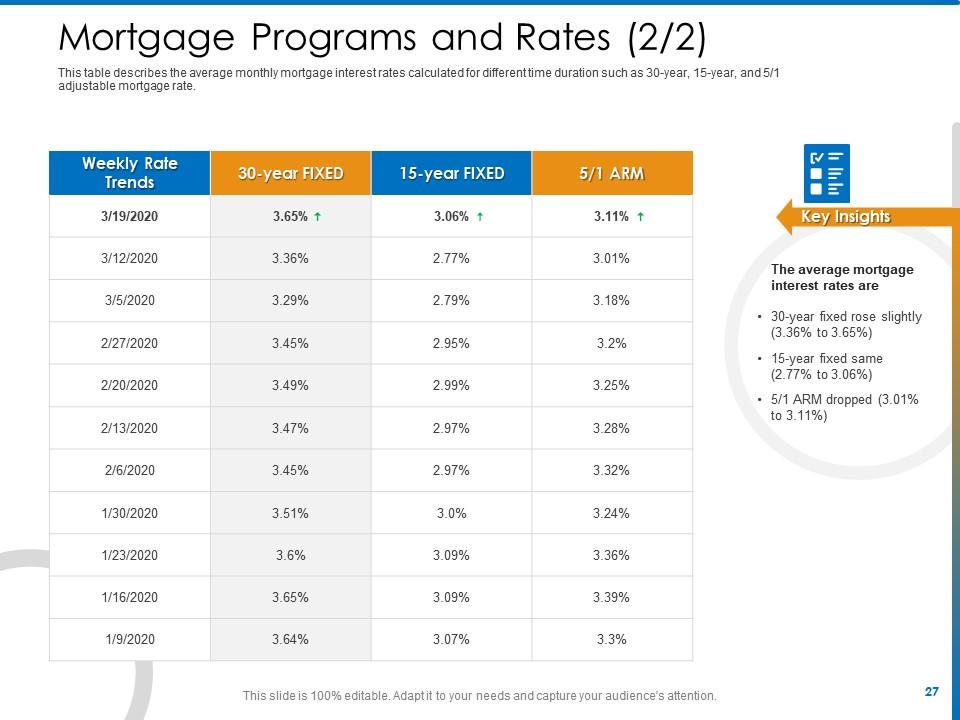

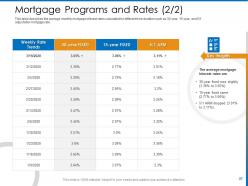

Slide 27: This slide presents the Mortgage Programs and Rates (2/2).

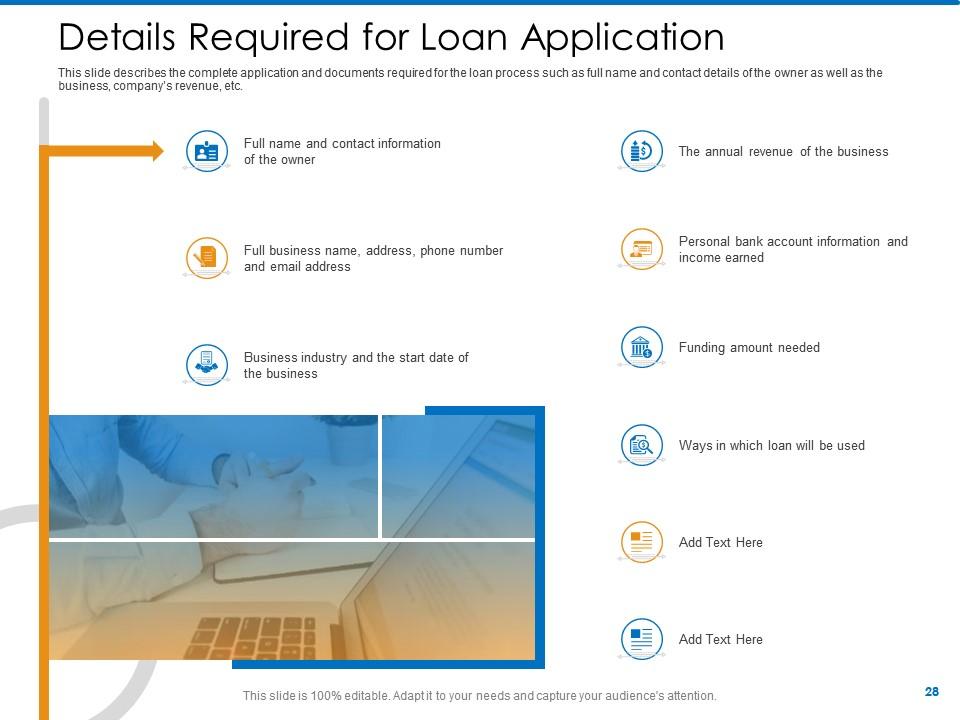

Slide 28: This slide presents the Details Required for the Loan Application. It describes the complete application and documents required for the loan process such as the full name and contact details of the owner as well as the business, company’s revenue, etc.

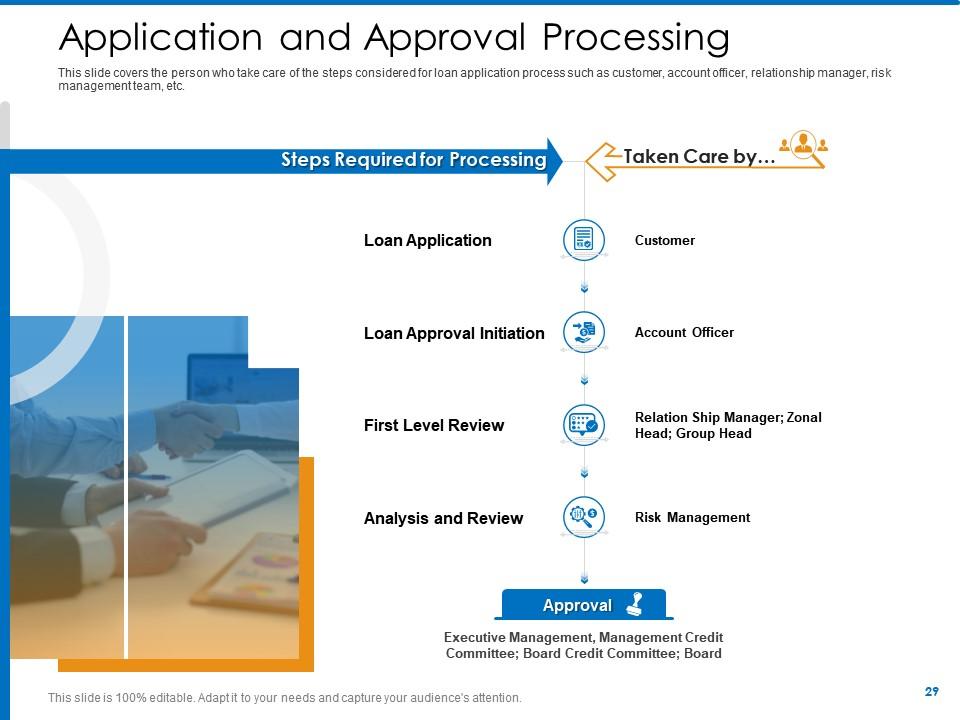

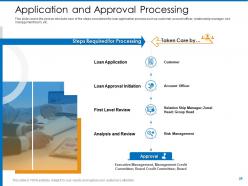

Slide 29: This slide presents the Application and Approval Processing. It covers the person who takes care of the steps considered for the loan application process.

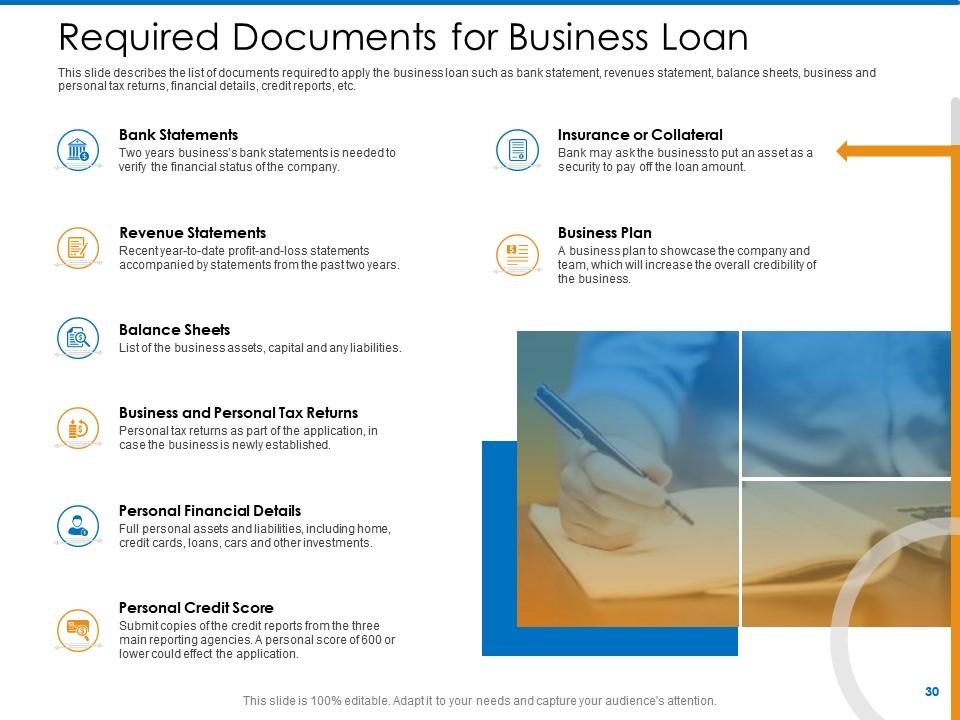

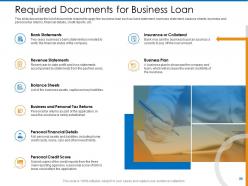

Slide 30: This slide presents the Required Documents for Business Loan. It describes the list of documents required to apply for the business loan.

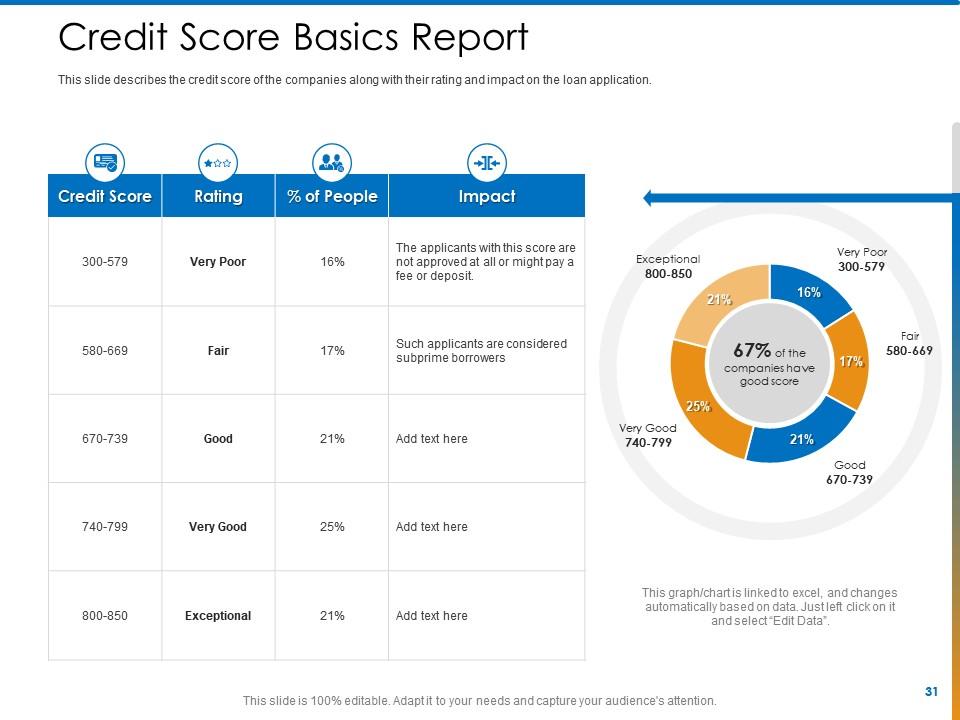

Slide 31: This slide presents the Credit Score Basics Report. It describes the credit score of the companies along with their rating and impact on the loan application.

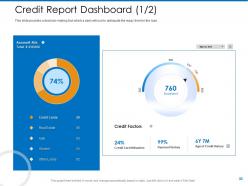

Slide 32: This slide presents the Credit Report Dashboard (1/2). It provides a decision-making tool that a bank will use to anticipate the repayment time for the loan.

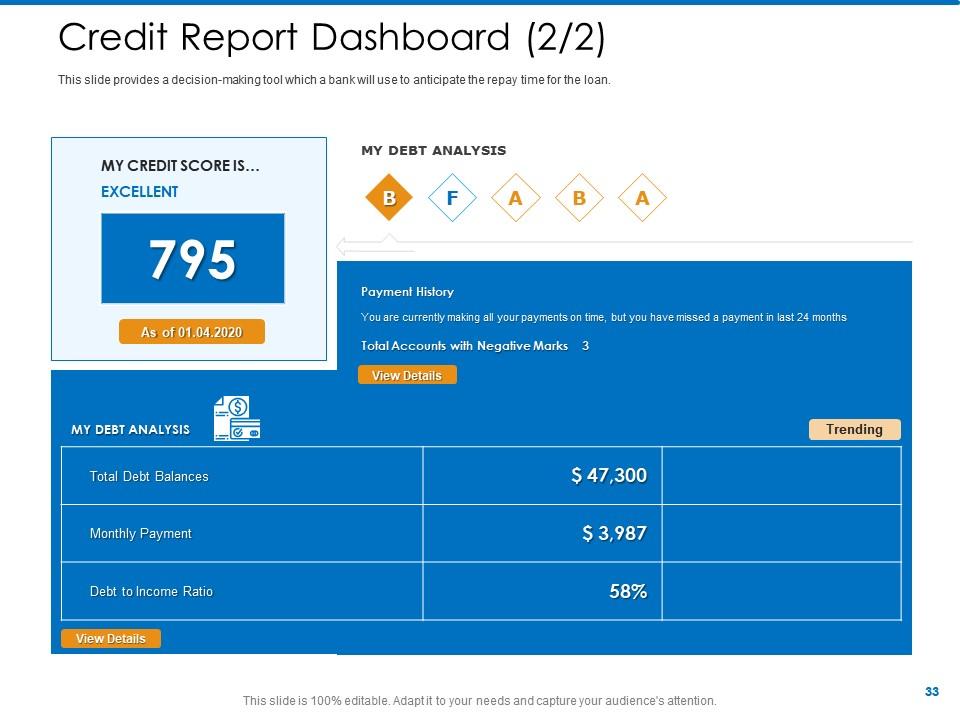

Slide 33: This slide presents the Credit Report Dashboard (2/2).

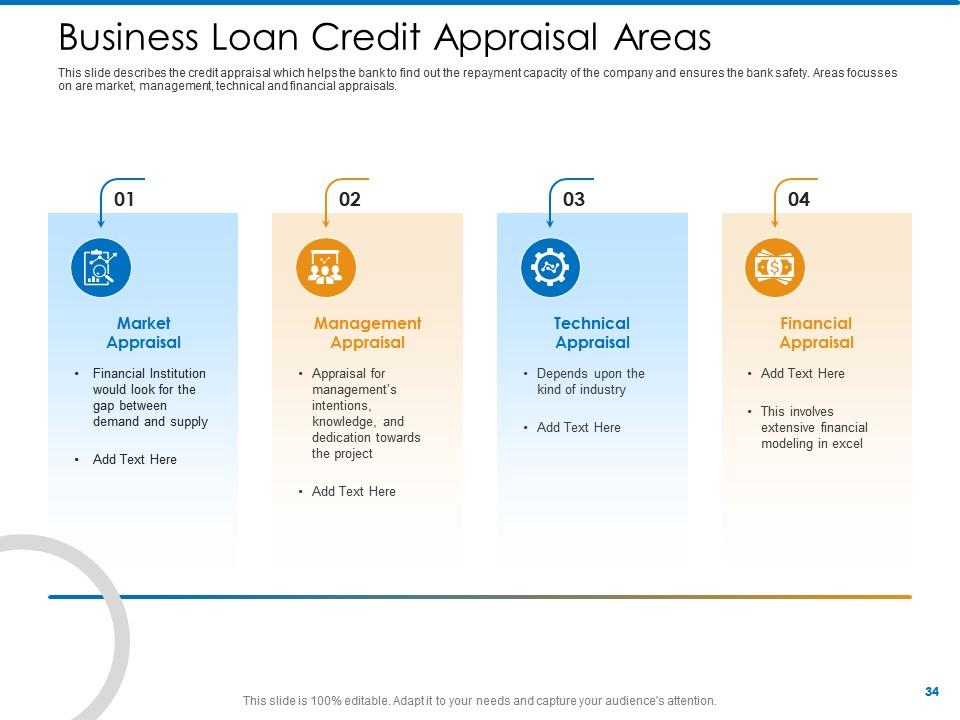

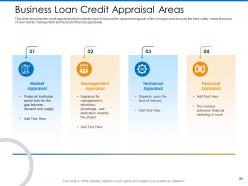

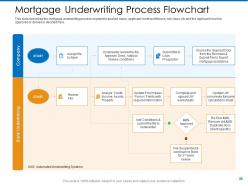

Slide 34: This slide presents the Business Loan Credit Appraisal Areas. It describes the credit appraisal which helps the bank to find out the repayment capacity of the company and ensures the bank's safety.

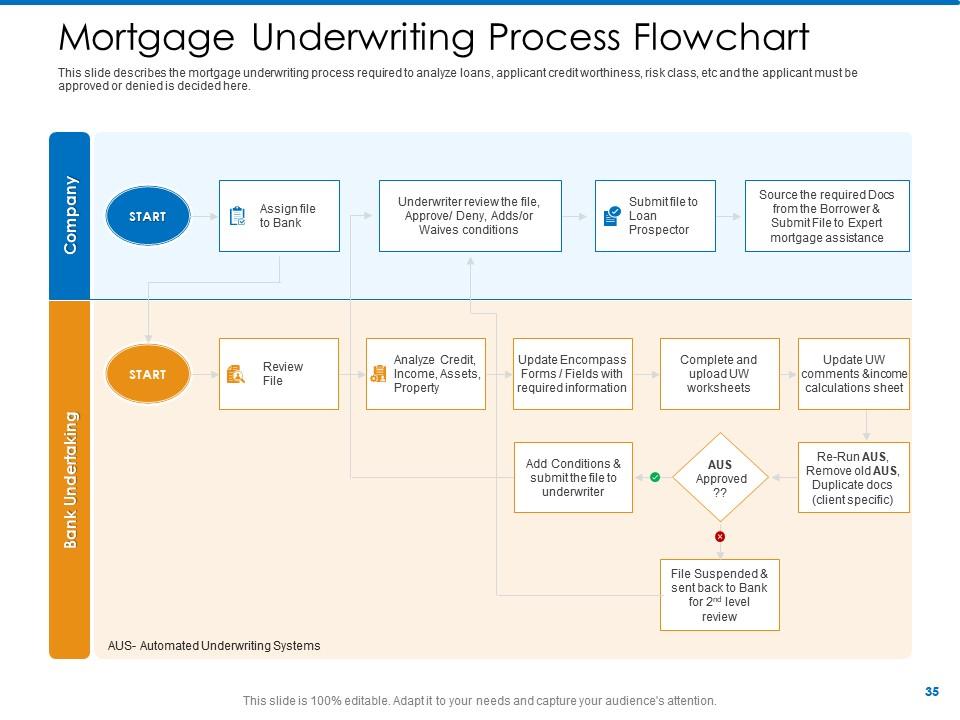

Slide 35: This slide presents the Mortgage Underwriting Process Flowchart. It describes the mortgage underwriting process required to analyze loans, applicant creditworthiness, risk class, etc, and the applicant must be approved or denied is decided here.

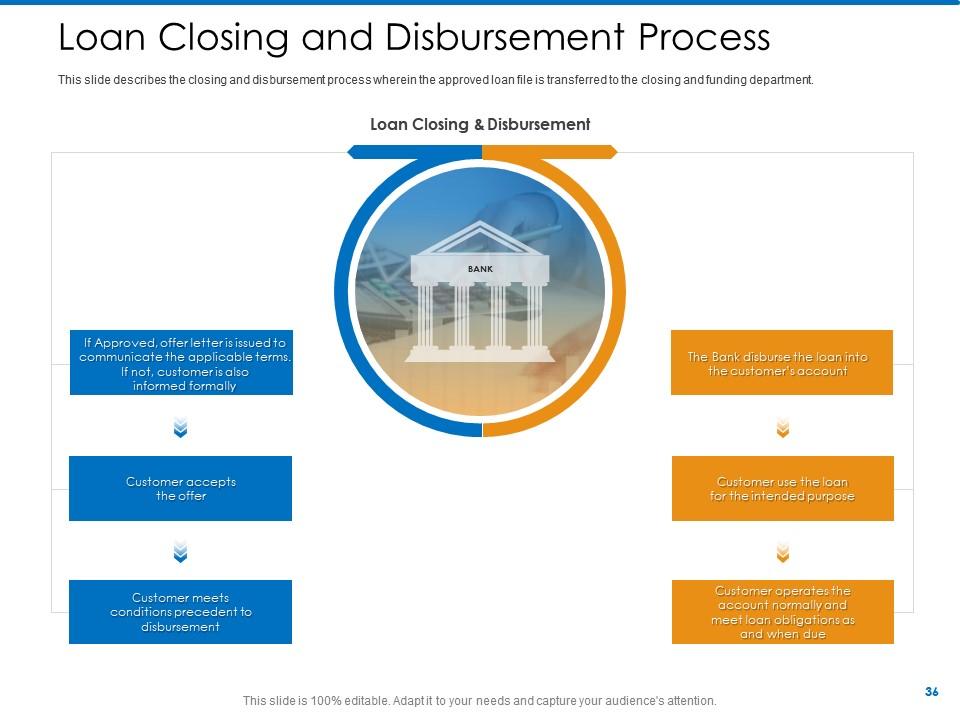

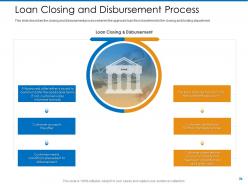

Slide 36: This slide presents the Loan Closing and Disbursement Process. It describes the closing and disbursement process wherein the approved loan file is transferred to the closing and funding department.

Slide 37: This is a table of content slide showing the Business Financing Application Checklist.

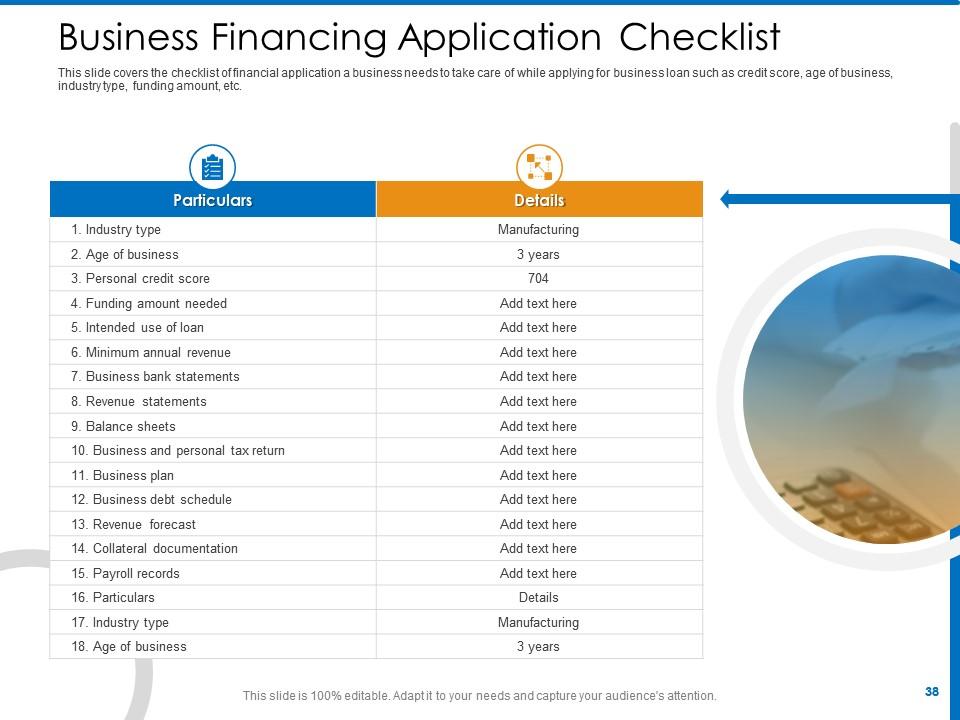

Slide 38: This slide presents the Business Financing Application Checklist. It covers the checklist of financial applications a business needs to take care of while applying for a business loan.

Slide 39: This is a table of content slide showing the Borrower’s Ability and Willingness to Repay Loan.

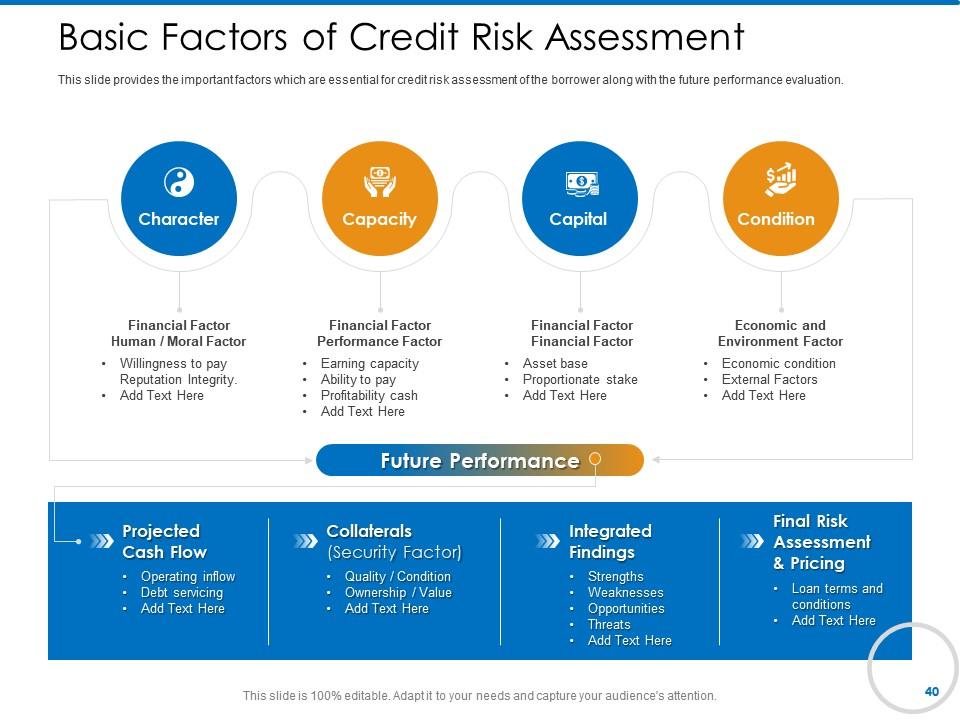

Slide 40: This slide presents the Basic Factors of Credit Risk Assessment. It provides the important factors which are essential for credit risk assessment of the borrower along with the future performance evaluation.

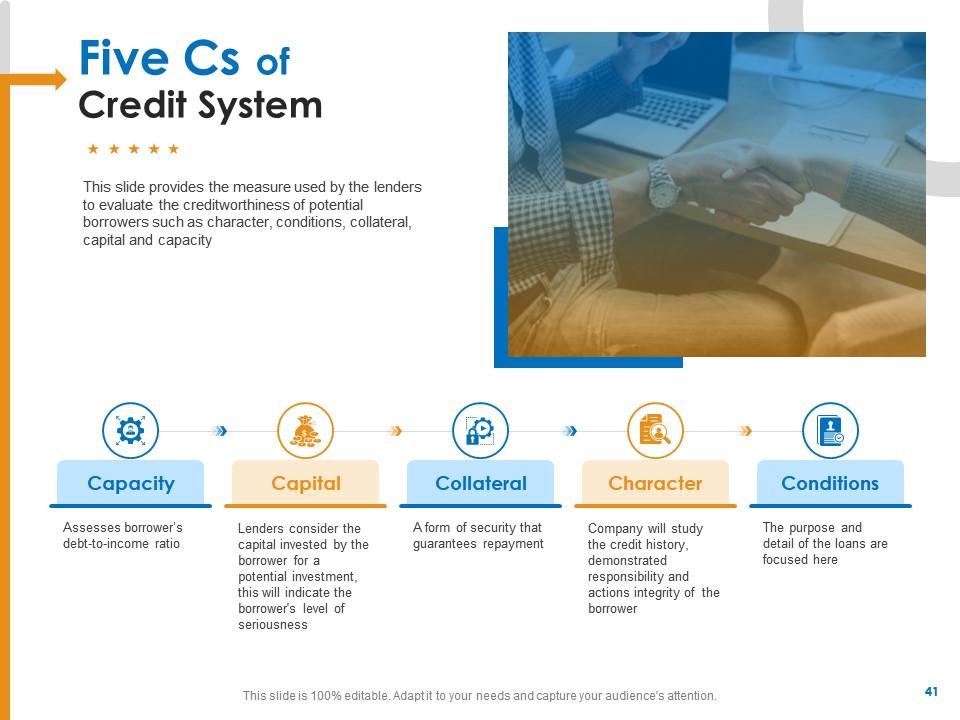

Slide 41: This slide presents the Five Cs of the Credit System. It provides the measure used by the lenders to evaluate the creditworthiness of potential borrowers such as character, conditions, collateral, capital, and capacity.

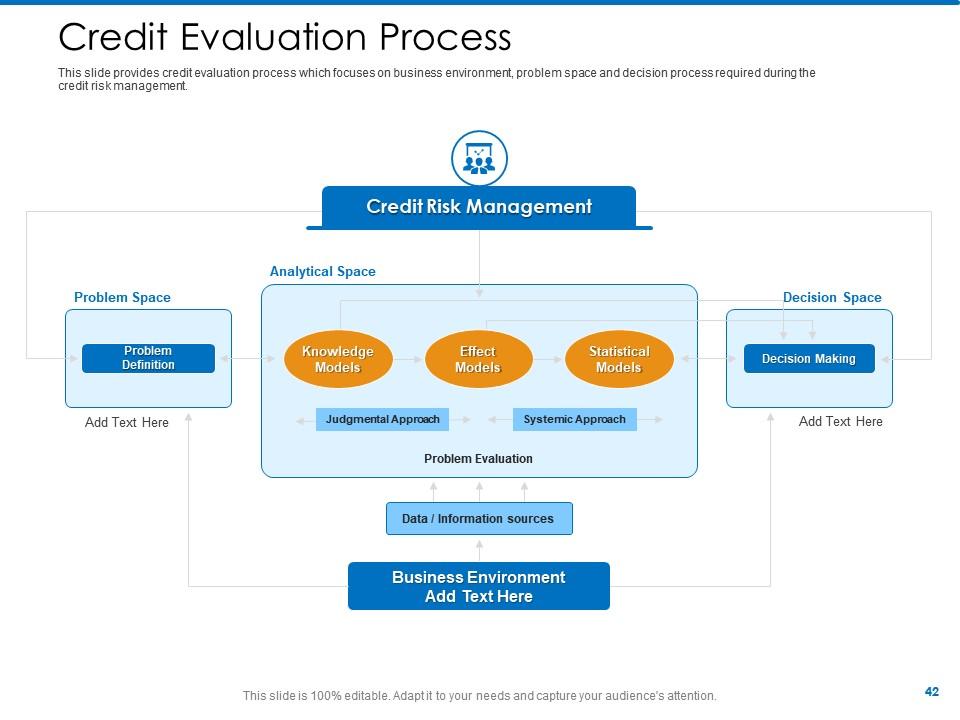

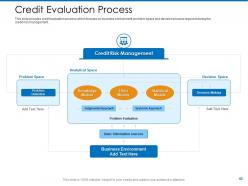

Slide 42: This slide presents the Credit Evaluation Process. It provides a credit evaluation process that focuses on the business environment, problem space, and decision process required during credit risk management.

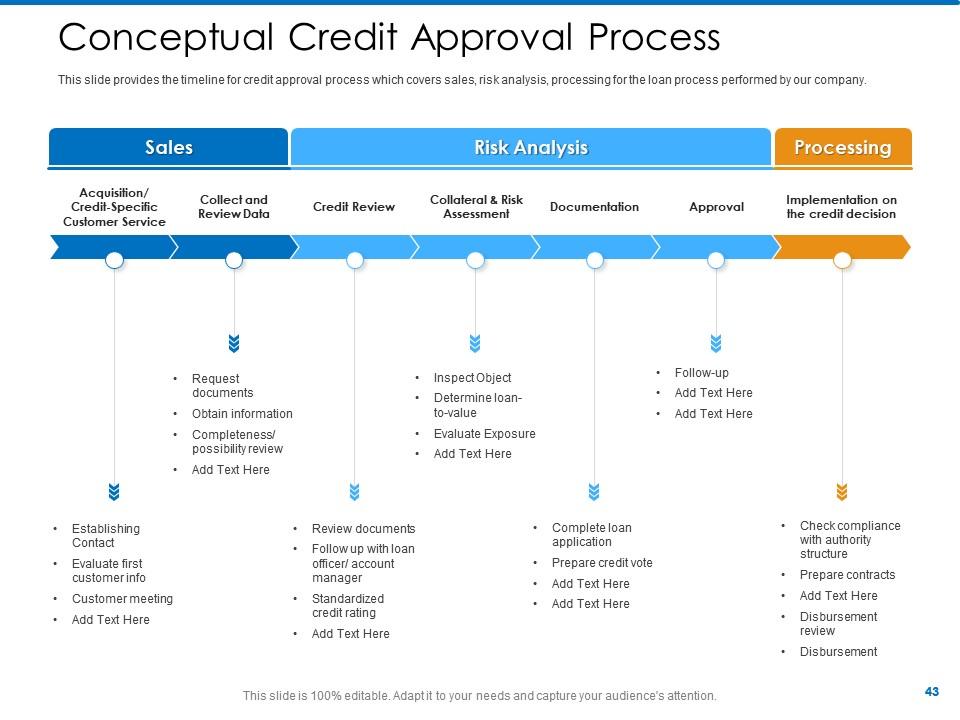

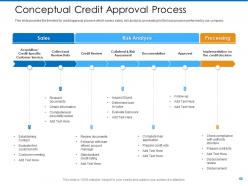

Slide 43: This slide presents the Conceptual Credit Approval Process. It provides the timeline for the credit approval process which covers sales, risk analysis, processing for the loan process performed by our company.

Slide 44: This is the Icons Slide for Bank Mortgage Procedure.

Slide 45: This slide introduces the Additional Slides.

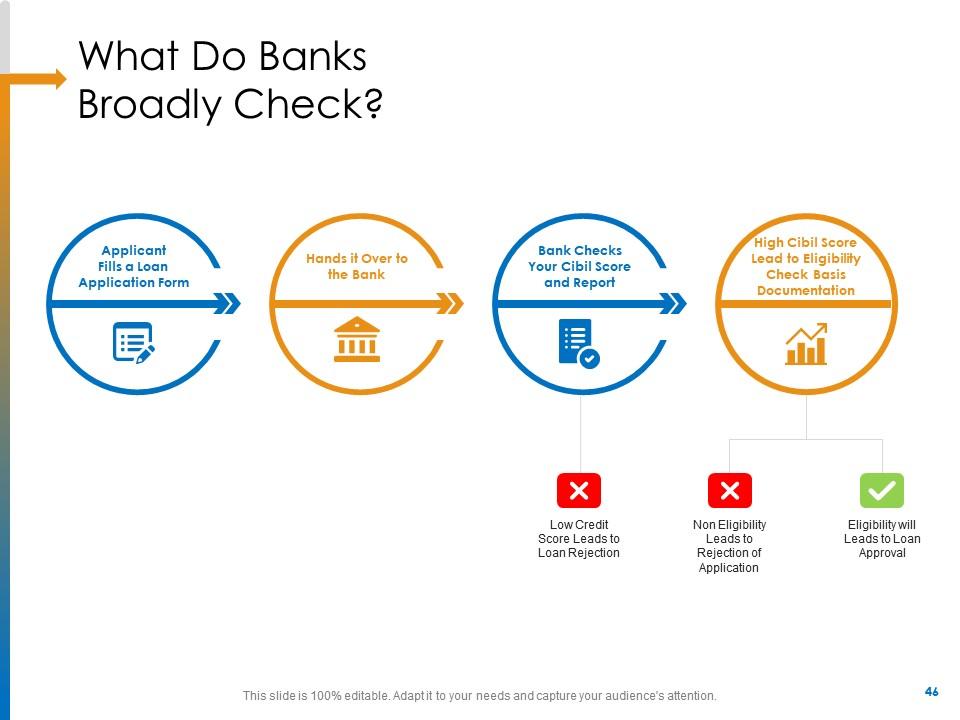

Slide 46: This slide presents What Do Banks Broadly Check?

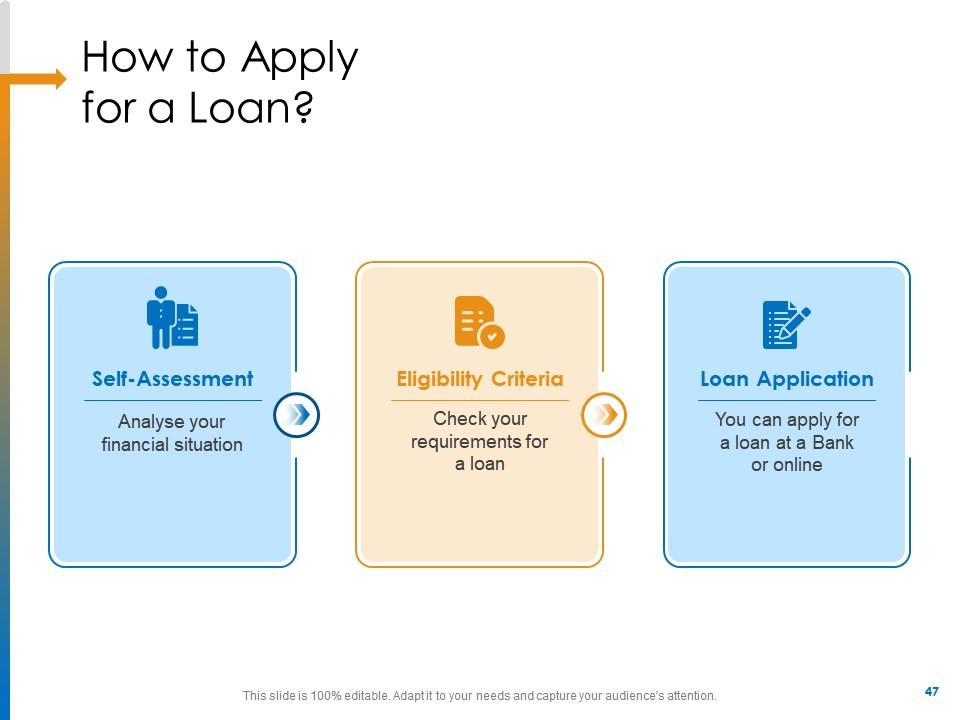

Slide 47: This slide presents the How to Apply for a Loan?

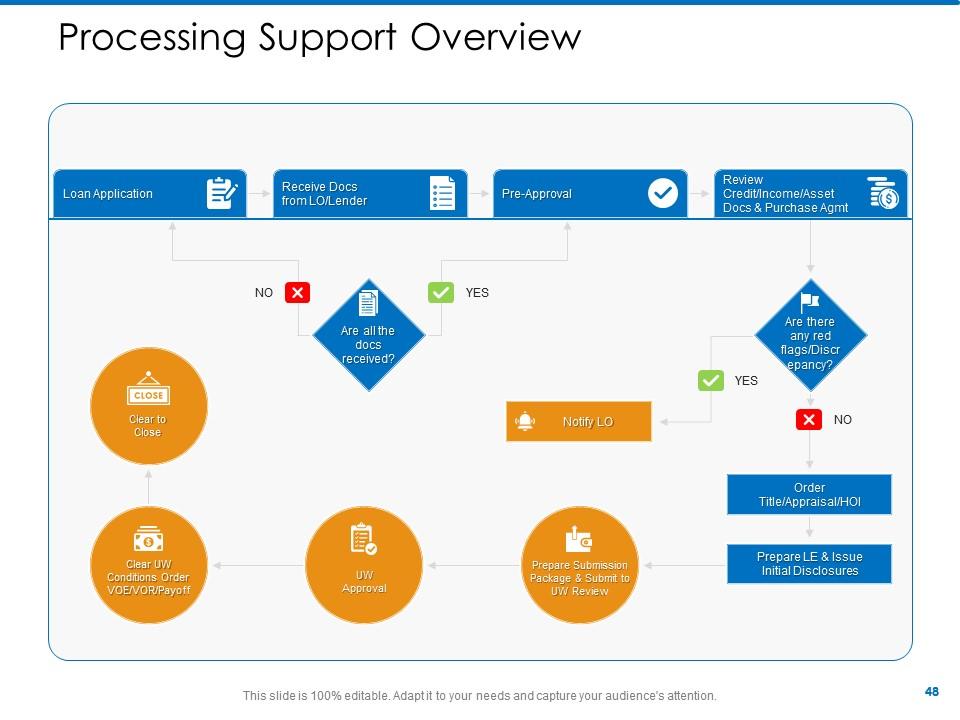

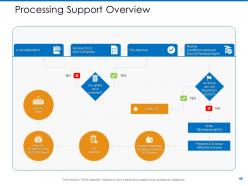

Slide 48: This slide presents the Processing Support Overview.

Slide 49: This slide provides the Mission for the entire company. This includes the vision, the mission, and the goal.

Slide 50: This slide shows the members of the company team with their name, designation, and photo.

Slide 51: This slide contains the information about the company aka the ‘About Us’ section. This includes the Value Clients, the Target Audience, and Premium Services.

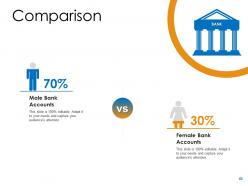

Slide 52: This slide presents the Comparison between the percentages of male and female bank accounts.

Slide 53: This slide presents the Financial with a data’s numbers at minimum, medium, and maximum percentage.

Slide 54: This is the Location slide.

Slide 55: This slide contains Post It Notes that can be used to express any brief thoughts or ideas.

Slide 56: This slide is a Timeline template to showcase the progress of the steps of a project with time.

Slide 57: This is a Thank You slide where details such as the address, contact number, email address are added.

Bank mortgage procedure powerpoint presentation slides with all 57 slides:

Use our Bank Mortgage Procedure Powerpoint Presentation Slides to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Excellent products for quick understanding.

-

Thanks for all your great templates they have saved me lots of time and accelerate my presentations. Great product, keep them up!

-

The Designed Graphic are very professional and classic.

-

Use of different colors is good. It's simple and attractive.

-

Editable templates with innovative design and color combination.

-

Good research work and creative work done on every template.

-

Use of icon with content is very relateable, informative and appealing.

-

The Designed Graphic are very professional and classic.