Quantitative Risk Management In Stock Portfolios Powerpoint Presentation

To make a PowerPoint presentation slides for the topic risk involve with stock portfolios can be a challenging task. Therefore, our team has provided 58 slide content-ready Quantitative Risk Management In Stock Portfolios Powerpoint Presentation Slides that will help you in presenting risk management steps effectively and visually. In this risk assessment PPT presentation, we have included slide like portfolio management process, investment objectives, risk tolerance analysis, risk reward matrix, assist allocation, risk return plot, target modelling, key driver analytics, resource capacity planning, financial planning, pareto optimal portfolio investment approaches and many more. Our risk assessment PPT show will save to a lot of time and effort. Moreover, you will also get various additional slides like performance attribution, security analysis, key evaluation metrics, dashboard, timeline, matrix, quotes, comparison etc. Whether you want to showcase individual portfolio or multiple portfolios and the multiple risk involved with managing portfolios, our Quantitative Risk Management In Stock Portfolios Powerpoint Presentation Slides is the answers for all your needs. Just download this PowerPoint presentation example and present in front of target audience. Glide over all obstacles in your way. Get the lift you need with our Quantitative Risk Management In Stock Portfolios Powerpoint Presentation Slides.

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Quantitative Risk Management In Stock Portfolios Powerpoint Presentation Slides. Set of 58 PowerPoint Slides and professional layouts. When you download the PPT, you get the deck in both widescreen (16:9) and standard (4:3) aspect ratio. This ready-to-use PPT comprises visually stunning PowerPoint templates, vector icons, images, data-driven charts and graphs and business diagrams. The PowerPoint presentation is 100% editable. Customize the presentation background, font, and colors as per your company’s branding. The slide templates are compatible with Google slides, PDF and JPG formats

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide showcases Quantitative Risk Management In Stock Portfolios .State Your Company Name and begin.

Slide 2: This slide presents agenda. You can add the agendas and make use of it.

Slide 3: This slide showcases portfolio management process with these stages- Measure, Improve, Analyze, Define, Control.

Slide 4: This slide shows investment objectives with these five factors- Set Your Goals, Management Team, Risk Management, Asset Management, Tax Reduction.

Slide 5: This slide presents investment objectives with these five steps- Increase Income, Finance Expenses, Reduce Tax Liability, Increase Saving, Fight Inflation.

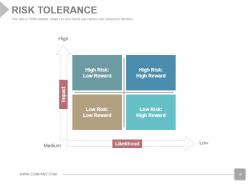

Slide 6: This slide presents risk tolerance analysis with five pointer both side arrow.

Slide 7: This slide showcases risk tolerance analysis with risk meter- High, Low, Middle.

Slide 8: This slide presents risk tolorence which further shows Impact and Likelihood- High, Medium, Low.

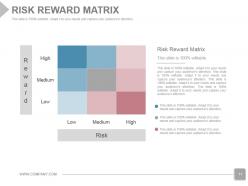

Slide 9: This slide shows risk reward matrix with Investment Reward.

Slide 10: This slide presents Risk reward matrix with these two factors- Bread and Butter, Probability Of Technical Success.

Slide 11: This slide shows risk reward matrix which further presents High, low, medium.

Slide 12: This slide showcases asset allocation with risk and reward.

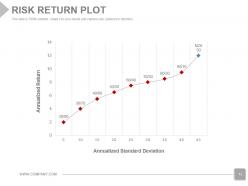

Slide 13: This slide presents risk return plot with these two parameters- Annualized Return, Annualized Standard Deviation.

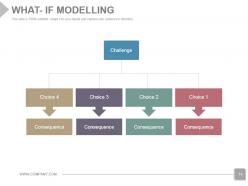

Slide 14: This slide showcases what if modelling with choices and consequences.

Slide 15: This slide shows what-if modelling with circular diagram.

Slide 16: This slide presents what if modelling with four stages.

Slide 17: This slide showcases target modelling with which you can add your targets.

Slide 18: This slide presents target modelling with these six points- Conservative Growth, Moderate Growth, Moderate AggressiveGrowth, Aggressive Growth More Diversification, Concentrated Growth, Concentrated Aggressive Growth.

Slide 19: This slide presents key driver analytics with four facts.

Slide 20: This slide presents key driver analytics.

Slide 21: This slide showcases resource capacity planning.

Slide 22: This slide presents resource capacity planning.

Slide 23: This slide shows financial planning with these five factors- Estate Planning, Cash Flow, Risk Management, Retirement, Investments.

Slide 24: This slide showcases scheduling with circular diagram.

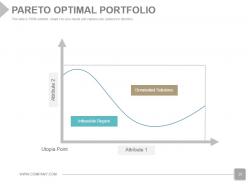

Slide 25: This slide presents pareto optimal graph and the curve showing the some region.

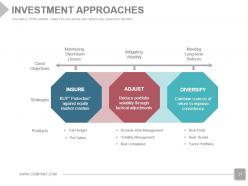

Slide 26: This slide showcases investment approaches with these four parameters.

Slide 27: This slide showcases invesment approaches.

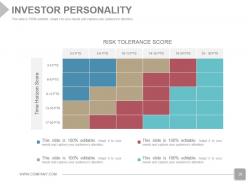

Slide 28: This slide can be used for investor personality.

Slide 29: This slide showcases investor personality with a matrix.

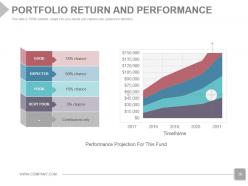

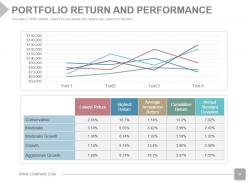

Slide 30: This slide presents portfolio return and performance.

Slide 31: This slide showcases portfolio return and performance.

Slide 32: This slide shows performance attribution with an icon.

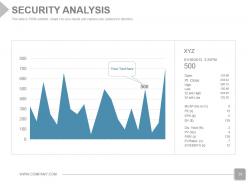

Slide 33: This slide shows security analysis with a graph which further shows a bar wave chart.

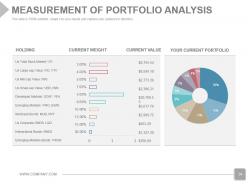

Slide 34: This slide presents measurement of portfolio analysis.

Slide 35: This slide shows portfolio selection table. Add the data and make use of it.

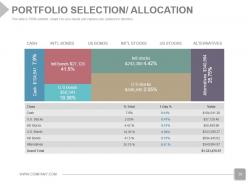

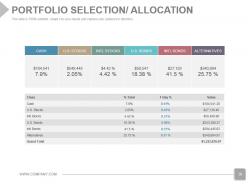

Slide 36: This slide presents PORTFOLIO SELECTION/ ALLOCATION. Add the cash, stocks and bonds.

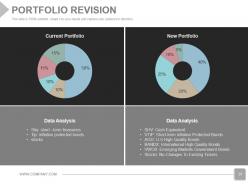

Slide 37: This slide showcases portfolio revision with current and new one.

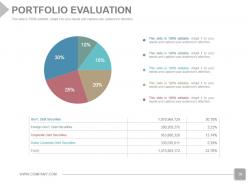

Slide 38: This slide portfolio evaluation with a percetage diagram.

Slide 39: This slide presents portfolio evaluation.

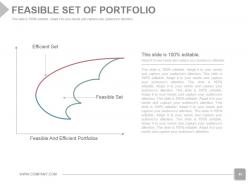

Slide 40: This slide showcases feasible set of portfolio.

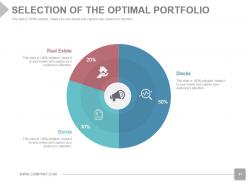

Slide 41: This slide presents selection of the optimal portfolio.

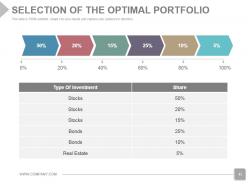

Slide 42: This slide shows selection of the optimal portfolio.

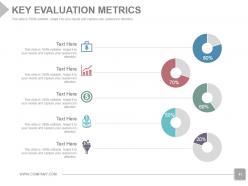

Slide 43: This slide presents key evaluation metrics.

Slide 44: This slide is titled Additional Slides to move forward.

Slide 45: This is a Vision, Mission and Goals slide. State them here.

Slide 46: This slide showcases Our Team with Name and Designation to fill.

Slide 47: This slide shows Our Goals for your company.

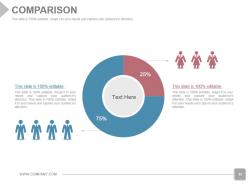

Slide 48: This slide shows Comparison of number of users and Time.

Slide 49: This slide is titled as Financials. Show finance related stuff here.

Slide 50: This slide shows Comparison of number of users and Time.

Slide 51: This is Dashboard slide to show information in percentages etc.

Slide 52: This slide presents a Timeline to show growth, milestones etc.

Slide 53: This is a Target slide. State your targets here.

Slide 54: This is a MATRIX slide. Put relevant comparing data here.

Slide 55: This is a LEGO slide with text boxes to show information.

Slide 56: This slide shows a Magnifying glass with text boxes

Slide 57: This slide presents a Bar graph in arrow form with text boxes.

Slide 58: This is a Thank You slide with Address# street number, city, state, Contact Number, Email Address.

Quantitative Risk Management In Stock Portfolios Powerpoint Presentation with all 58 slides:

Our Quantitative Risk Management In Stock Portfolios Powerpoint Presentation Slides generate appreciation in every community. It cuts across cultural boundaries.

-

Great product with highly impressive and engaging designs.

-

Much better than the original! Thanks for the quick turnaround.