Preparing a budget is an essential part of having a solid financial foundation for all our endeavors, especially business. It aids in debt repayment or avoidance, money management, expenditure restraint, increased savings, and debt elimination. In the book ‘The Total Money Makeover,’ America’s favorite financial advisor Dave Ramsay cited BUDGET as a foolproof strategy for eliminating all debt and a putting in place a secured retirement plan. He stated, “A budget is telling your money where to go, instead of you wondering where it went.”

A budget is a super-intelligent management tool, and the boss, when it comes to tracking expenses and income. Click here to read more on the budget breakdown.

INCOME VERSUS SPENDING

Nearly 70% of people struggle to keep their spending within their income. The problem worsens as more people in a home participate in the money management system. A clear and accurate picture of what you earn and what you spend (household budget) is essential for making better long-term and short-term financial decisions.

A household budget is an excellent tool for tracking expenditures and earnings. It allows you to practice financial discipline, save some money for the rainy day and gain a better financial footing.

This blog will help you get started on your personal finance journey. You’ll be able to perceive where you may cut back on wasteful and unnecessary expenses and make sure you’re saving and investing for a secure future. Use SlideTeam’s Must-Have Household Budget Templates to prioritize your financial health with better control over your expenditure, and always working to increase your savings. These templates can be modified to reflect your changing goals and lifestyle.

Making a yearly budget is the most effective way to keep your company’s finances on track. Click here to know more.

The 100% customizable nature of the templates provides you with the flexibility to edit your presentations. The content-ready slides give you the much-needed structure.

Put yourself in charge and control every dollar you earn or spend with SlideTeam’s top-notch PPT Templates!

Template 1: Helping Clients Develop a Household Budget PPT

Use this PPT Template to help your clients understand the importance of personal budget planning to reach their savings goal. This template includes a financial pyramid, cash flow analysis, financial highlights, resource capacity, new capital budgeting, cost comparison table, risk tolerance analysis, balance sheet dashboard, investment flow chart, and tax planning to help you track your cash inflows and outflows. It is an essential tool for personal budgeting, family budgeting, personal financial management, budgeting, and personal finance. Use this presentation template to demonstrate the potential benefits of budget implementation to improve efficiency, accuracy, and dependability of any spending plans you design. Get it now!

Template 2: Household Budget Template

Use this PPT Template to establish your personal or household budget to achieve your financial goals. Use this PPT to track your tax planning, income and expenses, and cash flow in a monthly budget. It will enable you to categorize your spending and estimate how much you must allot to each group. This is your go-to guide for calculating where your money should go each month. Download now!

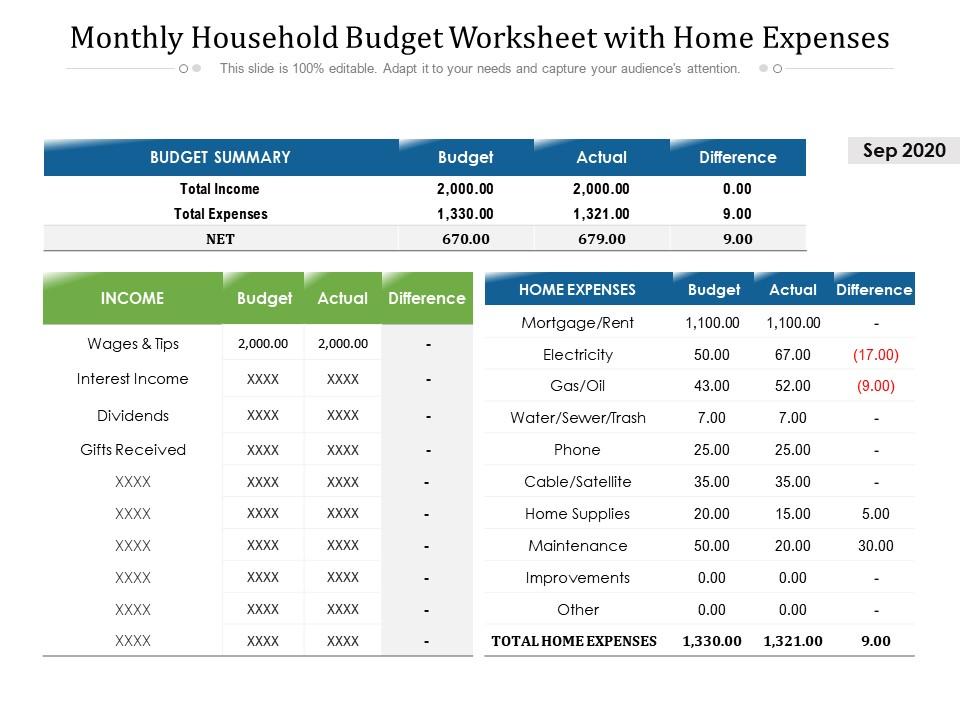

Template 3: Monthly Household Budget Worksheet with Home Expenses

Use this PPT Template to construct a budget financial plan to prioritize your financial health. This budgeting worksheet is a crucial aspect of maintaining a personal budget and increasing funds. It tracks how much money you spend each month. Use this presentation to support your efforts to adhere to your monthly spending plan and achieve financial objectives. Save it now!

******

Track Your Spending

Household budgets are crucial. They help you to save, making your life a little less hectic and more relaxed. This spending plan is a step–by–step process to plan for the future. Use SlideTeam’s PPT Templates to trim your expenses to achieve your goals and make the purchases you aspire to without taking on debt.

PS Check out our guide on monthly budget plan to allocate and use your financial resources in a wise manner.

FAQs ON HOUSEHOLD BUDGET

Explain the terms:

- Fixed expenses: Fixed expenses remain constant from month to month. A mortgage or rent, health insurance, a car payment, or housing taxes are some examples.

- Discretionary expenses: Discretionary expenses might vary dramatically from month to month. Dining out, streaming service subscriptions, a club membership, cable, and apparel purchases are all examples.

- Variable expenses: Variable expenses vary from month to month. Groceries, car maintenance, power, and water use are examples of such expenses.

What is the 50/20/30 budget rule?

The 50-30-20 budget rule is a percentage-based budget rule that recommends distributing an individual’s monthly net income into three components: Over 50% for requirements, 30% for wants, and 20% for savings. This is a wonderful technique to divide your money into budget categories, especially if you're making your first budget. Senator Elizabeth Warren popularized it in her book, All Your Worth: The Ultimate Lifetime Money Plan.

What are the steps that go into create a monthly household budget?

- Make a list of your income to effectively allocate money for expenses.

- List all fixed expenses and their amounts to help you figure out how much you typically spend each month.

- Subtract your monthly costs from your monthly revenue to calculate your net income.

- Use a ‘Wants versus Needs’ analysis to evaluate your spending.

- Keep track of your spending to keep your budget in check.

Customer Reviews

Customer Reviews