Money has always been a cryptic and mysterious entity, from the value we assigned to historical, early-age stones to deciding on gold as the backing for currency. What has always given money, legal sanction, and social acceptance has been the TRUST between transacting parties. Yet, trust is a variable that depends on the times and context.

For instance, the more we centralize an entity’s control over a country’s resources, the lower trust there seems to be in any business transaction there. Decentralized money is the natural solution to this problem, and cryptocurrencies (just one of which is Bitcoin) are proof of this concept.

Cryptocurrencies work and are already in play, with millions of people and major companies using these as legal tender (e.g., Tesla).

Its history, too, is very recent (a contradiction, but please let it pass for now).

In 2009, Bitcoin emerged as the first cryptocurrency in a white paper published by an anonymous person(s) under the name of Satoshi Nakamoto. It was open-source software that anyone could use to become part of a new decentralized payment system.

The use of cryptocurrencies is on an exponential rise worldwide. Businesses and individuals will find it best to learn about these as early as possible so they don’t have to play catch-up with their contemporaries. To this end, SlideTeam presents a hands-on, activity-based Comprehensive Training Curriculum on Cryptocurrency to help you educate your audience, be it your employees, other businesses, etc., on this currency of the present and the future.

The five training courses offer these benefits to an audience:

- Understanding a new and innovative technology: Learning about cryptocurrencies can give you a better understanding of the underlying technology. You always realize how this works to improve businesses’ response time to major changes in both the internal and external environment.

- Exploit financial opportunities: Cryptocurrencies can be a volatile but potentially lucrative investment, and understanding these can help you make informed decisions about whether to invest in these and how to do this safely.

- Being part of a growing community: Once a critical mass of the population adopts cryptocurrencies and blockchain technology, we will have everybody take to it. This will disrupt traditional financial systems and the way we think about money.

You get the chance to either be with the community or be an outcast. Participating in this community can be a rewarding and enriching experience in and of itself.

| SESSION NUMBER | TITLE |

|---|---|

| SESSION I | Introduction to Cryptocurrency |

| SESSION II | Architecture of Cryptocurrency |

| SESSION III | Economics of Cryptocurrency |

| SESSION IV | Key Cryptocurrencies & Investing in These |

| SESSION V | Impact & Analysis and Legal Aspects of Cryptocurrency |

The trainer can download the complete deck and get started immediately as it is content ready. We end each session with our standard, well-regarded format of:

- Key Takeaways

- Let’s Discuss, and

- Let’s Test What We Have Learnt

Click here to access the Comprehensive Training Curriculum on Cryptocurrency

Session I: Introduction to Cryptocurrency

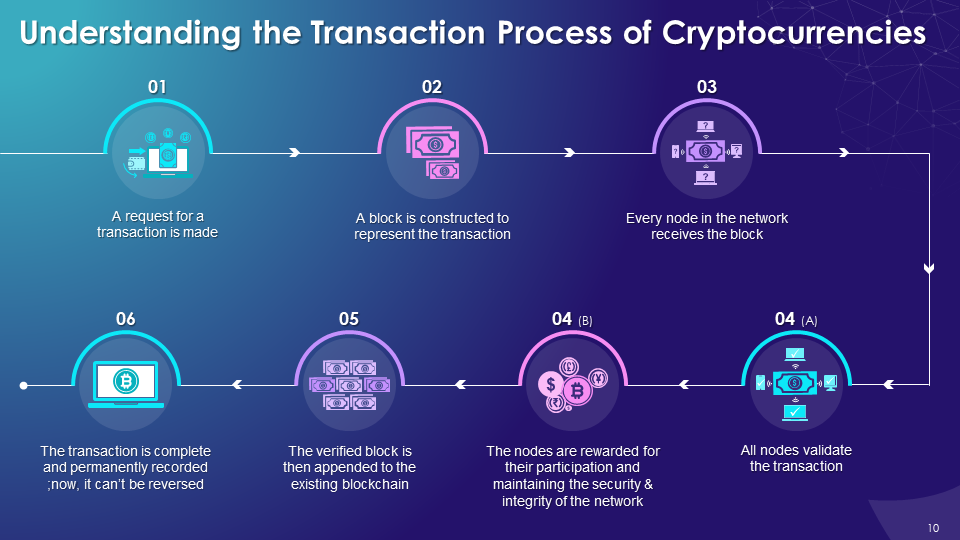

We begin the training with a detailed look and an interactive discussion on the underlying concept of cryptocurrency in Session I. We learn what defines it and locate its place in the evolution of technology as part of human history. We present how transactions work and compare cryptocurrency with traditional fiat currency (paper money, national currency, online banking, etc.).

Click here to access the Comprehensive Training Curriculum on Cryptocurrency

We explain the current scenario of this technology’s adoption with some statistics and Use Cases. We also list merchants who have been pioneers and are accepting cryptocurrency as legal tender for years now.

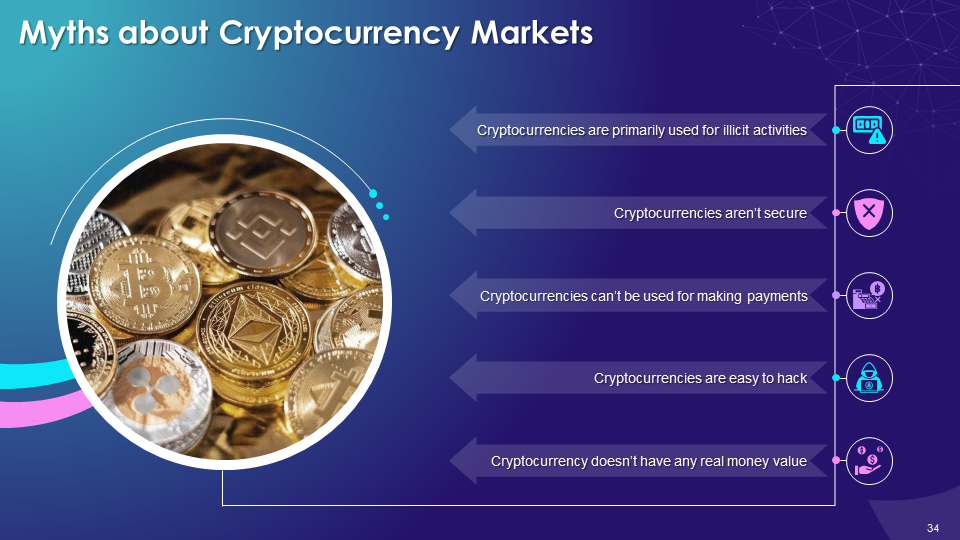

We transition to answer what factors work for cryptocurrencies with a look at the detractors’ point of view. The course studies the advantages and disadvantages of cryptocurrencies to help you make up your mind. We try to eliminate any unsubstantiated claims regarding the crypto market to ensure that the trainees are only informed of the facts.

Click here to access the Comprehensive Training Curriculum on Cryptocurrency

To dispel the notion that Bitcoin is the only popular cryptocurrency, we introduce Altcoins, what they are, and their several types (mining-based, stablecoins, security tokens, meme coins, utility coins, and governance coins).

The key takeaway from the session is that cryptocurrency is more than just a change in how we think about money. It is a new way of life, that we can ignore at our own loss.

Session II: Architecture of Cryptocurrency

As an intangible currency, the nature of crypto in being a computer program is daunting to most people. In Session II, we break down crypto and understand what it is made of and the technology that powers it: The Blockchain.

Click here to access the Comprehensive Training Curriculum on Cryptocurrency

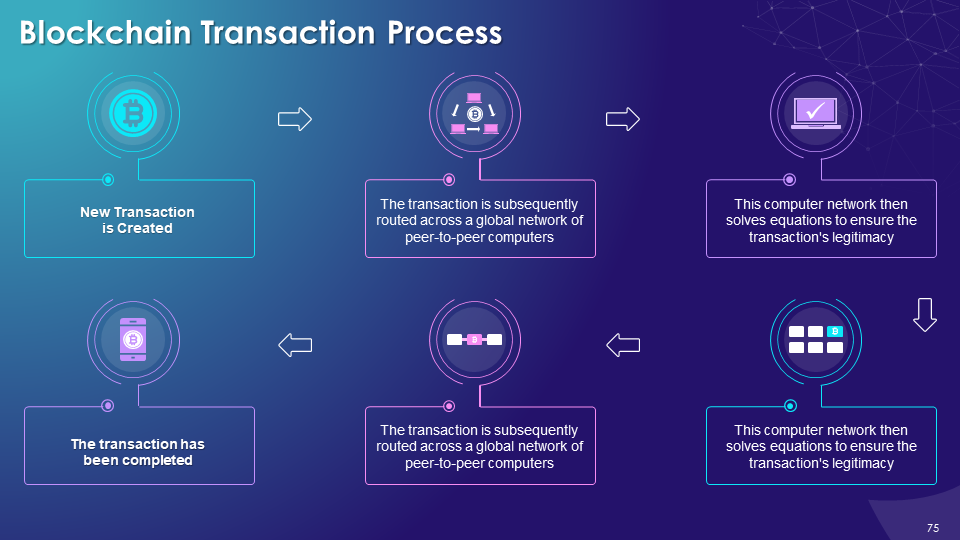

We begin with an introduction to the blockchain transaction process, its overview as a platform, and the number of blockchains that exist as of 2022 (10,000 and rising exponentially). We introduce nodes which are the computers that give rise to a blockchain (the servers, so to speak). We understand how these function and go through their types, of which there are several (full, pruned, archival full, authority, etc.).

We learn about Timestamping in blockchain through a slide and move to 'mining,' the fundamental step that generates cryptocurrency. It is how crypto is created. We use slides to understand the need for mining, the prerequisites for beginner miners, an overview of mining pools, and how and how much miners are compensated.

Click here to access the Comprehensive Training Curriculum on Cryptocurrency

Similar to physical or online wallets that we use to store traditional currency, the trainer gets to introduce blockchain wallets to trainees as the medium to store one’s cryptocurrency. We discuss wallet keys, features of the wallets, private key wallets, hot & cold wallets, and finish with the types (software, desktop, online, etc.).

Session III: Economics of Cryptocurrency

Cryptocurrency/blockchain has been a sustainable system, but to gain mass adoption, it will need institutional and governmental support and a lot of funding. In Session III, we study the economics of crypto to understand how it is sustained financially.

Click here to access the Comprehensive Training Curriculum on Cryptocurrency

We present the following topics in detail: Block rewards, transaction fees, cryptocurrency exchanges, atomic swaps, Bitcoin ATMs, and Initial Coin Offerings (ICOs). Each concept is introduced, explained, and its importance is noted.

Click here to access the Comprehensive Training Curriculum on Cryptocurrency

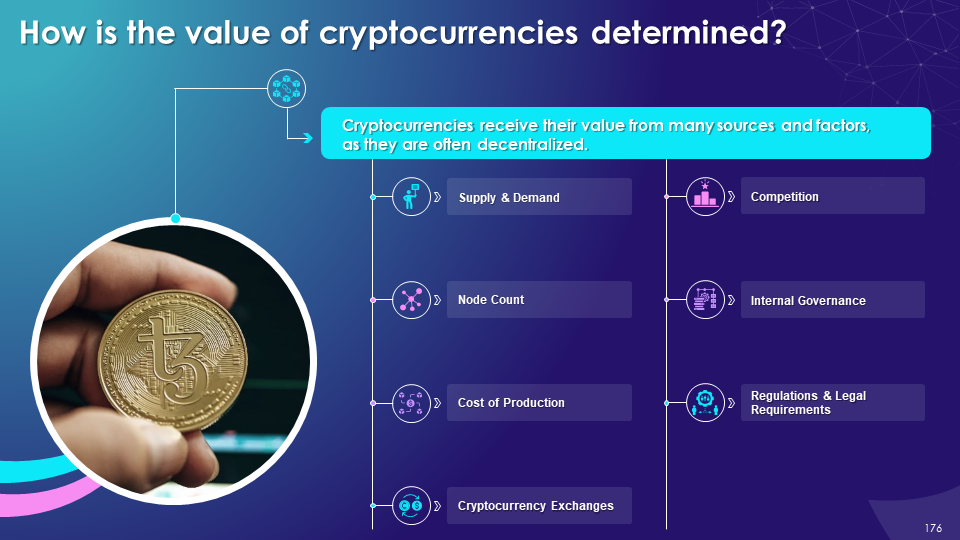

We transition to an important question that is on everybody’s mind these days and answer it: How is the value of cryptocurrencies determined? We end the session with a look at the price trends and databases related to crypto.

Session IV: Key Cryptocurrencies & Investing in These

Which crypto is the best? This is possibly a question that can never truly be answered. Some cryptocurrencies are more popular than others; some are cheaper, and some have greater potential. Too many factors are at play.

Click here to access the Comprehensive Training Curriculum on Cryptocurrency

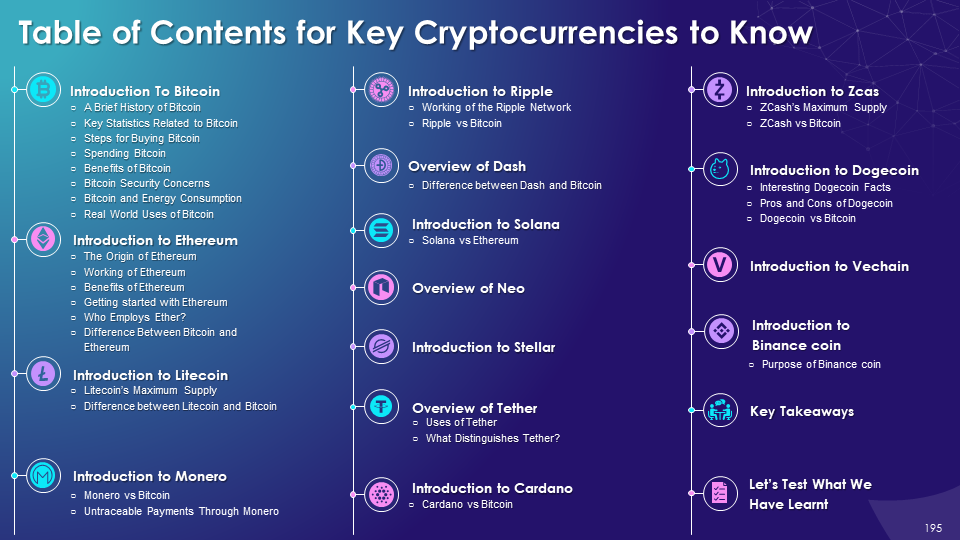

In Session IV, we bring you an overview of cryptocurrencies. They are Bitcoin, Ethereum, Litecoin, Monero, Ripple, Dash, Solana, Neo, Stellar, Tether, Cardano, Zcash, Dogecoin, Vechain, and Binance coin.

This will ensure that the trainees are informed before they make any decision regarding investments.

Click here to access the Comprehensive Training Curriculum on Cryptocurrency

We then move on to the section where we learn about investing in cryptocurrencies. We begin by understanding the crypto markets, comparing this investment to that in stocks, and emphasizing the risk of this investment. We present how crypto can be used by and for a business and showcase the factors to keep in mind when evaluating the market.

Click here to access the Comprehensive Training Curriculum on Cryptocurrency

We introduce active trading and spend some time on its types and peek through varied economic lenses to understand how cryptocurrencies are valued. Finally, we provide some great tips to help the trainees make smarter, more informed decisions when investing in cryptocurrencies. For instance, diversifying your investment in multiple cryptocurrencies and not investing it all in just one of them, to manage potential losses.

Session V: Impact & Analysis and Legal Aspects of Cryptocurrency

In this section, we take a look at how cryptocurrency has influenced our society, including the legal facets of creating and using it.

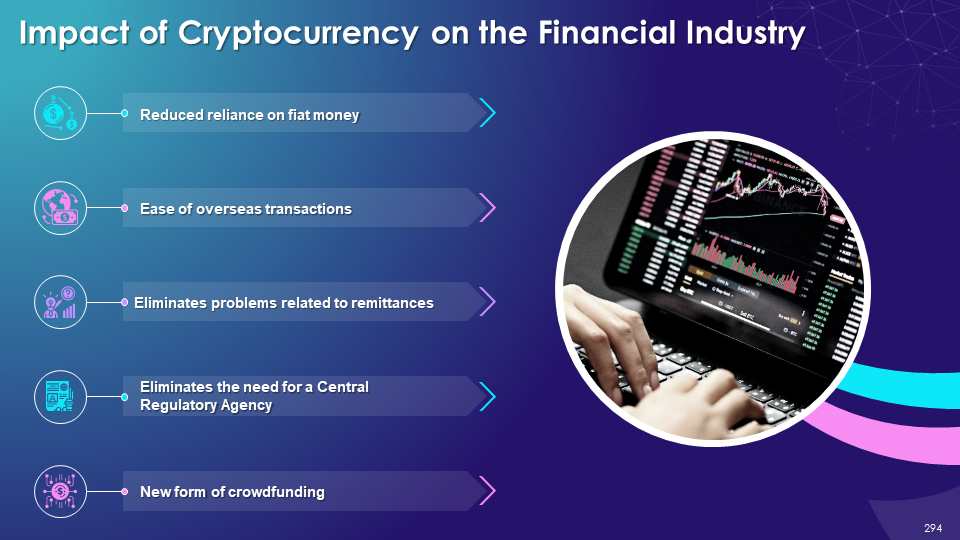

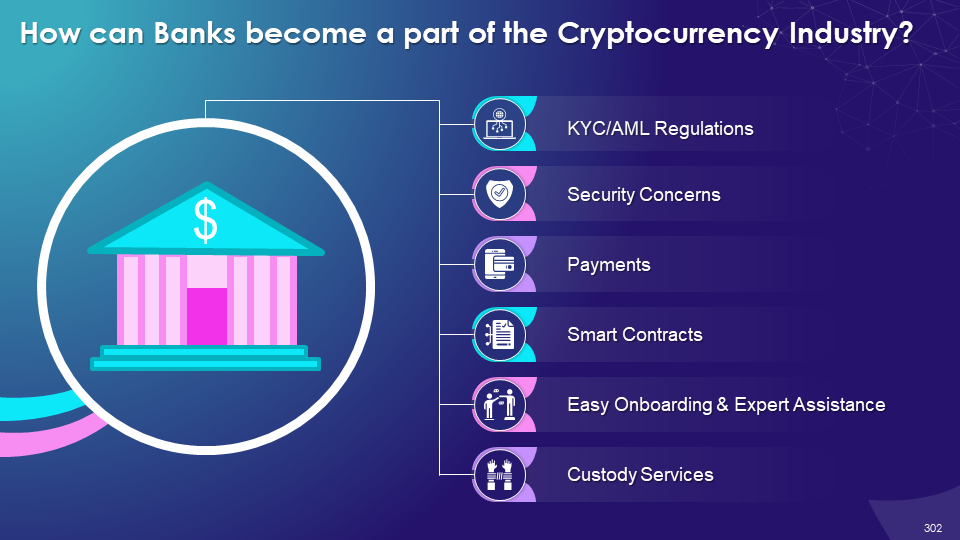

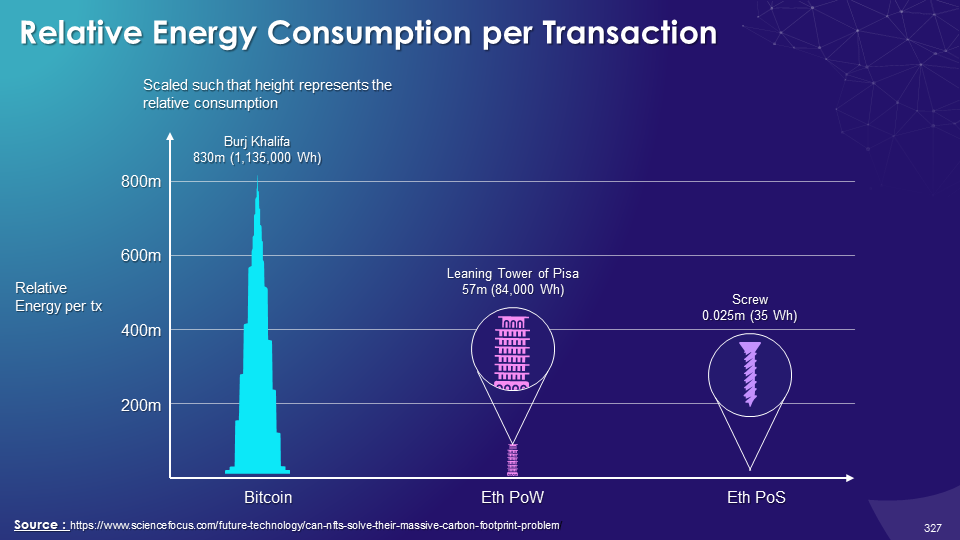

We begin this session by understanding the impact of crypto on structures that run our lives, like the financial, banking & gaming industry, transaction costs, entrepreneurship, and job markets. We look at entities that accept crypto, the new-age rage of Non-Fungible Tokens (NFTs), and the environmental impact of crypto (with mining being an energy-intensive exercise).

Click here to access the Comprehensive Training Curriculum on Cryptocurrency

We also dispel any rumors and speculation around cryptocurrency to ensure a fact-based training experience. We conclude this by looking at the underbelly of the cryptosystem, i.e., its misuse for criminal activities.

Click here to access the Comprehensive Training Curriculum on Cryptocurrency

We dedicate one slide each to a legal aspect of cryptocurrency. These include an introduction to its legality, advertising bans, taxes, money laundering, Darknet markets, wash trades, sanctions, tax evasions, and more.

Click here to access the Comprehensive Training Curriculum on Cryptocurrency

By the end of this training, we hope that the trainees are educated enough to make better use of cryptocurrencies, such as choosing whether to invest in them or not. We hope the trainees and the trainer are equipped with the skills needed to adapt to a crypto-based economy (which is coming, whether we like it or not). So, grab our professionally designed and content ready cryptocurrency ppt.

FAQs on Cryptocurrency

What is cryptocurrency, and how does it work?

A cryptocurrency is a digital or virtual currency that uses cryptography, or codes, for security. Cryptocurrencies are decentralized systems that use blockchain technology to record transactions on a public ledger in a secure and transparent manner.

Cryptocurrencies operate on a decentralized network, meaning that any single entity or government does not control these. This allows anyone on the network to view and verify all transactions. The decentralized nature of cryptocurrencies makes the resistant to censorship and fraud.

To use a cryptocurrency, you will need a digital wallet, which is a software program that stores your cryptocurrency and allows you to send and receive it. When you want to make a transaction, you will use your wallet to send the cryptocurrency to the recipient's digital wallet. The transaction is then broadcast to the network, where it is verified and added to the blockchain.

Cryptocurrencies use cryptographic techniques to secure transactions and verify the transfer of ownership. These techniques include the use of private and public keys, as well as hashing algorithms.

How do miners of Bitcoin make money?

Bitcoins are created through a process called "mining," which involves using computers to solve complex mathematical equations. These equations verify transactions on the bitcoin network and add them to the blockchain.

Miners are compensated for their efforts with a small amount of newly created bitcoins and transaction fees paid by the users of the network. The number of bitcoins that are released per block, as well as the transaction fees, are both regulated by the network and decrease over time. This is done to ensure that the supply of bitcoins remains limited and to control the rate at which new bitcoins are created to avoid an extreme mismatch between supply and demand.

Is Bitcoin a good investment?

Bitcoin and other cryptocurrencies have seen significant price volatility over the years. This volatility makes investing in bitcoin and other cryptocurrencies risky and unpredictable. There are a few reasons why some people believe that bitcoin and other cryptocurrencies could potentially be good investments. For example, cryptocurrencies offer the potential for high returns on investment, as their values have increased significantly in the past. In addition, some proponents of cryptocurrencies argue that they offer a more secure and transparent way to store and transfer wealth, as they operate on a decentralized network that is less vulnerable to fraud and censorship.

Cryptocurrencies are still a relatively new and untested asset class, and their long-term prospects are uncertain. There is a chance that you could lose all or part of your investment, and you should be prepared for the possibility of significant price fluctuations.

If you do decide to invest in bitcoin or another cryptocurrency, it is important to diversify your portfolio and invest only what you can afford to lose without a significant dent in your lifestyle. You should also carefully research the specific cryptocurrency and the company or organization behind it before making any investment decisions.

How do I start using a Bitcoin?

If you want to start using bitcoin, here are the steps you can take:

- Choose a digital wallet: In order to use bitcoin, you will need a digital wallet to store your cryptocurrency. Choose a wallet that meets your needs and security preferences.

- Buy bitcoin: Once you have a digital wallet, you will need to buy some bitcoin. There are several ways to do this. Using a bitcoin exchange: There are many online exchanges that allow you to buy and sell bitcoin using fiat currencies or other cryptocurrencies. Accepting bitcoin payments: If you own a business, you can accept bitcoin as payment for goods or services. Asking someone to sell you bitcoin: You can also ask a friend or family member to sell you some of their bitcoin.

- Use bitcoin: Once you have some bitcoin in your digital wallet, you can start using it to make payments or transfer it to other people.

Customer Reviews

Customer Reviews