Recently, when airline companies started offering “flights to nowhere” to their customers, it seemed like a peculiar concept to an average Joe wanting his daily update from a newspaper. After all, what storm have these companies not weathered? There have been epidemics and economic recessions before too. Aviation sector has overcome a lot of hardships, something that extended offers and perks could fix over time. So how will flying people back to the same airport they took off from, be any different a contingency measure?

But not this time! No. This time, a strain of virus has made a debilitating impact on the entire world. So much so that “unprecedented” or “back-breaking” have become the buzz words that only seem to stick with us forever. Coronavirus, or COVID-19, as we have come to call this strain, has spelled dismay and despair for every sector. The most devastating impact, though, has come for the airline and hospitality industry.

As lockdowns were clamped across major continents, civil aviation became one of the first sectors to take a hit. Also in the line of fire were small businesses that had to resort to drastic measures for survival. The multi-billion dollar industry, just like the rest of the world, was brought to its knees.

The fight to get back to the new normal may not come easy to a lot of industries. The airline sector, in particular, will have to go beyond simple measures to curb the negative impact. No doubt the economics of it will be a challenging task. But companies dealing with aviation will have to figure out a way to project remedial measures that work. In this blog, we will detail the effect of COVID-19 on the air transport industry, what stakeholders can do to power through, and how recovery strategies can be presented to shareholders and managements. Read on.

Assessing the impact of COVID-19 on airline industry

To understand the economics of how COVID-19 has impacted the air transport sector, one has to get a hold of the metrics considered for assessments in the sector. Simply defined, these metrics are as follows:

- Baseline scenario: This is the scenario that would include figures projected if it were business as usual or COVID weren’t there. Mostly, this is what the normal scenario looks like without the unprecedented deterrents and limitations (such as the year 2020 has seen so far).

- Best-case scenario or V-shaped: This indicative metric shows the best possible outcome. The projection follows a brief period of contraction and then smooth recovery, giving the graph a V shape.

- Worst case scenario or U-shaped: A rather pessimistic outlook for projections, this scenario follows a protracted period of contraction with little to no return to normal trend of recovery. The delayed recovery gives the graph a U shape (or L shape for severe precedents leading to no recovery).

While reading into these scenarios, one must understand that these are indicative and not definitive. Based on the demand and supply amid restrictions and changing consumer preferences, these scenarios can be different. Lockdown measures and pattern of COVID spread can also lead to change in the state of the projection graphs.

Demand drop

According to a comprehensive report by the International Civil Aviation Organization or ICAO, there has been an estimated drop of around 59-60% in the number of international and domestic passengers or air passenger traffic in 2020 as compared to 2019. As such, the report points to a drastic drop in demand by the fourth quarter 2020, with the seat capacity for international flights going down by 71% to 73%, and that of domestic flights by 29% to 31%. Figure-wise, for the entire 2020 (January to December), the report indicates a drop of 2,858 million to 2,891 passengers in all types of aviation.

Revenue decline

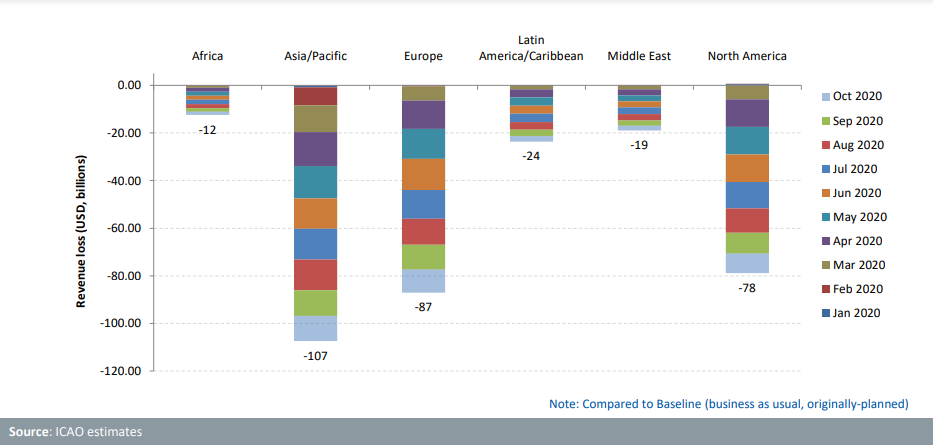

The stark decline in demand will translate to losses for the airline companies across the globe. According to the ICAO report, the global airline industry is set to lose $387 to $391 billion in gross passenger operating revenues. The organization estimates project varying degrees of demand and revenue losses across the globe according to the impact of the coronavirus on the travel and tourism operations in the countries.

Not only that, the report also cites the International Air Transport Association (IATA) projection of a 54.7% decline in the revenue passenger kilometers (RPKs) in both international and domestic aviation scenarios. RPK is an important airline metric signifying demand. It is determined by multiplying the number of kilometers travelled by paying customers with the distance travelled. This metric is different from ASK, or the available seat kilometers, which depicts the number of seats available multiplied by number of kilometers flown.

Tourism and trade downturn

Globally speaking, the decline in aviation activity has led to sharp drop in international tourism receipts, ranging from $910 billion to $1,170 billion, which is in sharp contrast to the revenue of $1.5 trillion generated in the year 2019. This was cited by the report from the UNWTO or United Nations World Tourism Organization. With more and more travel restrictions coming up, the related businesses of hospitality and services also took a major hit. As such, the figures also indicate a tumultuous wave for world trade. There is a projected contraction of -4.4% to -5.2% in the global GDP in the year 2020, the report cites World Bank and International Monetary Fund (IMF).

Fall of freight

Among the major components of airline business that took the heat of the pandemic, cargo volume demand also plummeted as the year progressed. According to a report by Lufthansa Consulting, air cargo volume in Q2 2020 fell by 25-30% from the corresponding figures of 2019. The air travel restrictions and health concerns seemed to have resulted in a dip in demand in April. The figures later improved as there was rising demand for transporting personal protective equipment and other medical goods over the international air cargo routes. In the second quarter, the demand for passenger flights dropped significantly. Also, from the context of the ICAO report, the recovery from that depends on how the countries will battle coronavirus spread.

Brand value reduction

The downward slope of the airline sector has not only dealt a heavy blow to consumer sentiment but also brought down brand value for various airline companies and related businesses. According to an August 2020 report by Brand Finance, the world’s top 25 most valuable airport brands could lose up to $1.7 billion in brand value due to the effects of the pandemic. Notably the Heathrow Airport, a major international airport in London, suffered a 7% brand value decline amid COVID-19, though it retained its position as the most valuable airport brand. Overall, the report says, brands in airport sector could face up to 20% brand value dip running in over a billion dollars.

Substantial job losses

Since the biggest chain of impact trickles down to the smallest businesses supported by the operations of airports and air transport, a substantial number of jobs have gotten the guillotine. In fact, the global aviation industry bore the brunt of over 350,000 job cuts and the figure is set to soar to 500,000 by the end of this year. For a wider perspective, this has led to a lot of economic slump for nations dependent on air travel and transport for a sustainable GDP. Air transport being the major focus for countries clamping lockdowns, airlines having to reconfigure their workforce are resorting to drastic measures like eliminating positions and making cutbacks amid zero revenue.

Recovery strategies for airline companies

One thing is clear. Only the prudent will survive. The rest may struggle or simply perish. This is the task for airline companies to analyze the situation with a finer lens and see where they can stand with respect to the competition. Market slump and external factors impacting domestic and international travel will prove a major challenge for these companies while they try to tide over the crisis. For most of the airline companies, chances of mergers and acquisitions simply may not be enough to put them in a safer position. Though the future scope (discussed later in this blog) has its own challenges of moving towards a graph of normal recovery, much rests on how airlines put their thinking caps on and chalk out a financial and risk management plan before their stakeholders.

However, strategy will stay the lifeblood of companies that survive. So airlines and air transport companies must take into account the following strategies for recovery from the effects of the pandemic:

Addressing passenger safety

This one is a no-brainer. A key part of the customer/passenger sentiment is the concern for health hazards posed by the coronavirus infection. And of course, social distancing being an important part of the standard operating procedures (SOPs) for businesses these days, the airline sector has to rely heavily on safety measures and contactless services at the airport terminals from entry to boarding to the actual flight and landing. The more coordinated the effort, the better the customer sentiment. Airlines can also provide personalized experiences that revolve around safety and comfort.

Evoking positive consumer behavior

A key aspect of addressing the changing consumer behavior pattern is the need to retain customers. Airline companies can address that in their loyalty programs. Herein, instead of giving monetary refunds or cancellation charges, airline companies can award loyalty points to passengers. This will help them gain trust and channelize the revenue streams. In fact, as per a Lufthansa Consulting report, a prominent player like Virgin Atlantic has extended the gold and silver statuses by 6 months, while Etihad Airways has enabled automatic accrual of monthly bonus tier miles into the customer’s account from March 31, and British Airways has cut the required status miles of its customers by 30% from April to June.

Cutting costs

Another significant step that airline companies need to undertake is cutting costs drastically. This can mean significant headcount reduction and resource consolidation in line with the revenue stream to avoid any cash burn. Most companies associated with these operations will be looking at prominent liquidity shortages. But there may be a trend of insolvency for system partners that may not be able to support the airlines. However, retaining loyal and experienced human resources will prove beneficial in the post-crisis scenario. Managing financial plans according to the market situation is, thus, very crucial. Airports and airline operators will also have to look for alternative channels of revenue as the demand shock may take a lot of time to stabilize.

Seeking financial support

With business environment so turbulent, cutting costs may not be the only saving grace for airline companies. The companies can seek bailout packages and funds from the government agencies in order to have some financial support toll the situation normalizes. Finding private institutional investors for the business for equity can also help. But the most pressing thing about seeking financial support is to have your most convincing material supplemented with a positive trajectory ready. Using the financial descriptors and negotiating for support won’t come easy. The best way out is to put together a plan to secure long-term liquidity till the markets gain traction.

Leveraging technology

The two most dominant sectors in these times are healthcare and technology. The latter, due to its immense significance for businesses, has turned out to be a savior for sectors in distress. Airline companies can devise better and safer operating procedures with the help of artificial intelligence and information technology. This can include the following:

- Contactless health and document screening

- Touch-screen boards and mobile notification for assistance

- Sensor-based crowd management in airport premises

- Upgrading crisis management and assessment dashboards

- Improving digitalization of reservation and cancellation systems

- Fee-based additional health screening

- Isolation work and relaxation rooms

- Quick medical response control

- On-demand delivery options

- Fee-based luggage sanitization

With technology, airline companies can bring ease-of-use for the customers. This can lead to better consumer sentiment while keeping the brand value sustained. The more services airlines have for passenger safety, the better the operations. It will pay-off as a lucrative investment in the long-run with improved customer engagement. Retail stores for airports can also see a rise in footfall by adopting safety techniques.

Better action planning

The airline companies having a robust action plan based on the current scenario can have a competitive upper hand. Herein action plan suggests remedy for each and every A-B scenario for various factors, be it airline delay, abrupt cancellations, lockdown and quarantine measures, coordination with emergency services, or funding. A flexible action plan can help airline sector get some control over unreliable situations. And while revenue streams can be diversified, contingency measures need to be in place for tackling the volatile business environment. Leveraging technology for able planning will also provide the firms a competitive edge.

Tracking performance

Analytics have become synonymous with agile businesses. Airports and airline companies need to manage and track their performance. Such measurement can be in the context of customer service, staff management and training, business adaptation and market review. The more detailed and agile the tracking is, the better the planning. Counting in all the worst case scenarios like insolvency of the system partners or abrupt disruptions of hub airports, the companies will have to monitor their performance and chalk out a good communication plan to tide over the crisis. Spontaneous financial tracking and reporting will go a long way for companies if revenue streams run dry.

Brand impetus

One cannot simply forget the necessity to spread the word about the brand in these turbulent times. If you as an airline company are doing something for the passengers besides simply extending their membership status and perks, let them know via carefully planned marketing campaigns. The best trick is to leverage social media and digital ad space to project your services. However, do this while keeping social distancing and sanitization measures in focus. Interacting with the customers digitally will add to brand loyalty and generate value. If they have to fly with you, why should they do that? Give them a reason to do so.

What the future holds

In the coming months and a post-COVID crisis world, consumer sentiment and air traffic recovery will be in focus. According to the Airport Council International or ACI as quoted in a study by Lufthansa consulting, the economic impact of the COVID crisis will translate well into the year 2021 too. The recovery will follow the U-shape graph or a second dip seeming to be the most likely course (W-shaped). Moreover, according to various industry analyses and projection reports, one can summarize the long-term impact for Q1 2021 and beyond as per the various components of the airline sector, though only conditionally as per the virus spread and prevention measures, as follows:

Reduced capacity for airlines

As per the estimates in the ICAO report previously, concerns over safety will translate to less seats offered by airlines. The reduction is in a range of 34% to 43% to be exact. This will mean 485 million to 601 million less passengers that use airlines to travel to their destinations. Also accompanying this downward trend is a possible $72 billion to $88 billion loss in revenue from passenger operations. A Lufthansa Consulting report says about 80% of all international passengers will get back on the plane within the first 6 months after gradual relaxation of measures and flight restrictions. It also says that about 40% of international passengers will continue to visit airport shops as dwell time. Ideally, shopping, eating within retail areas will consequently remain important post COVID-19.

Hopes for air cargo industry

The future scope seems to favor the air cargo industry amid volatile developments. As per a report, air cargo capacity is expected to gain a positive outlook in the year 2021. Meanwhile, high operations cost will help cargo operators to maintain a competitive but appreciable output. The report pins hope for the industry in around four years when air traffic gains more volume. This will lead the industry to have a lower drop than in the crisis-ridden world.

Government support crucial

Many government-owned airlines are filing for bankruptcy, leading to massive lay-offs and chaos in the market. Airlines do have the option of seeking financial support from private players. But the volatile business environment will discourage private financial institutions form lending a helping hand. Therefore, the government, in an effort to strengthen international trade ties, can help the airlines uplift themselves. It can include grants and wage subsidies to select players. Additionally, loans at preferential rates and financing with minimal risks and bank guarantees can also help. Better policy interventions to bring in investments can also aid the airline sector tide over the unreliable situation.

It's a wrap...

So in conclusion, one can see what propels the airline sector into a market in disarray. Essentially, there are more concerns over travel and safety due to the coronavirus pandemic. The sector undoubtedly has to look for cost-effective ways to consolidate its businesses to adapt to the new normal. And while recovery may be far in sight, a proactive approach to dealing with contingencies can make businesses the frontrunners. And till the world gets on board with shifting market dynamics and physical aspects, the airline sector will have to rely on robust and well-planned measures, while being on the lookout for the next wave of change.

Customer Reviews

Customer Reviews