InnovateTech, a growing technology company, decided to invest its surplus funds in a diversified equity fund. This wise decision helped it spread the risk and protect the company’s investment. The fund invested in many sectors, including renewable energy and e-commerce. As a result, InnovateTech has enjoyed substantial returns on its investment.

This judicious approach to investment is something that every business must emulate. It shows that it is possible to achieve good returns without taking on too much risk. The truth, however, is that most enterprises are unsure of how to start on this path, a major pain point to better returns.

SlideTeam’s equity fund templates are the perfect antidote for this pain point. These expert-curated, well-researched templates helps organizations manage resources, reduce risk, and work towards revenue-split goals.

Our equity fund templates help you to:

- Diversify your portfolio; this also lowers your risk if one private equity firm performs poorly.

- Promote accountability and transparency by providing guidelines on how your funds are being managed. This helps build trust with stakeholders.

- Achieve your financial goals by helping you to allocate your resources and track performance.

Welcome to this blog, where we learn about the 10 best private equity fund templates for judicious investments.

Template 1: Investor presentation to raise private equity funds PPT template

This PPT Template makes sharing information about your funds with stakeholders and potential investors easy. It provides a structured and appealing way to present key information, such as investment strategies, performance metrics, and potential returns. They also help ensure consistency in branding and messaging, making it easier for people to understand your funds and what you offer. If you’re looking to improve your presentations about private equity funds, this 47-slide deck is a must have.

Template 2: Structure for private equity fund PPT template

This PPT Template represents your fund’s structure in a clear, visual-oriented way. The template has four stages: General Partner, Outside Investors, Investment, and Individual Funds. Each stage includes slides that help present information about your fund, such as its investment strategy, risk management techniques, and potential returns. The template includes a sleek design and intuitive layout that will help to engage your audience.

Template 3: Private Equity Fund PPT bundles

Looking for a powerful presentation tool to help you convey your views on private equity funds? These PPT bundles are designed for expert discussion meetings and offer a range of slides. From captivating introductory slides to thought-provoking graphs and charts, you’ll find everything you need to create an engaging and informative presentation. These Private Equity Fund PPT Bundles will leave an impression on your colleagues and clients. Order your presentation template today and unlock endless possibilities for success!

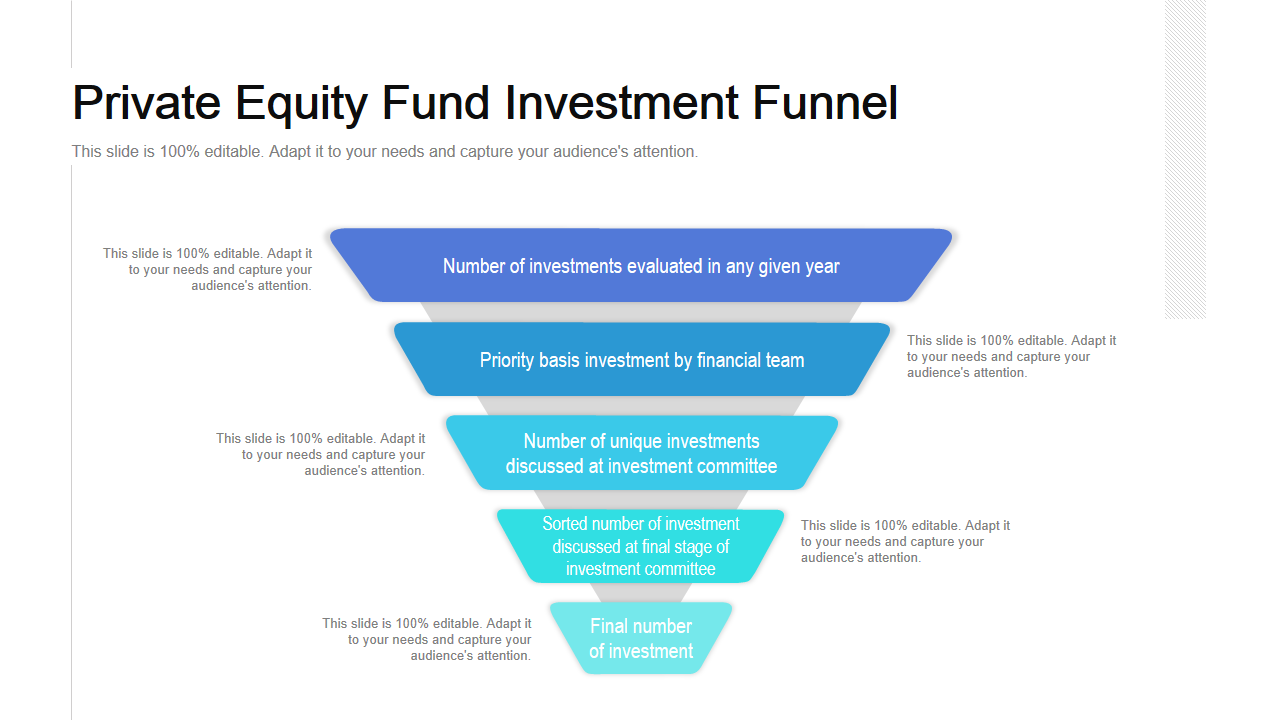

Template 4: Private equity fund investment funnel PPT template

If you want to evaluate potential investments, we’ve got you covered with this PPT Template. Use this presentation template to analyze past performance, set future goals, and make better decisions. It’s a precious resource for any organization looking to streamline its investment strategy.

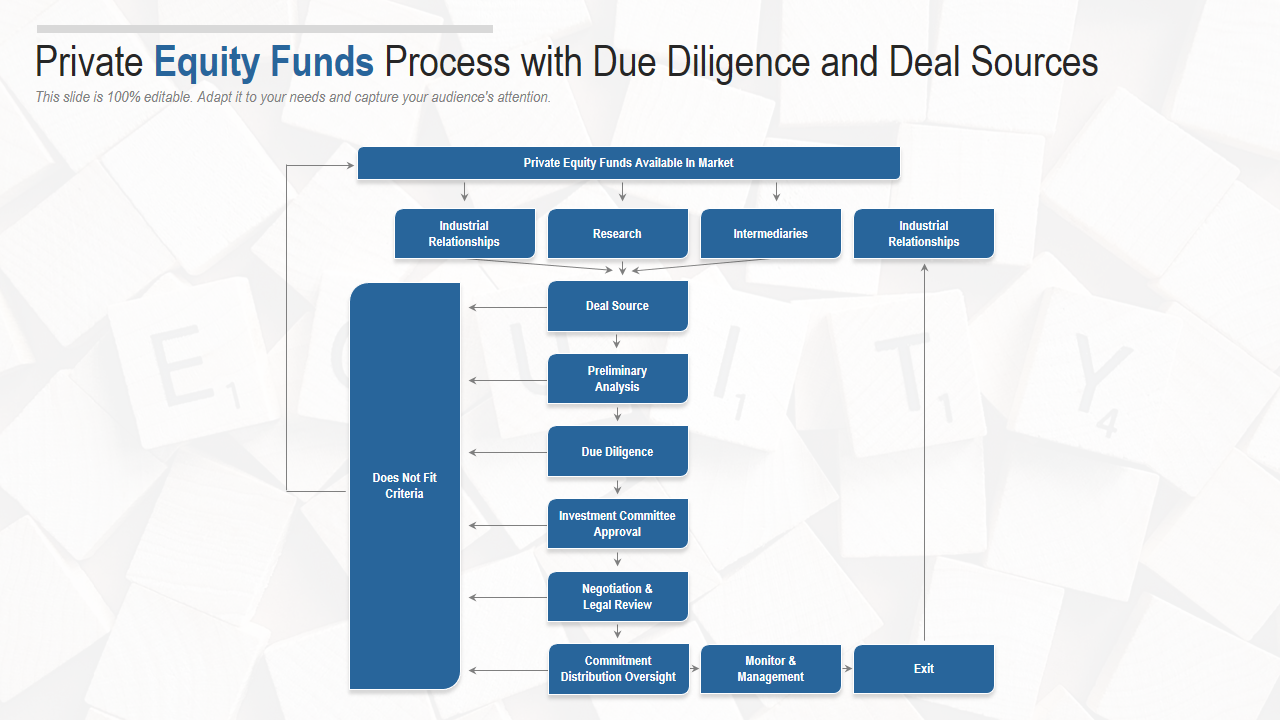

Template 5: Private equity funds process with due diligence and deal sources PPT template

The presentation template includes sections on industry trends, successful case studies, establishing partnerships, and identifying trustworthy intermediaries. It is designed to make informed decisions about private equity investments. For this, a dedicated flowchart is the centerpiece of this template, where we enlist steps like deal source, preliminary analysis, invest committee approval et al to a profitable exit.

Template 6: Private equity fund partnership structure PPT template

Elevate your professional presentations on private equity fund partnerships with this PPT Template. Use this template to showcase your expertise in explaining the role of limited partner investors; presenting an extensive portfolio of companies; highlighting the role of general partners and ultimately creating a working and profitable deal.

Template 7: Format of private equity fund PPT template

Do you want to enhance your professional presentations about private equity funds? The presentation template helps you explain the role of general partners; discuss the structure of a private equity fund; describe the due diligence process and highlight the role of limited partners.

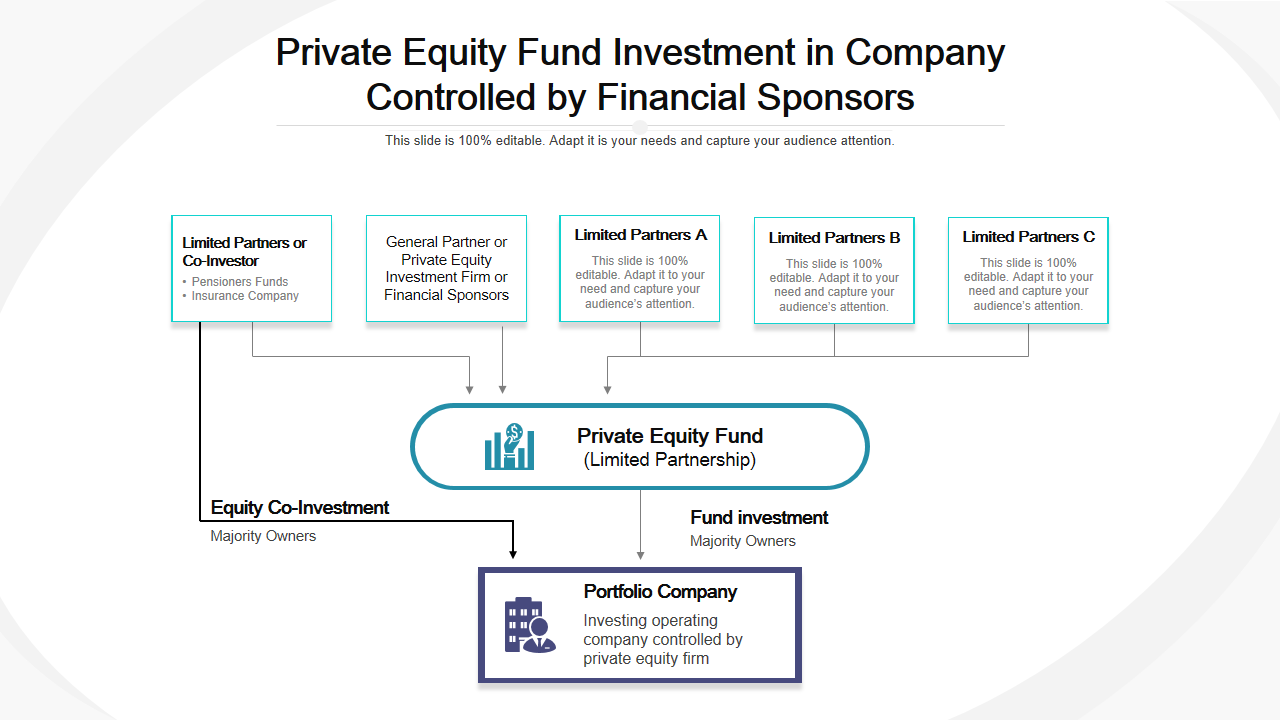

Template 8: Private equity fund investment in the company managed by financial sponsors PPT template

Use this PPT Template to highlight your risk mitigation strategies and performance metrics. Whether you're conducting investor presentations or internal meetings, our template will help you deliver your message. These layouts will make your presentations look polished and professional, and you can integrate your company's branding elements into the template. Showcase facets of private equity investing, including limited partners' contributions, equity co-investment opportunities, and diversified portfolios with this slide.

Template 9: Flowtab private equity funding pitch deck PPT template

This PPT pitch deck is a great way to showcase your services and present your business plans and vision. This presentation template covers your company’s viability, your product, and its USP. The deck is easy to use and download so that you can get started right away. It is suitable for investor presentations, internal meetings, and marketing materials. Download the PowerPoint Pitch Deck today and start wowing your audience!

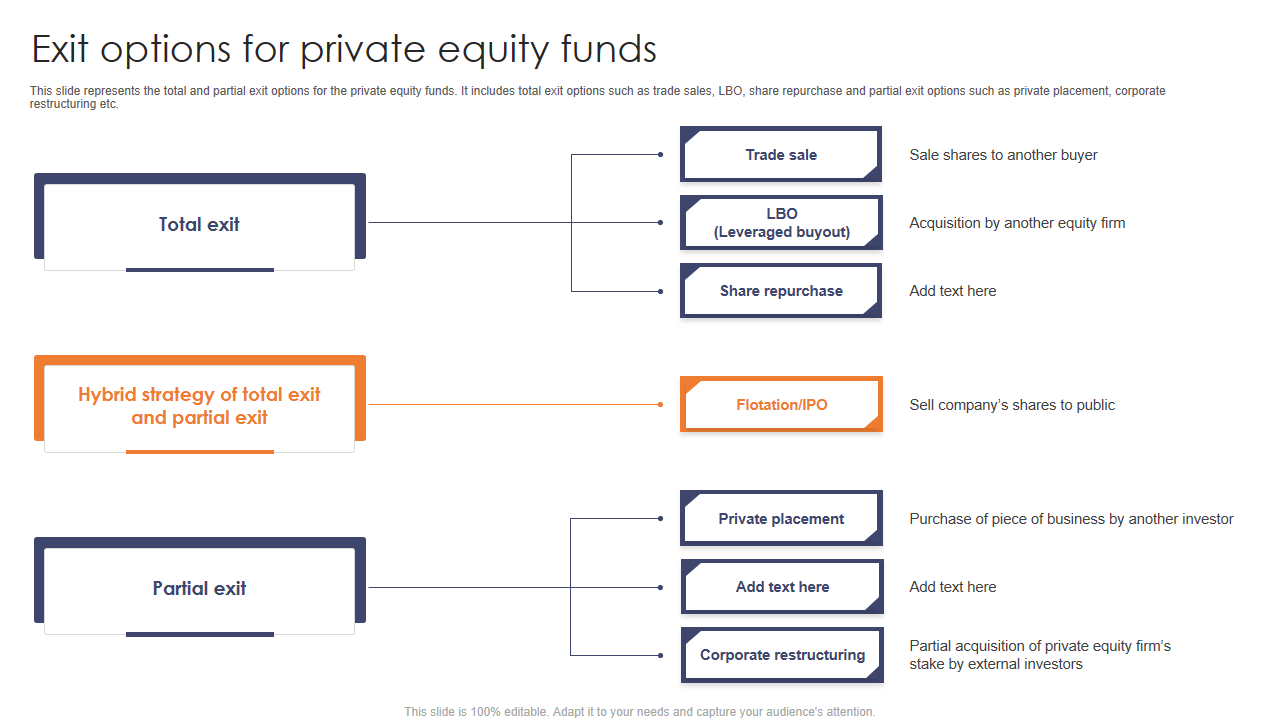

Template 10: Exit options for private equity funds PPT template

This slide showcases exit options available to private equity funds. There are two main types of exit options: Total exit options and Partial exit options. Total exit options involve selling the entire portfolio company to another company or taking the company public through an Initial Public Offer (IPO). These options are for private equity funds but can be difficult to achieve. This slide also shows the three stages of an exit which are preparation, where planning is done for the exit and identifying potential buyers or investors. Then, we have negotiation and completion for the sale.

ACHIEVE YOUR FINANCIAL GOALS

Investing in private equity funds requires the right communication tools with stakeholders and potential investors. That’s where private equity fund templates come in handy! Our investment ppt templates provide a professional and appealing framework for sharing information about your funds. Using these templates saves time and promotes transparency, which can assist you in reaching your financial goals while reducing risk.

Need to raise funds to upgrade your organization? Click to learn about such useful templates.

PS Raising funds is a critical business activity. Checkout this blog to get know about the best fundraising timeline templates.

FAQs on Private Equity Fund

What is a private equity fund?

A private equity fund is a type of investment fund that combines money from investors to invest in private companies. These funds have a longer investment horizon than other types of funds, and these seek to make significant changes to companies they invest in.

What is the difference between private equity and a hedge fund?

Private equity and hedge funds are alternative investments that pool money from investors to invest in varied assets. However, there are some key differences between the two:

- Private equity funds invest in private companies, while hedge funds invest in assets, including public companies, bonds, and derivatives.

- Private equity funds have a longer investment horizon than hedge funds, meaning they focus more on long-term growth.

- Hedge funds are more actively managed than private equity funds, and use more complex strategies to generate returns.

In general, private equity funds are considered a less risky investment than hedge funds. However, these also offer comparatively lower return.

What are the three types of private equity funds?

Venture capital funds invest in startups and have a high growth potential.

- Growth equity funds invest in more mature companies that are already profitable, but have the potential for more growth.

- Leveraged buyout funds acquire existing companies using a combination of debt and equity.

![[Updated 2023] 10 Best Private Equity Fund Templates for Judicious Investments](https://www.slideteam.net/wp/wp-content/uploads/2021/02/Size-1013x441-1-1.jpg)

Customer Reviews

Customer Reviews

![[Updated 2023] Top 25 Investment Presentation PowerPoint Templates for a Secured Future](https://www.slideteam.net/wp/wp-content/uploads/2020/04/Banner-17-335x146.png)

![[Updated 2023] Top 25 Cybersecurity PowerPoint Templates To Safeguard Technology](https://www.slideteam.net/wp/wp-content/uploads/2020/04/Banner-11-335x146.png)