From the ancient temples of Babylon to the bustling financial centers of today, banks have been an integral part of human civilization. It's a journey that spans centuries, evolving from the first known bank in history to the era of government-controlled institutions and finally reaching the modern age of privatization and digitalization.

As we fast-forward to the present, the services and advancements that today's banks offer are awe-inspiring. Gone are the days of long queues and manual transactions. Modern banks have transformed into digital powerhouses, offering a vast array of services from online banking and mobile apps to contactless payments and AI-powered financial advisors.

But amidst this digital revolution, one might wonder: Are banks different from other businesses?

The answer is both intriguing and enlightening.

Banks sometimes deal with intangible assets like Non-Performing Assets (NPAS) and complex regulations; at their core, they share similarities with businesses. They, too, need to build a reputation, gain the trust of customers, attract investors, and differentiate themselves from competitors. This creates the necessity of creating a banking company profile.

Why Banking Company Profiles

Akin to businesses, banks need a compelling profile that captures their essence, expertise, and unique value proposition. It serves as their calling card, presenting a cohesive image. A well-crafted banking company profile instills confidence in stakeholders, paves the way for strategic partnerships, attracts potential investors, and creates a lasting impression in a competitive industry.

According to a study by XYZ Research, banks with compelling profiles are 50% more likely to gain the trust of potential customers and secure long-term partnerships. Research from ABC Institute reveals that seven of 10 investors consider a comprehensive banking company profile a crucial factor in their decision-making process.

In this blog, we will dive deep into crafting an exceptional banking company profile. We explore elements that make it stand out, the key messages it should convey, and the strategies that can help banks communicate their story.

Elements of A Banking Company Profile

A banking company profile includes key elements that provide a comprehensive overview of the institution and its offerings. Here are some of these:

Introduction and Overview: Brief introduction to the bank, including its history, mission, vision, core values, guiding principles, and strategic objectives.

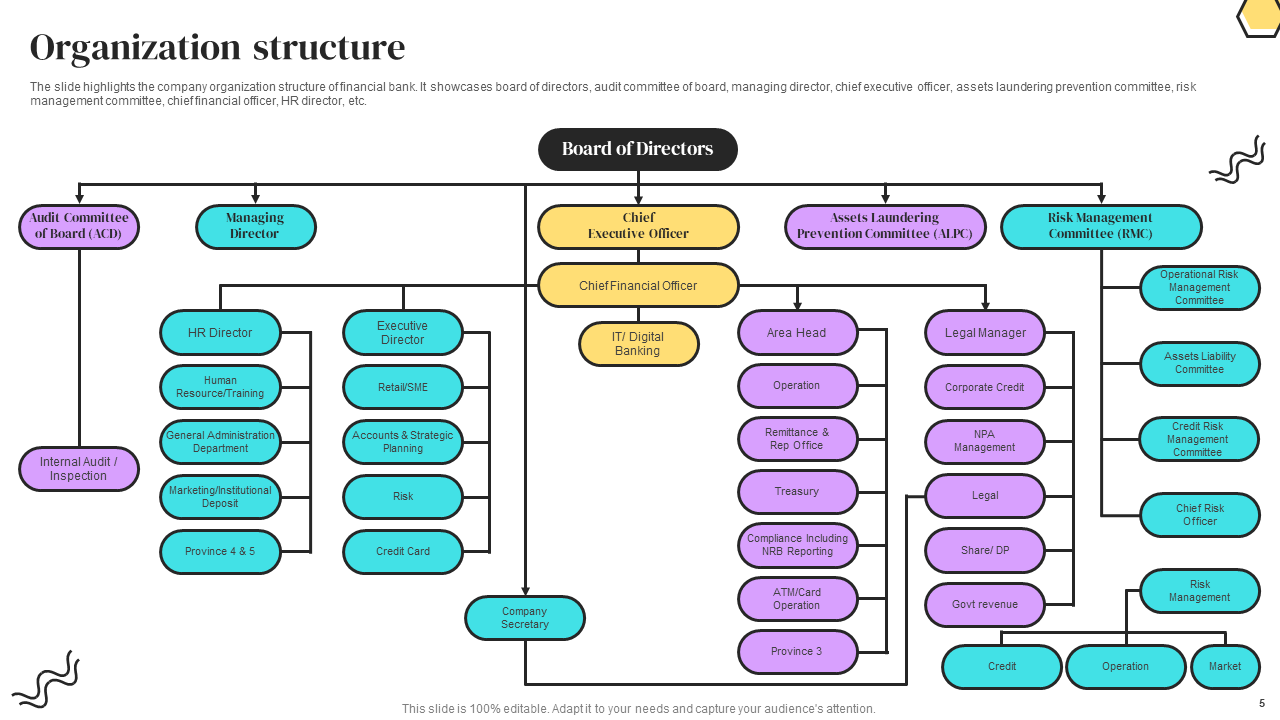

About the Bank: Background information, including its founding year, location, legal status, organizational structure, management team, and key personnel.

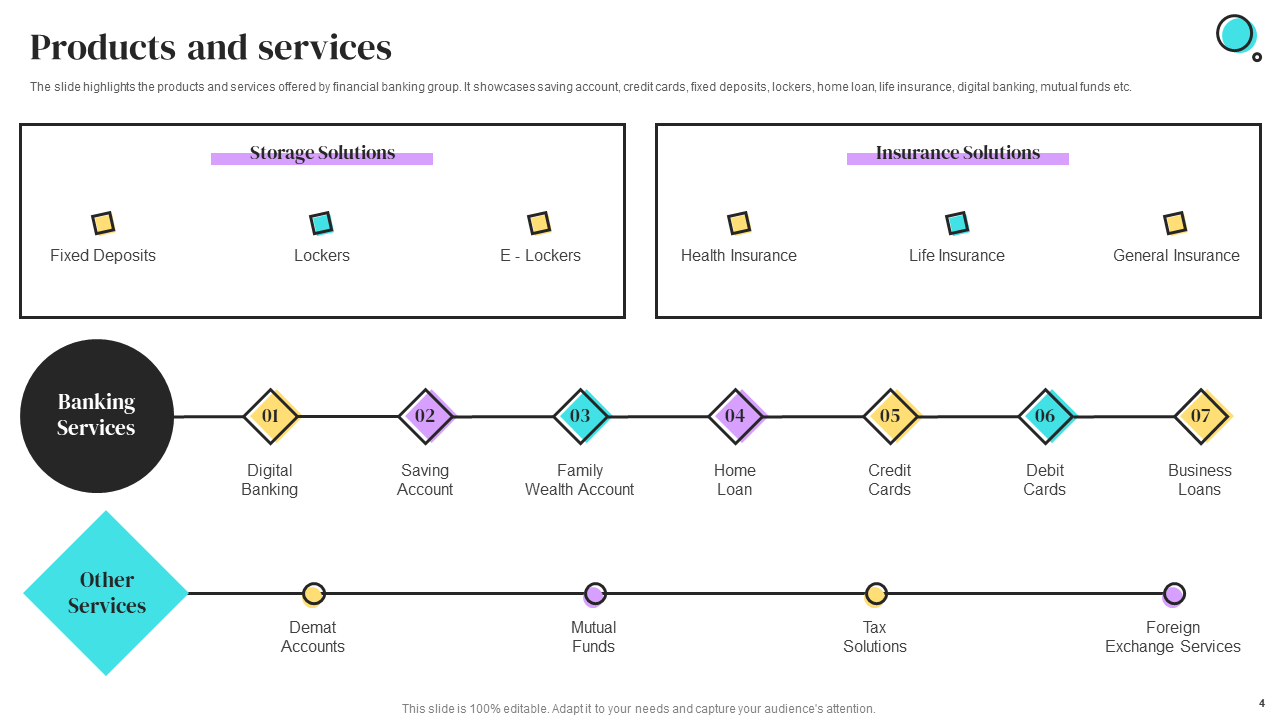

Products and Services: Comprehensive listing and description of the bank's products and services, such as savings accounts, checking accounts, loans, credit cards, investment options, and specialized financial solutions.

Target Market and Customer Segments: Identification and description of the bank's target market, customer segments, and how it caters to its specific needs and preferences.

Financial Strength and Performance: Summary of the bank's financial performance, including financial indicators, such as assets, deposits, loans, and profitability ratios. It also comprises industry recognition, awards, financial stability, and achievements linked to performance.

Technology and Innovation: Showcase the bank's technological advancements, digital capabilities, and innovative solutions. It emphasizes how banks leverage technology to enhance customer experience, improve efficiency, and stay ahead in the digital banking landscape.

Awards and Recognitions: List notable awards, certifications, or industry recognitions received by the bank.

Contact Information: Provide relevant contact details, including the bank's address, phone number, email, and website. It also mentions any customer support channels available for inquiries, assistance, or feedback.

These elements create a comprehensive and compelling banking company profile that communicates the bank's identity, offerings, and value proposition to stakeholders, potential investors, and customers.

Banking Company Profile Templates

Whether you're a banking professional, a business person, or are just curious about the inner workings of the financial world, join us on this captivating journey to unveil the secrets behind compelling banking company profiles with pre-designed templates.

Our presentation experts designed these research-based banking company profile templates to save time & effort for professionals. These PowerPoint Layouts have visually engaging elements like graphics, charts, and icons to make your profile presentation more eye-catchy. The 100% customizable nature of these templates will provide you with the desired flexibility to update your bank company profile before every presentation. The content-ready slides give you the much-needed structure to ensure a consistent and polished presentation of the banking company's information.

Let's discover how these banking company profile templates shape the perception and drive success for banks in an ever-evolving business landscape.

Download this complete banking company profile templates bundle

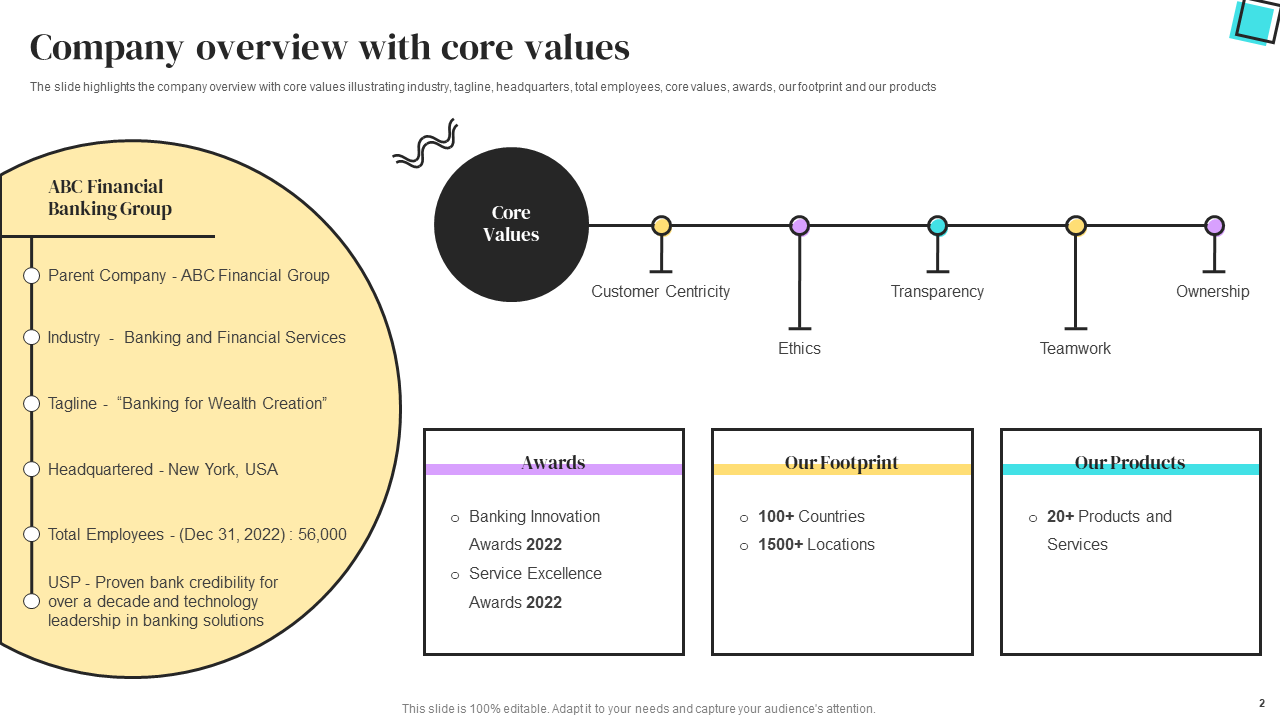

1. Banking Company Overview With Core Values PPT Template

This presentation design enables banking institutions to showcase their essence, expertise, and guiding principles. It provides a comprehensive structure for presenting the bank's core values, mission, vision, and insights. This presentation template helps create an impactful banking company profile that resonates with stakeholders, instills trust, and sets the foundation for a strong and reputable banking brand. Download it now!

Download this company overview template

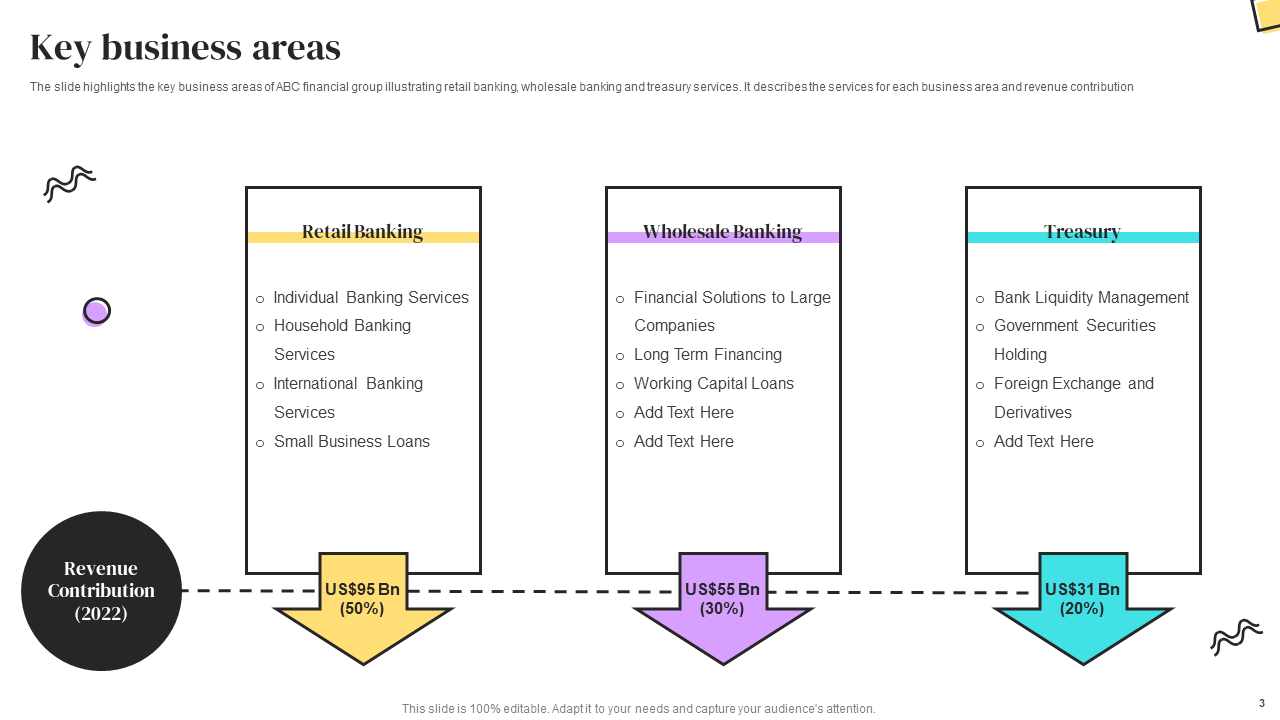

2. Key Business Area Presentation Template

With this comprehensive PPT layout and visually engaging design, banks can highlight their key business areas, such as retail banking, corporate banking, wealth management, wholesale banking, treasury, and more. Showcase your bank's expertise, capabilities, and market positioning in each area, along with revenue contributions, with the use of this presentation template. Whether you're presenting to potential investors, partners, or stakeholders, this template ensures a clear and concise representation of the bank's business focus, creating a solid impression and fostering trust in its capabilities. Get it now!

Download this key business area template

3. Banking Product And Services Presentation Template

The PPT Design is an indispensable tool for banking institutions to showcase their range of products and services. This expert-designed template offers an intelligent format to present offerings, including storage, savings accounts, insurance solutions, loans, credit cards, investment options, and specialized financial solutions. With easy-to-edit elements and attention-grabbing visuals, this PowerPoint Slide enables banks to highlight the features, benefits, and Unique Selling Points (USPs) of each product or service. Grab it today!

Download this product and services template

4. Organization Structure of A Banking Company

The organization structure is a vital component of a banking company profile presentation. This template offers a clear and visually appealing layout to showcase the hierarchical structure and departments within the banking organization. It provides an overview of the roles and responsibilities of teams, such as executive leadership, operations, finance, marketing, customer service, credit, etc. One can use this template to communicate their organizational framework, highlighting the expertise and synergy within the company in an effective manner. This presentation template offers a compelling representation of the bank's structure, fostering transparency and demonstrating the strength and efficiency of its internal operations. Download it now!

Download this organization structure template

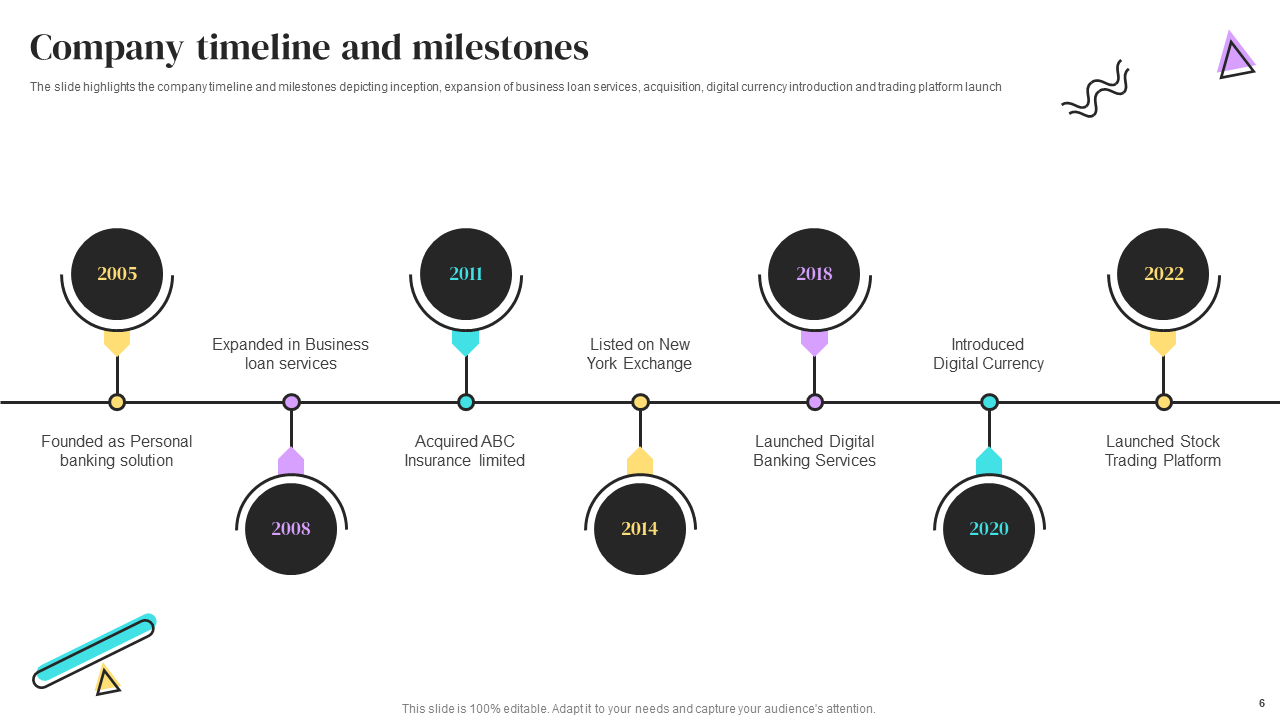

5. Company Timelines and Milestones Template

Use this presentation layout to showcase your banking company journey, accomplishments, significant milestones, historical timeline, and key events in an exquisite manner. With its customizable sections and attention-grabbing visuals, this template enables banks to tell their unique story from inception to present, demonstrating their growth, evolution, and contributions to the industry. Get it now!

Download this timeline and milestones template

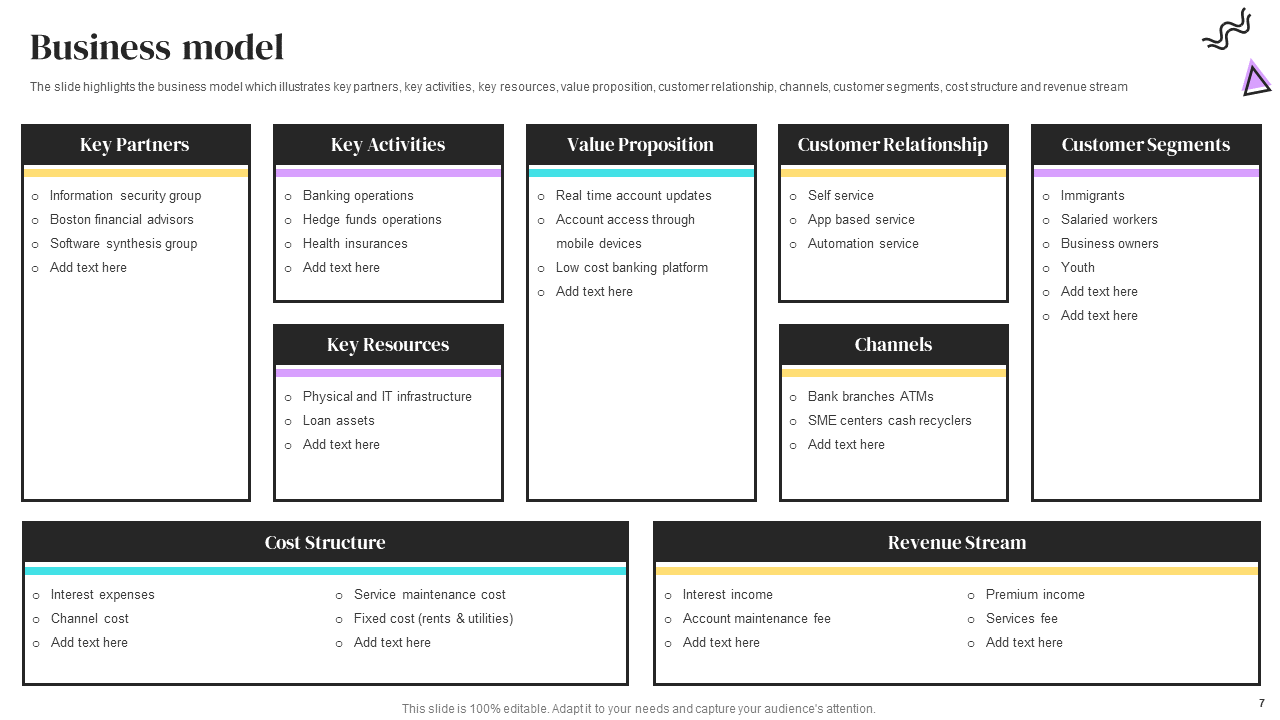

6. Banking Company Business Model Presentation Template

This PPT Set is an ideal tool for banking institutions to articulate and showcase their business model, including revenue streams, customer segments, value propositions, and distribution channels. With customizable sections and eye-catching graphics, this template allows banks to communicate their unique approach and strategic framework in an easy-to-understand manner. You can highlight business partners, activities, resources, customer relationships, and cost structure with this banking business model design. Grab it today!

Download this banking business model template

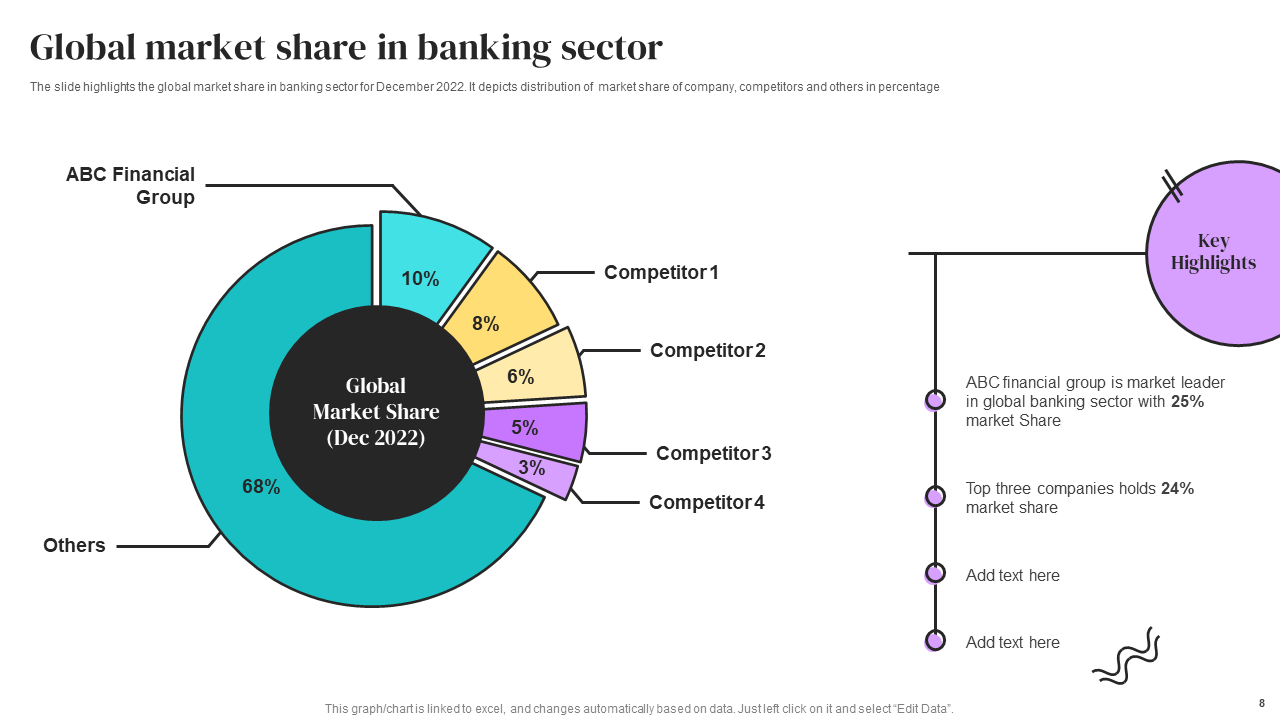

7. Global Market Share Template for A Banking Company Profile

Take advantage of this PowerPoint Layout to analyze and present your financial institution's position in the global market and competitive landscape. This presentation slide showcases the bank's market share, regional presence, and key competitors. It allows banks to present market insights, trends, and comparative analysis while demonstrating their competitive advantages and growth opportunities. Showcase your market position and competitive landscape with this design, aiding strategic decision-making and driving business success. Download it now!

Download this global market share template

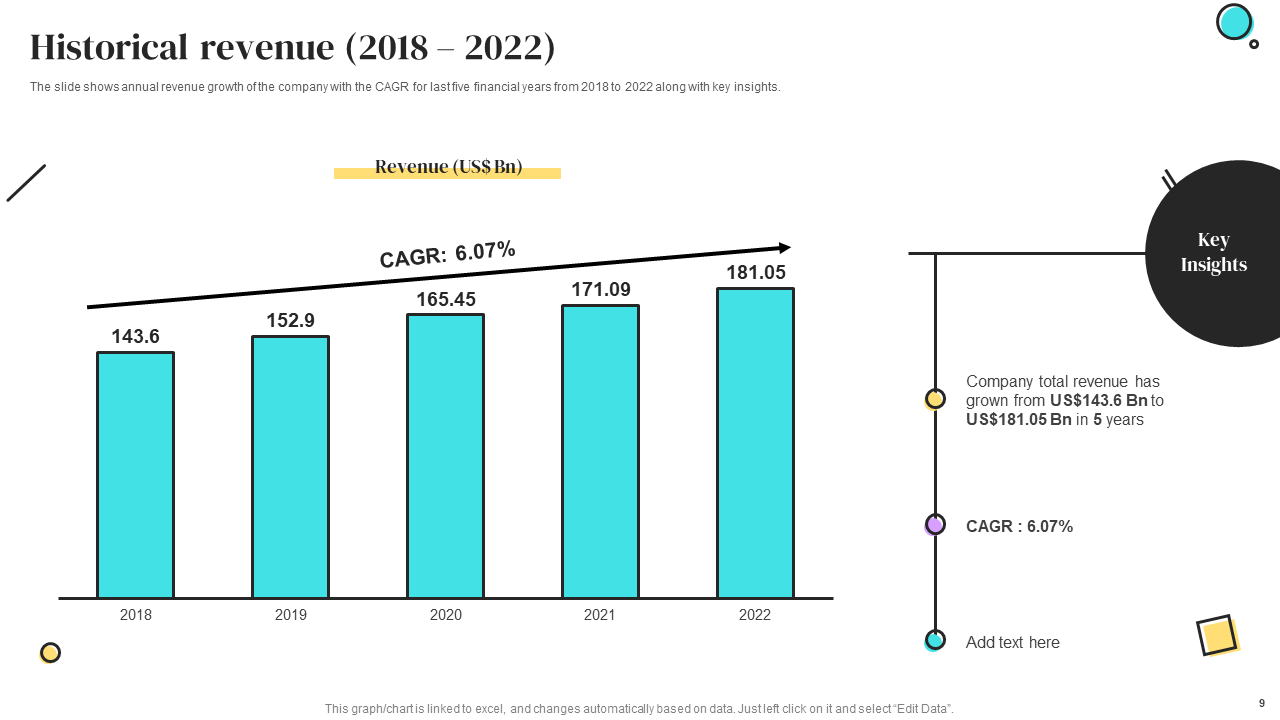

8. Banking Company Historic Revenue Template

Showcase your banking company revenue performance over time in a clear and impactful manner with this easy-to-read presentation design. This template features a dynamic bar graph that illustrates revenue trends, accompanied by a key insights column to highlight significant financial milestones and observations. It enables them to demonstrate the Compound Annual Growth Rate (CAGR), and revenue, identify patterns, and communicate achievements, providing insights into the bank's financial performance. Get it now!

Download this historic revenue template

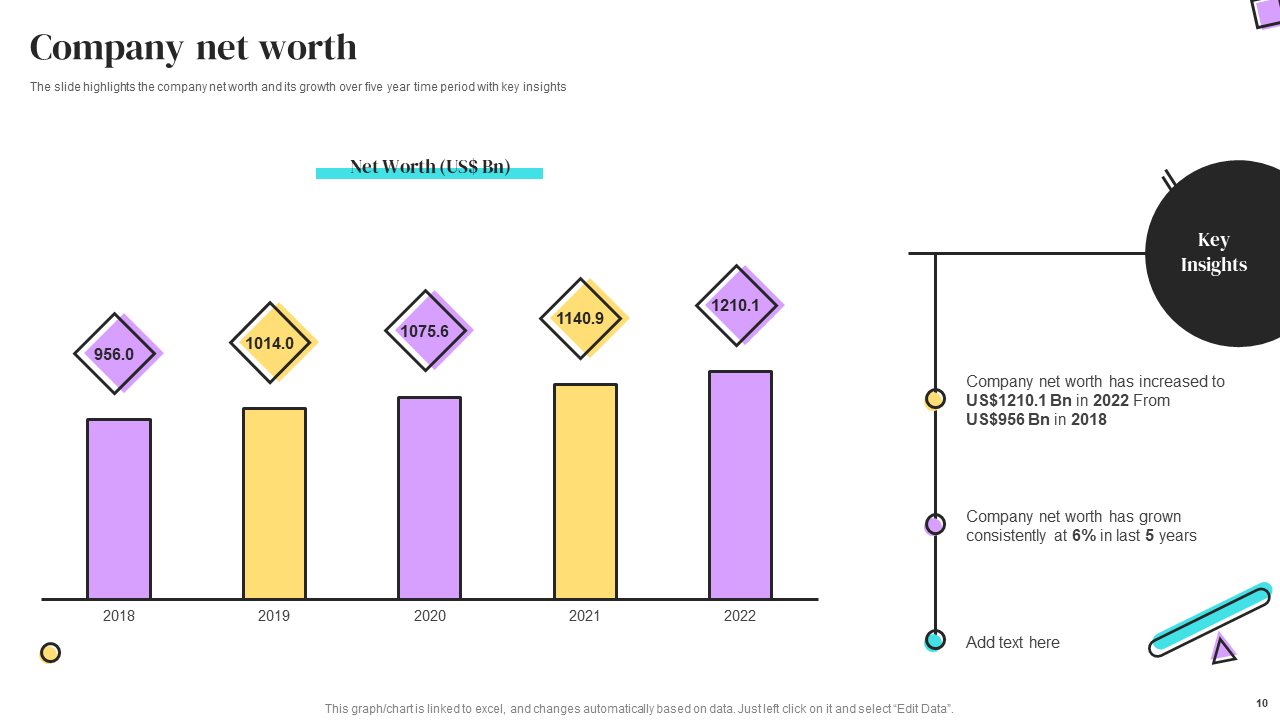

9. Company Net Worth Presentation Template for Banking Company Profile

This template features a visually engaging bar chart showcasing net worth trends, accompanied by a key insights column highlighting significant observations and analysis. With customizable elements and an attention-grabbing design, this template allows you to communicate the financial strength and stability of your bank to the audience. It enables you to demonstrate the growth and value of the bank's net worth over time, providing insights into its financial performance. Get it now!

Download this company net worth template

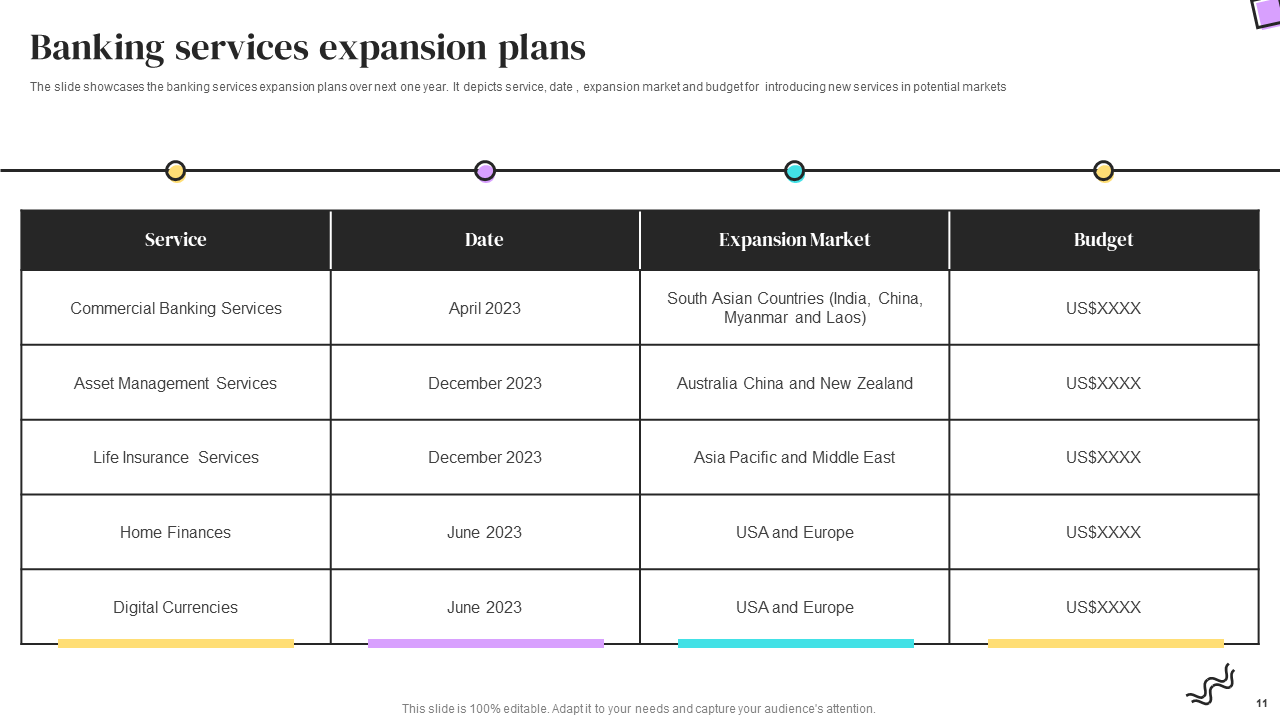

10. Banking Services Expansion Plan Template

Outline and present the strategic plan of your financial institution for expanding its range of services with this PPT Slide. It includes a well-organized four-column table to illustrate your new services, their launch date, expansion market, and allocated budgets. Use this design to communicate your vision, objectives, target markets, and implementation strategies for expanding the service offerings. Grab it today!

Download this services expansion plan template

Always At Your Service!

In conclusion, the role of a well-crafted banking company profile cannot be underestimated in the success of banks. It is a powerful tool to establish credibility and attract investors.

By leveraging the potential of these ready-to-present company profile ppt templates, financial institutions can unlock a world of possibilities, saving time and resources while creating profiles that leave a lasting impact. Whether you're a well-established financial institution or a budding startup, invest in these compelling profile templates and watch your graphs touch new thresholds.

Download these banking company profile templates to present your finance brand, products, and services in an impressive customer-winning way.

FAQs on Banking Service

What is banking as a service company?

Banking as a Service (BaaS) company is a type of financial technology (fintech) company that provides infrastructure and technology solutions to enable businesses to offer banking and financial services to their customers without becoming a fully-licensed banks.

BaaS companies partner with traditional banks to access their regulatory framework while leveraging their technology platforms to deliver banking services to clients. It allows non-financial companies, such as e-commerce platforms, startups, or other technology companies, to integrate banking services into their offerings and provide a seamless user experience.

What comes under banking services?

Banking services encompass financial activities that banks and other financial institutions provide. Some common examples of banking services include:

- Deposit services: This includes types of accounts offered like checking, savings, and fixed deposit.

- Lending services: Banks provide loans and credit facilities to individuals and businesses, such as personal loans, mortgages, business loans, and lines of credit.

- Payment services: Banks facilitate transactions and payments, including issuing debit and credit cards, electronic funds transfer (EFT) services, and supporting online and mobile banking transactions.

- Foreign exchange services: Banks offer currency exchange services for individuals and businesses involved in international trade or travel.

- Investment services: Some banks provide investment products and services, including brokerage, mutual funds, and wealth management.

- Financial advisory services: Banks offer financial advice and guidance to individuals and businesses regarding their financial goals, investment decisions, and financial planning.

What are modern banking services?

Modern banking services refer to the evolving range of financial services and technological advancements that have transformed the traditional banking industry. Some examples of modern banking services include:

- Online and mobile banking: Customers can access their bank accounts, perform transactions, transfer funds, and manage their finances through secure online and mobile applications.

- Digital payments: Electronic payment methods, such as mobile wallets, contactless payments, and peer-to-peer transfers, have become popular.

- Open banking: Open banking initiatives enable customers to share their financial data with authorized third-party providers, allowing for personalized financial management, comparison of products, and integration of services from multiple providers.

- Fintech collaborations: Banks are partnering with fintech companies to leverage their innovative solutions and offer enhanced services, such as robo-advisory platforms, automated lending processes, and AI-driven customer support.

These modern banking services aim to enhance the overall banking experience, improve convenience, streamline processes, and empower customers with greater control and access to financial services.

Customer Reviews

Customer Reviews

![[Updated 2023] 25 Best Finance and Banking PowerPoint Templates to Shape your Future Transactions](https://www.slideteam.net/wp/wp-content/uploads/2020/04/F-and-B--335x146.png)

![Top 10 Investment Banking Templates to Attract a Loyal Base of Investors [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/07/Top-10-Investment-Banking-Templates_1-1013x441.png)