The best investment strategies aren't always those with the highest historical returns. The best ones are those that fit your goals and risk tolerance. In other words, the best one is the one that meets your needs to the greatest degree.

You need investment strategies that lend to easy customization and are akin to bespoke clothing. It is especially true if you are making long-term plans. Don't start an investment strategy and then abandon it for some hot new trend you discovered online. Stick to the tried-and-true basics. Determine which of the best investing strategies is right for you.

Now the vexed questions arise: How do you know if an investment strategy is good for your business? How to ensure that the investment strategy you’ll bet on will pan out exactly the way you planned? Is there a predefined structure to follow?

The quick answer: Investment Strategy Templates that SlideTeam has curated for you.

Investment Strategy Templates You Need

Every successful investment manager has a written, measurable, and repeatable investment strategy. Many investors, however, jump from one trade to the next, putting little effort into developing and measuring their overall strategy.

The following templates can help devise an inclusive investment strategy.

Template 1: Nine Investment Strategies PPT Template Bundle

Investment strategies are more complex than they appear on paper. A lot goes into preparing just one investment strategy, let alone multiple ones. This PPT Bundle offers you nine investment strategies encompassing asset allocation, personal investment, stock market, and more. Get it all within your grasp. Use this presentation template to showcase your expertise in managing all kinds of investment goals and time horizons. Grab this template now.

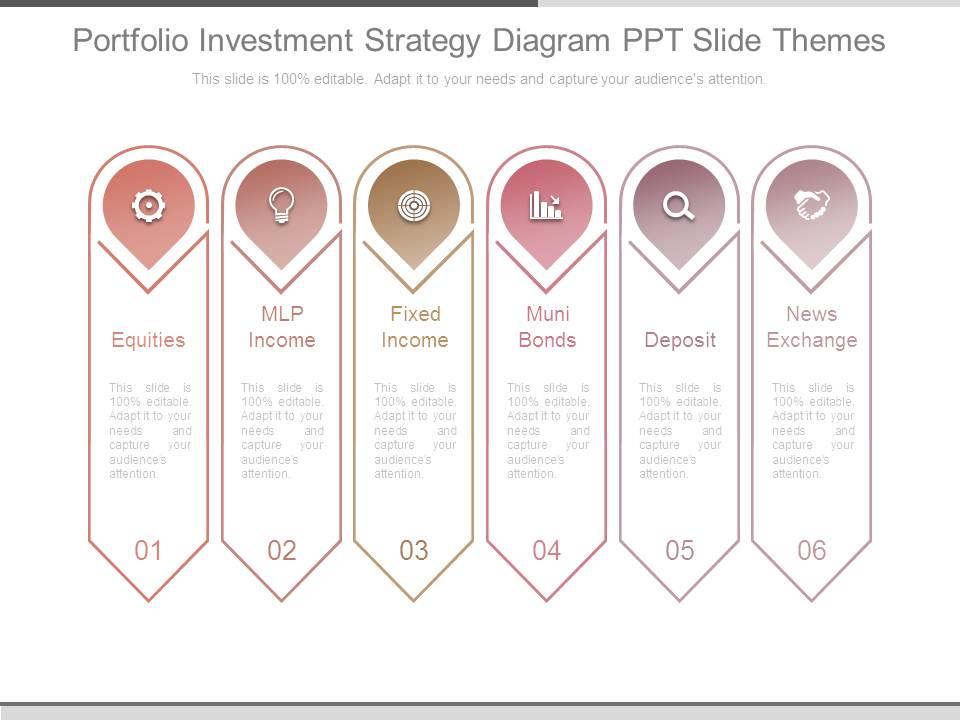

Template 2: Portfolio Investment Strategy PPT Template

Investing is all about balance! Striking the perfect proportion between equity and fixed-income investments is where most investors struggle. To simplify things for you, here is an inclusive portfolio investment strategy with an appropriate mix of assets. It covers equities, MLP (Master Limited Partnership) income, fixed income, mini-bonds, deposits, and news exchange. Get it now.

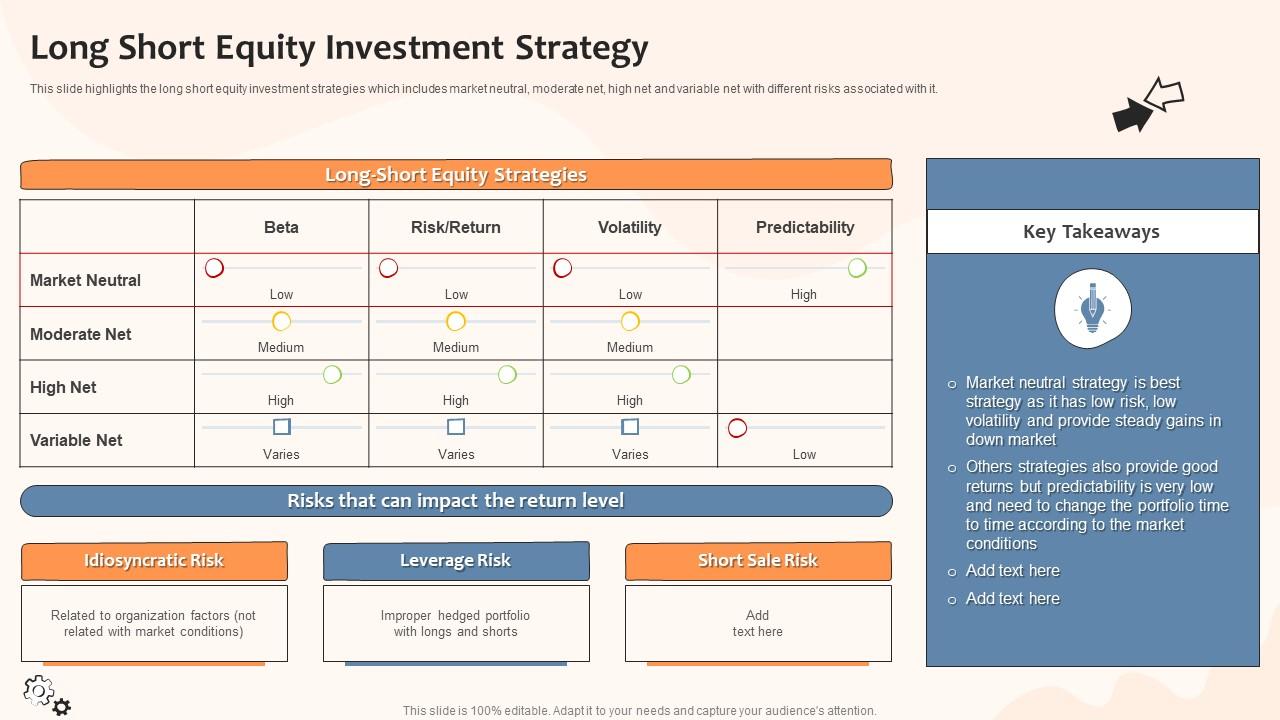

Template 3: Long and Short Equity Investment Strategy

A long-short equity investment strategy is a tough nut to crack. SlideTeam understands the intricacies of this subject and presents a well-structured PPT template built after extensive research. With this, you get an overview of the risks that can impact the return on investment. Key takeaways are presented as well for the audience for better comprehension. Download it now.

Template 4: Investment Strategy for Maximizing Company’s Return

Want to maximize your company’s returns, deploy this five-step investment strategy. From collecting facts based on external trends to supporting final implementation, this PPT Template offers a comprehensive framework for building an inclusive strategy. The five cornerstones to doing this are: Context, Vision and Mission, Investment Principles, Strategy Formulation and Selection, and Implementation. Grab this presentation template now.

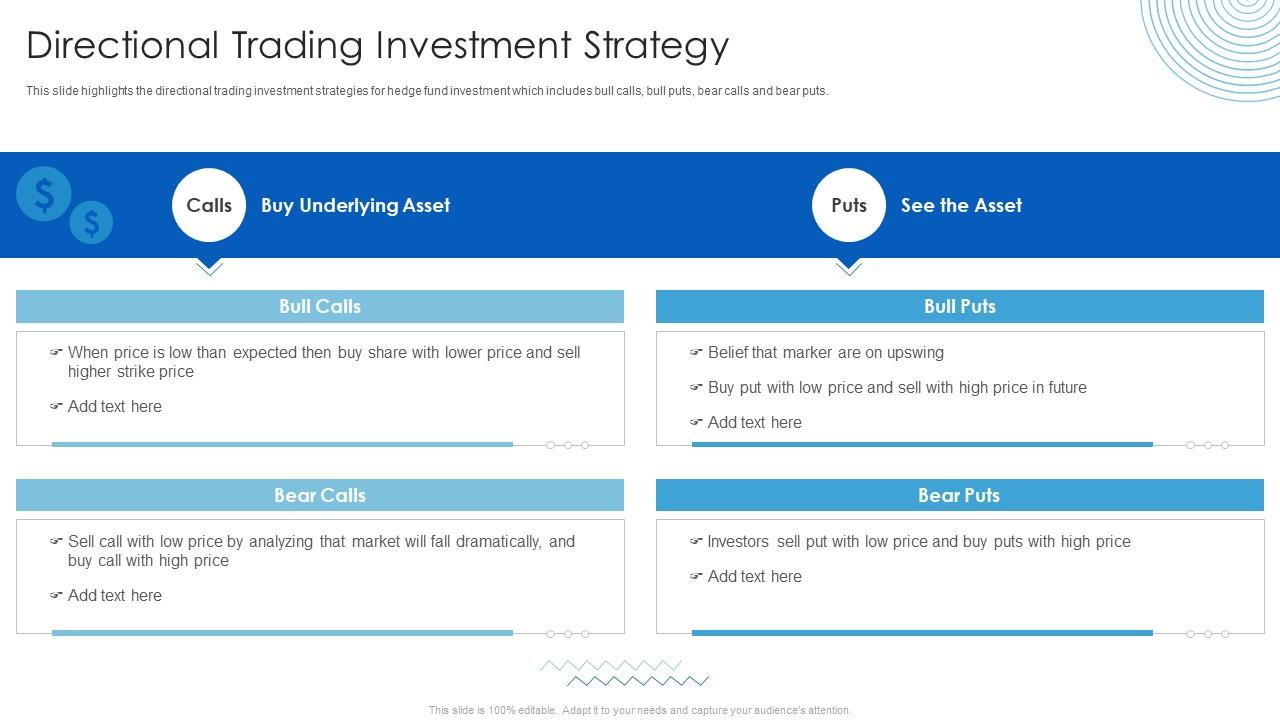

Template 5: Directional Trading Investment Strategy PPT Template

Directional trading underlines the investor's prediction of the market's future direction. With this PPT Framework, investors can implement a basic directional trading strategy by taking a long position if the market, or security, is rising or a short position if the security's price is falling. Download now.

Template 6: Event-Driven Investment Strategy PPT Template

Multiple factors define the nature of investment strategies. This PPT Template explains a few of such variables. Its design also highlights the critical areas aligned to each event with concise descriptions to promote a better understanding of the subject. It lays the groundwork for building an effective investment strategy. Download it now.

Template 7: Income Investment Strategy for Retirement

Everyone saves for retirement. But, not everyone has the right investment strategy to live the desired life after retirement. This PPT Template offers you a strategic plan that divides your investment income into buckets. Each bucket shows a projected growth rate to help maximize your return from every dollar invested. Download it now.

Template 8: Age-Wise Investment Plan With Asset Allocation Strategy

People from different age groups have distinct plans for investment. Getting them to weave a close-knit investment strategy can be challenging. With the help of this PPT Framework, you just have to fill out details concerning asset allocation. It also highlights the key responsibilities and the risk profile against each age group to help you make an informed investment. Grab it now.

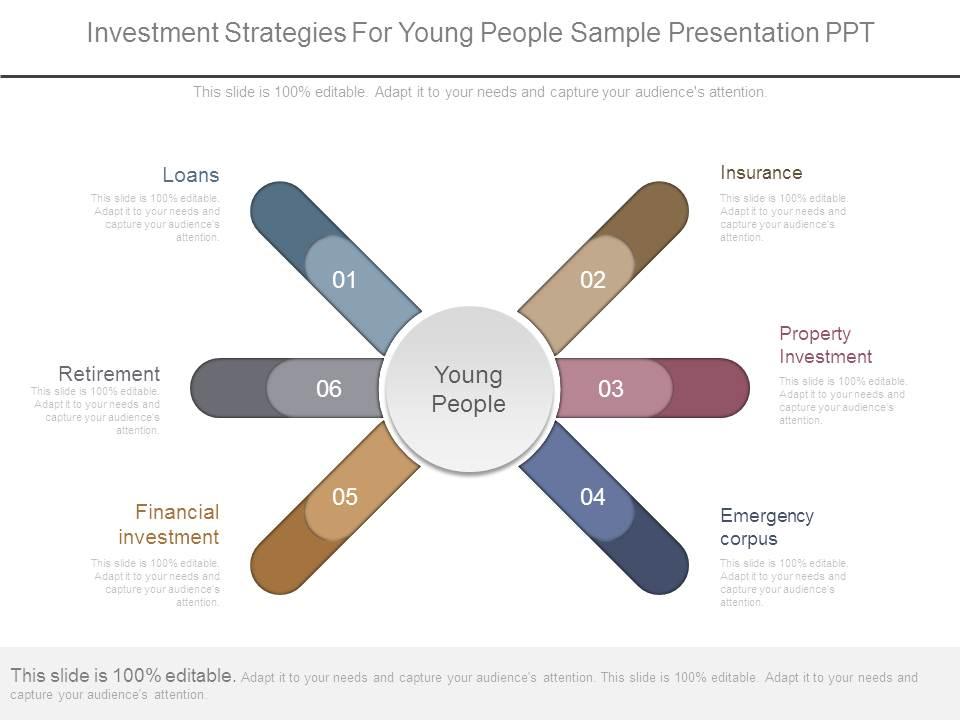

Template 9: Investment Strategies for Young People

Youngblood is all about living life to the fullest. They seldom sit down to plan for investing. If not well invested, their savings will eventually evaporate. Addressing the need of the hour, SlideTeam presents critical investment strategies you can implement for maximum benefits. This slide explains six strategies: Loans, Insurance, Property Investment, Emergency Corpus, Financial Investment, and Retirement. Get it now.

Template 10: Investment Management Strategy PPT Template

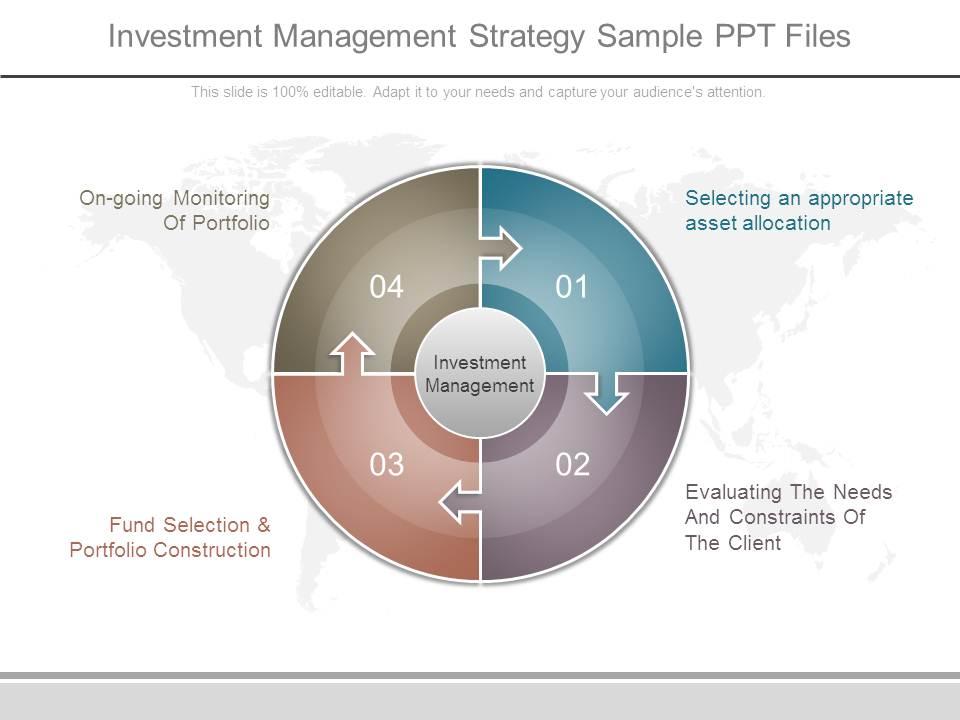

Investment management strategy is a stress-inducing task that demands absolute attention to detail. A minor error can mean thousands of dollars smoked into flames. With our predesigned template, you can rest assured you won’t have to suffer such losses. Its circular donut design explains the four stages of the investment management strategy:

- Selecting an Appropriate Asset Allocation

- Evaluating the Needs and Constraints of the Client

- Fund Selection and Portfolio Construction

- Ongoing Monitoring of Portfolio

Download it now.

Over To You

There are multiple investment strategy templates to suit almost every level of risk, involvement, and timing. Understanding your personal preferences and financial situation is key to determining the best strategy for you. When it comes to investing, there is a lot at stake, but with the right determination (and our PPT Templates), you can find a strategy that strengthens your financial health and helps you achieve your goals.

FAQs on Investment Strategy

Why is investing important?

Investing is critical to beat the rising cost of living, which is a by-product of inflation. Your cash today may not be worth as much in a year, and it will be worth far less in 30 years. If you don't have an investment strategy that can at least outperform the rate of inflation, you're losing money and becoming poorer by the day.

What are the types of investment strategies?

Growth Investing

Growth investing focuses on companies expected to grow at a faster-than-average rate in the long run, even if their share price appears to be high. Smaller companies, emerging markets, recovery shares, and internet and technology stocks are all examples of growth investments.

Value Investing

This strategy is based on the market overreacting to both good and bad news, resulting in extreme stock price movements that do not always correspond to a company's long-term outlook.

Quality Investing

Quality investing focuses on companies with exceptional characteristics such as management credibility or balance-sheet stability. A good portfolio can have both growth and value components.

Index Investing

Index investing, also known as passive investing, focuses on developing a portfolio of assets to match the returns of a market index. The components of the chosen index will entirely define the portfolio's assets.

Buy-and-Hold Investing

Buy-and-hold investing entails purchasing securities and holding them for an extended period (usually many years) to generate returns.

What is a 70/30 investment strategy?

A 70/30 investment portfolio invests 70% of your capital in stocks and 30% in fixed-income products such as Certificates of Deposits (CDs), bonds, and fixed-income exchange-traded and mutual funds.

It depends on the age of the individual, and the 70/30 proportion can be moved according to the risk appetite as well. Remember, the two real rules of investment are:

- Start early in life, preferably as soon as you hit adulthood.

- Protect your principal and be aware of the wonderful power of compounding.

Customer Reviews

Customer Reviews