Business due diligence process ppt outline

Our Business Due Diligence Process Ppt Outline are a fail safe device. It assures you of a huge back up.

Our Business Due Diligence Process Ppt Outline are a fail safe device. It assures you of a huge back up.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

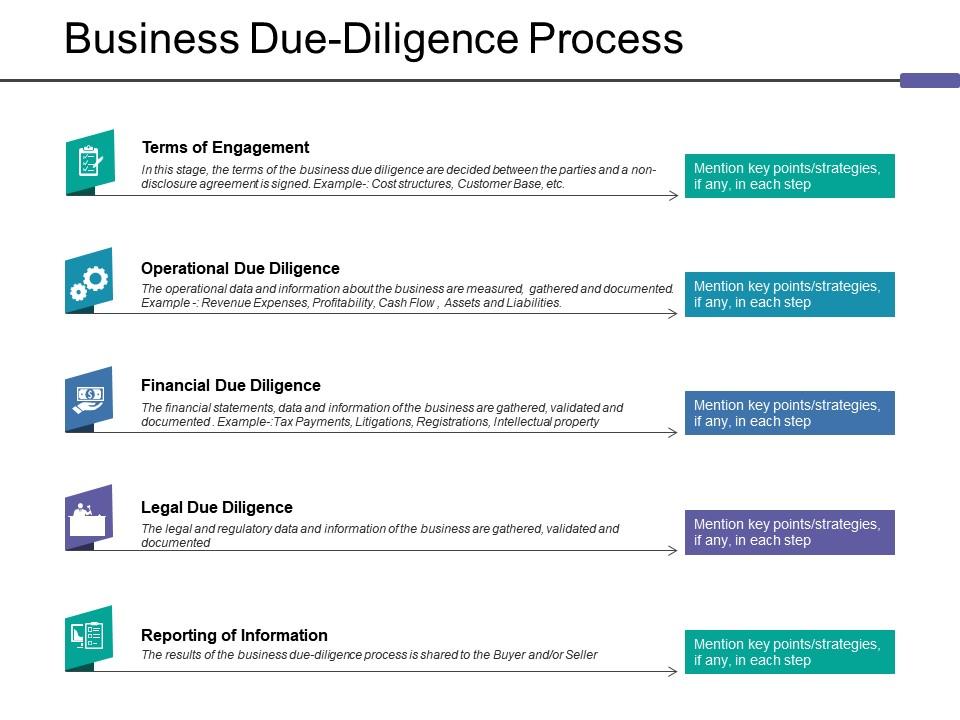

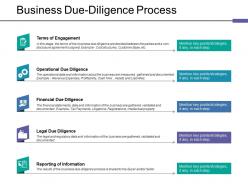

Presenting this set of slides with name - Business Due Diligence Process Ppt Outline. This is a five stage process. The stages in this process are Terms Of Engagement, Operational Due Diligence, Legal Due Diligence, Financial Due Diligence.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Description:

The image is a PowerPoint slide titled "Business Due-Diligence Process," which outlines the key stages in a due diligence investigation. The slide is divided into four main sections, each representing a critical aspect of due diligence:

1. Terms of Engagement:

This section suggests the preliminary agreements and understandings that are established before a due diligence process begins, such as cost structures and customer base.

2. Operational Due Diligence:

It details the evaluation of the business's operational aspects, including revenue, expenses, profitability, cash flow, and a balance of assets and liabilities.

3. Financial Due Diligence:

This focuses on examining the financial health of the business, with a review of financial statements and considerations such as tax payments, litigations, registrations, and intellectual property.

4. Legal Due Diligence:

It involves assessing the legal standings of the business, ensuring all regulatory requirements are met and documented.

5. Reporting of Information:

The final step where the findings from the due diligence process are reported back to the involved parties.

Each section includes a placeholder to "Mention key points/strategies, if any, in each step," prompting the presenter to provide more detailed information and insights relevant to each specific stage of due diligence.

Use Cases:

Industries that would benefit from using these slides include:

1. Mergers & Acquisitions:

Use: Guiding due diligence in business mergers or acquisitions.

Presenter: M&A Consultant.

Audience: Corporate Executives, Legal Teams.

2. Investment Banking:

Use: Evaluating potential investment opportunities.

Presenter: Investment Banker.

Audience: Investors, Financial Analysts.

3. Legal Services:

Use: Advising on compliance and risk management.

Presenter: Legal Advisor.

Audience: Business Clients, Corporate Counsels.

4. Real Estate:

Use: Assessing property and developer credibility.

Presenter: Real Estate Analyst.

Audience: Investors, Property Buyers.

5. Healthcare:

Use: Ensuring medical entities' operational and financial compliance.

Presenter: Healthcare Consultant.

Audience: Hospital Administrators, Medical Practitioners.

6. Technology:

Use: Validating tech startups or partnerships.

Presenter: Tech Industry Analyst.

Audience: Venture Capitalists, Tech Entrepreneurs.

7. Manufacturing:

Use: Inspecting supply chain and production facility acquisitions.

Presenter: Operations Manager.

Audience: Business Partners, Stakeholders.

Business due diligence process ppt outline with all 5 slides:

Conquer your demons with our Business Due Diligence Process Ppt Outline. Gain control of doubts and dilemmas.

-

Wonderful templates design to use in business meetings.

-

Designs have enough space to add content.