Woke up today to an email from Revolut informing Recent Update regarding their product. As I was one of the many customers to sign up and use their service, I thought, why not share the company's success story along with its original pitch deck:

- 54% of Customers Use Revolut to Save Money.

- 2% of Customers Use Revolut to Earn Money.

- The Average Weekly Spend on All Revolut Cards is £1,111.

- The Average Customer Spends £2,177.50 per Month.

- Revolut Users Spend £430.00 More per Year.

- The Most Popular Revolut Card is the Euro Card.

- The Average Customer Sends Two Transactions Every Week.

- 57% of Customers Use Revolut for Remittances, Which Are Faster, Cheaper, and More Convenient.

What Made Revolut So Popular?

Revolut is a digital banking alternative in multiple countries, including most European nations. It provides banking services traditionally accessible to the wealthy — to the average consumer, trading at a premium on the interbank exchange rate. The company also offers a multi-currency Mastercard debit card and P2P solutions.

The Prominent Reasons Behind Revolut's High Customer Acquisition Rates Are Its Competitive Advantages Compared to Traditional Banks:-

Revolut doesn't charge any fees for any of its services, whereas competitors like TransferWise do. Users can also instantly exchange between currencies at interbank rates, which are the most competitive.

Revolut has also recently launched a premium account that costs €7.99 a month and includes additional benefits such as savings accounts, personal IBANs, dedicated support, and special rates on foreign currencies.

Additionally, the company has partnered with many fintech startups to provide users with even more services through its platform.

According to a study by Experian, 83% of millennials switch to a new bank every four years, which is much more frequent than prior generations. Thus, Revolut's business model provides millennial users with the most modern and efficient financial products possible.

Ultimately, Revolut's competitive advantages combined with its innovative business model led to rapid growth in customer acquisition and helped it become a household name within less than three years of its existence.

What is the Idea Behind Revolut?

What if I told you that everyone in the world would soon have access to a bank account and payment card? All they'd need is their smartphone. Imagine if you could go to any restaurant in town, order your food and pay for it on the spot. You wouldn't need to worry about cash, cheques, or cards anymore, and it would be the quickest and most straightforward way to pay for anything you buy.

Your meal arrives, you've got the bill, and you use your phone to pay. This is not some futuristic technological dream - it's taking place in shops and restaurants across the country right now. You wouldn't even need a bank account or a credit card. All you'd need is your smartphone, and a device called a contactless card reader. It's become part of everyday life.

But what about the future? What if it wasn't just you paying for your meals with your phone on the spot, but multiple people? What if you could split bills with friends on an evening out, pay for shopping, or purchase tickets for the local cinema?

We need to move away from cash transactions. No one has any idea how much Money they have in their pocket or purse, and it's a form of slavery.

Well, now, that technology already exists too.

It's called the Revolut card, and it can do anything a standard debit or credit card can do – except you wouldn't need to carry cash around with you anymore. The best part? Your smartphone powers it.

And it's not just limited to the UK; it works in any country, with over 130 currencies. You can instantly exchange currencies at interbank rates instead of being ripped off by hidden fees from your bank. And you get the best exchange rate on international money transfers. Plus, when you travel abroad, there's no need to worry about finding a cash machine – you can use the app to withdraw Money from any ATM.

Revolut Funding Rounds, Valuation, and Investors

In 2012, Nik Storonsky and Vlad Yatsenko founded a digital banking alternative called "Revolut." It started as a way for (mostly tech and ex-pat) to make cheap international money transfers.

Initially, the company raised ~$3,5 million of seed funding in 2013. This Money was used to build the app and its features.

As it grew, Revolut became a "digital bank" and started providing loans and savings accounts.

In 2016, it already had over 40,000 customers and raised $4 million in a Series A funding round.

In 2017, it reportedly had close to 100.000 customers and raised another $66 million in a Series B funding round.

And, In 2018, Revolut reportedly said it had reached 2 million customers and raised another $250 million in a Series C funding round at a reported $1,5 billion valuation. The most recent funding round was Series E in July 2021, where the company raised $800 Million.

Revolut's Original Fundraising Deck

Your business model is new and unique, which makes it difficult for potential investors to get a sense of its scale. What we need is a story that will make it come alive. With this objective, Revolut's founder and his team devised a convincing fundraising deck that helped them raise Money in every funding round they participated in.

The Key Highlights of Revolut's Pitch Deck Are As Follows:-

- The text is specific & descriptive and contains numbers & figures to prove how valuable their product is.

- They also use graphs and charts to illustrate their product. At the same time, they ensure that the visuals are not overpowering.

- Use a lot of white space for easy readability and allow the figures and charts to stand out.

- Have a lot of data to back up statements, solutions, and business models.

- They have a clear vision of what they want to accomplish with the pitch deck.

Click here to explore the world's largest collection of Pitch Decks!

What's Included in Revolut's Original Pitch Deck

Here Are the Top Slides Are a Glance:-

Slide 1: The Cover

The title slide is elegant and straightforward, and the high-quality image adds to the overall visual appeal. Like any other effective investor deck, the cover slide of this template has the Agenda of Presentation in the center and the Name of the Startup below it.

Download Original Revolut Pitch Deck

Slide 2: The Problem Statement

No matter if your company is creating a new tech gadget, trying to disrupt an industry with a fresh new approach, or simply trying to convince investors to get on board, the problem statement holds the key. This is where you tell them what kind of problem your company is trying to solve and why it matters.

Revolut's problem slide sheds light on users' hassles when transferring and spending Money overseas. These include high transaction fees, the entire process is inconvenient, and the possible risk of fraud & card theft. This problem slide template is clear and concise, communicating the real message compelling to the potential investors.

Download Original Revolut Pitch Deck

Slide 3: The Solution Statement

The solution slide is where you tell your audience about the technology or innovative approach you're using to solve the problem. This is what investors are looking for because this information means them how likely they'll make Money once they invest in your company.

Revolut's solution slide is impressive as it practically illustrates the product through snapshots. The slide emphasizes conveying how convenient it is to enhance, spend, and send Money internationally. They also have included the link to a one-minute product explanatory video.

Download Original Revolut Pitch Deck

Slide 4: The Business Model

The Business Model slide is aimed at answering three main questions:

- How are you going to make Money?

- Who are you selling to?

- What is your competitive advantage?

A great example of a simple and elegant business model slide is the one from Revolut's pitch deck: The information presented in this slide is relevant to both investors and customers. A clear, concise, and easy way to explain how your company makes Money - that's just what you want!

Download Original Revolut Pitch Deck

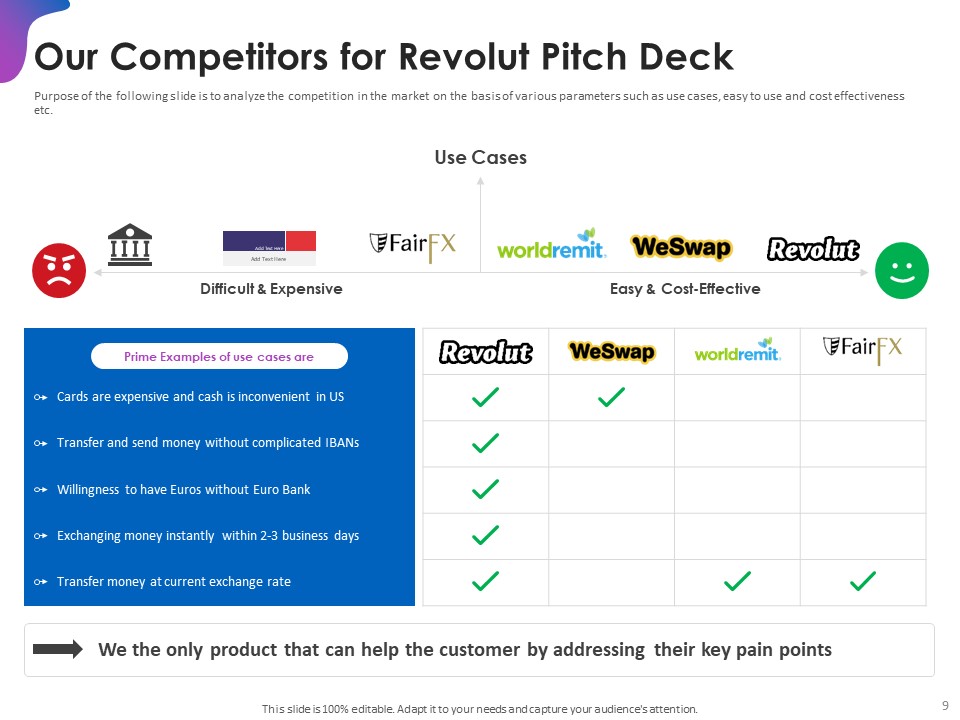

Slide 5: Competitive Advantage

This slide is a vital component of a pitch deck, and it shows the competitive strength of your company. Therefore, in this slide, Revolut tells explicitly them about different features from their competitors.

Download Original Revolut Pitch Deck

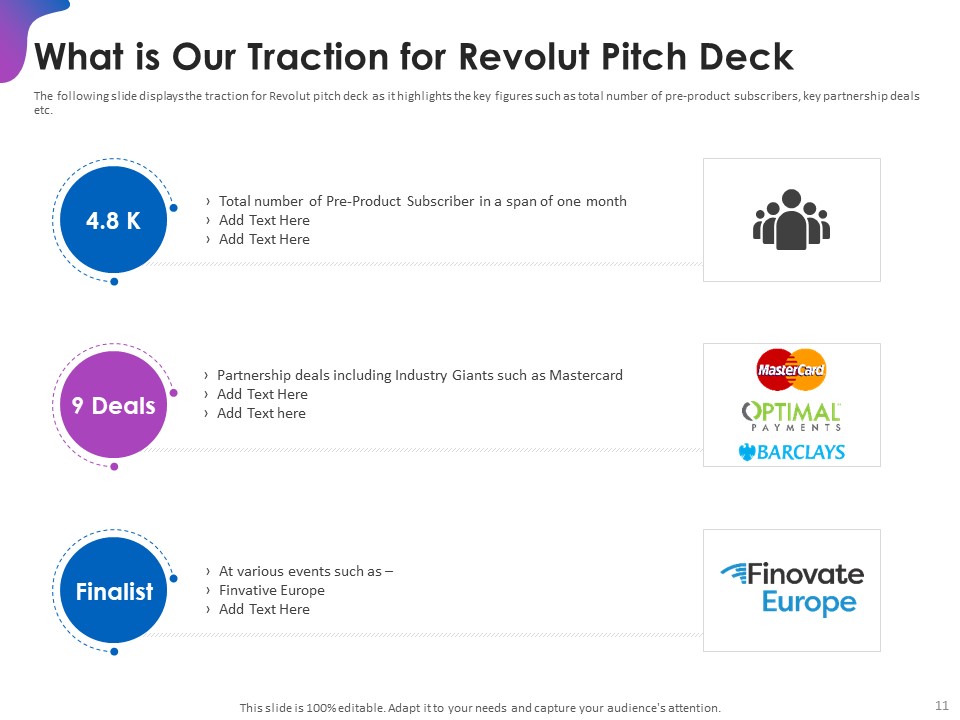

Slide 6: The Traction

Fintech startups are all about numbers. Of course, we mean growth-related metrics, such as Monthly Subscriptions, Partnership deals, Events Participated. Monthly Subscriptions, after all, are critical to a startup's long-term success and momentum.

Revolut's investor deck has the "perfect" traction slide that sheds light on explaining broader trends, providing context, and projecting future growth.

Download Original Revolut Pitch Deck

Slide 7: Use of Funds

Use of Funds Slide in a pitch deck is often the last slide to be created; if not done, it creates a feeling of incompleteness. Devising this slide is not an easy task and requires a lot of brainstorming and testing, but Revolut did a terrific job. Their Use of Funds slide template shows how they plan to use the funds raised through the venture.

Download Original Revolut Pitch Deck

Let's Wind Up

So what can you learn from Revolut's pitch deck?

1. Keep It Simple.

2. Use Images and Infographics to Break Up the Text and Make Your Points Visually Appealing.

3. Highlight Your Company's Unique Selling Points (USPs).

4. Be Clear About Your Business Model and How You Plan to Make Money.

5. Make Sure Your Financial Projections Are Realistic.

6. Use Statistics and Data to Back Up Your Claims.

7. Tell a Story That Engages the Reader and Draws Them In.

8. End With a Solid Call to Action.

SlideTeam has created an easy-to-use, 100% editable template based on Revolut's original pitch deck, which you can download for free here.

Customer Reviews

Customer Reviews