Steps Required In Consumer Lending Process Powerpoint Presentation Slides

Educate the clients about the company and its loan offerings by employing professionally designed Steps Required In Consumer Lending Process PowerPoint Presentation Slides. This infographics of this readily available presentation contain a company overview, need for a loan in the business organization, types of business loan offered, features and benefits of loans, competitive landscape of loans, loan process, business financing application checklist, borrow’s ability and willingness to repay the loan. The slides also cover the products and services offered by banks. Take the assistance of the loan process PPT slide deck, and depict the need for business loans in the organization such as to purchase real estate, equipment, inventory, increase working capital, etc. Showcase the types of loans offered with the advantages and disadvantages of each type of loan. Utilize this customer loan process PowerPoint templates and discuss the features and benefits of each type of loan. Make your audience familiar with the loan process by covering details like required documents, and the closing process with this business lending process PowerPoint presentation.

Educate the clients about the company and its loan offerings by employing professionally designed Steps Required In Consume..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting Steps Required In Consumer Lending Process Powerpoint Presentation Slides. You can modify the font size, type, and color of the slide as per your requirements. This slide can be downloaded into formats like PDF, JPG, and PNG without any problem. It is Google Slides friendly which makes it accessible at once. This slide is available in both the standard(4:9) and the widescreen(16:9) aspect ratio.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This is the title slide for Steps Required in Consumer Lending Process. Add Your Company's Name and get started!

Slide 2: This slide shows the Agenda for Loan Process covering key points such as Educate clients and potential customers about the company and its loan offerings, Communicate lending process to the customers and help them to fill their complete and accurate application, and Evaluate the borrower's ability and willingness to repay a loan.

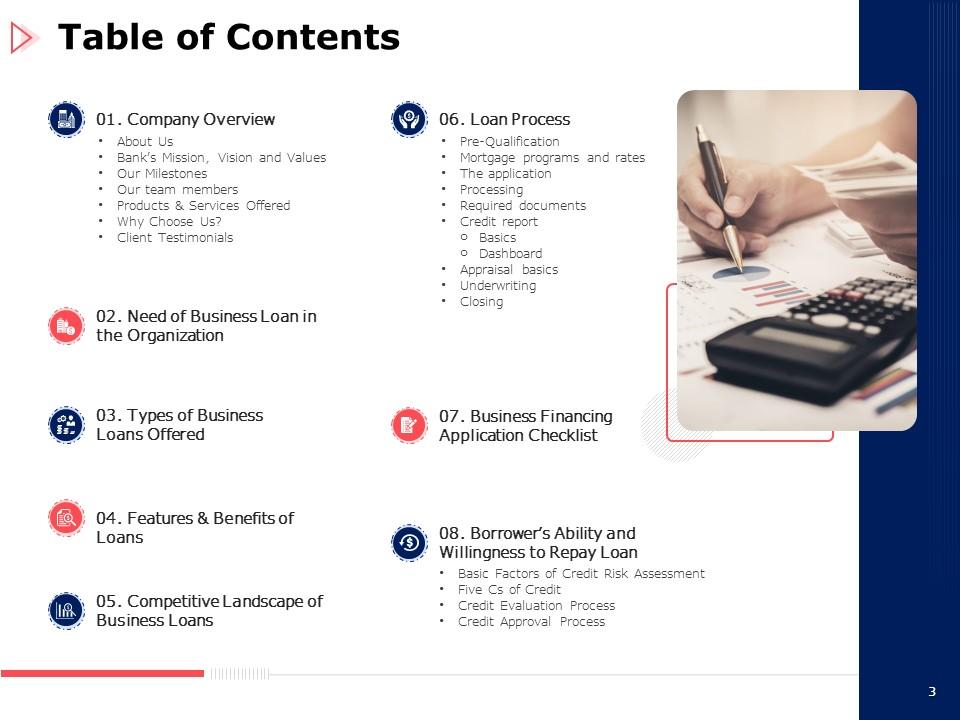

Slide 3: This slide enumerates the Table of Contents for this presentation including Company overview, Need of business loan in the organization, Types of business loans offered, Features and benefits of loans, Competitive Landscape of Business Loans, Loan process, Business Financing Application Checklist, and Borrower’s Ability and Willingness to Repay Loan.

Slide 4: This slide introduces the Company Overview section of this deck with seven sub-topics including About Us, Bank’s Mission, Vision and Values, Our Milestones, Our team members, Products & Services Offered, Why Choose Us? and Client Testimonials.

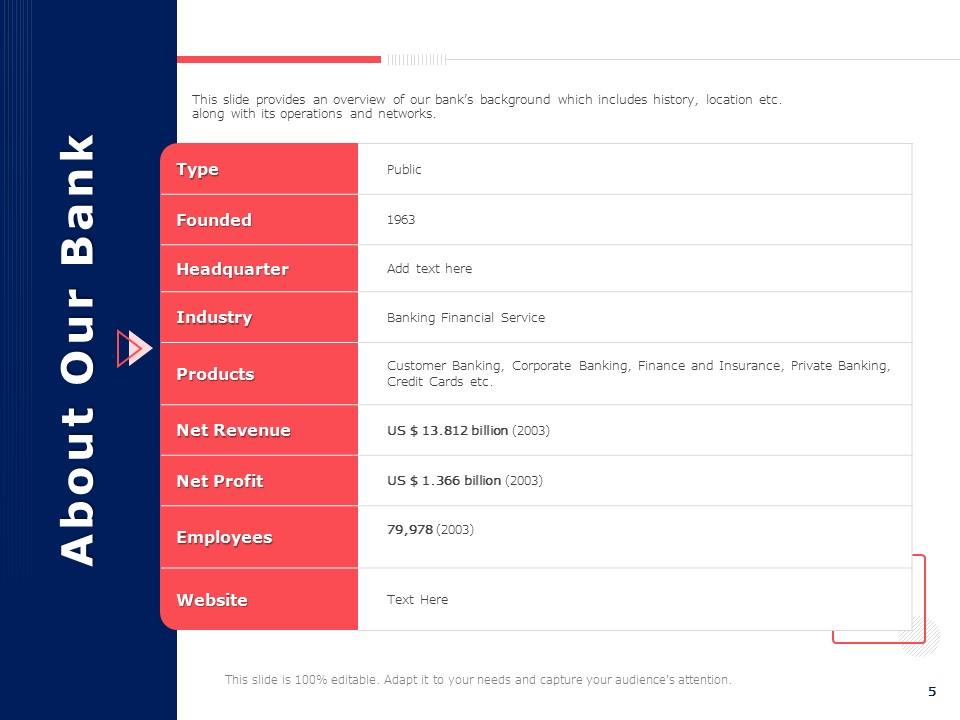

Slide 5: This slide shows details About Our Bank such as Type, Founded, headquarters, Industry, Products, Net revenue, Net profit, Employees, and Website.

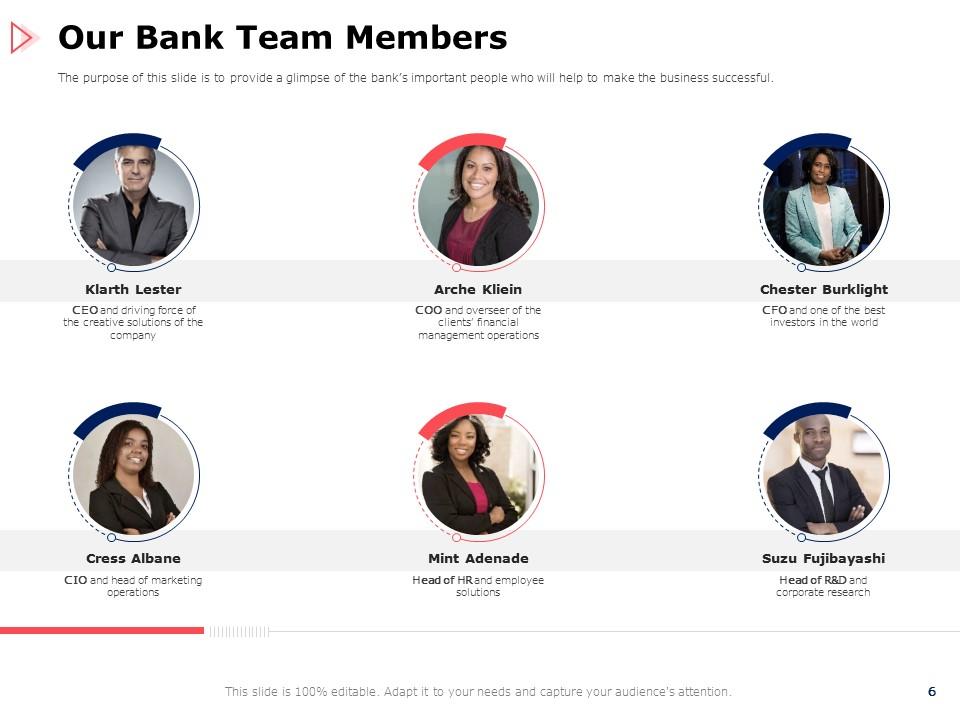

Slide 6: This slide displays Our Bank Team Members with their Pictures, Designations, and Job responsibilities.

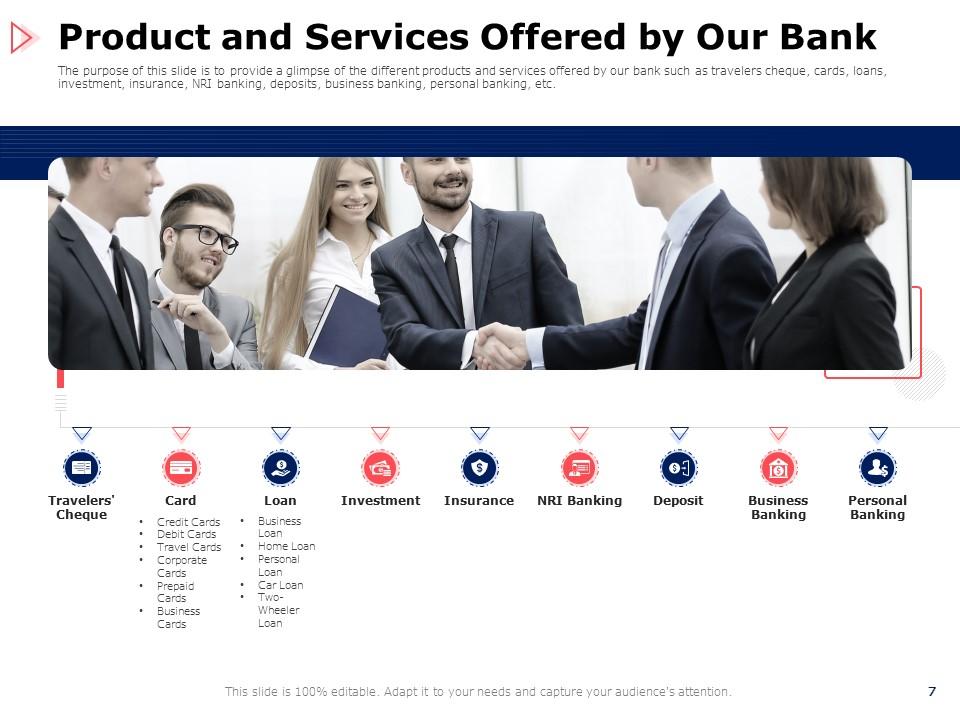

Slide 7: This slide showcases the Product and Services Offered by Our Bank such as Travelers' cheques, Card, loans, Investments, Insurance, NRI Banking, deposits, Business Banking, Personal Banking.

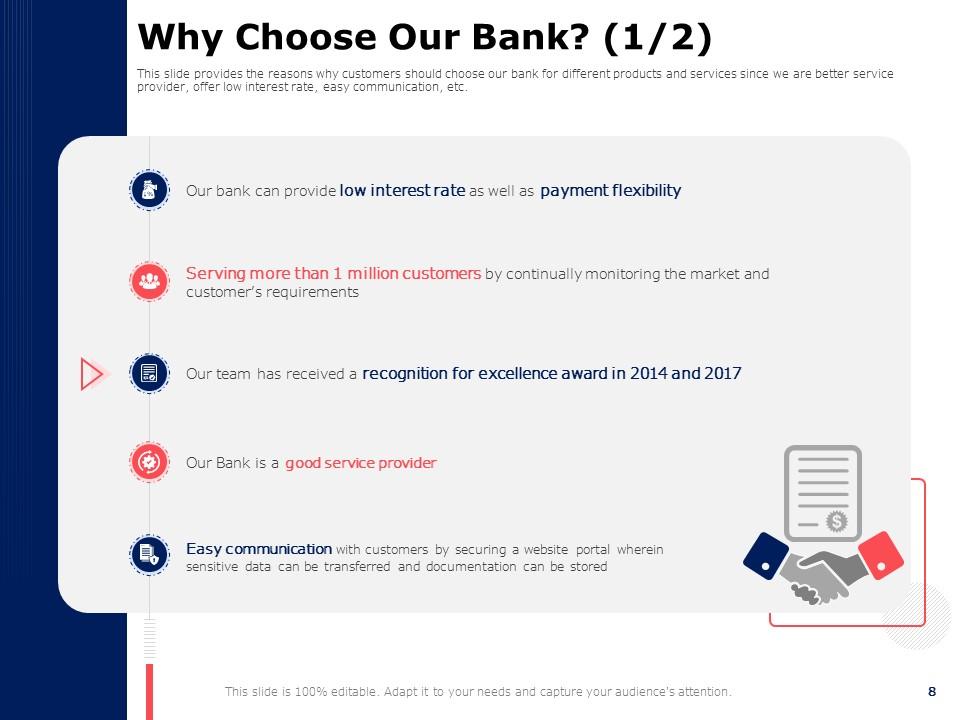

Slide 8: Does this slide describe Why Choose Our Bank? It provides viable reasons such as Our bank can provide low-interest rates as well as payment flexibility, Serving more than 1 million customers by continually monitoring the market and customer’s requirements, Our team has received recognition for excellence award in 2014 and 2017, Our Bank is a good service provider, and Easy communication with customers by securing a website portal wherein sensitive data can be transferred and documentation can be stored.

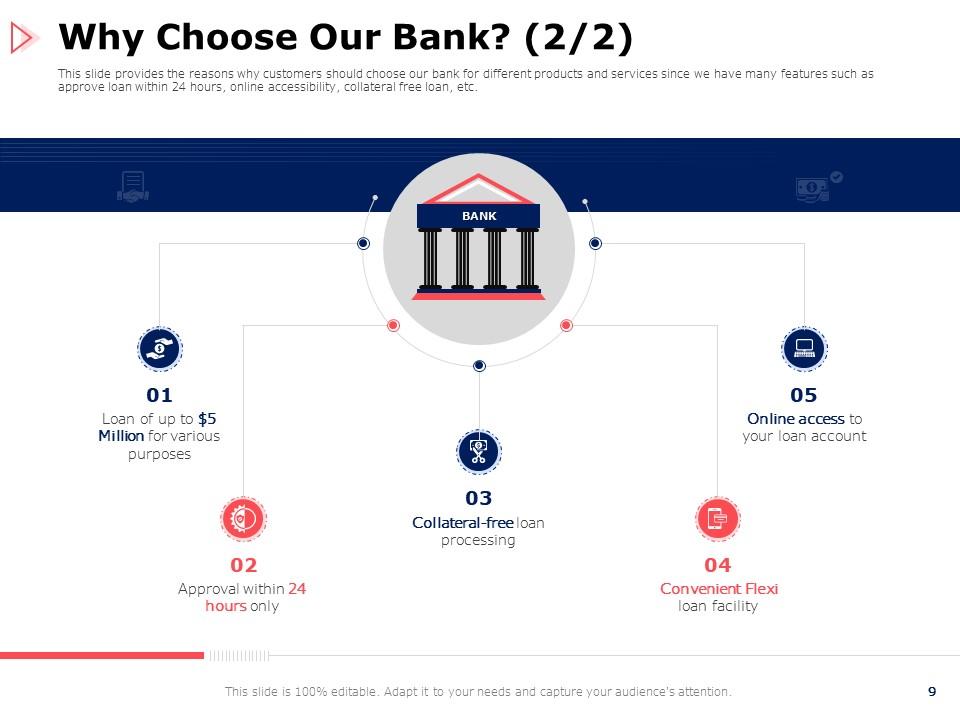

Slide 9: This is the continuation slide for Why Choose Our Bank with five features including a Loan of up to $5 Million for various purposes, Approval within 24 hours only, Collateral-free loan processing, Convenient Flexi loan facility, and Online access to your loan account.

Slide 10: This slide shows client testimonials with their picture, designation, and reviews.

Slide 11: This is the continuation slide for Client Testimonials with Client images, their destinations, and their reviews.

Slide 12: This slide displays Bank’s Mission, Vision & Values with dedicated sections for each.

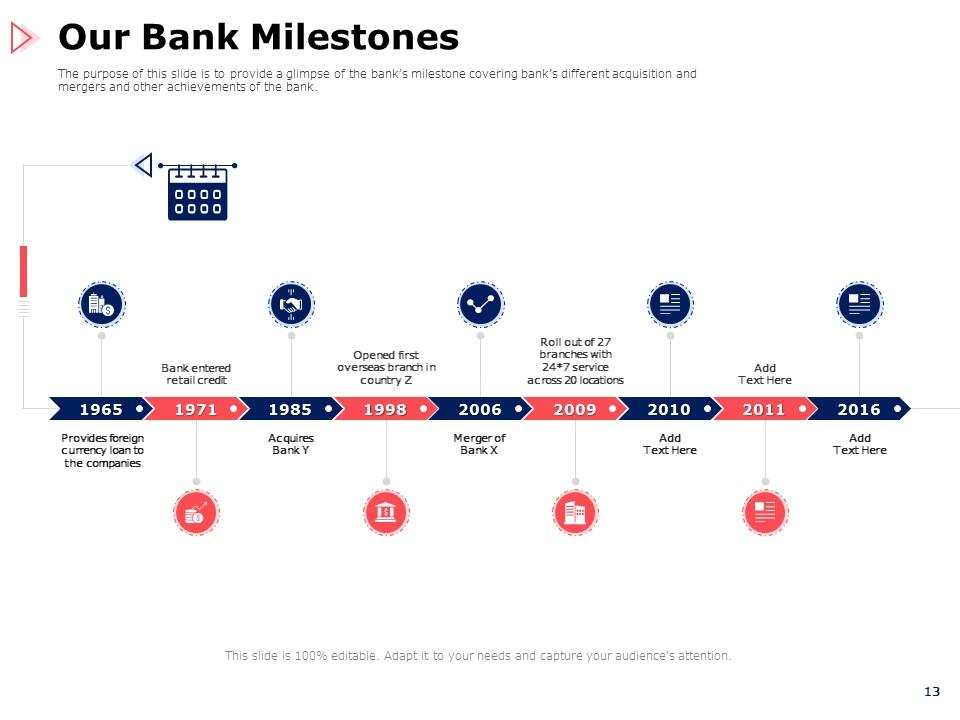

Slide 13: This slide presents Our Bank Milestones over the years 1965 to 2016.

Slide 14: This slide introduces the Need for a Business Loan in the Organization section of this presentation.

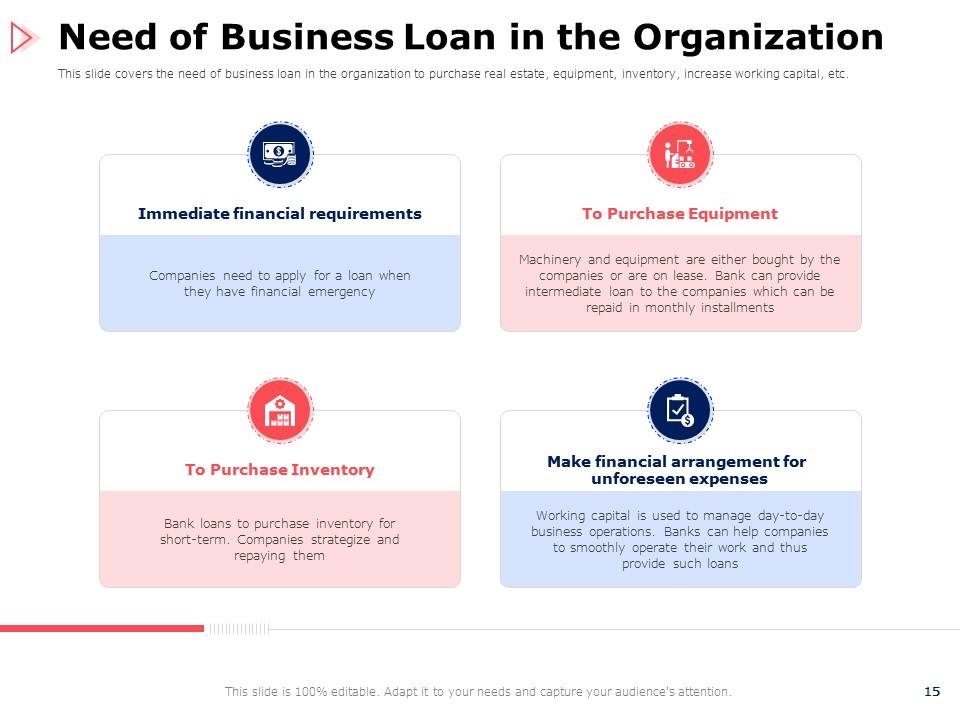

Slide 15: This slide describes the Need for a Business Loan in the Organization with key points such as Immediate financial requirements, To Purchase Equipment, Purchase Inventory, and Make financial arrangements for unforeseen expenses.

Slide 16: This slide introduces the Types of Business Loans Offered section of this deck.

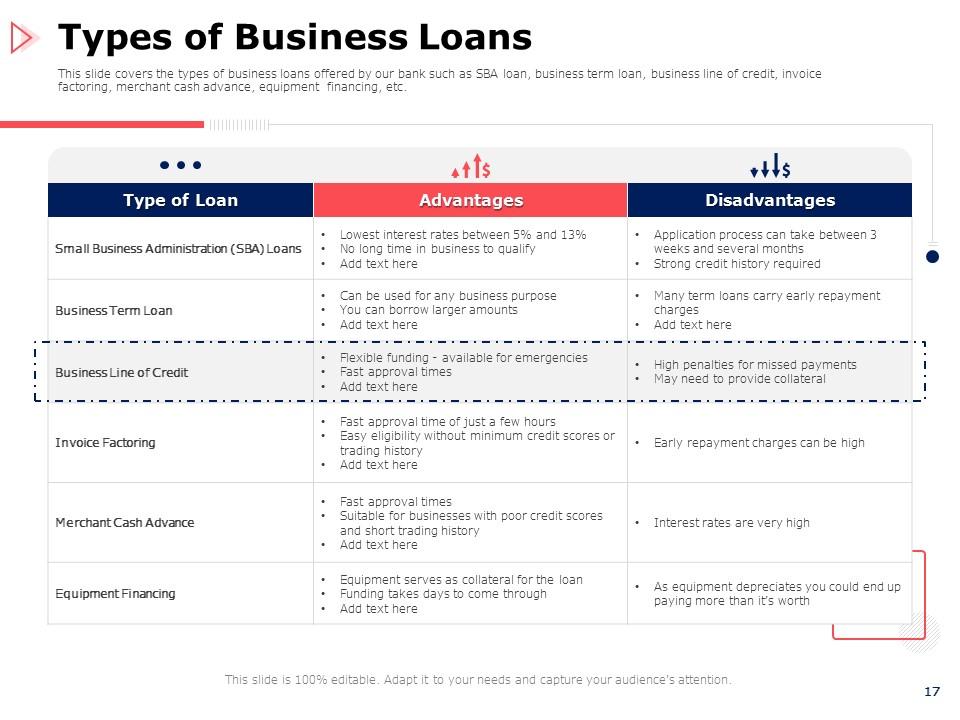

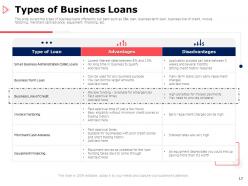

Slide 17: This slide shows the Types of Business Loans with their Advantages and Disadvantages.

Slide 18: This slide introduces the Features & Benefits of Loans section of this presentation.

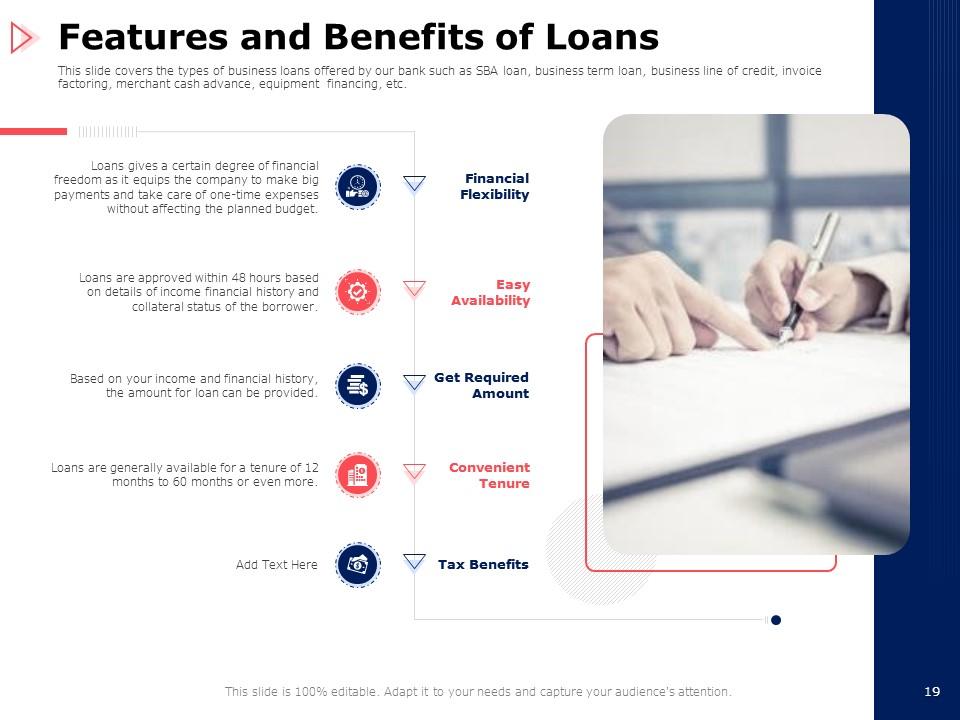

Slide 19: This slide showcases the Features and Benefits of Loans including Financial Flexibility, Easy Availability, Get Required Amount, Convenient Tenure, and Tax Benefits.

Slide 20: This slide introduces the Competitive Landscape of Business Loans section of this presentation.

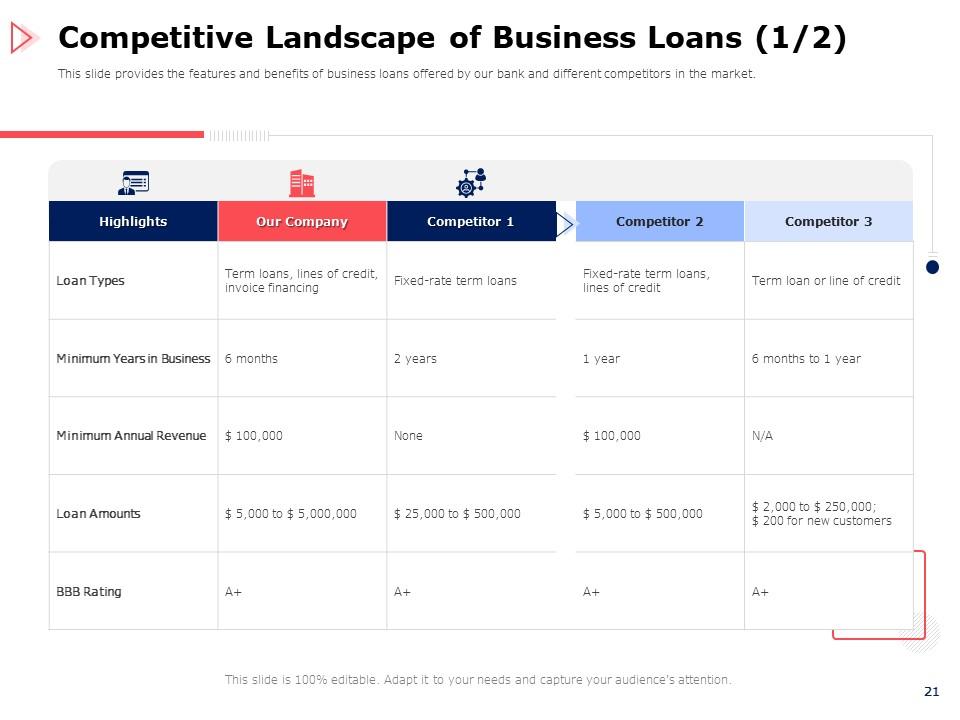

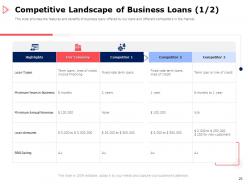

Slide 21: This slide displays the Competitive Landscape of Business Loans with Highlights for your company and that of three competitors.

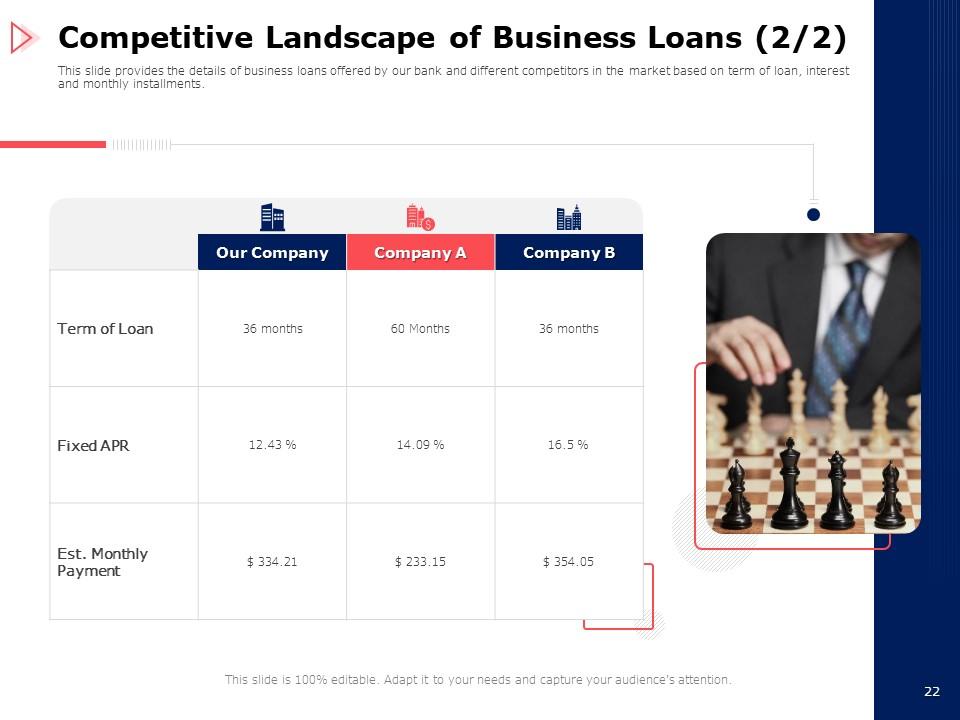

Slide 22: This slide is the continuation of the Competitive Landscape of Business Loans with Term of Loan, Fixed APR, and Established monthly payments.

Slide 23: This slide introduces the Loan Process section of this deck. It has nine sub-topics including Pre-Qualification, Mortgage programs and rates, The application, Processing, Required documents, Credit report, Appraisal basics, Underwriting, and Closing

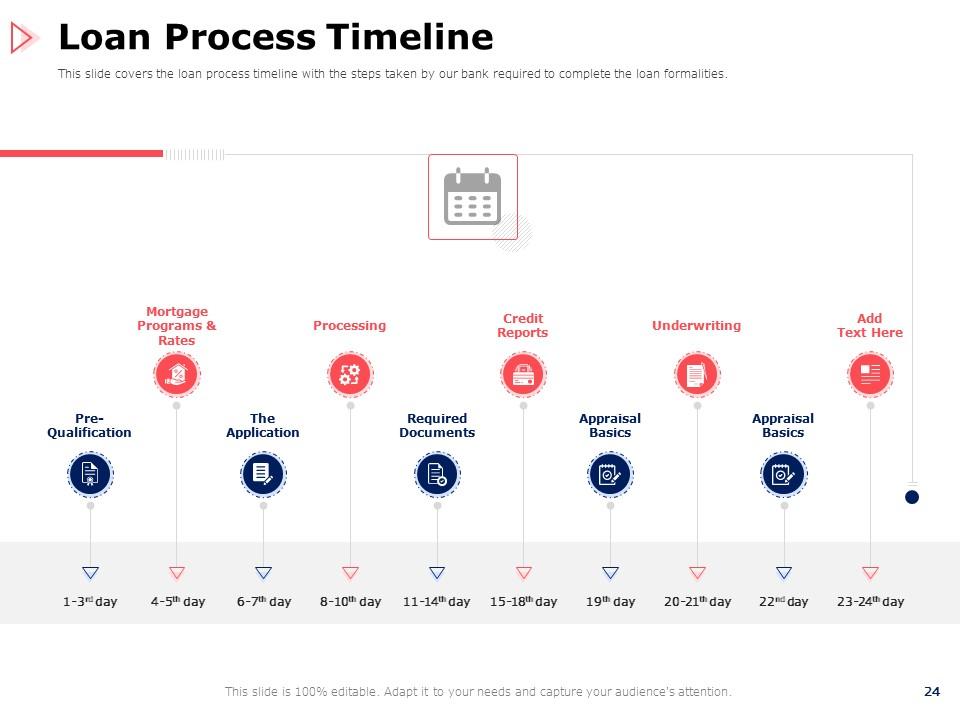

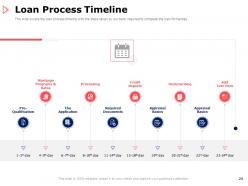

Slide 24: This slide shows the Loan Process Timeline through 24 days and the expected tasks to be accomplished by then.

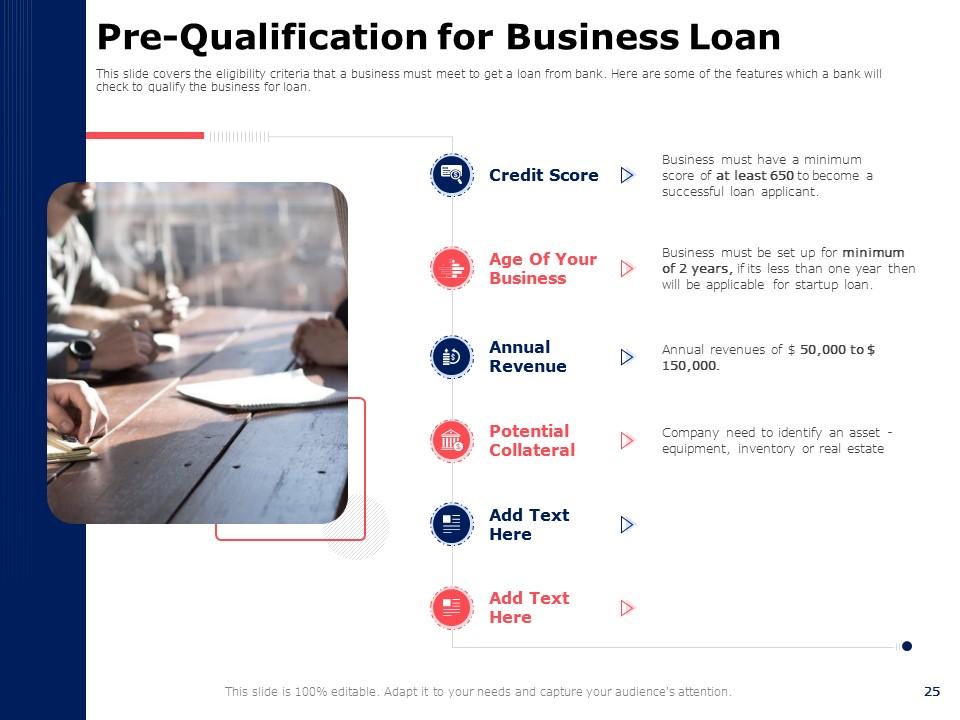

Slide 25: This slide explains the factors for Pre-Qualification for Business Loans such as Credit Score, Age Of Your Business, Annual Revenue, and Potential Collateral.

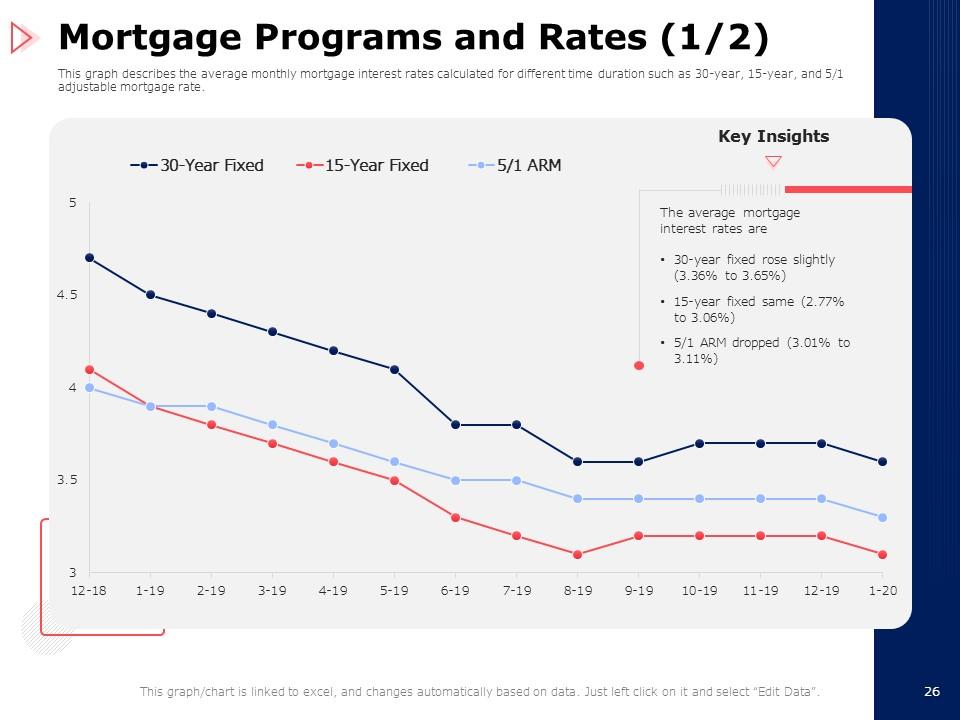

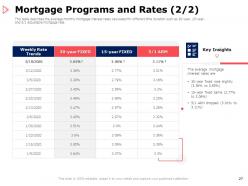

Slide 26: This slide exhibits the Mortgage Programs and Rates with a detailed graph.

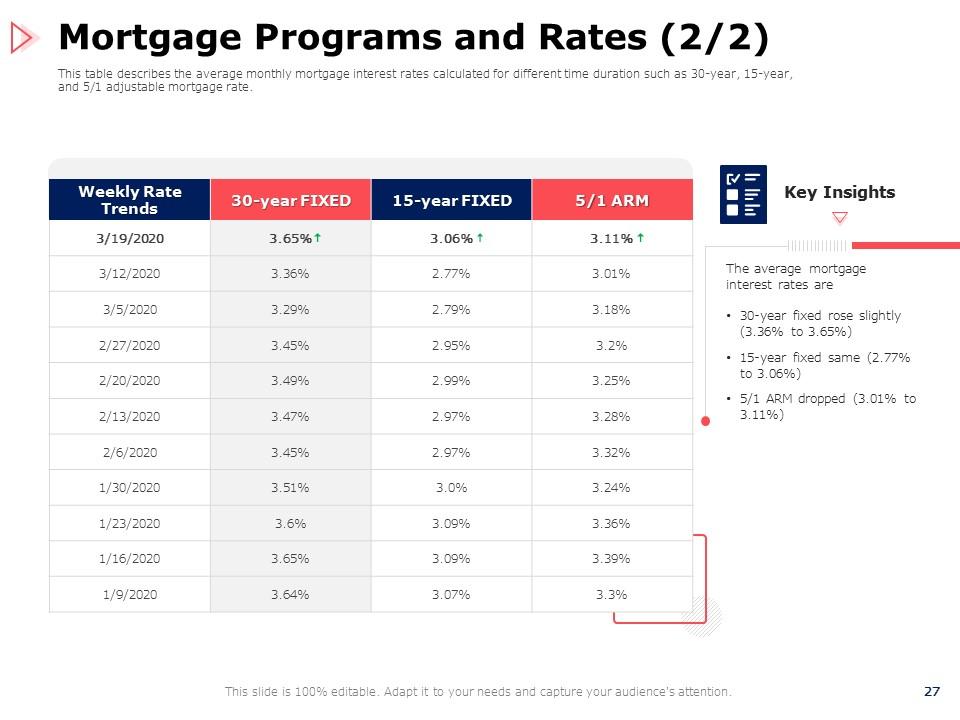

Slide 27: This slide describes the Mortgage Programs and Rates under Weekly rate trends, 30-year Fixed, 15-year Fixed, and 5/1 ARM.

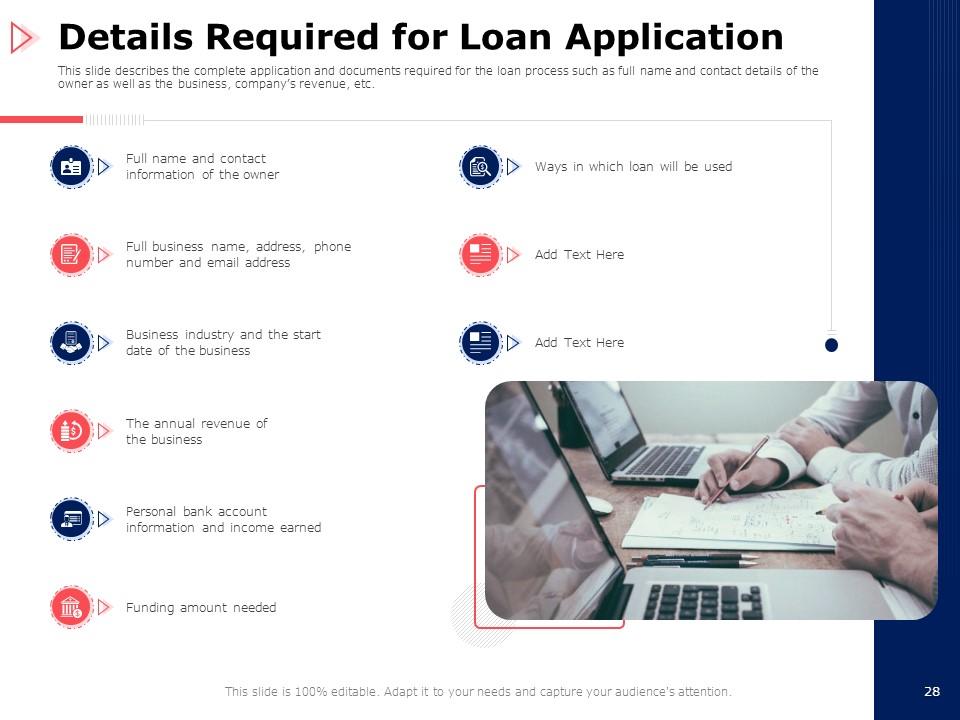

Slide 28: This slide enlists the Details Required for Loan Application including Funding amount needed, Full name and contact information of the owner, Full business name, address, phone number and email address, Business industry and the start date of the business, The annual revenue of the business, Personal bank account information and income earned, and Ways in which loan will be used.

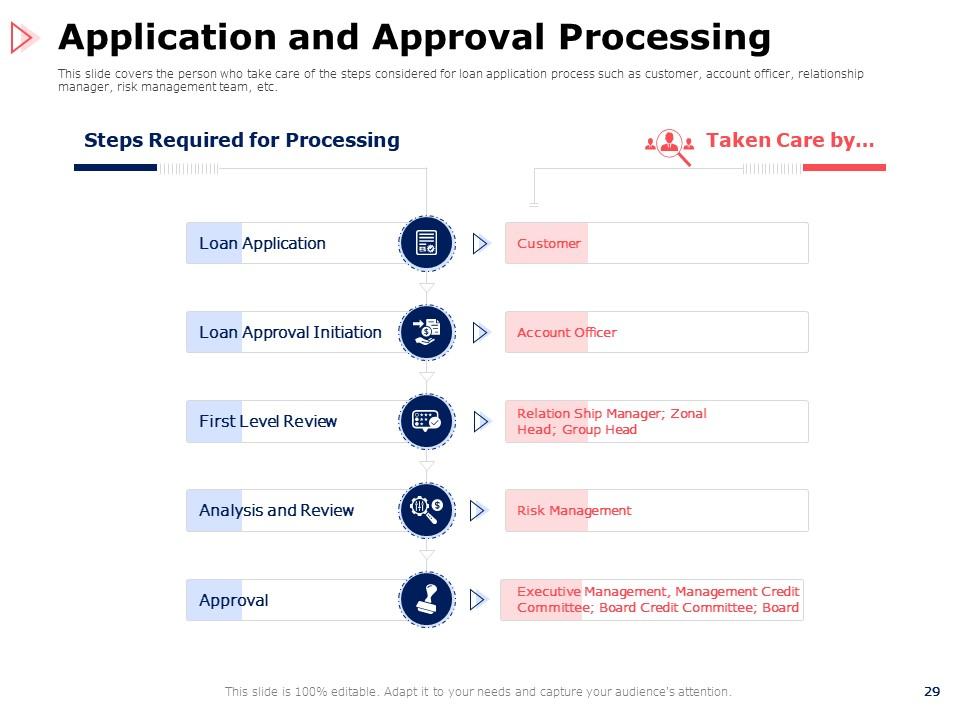

Slide 29: This slide presents the Application and Approval Processing with Steps Required for Processing and the parties that take care of these steps.

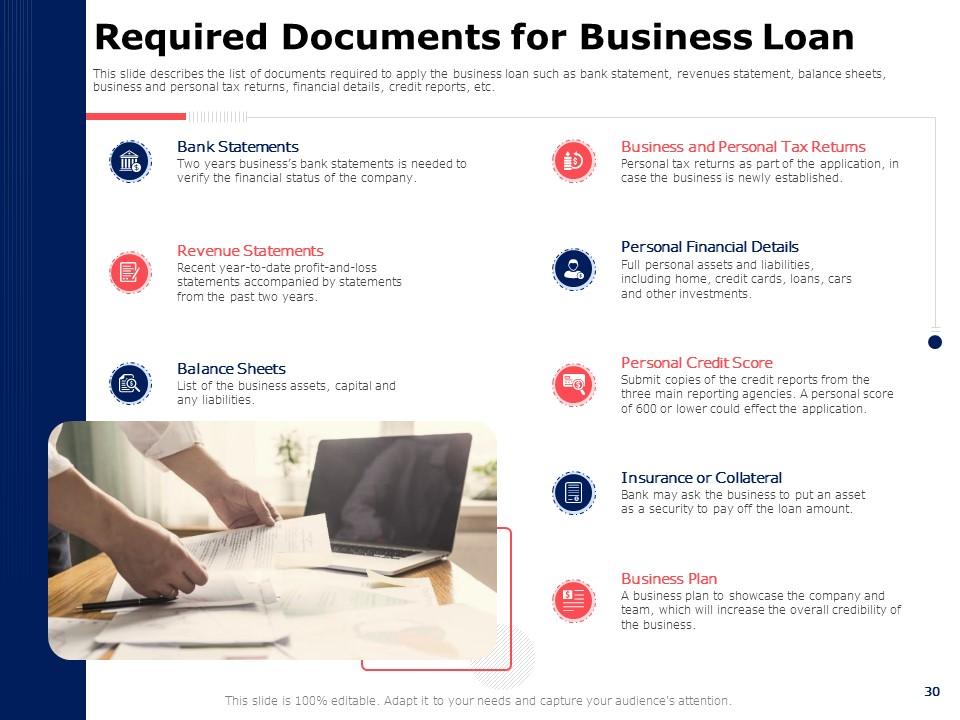

Slide 30: This slide displays the Required Documents for Business Loan including Bank Statements, Revenue Statements, Business, and Personal Tax Returns, Personal Financial Details, Personal Credit Score, Insurance or Collateral, Business Plan, and Balance Sheets.

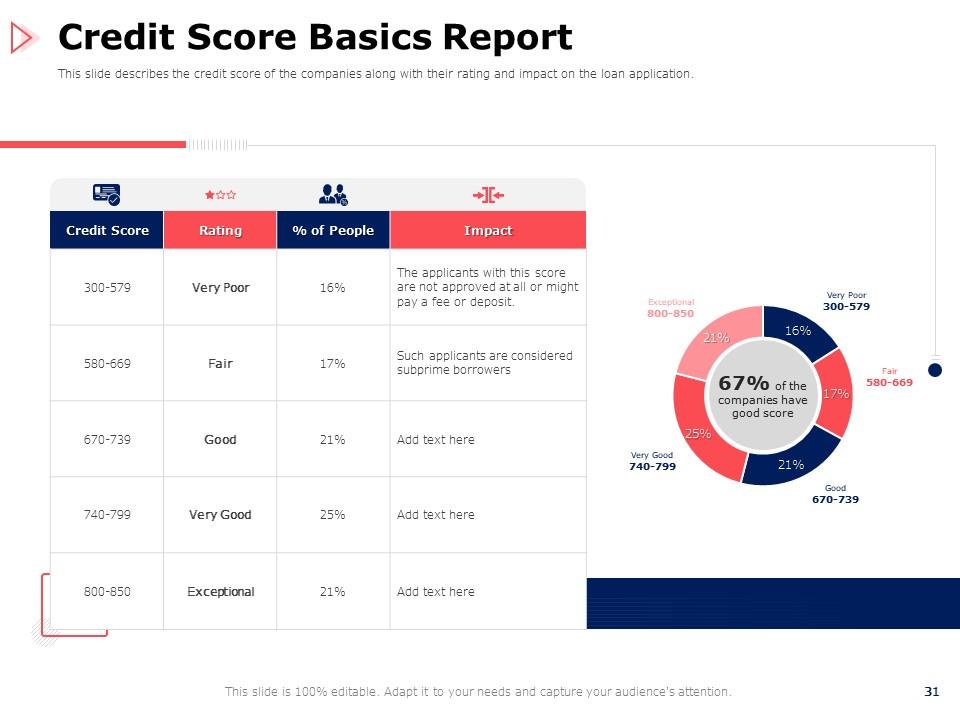

Slide 31: This slide showcases the Credit Score Basics Report with a table and a pie chart for Rating, % of people, and impact.

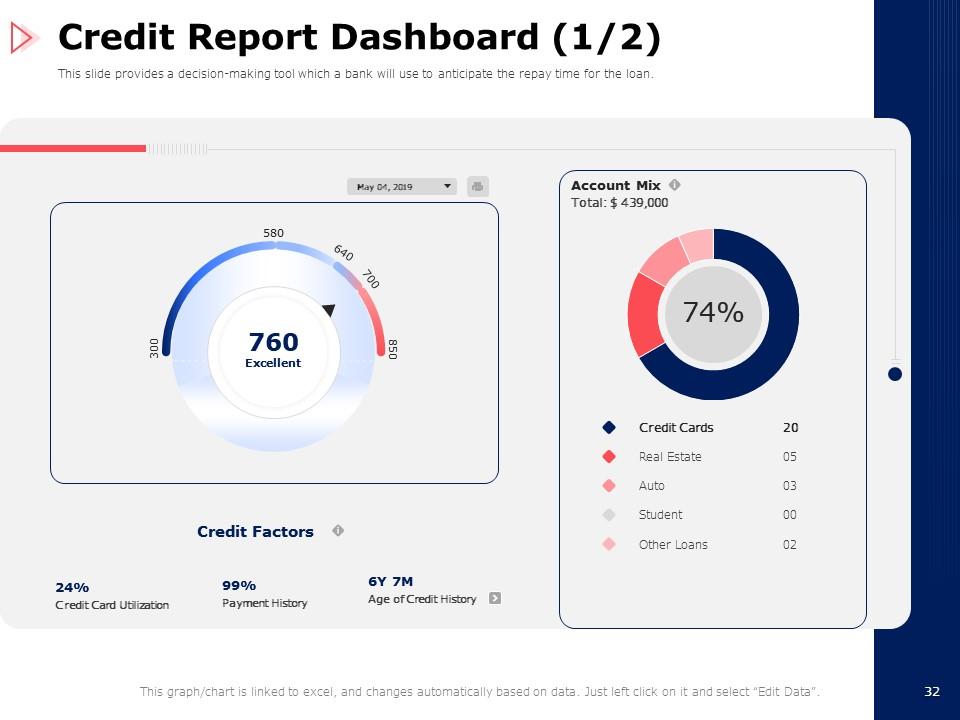

Slide 32: This slide displays the Credit Report Dashboard explaining the credit factors and donut chart for account mix.

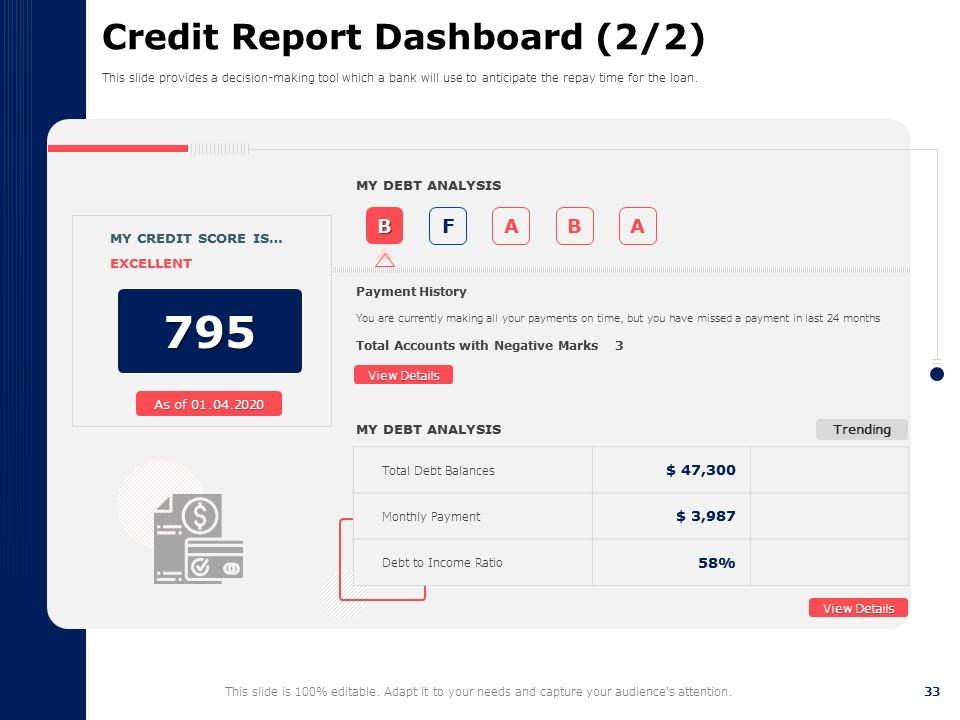

Slide 33: This is the continuation slide for the Credit Report Dashboard showing debt analysis and credit score.

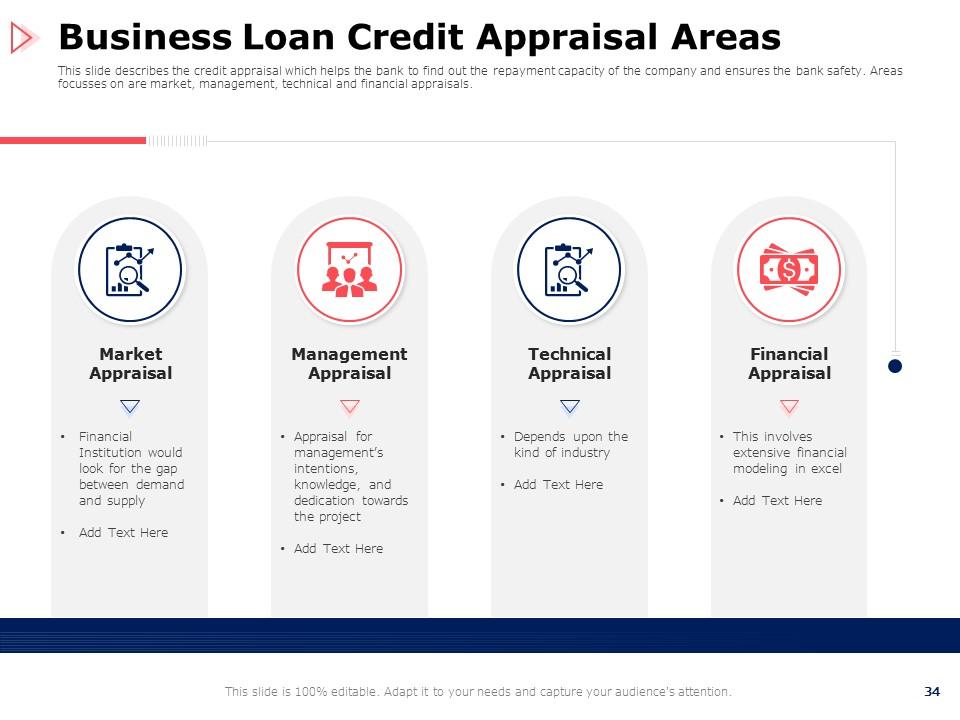

Slide 34: Thi slide shows the Business Loan Credit Appraisal Areas including Market appraisal, Management appraisal, Technical appraisal, and Financial appraisal.

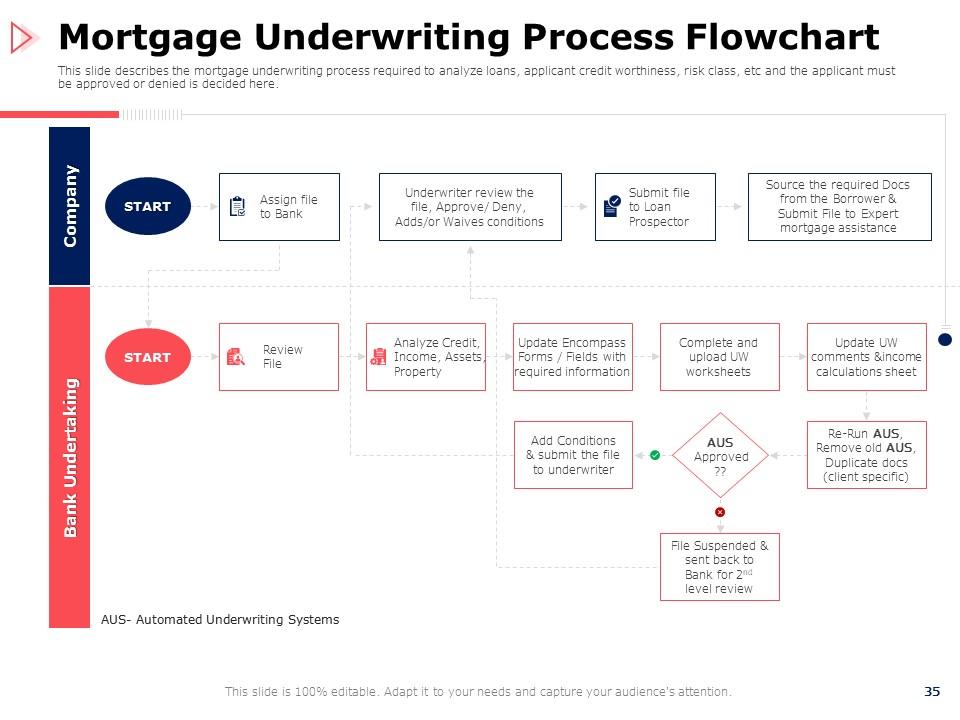

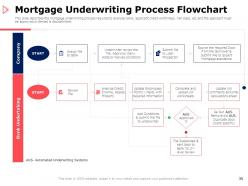

Slide 35: This slide presents Mortgage Underwriting Process Flowchart for the Company and the Bank undertaking.

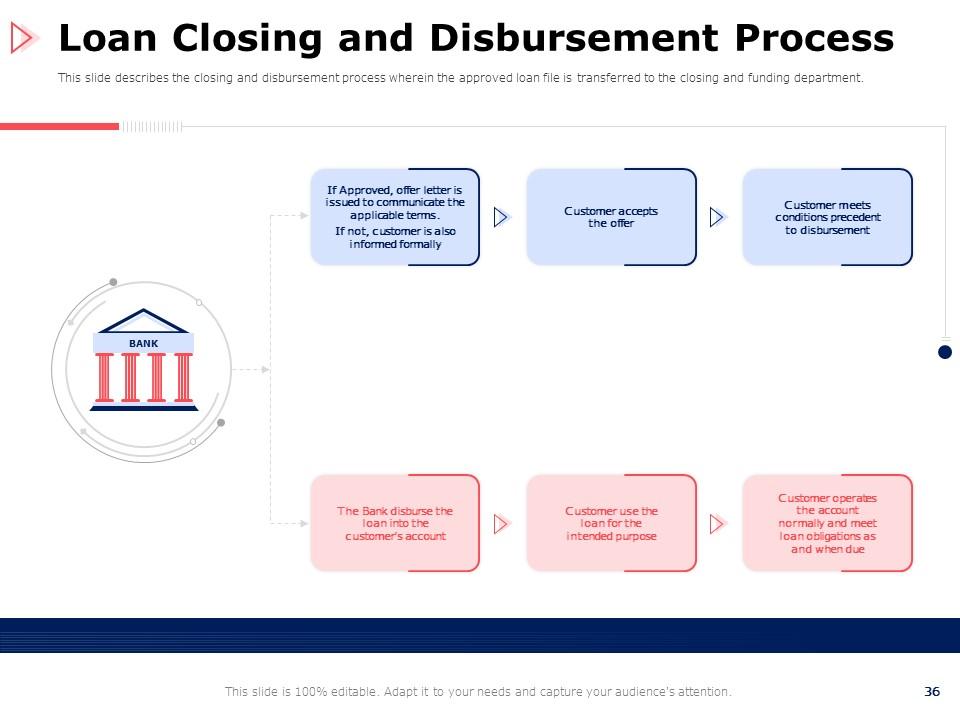

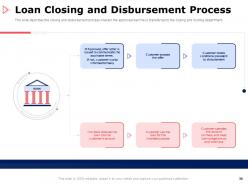

Slide 36: This slide displays the Loan Closing and Disbursement Process.

Slide 37: This slide introduces the Business Financing Application Checklist section of the presentation.

Slide 38: This slide elaborates the Business Financing Application Checklist with a list of particulars and their details.

Slide 39: This slide introduces the Borrower’s Ability and Willingness to Repay Loan section of the deck. It has four sub-topics including Basic Factors of Credit Risk Assessment, Five C’s of Credit, Credit Evaluation Process, and Credit Approval Process

Slide 40: This slide explains the Basic Factors of Credit Risk Assessment such as Character, Capacity, Capital, and Condition along with Future performance assessment.

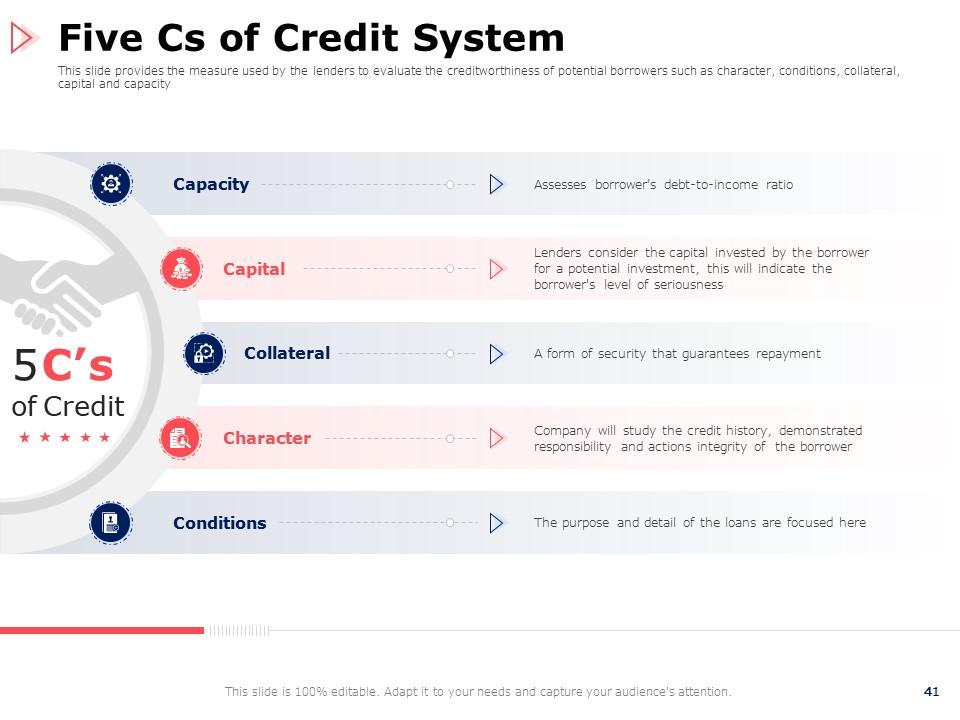

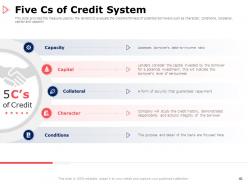

Slide 41: This slide provides the Five Cs of Credit System including Capacity, Capital, Collateral, Character, and Conditions.

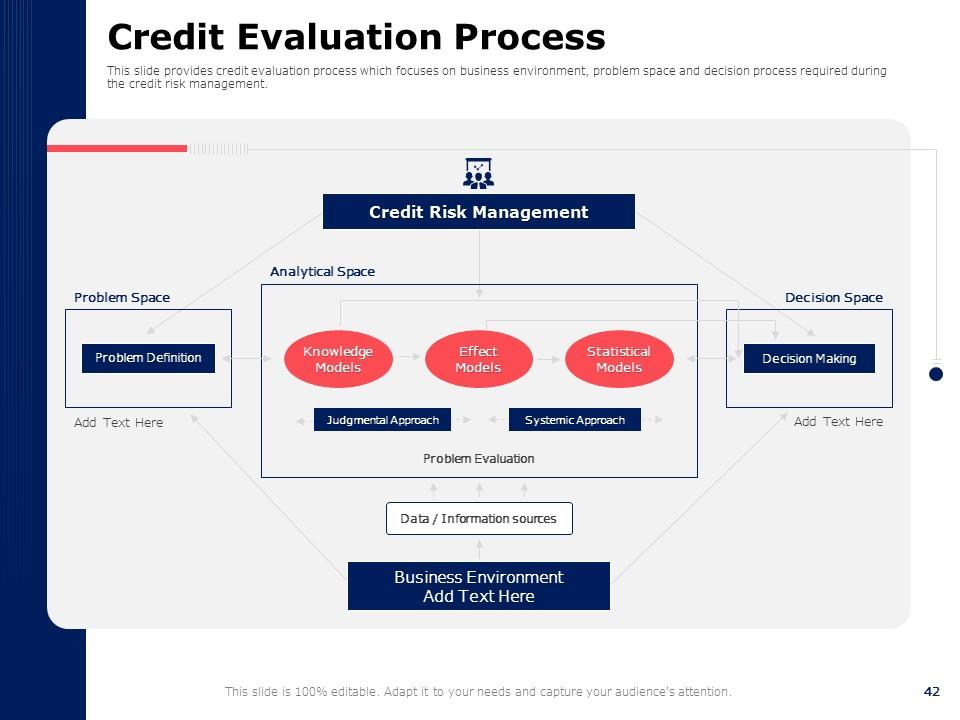

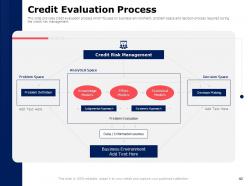

Slide 42: This slide depicts the Credit Evaluation Process in a detailed flowchart.

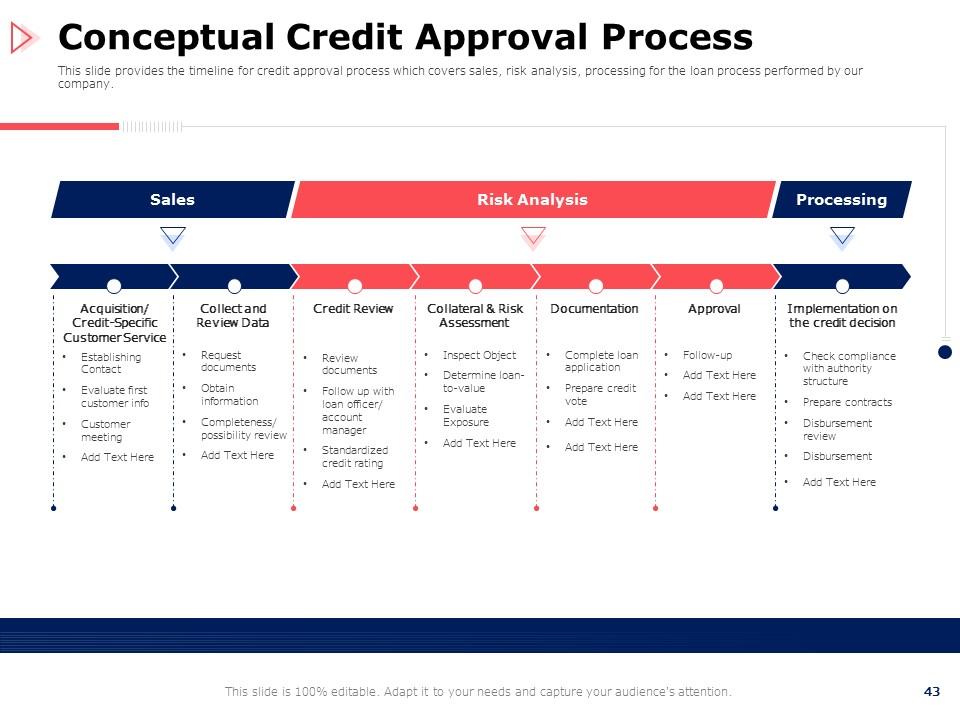

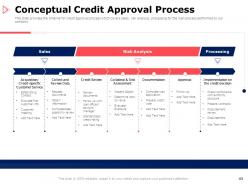

Slide 43: This slide shows the Conceptual Credit Approval Process covering Sales, Risk Analysis, and Processing.

Slide 44: This slide includes a wide range of additional Icons for customization on the user's end.

Slide 45: This slide introduces the Additional Slides provided with this presentation.

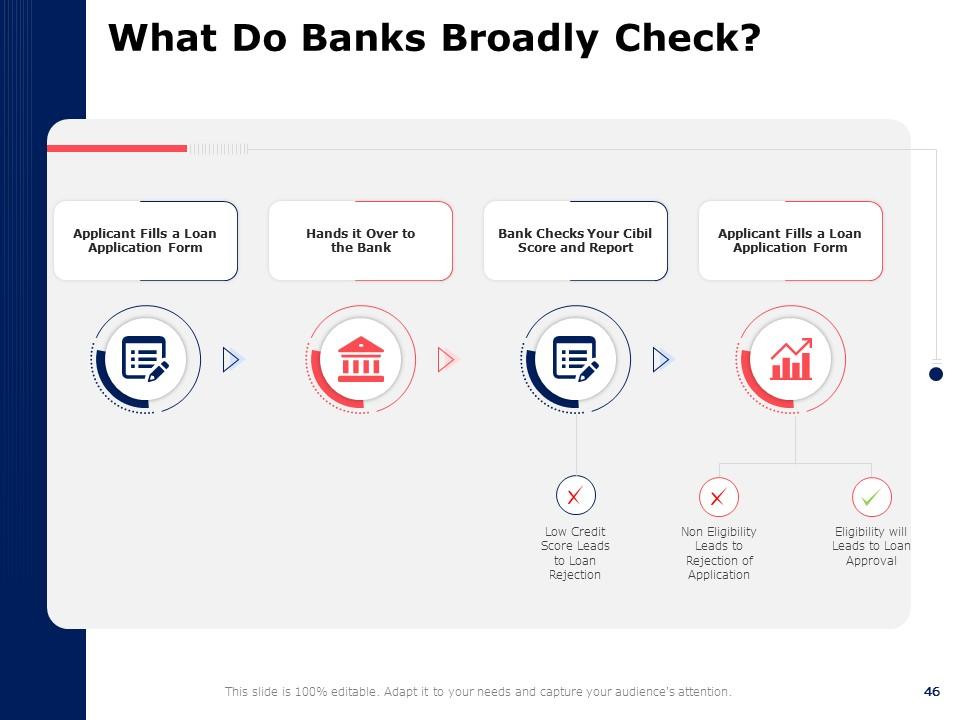

Slide 46: This slide shows What Do Banks Broadly Check including a flow chart of the process. Applicant Fills a Loan Application Form, Hands it Over to the Bank, Bank Checks Your Cibil Score and Report, and then Low Credit Score Leads to Loan Rejection, Non-Eligibility Leads to Rejection of Application, and Eligibility will Leads to Loan Approval.

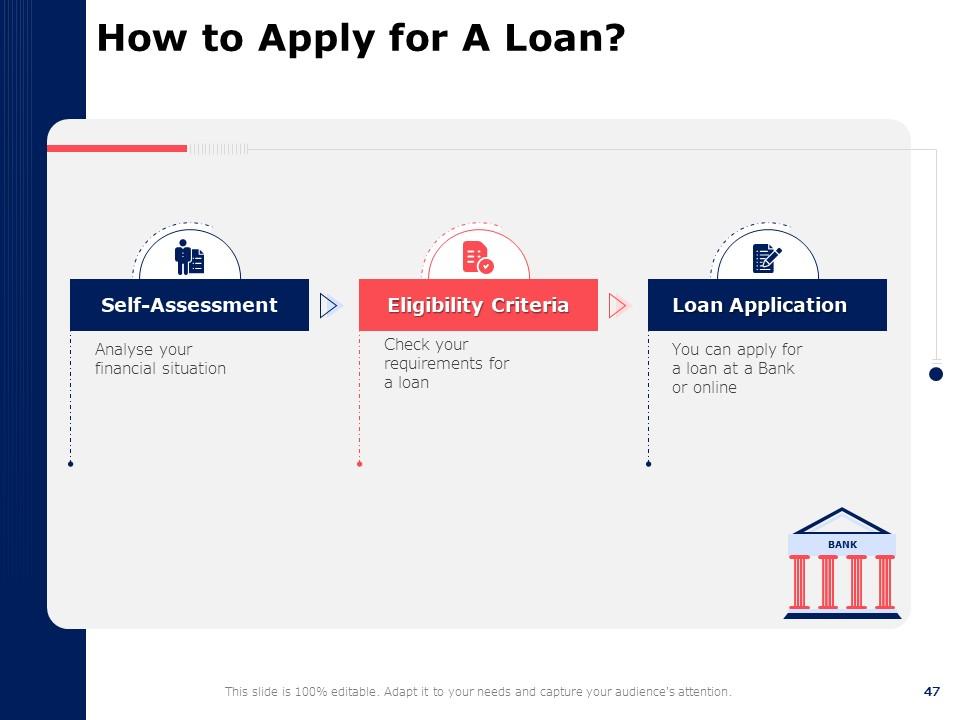

Slide 47: This slide shows How to Apply for A Loan with three steps including Self-Assessment, Eligibility Criteria, and Loan Application.

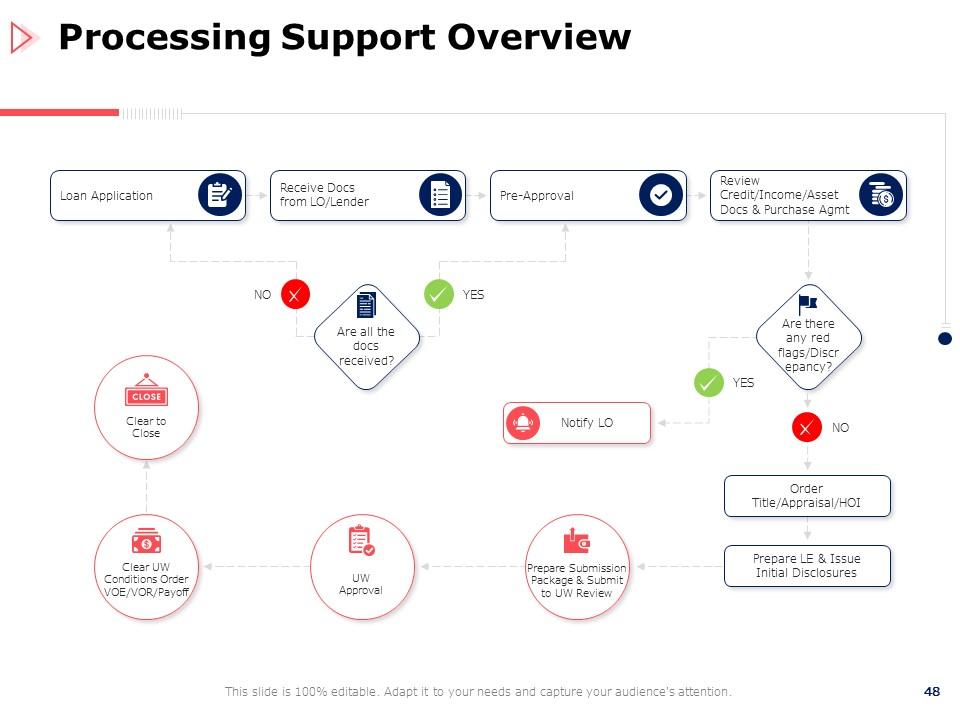

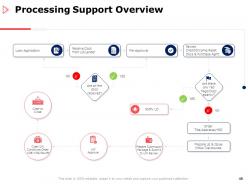

Slide 48: This slide describes the Processing Support Overview with the Loan application, Recieve docs from a lender, Pre-approved, and Review credit documents and purchase agreement.

Slide 49: This is the Our Mission slide with dedicated spaces for describing your company's Goals, Vision, and Mission.

Slide 50: This slide introduces Our Team with their Pictures, Designation, and Names.

Slide 51: This slide describes the About Us part of their company with Target Audience, Premium Services, and Values Client.

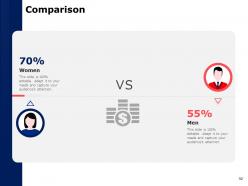

Slide 52: This slide shows the Comparison between genders with percentages.

Slide 53: This slide displays the Financial thresholds of Minimum, Medium, and Maximum.

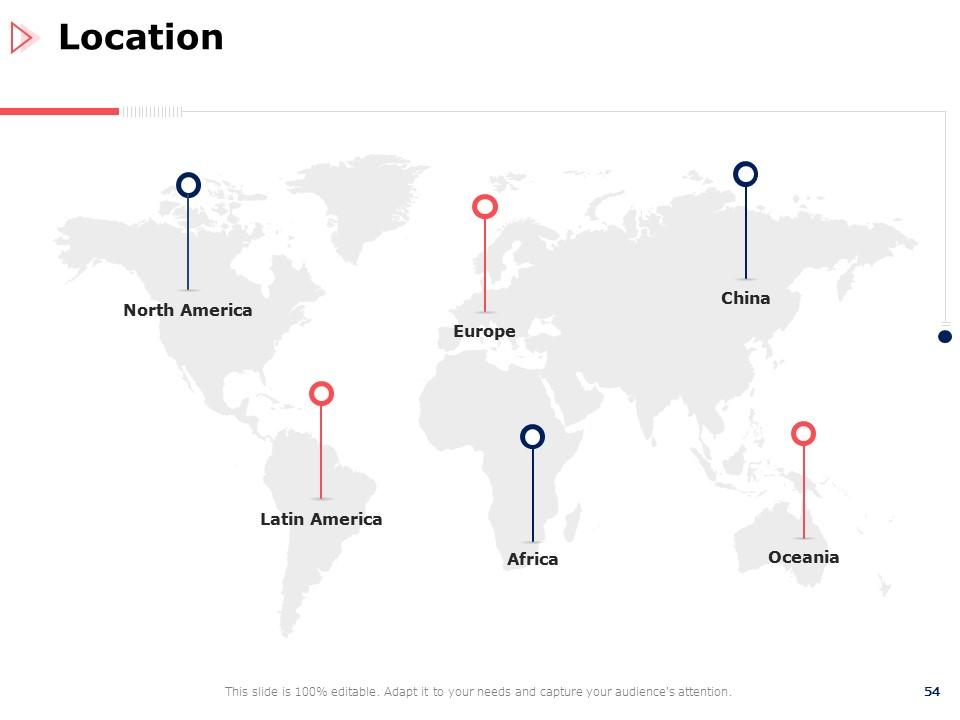

Slide 54: This slide presents the key Locations marked over a world map.

Slide 55: This slide displays the Post-it Notes to add highlighted text for your presentation.

Slide 56: This slide shows the process Timeline over five years from 2016 to 2020.

Slide 57: This slide shows the conclusive Thank You for Watching! a message with your company's address, contact numbers, and e-mail address.

Steps Required In Consumer Lending Process Powerpoint Presentation Slides with all 57 slides:

Use our Steps Required In Consumer Lending Process Powerpoint Presentation Slides to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Colors used are bright and distinctive.

-

Perfect template with attractive color combination.

-

The content is very helpful from business point of view.

-

Awesomely designed templates, Easy to understand.

-

Easily Editable.

-

Content of slide is easy to understand and edit.