Are you looking to develop a successful strategy for digital banking? Perhaps you've tried, but nothing has worked out. If it helps, we've all been there; we understand how much work that necessary expertise may need. Fortunately, the story doesn't need to end there.

In a setting with numerous potential paths for digital banking, the most effective strategy may be to prioritize ease. Providing rapid help or the opportunity to create an account via a smartphone or tablet or a branch visit (or both) is a more straightforward approach to achieving customer satisfaction than attempting to find the best channel strategy for each individual.

An integration hub is the foundation of a robust digital banking strategy. It links different systems and apps to simplify operations and improve consumer experiences. This centralized center provides data integrity and personalized interactions, allowing banks to deliver specific services and promotions more efficiently.

Also, explore our carefully created a well-thought-out and expertly designed "Digital Lending" PowerPoint Presentation. This resource will provide you with the knowledge and tactics required for effective implementation.

Banks must prioritize customer-centricity, using data analytics to understand and anticipate their demands. Banks that embrace innovation and invest in emerging technology may differentiate themselves in a competitive industry, boosting growth and loyalty.

SlideTeam has curated these top 10 PowerPoint templates that can help accelerate the process of creating and presenting a digital banking strategy. These pre-designed slides are completely editable and customizable. They not only improve appearance but also help ensure communication clarity and consistency.

Let’s explore!

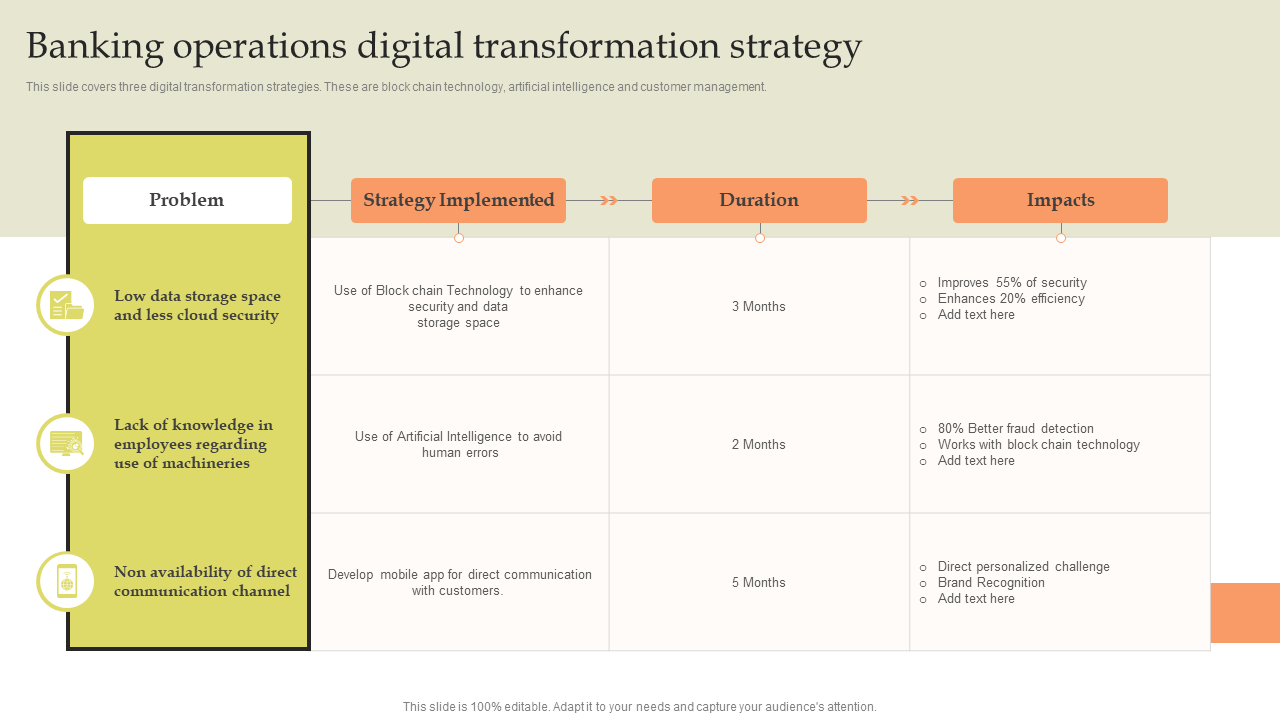

Template 1: Banking Operations Digital Transformation Strategy

This slide illustrates that the digital transformation strategy aims to address operational difficulties by utilizing blockchain technology, artificial intelligence, and customer management. Blockchain improves transaction safety and transparency, AI accelerates operations to increase effectiveness, and customer management offers personalized services. This presentation specifies the strategies implemented against multiple problems, their time duration, and their impact. This aims to improve banking processes, reduce expenses, and increase customer happiness, leading the bank to a profitable future in the age of digital technology. Grab today!

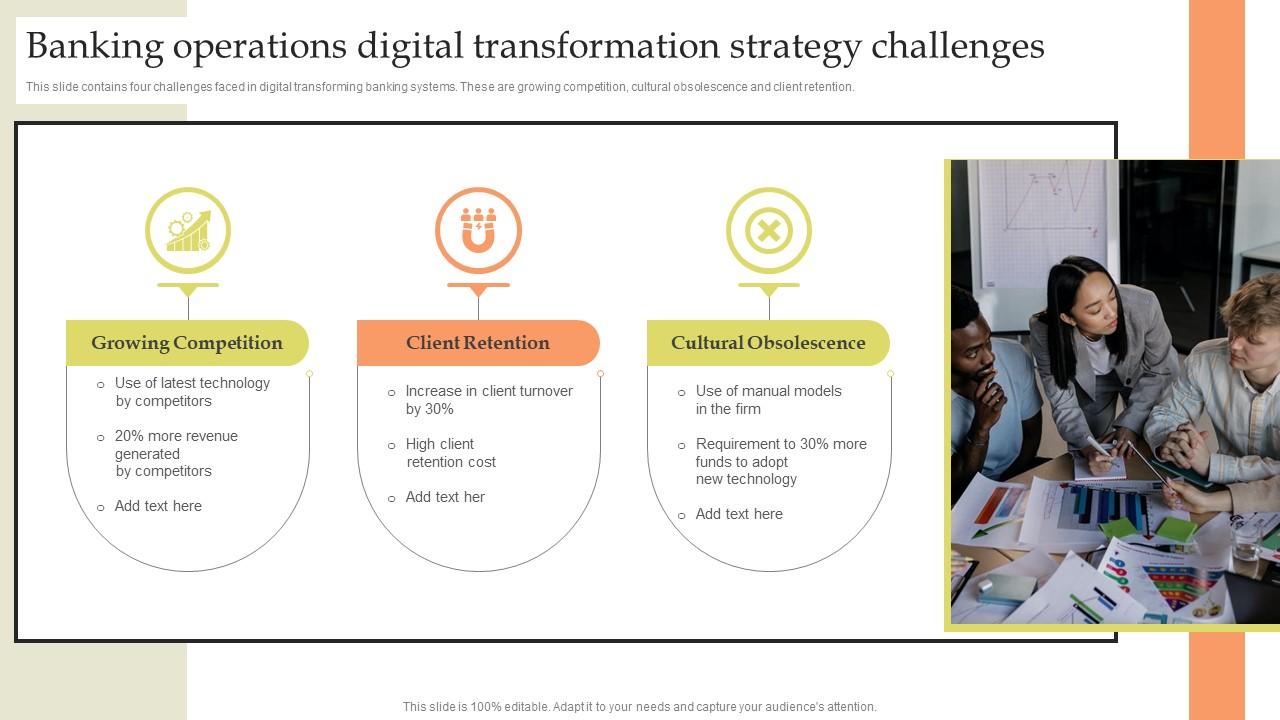

Template 2: Banking Operations Digital Transformation Strategy Challenges

This PowerPoint Slide highlights four major problems in the digitization of banking operations. It focuses on challenges like increased competition, cultural unwillingness to change, and retention of clients issues. Every challenge is visually displayed with color-coded icons, which improves understanding. The presentation provides a brief outline of the challenges affecting banks' digitization efforts. Addressing these difficulties directly allows banks to better negotiate the complicated details of modernizing their operations and maintain a competitive edge in the fast-changing financial world.

Template 3: Six Digital Transformation Strategies for Banking Industry

This PowerPoint Slide highlights six vital digital transformation strategies built particularly for the banking sector’s success. It contains important information about artificial intelligence, cloud computing, robotic process automation, blockchain, IoT, and augmented reality. Each technique is visually illustrated using interesting graphics, allowing the audience to comprehend it clearly. By welcoming these new innovations, banks may increase operational efficiency, improve relationships with customers, and remain ahead of the competition. The presentation helps to highlight the relevance of these initiatives, encouraging the banking workforce to welcome digital innovation for long-term success.

Template 4: Choosing the Right Digital Industry Transformation Strategy

This PowerPoint Template highlights several digital industry transformation initiatives for banking institutions seeking an edge over their competitors. Mobile banking technology, blockchain, artificial intelligence, machine learning, robotic process automation, and open bank APIs are among the strategies. Each approach is supported by a forecast of its execution costs, helping with decision-making. The informative slide provides an in-depth review of the possible alternatives, including information on the strategies that are used, allowing banks to match their transformation initiatives with organizational goals and constraints on finances. Banks may successfully use innovations in technology to improve customer experience and streamline operations.

Template 5: Omnichannel Strategies For Digital Banking

This PowerPoint template bundle, with 83 slides, showcases various banking services offered to customers for easy access to banking solutions. It has reduced the need for physical bank branches, which saves customers time. It provides different omnichannel banking services with a gap analysis based on challenges faced by the traditional banking system. The benefits include electronic wallets, IVR and API bill payments, kiosks, chatbots, live chats, and video branch banking services. It further contains the operational and financial impact of these omnichannel banking services.

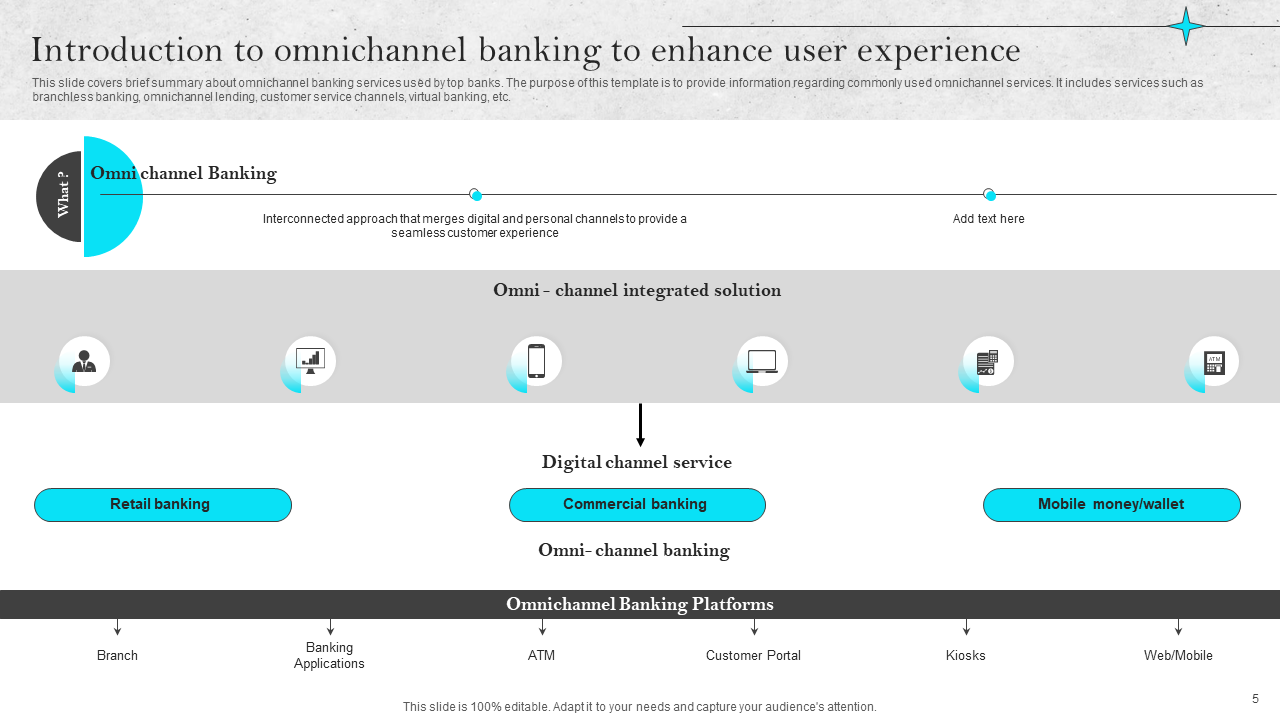

Template 6: Introduction to Omnichannel Banking to Enhance User Experience

This slide highlights omnichannel banking services and the key components used by financial institutions. It attempts to educate users on widely utilized omnichannel services such as branchless banking, omnichannel loans, customer support channels, and virtual banking. By using visually attractive features, this slide encourages clarity and understanding, allowing for successful communication of the benefits of omnichannel banking. Banks benefit from greater customer satisfaction, retention rates, and brand loyalty, enabling banks to provide personalized services, streamline processes, and acquire insights into consumer habits through data analytics.

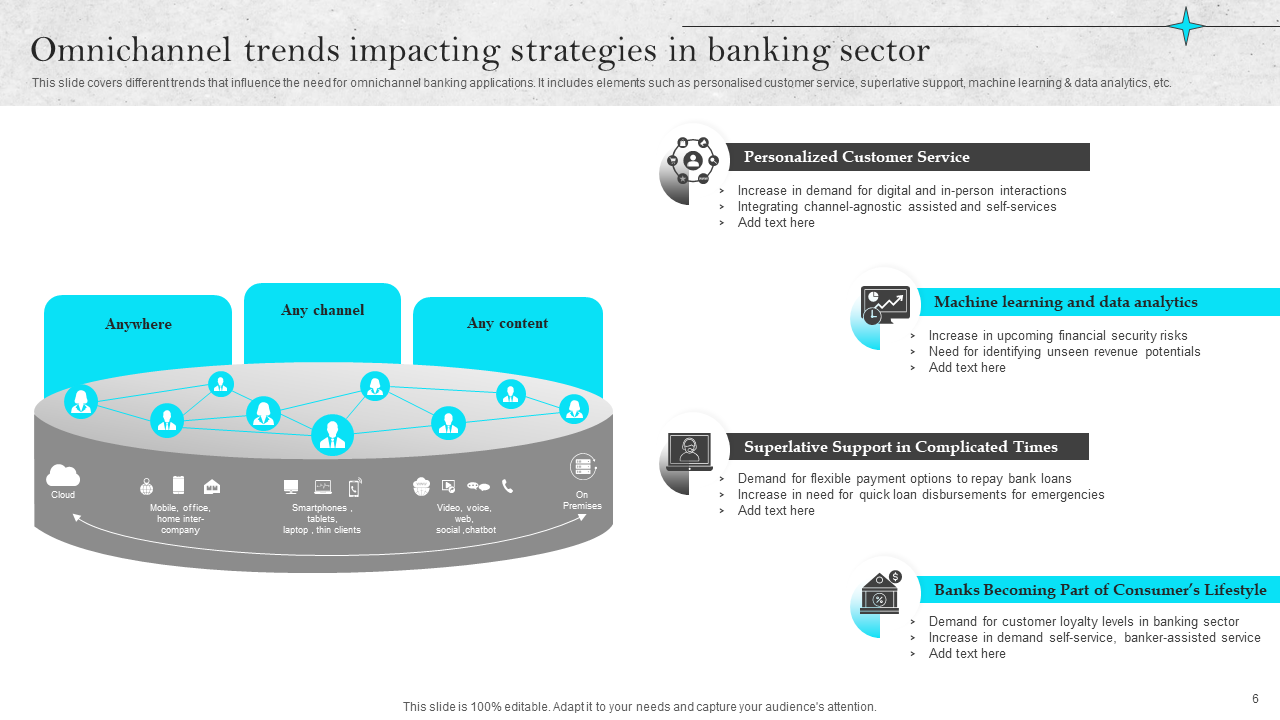

Template 7: Omnichannel Trends Impacting Strategies in the Banking Sector

This PPT Slide emphasizes the need for personalized customer care, excellent assistance, and the use of machine learning and data analytics. Furthermore, it indicates a pattern of banks smoothly integrating into consumers’ lifestyles. The presentation demonstrates that each trend is clearly conveyed, offering a thorough understanding of the reasons driving the need for omnichannel banking services. Identifying and adjusting to these developments allows banks to better match their strategy with progressing customer demands.

Template 8: Focus Areas of Omnichannel Banking Strategy

This PowerPoint Slide outlines the key components of an efficient omnichannel banking strategy. A detailed graphic identifies crucial areas for execution. It includes four key channels of digital banking services, such as branch digitization, video banking, etc., with a focus on customer convenience. Information enablers like data integration and banking sector integration are vital for smooth operations. Furthermore, important factors such as strategy alignment, governance, and performance measures support effective implementation. This visually helpful template serves as a roadmap for banks wanting to maximize their omnichannel approach, promoting innovation.

Template 9: Why Omnichannel Strategy is Important in the Banking Sector?

This PowerPoint Slide uses a comparison chart to emphasize the need for an omnichannel strategy in the banking business. It covers numerous initiatives, such as digital operations, new income streams, higher safety standards, etc., and provides explanations of each. The graphic depicts the advantages of applying these methods, demonstrating how an omnichannel strategy enhances customer experience, accelerates revenue growth, and strengthens security measures.

Template 10: Introduction to Secure Digital Wallets for Financial Transactions

This PowerPoint Template introduces safe digital wallets for financial transactions, emphasizing the benefits of e-wallets. It emphasizes increased security, discounts, and incentives while minimizing dependability on physical banks. The slide also emphasizes minimized checkout procedures and customer comfort. By clearly showing these benefits, customers acquire insights into digital wallets' value proposition. This helps people understand their position in modern financial transactions, enhancing acceptance and use for smooth, secure, and successful payment experiences.

Efficiency, Security, Connectivity

Banks are compelled to stay ahead of the curve in today’s financial landscape. Having a digital banking strategy is of the utmost importance to drive success and get ahead in the competitive market. PowerPoint templates are a practical and effective way to simplify the process of generating and presenting digital banking strategies. These templates help banks convey their digital banking strategy effectively and professionally by offering pre-designed frameworks, visual representations of concepts, customization choices, consistency across presentations, and easy updates and changes.

P.S:Digital wallets are fast becoming the go-to medium for transactions. It is quick, safe, and, best of all, social-distancing friendly. We at SlideTeam have curated the Top 7 Advantages of Incorporating Digital Wallets in Your Business along with its Best Templates.

Customer Reviews

Customer Reviews