Remember the scene of the “Everyone and their brother” episode of 9-1-1 Lone Star (An American procedural drama TV series), where two boys step into a farmer’s field full of landmines and get stuck there? Later Owen and TK risk their life by jumping through that minefield and reaching the victims, especially to save the elder and the injured brother. It is one of the best scenes in the whole series. That’s what business is, and just like Owen and TK, business people risk their fortune, investment, resources, and image daily. In fact, we can say that ‘risk’ is an emblematic word for ‘business.’ Although risks are inevitable in business transactions and activities, a business person tries to avoid or minimize the risk. One such risk detection and mitigation tool or technique in business is — The risk Governance Framework.

What Is A Risk Governance Framework

A risk governance framework is a set of guidelines and procedures that an organization uses to identify, assess, and manage risks. It helps in consistent and effective risk identification and management across the organization. The framework outlines the roles and responsibilities of individuals, groups, levels, teams, and departments. It also includes the processes and tools used to determine, evaluate, and mitigate threats.

The governance framework specifies the criteria for prioritizing risks and the methods to communicate and report on risk management activities. It is an essential tool for businesses that helps protect their assets, reputation, and stakeholders.

Elements of Risk Governance Framework

Critical elements of a risk governance framework are:

- Risk appetite: This is the level of risk the organization is willing to take in pursuit of its objectives. It should be defined and communicated to all stakeholders.

- Risk identification: This includes identifying and maintaining a catalog of risks that the organization is susceptible to. Methods like brainstorming sessions, risk assessments, and stakeholder consultations work here.

- Risk assessment: Evaluate the likelihood and impact of identified risks. It includes an analysis of the potential consequences of the risk and its probability check.

- Risk management: It involves implementing controls and procedures for identified risk mitigation. Executing risk treatment plans, transferring risk through insurance or other means, and monitoring and reviewing risk management activities are undertaken here.

- Risk communication and reporting: This includes preparing risk reports for management and communicating risk information to employees and stakeholders.

- Risk culture: Refers to the values, attitudes, and behaviors that support effective risk management within the organization. It should be promoted and reinforced.

Risk Governance Framework Templates

Governance frameworks hold great importance for businesses as they ensure the safety of data, assets, workforce, and organization. Their drafting must be detailed and error-free, and omitting a single element is unacceptable. Our pre-designed risk governance framework templates help you design a threat management system with no room for error. These PPT Templates are easy-to-customize for your framework requirements.

Let’s explore these presentation layouts and prepare a comprehensive risk governance framework!

Bonus: Risk Assessment and Mitigation Plan Presentation Deck

This presentation deck will help you deal with uncertainties related to your business operations and transactions. It will help you identify risk, track it, develop mitigation techniques, the response matrix, and conduct an assessment. You will find the essential risk management plan and register components like risk type, outcome, treatment, description, contingency plan, etc., enclosed in this PPT Set. Get this PowerPoint Deck to give a graphical presentation of risk management and response to your team.

1. Operational Risk Management Governance Framework Template

Operations refer to daily business core activities required for keeping it running. It includes an extended range of activities, from product development to supply chain management. There is always some risk associated with these sensitive activities. This template will provide you with an operational risk governance framework that reflects indicators, risk & control assessments, along with action plans and reporting. Get it now!

2. Risk Governance Framework Template for Operations Management

Operations have multiple risks associated with material procurement risks, machinery/tools risks, supply chain management risks, etc. These threats have a significant impact on organizational finance, product development, distribution, and revenue. Use this template to create a governance framework for effective operational risk management and mitigation. It monitors internal and external data loss, risk & control assessment, scenario analysis, and key operational risk indicators. Get it now!

3. Digital Business Risk Governance Framework Template

Whether it is transforming your regular offline trade to e-commerce or running a well-established HTTPS-secured website, there is always a high-level risk associated with digital assets. These cybersecurity risks include server crashing, hacker attacks, data theft/leakage, information protection, etc. With this template, create a risk governance structure that helps foresee threats and secure your digital business. It will help you form committees, assign roles and responsibilities for each department/team under committees, appoint responsible persons, and define functionality in risk governance. Get it now!

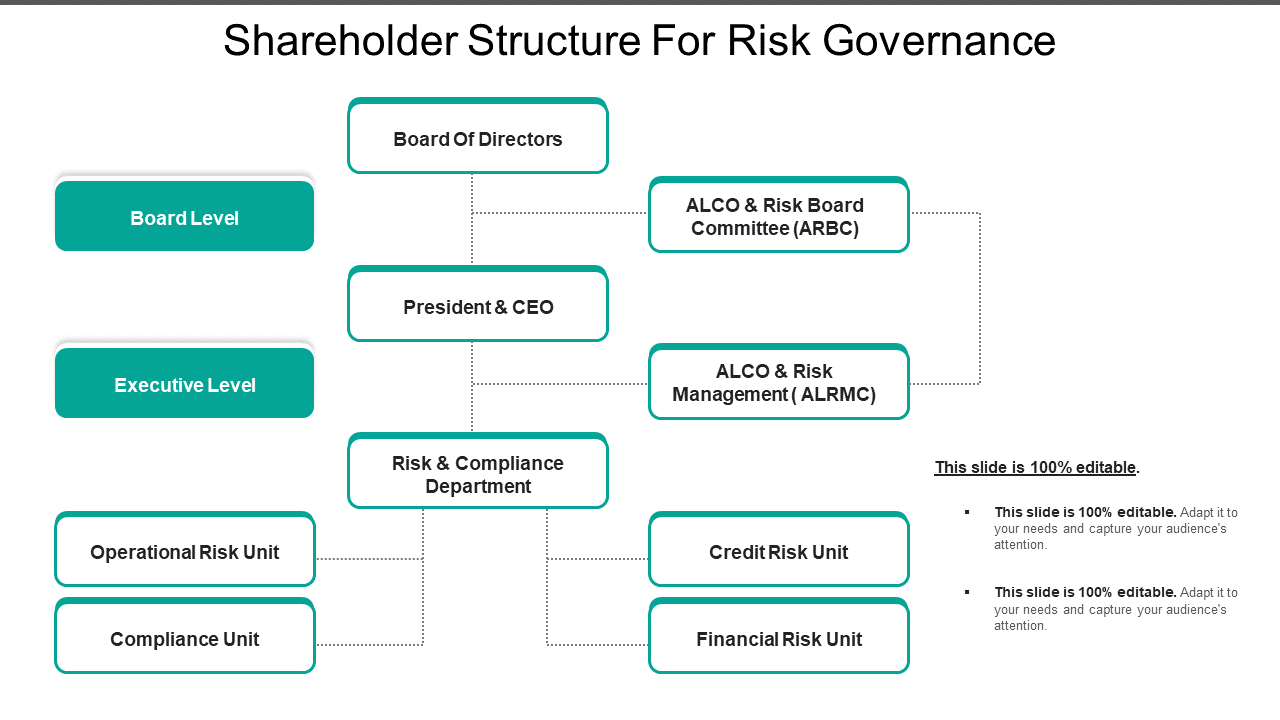

4. Risk Governance Structure Template for Organization Levels

Defining clear roles and responsibilities throughout the organization is required for effective risk management. This presentation template will help you design a governance structure calibrating organizational levels as one big risk management committee. At the top of the hierarchy, it had a board of directors, then presidents & CEOs at the board level, and the risk & compliance department (executive level). In the end, the hierarchy had an operational, credit, compliance, and financial risk unit. Grab it today!

5. Information Risk Governance And Factor Analysis Template for IT

Data protection and information management are critical for IT and development firms. Identifying and neutralizing related risks is a crucial part of it. This template will help you analyze information risks with factor analysis and devise an actionable governance framework. Use this presentation template to present valuable insights, critical details, or steps to study and execute the risk governance framework. Download it now!

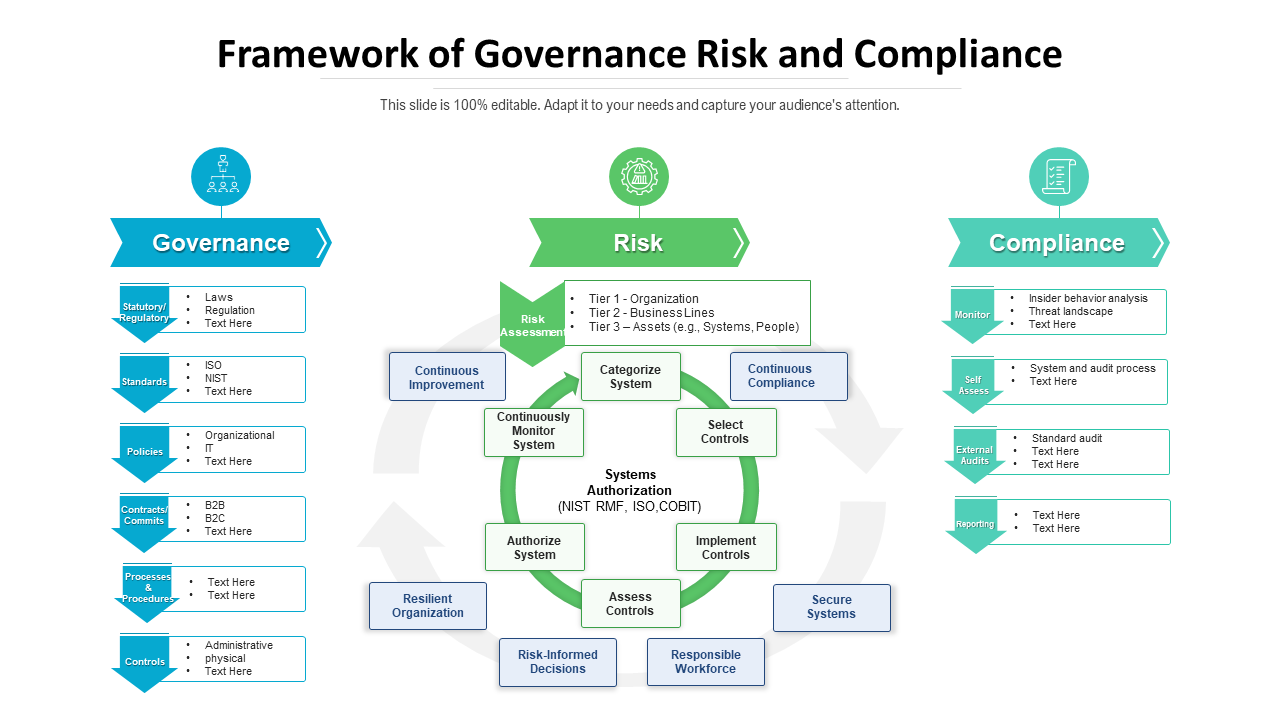

6. Risk Governance Framework Template With Compliance

This PPT Template is home to a three-level risk governance framework that will assist you in analyzing, managing, and regulating risk. These are:

- Governance level: Policies, standard protocols, processes & procedures, and controls to avoid the risk.

- Risk assessment and governance implementation to improve the organization’s risk appetite and make risk-informed decisions.

- Compliance: Long-term practices and procedures are defined to monitor, assess, audit (internal & external), and report risk.

Grab this presentation design today to develop a complaint risk governance framework!

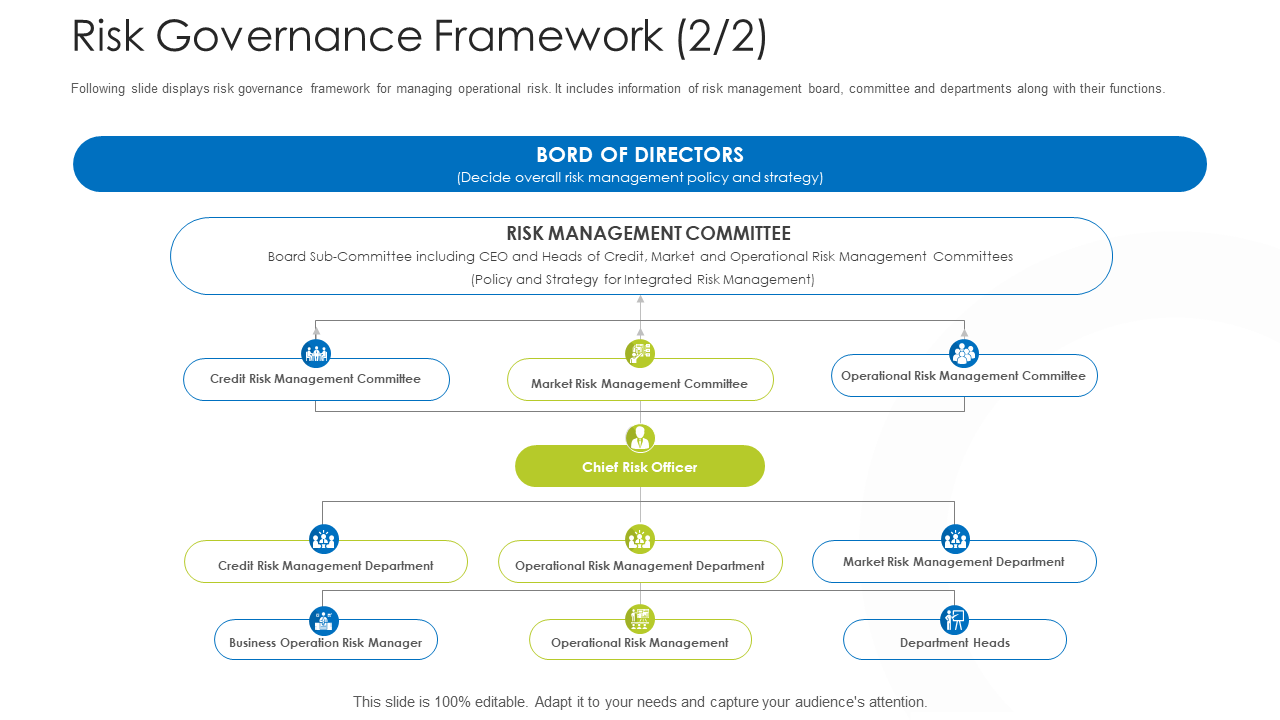

7. Organizational Risk Governance Framework Presentation Template

With this risk governance framework template, you can form responsible committees to manage, audit, control risk, and develop mitigation strategies. It enables you to put departments and higher management personnel in a reporting line with these committees to ease the process. Use this presentation layout to form a risk governance organization hierarchy for effective management.

8. Risk Governance Framework PPT Presentation Template

This PowerPoint Set will help you define roles & responsibilities, members, and divisions of the risk management committee. The framework recommends appointing a chief risk officer to smooth the information-sharing and reporting process between risk committees and departments. A responsible person like the department head at the end of the hierarchy for help in rigorous risk management. Get it now!

9. Risk Governance Framework Template With Communication Aspects

Use this template to show your team how risk governance is a continuous process. Present the four levels of governance — pre-assessment, appraisal, characterization & evaluation, and management with this PPT Layout. You can also add sub-levels, detailed steps, insights, and procedures of these risk governance and cost-cutting communication aspects. Get it now!

10. One-page Risk Governance Framework Template

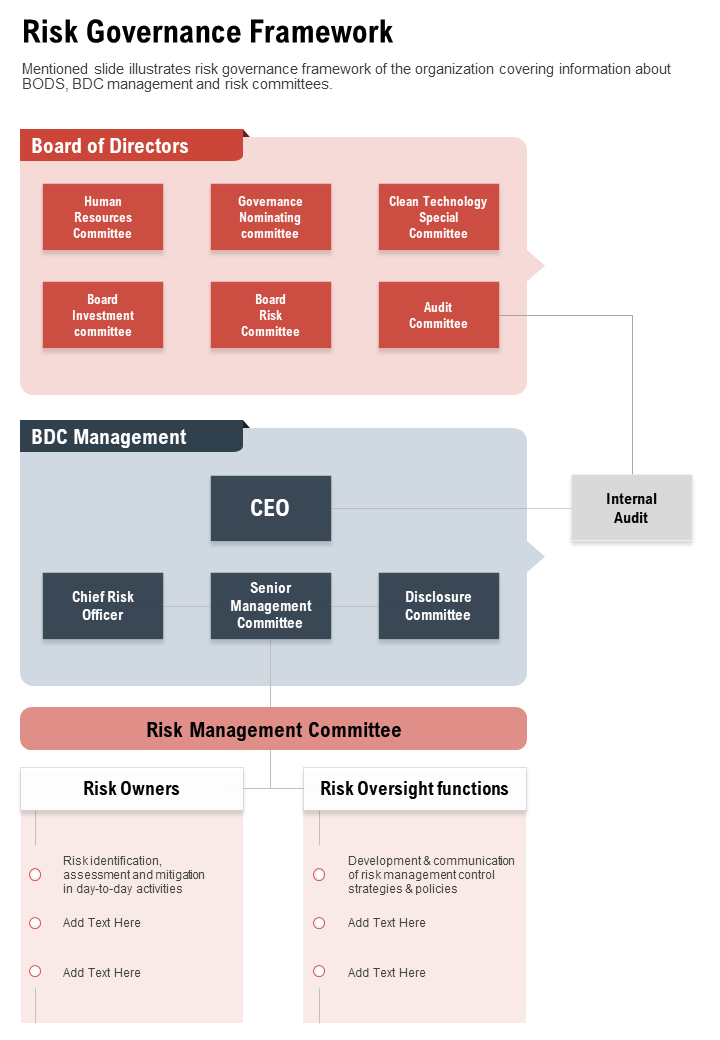

This one-pager presentation template is an ideal presentation of a compact risk governance framework. It exhibits the roles and responsibilities of the board of directors, the BDC management, and the risk management committee in a clear and concise manner. Use this presentation template to showcase the three things that matter in a risk governance framework. One is the risk owners or people who have dealt with and take responsibility for safeguarding your organization against the risk and the root cause of the risk. Finally, also use this one-pager to highlight the precautions the organization has to take to deal with the threat or limit its adverse impact. Download now!

Few Last Words!

Risk governance is the process by which an organization manages and controls the risks it faces. An organization puts this framework in place to manage and control risks. It is an essential component of effective risk management, as it ensures risks are identified, assessed, and worked on in a consistent and systematic way. Our risk governance framework templates will help businesses develop a robust threat mitigation system. These presentation designs support 100% customization and data and risk management software, tools, and techniques.

Download your favorite risk governance framework templates with a few clicks and secure your business from being ambushed!

FAQs on Risk Governance Framework Templates

1. What is the risk governance process?

Risk governance is the process of managing and controlling risks that an organization faces. It involves establishing a set of rules, procedures, and strategies to identify, assess, and address potential or emerging risks in a consistent and systematic way.

2. What are the key components of risk governance?

The key components of risk governance include but are not limited to the following:

- Policies and procedures: These outline the organization’s approach to risk management, including its risk appetite, tolerance, and management philosophy.

- Risk identification and assessment: It involves determining and evaluating the risks that the organization faces, including the frequency of occurrence and possible loss or damage.

- Risk treatment: Strategy development and implementation to manage and control risks, including risk mitigation, transfer, and acceptance.

- Risk monitoring: Regular review and monitoring of the effectiveness of the organization’s risk management strategies and making necessary adjustments.

- Communication and reporting: Effectively communicate information about risks and risk management throughout the organization and to stakeholders like the board of directors, management, and employees.

- Risk culture: It refers to the attitudes, beliefs, and behaviors that relate to risk management in an organization. A positive risk-cultured organization identifies and manages risks proactively. These organizations are willing to challenge the status quo with new approaches to risk management.

3. What are the 5 steps in the risk governance framework?

Risk governance is a continuous process, but with the following five broad steps:

- Identify risks: Recognize potential risks, their chances or frequency of occurrence, and their impacts by conducting a risk assessment.

- Assess risks: Evaluate and prioritize the identified risks based on their possibility and potential impact.

- Develop risk management strategies: Devise strategies to manage, control, or minimize the identified risks or impact,

- Implement risk management strategies: Putting risk management strategies in action, including necessary policies, procedures, controls, and compliance.

- Monitor and review: Keeping a bird-eye on the effectiveness of the strategies and making any required adjustments. Conducting additional risk assessments to identify new risks is part of this.

Customer Reviews

Customer Reviews

![Top 10 Risk Probability and Impact Matrix Templates to Assess Possible Threats [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/07/Top-10-Risk-Probability-and-Impact-Matrix-Templates_1-1013x441.png)

![Turn Operational Risk Management Into a Breeze, Enjoy the Ease It Brings [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/08/1013x441no-button-2-2-1013x441.jpg)