When you email a client, and the communication is interpreted incorrectly, do you blame the internet? Regardless of your answer, we have experienced that communication ethics and meaning have been revolutionized since the internet created its own critical role in the business world.

The global business ecosystem today is on the cusp of another unprecedented era as finance and money see blockchain emerge as the powering technology. To date, fiat money has been a tangible, physical entity, even as it has mostly been reduced to a computer code. Now, that code is also being shifted to the wonderful, never-before-explored depths of the internet.

Trust, the factor that gave all fiat money any legitimacy, is now in the hands of anonymous network nodes that use blocks as the chain to record transactions. Enter, BLOCKCHAIN TECHNOLOGY.

SlideTeam’s Comprehensive Training Curriculum on Blockchain in Finance offers you the following benefits:

- Understand case studies to internalize the concept and prepare for an evolving financial services market that will create newer and better job opportunities. For those already, newer avenues open.

- Learn about the many applications of technology that will shape our lives permanently. No business domain will be left untouched. Entrepreneurship, as we know it, will change. Fundraising, peer-2-peer transactions, trade, finance, etc., everything will have a new hue.

- After this course, you will gain a deep appreciation of the importance of the emerging use cases of blockchain in finance. Also, get a head-start in preparing to invest or store cryptocurrency to your business’s competitive advantage.

TABLE OF CONTENTS:

| SESSION NUMBER | SESSION TITLE |

|---|---|

| SESSION I | Blockchain as a Financial System |

| SESSION II | Blockchain-Based Cryptocurrencies |

| SESSION III | Applications of Blockchain in Finance |

| SESSION IV | Case Studies of Blockchain in Finance |

| SESSION V | Limitations of Blockchain Adoption in Finance |

Trainers can download the content-ready complete deck here and be ready to educate their audience on the influence and applications that blockchain has in finance. We end each session with our standard format of:

- Key Takeaways

- Let’s Discuss

- Let’s Test What We Have Learnt

Click here to access the Comprehensive Training Curriculum On Blockchain in Finance

Session I: Blockchain as a Financial System

Here, we clarify and explain the underlying technology governing the blockchain, its characteristics, and its three generations (Peer-2-Peer Networks, Databases, and DApps). Consensus mechanisms, broadly, the broad playing rules of how the blockchain will function, are also explained in great detail.

Click here to access the Comprehensive Training Curriculum On Blockchain in Finance

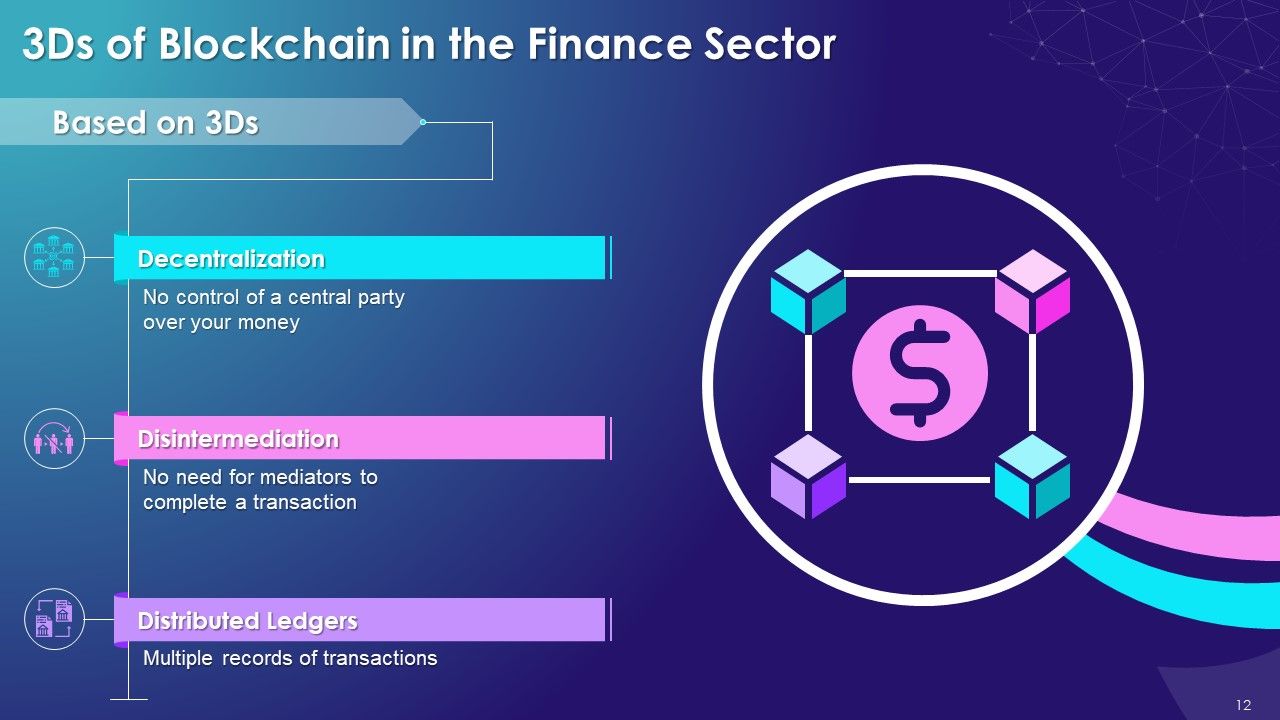

We introduce the 3Ds (Decentralization, Disintermediation, and Distributed Ledgers) and the benefits of blockchain in finance, which, as illustrated previously, are phenomenal.

Click here to access the Comprehensive Training Curriculum On Blockchain in Finance

With the pros presented, we deliver the limitations within which any blockchain functions. These are also huge stumbling blocks as of now and include issues with privacy, limited flexibility of a blockchain, concerns over secure, safe mass adoption (scalability), etc.

Session II: Blockchain-Based Cryptocurrencies

Cryptocurrency was the first and the most natural product of blockchain technology, and it has carved a niche in the financial services sector while also impacting other industries like gaming, art, content creation, insurance, etc. We begin Session II with an introduction to cryptocurrency and its nature.

Click here to access the Comprehensive Training Curriculum On Blockchain in Finance

We compare it with the traditional currency today, such as paper bills, coins, online transfers, etc.

Click here to access the Comprehensive Training Curriculum On Blockchain in Finance

We zoom in to focus on the most popular cryptocurrency today, Bitcoin. The trainees learn about what Bitcoin is, see its history, and learn to paint a picture of its influence based on the evidence of key statistics its use has generated to date.

Session III: Applications of Blockchain in Finance

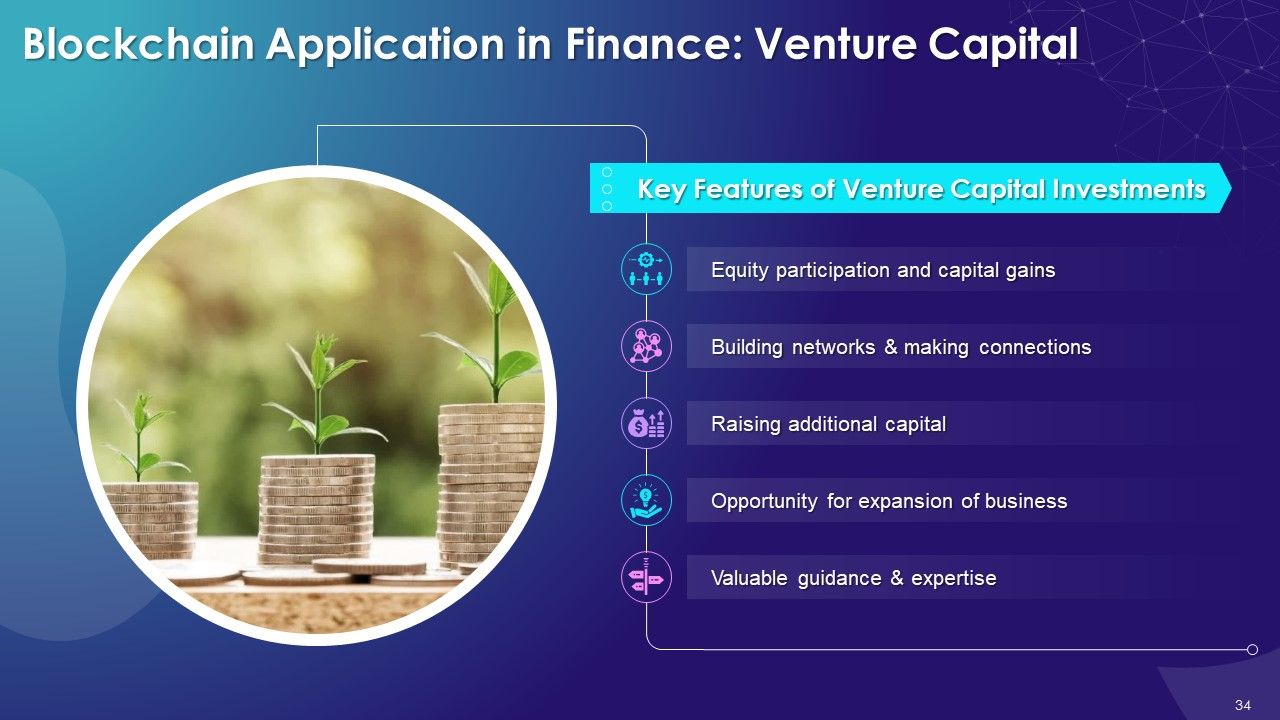

Now, we get to the juicier part of the training module, which is the applications of blockchain in finance. In Session III, we go through innumerable applications, some of which are already harvested and in practical, daily use. We understand what the application is, its key features, the problem it is solving, the solution it is providing, its advantages, and its operation.

Click here to access the Comprehensive Training Curriculum On Blockchain in Finance

A few of these applications are in the areas of venture capital, asset management, syndicated loan, equity post trade, trade finance, peer-2-peer transactions, etc. Here, the business processes and payments are simplified and intractable issues like multiple ownership claims are easily resolved with blockchain. This happens as everybody is a witness to transactions, and not just one individual, or the state, as the case may be.

Click here to access the Comprehensive Training Curriculum On Blockchain in Finance

By the end of this part of the module, trainees have a clear understanding that the financial landscape is changing fast, and people, as well as organizations, must keep up with these changes to stay relevant.

Session IV: Case Studies of Blockchain in Finance

This section of the training showcases real-life applications of blockchain in finance with case studies. In Session IV, each case study presents a problem, a solution for the problem through blockchain, and, in some cases, avenues for more research.

Click here to access the Comprehensive Training Curriculum On Blockchain in Finance

A few of the case studies are Santander: Banking System, HMLR, Real Estate, Bullion, Bloom, SALT, etc. For Santander, the issue was to provide financial services that directly benefit people and help people in their business growth. The solution provided by blockchain was to help Ripple-assisted Santander in developing a One Pay FX service that allowed the users to make fast, low-cost payments. The solution is now available to users in six countries which the ability to transfer money to over a dozen countries, including Europe.

Session V: Limitations of Blockchain Adoption in Finance

Blockchain has had a significant impact on the finance world, but there is still a long way to go. The limitations of our current infrastructure are impeding the unlimited potential of blockchain. We will discuss these limitations in Session V.

Click here to access the Comprehensive Training Curriculum On Blockchain in Finance

We study the cooperation and established standards, legal framework, settling values of cryptocurrencies in fiat money, scalability and resilience, and regulatory orthodoxies that could act as stumbling blocks.

Session VI: Appendix

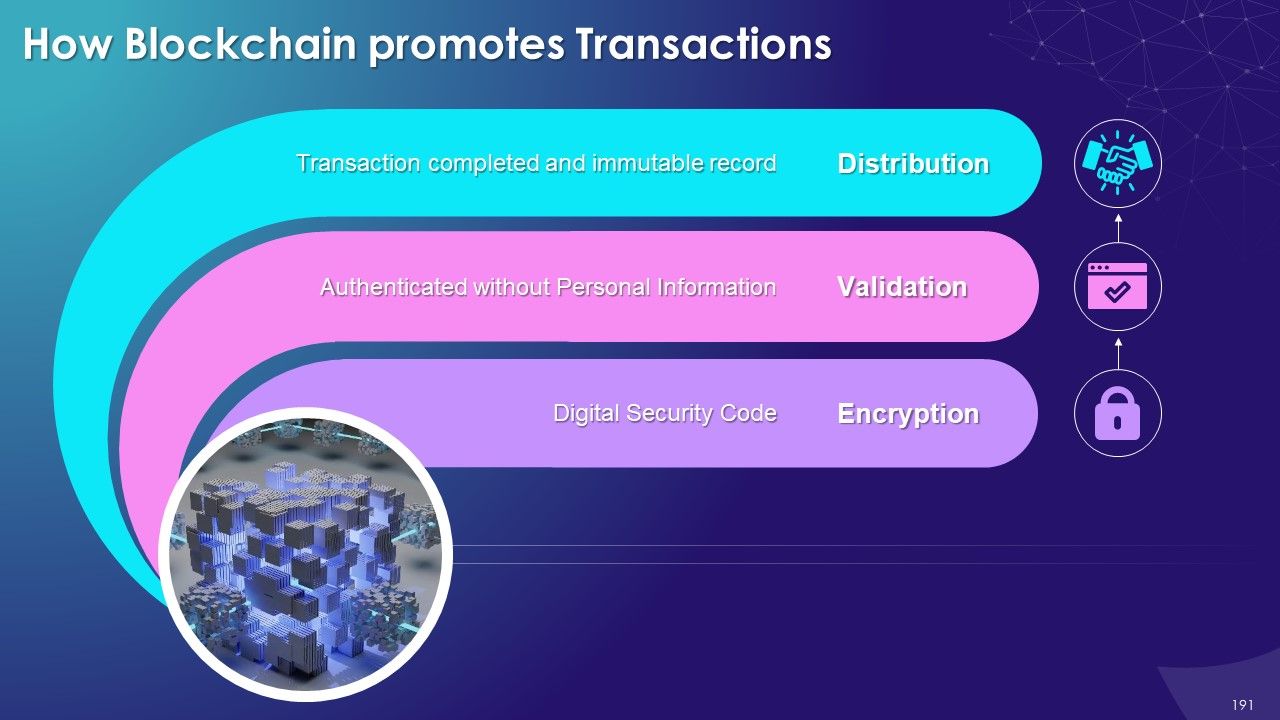

Our comprehensive training courses have more business value to offer. In Session VI, we answer Frequently Asked Questions (FAQs) the trainees might have regarding blockchain in finance. We dedicate a slide each to these topics, some of which are how blockchain promotes transactions, blockchain application in finance payments, centralized finance (CeFi), decentralized finance (DeFi), smart contracts, and more.

Click here to access the Comprehensive Training Curriculum On Blockchain in Finance

With this final session, we conclude the training and open the floor for discussion to ensure questions are answered and doubts are cleared. Through this training module, we hope your audience comes to understand and appreciate the magnitude of the changes already brought and hear the drumbeat of the newer era that will soon be upon us in the world of finance.

Money, as we know it, will change, undeniably, truly, and in a way that the world will come to life.

FAQs on Blockchain Technology in Finance

How is blockchain used in finance?

- Cryptocurrencies: Blockchain technology is used to create and track transactions in cryptocurrencies like Bitcoin and Ethereum.

- Payment processing: Blockchain can be used to process and verify financial transactions more efficiently, potentially reducing the need for banks and other financial intermediaries.

- Identity verification: Blockchain technology can be used to create secure, immutable records of identity, which can be used to check money laundering.

- Supply chain financing: Blockchain can be used to create a permanent, unchangeable record of a product's journey through the supply chain. This serves as a certificate of authenticity for the product and facilitates financing.

- Trade finance: Blockchain can be used to automate and streamline trade finance, reducing the risk of fraud and speeding up the settlement of trades.

What is blockchain financial technology?

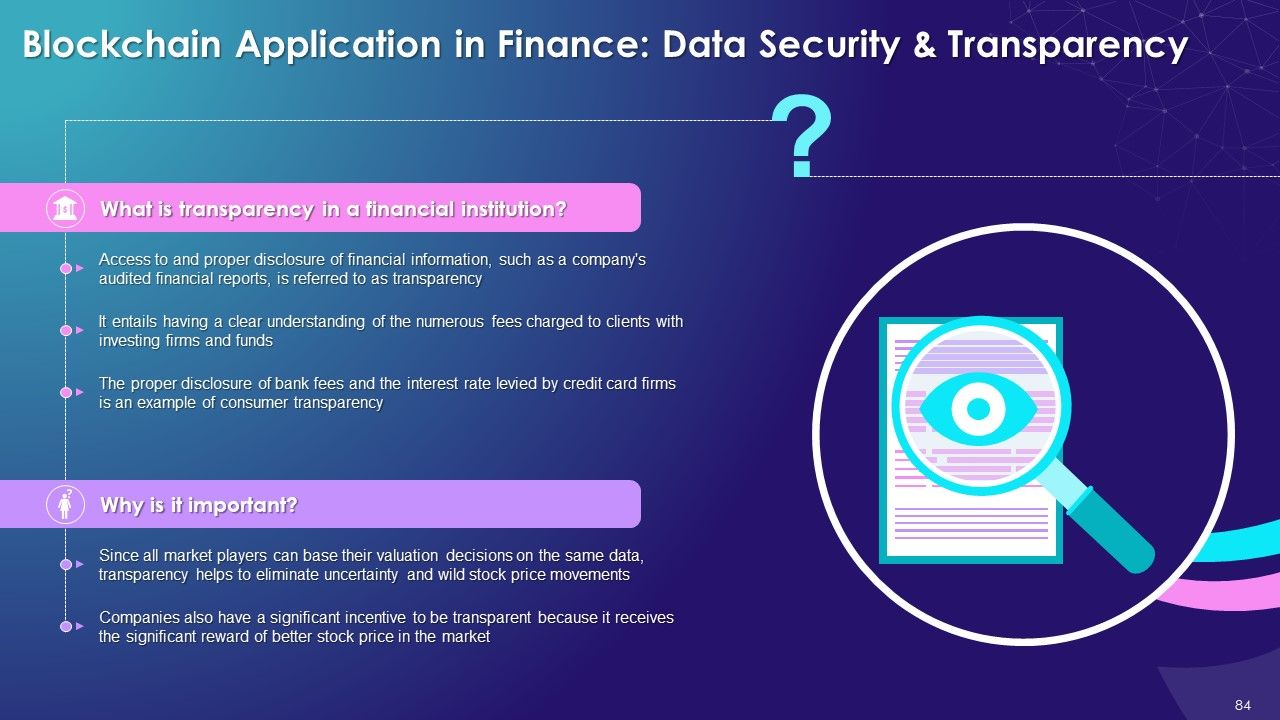

Blockchain financial technology (fintech) refers to the use of blockchain technology in the financial industry. Blockchain is a decentralized, distributed ledger technology that can be used to record and verify transactions in a secure and transparent manner. Some specific applications of blockchain fintech include the use of cryptocurrency, the automation of payment processing and trade finance, and the creation of secure, immutable records of identity.

Is blockchain a part of finance?

Yes, blockchain is a part of the finance industry. In fact, the financial industry is one of the areas where blockchain technology is being explored and implemented most actively. Blockchain has the potential to revolutionize the way that financial transactions are processed by reducing the need for intermediaries, increasing transparency and security, and reducing transaction costs.

Is blockchain the future of finance?

It is difficult to predict the future, but many experts believe that blockchain technology has the potential to impact and transform the finance industry. It is important to note, however, that the adoption of blockchain in finance is still in a nascent stage, and it will take time (at least a decade) for the full potential of this technology to be realized.

Customer Reviews

Customer Reviews