Debt financing investment pitch deck powerpoint presentation slides

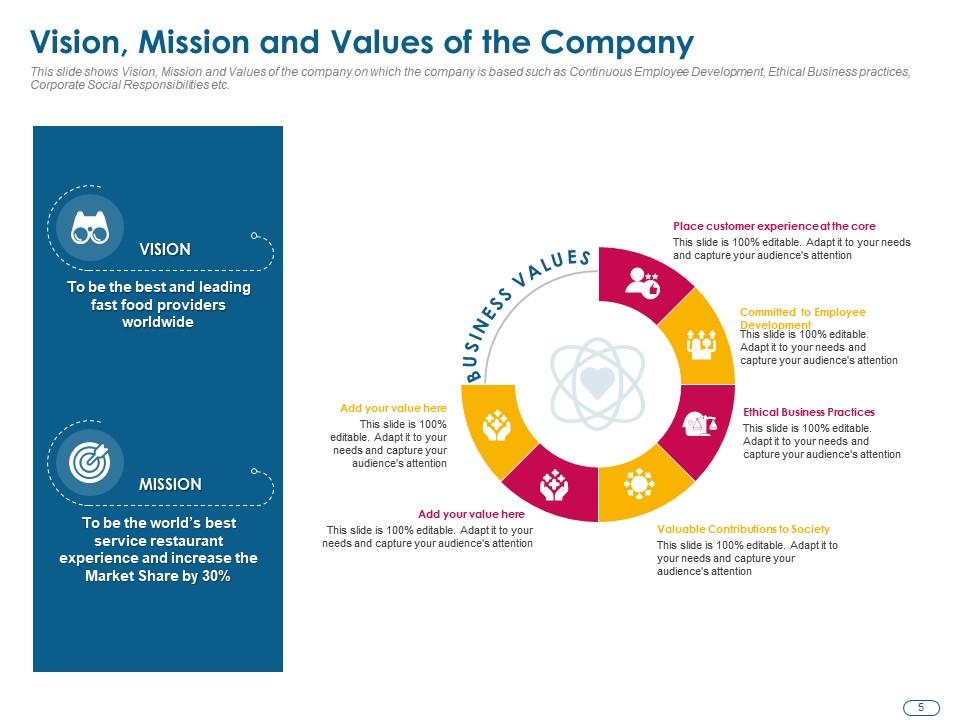

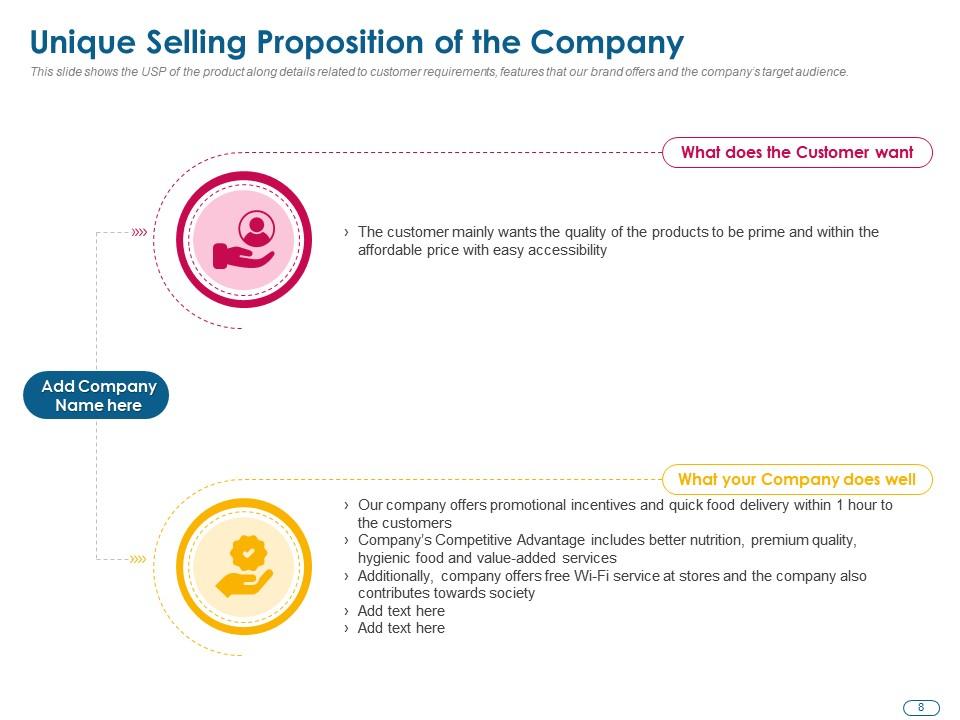

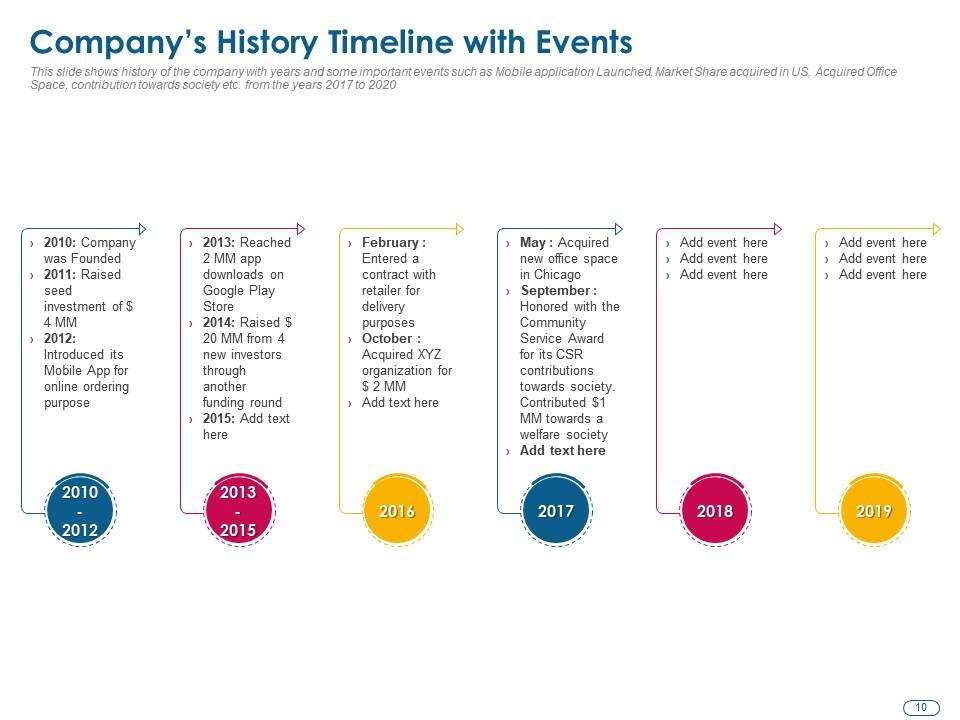

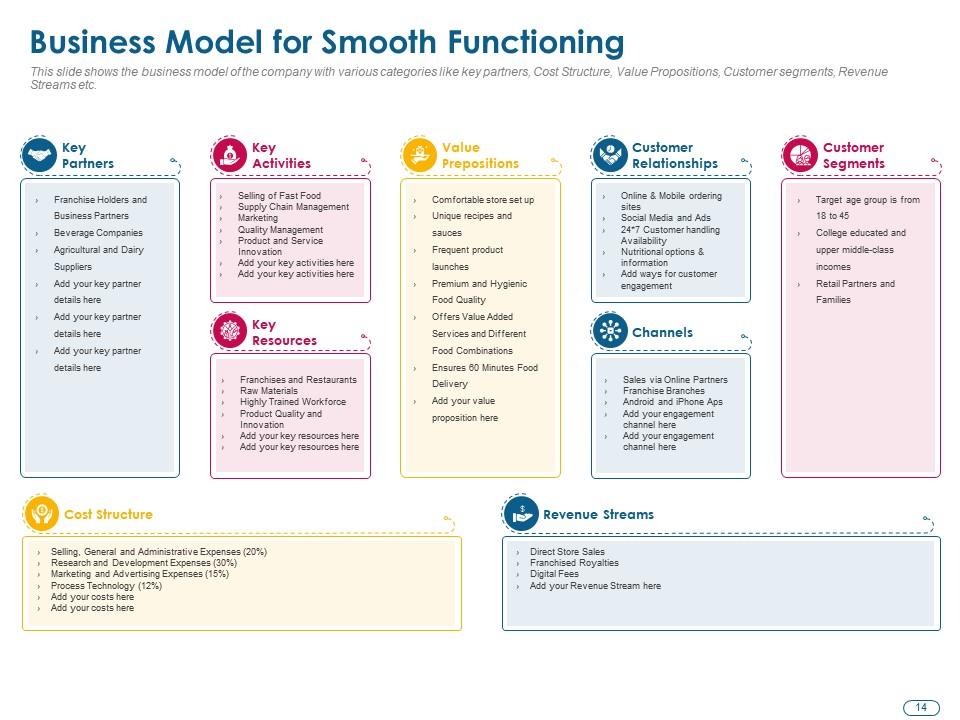

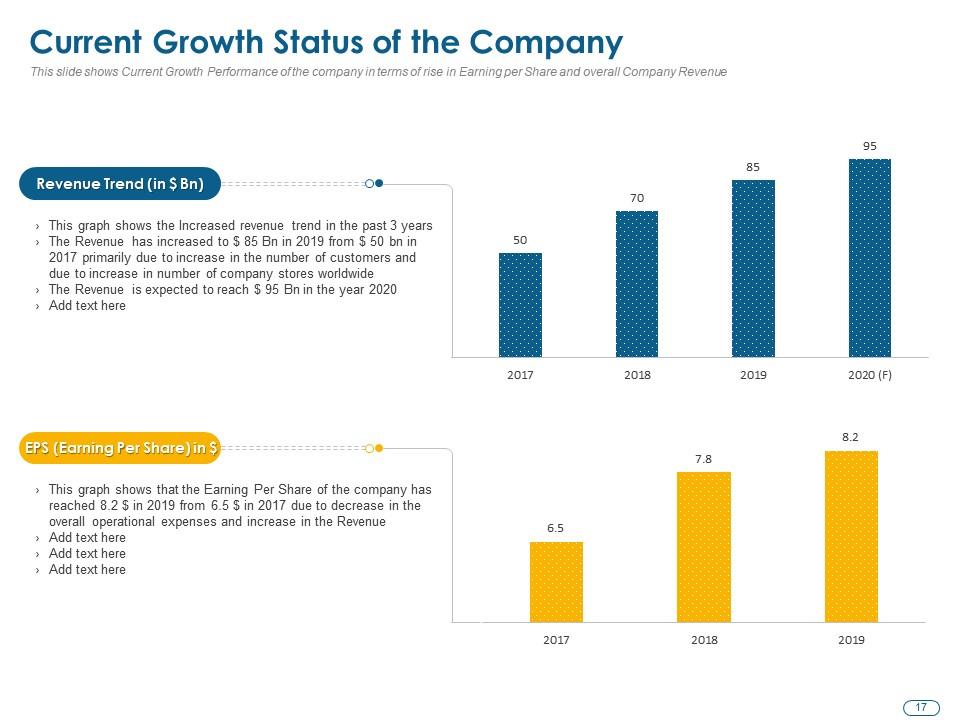

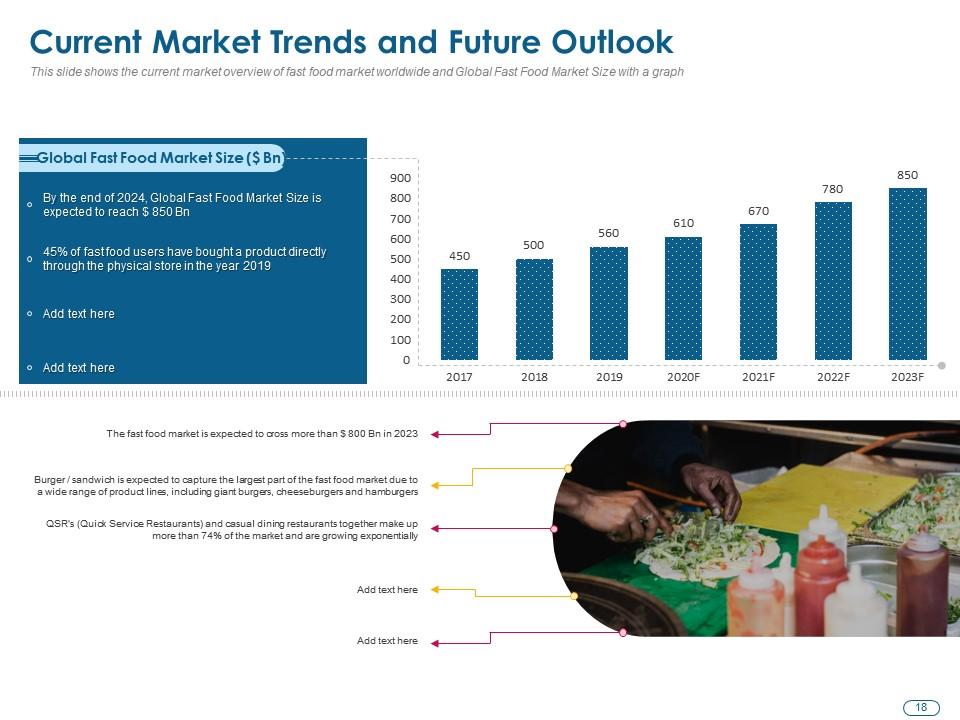

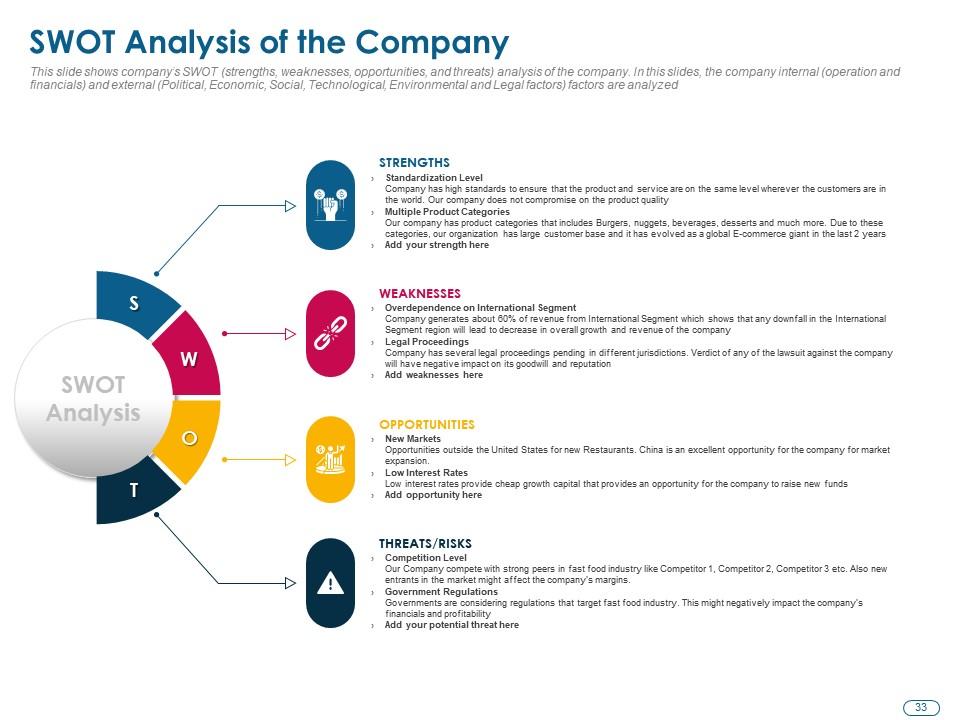

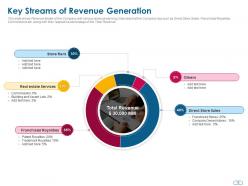

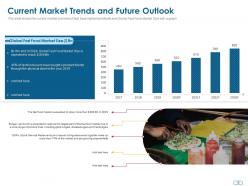

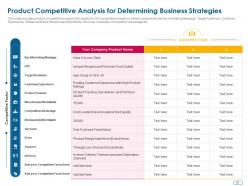

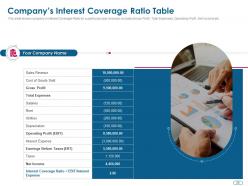

Employ our Debt Financing Investment Pitch Deck PowerPoint Presentation Slides to provide the company's operational overview with segments and revenue split in a well-organized format. Select this fundraising PPT slideshow to showcase your company's vision, mission, and values in an attractive manner. Grab the attention of the audiences by providing accurate business revenue and finance-related statistics through these equity investment PowerPoint templates. You can easily highlight the operational issues along with their solutions like global standardization and franchise expansion by taking the aid of these private investment PPT slides. Capture the attention of your potential investors by using these well-color-coded financial PPT layouts to display the company’s unique selling proposition. Compel the venture capitalists to invest in your company by utilizing these fiscal outlay PPT themes to put forward your ideas, key features, elements, awards, achievements, and product categories. Share the list of corporate tie-ups and partnerships of your company with the assistance of this equity-raisingPowerPoint presentation. Click the download button and make this capital funds PPT deck your source for impressing potential investors.

Employ our Debt Financing Investment Pitch Deck PowerPoint Presentation Slides to provide the company's operational overvie..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting our Debt Financing Investment Pitch Deck PowerPoint Presentation Slides. This is a completely adaptable PPT slide that allows you to add images, charts, icons, tables, and animation effects according to your requirements. Create and edit your text in this 100% customizable slide. You can change the orientation of any element in your presentation according to your liking. The slide is available in both 4:3 and 16:9 aspect ratios. This PPT presentation is also compatible with Google slides.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Debt financing investment pitch deck powerpoint presentation slides with all 50 slides:

Use our Debt Financing Investment Pitch Deck Powerpoint Presentation Slides to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Unique research projects to present in meeting.