“A budget is telling your money where to go, instead of wondering where it went.”– Dave Ramsey, one of America's most trusted financial advisors.

Tracking company’s internal expenses, with methodical accuracy, is an essential skill that entrepreneurs who want make the most of their money have to master. A cost-effective budgeting requires number crunching, attention to detail, and making informed judgments regarding resource allocation—but the work is well worth it. You can control costs, minimize overspending, and achieve financial goals if you create and stick to a budget.

This is an ongoing process and a vital practice that most firms need to pay greater attention to. It also helps businesses prepare for unexpected expenses or financial crises. Failure to budget properly can have a significant impact on your bottom line and a possible threat to the future of your business.

To help you create low-cost budget, SlideTeam offers Business Budget Templates suitable for any organization - from startup companies to established enterprises.

This blog gives you valuable resources in the form of Top 10 Business Budget Templates to assist you in forecasting cash flow, identifying functional areas that require development, and running your operations in an efficient manner.

Fill in the blanks with projected revenues and any recurrent or anticipated business expenses, and you’ll have your financial roadmap set. Revisit and rework this business budget on a monthly, quarterly, or annual basis to help you meet your objectives, and see where you are going.

Check out our pre-designed startup business plan templates to help you create one for your business.

Download these well researched, 100% editable, and vivid PPT Templates that best suit your needs, and get started on strategy that leads to financial success.

Lay the groundwork for financial literacy and examine your budget to see if it's time to move your firm forward with SlideTeam's top-notch PPTs.

Template 1: Business Budgeting PPT

Use our content-ready Business Budgeting PPT Deck to translate defined resource requirements (amount of capital, amount of material, and number of personnel) into time-phased goals and milestones and make wise financial decisions. This PowerPoint Presentation is an excellent tool for budget forecasting and projection, as it shows how close projections were to actual spend. With the help of this aesthetically stunning PowerPoint Presentation, outline your organization's financial and operational goals. This template includes the important components for discussing actual cost vs. budget, month-by-month forecasting, overhead cost analysis, quarterly budget analysis, variance analysis, and so on. Reduce complexity by linking cost management activities to budgeting.

Template 2: Monthly Business Report Actual Budget Marketing Template

Compare actual costs vs budget to obtain a thorough analysis of variations to determine where you are fulfilling your financial planning objectives. Use this pre-designed PPT Template to create a Monthly Business Report that includes revenue, budget analysis, cash flow, and profit statistics. This deck is an excellent resource for reviewing and assessing your company's financial and operational performance on a monthly basis. Convey your important deliverables in a well-structured manner so that your management team can compare company's past and present performance and make informed business decisions.

Template 3: Effort Estimate Budgeting Upward Graph Template

Create a viable estimate by projecting the time, cost, and resources required to complete a project with this PowerPoint Template. Highlight fixed and variable expenses to give a more refined strategy to your team as you learn more about the project. This deck will assist you in becoming intimately acquainted with your team, deliverables, tasks, and process. With this download, you'll get a framework for precise cost estimation as well as direction for schedule development and control.

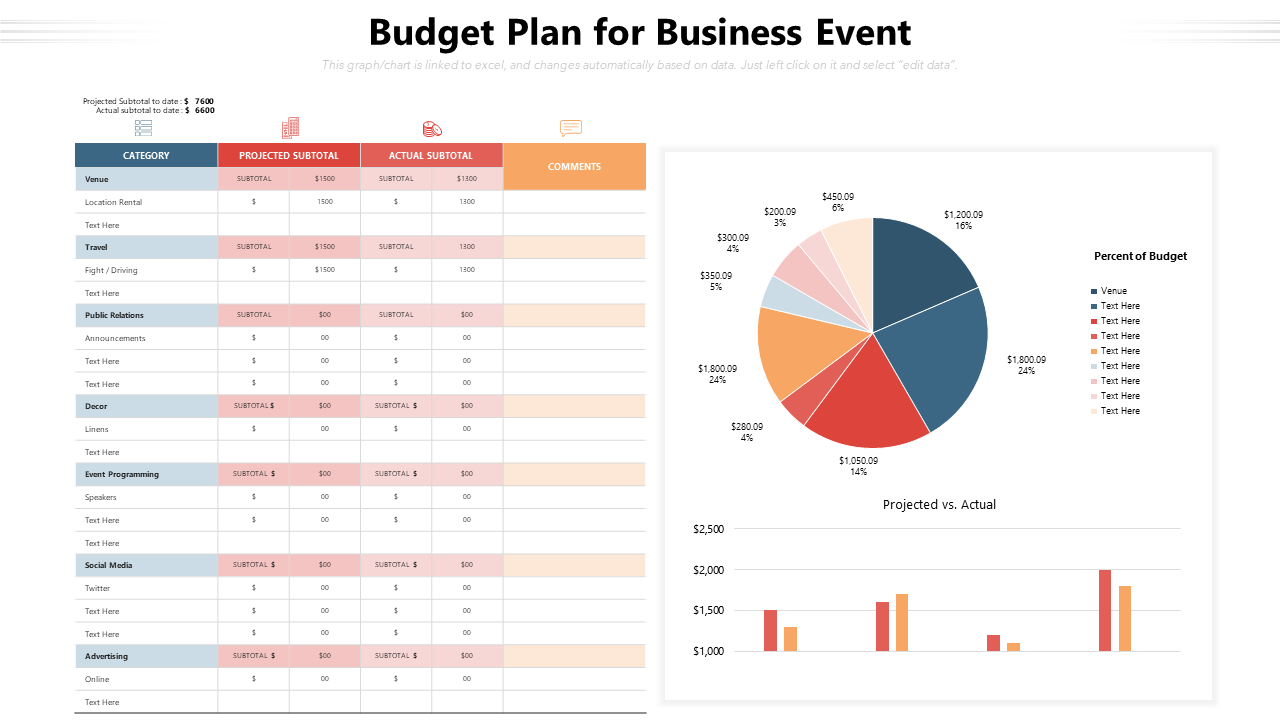

Template 4: Budget Plan for Business Event PPT

Make better use of your budget by using this professionally designed PPT Template to maximize the ROI of your event. The slide includes all of the relevant event budget expenses to track your expenses on the event day.. If you utilize our event budget template, you will be able to plan thoroughly and prepare for the unexpected. Schedule activities to save time and money so that you can use those extra resources to host a memorable event for your guests.

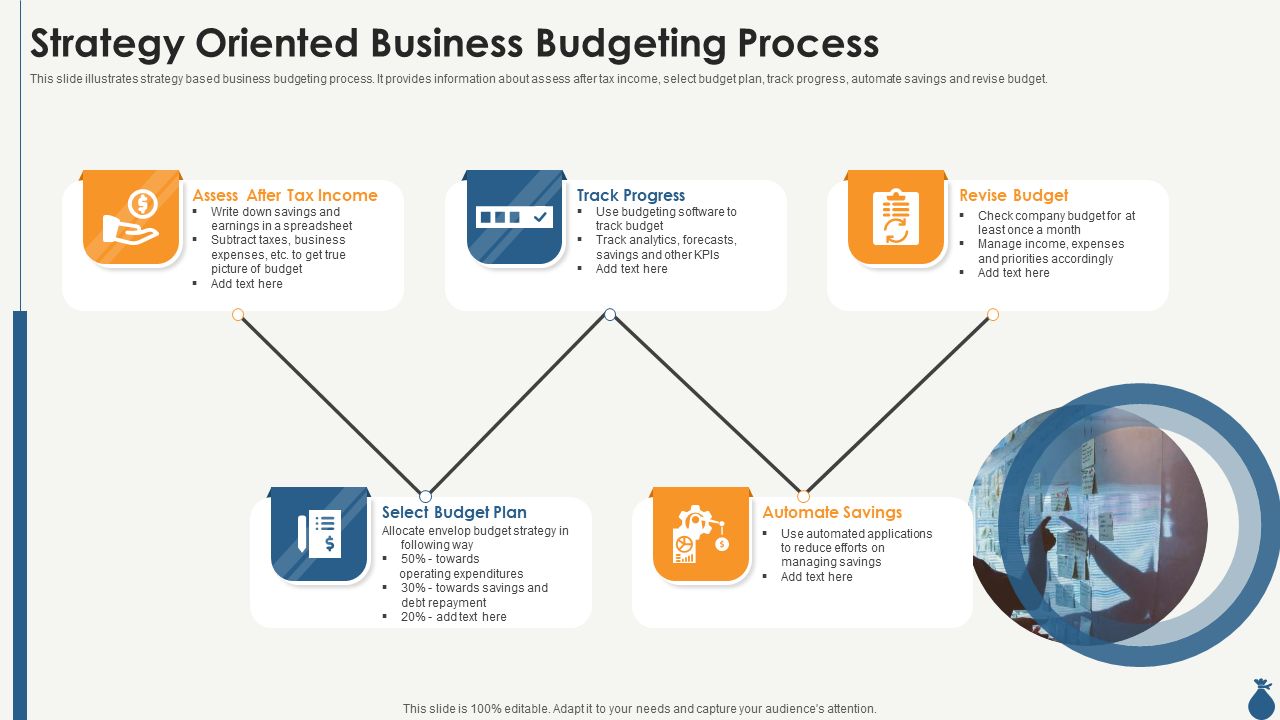

Template 5: Strategy Oriented Business Budgeting Process Template

The primary objective of budgeting is to assist execution by allocating resources to activities that add value. Use this pre-made PowerPoint Template to demonstrate a strategy-based business budgeting approach to develop a better way to forecast, plan, and distribute your funds. This budget analysis will provide an informative summary of processes such as after-tax income assessment, budget plan selection, tracking progress, automating savings, and budget revision to change the focus from the big picture to particular facts.

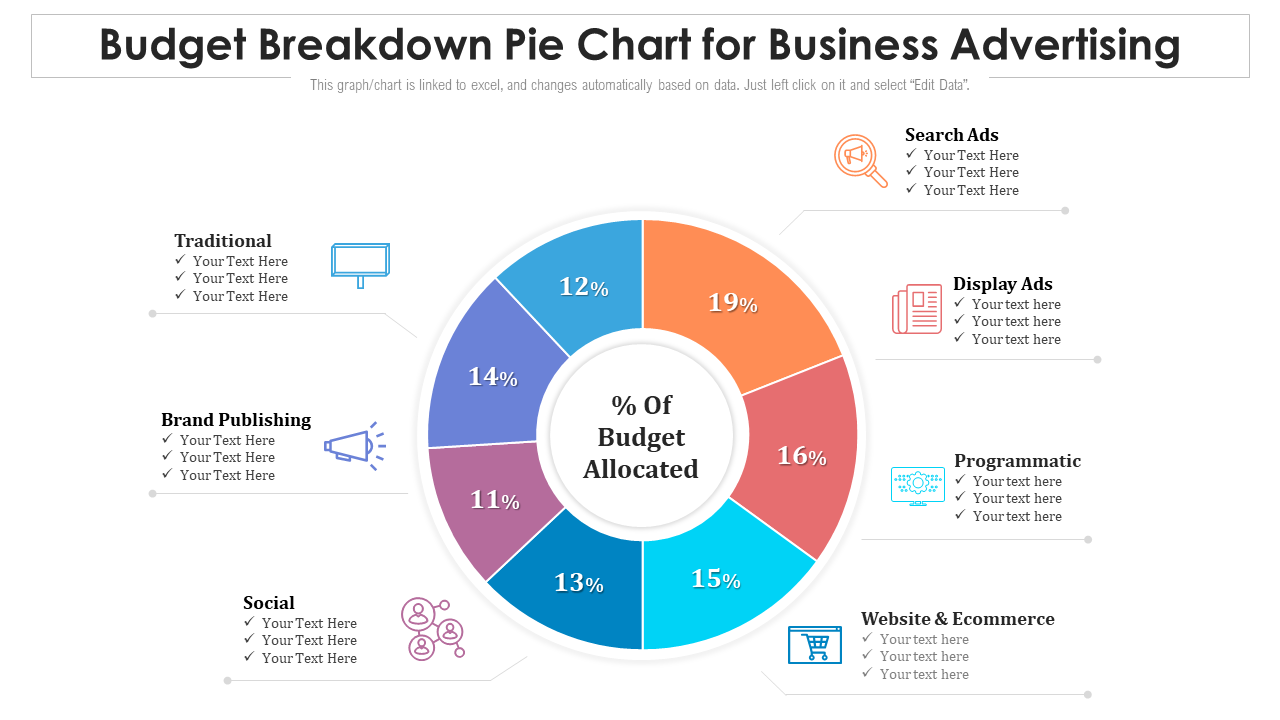

Template 6: Budget Breakdown Pie Chart for Business Advertising PPT

Our carefully designed PowerPoint Template will help you manage your complete marketing budget from beginning to end so you can make sound financial decisions. Monitor your monthly, quarterly, and annual expenses, as well as your cash flow across numerous marketing campaigns and techniques. Prepare a budget analysis by consolidating enormous amounts of data and presenting it visually. This budget plan allows you to categorize all of your marketing expenses. This pre-designed pie chart visualizes your budget for the year at the end of the plan.

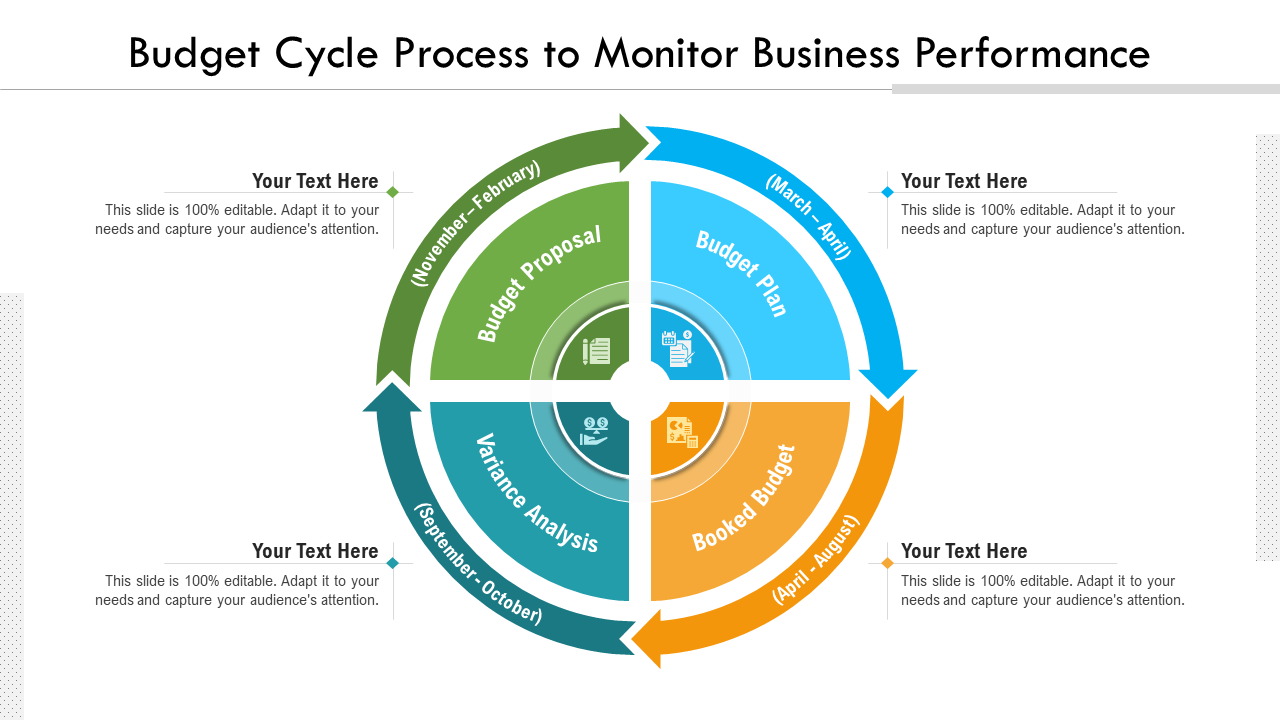

Template 7: Budget Cycle Process to Monitor Business Performance PPT

Use our professionally created PowerPoint Template to review previous budgets, identify and anticipate revenue for the coming quarter, and assign amounts to spend on a company's various costs. Add important deliverables such as Budget Plan, Booked Budget, Variance Analysis, and Budget Proposal to visually illustrate your budget full of statistics and data. As the year continues, use the slide to review, analyze, and change your spending.

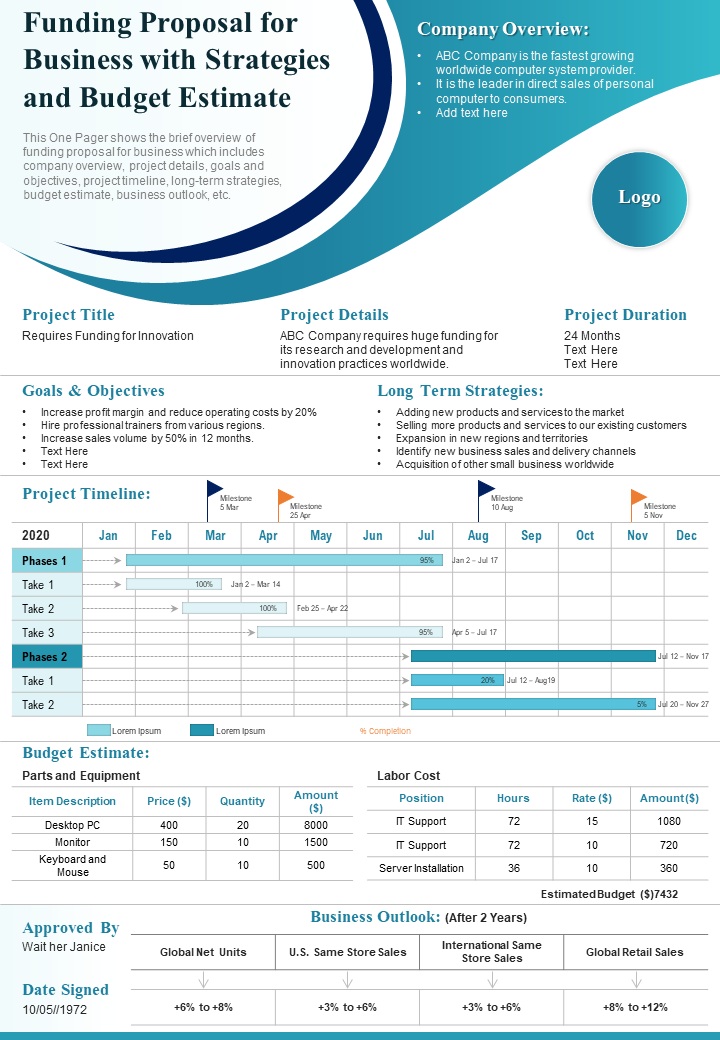

Template 8: Funding Proposal for Business with Strategies and Budget Estimate Report

Estimating the project's cost and allocation of funds can make or break the project. To raise funds from possible investors for your business ventures, use our one-pager template on Funding Proposal for Business. This persuasive financial proposal covers Revenues, Direct costs, Overhead costs, and Budget Analysis to provide a thorough picture of your project with the appropriate tactics and budget estimations. This resource funding proposal slide includes information on the firm overview, funding objectives, long-term plans, marketing plan, expected budget, project timeframe, and financial projections to assist you in developing an organizational financing strategy.

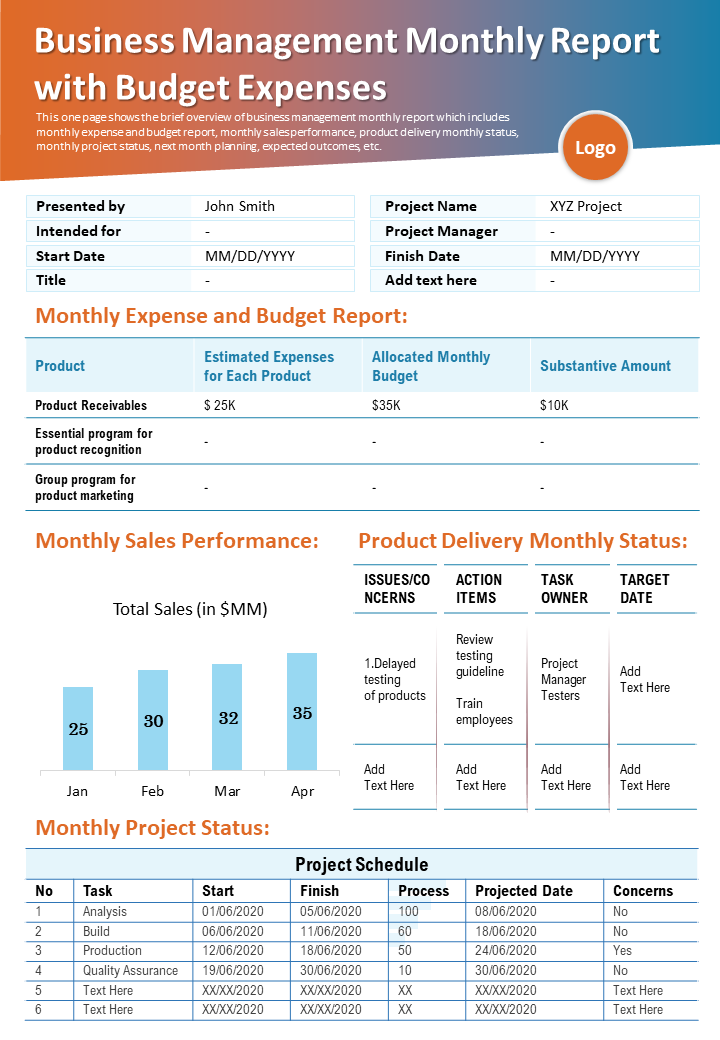

Template 9: Business Management Monthly Report with Budget Expenses

Strong financial capabilities are essential for a firm to succeed, thus managing your finances effectively is crucial. Use this pre-made one-pager to create regular and organized monthly management reports and prepare your monthly profit, revenue, and one-time expenses appraisal. This PowerPoint template provides crucial statistics that illustrate the monthly expense and budget report, monthly sales performance, product delivery monthly status, and monthly project status in an easy-to-understand format for your audience.

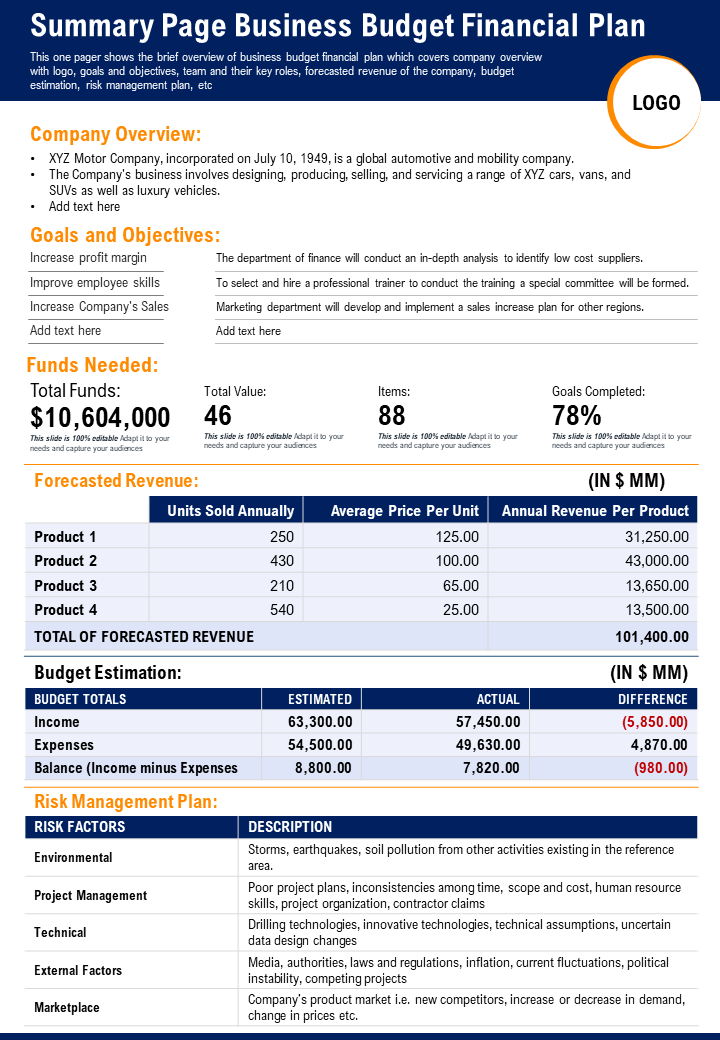

Template 10: Summary Page Business Budget Financial Plan PPT

To provide greater visibility into the company's financial performance, use this skillfully curated one-page summary report on Business Budget Financial Plan. This template is ideal for demonstrating Actual cost vs Budget, Budget forecasting and projection, Budget Analysis, Tax after income, One-time expenses, Cash flow, and other Variable expenses to help the firm grow and accomplish its goals. Companies can prevent going overboard on spending by keeping this handy as a reference.

Figures are a budget's "cornerstone."

Business fundamentally dictates that you must plan your spending before you can earn money. All businesses must forecast their sales and expenses to be profitable. By keeping a record of your estimated monthly company expenses, you may manage your finances and keep an eye on your regular expenses. The customizable PPT Templates from SlideTeam will provide you with an essential budgeting tool for forecasting revenues and expenses. This, in turn, will aid in the development of a financial model of how a corporation might perform if various tactics, events, and plans are implemented. Furthermore, it will allow the comparison of organization's actual financial performance with the predictions.

Explore our guide on strategic growth planning to schedule and track revenue growth in business.

PS: Check out our comprehensive Budget Proposal Templates deck, which covers every component of a successful proposal.

FAQs ON BUSINESS BUDGET

Why is a business budget important?

The process of creating a budget involves converting defined resource requirements—such as money, materials, and personnel—into time-phased objectives and benchmarks. This budget can act as a yardstick for setting up financial goals.

The knowledge of how much money you have, how much you have spent, and how much money you will need in the future will guide crucial business decisions such as lowering unnecessary spending, boosting employees, or purchasing new equipment. The following are some other crucial applications of budgets:

- To share plans with diverse managers of responsibility centers.

- To encourage managers to work hard to meet budgetary objectives.

- To assess management's performance.

- To make the performance of the business visible.

- To promote accountability.

What are the key components of a business budget?

A budget is a financial spending plan that forecasts revenue and costs for a given time period. The key components of business budget are:

a) Revenue projections: This is the amount of money you anticipate your company will make from the sale of goods and services. Estimated revenue consists of two major components: sales forecast and estimated cost of goods sold or services rendered.

b) Fixed cost: A fixed cost is one that your company pays on a consistent basis for a certain item. Building rent, mortgage/utility payments, employee salary, internet service, accountancy services, and insurance premiums are all examples of fixed costs. It is critical to include these charges in your budget so that you can set aside the exact amount of money needed to cover these costs.

c) Variable costs: This category comprises the cost of goods or services, which can vary depending on the profitability of your business. The costs of raw materials used in manufacturing, distribution methods used to sell the product, and production labor will all change as output increases, hence they will all be considered variable expenses.

d) One-time expenses: These are one-time, unexpected expenses that your company may face in any given year. There is no sure way to quantify these costs because they are impossible to foresee.

e) Cash flow: This is the money that flows in and out of the company. You can gain an idea from your previous financial records and use that knowledge to anticipate your earnings for the budgeted year.

f) Profit: Profit is the last budget component, which is calculated by deducting your expected cost from income. You'll be able to select how much to invest in each functional area of your firm once you've forecast how much profit you're going to make in a year.

Key budget terminologies:

- Balanced budget: The budget is said to be balanced when the current receipts equals current expenditure i.e. revenue from taxes and other sources are sufficient to meet payments for goods and services.

- Capital Assets: Assets of significant value and having a useful life of several years. Capital assets are also called fixed assets.

- Balance Sheet: A statement purporting to present the financial position of an entity or fund by disclosing the value of its assets, liabilities, and equities as of a specified date.

- Operating Funds: Resources derived from recurring revenue sources used to finance ongoing operating expenditures and pay-as-you-go capital projects.

- Fund Balance: The excess of an entity’s or fund’s assets over its liabilities. A negative fund balance is sometimes called a deficit.

Customer Reviews

Customer Reviews