Klarna is an online payment portal that enables us to make simple, quick, and easy payments for our transactions.

It also provides 'Buy Now, Pay Later' services with deferred interest to customers in Germany, Austria, the Netherlands, Belgium, and the UK.

Klarna's name comes from the Swedish word for 'Clear' or 'Clean.'

Innovation is the Recipe of Klarna Global Success

The company is well-known for its innovation and willingness to push boundaries.

In 2011, it introduced its' Click and Buy' service, which allowed customers to buy items without sharing any personal or financial information.

It also allowed customers to pay only after they returned the purchased item, removing the risk of non-payment.

In 2012, it introduced Klarna Checkout, which allowed customers to check out using just one click.

Klarna Supporting Financial Literacy

Klarna is an active participant in promoting financial literacy among young people.

In 2012, it partnered with the Swedish Financial Education Academy to create a pilot program for 300 schools across Sweden. The program involved a series of online videos, educational games, and workbooks designed to teach children good financial habits.

The program has been successful and is gaining ground in several other countries.

Klarna is a significant sponsor of education initiatives in the UK through its sponsorship of The Finance Museum in London.

In 2015, it also announced a sponsorship deal with the British Academy of Film and Television Arts (BAFTA).

Klarna Has Received Numerous Awards for Its Innovative Approach, Including:

- Best E-Commerce Service in the Nordics' (2010)

- Best Domestic E-Commerce Payment Service in Europe (2011)

- Most Innovative Financial Services Company in the Nordics' (2011)

- Best Mobile Payment Service in Europe' (2013)

The Journey of Klarna

Klarna was founded in a basement in Stockholm by Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson.

Today, the company is one of the world's leading service providers in e-commerce payments.

It began with buying a book at school when Sebastian Siemiatkowski borrowed money from his father with a promise to pay back when he sold the book.

But the book was not sold, so Siemiatkowski had to borrow more money from his father for the next book.

When the third book was bought, he decided it would be easier to borrow money from him in advance.

The interest was high, and Siemiatkowski realized he could build a business on lending to friends, which turned out to be a success.

The next step was to think about how he could grow the business, and when Siemiatkowski bought his first mp3-player, he saw the opportunity to sell music over the internet. But it would only be possible to get paid when someone bought their first song, which was not worth the risk. Instead, he decided to offer consumers to buy their first song for free, and if they liked it, they would be offered more songs. If they didn't like any song, they would not be charged.

The idea was implemented at the ISP Blix in 2000, where Siemiatkowski was working. But he soon realized that it would be better to set up his own company, so Klarna was founded.

In the first year, Siemiatkowski worked at Blix during the day and built Klarna in his spare time, early in the morning and late at night.

When Klarna was founded in 2005, payments were made by sending invoices to customers after delivering their products. The founders wanted to make online shopping easier and safer for consumers.

The Big Milestone...

In 2008 Klarna got a lot of attention after it was valued at more than 200 million US dollars. The same year, it began its international expansion by opening an office in London.

In 2009, the company launched Klarna Checkout, making online shopping even more straightforward. This service has since been used by millions of consumers worldwide.

In 2012, Klarna took its first step into the largest e-commerce market in Scandinavia by acquiring the Norwegian payment company Min Elleve, which today operates under Klarna Norge.

A year later, it acquired the UK payment company Direct Credit and rebranded the service to Klarna Checkout.

In 2015, Klarna decided to expand its service to offer a complete e-commerce payment solution called integrated payments. The solution enables merchants to accept Klarna credit, e.g., PayPal, Apple Pay, and Android Pay, in one checkout lane.

The year after, Klarna acquired the San Francisco-based company Epishopper.

In 2017, Klarna announced plans to establish an office in New York. The company also acquired the German startup Paymorrow, offering merchant financing to online sellers.

The present-day scenario: - Klarna is one of the world's leading service providers in online shopping, and it offers integrated payment solutions to over 180,000 merchants in 18 countries.

In addition to the internet, Klarna has been active in the stock market since 2013 and is listed on the Nasdaq Stockholm with the ticker symbol KAR.

Klarna Funding Rounds

First Funding Round in 2005

The company's first funding round took place in November 2005, when the founders raised 10M SEK from VC firm Northzone Ventures for a 30% stake.

In 2012, the company generated USD 1B in payment transactions. In the same year, it received a 500M SEK investment from Vostok NAFTA, a Russian investment bank. Later, the company raised another USD 112M in funding from Vostok NAFTA in 2013.

Second Funding Round in 2014

To boost growth, Klarna raised USD 360M of funding in September 2014. The round was led by DST Global, a venture capital firm founded by the Russian billionaire Yuri Milner, and San Francisco-based Dragoneer Investment Group also participated in the round.

The company announced the following month that one of its shareholders had invested another USD 80M to put its total funding at USD 440M.

Third Funding Round in 2017

In May 2017, the company announced it had raised USD 400M in a round led by General Atlantic. The financing was reportedly one of the largest ever to an online finance firm and gave Klarna a valuation of USD 2.5B.

A total of five investors took part in the round, including Dragoneer Investment Group.

Moreover, Klarna raised USD 313M in debt financing from eight major international banks.

Click here to explore the world's largest collection of Pitch Decks!

Klarna's Original Pitch Deck

We will look at an original pitch deck template that helped them raise millions of dollars. Let's dive in:-

Slide:1 The Title Slide

The Title, First, or Cover Slide always creates the first and last impression. And, Klarna lends a power-punch here with a cover slide that syncs with their overall brand identity.

First, there is one high-quality image that relates to the world of Fintech.

The agenda of this presentation is mentioned with a clear font and color scheme to avoid any confusion.

The founder's name on the right-hand side adds authenticity to this presentation.

Slide:2 Table of Contents

Coming onto the next slide, we have the Table of Contents.

The Table of Contents slide in the original Klarna's deck is straightforward.

The topics in discussion throughout the presentation were presented as a listicle with an easy-to-read font.

Klarna's Table of Contents helps the audience stay oriented within the pitch deck.

Slide 3: Shopping Today- Simple and Safe

The slide in Klarna's investor deck intended to demonstrate that it is convenient and safe to shop offline from a local brick-and-mortar store or a large shopping mall.

The image of a woman selecting the perfect dress from a physical store's collection throws weight behind the substantial statement that offline shopping delivers the ultimate experience.

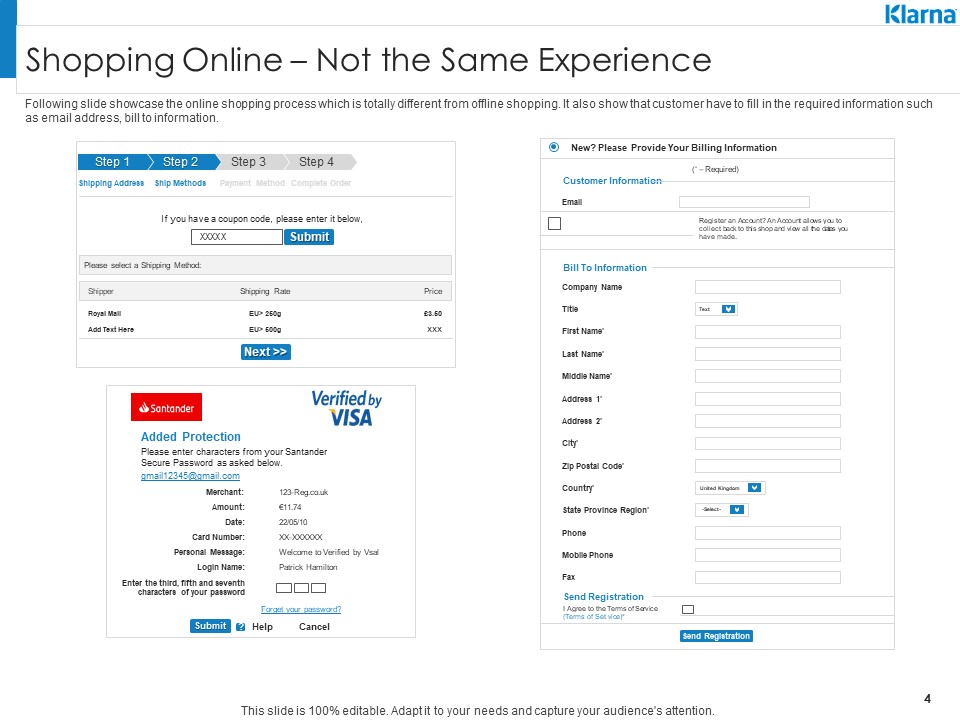

Slide 4: Shop Online - Not the Same Experience

Taking from the previous slide, this one illustrates that online shopping is baffling.

Here, a customer has to sign-up, provide personal information, and make the payment with no surety of data protection.

The slide visually explains this problem through images that even a layperson with no fintech knowledge can quickly interpret.

Slide 5: How Do Customers Want to Pay Online?

As the name suggests, this slide puts forth stats regarding the preferable mode of payment for customers online.

There is one bar graph that compares the popular preferred payment methods.

The Invoice After Deliver is the most opted payment method by customers while shopping online, the second is PayPal, and then comes other options such as credit and debit cards.

The Key Takeaways on the right-hand side summarize the data represented in the graph.

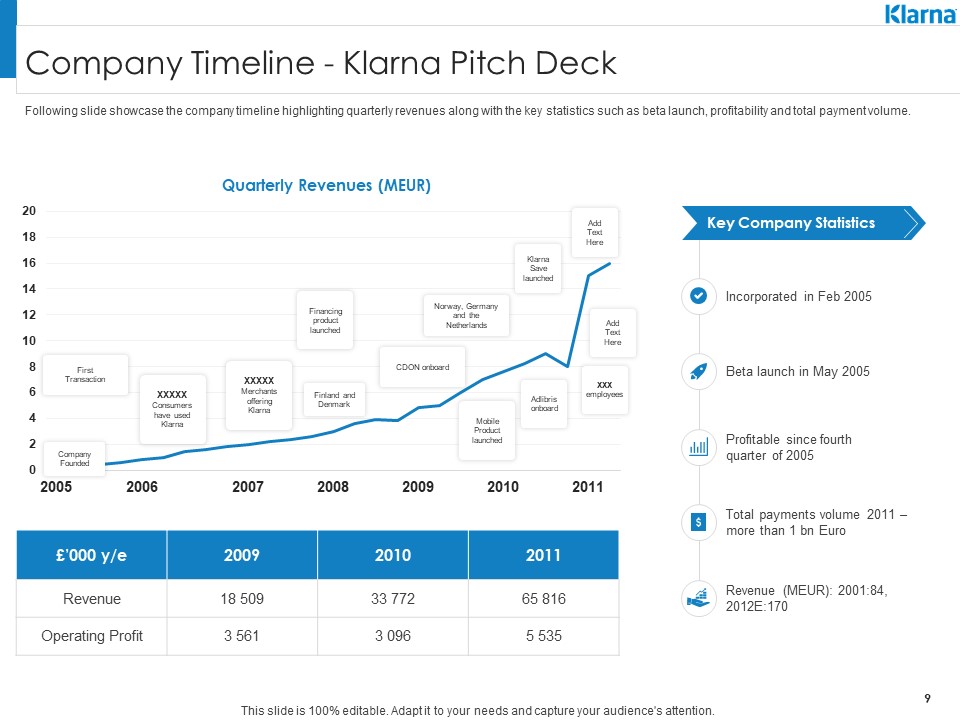

Slide 6: The Company Timeline - Klarna Pitch Deck

The slide uses a graphical format to exhibit the company's growth with statics such as Beta Launch, Profitability, and Total Payment Volume.

The table at the bottom end of the slide shows how tremendously the revenue has increased with each passing fiscal year.

Let's Wind Up

Klarna, a Swedish fintech company that renders an online payment solution for both consumers and retailers, is one of the fastest-growing companies in Europe. They were able to raise USD 400M from its third fundraising round, and their pitch deck played a vital role. Download the original PPT now at Slideteam.

Call Us at 408-659-4170 or Inbox Your Query at [email protected] - You'll Receive a Quick response.

Download the free Klarna Original Pitch Deck Template PDF.

Click here to explore the world's largest collection of Pitch Decks!

![The Story of Fintech Giant, Klarna and Reviewing Its Original Pitch Deck [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/01/Banner_design_190b-1013x441.png)

Customer Reviews

Customer Reviews