Retirement is a phase of life, when you have the time to rest. You have worked most of your life, and now is the time to give those muscles a bit of breather. Yet, paradoxically even as you plan how you will spend your time, a major agenda of retired life is ensuring that you will enough income to live on for the decades to follow. In fact, this planning has to begin when you are in your youth; the earlier you start planning, the better it is.

You need to track your income and expenses and, above all, your income sources. While tracking your income and expenses is difficult, especially at that age, you can always use retirement budget planning templates to make the job easier.

SlideTeam makes it easy and super-convenient to budget for retirement with content ready, and ready to use templates that you can leverage to keep track of your finances.

Don’t forget to check out these personal budget templates here.

Each of the templates is 100% editable and customizable. You get the much-needed structure, a starting point for the presentation and editability to tailor the PPT to unique audience profile.

Let’s explore these templates now!

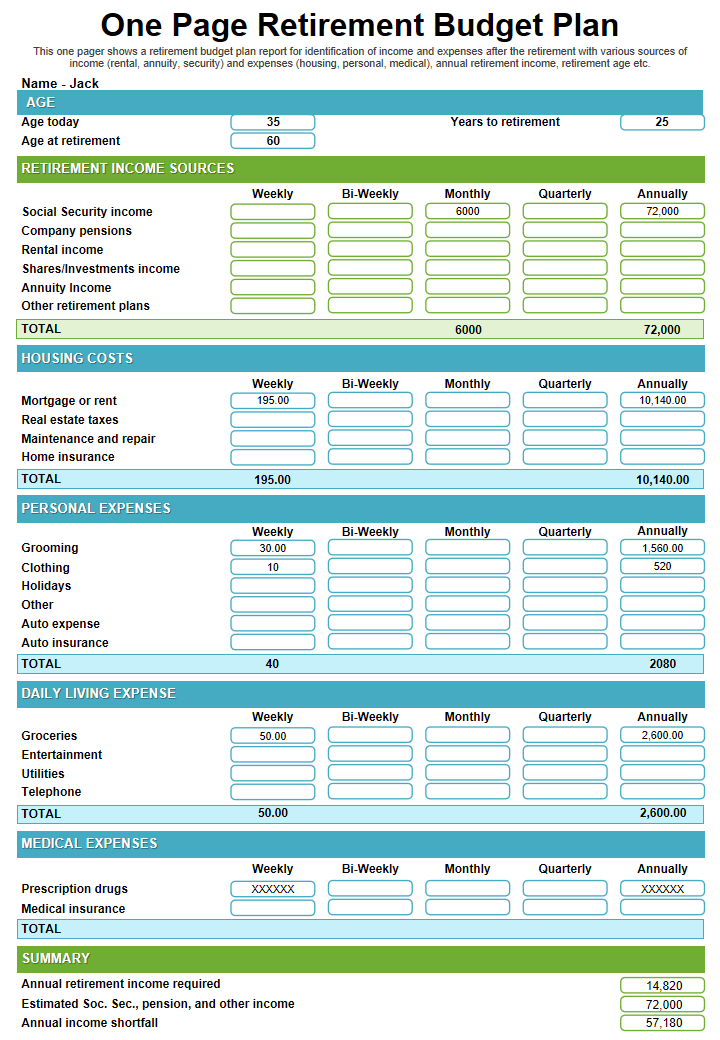

Template 1 One-page retirement budget plan presentation report infographic PPT

This PPT Template showcases resources you need for financial planning at your fingertips. The one-page slide includes the current age, retirement age, and years left for retirement. Identify the income sources that will support you after retirement, and also plan on the amount you will need, at what frequency. The template highlights some of these as income from social securities, pensions, rentals, or shares and investments. Annuity income or pension from other retirement schemes also gets a look-in with the PPT. Similarly, you can manage your expenses with the help of this template. Expenses include housing costs, rent or mortgage, taxes, insurance, or maintenance or repair. Use this template to document its further types such as daily living, medical, or personal expenses. With this slide, retirees get to earmark and plan for income sources to deliver, and effectively manage their expenditure.

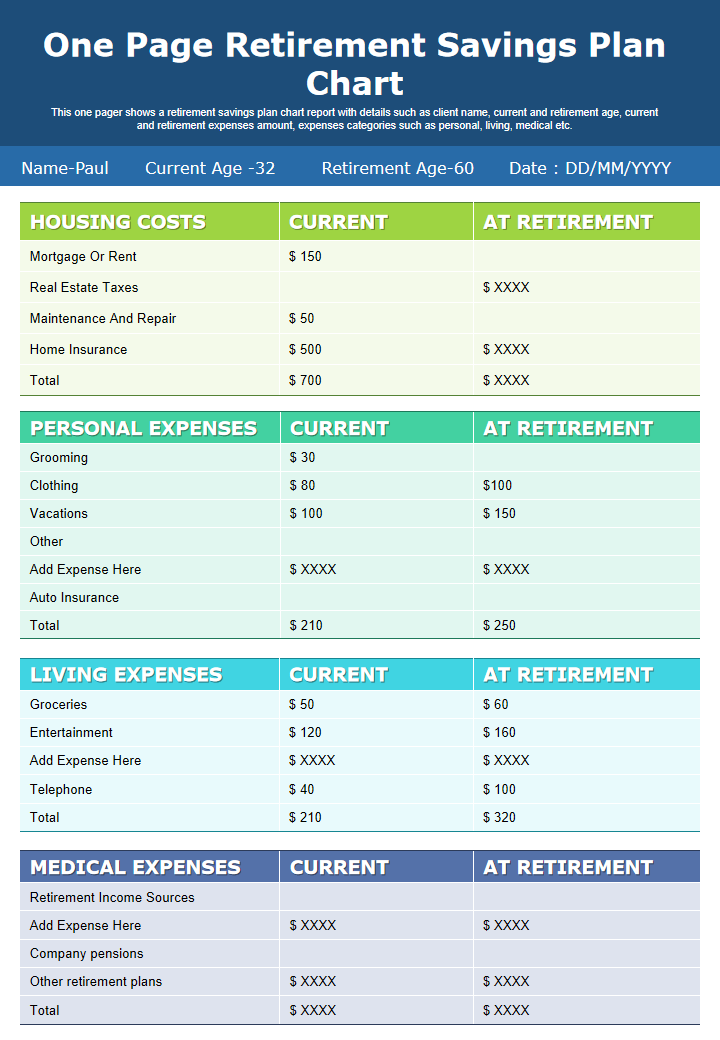

Template 2 One-page retirement savings plan chart presentation report PPT PDF Document

Manage your expenses like a pro with this one-page retirement savings plan PPT Template chart. Use this presentation template to chart your expenditure under categories, be it be housing, personal, living, or medical expenses. With this template, you also get current expenses. That is, how much it costs now and how much it may cost after retirement, based on the concept of time value of money.

Template 3 One-page financial retirement budget planner PPT presentation report

This PPT Template is the ultimate budgeting tool that you can use to create a financial roadmap for a retired life. It is a complete solution for retirement budget planning, where you can state your current age and the age at which you want to retire. It also comes with income sources, and you can showcase multiple income streams to support you after retirement. The amount against the sources of income is displayed, both monthly and annually.

These could include pensions, salaries, and investments. It also has an expenses column where you can plan your expenses. The spending plan segment and the income versus expenditure graphic are the two USPs of this presentation template. With the spending plan, you can reduce costs.

Get the Best Out of your Retirement

Retirement budget planning templates can come in handy for planning your income and expenses after retirement. These templates are as versatile as they get since you can put your numbers in there regarding income and expenses. Also, these provide you an estimate of how much you may end up spending or saving. Our budget presentation templates are handy tools that you can use to plan for a happy and healthy retired life.

While you’re scouring through our retirement budget plan templates, don’t forget to check these budget projection templates here.

PS If your need is for streamlining your household budget, look at these household budget templates here.

FAQs on Retirement Budget Planning

What is a simple budget for retirement?

No matter what age you want to retire, it would help if you still planned for it. Planning your retirement budget may not seem simple, but you can still do it, especially with the 30x rule. The 30x rule can help you estimate how much you will need for a comfortable retirement. The rule is simple. All you need to do is multiply your current expenses by 30. Your retirement corpus should be at least 30 times your current expenses.

How do you create a retirement budget?

You can create a retirement budget in four easy steps.

- Add up your income sources. Your income sources are where you will be pulling your money from, including retirement accounts, social security benefits, pensions, part-time earnings, taxable investments, real estate, and annuities.

- Plan how you want to distribute the money that comes from these sources.

- Don’t forget about medical expenses. After retirement, you will need to look after your health and possibly end up spending a lot more than you thought. Save up for those medical emergencies or buy health plans.

- Create a zero-based budget. With a zero-based budget, you can ensure that there’s nothing left over and that you are spending every single dime as planned. It involves subtracting your monthly expenses from your income so that it results in zero. It involves careful tracking of your spending.

What is the best budget for retirement?

When creating a retirement budget, the rule is to estimate your expenses to be between 70% and 80% more than your working life. For example, if you were spending $1,000 each month before you retired, you can expect to spend at least 70% more, or $1,700 every month, after retirement.

What are the seven steps in planning for your retirement?

- Start planning as early as possible.

- Be clear and focused about your retirement goals.

- Do not just create a savings plan, but build upon it.

- Consider longevity and inflation as possible risk factors.

- Do not forget to review your retirement plans.

- Calculate your retirement income and expenses.

- Downsize your debts.

Customer Reviews

Customer Reviews

![Top 7 Slides on Green Marketing Guide for Sustainable Business! [With Free PPT and PDF]](https://www.slideteam.net/wp/wp-content/uploads/2023/09/BANNER-1-1013x441.jpg)