Are you a loan business planning to lend money to your customers? Hold on a second. Are the contract and other legal documentation on hand and ready for future business certainty? Agreements or contracts aid in securing deals. Throughout the sector, there have been several professional transactions. More than half are fake, but some are secure.

Whether it is a loan agreement or any other professional contract, well-laid rules are always helpful for professional transactions. It is essential to protect the monetary worth against scams when operating in the market. Even if the parties are well-known, there is a potential that one of them might back out of the planned agreement in the middle of it.

These intuitively designed Must-Have Installment Agreement Templates help in creating your next agreement in a professional manner. Let us take a look at these:

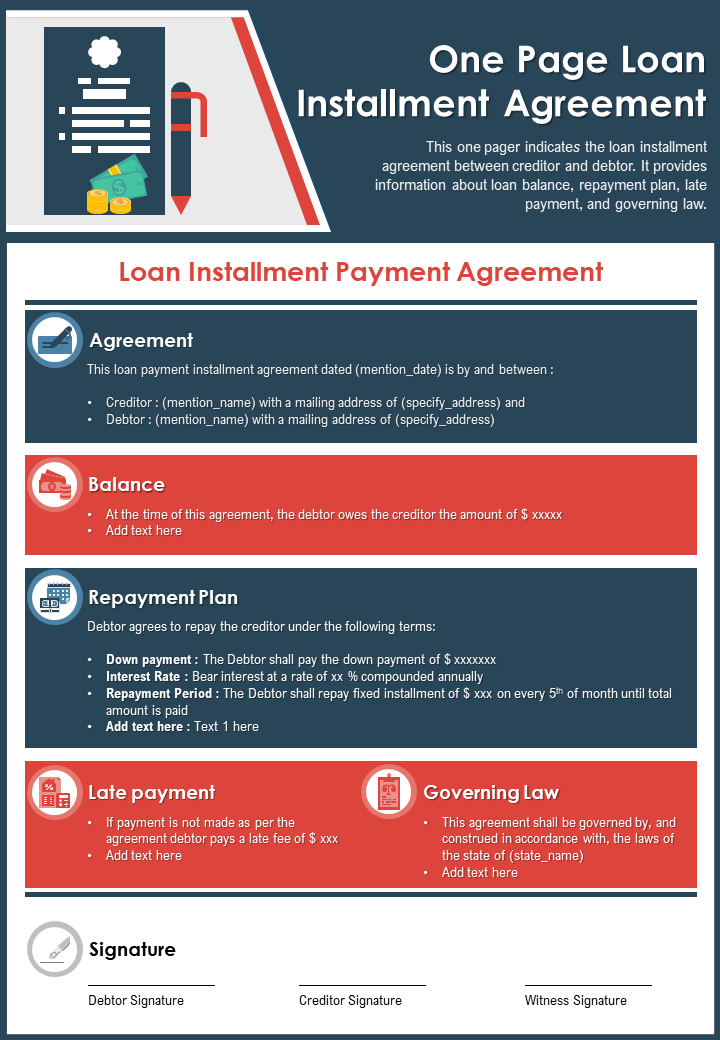

Template 1: One-Page Loan Installment Agreement Presentation Report Infographic

This PPT Template Agreement allows the users to share details of what is being loaned. The one-pager contains the loan agreement along with terms and conditions and the details of all the things required from the persons involved. It includes a section where you can specify information about the lender as well as the borrower. Additionally, the PowerPoint Slide presents the tenure for which the loan is sanctioned. For a smooth loan process, all these details have to be carefully read and specified. List down the repayment plan and procedure for late payment and laws governing the same. Create an illustration of the loan's principal and the interest that will be added to it. You can also include any additional duties imposed on the borrower. With the help of this freely downloadable PowerPoint Layout, you may explain how disagreements will be resolved.

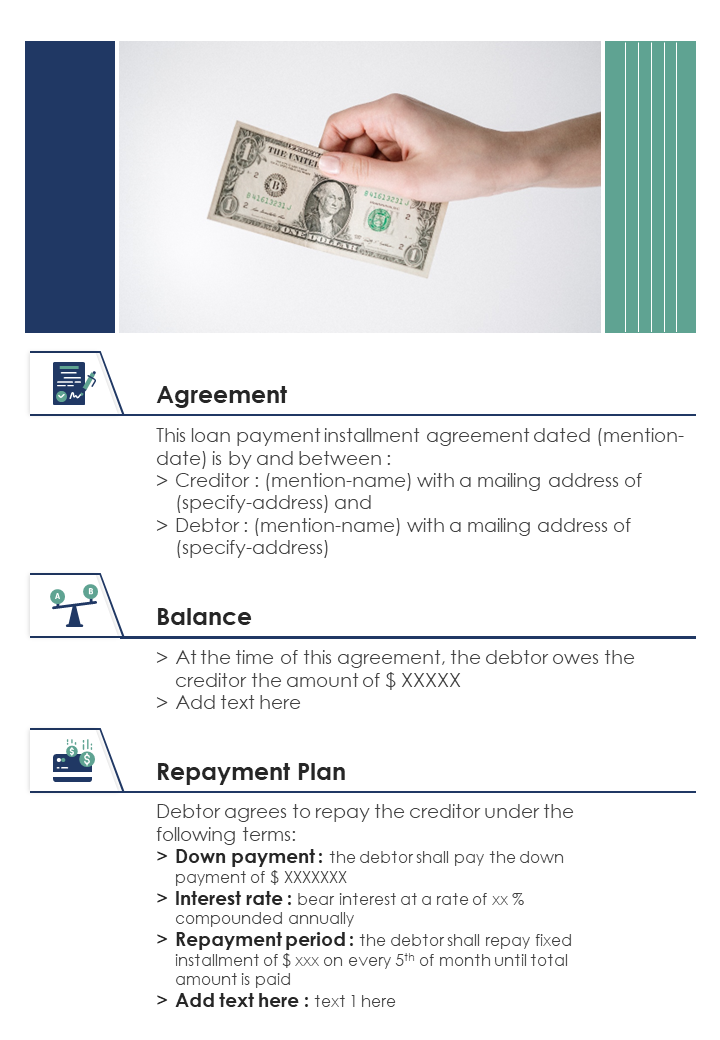

Template 2: Bi-Fold Loan Installment Agreement Document Report PPT Template One-Pager

This PPT Preset has four slides within. The first page of the PowerPoint Template can also be considered as a cover page for the entire agreement. It will contain the right images and visuals that can aptly describe the agreement. You can include a glimpse of the agreement and use a color theme that matches the theme of your business. This one-pager template will help you establish remarkable communication with the viewers and capture their attention for the upcoming pages of this agreement.

Template 3: Bi-Fold Loan Installment Agreement Document Report PPT Template One-Pager

This page in the bi-fold PPT Template contains visuals as well as text that explain the agreement in a detailed yet clear manner. You can include information like the date of the agreement, along with the name and mailing address of the creditor and the debtor. Also, you can include the amount covered under the loan at the time of the agreement. Different repayment plans and terms and conditions can also be added. These are rules for the down payment, interest rate, repayment period, and more. Download this template from the link below.

Template 4: Bi-Fold Loan Installment Agreement Document Report PPT Template One-Pager

This PowerPoint Slide consists of elaborate information on some more topics linked with your loan. You can include the clauses that contain instructions and rules related to late payment and the penalty that follows. Also, you can add the governing laws that should be followed in case of discrepancies. And finally, the agreement template contains space for the signatures of the debtor, creditor, and one witness. The information in the template can be changed as per your requirement and business needs.

Template 5: Bi-Fold Loan Installment Agreement Document Report PPT Template One-Pager

This is the last page of the bi-fold loan installment agreement document and can include a number of industry-specific customizable shapes, graphics, text, and more. This template is a fantastic visual communication and marketing tool to highlight your company and its potential customers. Use it to create a fruitful commercial venture that amplifies the viewer's interest in your offerings while speaking volumes about your company's brand. The template can include the address and contact details like number and e-mail address.

This one-pager installment agreement document template can be used to illustrate the information important for your loans. These attractive one-pager contract templates emphasize the agreement between the lender and borrower. To customize this template, you may add or remove different components. Also, you can choose a pleasing color-coding system to present details making your agreement more recognizable.

FAQs on Installment Agreement Templates

What is an installment agreement?

An installment agreement is a well-laid-out plan between the borrower and the business that includes all the rules and regulations related to the loan. The agreement can include all the essential terms and conditions related to the borrowed amount and the tenure for repayment.

A well-curated installment agreement can include detailed information on the topics like:

- The amount that the debtor has to pay to the creditor.

- Repayment plan and terms.

- Down payment made at the time of borrowing.

- Interest rate agreed upon whether simple or compound.

- Period of repayment and the frequency of installment.

- The clause regarding late payment.

- Governing laws, and more.

What are installment payment plans?

Installment payment plans are arranged between the debtor and the creditor. The plan contains every small detail in the agreement, including the payment terms. The interest incurred on the loan is also specified in the payment plan, along with the duration and the mode.

In case of late payments, the rules governing the penalties are also specified beforehand in the plan. Installment payments can benefit both the debtor and the creditor in different ways.

Benefits to the debtor:

- Helps in keeping track of the finances.

- Aids in keeping to the budget.

- Helps in stretching the cost of a purchase over a period of time.

- Include low monthly payments.

Benefits for the business:

- Helps in attracting more sales.

- Regulates the cash flow.

- Ensures more flexibility to the customers.

Customer Reviews

Customer Reviews