A budget is a roadmap to securing your financial future. Most people tend to neglect personal budgets as they either find it difficult to create or manage the finances. However, personal budgeting can help in many ways. For instance, you can track your spending and stop yourself from draining your savings. Personal budgeting can also help you achieve your financial goals, such as planning for retirement.

Personal budgeting doesn’t have to be complicated. However, if you can’t account for your income and expenses, you can use our ready-to-deploy personal budget templates.

Let’s begin!

Template 1 - Personal Financial Planning with a Budget Worksheet

Our budget worksheet has all the necessary elements for personal budgeting and financial planning. You can use the dedicated income section to indicate your income or expense, where you can show what you are spending your money.

Income sources could include your or your partner’s salaries, income from house rent, or other sources. You could track your spending on different things, such as paying your electricity, telephone, or internet bills. The template can come in handy for computing your total income and expenses as well as your income.

Template 2 - Personal Financial Planning Template

This is a top-notch PowerPoint template that showcases difference and notes sections besides the usual Budget and Actual. Here, you also get additional sections for entering different expenses, such as Auto and Living expenses. Auto expenses could include those for repairing your car and repaying your loans. On the other hand, living expenses could involve groceries and any other items you may need to buy for a living.

So, you can use this template to indicate how much you have spent and compare it against your budget and the difference amounts, and indicate them in the Notes section.

Template 3 - Personal Monetary Planning and Budgeting Checklist

With this template, set monetary goals for the month and prepare a checklist for planning your budget. The slide comes with sections on setting financial goals, building a plan, and reviewing status, all of which help in financial planning. Other essentials include setting calendar reminders, reviewing priority actions and previous statements, and creating a budget. Besides this, you can also use this template to include in your checklist ‘create emergency funds’ and ‘find an accountability partner.’

Template 4 - Personal Monthly Budget Worksheet with Savings Goals

Savings are an essential part of your budget. This pre-designed PowerPoint template you can help you achieve your savings goals by outlining a comprehensive budget. You can use this template to create a monthly budget that helps meet your savings goals. You can include all the bills due for a particular month, such as Electricity, Water, Gas, Internet, etc., in the Checking column. In the Savings column, you mention the Opening and Closing balances for the month and your savings goals. Using the column, you can find at the end, you can specify your monthly income and check deposits, bills, savings, and closing balances.

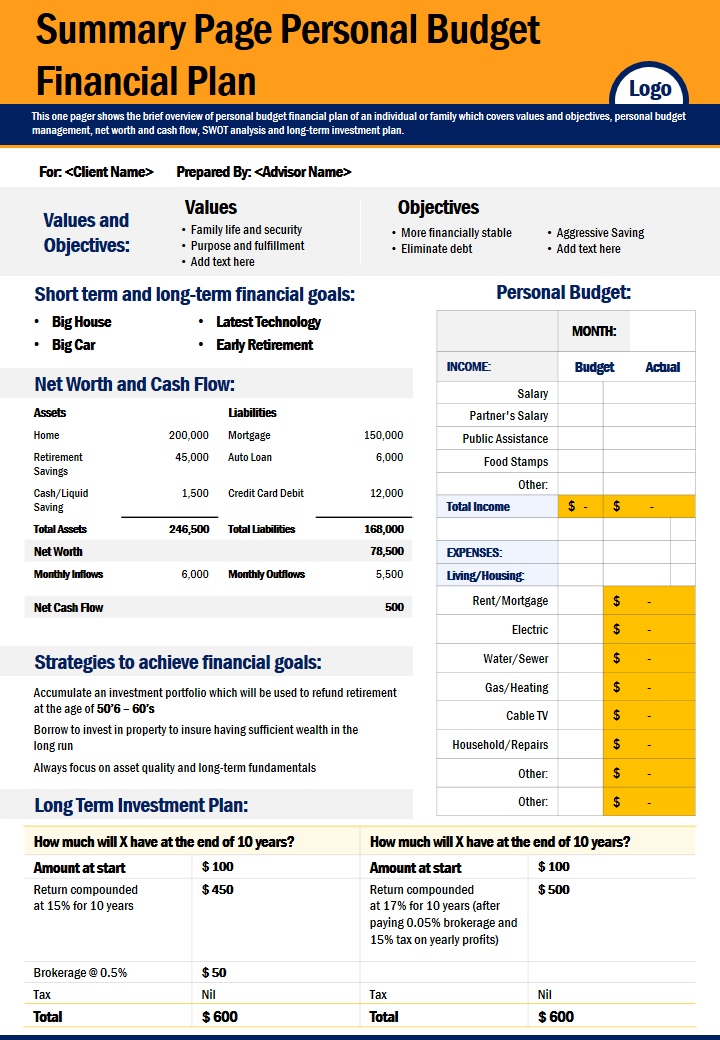

Template 5 - Summary Page Personal Budget Financial Plan Template

The template gives you a summary of a personal budget and financial plan. It includes core budgeting components, such as values and objectives, short- and long-term financial goals, and strategies to achieve them. It also has your net worth, cashflows, personal budget, and long-term investment plans. You can mention your budget and actuals in the dedicated columns for both income and expenses. This flexible template is ideal for not only planning your budget but also for planning your investments.

Track your Earnings, Expenses, and Savings

For many reasons, you might want to use personal budget templates to track your earnings and expenditures. These premium templates can help you track the minutest of details and manage your finances. Grab these PPT slides today and achieve financial independence.

FAQs on Personal Budget

What is an example of a personal budget?

Let’s say that you have $3,000. Now, out of this $3,000, let’s say you want to contribute 10% to charity and save up 10%. That means you are contributing $300 to charity and saving another $300. So, you will need to create a personal budget, where you will put $300 under Expenses, and another $300, under Savings.

Similarly, you will be putting $3,000, which is how much you have, under income. So, tracking your income, savings, and expenditure is an example of a personal budget.

Why do you need a personal budget?

Personal budgets serve many purposes. They not only help track your income but also help you save up by keeping tabs on your spending. Also, since a personal budget helps you save up, it prevents you from overspending and enables you to achieve your financial goals. So, these are reasons enough you need a personal budget.

What are the 3 types of personal budgets?

There are many types of personal budgets. However, three are most prominent: zero-based budgeting, 50/30/20 budget, and reverse budget. Zero-based budgeting involves starting from scratch rather than building on previous budgets. It entails assessing your current financial situation and allocating funds on the go.

As for the 50/30/20 budget, it follows the 50/30/20 rule. According to this rule, you must allocate 50% of your income for housing, utilities, and transportation, 30% towards clothing, personal care, and entertainment, and save 20%.

Reverse budgets focus on savings. So, rather than figuring out how much to spend, you begin by assessing how much you want to save.

Customer Reviews

Customer Reviews