Implementing Tax Planning And Management Strategies For Small Businesses And Startups Fin CD

Grab our efficiently designed Implementing Tax Planning and Management Strategies for Small Businesses and Startups PowerPoint presentation. This comprehensive guide is tailored to equip entrepreneurs with vital strategies and insights crucial for effective tax management. Covering various facets, from taxation fundamentals to advanced planning techniques, this Financial Planning PPT offers an extensive roadmap essential for financial sustainability and growth. The presentation begins with an insightful overview section detailing fundamental tax principles, compliance essentials, and the significance of strategic tax planning for small enterprises and startups. It further delves into diverse modules covering tax minimization strategies, deductions, credits, and compliance obligations specific to small businesses. In addition, this Income Tax PPT provides in-depth guidance on leveraging tax-efficient structures incentives, aiming to optimize their financial resources while ensuring regulatory compliance. Lastly, it serves as an invaluable tool empowering entrepreneurs with the knowledge and strategies necessary to navigate the intricacies of tax planning, fostering financial health and sustained growth for small businesses and startups. Get access now.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

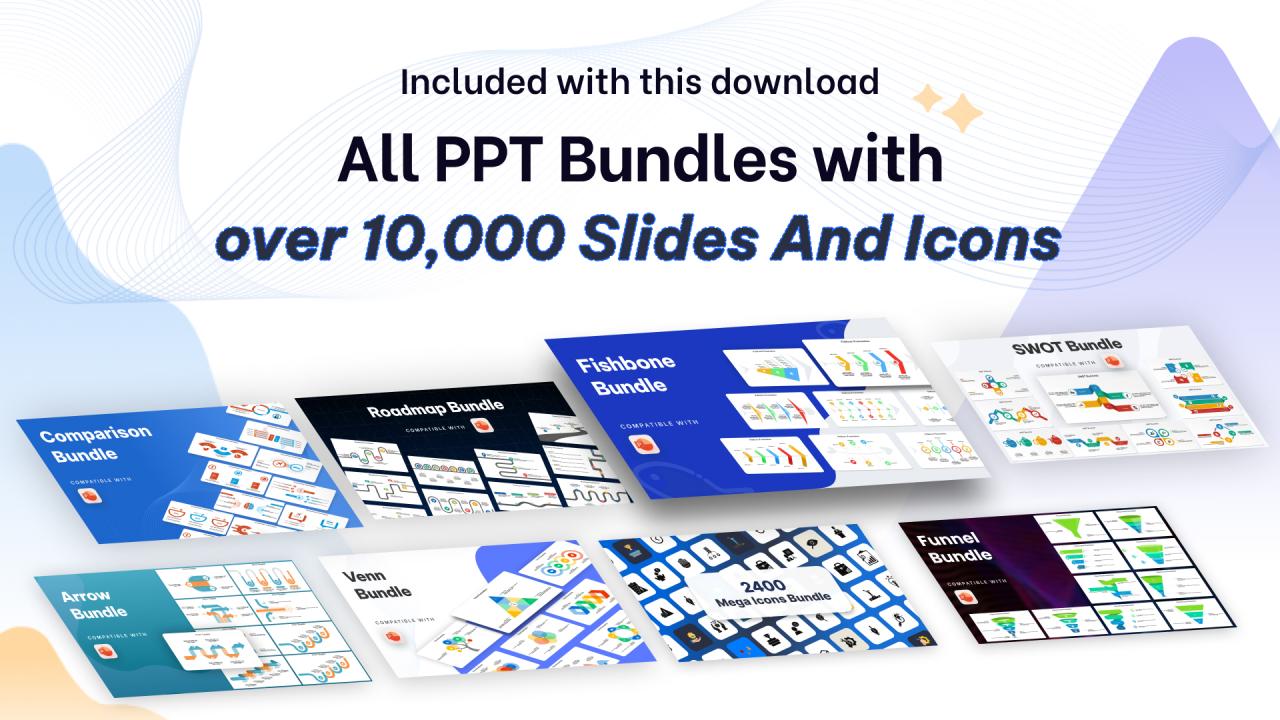

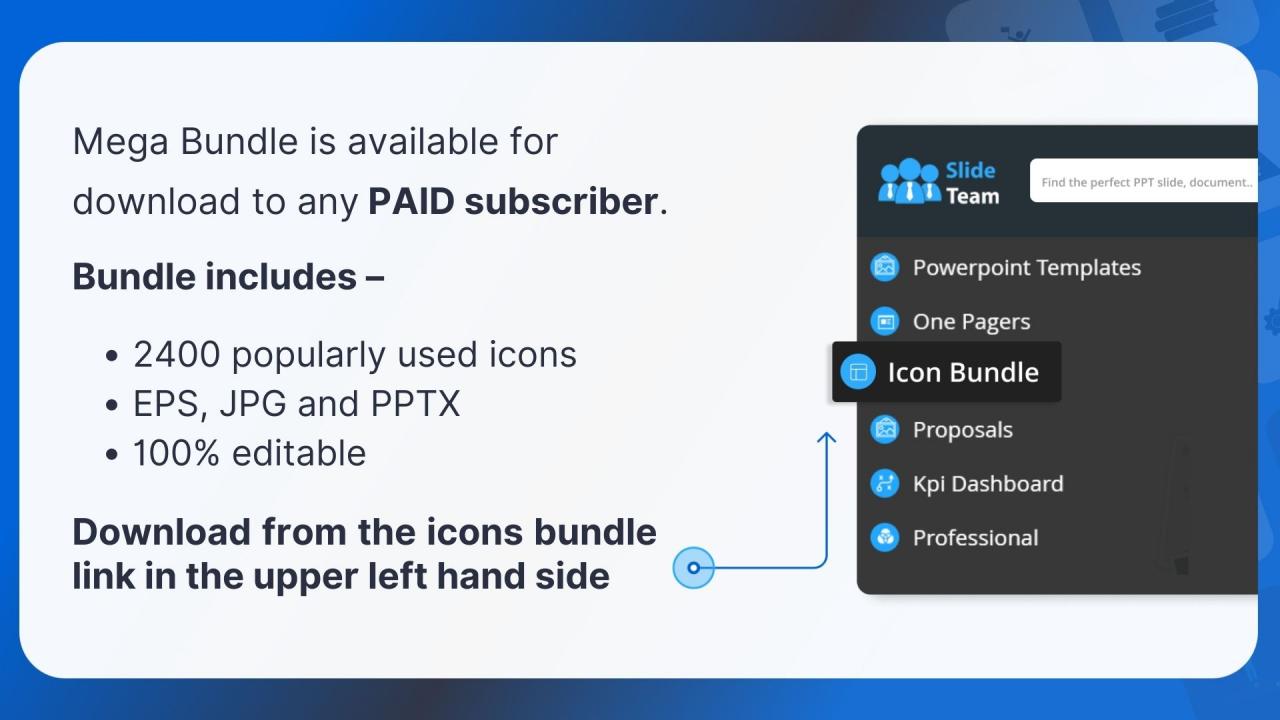

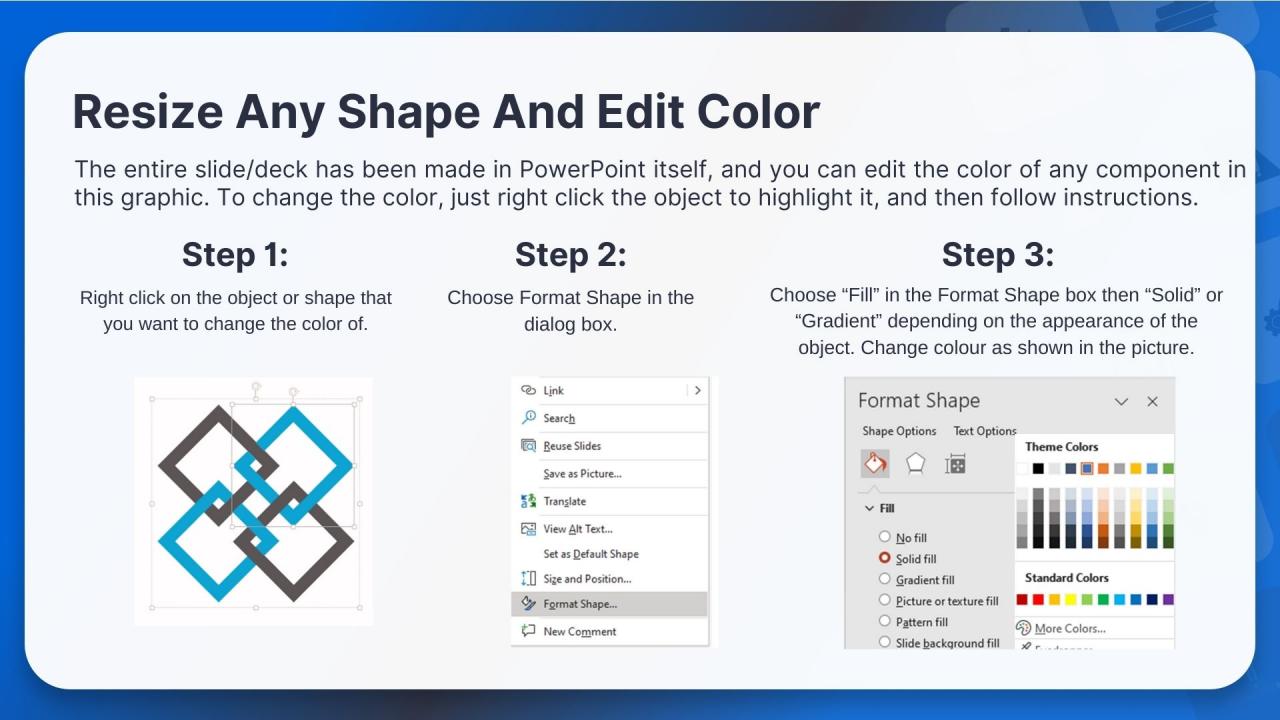

Deliver this complete deck to your team members and other collaborators. Encompassed with stylized slides presenting various concepts, this Implementing Tax Planning And Management Strategies For Small Businesses And Startups Fin CD is the best tool you can utilize. Personalize its content and graphics to make it unique and thought-provoking. All the fourty three slides are editable and modifiable, so feel free to adjust them to your business setting. The font, color, and other components also come in an editable format making this PPT design the best choice for your next presentation. So, download now.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Implementing Tax Planning and Management Strategies for Small Businesses and Startups.

Slide 2: This slide states Agenda of the presentation.

Slide 3: This slide shows Table of Content for the presentation.

Slide 4: This slide highlights title for topics that are to be covered next in the template.

Slide 5: This slide represents the challenge faced by startup businesses during tax planning.

Slide 6: This slide represents challenges faced by startups during tax planning, i.e. inefficient recordkeeping and financial management.

Slide 7: This slide represents challenges faced by startups during tax planning, i.e. inadequate planning for growth and liabilities.

Slide 8: This slide highlights title for topics that are to be covered next in the template.

Slide 9: This slide showcases Tax planning goals and objectives for startup.

Slide 10: This slide shows Available tax deductions and credits for startup business.

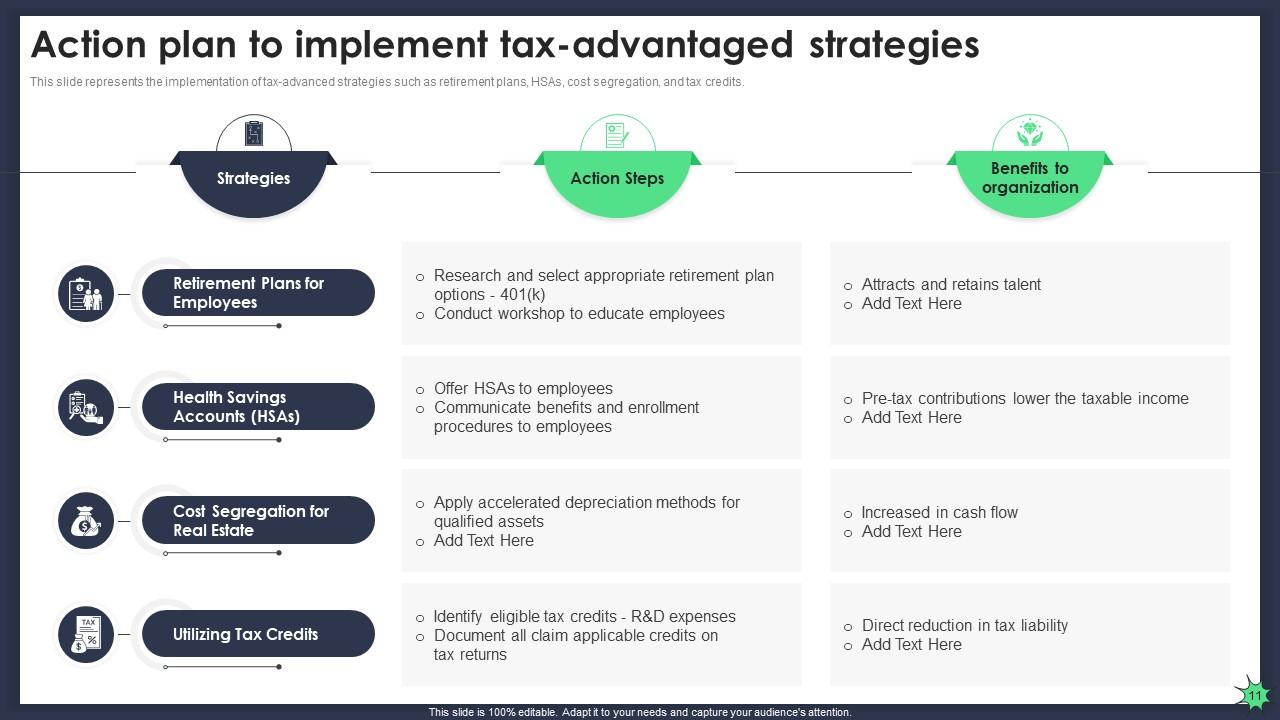

Slide 11: This slide presents Action plan to implement tax-advantaged strategies.

Slide 12: This slide highlights title for topics that are to be covered next in the template.

Slide 13: This slide displays Timeline showcasing implementation of tax planning strategies.

Slide 14: This slide represents Timeline showcasing implementation of tax planning strategies.

Slide 15: This slide showcases Assessment and evaluation of tax planning strategies.

Slide 16: This slide highlights title for topics that are to be covered next in the template.

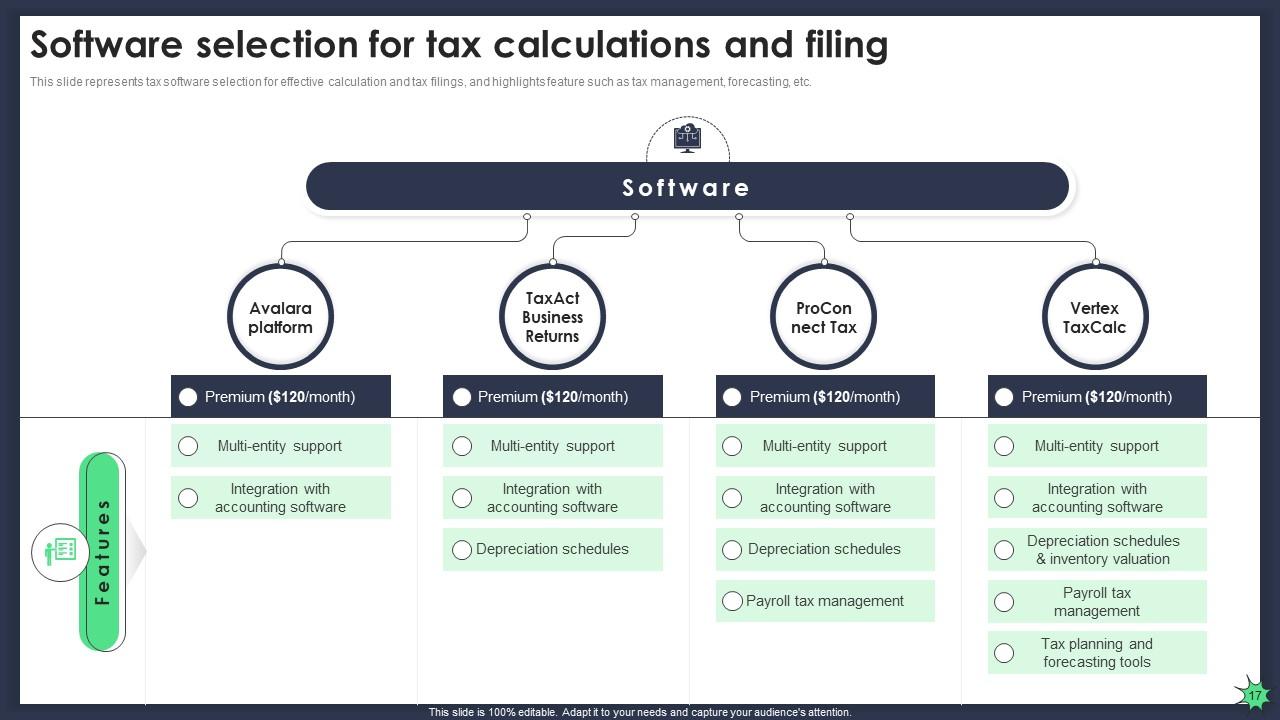

Slide 17: This slide shows Software selection for tax calculations and filing.

Slide 18: This slide presents Employing cloud-based accounting solution in organization.

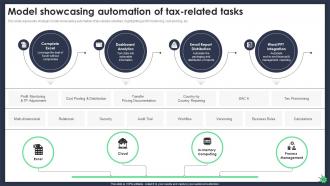

Slide 19: This slide displays Model showcasing automation of tax-related tasks.

Slide 20: This slide highlights title for topics that are to be covered next in the template.

Slide 21: This slide represents Assigning tax management responsibilities to team.

Slide 22: This slide showcases Key people involved in tax management team.

Slide 23: This slide shows Responsibilities of internal and external tax consultant.

Slide 24: This slide presents Strategic plan for tax management and communication.

Slide 25: This slide highlights title for topics that are to be covered next in the template.

Slide 26: This slide displays Forecasting potential impact of tax planning on business.

Slide 27: This slide highlights title for topics that are to be covered next in the template.

Slide 28: This slide represents Long-term tax optimization for business growth.

Slide 29: This slide showcases Exit strategies for business and their tax implications.

Slide 30: This slide shows Awareness training to educate employees on tax.

Slide 31: This slide presents Future trends associated with tax planning and management.

Slide 32: This is another slide continuing Future trends associated with tax planning and management.

Slide 33: This slide contains all the icons used in this presentation.

Slide 34: This slide is titled as Additional Slides for moving forward.

Slide 35: This slide displays Tax planning overview with key importance.

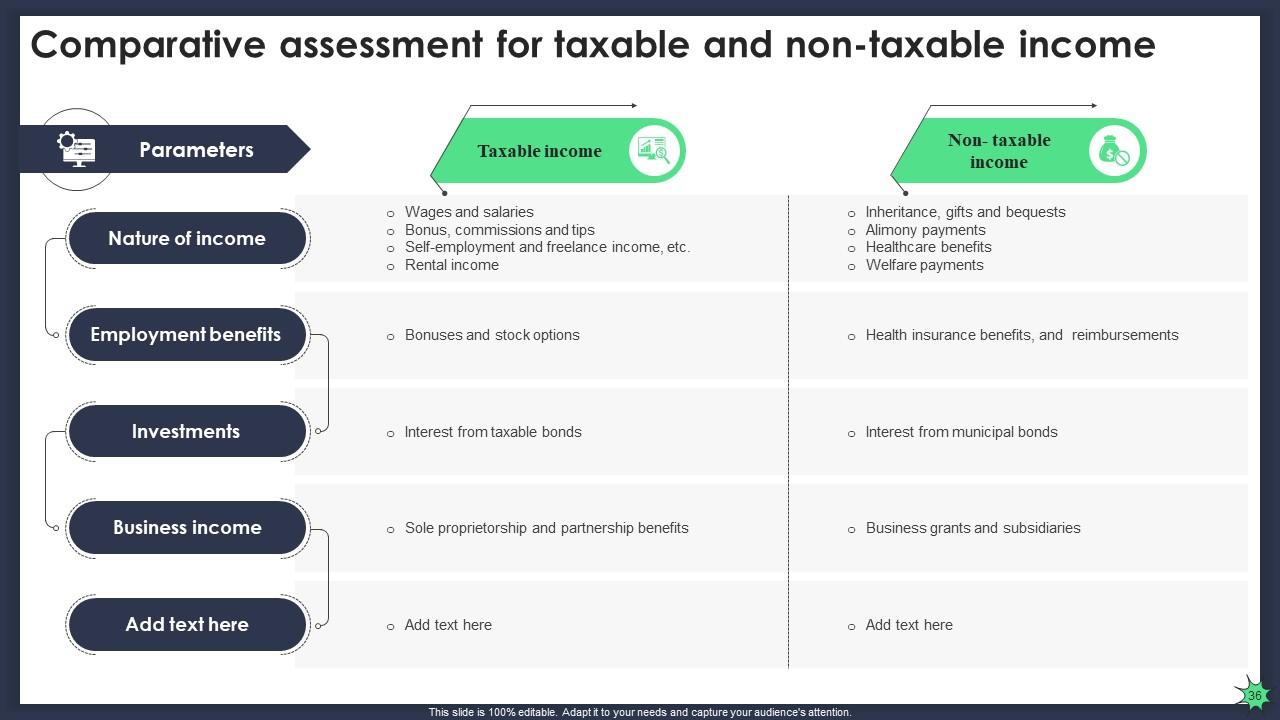

Slide 36: This slide represents Comparative assessment for taxable and non-taxable income.

Slide 37: This slide displays Types of tax deductions and criteria in business.

Slide 38: This slide contains Puzzle with related icons and text.

Slide 39: This is Our Target slide. State your targets here.

Slide 40: This slide shows SWOT describing- Strength, Weakness, Opportunity, and Threat.

Slide 41: This is a Quotes slide to convey message, beliefs etc.

Slide 42: This slide displays Mind Map with related imagery.

Slide 43: This is a Thank You slide with address, contact numbers and email address.

Implementing Tax Planning And Management Strategies For Small Businesses And Startups Fin CD with all 52 slides:

Use our Implementing Tax Planning And Management Strategies For Small Businesses And Startups Fin CD to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

I am so thankful for all of the templates I've found on your site. They have saved me hours every week and helped make my presentations come alive. Keep up with these amazing product releases!

-

Qualitative and comprehensive slides.