Once upon a time in a vibrant metropolis, a small business owner named Sarah embarked on a quest to redefine her corner store's destiny. The humdrum routine of counting cash and wrestling with the complications of change-making became a thing of the past as Sarah embraced the digital revolution.

Her decision to adopt cashless payments wasn't just a pragmatic business move; it was a gateway to a customer experience that transcended the ordinary. As Sarah tapped into the domain of mobile wallets, credit cards, and futuristic QR codes, her customers were no longer constrained by the limitations of physical currency.

Word spread like wildfire through the neighborhood. Customers, once hesitant, now flocked to Sarah's store enticed by the attraction of a swift and secure shopping experience. It wasn't merely about the products on the shelves; it was about the seamless dance of digits that made each transaction a joyous affair.

The same story repeated itself across industries and continents. From the towering skyscrapers of financial districts to the quaint markets nestled in suburban corners, businesses awakened to the transformative power of cashless payments.

But this narrative isn't just about profit margins and bottom lines. It's about the customer who, armed with a smartphone, felt the thrill of effortless transactions. It's about the entrepreneur who dared to reimagine the very fabric of commerce.

Join us on this exhilarating journey through the domains of Cashless Payment Adoption. Discover how businesses are not just adapting to change but orchestrating a symphony of progress, one digital transaction at a time.

Advantages of adopting cashless payments

Companies that adapt to this change and take advantage of customers' increasing reliance on digital solutions will benefit greatly, particularly in terms of higher sales. Here are a few ways that using cashless payments can boost sales for businesses.

1. Convenience is Key

The unparalleled convenience that cashless payment methods offer to customers is the primary driver behind their growing adoption. The ability to conduct transactions without using physical currency is revolutionary, whether it be through online payment platforms, credit/debit cards, or mobile wallets. This ease of use not only improves the general client experience but also promotes return business. Customers are more likely to return and make larger purchases when they find the purchasing process to be simple, which increases sales.

2. Expanded Customer Base

Cashless payments remove geographical barriers, allowing businesses to reach a global customer base. With the rise of e-commerce, businesses can now attract customers from various regions, countries, and time zones. This expanded reach opens up new opportunities for sales growth.

3. Security and Trust

Advanced security features are often included in cashless transactions, giving customers a sense of dependability and trust. Tokenization and biometric authentication are two payment methods that improve financial transaction security and lower fraud risk. Businesses benefit from higher sales when customers feel comfortable that their financial information is secure and they are inclined to make larger purchases and conduct transactions more frequently.

4. Faster Transactions, Faster Sales

Transaction times are accelerated by the effectiveness of cashless payments. Digital payment transactions are handled instantly, in contrast to cash transactions, which might require waiting for approval or counting change. In addition to enhancing the entire shopping experience, this quick turnaround time enables businesses to serve a larger number of customers in less time. Increased sales volume is the outcome, particularly during peak times.

5. Data-Driven Insights for Targeted Marketing

A wealth of information about consumer behavior, preferences, and purchase trends is produced by cashless payment systems. Companies are able to better target their marketing strategies by using this data to obtain insightful knowledge about their target audience.

Cashless Payment Adoption to Increase Business Sales PowerPoint presentation slides

Let's explore the various ways in which incorporating cashless payments can promote increased sales, utilizing the Cashless Payment Adoption PowerPoint slides as an effective tool to assist businesses in smoothly embracing this transition.

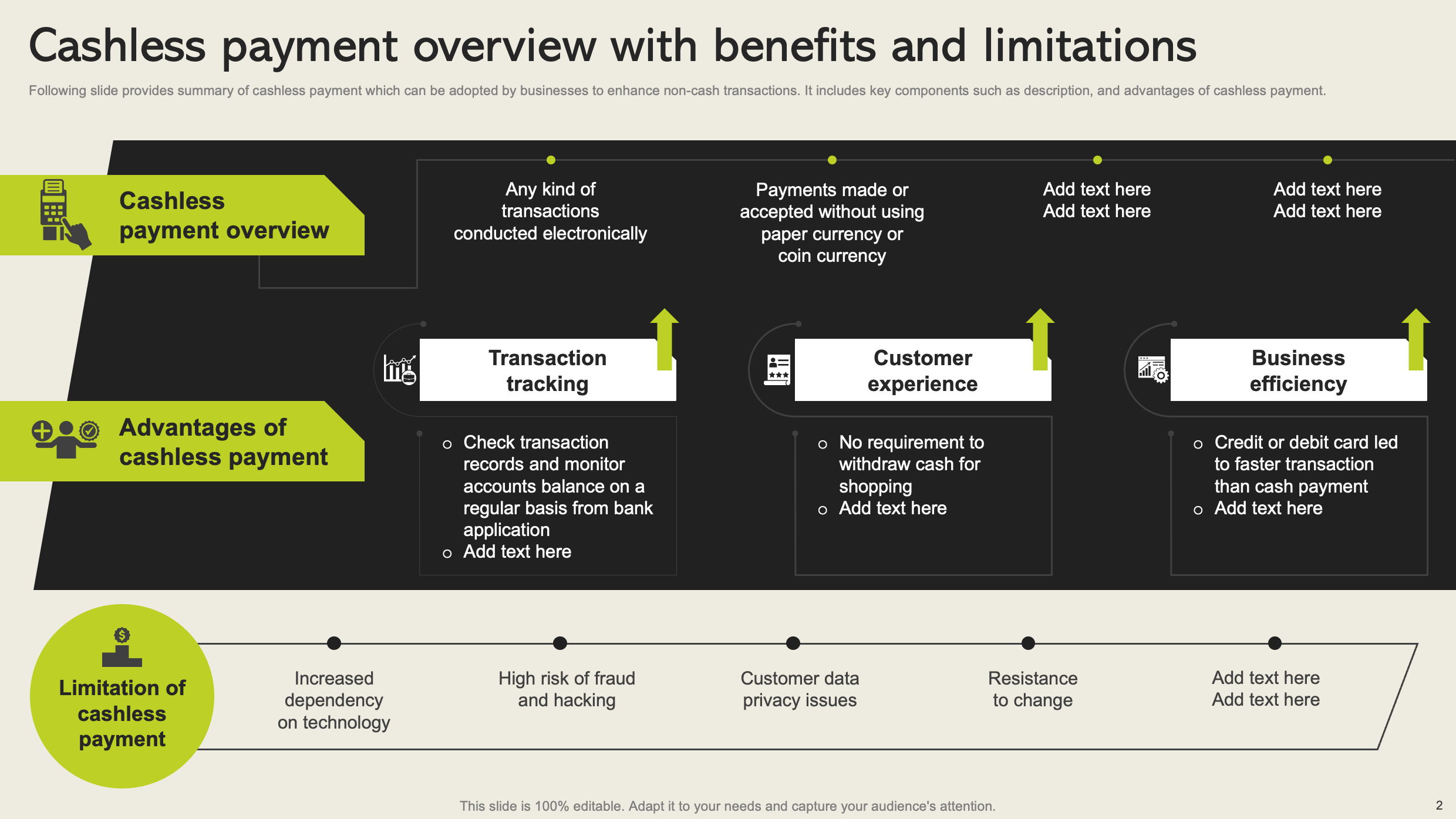

Cashless Payment Overview with Benefits and Limitations

This slide shows the essence of cashless payments for businesses, offering a concise overview of its key components. It outlines a comprehensive description of cashless payments, detailing their seamless nature and diverse options like mobile wallets and online platforms. The advantages of adopting this system, including enhanced customer experience, heightened security, and accelerated transactions, are clearly presented.

With the adoption of cashless payments, businesses can seamlessly transition to non-cash transactions, ensuring convenience, security, and efficiency in their financial interactions.

Download this PowerPoint Template Now!

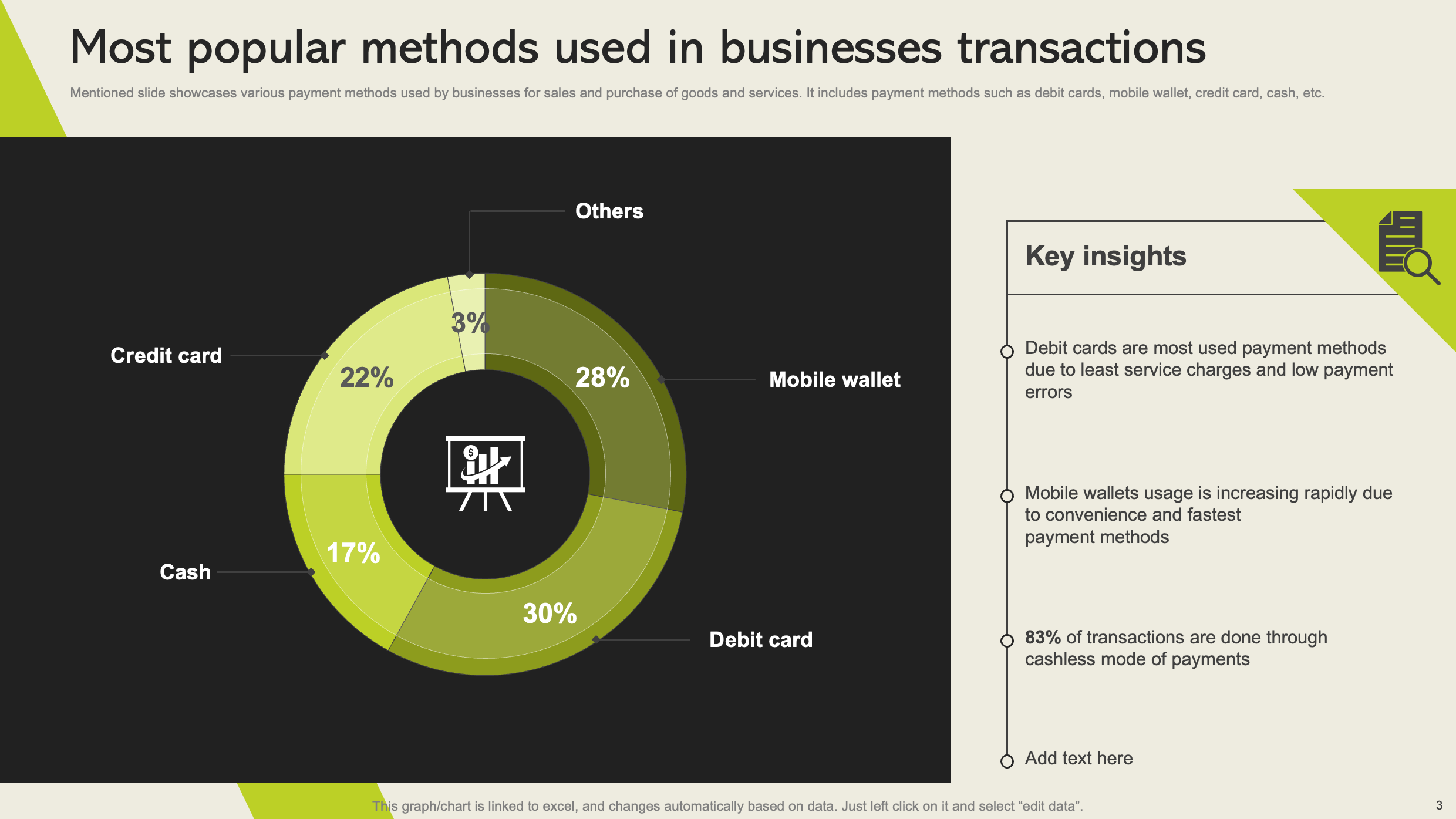

Most Popular Methods Used in Businesses Transactions

This slide discusses the range of payment options that companies offer for the exchange of goods and services. It offers a thorough summary of the various pathways accessible for financial transactions and incorporates a range of choices, such as cash, credit cards, debit cards, and mobile wallets.

Businesses are able to accommodate a wide range of customer preferences by using these payment methods, which guarantee ease and flexibility in the sales and purchase processes. By combining cash, credit cards, debit cards, and mobile wallets, companies demonstrate their flexibility in accommodating different payment methods and raise the general accessibility of their goods and services.

Download this PowerPoint Template Now!

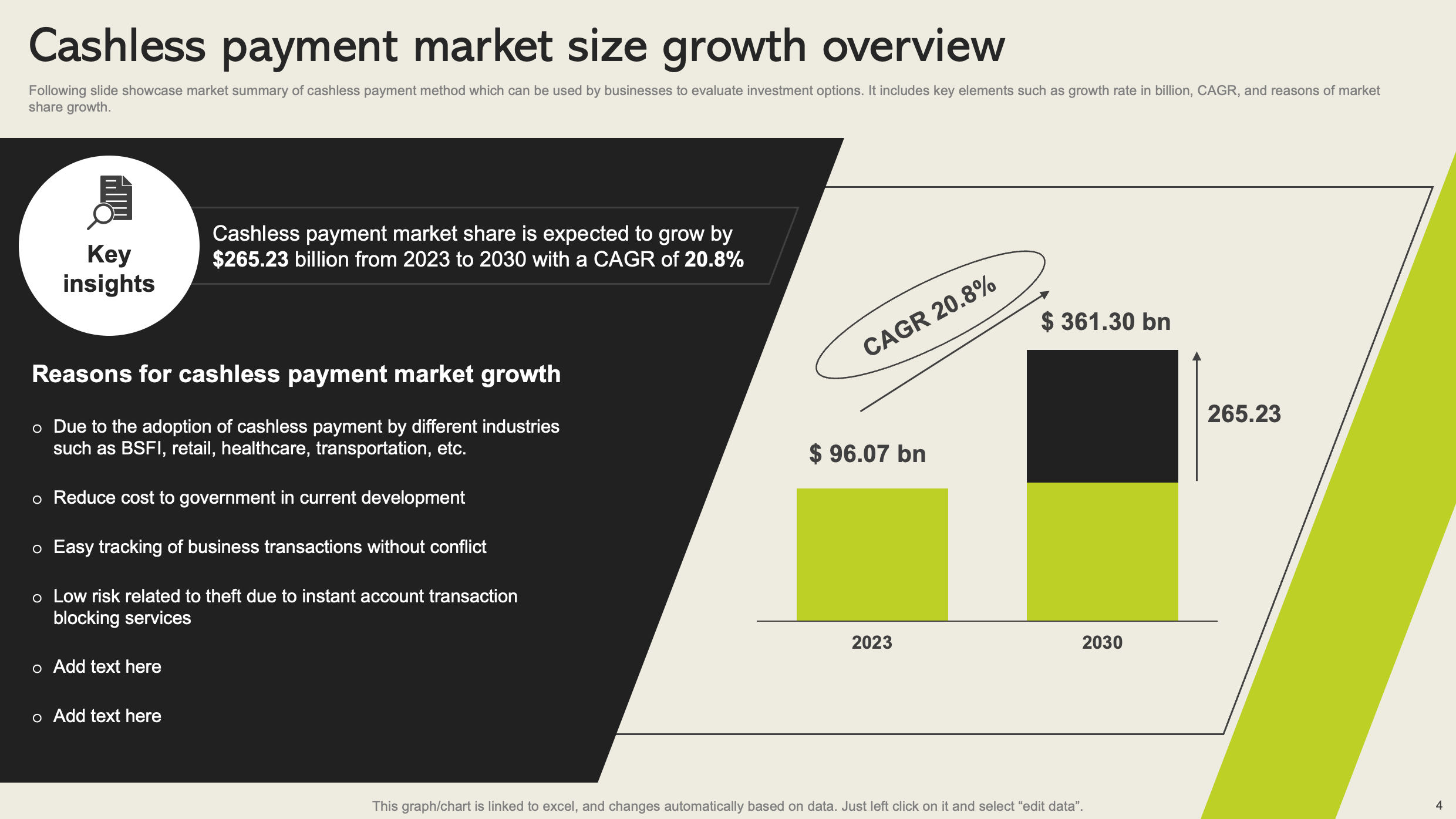

Cashless Payment Market Size Growth Overview

This slide presents a market summary of cashless payment methods, offering businesses valuable insights for evaluating investment options. Key components featured include the growth rate in billions, Compound Annual Growth Rate (CAGR), and the factors contributing to the expansion of market share.

Providing essential metrics, this summary equips businesses with data-driven perspectives, facilitating informed decision-making regarding investments in the dynamic landscape of cashless payments.

With details on growth rates, CAGR, and the drivers of market share expansion, this slide serves as a strategic resource for businesses seeking to navigate and capitalize on the evolving market trends in cashless payment methods.

Download this PowerPoint Template Now!

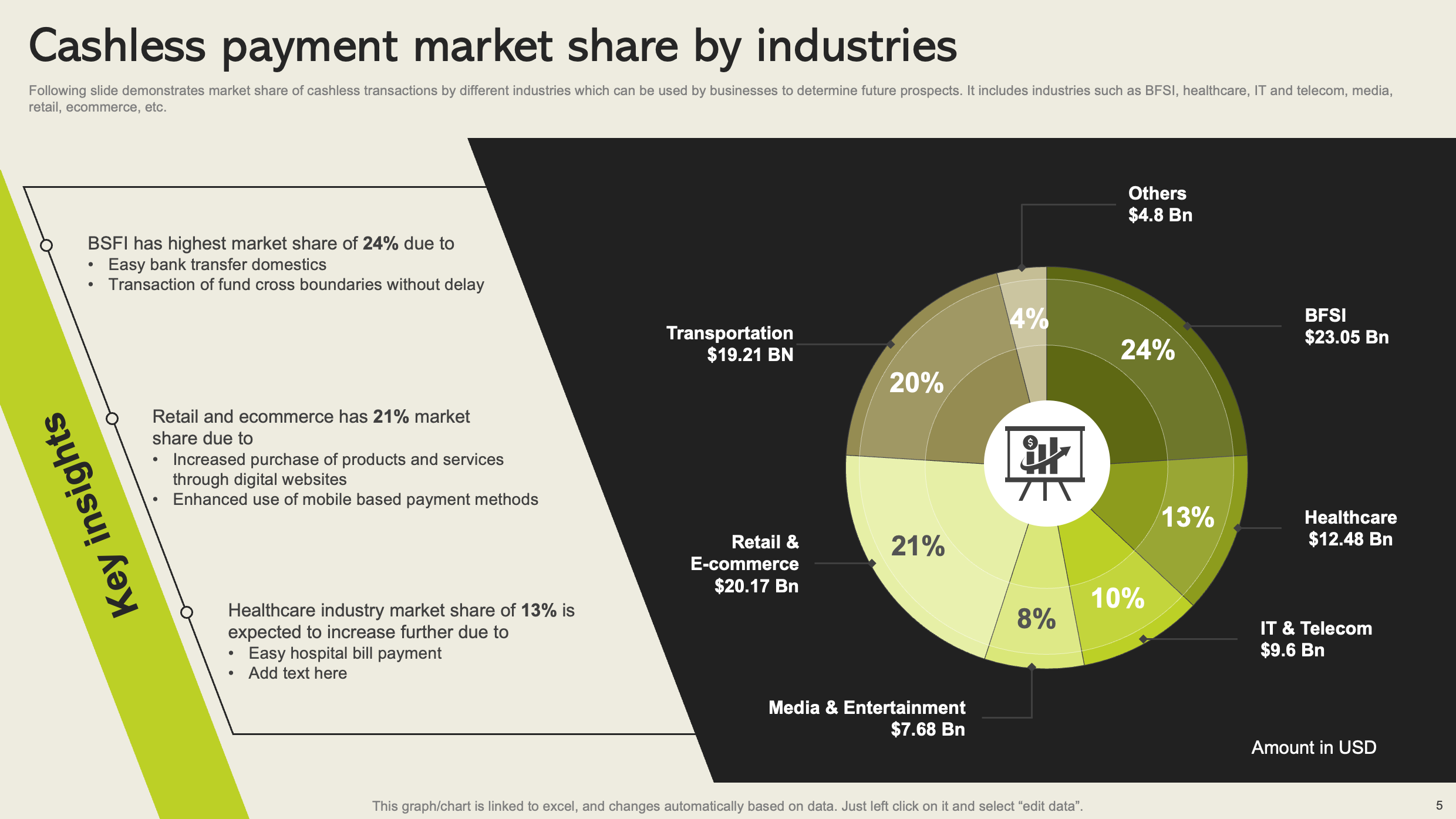

Cashless Payment Market Share by Industries

This slide presents the market share distribution of cashless transactions across diverse industries, providing businesses with valuable insights to gauge future prospects. Highlighting sectors including BFSI, healthcare, IT and telecom, media, retail, and ecommerce, it offers a comprehensive overview of the prevalence of cashless transactions in various business domains. Showcasing the market share dynamics within each industry, this slide aids businesses in strategic planning, enabling them to identify lucrative opportunities and potential areas for growth.

With a focus on different sectors, businesses can tailor their approaches to align with industry-specific trends and capitalize on the evolving landscape of cashless transactions.

Download this PowerPoint Template Now!

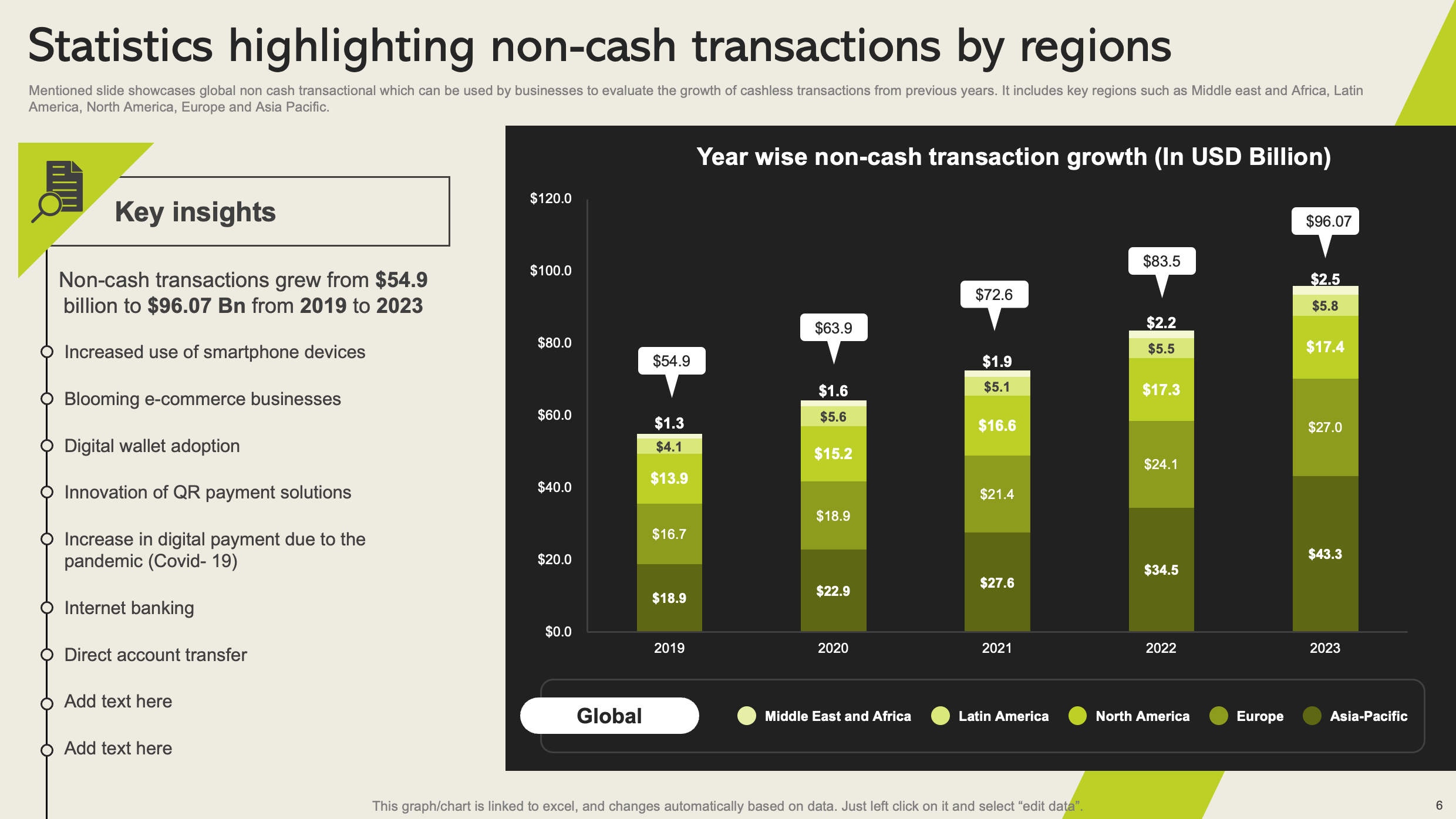

Statistics Highlighting Non-Cash Transactions by Regions

With its snapshot of the global non-cash transaction landscape, this slide is an invaluable tool for businesses evaluating the cashless transaction growth trajectory over the previous years. It offers a thorough overview of the development of non-cash transactions globally, encompassing important regions such as the Middle East and Africa, Latin America, North America, Europe, and Asia Pacific.

Enterprises can leverage this data to examine patterns, predict changes in the market, and proactively position themselves to address the diverse dynamics present in various locations. This helps to cultivate an advanced comprehension of the rapidly growing global cashless transaction landscape.

Download this PowerPoint Template Now!

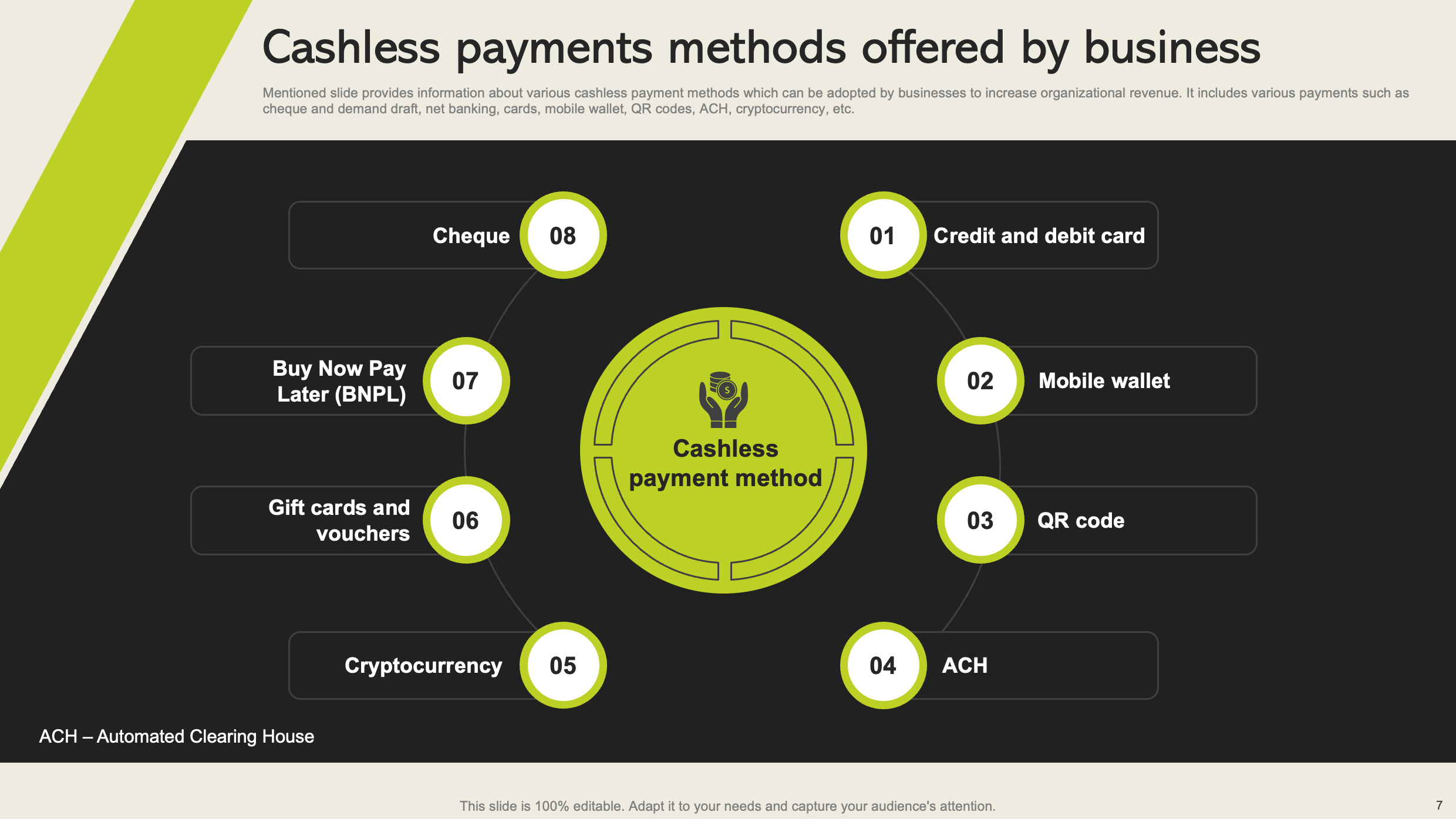

Cashless Payments Methods Offered by Business

This slide provides details on diverse cashless payment methods, offering businesses insights into adopting strategies that can elevate organizational revenue. Encompassing a range of options such as cheque and demand draft, net banking, cards, mobile wallets, QR codes, ACH, and cryptocurrency, it provides a comprehensive overview of the array of cashless transactions available.

Featuring these methods, businesses can strategically broaden their payment channels, catering to diverse customer preferences and expanding revenue streams. The inclusion of varied payment options positions businesses to harness the full spectrum of cashless transactions, fostering financial versatility and potential revenue growth.

Download this PowerPoint Template Now!

Conclusion

The adoption of cashless payments is not merely a technological trend but a fundamental shift in the way businesses and consumers interact. Embracing this change positions businesses to thrive in a digital economy, fostering customer loyalty and driving sales growth. As we navigate the evolving landscape of commerce, those businesses that prioritize the integration of cashless payment options are likely to enjoy a competitive edge and a more prosperous future.

Our Cashless Payment Adoption to Increase Business Sales PowerPoint presentation serves as a valuable tool, guiding businesses through this transition seamlessly. With cashless payments, not only can businesses enhance customer satisfaction and security, but they can also pave the way for increased sales and sustainable growth. Embrace the future of transactions with the Cashless Payment Adoption presentation and watch your business thrive in the digital age.

FAQs

Q1: Why should businesses consider adopting cashless payments?

A: Embracing cashless payments enhances customer convenience, accelerates transactions, and fosters a more secure and efficient business environment, ultimately boosting sales.

Q2: What are the key components of cashless payment adoption for businesses?

A: Businesses can benefit from integrating various payment methods, including mobile wallets, credit cards, QR codes, and online platforms, creating a diverse and accessible payment ecosystem.

Q3: How can cashless payments contribute to increased customer loyalty?

A: The seamless and secure nature of cashless transactions enhances the overall customer experience, leading to higher satisfaction levels, repeat business, and ultimately, increased customer loyalty.

Q4: Is cashless payment adoption suitable for all industries?

A: Yes, the transformative power of cashless payments transcends industries. From retail and healthcare to IT and finance, businesses across diverse sectors can leverage this shift to drive sales growth.

Q5: How can businesses ensure a smooth transition to cashless payments?

A: Utilizing tools like the Cashless Payment Adoption PowerPoint presentation can assist businesses in seamlessly integrating digital transactions. Training staff, offering multiple payment options, and communicating the transition effectively are also crucial steps.

Related Products

Digital payment business solution Digital Payment Transformation Electronic Money

Customer Reviews

Customer Reviews