Fixed asset list with depreciation showing gross block with net block

Gain good ground with our Fixed Asset List With Depreciation Showing Gross Block With Net Block. Your thoughts advance much farther.

Gain good ground with our Fixed Asset List With Depreciation Showing Gross Block With Net Block. Your thoughts advance much..

- Google Slides is a new FREE Presentation software from Google.

- All our content is 100% compatible with Google Slides.

- Just download our designs, and upload them to Google Slides and they will work automatically.

- Amaze your audience with SlideTeam and Google Slides.

-

Want Changes to This PPT Slide? Check out our Presentation Design Services

- WideScreen Aspect ratio is becoming a very popular format. When you download this product, the downloaded ZIP will contain this product in both standard and widescreen format.

-

- Some older products that we have may only be in standard format, but they can easily be converted to widescreen.

- To do this, please open the SlideTeam product in Powerpoint, and go to

- Design ( On the top bar) -> Page Setup -> and select "On-screen Show (16:9)” in the drop down for "Slides Sized for".

- The slide or theme will change to widescreen, and all graphics will adjust automatically. You can similarly convert our content to any other desired screen aspect ratio.

Compatible With Google Slides

Get This In WideScreen

You must be logged in to download this presentation.

PowerPoint presentation slides

Presenting this set of slides with name - Fixed Asset List With Depreciation Showing Gross Block With Net Block. This is a three stage process. The stages in this process are Fixed Asset, Tangible Assets, Fixed Property.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Description:

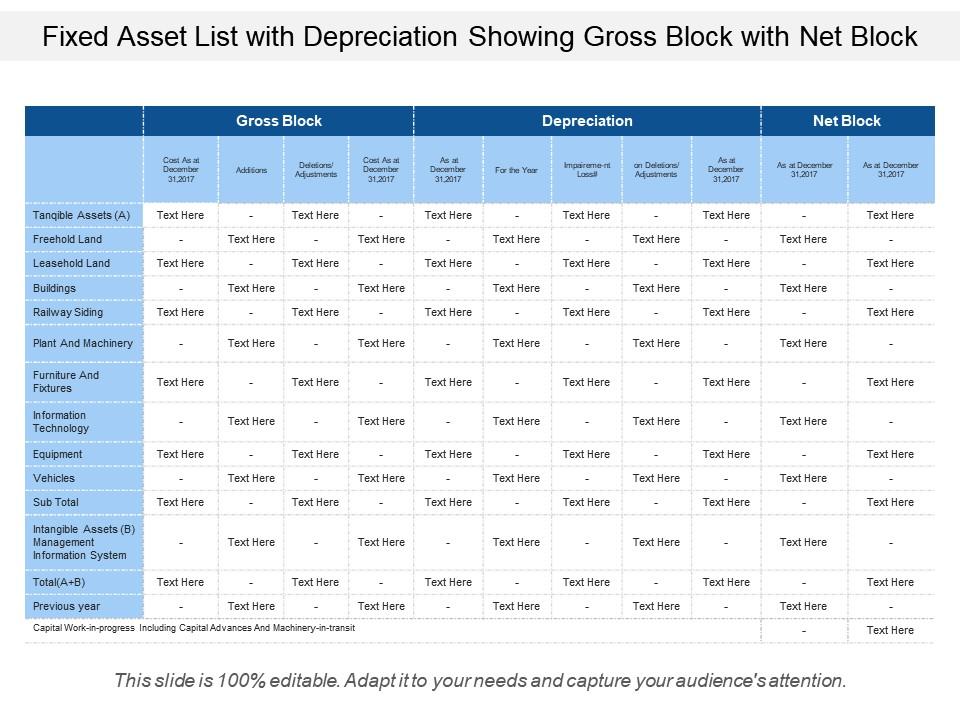

The image displays a PowerPoint slide titled "Fixed Asset List with Depreciation Showing Gross Block with Net Block." The slide is formatted as a comprehensive table, categorizing various fixed assets and accounting for their depreciation over time. The table is divided into several columns, including:

Cost as at December 31, 2017, and additions during the year for each asset type.

Deductions/adjustments during the year and cost as at December 31, 2017, after adjustments.

Depreciation for the year, impairments/losses, and deductions/adjustments for depreciation.

Net Block as at December 31, 2017, which represents the value of the assets after accounting for depreciation.

The asset types listed include tangible assets such as land, buildings, machinery, and vehicles, as well as intangible assets like information systems. "Sub Total" and "Total" rows are provided to sum the values. Each cell includes a "Text Here" placeholder indicating that the data is to be entered.

Use Cases:

Industries where this slide can be effectively utilized:

1. Manufacturing:

Use: Tracking and reporting the value of physical assets.

Presenter: Financial Controller.

Audience: Management, Investors.

2. Construction:

Use: Accounting for the depreciation of construction equipment and machinery.

Presenter: Accountant.

Audience: Project Managers, Stakeholders.

3. Technology:

Use: Managing the valuation of IT equipment and software.

Presenter: IT Asset Manager.

Audience: CFO, IT Department.

4. Healthcare:

Use: Calculating the current and depreciated value of medical equipment.

Presenter: Finance Director.

Audience: Hospital Administrators, Finance Team.

5. Real Estate:

Use: Determining the value of property assets over time.

Presenter: Real Estate Analyst.

Audience: Property Investors, Tax Assessors.

6. Education:

Use: Assessing the depreciation of educational infrastructure and technology.

Presenter: Budget Analyst.

Audience: School Board, Administrative Staff.

7. Retail:

Use: Depreciation accounting for store fixtures and equipment.

Presenter: Retail Financial Planner.

Audience: Store Managers, Operations Teams.

Fixed asset list with depreciation showing gross block with net block with all 5 slides:

Eliminate factors causing hindrance with our Fixed Asset List With Depreciation Showing Gross Block With Net Block. Identify areas of inhibited growth.

-

Colors used are bright and distinctive.

-

Awesome use of colors and designs in product templates.