Parkinson’s law, named after its developer, Cyril Northcote Parkinson, has one financial administration corollary that says: “No matter how much money people earn, they tend to spend the entire amount and a little bit more besides. Their expenses rise in lockstep with their incomes (Oreilly).”

From individuals to businesses, everyone has the same story about expenses. Seven of 10 individuals and six of 10 businesses fail to manage these with any degree of success or rationality.

Not everyone is able to master the skill or art of expense management over time, but those who have, know the role of expense sheets in it.

What Are Expense Sheets

Expense sheets, also known as expense reports or reimbursement forms, are financial logs used to track and record expenses. These sheets contain critical information about the expense date, category (travel, meals, entertainment), purpose (business trip, client meeting), and the amount spent. With this valuable organization of information, expense sheets are useful documents for reimbursement, accounting, or tax purposes.

Expense sheets are tools with broad-spectrum applications. They are handy for an individual/employee, teams or even departments, and finally, organizations. Employees can secure reimbursement for expenditures made on behalf of their company using expense sheets. Businesses deploy these tools of financial propriety or correctness to track expenses and ensure compliance with internal accounting procedures and government regulations.

Get Organized With Expense Sheet Templates

Expense sheets are submitted on a regular basis, like monthly or quarterly, or on an as-needed basis. Many organizations have specific templates or formats for expense sheets to ensure consistency and accuracy in reporting. If you want an organized structure for your expense sheets or want to upgrade the existing or simply change it, then our expense sheet templates are the right choice.

These content-ready presentation slides give you the much-needed structure to create professional and easy-to-handle sheets. The 100% customizable nature of these PPT Templates provides you the desired flexibility to edit your creation.

Manage organizational expenses, from project to process, in an effective and efficient manner with these expense sheet designs!

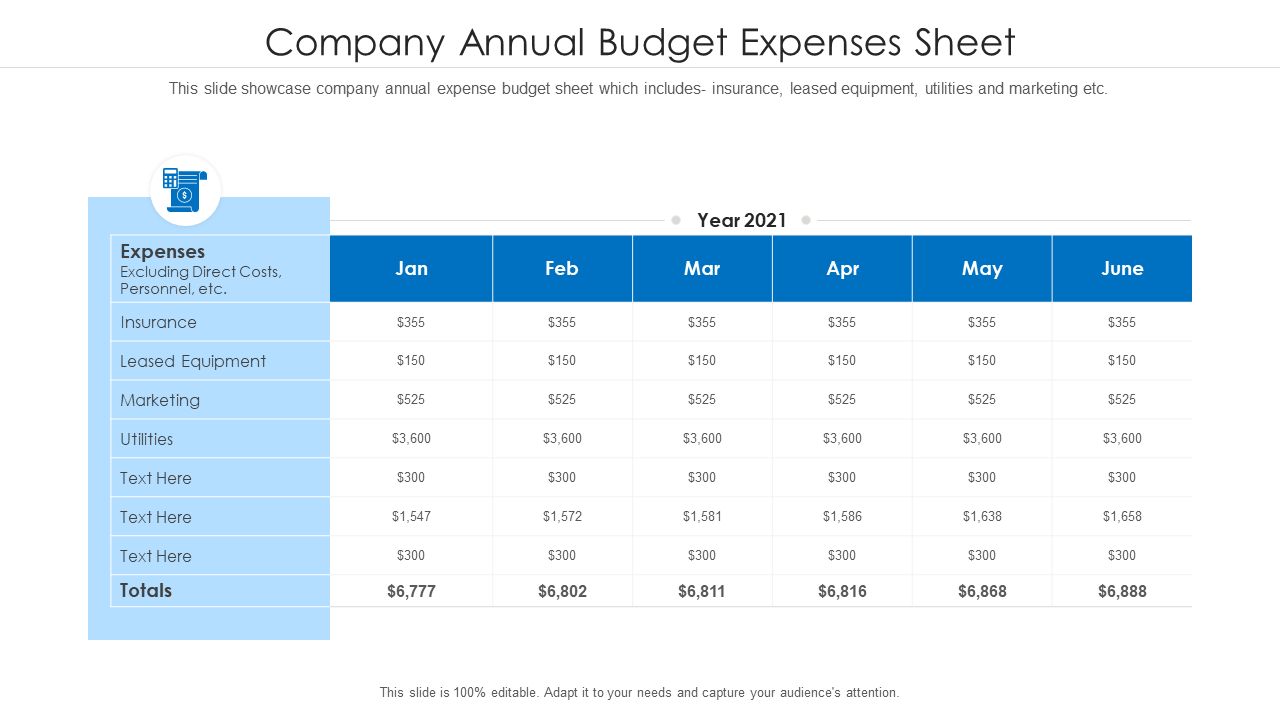

1. Company Annual Budget Expenses Sheet Template

Expense sheets provide a systematic way to track business expenses that individuals or teams incur over a given period. This presentation template will help organizations record and analyze monthly payments made on insurance, equipment lease, operations, marketing, etc. It also provides a professional and neat structure to share yearly data with management. Download it now!

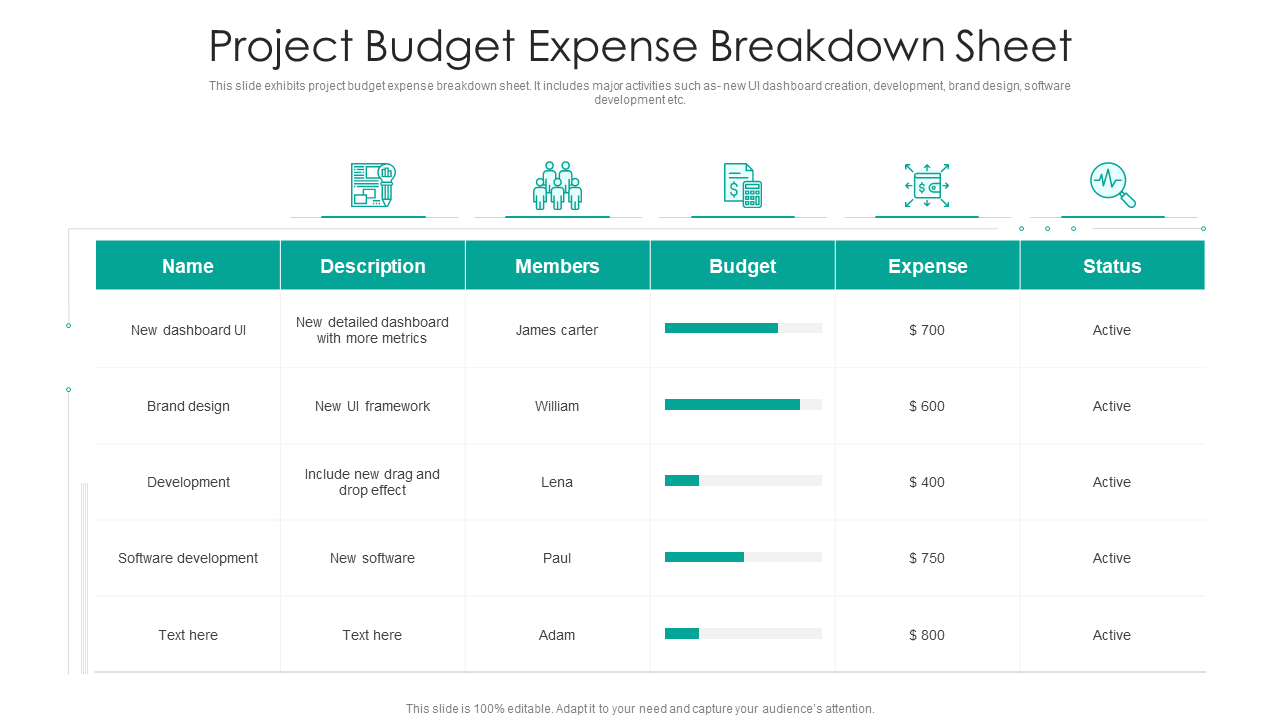

2. Project Budget Expense Breakdown Sheet Template

Expense sheet data is critical to analyze spending patterns, identify areas where expenses can be curtailed, and ensure that spending is within budget. Use this all-inclusive presentation design to keep a record of your project expenses with information about the item name, description, members, the budget allocated, expense amount, and status. Get it now!

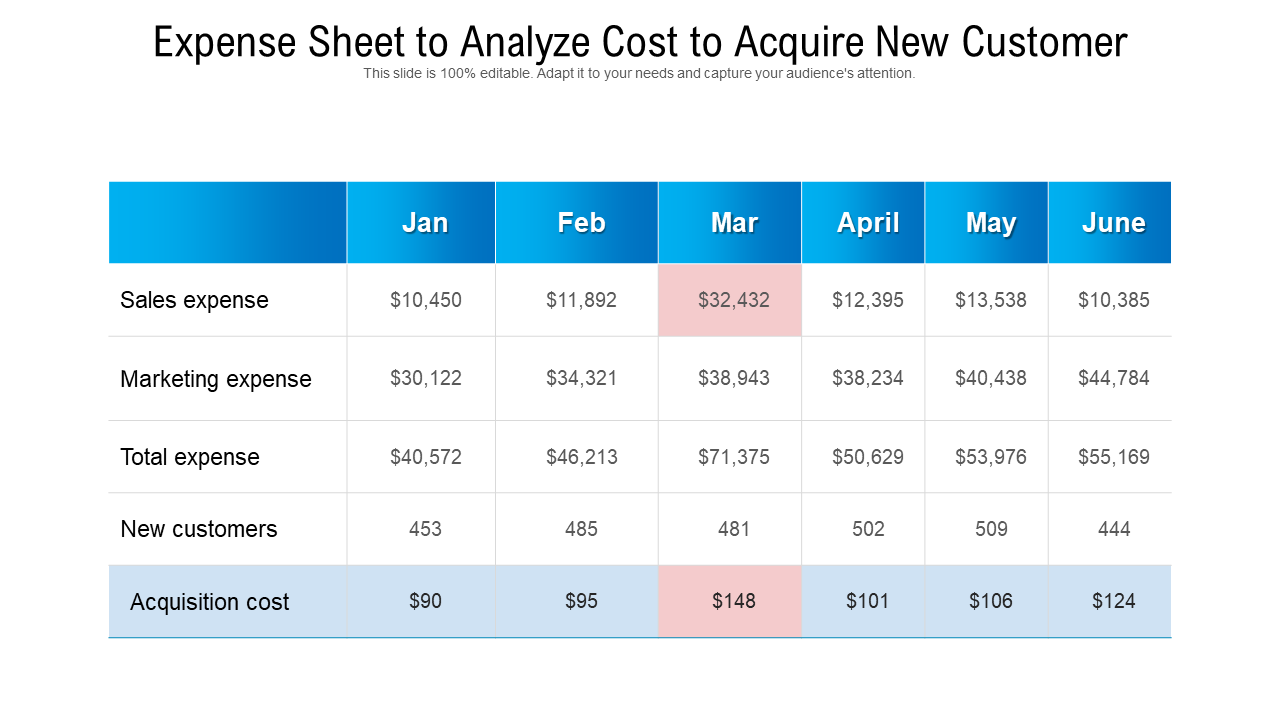

3. Expense Sheet to Analyze Customer Acquisition Cost

Expense sheets lay a strong foundation for businesses to design realistic budgets and ignore over-budgeting as well as overspending. Take advantage of this pre-built expense sheet template to monitor monthly levied costs for your business to acquire new customers. It will help you gain valuable insights into sales and marketing expense trends, with customers acquired each month mapped against spending. Grab it today!

4. Expense Tracking Sheet For Effective Material Planning

Looking for an expense sheet to record your real estate/construction project cost and ease your material planning process? Then this ready-to-use PPT Design is for you. With this customizable presentation template, enlist construction elements information like cement, bricks, stones, grass, paint, etc. It will help you record details of each element like units per square, cost of units per square, total cost, estimated budget, and under/over. Download it now!

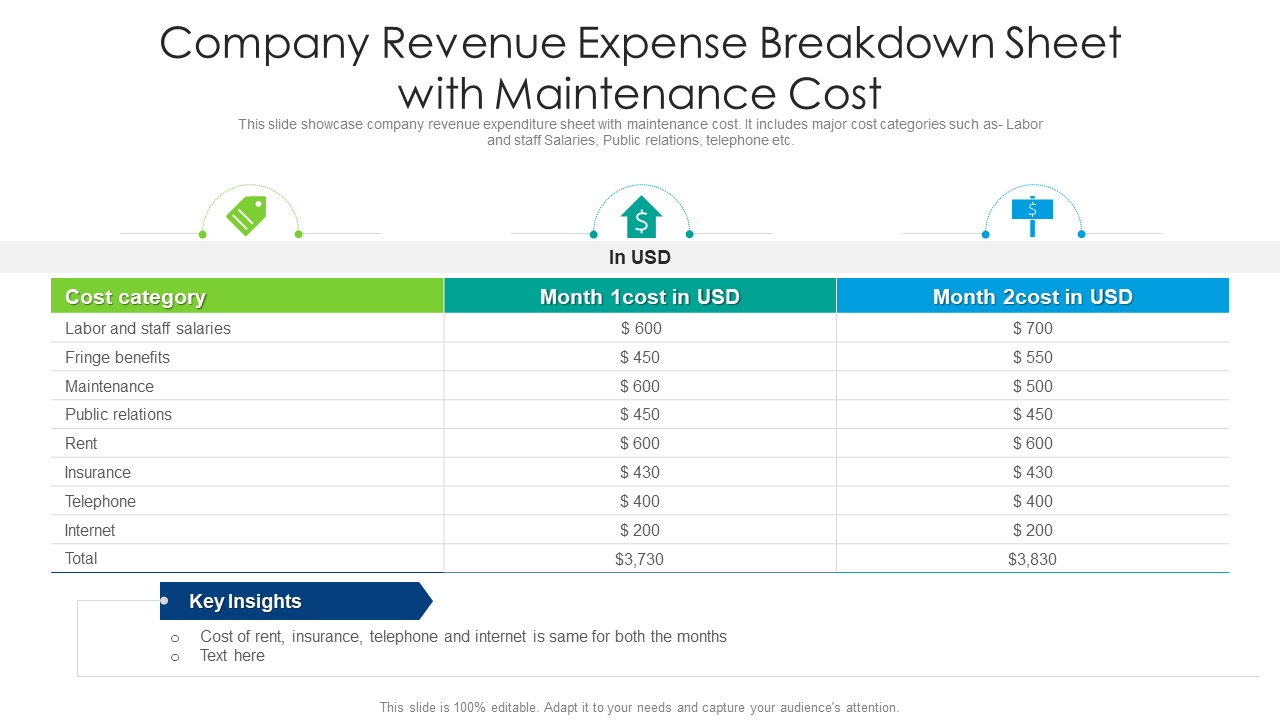

5. Company Revenue Expense Breakdown Sheet Template

Present your business expenditure in an easy-to-understand manner with the help of this comprehensive revenue expense breakdown sheet template. It has three pre-designed spacious columns earmarked for cost category and two months’ cost for easy comparison. It also has ample space to write insights harvested from the data. Get it now!

6. One-page Product Expense Sheet Presentation Template

Products are the backbone of businesses and revenue generators, but these also drain the budget. Organizations can run dry if product development costs are not monitored and controlled strategically. This one-page expense sheet will help you track product expenses and make informed decisions about investments. It comes with columns for exhibiting detailed product costing, raw material consumption norms, product cost tracker, and one-year forecasting of the cost of goods. Grab it today!

7. One-page Retail Sales Expense Sheet Presentation Template

This presentation slide is prepared with extensive research to meet the financial tracking needs of retail businesses. It will help you present category-wise expenses, sales promotion expenditure, and its comparison with other years using well-structured tables and bar charts. Download it now!

Down To Every Penny!

Expense sheets back up major financial and investment decisions of businesses. These create a robust system to track expenses, highlight spending patterns, and help control or eliminate extra costs. With expense sheets, organizations can write accurate and practical budgets and financial reports.

Our ready-to-use expense sheet templates create perfect easy-to-read records of your personal or business finances. These PPT Slides have all the bases covered, as well as essential elements, with pre-designed spaces to record them with ease.

Download these user-friendly expense sheet templates to make financial tracking effortless for your organization!

FAQs on Expense Sheet

1. How do you make an expense sheet?

Each organization has its policies and procedures for documenting finances, which it follows down to the last detail while creating an expense sheet. The basic process remains the same for creating expense sheets:

- Determine the purpose: Whether it is for tracking your personal or business expenses.

- Create a spreadsheet: Use a spreadsheet program or software like Microsoft Excel or Google Sheets, or choose one of our expert-designed, ready-to-use expense sheet templates to create a new spreadsheet.

- Set up the layout: The spreadsheet must have columns for information: date, description, category, payment method, amount, and other required information.

- Add categories: Create a list of customized categories (based on your specific needs) that you will use to track your expenses, like travel expenses, office supplies, meals, entertainment, etc.

- Add entries: Start adding entries to the sheet as you incur expenses. Fill in the details required in pre-designed columns with a brief description of the expense, the category it falls under, the payment method used, and the amount spent.

- Review and analyze: Evaluate the expense sheet to understand your spending patterns, identify areas to reduce expenses, and spend within budget.

2. What is required on an expense report?

The requirements vary depending on the organization’s policies and procedures. It is important to follow these guidelines to ensure that the account is complete and accurate and to avoid any delays or issues with reimbursement. In general, an expense report includes the following:

- The list of expenses incurred in the reporting period, including the date, the purpose, and the amount spent.

- Name of the person and details of the reporting period or the event for which expenses were made.

- The category of each expense, such as travel, meals and entertainment, office supplies, etc.

- The payment method — whether cash, a credit card, UPIs, a mix of payment methods, etc.

- Relevant receipts or documentation that supports the expenses claimed.

- A total amount of all expenses incurred during the period covered by the report.

- Any other information required by the organization’s expense policy or guidelines.

3. What are the 4 types of expenses?

Understanding the types of business expenses is essential for budgeting, forecasting, and financial planning. Classifying expenses into these categories helps businesses better manage their cash flow, identify areas for cost reduction, and make strategic decisions about investment and growth. The four types of business expenses are:

- Fixed Expenses: Regardless of the volume of business or sales, they remain the same, like rent, salaries, insurance, and loan payments.

- Variable Expenses: These vary based on the business or sales volume, such as the materials costs or supplies needed to produce a product or service, commissions, and shipping costs.

- Semi-Variable Expenses: These are expenses with a fixed and a variable component, like utility bills that have a fixed monthly charge, but the actual cost varies based on usage.

- Capital Expenses: Expenditures made for long-term asset investments, such as equipment or property, will benefit a business over the years.

Customer Reviews

Customer Reviews