Imagine a busy professional who spends hours after hours every week, manually tracking expenses, calculating budgets, and reconciling accounts for their finances. They struggle to keep their finances organized without a budget and often find themselves stressed and overwhelmed.

Now, let's apply the concept of budgeting and budget projections to another business setting. A company without a well-defined budgeting process would face similar challenges. A business where employees spend countless hours tracking expenses, managing cash flows, and trying to make sense of financial data scattered across multiple spreadsheets. However, the transformation is remarkable when this business implements a budgeting system with accurate budget projections.

Automated tools and processes streamline financial management, saving time and effort on daily repetitive tasks. By simply inputting data and parameters into budgeting software, the business can generate comprehensive financial reports, forecasts, and analyses in a fraction of the time it used to take. This newfound efficiency extends beyond daily financial chores. Rather than relying on guesswork or gut feelings, budget projections provide a solid foundation for assessing the financial implications of different scenarios and strategies.

Unlock your time and prioritize what matters with our tailor-made Budget Projection Templates. Take control of your finances and experience the freedom to pursue what truly matters with our customized Budget projection templates. Let's go through these templates one by one!

Template 1: Budget Projection PowerPoint Presentation Slides

Use this expertly crafted budgeting and forecasting presentation deck to project your company's expected revenues and expenses. This comprehensive PowerPoint Deck on financial forecasting includes a range of ready-to-use templates that cover various aspects such as actual cost versus budget, monthly forecasting, overhead cost analysis, quarterly budget analysis, variance analysis, actual versus target variance, budget versus plan versus forecast, and forecast and projection, among others. Using this presentation deck, you can demonstrate your organization's commitment to sound financial planning and showcase your ability to meet financial goals.

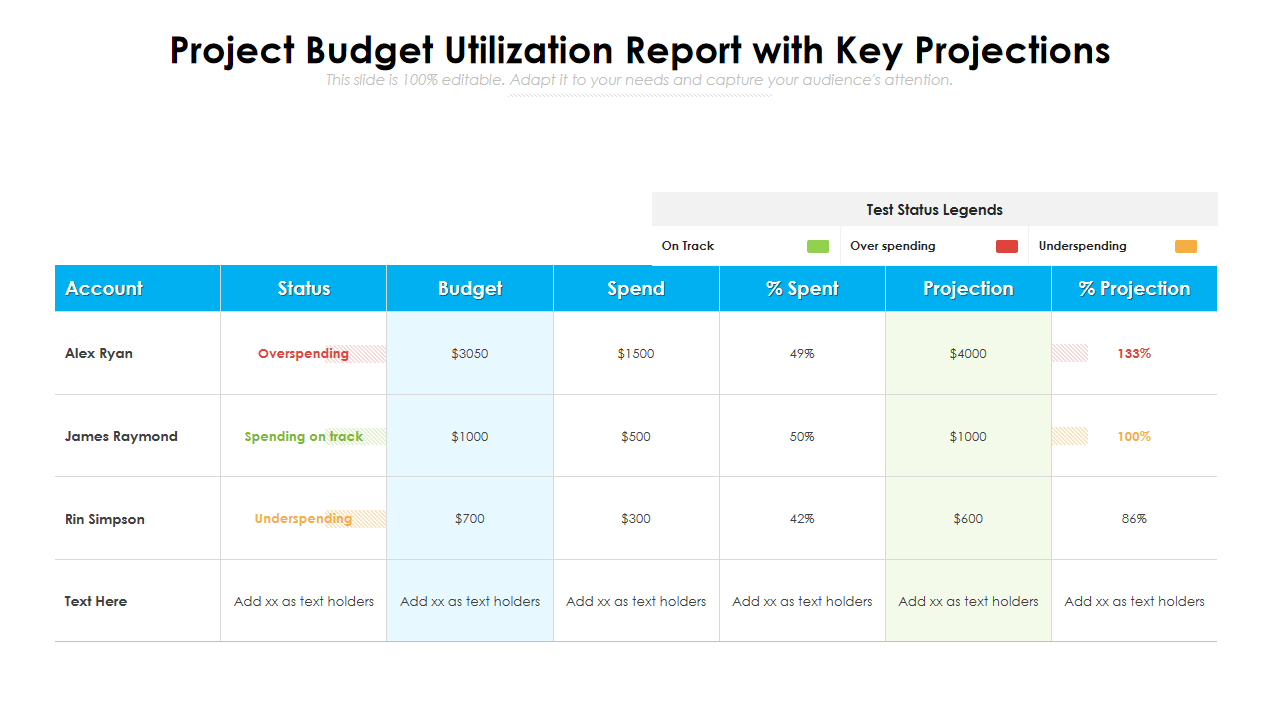

Template 2: Project Budget Utilization Report with Key Projections

Download this template to forecast and analyze your project expenditures accurately. With these slides, you can compare actual costs to your budget, identify any discrepancies, and track the progress of your project over time. Gain a thorough grasp of the allocation and use of the funds for your company. Download the template now and take control of your project's financial success.

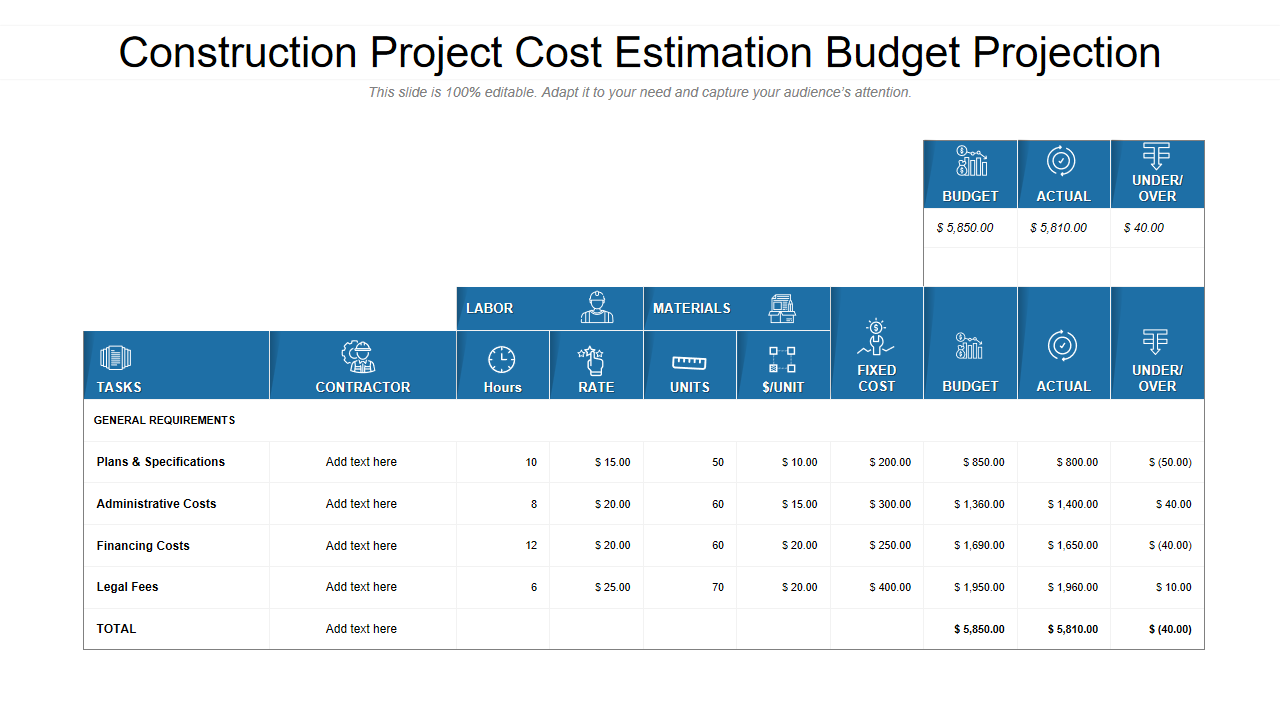

Template 3: Construction Project Cost Estimation Budget Projection

This PPT Template helps businesses accurately estimate project costs for construction projects. It provides a systematic approach to budgeting, allowing users to input project details and generate comprehensive cost projections.

This template allows businesses to enhance their cost estimation accuracy, streamline budgeting processes, and improve project management efficiency. It empowers users to effectively plan and control project expenses, ultimately contributing to the success and profitability of their construction ventures.

PS: Take control of your finances today with our customizable budget sheet templates!

Unleash the potential of our budget analysis templates and transform your financial management journey now!

If you feel that your resource allocation skills could use some improvement, use these Capital budgeting templates.

By using these templates, you can enhance your skills and make more informed decisions, leading to a smoother operational runway over time.

Fuelling Your Path to Financial Excellence

Budget Projections are a game-changer when it comes to managing your finances effectively. Accurate projections give you valuable insights into your financial health, make the best decisions, and plan for a prosperous future. Don't miss out on the benefits of Budget Projections. Take control of your finances today with our customizable Budget Projection templates.

FAQs on Budget Projections

What is budget projection?

Budget projection estimates future income and expenses based on historical data and anticipated changes. It involves forecasting financial figures for a specific period, such as revenue, costs, and investments. Budget projections help individuals and businesses plan and allocate resources, make informed financial decisions, and track progress toward financial goals.

How do you develop budget projections?

Here's a general process for creating budget projections:

- Gather financial data and consider external factors.

- Identify all income sources, both recurring and one-time.

- Estimate expenses by categorizing and using relevant data.

- Differentiate variable and fixed costs, considering changes.

- Project revenue based on analysis, forecasts, and growth plans.

- Calculate net income by subtracting projected expenses from revenue.

- Set specific financial goals aligned with the projections.

- Regularly review and update the budget, adjusting as needed.

What is the 5-year budget projection?

A 5-year budget projection is a financial roadmap that estimates income, expenses, and financial goals for five years. It offers a comprehensive view of the financial future for individuals, businesses, or organizations.

This projection involves predicting future revenue, estimating expenses, and considering factors like inflation, market trends, and growth strategies. It aids in establishing financial targets, strategic decision-making, and ensuring stability in the long run.

By projecting finances over five years, individuals and businesses gain valuable insights into their financial well-being, identify potential opportunities or challenges, and make informed choices to reach their financial objectives. It guides financial management, progress tracking, and making necessary adaptations along the journey.

What are the five key areas of budgeting?

The five crucial aspects of budgeting are:

- Income: Estimate and plan for all income sources, including wages, salaries, investments, and business profits.

- Expenses: Identify and categorize necessary expenses such as rent, utilities, groceries, transportation, debt payments, and discretionary spending.

- Savings: Allocate a portion of income for savings and investments to build an emergency fund and achieve future financial goals.

- Debt Management: Budget for debt repayments, prioritize high-interest debts, and develop a strategy to reduce and eliminate debt.

- Financial Goals: Set and prioritize financial objectives like homeownership, retirement planning, education funding, or starting a business. Align budget allocation with these goals.

Customer Reviews

Customer Reviews