The global economies have come undone with the rise and spread of the coronavirus disease or COVID-19. The paradigm of world markets has been suffering huge damage from the virus that ravaged continents and their residents alike. And while we get accustomed to the new normal with social distancing and mask-wearing regimen, much has gone haywire in the financial investment markets.

As far as private equity firms and portfolio management companies are concerned, one can see how funds and portfolio are driving returns on investment. A lot has changed for those markets ever since the upsurge in coronavirus cases. Most markets have taken over a depressed outlook and for private equity investors, this has brought in an opportunity to reconsider the investment profiles according the sector that is performing well or poorly.

For the uninitiated, private equity or PE is a type of corporate funding wherein a pool of investors brings together funds for buying and then restructuring privately-owned companies to sell them off at a higher rate. In essence, private equity firms utilize limited partnerships and institutional capital to perform leveraged buyouts of companies or facilitating mergers, acquisitions or initiation of new projects to develop the company portfolio. Small to medium companies can leverage private equity to get out of a distressing situation, while the investors can enjoy good returns on their investment without worrying about stocks and shares as is the case in publicly-traded companies.

With the type of potential private equity firms contain for companies looking to diversify their funding or raising capital via an alternative channel, one can gauge that PE markets have a lot to account for as far as COVID impact is concerned. And since the possible impact of the pandemic is yet to be ascertained (or may never fully be), those dealing with PE need to understand what trends the market is conforming to and what impact anything will have on the deals that may come across. This blog details what kind of impression coronavirus is having on PE firms and portfolio management companies, and what the future holds for them. Read on.

Tracing the trends amid COVID impact on private equity

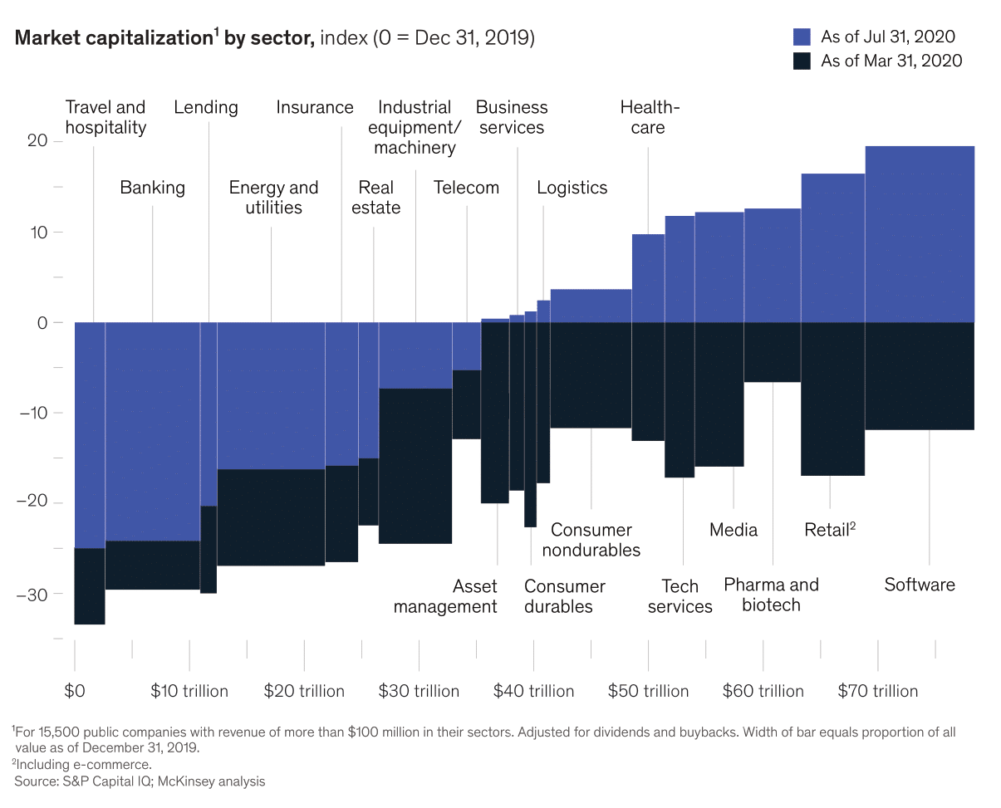

A key indicator of the situation and stability of PE markets is assets under management. Another factor is the dry powder, or investable cash, the firms have. If a comprehensive report by the United States-based management consulting firm McKinsey is any indication, various sectors for PE investment are seeing assets running in trillions for real estate, energy and utilities, business and professional services, industrial equipment and machinery, healthcare and software. In fact, PE portfolio reduced by 4% by July 31, 2020 at global scale as compared to 20% decline by March 31, 2020. This brings the following key points into focus:

- The market is undoubtedly tumultuous so PE firms have a chance to focus on analyzing consumer behavior and making the business models more adaptive. The key focus has to be to invest in companies that have emulated a flexible and robust outlook in terms of crisis management, what with the lockdowns and curfews imposed across global economies.

- Certain systems of PE investments that could gather more traction have in fact done so thanks to their nature. For instance, IT has emerged as the strongest sector which has seen market capitalization due to workspace going digital. The sectors that follow are retail and healthcare, of course. It has been the epicenter of the pandemic situation and companies focusing on employee safety have definitely gravitated towards an upward trend, the report says.

- An arduous situation has emerged for PE in travel and tourism sector which is signaling to an unstable recovery. As more and more lockdown restrictions emerge or are lifted across countries, the market caps are also seeing a varying trend. This has, in turn, changed the objective of PE firms for investment, with trends pointing to the sectors in focus during the pandemic. By July 31, 2020, market capitalization for travel and hospitality decreased by 25% while that for banking reduced by 24%.

How portfolio companies figure into the mix

For PE firms, the major stakes rest with the portfolio companies. For these companies, there have emerged various challenges, courtesy the coronavirus. It is not the PE firms haven’t gained ground on many real-time dynamic issues of the portfolio companies they are funding ever since the financial crisis of 2008-2009. But a major component for the portfolio companies is how to utilize the expertise of PE investors for their growth and development. This includes the following pain points they face:

- HR solutions: Younger companies with little to no human resource management systems look to their PE investors for guidance. There are issues related to hiring fresh talent and restructuring salaries and capital for asset management that portfolio companies have come to need help with.

- Remote working: While troublesome markets are not of that much concern for well-established companies, making the switch to digital may not come easy for companies in a primitive stage. Therefore, they need to bank on the expertise of PE companies to gain some cash-positive portfolio.

- Risk readiness: Since portfolio companies will look for optimizing their supply chains in this situation of crisis. For example, portfolio companies will look to source those vendors who show promise of a stable supply. However, choice of dependable cost is what portfolio companies will need help with.

- Compliance: The impact of pandemic-related adversities is different for different locations. The imminent consideration for managing firms will be to ensure quicker compliance to changing norms and tax regimes. A robust communication plan for all stakeholders can bolster the stance of the company in all types of markets.

- Customer behavior: Some portfolio companies are facing issues with changed consumer behavior pattern. The shift from outdoors to indoor online purchasing has led many companies to slow down the production and arrest other expenses. The primary concern is essential goods for which online retail is emerging as an area of interest. So PE firms have to lend a hand to the portfolio companies who are on the down slope due to reduced consumer activity.

Numbers that signal change

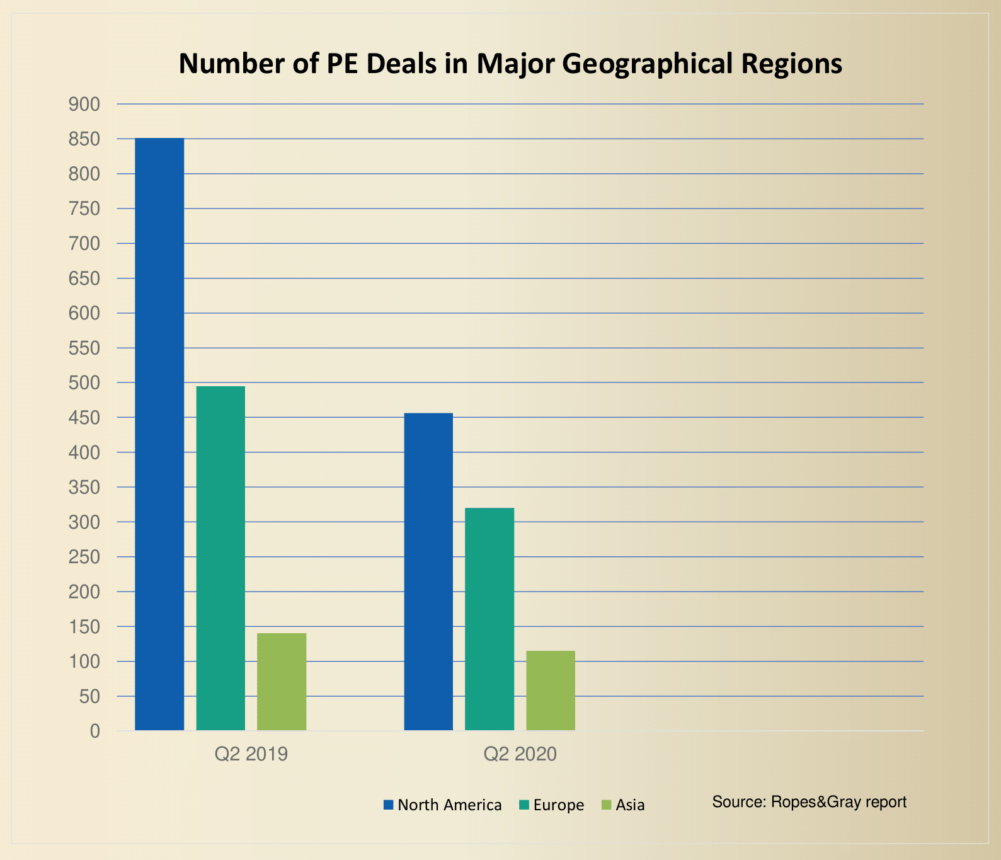

According to a survey by American financial information and analytics firm S&P GlobaI Inc, a lot has been happening in the PE deal market across the world. While the record amount of dry powder is signaling to a sea change waiting to happen, one has to observe what the impact of the pandemic has been on markets across various regions in the world. This will give an idea of how PE companies are using equity distribution to not make any quick decisions and are rather gauging the market rise and fall for the right opportunity. The figures also hold significance due to the fact that equity investment opportunities are gravitating towards the ventures that have a solid backing of science and communication technologies. And while the world adapts to the new normal, private equity investments are following suit. As for the figures, here’s a breakdown of the PE deals according to major geographical spans:

If one considers the number of PE deals that are happening across North America, one can see that there has been an overall almost 50% drop from second quarter (Q2) of 2019 to Q2 of 2020. On the other hand, the corresponding figure for Europe is 31.5% while for Asia, the trend has been on the lower side, which is now picking up. In the same manner, the transaction value for the PE deals has also decreased as companies look to restructure their strategy for combating the adverse effect of global shortfalls. These figures point to the following effects:

- Geographical effect: Corporate PE funding across American nations has been staring at a distressing curve ever since coronavirus spread its tentacles. The dropping figures on PE deals thus suggest that venture capitalists and other private investors are taking up decline in consumer sentiment and planning their strategies accordingly. On the other hand, European and Asian markets which were the first to face the body blow by the coronavirus are steadily rising as corporate PE structures are able to adapt to the crisis management plans or put in new ones for their survival.

- Portfolio dynamics: The steep decline in PE deals in North American nations could signal the temperament of investors towards economies affected by the pandemic. The market slump has led investors to pick only those companies which are performing well on economical as well as geopolitical side. The reduction in PE transaction from $56.2 billion to $30.9 billion from Q2 2019 to Q2 2020 shows that fundraising has gone more strategic in order to mitigate any possible losses.

- Time allocation: Another behavior pattern that PE firms are exhibiting is the way they have retracted in the face of market slump. While for Asian nations, the road to recovery may be getting paved with more deals, but in order for equity to perform well for the PE firms, it is imperative to note that not all resources are funds. PE firms seem to have taken “a step back or wait” approach where the exits for partners have delayed in markets showing promise. Time is also a crucial resource for such a situation of crisis.

- Funding impact: In a bigger perspective, one can see that the pandemic has led venture capitalists and PE firms to rethink their investment plans. In essence, it has meant that the companies who are in the seed funding stage are affected badly as the funding has taken a hit. The market disturbance has also led to write-downs in portfolio firm’s valuation and given PE firms a chance to hold onto their funds instead of writing off assets in turbulent markets.

What PE firms can do to stay ahead

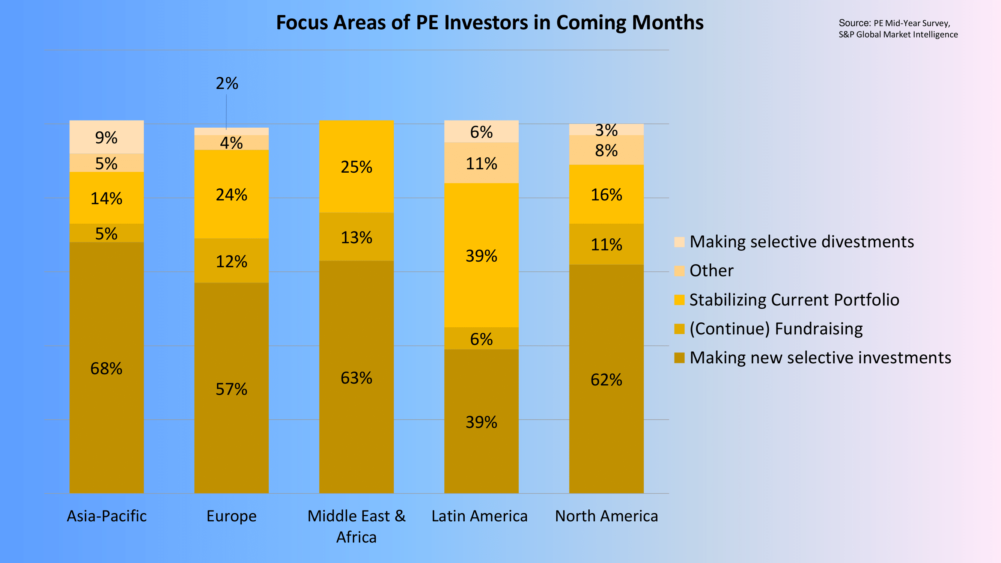

A key factor that emerges out of the S&P Global survey is that much focus is on how to tide over the crisis. In fact, PE firms are looking forward to a lot of bigger investments in markets that offer chances of strategic investment. According to the regional breakdown of intentions of PE firms for the course of fundraising, the following bar graph shows the various aspects of handling portfolio companies that have emerged in the survey.

Now, if one gauges the inclination of PE investors towards stability and better standing, there are a lot of pointers that will emerge for these investors to follow to mitigate the harm posed to the financials of the portfolio company. What remains to be seen is how markets bounce back as coronavirus recoveries mount in a particular country. Ideally, these firms can either put surplus funds to good use or just take measures to execute a crisis management strategy. Here’s what PE firms and private investors can do to address the issues:

Strategic portfolio upgrade

The need is to diversify investment portfolios through companies that have stronger crisis management initiatives in place. In fact, more robust and lucrative business models are able to take the blow head on. For instance, Asia Pacific region leads in PE investor sentiment for making new selective investment. This points to more strategic deals for mergers and acquisitions in this region than taking on new investment projects. This can help PE firms emerge stronger in post-pandemic markets.

Selective divestments

As a result of the reduced opportunities for investment and huge negative demand shock, PE firms are in a stable position to make selective divestments. By divestments here we mean decreasing assets for monetary objectives so as to gain a better holding of the portfolio company. This can lead to strategic consolidation that can improve fiscal health of the portfolio companies. PE firms can then utilize analyses to go for selling the business for better monetary footing in other stronger markets.

Contingency measures

For PE firms in a stronger position, there is a possibility for general partners (GPs) and limited partners (LPs) to delay their exit strategies to buy time for more informed decision-making. So PE firms have to dabble with some financial restructuring so that the portfolio companies have enough assets to survive through the pandemic. Much PE firm activity will be focused on crisis management and helping out the portfolio companies gain better cash flows. If the companies have no scope of survival, then PE firms can go for mergers and acquisitions for better trade-off.

Resource planning

The disruption in workflow of the portfolio companies can prove hazardous if not regulated properly. PE firms can initiate proper remote training measures and tracking procedures to let employees be familiar to the new normal. Also, much focus can be given to health benefits for employees to instill more confidence and flexibility. PE firms can also assist the portfolio companies to develop online training routines in accordance with the market demand.

Operational changes

Since the firms dealing with third-party vendors have to face some issues with supply chain, PE firms invested in these companies will have to look for modifications in indirect and direct expenditures on operational supplies. It’s all business. So there is no harm in devising newer strategies to source vendors that can deliver close-by. A proper communication channel to address delivery failures can also help tide over the financial and legal ramifications of the pandemic-related contingencies. Selling excess inventory can also help cash trickle down to the operations department.

Creating value

Company valuation can influence a lot of decisions for PE firms. Factors like debt indentures and lender agreements can determine how companies fare in the midst of the pandemic. PE firms and investors can create value for the portfolio companies by helping the latter grow strategically and adapt to the new normal for fundraising rounds giving higher returns. Any new substantive acquisition may not be in favor of the PE firms managing high liquidity concerns besides low-asset valuations. Therefore, PE firms can choose to restructure only those companies that have a high-valuation profile.

Mitigating risk

Essentially, risks are a part and parcel of investment. But for these risks to turn into rewards in the long-run, PE firms have to substantiate their operations with a well-defined risk containment strategy. Sudden disruption in supply chain, loan repayment delay and COVID-related contingencies can rattle portfolio companies. So PE firms can help them address and stabilize their supply chain with a risk management initiative. They can also help them handle transformation without putting much pressure on the existing debt structure. Additionally, they can help these portfolio companies re-analyze their operational strategies and tackle risks involving cybersecurity. Moreover, they can also get back to high-valuation deals after assessing federal small business bailout packages.

Brand sustenance

For portfolio companies as well as PE firms, customer engagement often seems to get overlooked while planning out such crisis management strategies. This is especially crucial when talking about mid-level companies looking to thrive amid the pandemic. And with online being the buzzword for a world dealing with the new normal, PE firms have to assist the portfolio firms stay on top of their digital brand strategy game. This can mean helping out campaigns that can drive in more consumers online towards retail, engaging people on social media and with the help of the press, and effective brand communication.

What the future holds

According to a July-August research survey by three faculty members — from Harvard Business School; University of Chicago; and Georgetown University — investment and operating partners in PE firms are working in excess of over 50 hours per week to help the portfolio companies stay afloat. Though PE firms with a well-defined and substantive portfolio have a stable footing despite the shock value of the pandemic, predicting anything beyond the market turbulence seem highly speculative. And with the COVID infection graph entering second waves in some powerful economies across the globe, one can expect more perturbing scenarios. However, considering the PE investor sentiment, one can gauge what changes or values are here to stay in the post-pandemic world.

Long-term optimism

One thing that the research survey points to is that with the stable stance and enough dry powder running in trillions of dollars, PE investors can expect better returns in the long run. This can stem from PE managers’ notion that private equity can somewhat or substantially outperform the public markets in the coming ten years. Also on the table is the chance to directly invest in public markets, shares buying, debentures, and equity warrants from issuers. Lower valuations in stock market can help private equity investors take informed decisions for distressed companies. As for companies with a better profile, fundraising will have to be strategized and according to demand. For instance, industries like IT and healthcare will pull in more funds from venture capitalists and investor pools, now that the world markets have experienced that shock from the pandemic and resultant lockdowns.

Difficult decisions

Well-planned companies with a good crisis management strategy are likely to perform than their seed-funded counterparts. And with public markets with focus on IT and digital possibly stressing PE funds, distressed companies will have to endure employee layoffs and restructuring for better returns. Financially, leverage buyouts of such companies will be an essential plan for steady performance of private equity funds, more so than growth equity, which will see a calculated rise. For most of the companies seeking funds, a low-debt portfolio may attract money from venture capitalists given that they have an idea that can stand the test of time (and pandemic).

Post-pandemic view

As far as the track record of vaccine development goes, one can expect certain overhauls in the way global supply chains work. For instance, more funding and strengthening can be expected in the healthcare sector, which also includes the logistics and manufacturing needs of an entire nation. One can certainly see companies going for diversification of their vendor base to procure and ship materials safely at lower costs. Companies can also be expected to source their raw material from local vendors at better costs. Digital will get the biggest push. So those investing in IT can expect to stay in a better position post pandemic. Investors will also likely be inclined towards making their contribution towards initiatives that make the world a better-managed and sustainable place.

So in conclusion, private equity investors can bank upon informed decisions and business strategy to tide over the crisis inflicted upon the world by the coronavirus disease. Geographical impact and consumer behavior patterns will drive the funding strategy for the private equity firms and venture capitalists alike. The world market may go rogue or favorable, thanks to a pandemic of this unprecedented scale and distressing force. A better business plan coupled with risk management strategies will be the key to success of PE in the age of COVID and whatever comes after.

Customer Reviews

Customer Reviews