An ancient saying from Roman poet and playwriter Titus Maccius Plautus (known as Plautus) is the foundation of every business everywhere in the world, “You must spend money to make money.” The concept of Revenue Expenditure revolves around this.

Revenue expenditures are expenses made to meet the operational costs of a business to generate revenue; the typical time over which this is tracked, measured, and recorded is a year. These short-term costs are similar to Operational costs (OPEX).

What Are the Examples Of Revenue Expenditure?

A few examples of revenue expenditure are — essential costs of repair and maintenance to keep assets working, employee salaries, rent, utilities, Travel Allowance (TA), annual taxes, etc. These expenses are recurring and have to be incurred in real-time compared to long-term investments like capital expenditures (CapEx).

How Are Revenue Expenditures Linked To Financial Statements?

You can find revenue expenditures in the Income Statements as Operating Expenses (OPEX). Subtracting the expense from the revenue generated will give us net income or net profit for the period. A business must ensure that its revenue exceeds its expenditure to stay alive and running. From a tax standpoint, revenue expenditure will reduce the taxable income of the business and save some money for the organization.

Coming on the financial well-being slide, we offer another comprehensive product on financial management that also helps you track your money-management skills. Please download this collection of templates here!

What Are the Types of Revenue Expenditure?

Revenue Expenditures can be broadly classified into two categories:

1. Direct Revenue Expenditures: These are the expenses incurred in the production of goods and services and the day-to-day operations of businesses. For example, Direct expenses include production costs, electricity used in production, rent, packaging cost, workforce wages, etc.

2. Indirect Revenue Expenditures: These expenses are not related to the direct production or finishing of goods and services but are essential for their distribution. For example, freight charges, marketing costs, repair costs, legal charges, etc.

Some of these costs overlap and are difficult to put into any one category; therefore, they are concluded as miscellaneous revenue expenditures. Understanding and calculating the correct revenue expenditure is essential for operation management, budget planning, and financial analysis of enterprises. One single mistake in calculation will change the income statement and, in turn, the other two financial statements — balance sheet and cash flow statement.

If you need finances to shore up your business and breathe easy, whether on the capital or revenue slide, please click here!

Top 10 Revenue Expenditure Presentation Templates

We offer our well-researched and pre-designed revenue expenditure templates to support you in controlling these expenditures and in communicating their importance to the team. These templates will benefit you in crafting and presenting an intelligible revenue expenditure report. Let’s explore these and find a suitable template to fit your purpose!

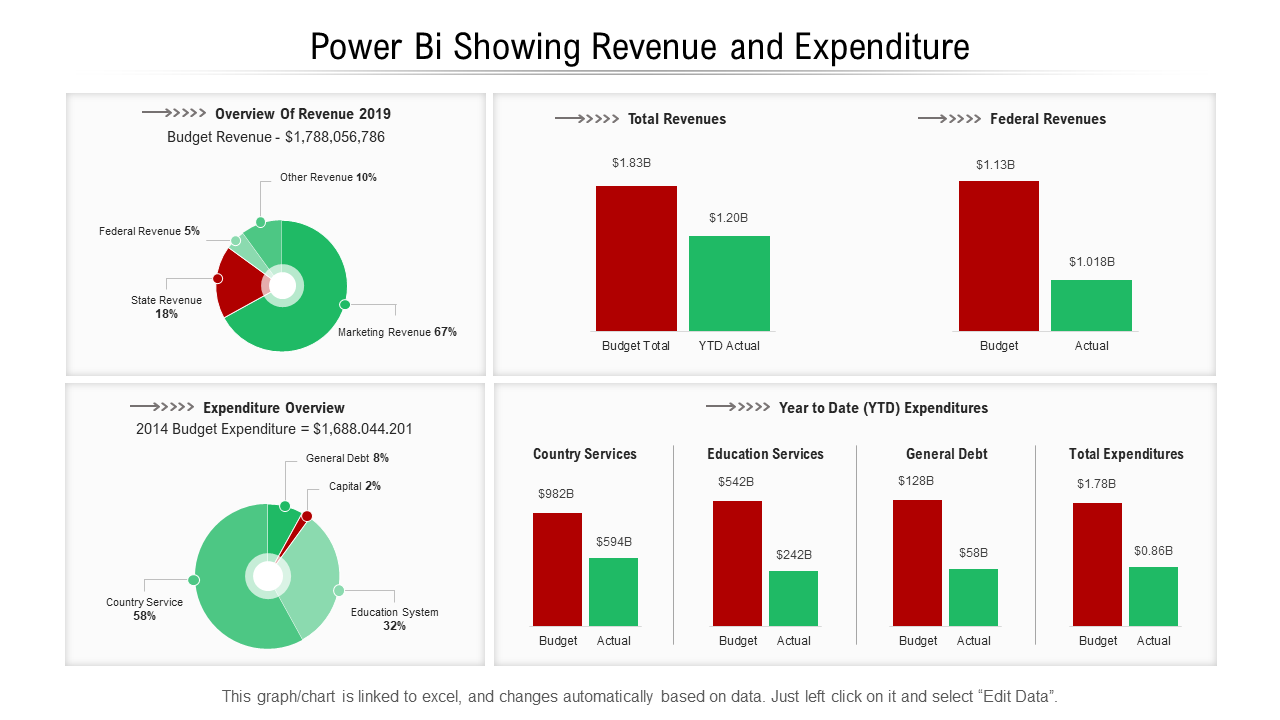

1. Business Intelligence Revenue Expenditure PowerPoint Template

This Business Intelligence (BI) theme-based presentation template will help you compare and contrast revenue and expenditure. It will assist you in presenting an overview of annual expenses in the form of attractive graphs that work. Grab this design today!

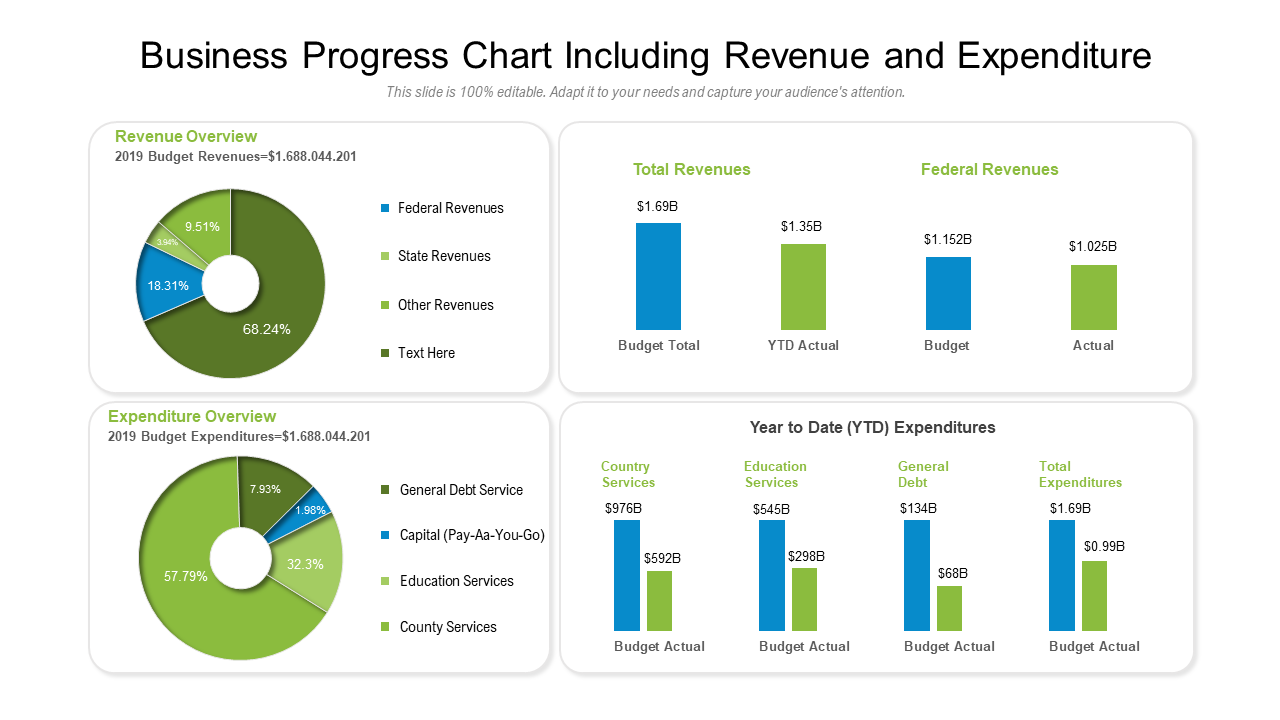

2. Business Progress Chart Including Revenue Expenditure Presentation

This colorful PPT layout will assist you in a Year-to-Date (YTD) comparison of revenue expenditure. With this PowerPoint set, you can share revenue and expenditure data of departments and draw a comparison on the basis of profit and the finances allocated. Download this presentation template now!

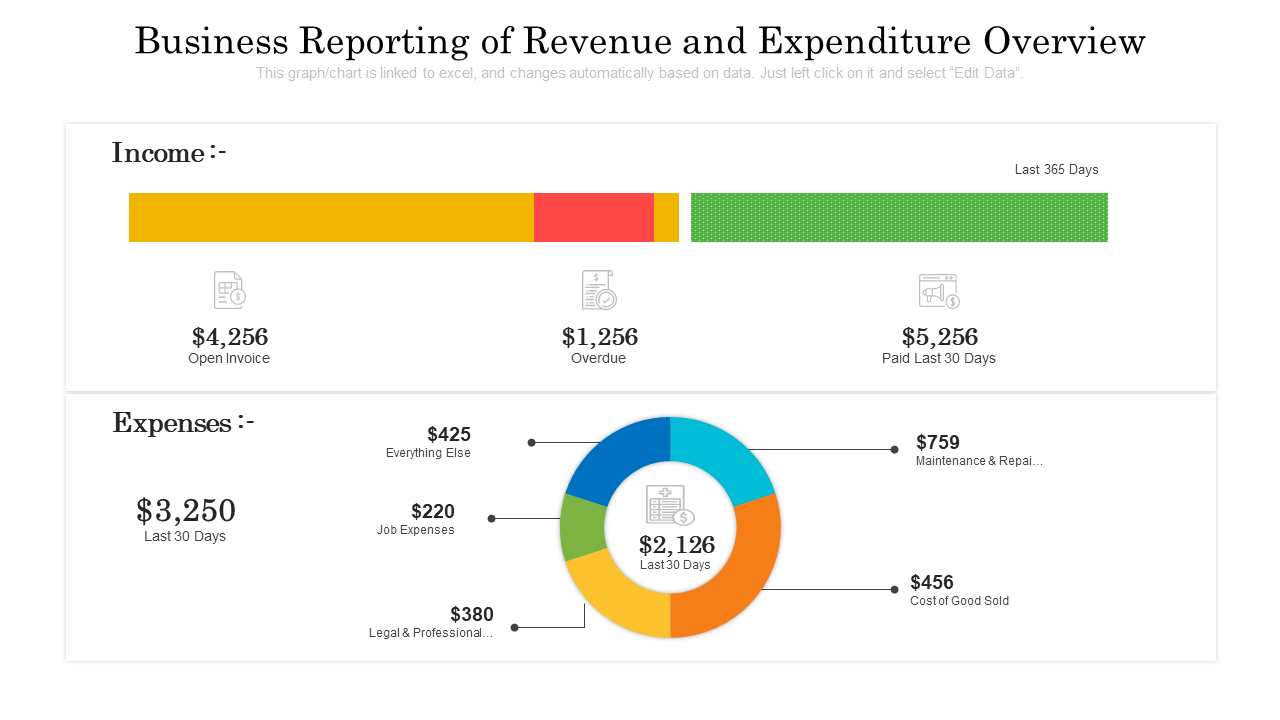

3. Business Reporting of Revenue Expenditure PPT Slide

This multicolor presentation infographic can be ideal for comparing income and expenses. It will help you determine the areas/departments/products/service with more revenue expenditure or less profit. This PowerPoint preset also has pre-defined space for elements like 30-day profit, overdue, open invoice, etc. Use these to share valuable insights with the audience.

If you want to up your game, please click here to get our other products on finance and management.

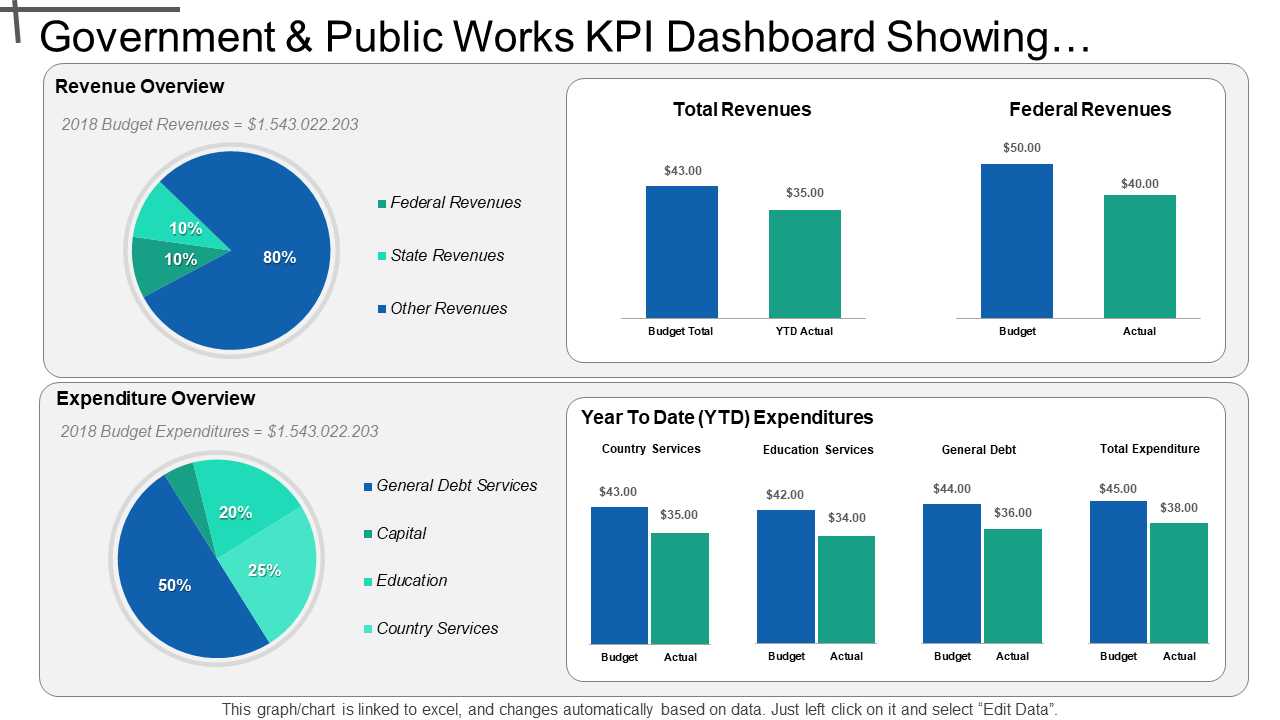

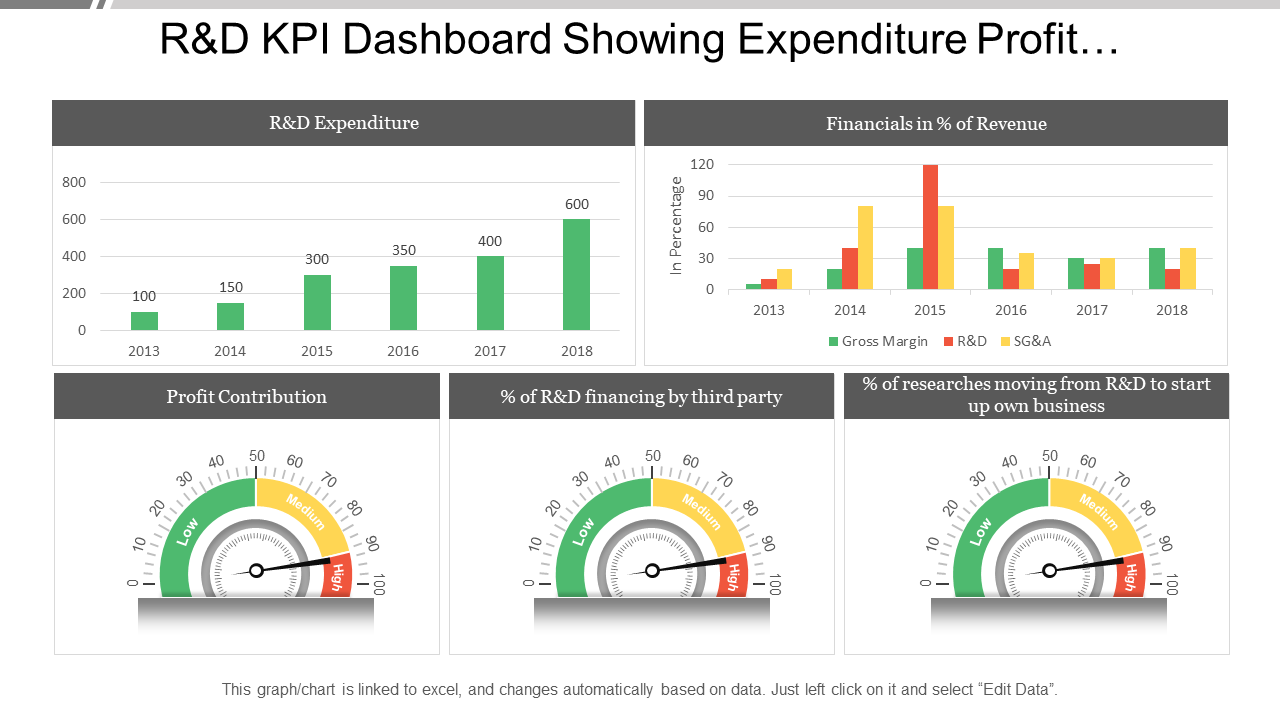

4. Revenue Expenditure KPI Dashboard PowerPoint Template

Use this illustrative dashboard template to help stakeholders understand the business and the way it is mostly expenditure control. It will add value to the comparison presentations with its charts and graphs. Grab this slide today to share revenue expenditure and budgets of different services with the audience!

5. Revenue Expenditure KPI Dashboard Presentation Slide

This comprehensive financial model slide will help you collate and share all financial information of the business at one glance through a dashboard. It has be a part of your next budgeting presentation to make strategic decisions based on data and insights. Grab this slide today!

6. Revenue Expenditure Budget And Marketing Strategy PPT Layout

This strategic presentation layout will help you share the market research-based plan of revenue expenditure. It will be useful in sharing succinct and critical information about your financial plan. Get this slide and start planning!

7. Deferred Revenue Expenditure Document PowerPoint Presentation

With this PPT infographic, plan and secure the future profit of your business. It will help you figure out opportunities for deferred revenue and convert them into revenues for the financial year. Get this PowerPoint slide today to grab opportunities that you may be missing or may not be aware of.

8. Annual Business Revenue Expenditure Document PPT Slide

This revenue expenditure slide will add value to your financial presentation as it simplifies complex information. It will help you share required information and ensures you do this in an engaging manner for your audience, which really makes an impact. Get a hold of this PPT graphic today!

9. Revenue Expenditures Cycle PowerPoint Template

This PowerPoint layout will help you share steps in the revenue expenditure model. Use this visual presentation to give your team a better understanding of the steps involved in the process. It is an ideal tool for managing revenue expenditure through checkpoints.

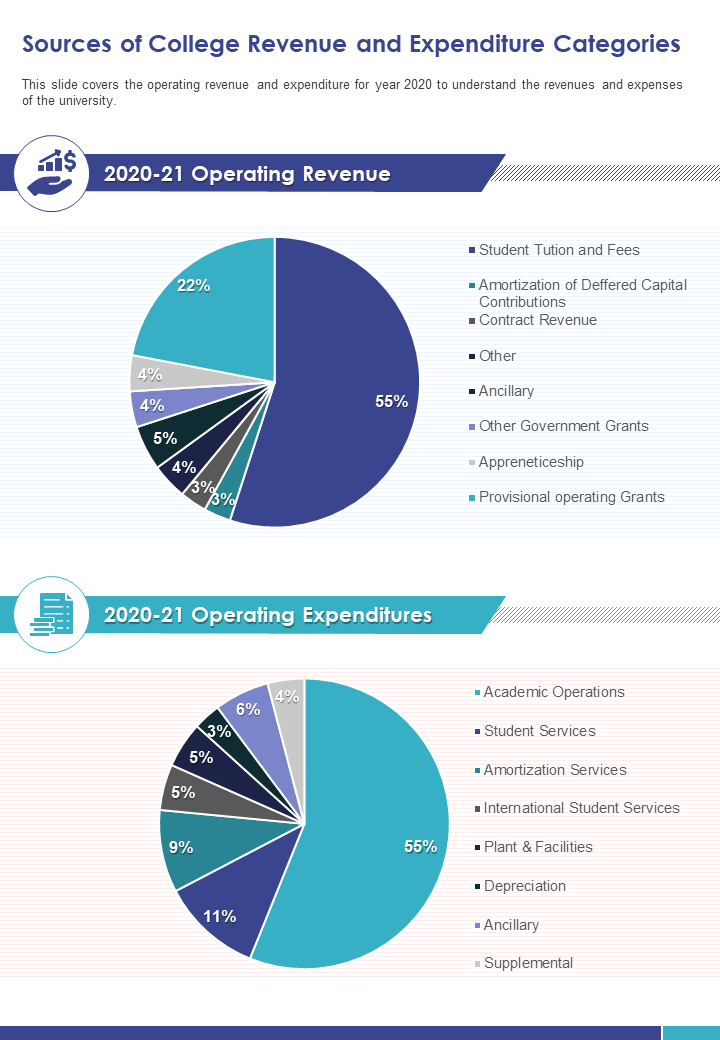

10. One-page Revenue Expenditure Report PowerPoint Template

This one-page revenue expenditure model will help you draw a relationship between annual operating expenditure and revenue. You can use easy-to-understand pie chart figures of this compact design to understand how business earnings are moving across departments or processes. Get this one-page PowerPoint infographic today!

What Is The Difference Between Revenue Expenditure And Capital Expenditure (CapEx)?

Revenue expenditures are the real-time, short-term, recurring expenses made in business to generate revenue. These investments don’t add to the fixed assets of an organization and are equal to operating expenditures (OpEx). In contrast, Capital Expenditures (CapEx) are the investments made to grow and maintain business capital (fixed assets) — factories (plant), sites (property), and working equipment (PP&E). These are long-term investments and are one-time.

What Is Deferred Revenue Expenditure?

Deferred Revenue expenditures refer to the expenses made in the current year; however, revenue or profit will come in the upcoming year from these investments. These investments are added to ‘assets’ in a balance sheet as these signify fixed amounts spent towards resources that are not fully consumed at one time or year. If assets get consumed within a year, then these are donated as ‘current assets.’

In The End

Revenue expenditure is a critical component of financial management and the documents of businesses. A simple look at these figures will help you know the financial well-being of your organization. Do not miss out on these simple and comprehensive Revenue expenditure PowerPoint designs to understand and present this important, timeless concept in a more salient manner!

Customer Reviews

Customer Reviews