Every year, a humungous number of small businesses and startups fail because of their failure to set up an effective and efficient credit control system. Customers, who are slow to pay up, cause cash flow problems; this stalls growth and ensures that projections go haywire.

Unless small businesses incorporate a stringent credit control process into their DNA, the fear of a fold-up remains very real.

Having said that, our aim is only to educate you. We don’t want you to fall prey to ignorance and inaction when the simple action of stringent credit control can put you on the highway to growth. If credit-control is not mastered in the initial stages of your business, you are playing with fire.

Stripped to its basics, collecting payment on time from customers has always been a challenge for businesses. In this blog, we will explore tips to improve your credit control system.

What is Credit Control?

There’s no fun way of describing a financial term unless it is a scene from The Wolf of the Wallstreet. Credit control is the technique of monitoring and measuring a business’ accounts receivables (the invoices that are issued to customers which have not been paid yet).

By tracking these accounts and taking necessary action when a payment is late or delinquent, you can improve your cash flow situation and avoid the problem.

Why is Credit Control Important?

A robust credit management system is quintessential if you don’t want the cash flow of your business to suffer. Get it right, and you'll enjoy a seamless framework where customers pay their invoices on time.

Failure to use apt credit control measures can put your business's financial health at risk, reducing its credit score. This is where your business could go if your control is below average or even poor.

Six Simple Credit Control Tips

We have compiled a list of six key considerations for consolidating your credit control policies and procedures.

Check Your Sales Ledger

Always keep your sales ledger updated with every transaction concerning sales, including credits issued (if any). Religiously check the ledger to determine upcoming or missed payment deadlines. Flagging problems will help you avoid large and unmanageable debt.

How can you do that? We’ve got a PPT template for you!

Template 1: Credit Control List for Accounts Management

This PPT template is designed for ease of use. You won’t have to sprint searching for magnifying glasses to find accounts of customers who owe you hefty amounts. It presents clear information to support quick understanding. Get it now.

Prioritize Customer Relationship

Although customer relationships are pivotal for business growth, never let these get into the way of managing your finances. Lending credit to a penniless customer on account of a good relationship is absurd. Get your priorities straight and mark customers you can count on before issuing invoices on credit.

Seems a lot of hard work? Here’s how to make it easy:

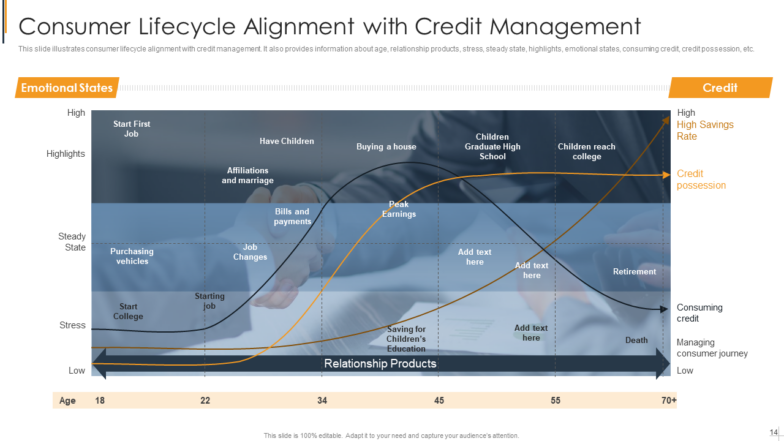

Template 2: Consumer Lifecycle Alignment with Credit Management

This insightful PPT framework walks you through the consumer lifecycle and highlights the points that influence their buying decisions and need for credit. It would serve as your armor against credit invoices that you might have to write off.

Revisit Your Invoice Design

If you are often investing time chasing late payments from customers, which you would rather dedicate to other significant operations, it might be time to rethink your invoicing process. Make it as clear and concise as possible. You wouldn’t want late payments because your customers didn’t understand the invoice correctly and couldn’t figure out when it was due. Choose this template to resolve the issue.

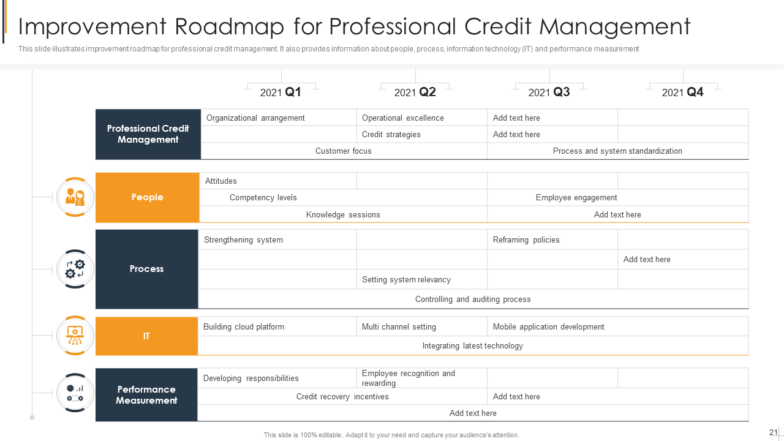

Template 3: Improvement Roadmap for Professional Credit Management

You can find the shortcomings of your credit management plan in your invoice from this PPT layout. Get this PPT to identify the areas of improvement.

Monitor Credit Scores

Running credit checks on new suppliers or clients is part of the Standard Operating Procedure (SOP) of most businesses. Remember, however, to incorporate inspections on your existing customers, to ensure their finances are in order.

Not sure how to do it? We offer the solutions.

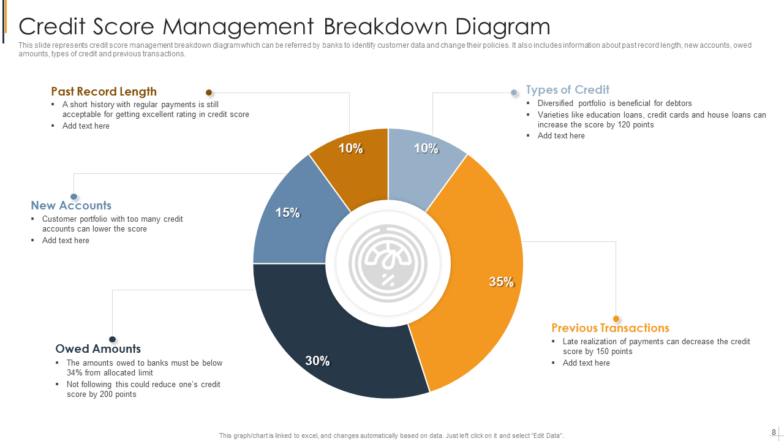

Template 4: Credit Score Management Breakdown Diagram

This PPT set offers you the right information in one place to help you monitor credit scores. It illustrates data and insights that need your attention and helps you focus on making better credit decisions. Get it now.

Prioritize Bigger Debts

Imagine how overwhelming it would be if your business was facing multiple outstanding debts. However, if you are stuck in a similar situation, it is time to reevaluate your credit control process.

Meanwhile, concentrate your time and efforts on fixing the largest debt, which is impacting your cash flow in a disproportionate manner.

Need help doing that? We have you covered.

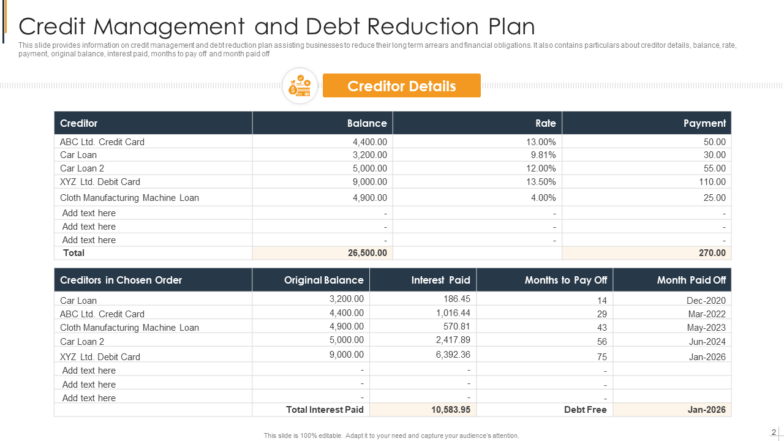

Template 5: Credit Management and Debt Reduction Plan

This data-driven PPT breaks down the information and organizes it to help you identify who owes you big. You can make a list of all customers holding debt above a specified amount so that you can frame a plan of action. Employ it now.

Take Appropriate Action

If your efforts to extract outstanding payments from your customers went in vain and the debt is still climbing, it is time to take action. You can seek multiple options, including mediation, court claim, or statutory demands. The apt option, however, will be determined after considering the amount of money owed.

Waiting for the template? Download it here:

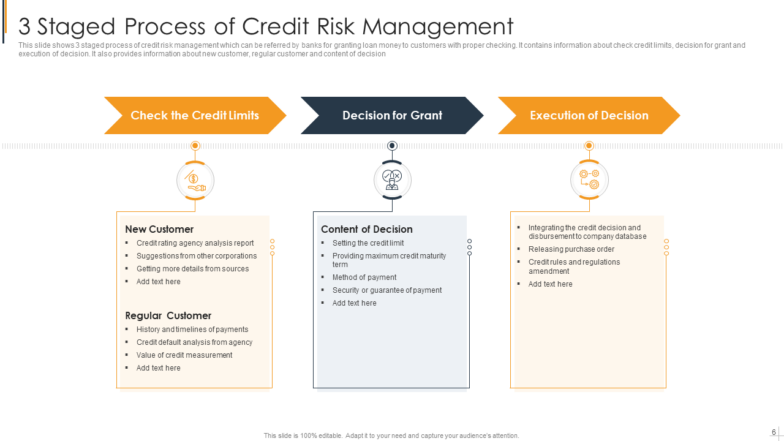

Template 6: Three-stage process of Credit Risk Management

This content-ready PPT set saves you from drowning in the sea of unmanageable debts. It processes insights structured into credit limit inspection, granting credit, and monitoring it to eliminate chances of non-payment. Get it now.

The Takeaway

Credit Control isn’t a cakewalk. It demands organization, professionalism, persistence, and understanding.

Having set processes in place and following them to a T can help minimize any risks of financial loss besides improving the cash flow. That’s how you translate success and smooth operation of the business.

PS: Debt management is an integral part of credit control. We have a complete blog on it as well. Click here to explore.

Customer Reviews

Customer Reviews