Health, technology, and finance are three industries that get human attention without their conscious. About 60 percent of the internet is flushed with information on them. Health requires habits, and technology is a matter of interest, but finance affects each human life and is necessary to be aware of. The wake of the recent financial crisis highlighted the importance of sound credit management and made people realize the criticality of staying on top of their finances. That’s where a credit dashboard comes in.

A credit dashboard is a tool that helps individuals keep track of their credit scores and history. It summarizes the fundamental credit information like credit score, limits, and balances on the credit accounts. A credit dashboard also provides cues for changes in the individual’s credit score or credit report and offers tips for improving it.

For Finance/insurance/credit card sellers, credit dashboards are a competitive advantage, and they provide access to them as (complimentary) monitoring services, while others offer them as stand-alone tools.

Elements of Credit Dashboard

The elements of a credit dashboard vary depending on the specific tool or service. In general, a credit dashboard will provide a summary of key credit information, including

- Credit score: This is a three-digit number that represents an individual’s creditworthiness based on information from their credit report. Lenders use it to determine the individual’s likelihood of repaying a loan. A credit dashboard displays the individual’s credit score and data-driven insights about the factors impacting the score.

- Credit limits: It refers to the maximum amount of credit that an individual is allowed to borrow on a credit account (a credit card, loans, or mortgages). This section in the credit dashboard shows the limits for each individual’s credit accounts and the overall credit utilization ratio (the amount they use relative to their credit limits).

- Credit balances: This reflects the current balances (amount of money an individual owes) on each individual’s credit accounts and credit card debt in the dashboard.

- Credit accounts: This element in the credit dashboard exhibits the summary of the individual’s credit accounts, including the type of account (e.g., credit card, mortgage, auto loan), the account balance, the credit limit, and the payment due date.

- Credit history/credit report summary: A record of the individual’s credit activity, including information about their credit accounts, scores, and inquiries. It also comprises information about the span of credit history, the types of credit accounts, and payment history, along with any negatives like late/missed payments or collections.

- Alerts: A credit dashboard may provide alerts for changes in the individual’s credit score or credit reports, such as a sudden drop in their credit score or the addition of a new credit account. These alerts can help the individual identify and address potential issues with their credit.

- Insights and tips: A credit dashboard provide valuable insights and suggestions for improving credit, such as paying bills on time, reducing credit card balances, and disputing errors on credit reports. These tips will help individuals maintain a good credit score and improve their financial health.

Credit management is a mandate for an organization as well as for individuals to stay at the top of their finance game. Here is a collection of templates that gracefully caters to the needs of both businesses and individuals. Click here to explore!

Pre-designed Credit Dashboard Templates

Although credit dashboards provide a lens of simplicity to the world of personal finance, just like any other financial tool, they are time-consuming and nerve-wracking to create, read, and understand. Our ready-to-use credit dashboard templates will help you here and save you from the trouble of creating this all-inclusive credit tool from scratch. SlideTeam’s content-ready credit dashboard PPT templates include every element of the credit dashboard; however, if you want to customize them, they are a piece of cake.

Let’s explore these illustrative credit dashboard templates to get you a personal digital finance manager!

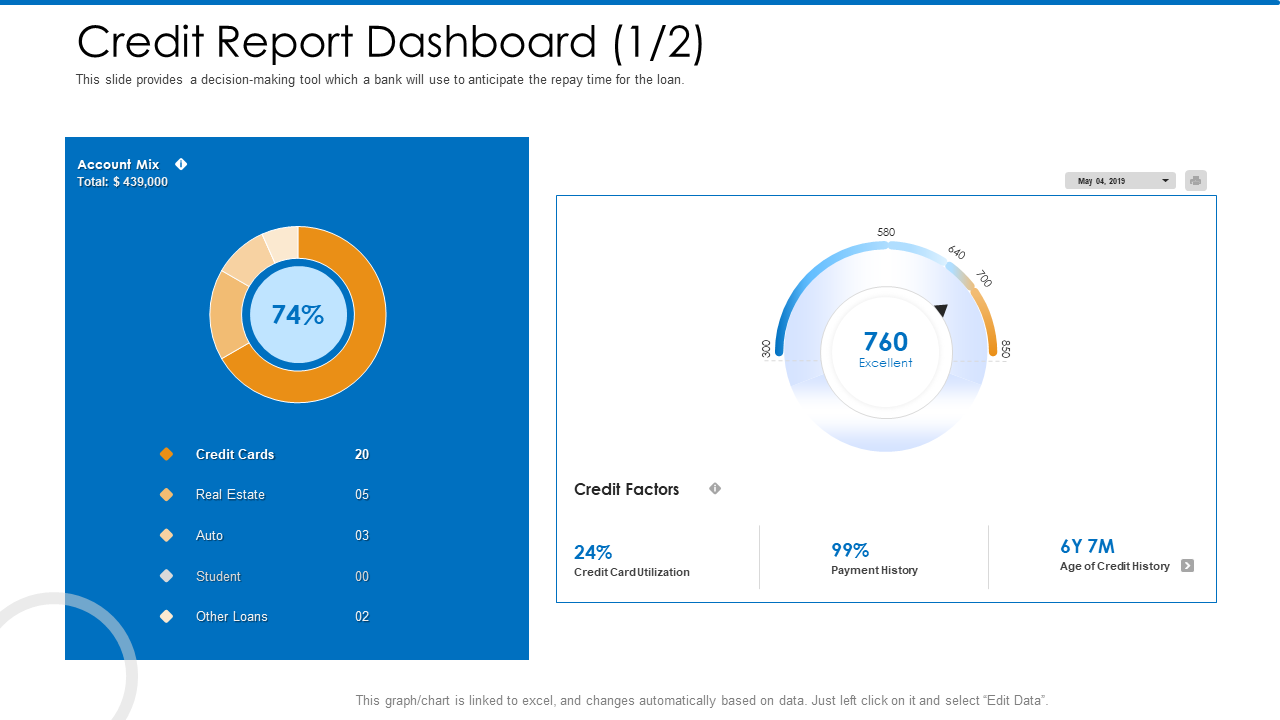

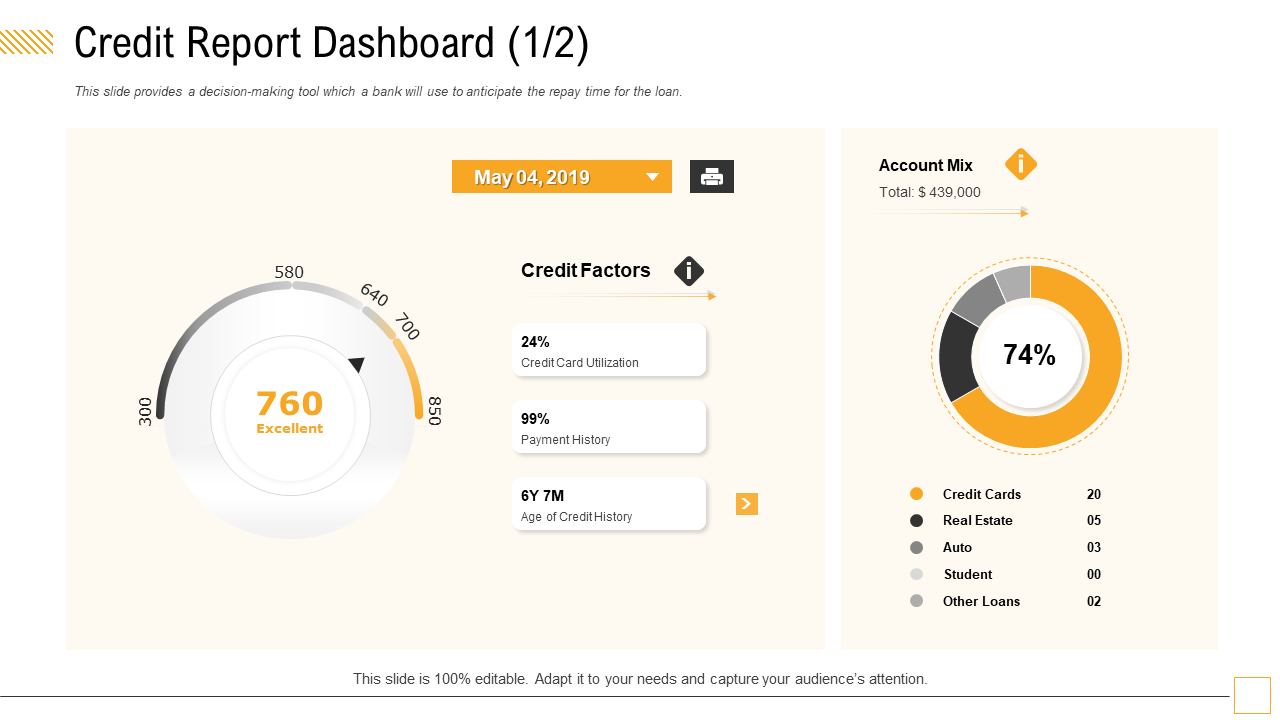

1. Credit Report Dashboard PowerPoint Presentation Template

With a credit dashboard PPT Template, monitor personal credit health and make informed decisions about your money to secure your finances. This PPT template will help you create a credit report reflecting your account mix of credit cards, automobile, real estate, education, and other loans. It highlights your credit score and factors affecting such as credit utilization, payment history, and age of credit history. Get it now!

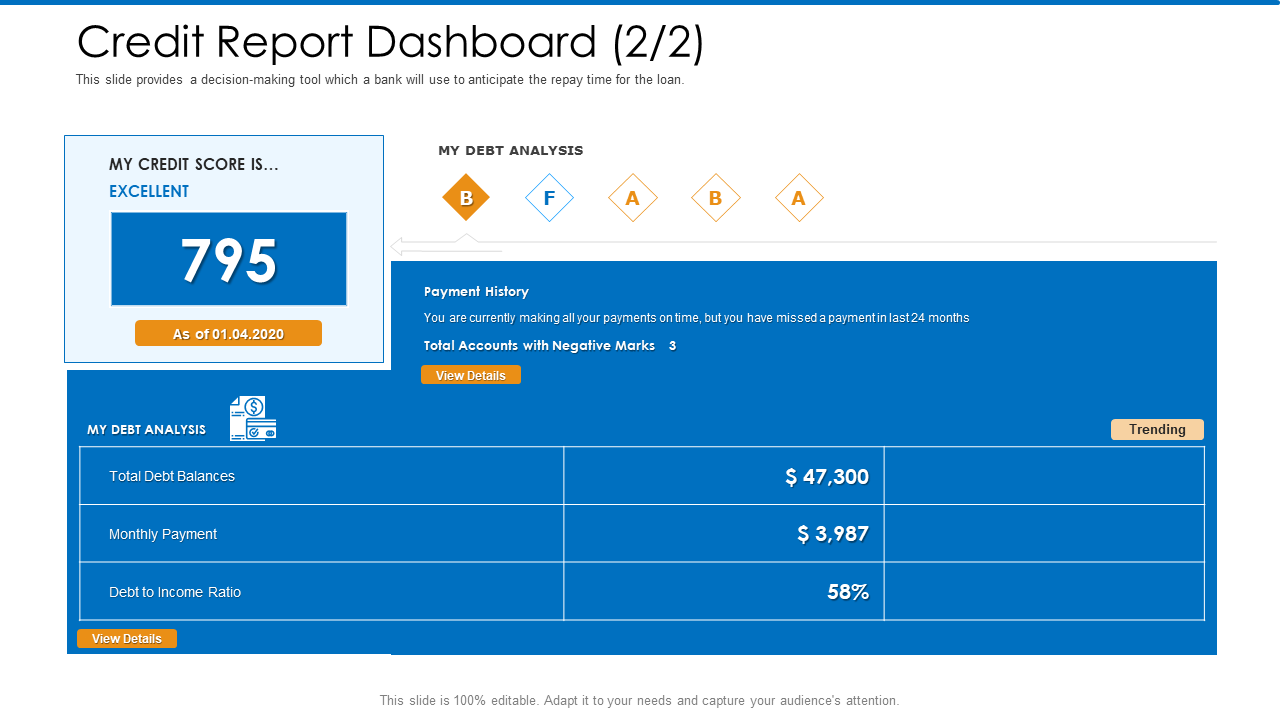

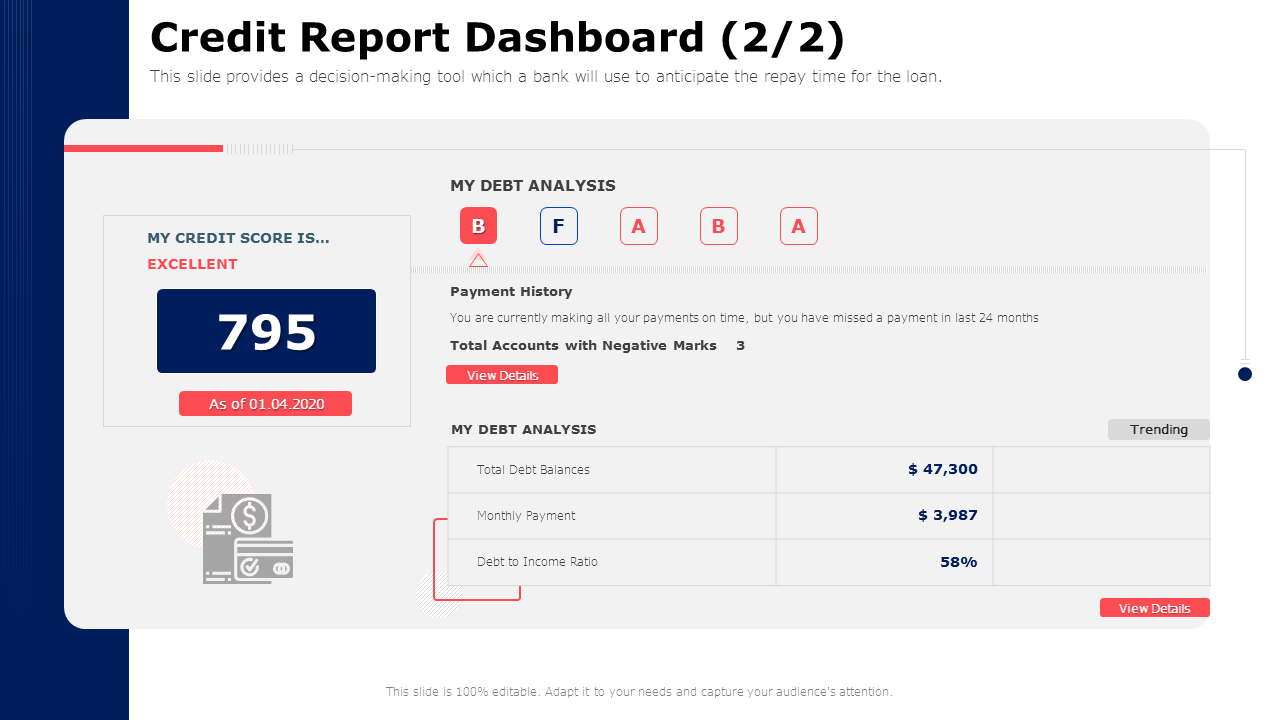

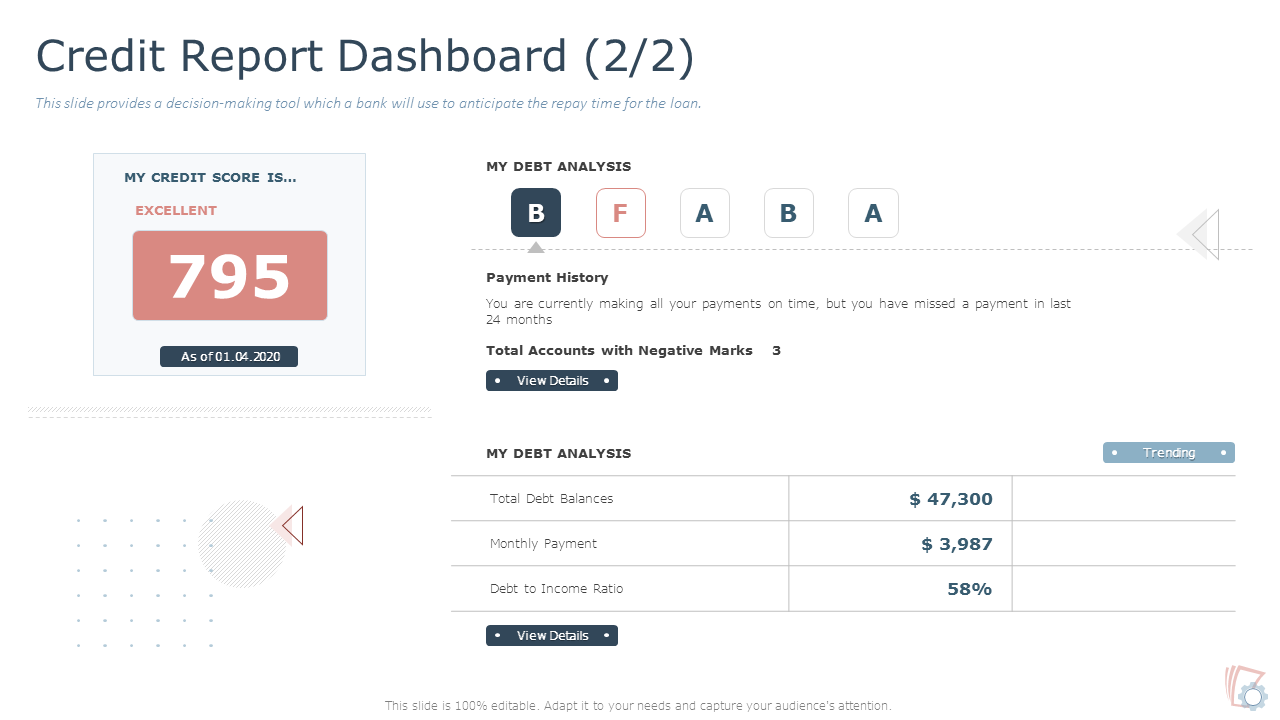

2. Credit Report Dashboard PPT Presentation Template

“Knowledge is the power,” — said the English Statesman, philosopher, attorney general, and lord chancellor Francis Bacon. This stands true and also extends to ‘control’ and ‘comfort’ in financial awareness and Power. Our credit dashboard presentation Template will help you to stay on top of your personal finance management with debt analysis — debt balances, monthly payments, and debt-to-income ratio. It also highlights the credit scores and payment history of an individual. Grab this today!

3. Credit Report Dashboard Analysis Presentation Template

A credit dashboard is like the dashboard of your car. It provides a quick & easy way to read and analyze all your important credit information. With a credit dashboard PPT Slide, keep track of your credit score, credit limits, balances, and credit history, all in one convenient location. This template will help you create a credit dashboard with all the essential elements to leverage and take control of your personal finance.

4. Credit Account Dashboard PPT Presentation Template

A credit dashboard provides valuable insights into your credit and financial situation, which will help you make more informed decisions about your money. Using a credit dashboard PowerPoint Template will help you increase your financial knowledge and attain financial independence. This template will become your blueprint to create a credit dashboard that entails components like credit score, history, account mix, and factors affecting your credit health. Download it now!

5. Credit Analysis Dashboard PPT Presentation Template

A glance at the credit dashboard will provide you with a wealth of information at your fingertips. This tool makes personal finance management exciting and easy. Our eye-catching credit dashboard Template will add to this experience of looking at the numbers from a new angle. Get this easy-to-read design today to create a dashboard with insights and data created for your personal use only!

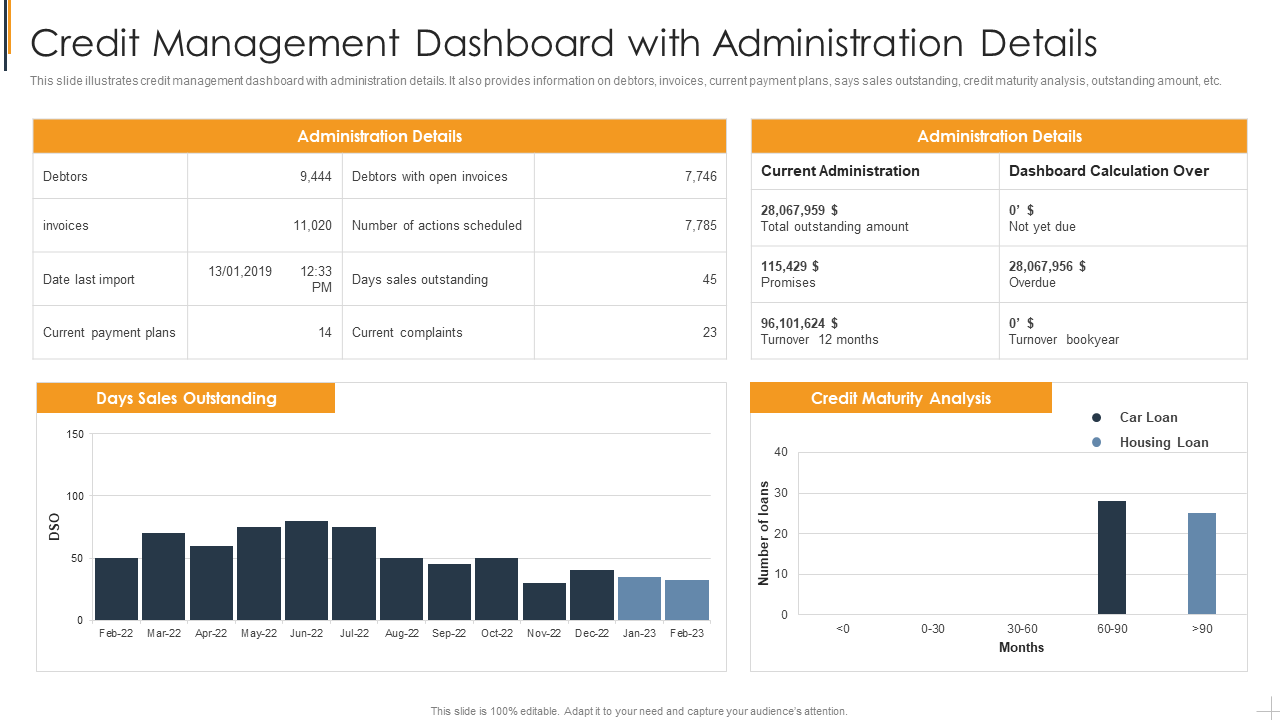

6. Credit Management Dashboard Presentation Template

Managing a good credit score is crucial not only for individuals but for businesses as well. An excellent score and flawless credit history mean the same for both when it comes to taking loans from lenders. This template will help you get a picture of the credit dashboard of a business. It highlights the crucial finance administration details and day sales outstanding to read the pecuniary of the enterprise. Using this credit dashboard template, you can read and present credit maturity analysis in a graphical format. Get it now!

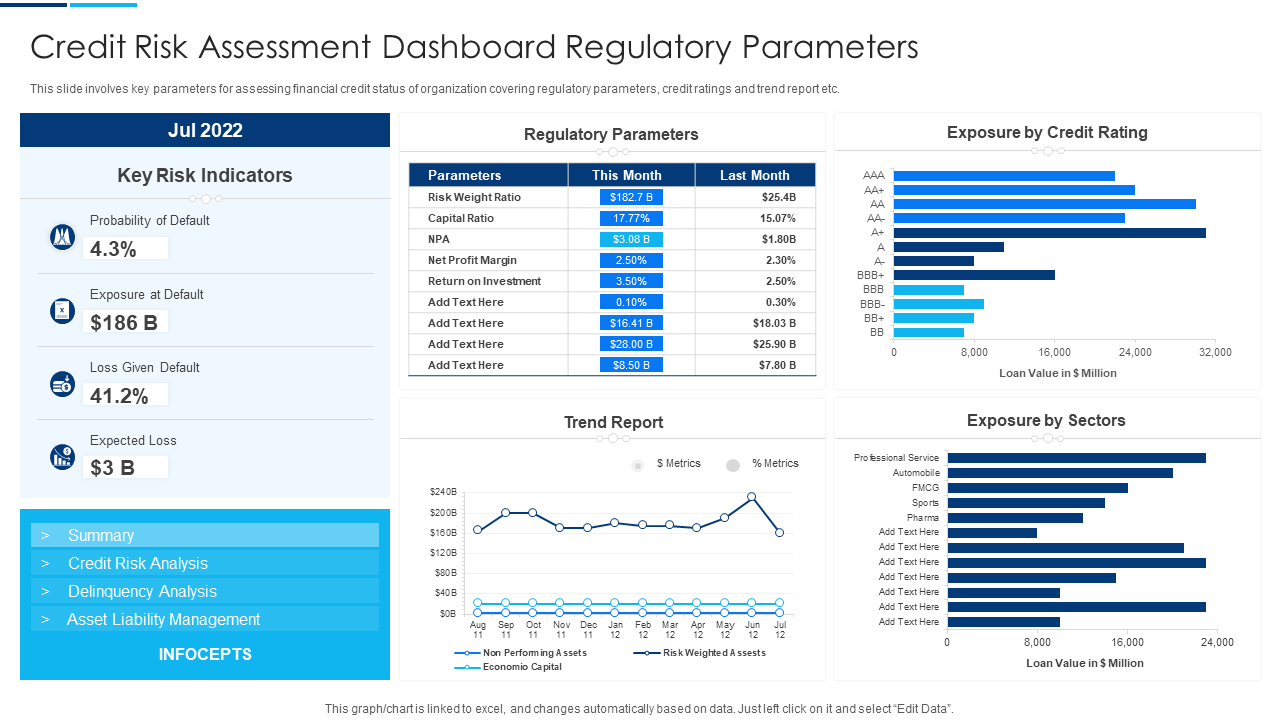

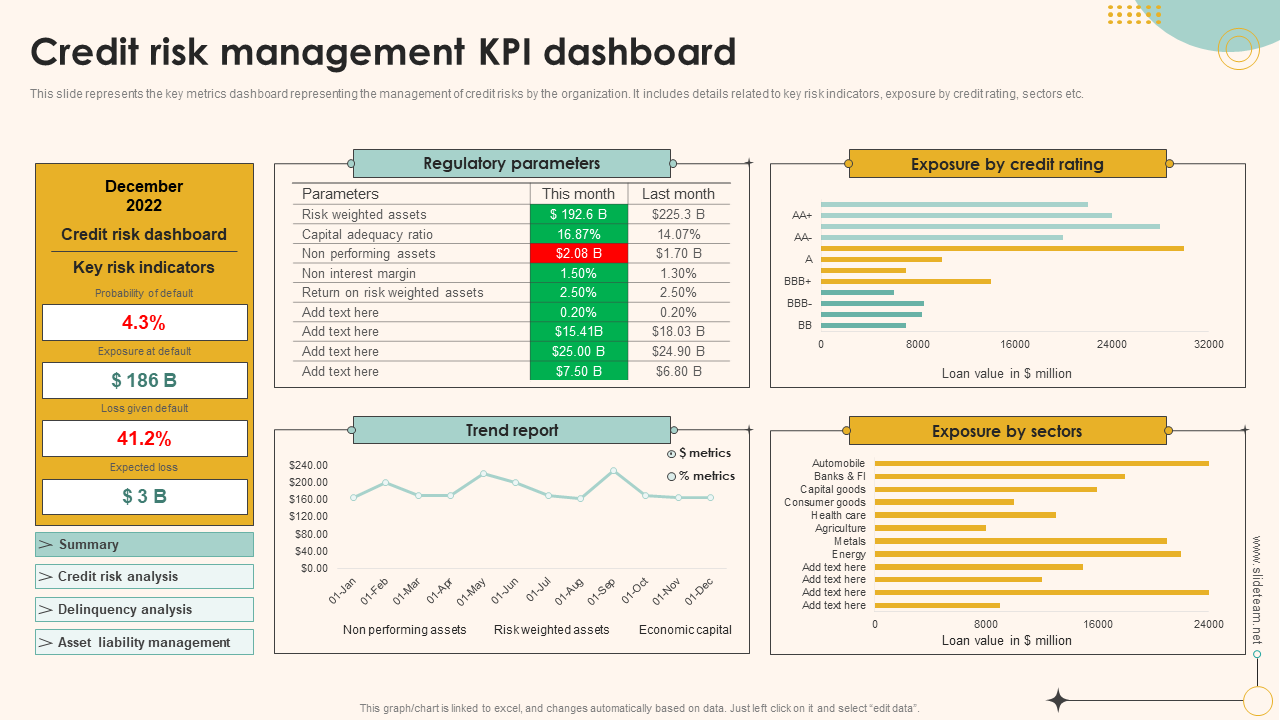

7. Credit Dashboard with Risk Assessment Regulatory Parameters Template

Business, credit, and risks are interconnected, with companies relying on credit to finance their operations and financial institutions using credit ratings and other measures to manage the risk of lending to them. This credit dashboard template will help both borrowers and lenders with an in-depth risk assessment before taking/assigning a loan. It allows the user to access key risk indicators, regulatory parameters, credit ratings, and industry financial trends. Grab it now!

8. Credit Dashboard with Risk Management KPI PPT Template

A credit dashboard with important business finance KPIs provides a quick and easy way for businesses to monitor their credit risk and identify potential issues. A regular review of these metrics will help enterprises devise strategies to reduce risk and maintain a healthy credit profile. This template will help companies design a credit dashboard for risk management with key indicators like default probability, risk-weighted assets, non-performing assets, capital adequacy ratio, trend report, and credit ratings. Download it now!

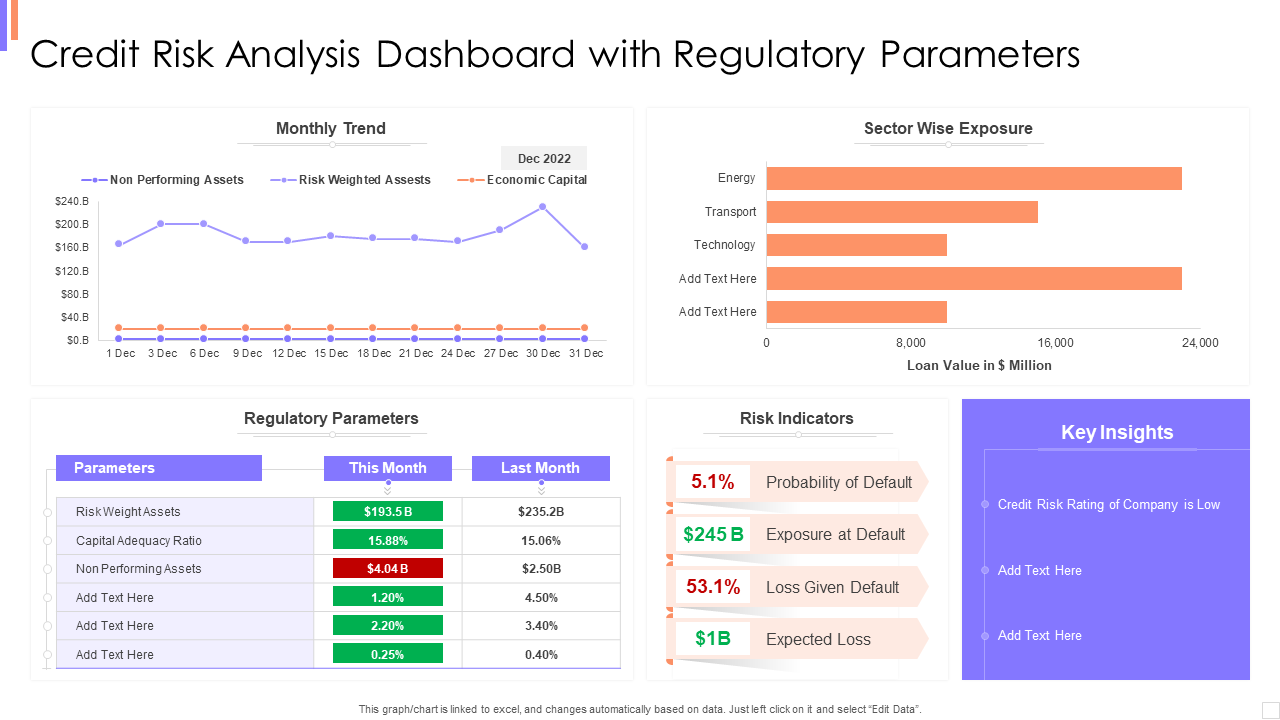

9. Credit Dashboard with Risk Analysis Parameters PPT Template

Elon Musk’s fall from the rank of the first billionaire and Bernard Jean Étienne Arnault (and family) becoming the wealthiest man for a brief time shows the dynamic state of the finance industry. It is crucial for businesses to be financially aware and sound. This credit dashboard Template will help you stay hawk-eyed about your business credit score and any changes occurring. It includes regulatory parameters, risk indicators, sector-wise exposure, and monthly trends about industry money glide. Get it now!

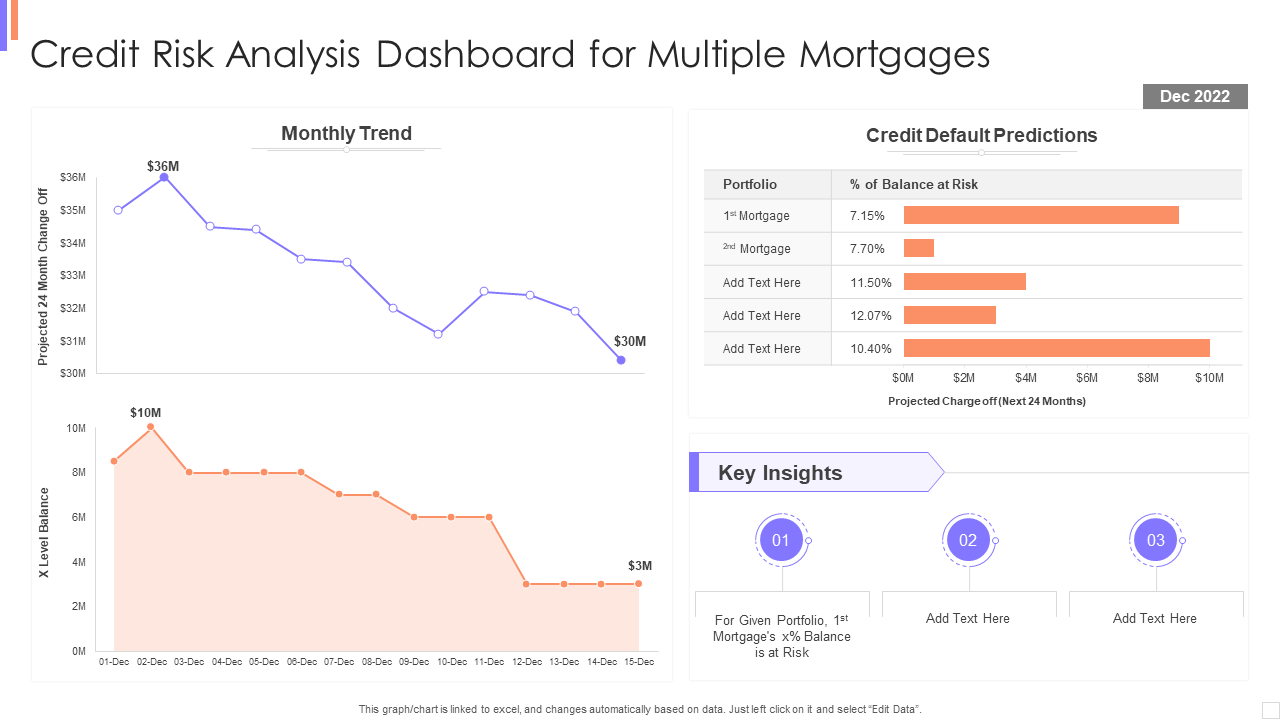

10. Credit Dashboard Presentation Template for Multiple Mortgages

A businessman’s routine includes borrowing and lending money. It’s continuous and necessary. This credit dashboard template will relieve you from the headache of managing multiple mortgages at different locations/devices/tools/tabs. It will accommodate the data in one convenient place for your daily lookup and tracking to help you with easy credit profile management. Get it now!

The Last Credit

Whether as a personal finance management tool or a competitive advantage, complementary benefit, or stand-alone tool, credit dashboards hold great significance in this world where financial awareness and strength determine the value of your words. Our plug-and-play PPT templates will help you curate credit dashboards that are stress-free to the eyes and minds of viewers. These presentation designs are the results of extensive research and the designing skills of our teams. You can rely on these to create or customize a comprehensive credit dashboard.

Download these 100% customizable credit dashboard templates to get a head start on your journey of personal financial awareness and credit control.

FAQs on Credit Dashboard

1. What is a credit dashboard?

A credit dashboard is a financial tool that allows individuals to monitor and manage their credit score and related information in one convenient location. It includes information such as an individual’s credit score, history, and outstanding & closed debts. This information can be accessed online, helping users to keep track of their credit status and take steps to improve their credit, if necessary. Overall, a credit dashboard is helpful in managing credit and staying on top of financial health.

2. How do I check my credit report?

You need to request a copy of your credit report from one of the three major credit bureaus in the United States — Experian, Equifax, or TransUnion. Each individual is allowed to get one free report from (each of) these bureaus annually. Visit the website of the respective credit bureau and follow the steps provided to request a copy of your report. For identity verification, you will need to provide personal information — your name, address, and Social Security number. Once you have submitted your request, you should receive your credit report within a few days/weeks. If you prefer, requesting a credit report by phone or mail is also an option.

3. What is the three-credit monitoring?

Credit monitoring can be classified based on criteria like bureau or preference set by lenders/banks/financial institutions or period of monitoring or criticality level. The most basic classification of credit monitoring is:

- Self-monitoring: Individuals monitor their own credit reports and scores, either on their own or with the help of a financial tool/service like a credit dashboard.

- Alert-based monitoring: Set up alerts with a credit bureau or credit monitoring service to get notified if there are significant changes to the credit report/scores.

- Continuous monitoring: A credit bureau or credit monitoring service continuously monitors the individual’s credit report and score for minute changes or potentially fraudulent activity. This provides the most comprehensive protection against identity theft and other credit-related issues.

4. What is a good credit score?

A good credit score is generally considered a score of 670 or higher on the FICO scale, the most used credit scoring model in the US. An excellent credit score makes obtaining credit easier and qualifies an individual for better interest rates and other favorable terms on loans and credit cards. However, the definition of an excellent credit score varies depending on the credit scoring model and the lender or creditor you are dealing with. Check with the specific lender or creditor to determine their definition of a good credit score.

Customer Reviews

Customer Reviews

![How to Do Personal Financial Planning to Secure Your Future [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/07/How-to-Personal-Financial-Planning-Templates-Included_1-1013x441.png)