Brex is a financial technology company that offers corporate credit cards to startups in their early funding stage.

In addition, it provides a cash account & tools for managing cash, taxes, and many other aspects of running a financially-secure business.

A survey by the FED on Small Business Credit revealed that receiving a credit card is the second biggest challenge that SMEs throughout the United States of America has to deal with.

The Story Behind Brex

Brex, like any other successful startup, is born out of a problem that the founders themselves faced.

Two Brazilian college dropouts in the early 20s, Dubugras and cofounder Pedro Franceschi, were frustrated as they were unable to get a corporate credit card for their startup.

This is where Brex comes into play, offering credit cards to young startups based on the money in their corporate accounts.

Early-stage startups have difficulty obtaining credit cards solely because they do not have any revenue to show.

Traditional credit card issuers often reject the application of startups, therefore forcing the founders to use personal credit cards for funds.

How Did They Do It?

I've Had Two Failed Attempts, One Successful Attempt and One on the Way to Being a Successful Attempt, said Dubugras.

At the tender age of 14, when most kids talk about peer pressure at high school, Dubugras was concerned about his second business attempt.

He had already built a successful online game that he had to shut down because of patent infringement notices.

Dubugras used the cash acquired from the online game to launch an Education startup to help Brazilian students apply for American schools. He also desired to join Stanford and was amazed at how little the Brazilian students knew about the process of applying for American graduate colleges.

The startup was a success with over 80,000 users but could not generate good revenue.

There Aren't a Lot of VCs in Brazil That Are Willing to Fund 15-Year-Olds, Said Dubugras

The Debacle of Edtech and the Launch of Brex

He decided to wrap up Edtech and met Franceschi, a Brazilian teen from Rio. They both had a real passion for innovation and a hunger for success.

They launched Pagar.me, the "Stripe of Brazil." It raised over $30 million and had a staff of 100 individuals, and processed up to $1.5 billion when Pagar.me was sold. Now, they tasted some real success, so it's time for the big thing.

We Wanted to Come to Silicon Valley to Build Stuff Because Everything Here Seemed So Big and So Cool, Dubugras said

They did come to Silicon Valley. In 2016, the duo enrolled at Stanford University. Shortly, they were in touch with Y Combinator — An American Technology Startup Accelerator — for a VR startup known as Beyond.

I Think Three Weeks in We Gave It Up, Dubugras said. We Realized We Aren't the Right Founders to Start This business. He believed that they were good at payments.

As founders, they were well-aware of how baffling the journey of an entrepreneur is, especially the access to credit. Big businesses perceive startups as a threat and often overlook their applications.

Now, the idea of Beyond was scrapped, and in April 2017, Brex was launched.

Their company grew big in no time; thus, they decided to drop out of college and invested their time in scaling the business.

Brex Simplifying Financial Access for Entrepreneurs

Brex credit cards require no personal financial guarantee or any security deposit. It does not use any third-party software but built the platform from scratch.

Brex simplified the process of corporate expenses by offering startups a consolidated look at their spending. At the end of the month, CEOs can check how much ithey spent on Uber or corporate dinners.

In addition, the credit limit of Brex's credit card is ten times higher than what SMEs will receive from elsewhere.

The process of applying for a Brex corporate credit card is entirely online.

We Have a Very Similar Effect of What Stripe Had in the Beginning, but Much Faster Because Silicon Valley Companies Are Very Good at Spending Money but Making Money is Harder, Dubugras explained

They offered rewards to entrepreneurs based on their needs and spending patterns. They used the capital gained to hire more engineers and grow their client base.

We Want to Dominate Corporate Credit Cards, Dubugras said. We Want Every Single Company in the World, Whenever They Do Business Expenses, to Do It on a Brex card.

Brex's Funding Details

Brex has raised approximately $1.5 billion from the eleven funding rounds. Their latest funding round was on 22nd October 2021.

Fifty-one investors financially backed the FinTech company, and their most recent ones are Greenoaks and Institutional Venture Partners.

In the next segment, we will talk about their secret recipe of gaining investors' trust to drive a good amount of funds.

How Did Brex Manage to Accumulate the Necessary Funds?

The answer is straightforward, their pitch deck's ability to convince the angel investors and venture capitals to believe in their idea.

They emphasized that on drafting a compelling presentation that quickly connects with prospective inventors with visually-stunning graphs and numbers that tell a tale.

So, Without Further Ado, Let's Check Brex's Most Famous Pitch Deck That Helped Them Raise Millions of Dollars.

Click here to explore the world's largest collection of Pitch decks

Slide 1: A Robust Cover Slide

The title slide makes or breaks the investor presentation.

Therefore, Brex has given great importance to this slide so that their investor meet starts on the right note.

The slide has an image that relates to their business idea.

The agenda of the presentation is mentioned in this first slide, "Investor Funding Elevator Pitch Deck," to avoid any confusion.

The name of the company is mentioned below.

Apart from these details, Brex had no text because giving too much information in the title slide is a mistake many entrepreneurs make.

Download Brex Original Pitch Deck

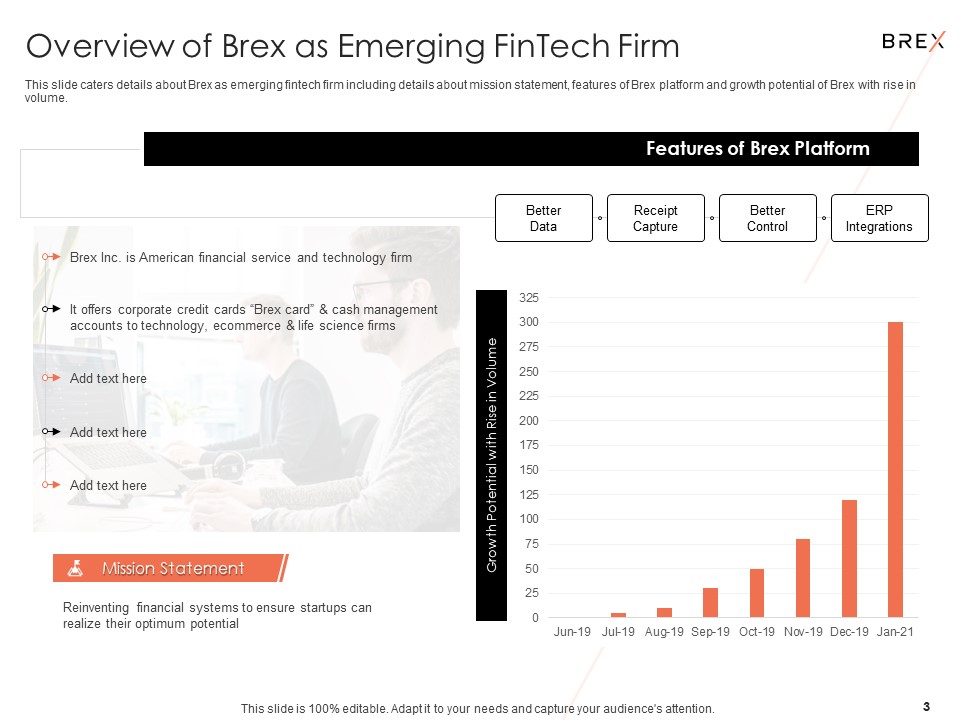

Slide 2: Overview of "Brex as an Emerging FinTech Company"

The company overview slide caters to all the crucial details related to the Brex FinTech company.

It starts with a section on the left-hand side that provides a glimpse of the company in a few bullet points. These include Brex Inc., an American Financial And technology firm that offers corporate credit cards and cash accounts to e-commerce, technology, and life science firms.

Below this section, the slide presents the Mission Statement of the company.

A bar graph on the right-hand side shows the increasing Growth Potential With the Rise in Volume.

Above this section, the slide introduces vital features of the Brex platform, such as Better Data, Receipt Capture, Better Control, and ERP Integrations.

Download Brex Original Pitch Deck

Slide 3: A Riveting Slide "Exhibiting Leadership Teams & Leading Investors"

Investors look at the team members at leadership positions before deciding whether to invest or not.

The Slide Covers:

- Pictures of the Primary Team Members.

- Name Along With the Job Titles.

- Prior Employment and Domain Experience.

- Essential Technology and Payment Investors.

Download Brex Original Pitch Deck

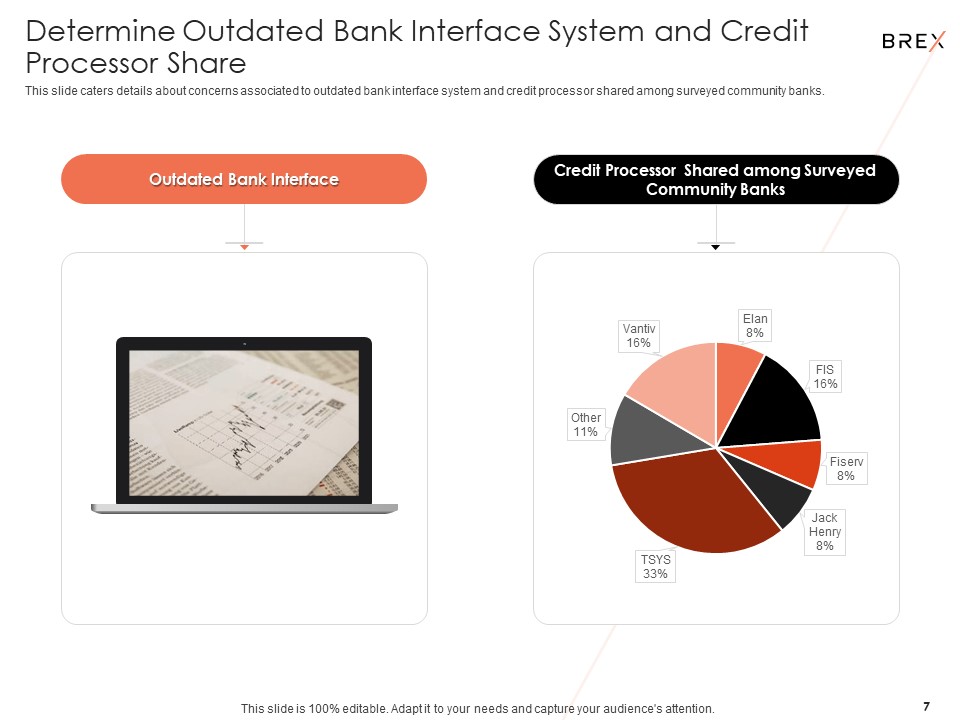

Slide 4: A Well-Illustrated Slide Illustrating "Outdated Banking Interface System"

Online business transactions grew exponentially with the world going into lockdown last year.

It presented unique opportunities for fintech companies to grow their business.

An efficient and intuitive user interface is the need of the hour.

The presentation slide demonstrates the problems faced by customers using an outdated banking interface.

A carefully placed colored pie-chart showing credit processors shared among surveyed community banks on the right-hand side.

Download Brex Original Pitch Deck

Slide 5: Determining Addressable "Market Size Opportunities"

Investors want to invest in ample opportunities with substantial addressable markets.

The slide shows annual card revenue opportunities across the globe, in the US and the US ventures.

It works great for investors that want to know the market dollar size by skimming through the presentation.

Download Brex Original Pitch Deck

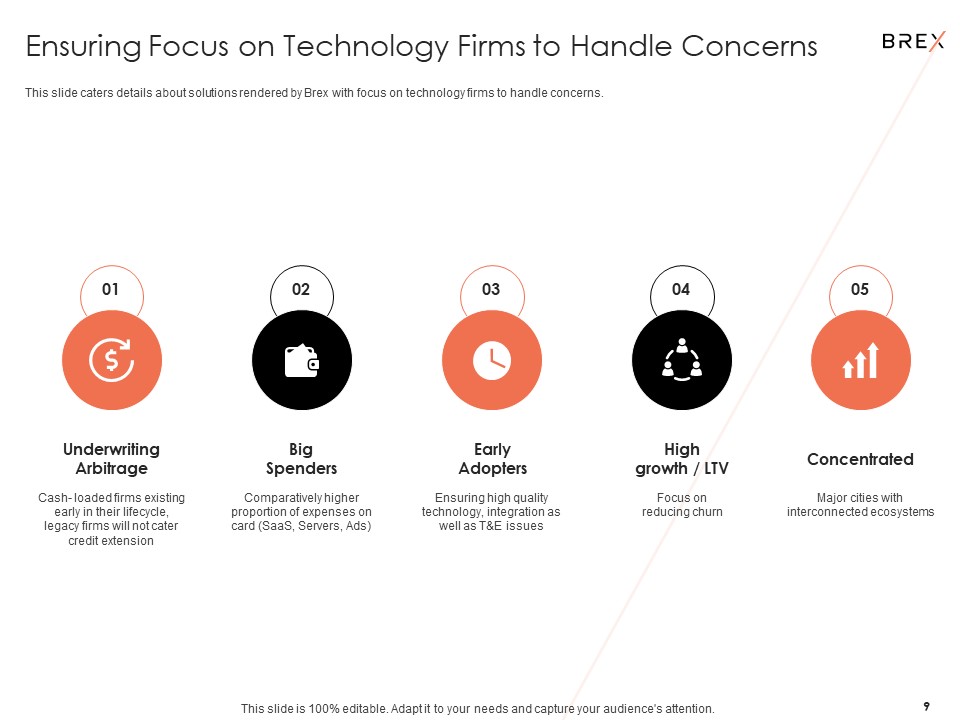

Slide 6: An Easy Graspable Slide Ensuring Focus on Technology Firms to Handle Concerns

The slide displays details of solutions offered by Brex in an easy-to-view and understandable format.

The prime focus is on technology firms and how they will handle issues.

Some of the Major Points Covered in the Slide Are:

- Cash Loaded Firms Exiting Early in Their Lifecycle Will Not Cater to Credit Extension

- SaaS, Servers, and Ads Are the Big Spenders.

- Ensuring High-Quality Technology Integration as Well as T&E Issues.

- High-Growth by a Focus on Reducing Churn.

- Cities With the Interconnected Ecosystems Are Concentrated.

Download Brex Original Pitch Deck

Slide 7: A Slide Catering Details of an Impressive "Value Proposition of Acquisition"

The aptly designed slide put forth ways to achieve a fast market share with effective credit card options.

- They Are Providing Credit Cards Without Any Personal Guarantee or Security Deposit.

- Increasing the Limit is a Sure-Shot Way of Getting More Customers.

- Faster Signups Are Another Method of Ensuring Additional Customers.

Download Brex Original Pitch Deck

Slide 8: A Slide Addressing the Primary Objective of Brex Ensuring "Sustainable Customer Retention"

A minimalistic use of colors and layout ensures the focus is on the vital points. Customer retention is crucial for any organization.

Various studies have shown that it is 25% expensive to get new customers than to retain existing ones.

Download Brex Original Pitch Deck

Slide 9: A Slide Exhibiting Easy to Implement Strategies for "Greater Control Over Employee Spending Transactions"

A precisely designed layout shows the approaches for enhancing employee spending control.

Frequent subscriptions without logging in is a prominent feature.

Mandatory approval for large transactions is another fundamental attribute.

Designers have taken careful consideration of colors and text placements for attracting attention.

Download Brex Original Pitch Deck

Slide 10: A Meticulously Created Slide Demonstrating Ways to Ensure "ERP Integrations" For Track Financial Transactions

An eye-catching and easy-to-understand slide to show ERP integrations to track financial transactions.

The world's most prominent companies use this feature to keep track of transactions in real-time.

Employers can get a high-level view of all transactions.

Download Brex Original Pitch Deck

Slide 11: A Slide With a Bar Chart to Show "Increased Volume Matrix"

People can easily understand a bar chart by looking, and it can easily display and summarize a large amount of data.

Designers have taken full advantage of colors and fonts to show increased volume metrics of Brex.

Investors can readily view the increase in revenue year after year.

Download Brex Original Pitch Deck

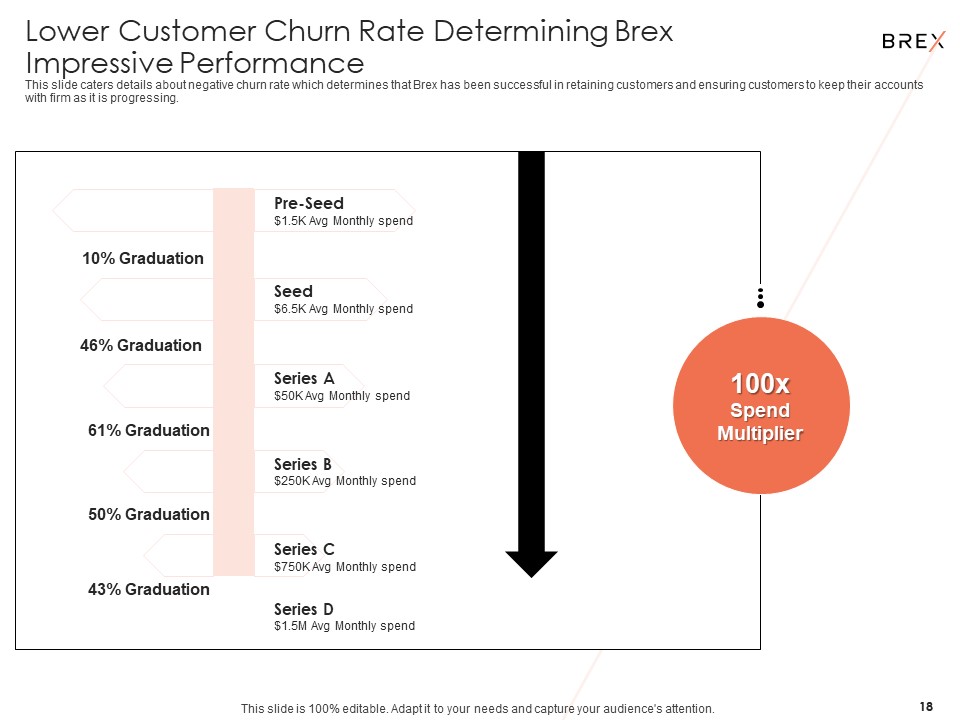

Slide 12: A Captivating Slide Illustrating "Lower Customer Churn-Rate"

Brex illustrates that they can successfully retain customers with a negative churn rate. The company is gradually increasing its average revenue per customer.

Download Brex Original Pitch Deck

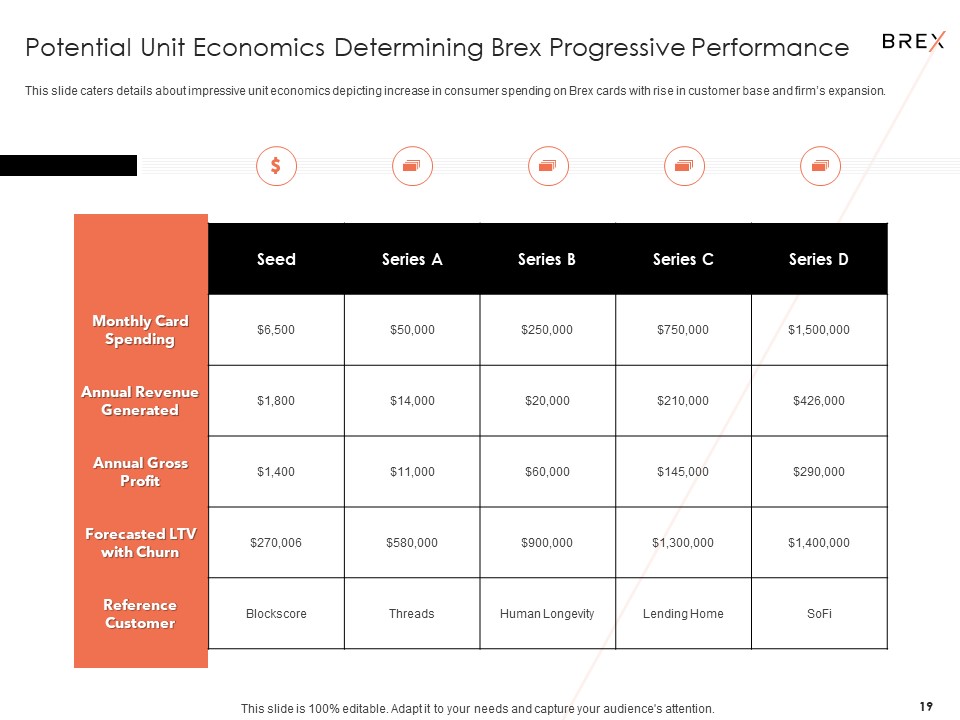

Slide 13: An Impressive Slide to Show "Potential Unit Economics Determining Brex Progressive Performance"

With a Tabular Presentation, Brex is Exhibiting:

- Monthly Card Spending

- Annual Revenue Generated

- Annual Gross Profit

- Forecasted LTV With Churn

- Reference Customer

Companies can represent large amounts of data while investors can swiftly analyze and understand the data.

Download Brex Original Pitch Deck

Slide 14: A Remarkably Designed Slide for Addressing the "Value Proposition"

Every successful business needs to understand the needs of its customers, the problems they are facing, and how they can help them.

With this slide, Brex demonstrates how they reinvent underwriting for startups for credit card access.

They acknowledge payments and focus on developing companies with financial & technical infrastructure.

The value proposition must be short and precise.

Download Brex Original Pitch Deck

The Bottom Line

Want to Download Brex's Original Pitch Deck? Get our membership starting at $49.99, and you will have access to ten presentations of your choice.

The Brex template is 100% editable and compatible with Google Slide.

We are also ready to give a FREE DEMO.

Stunning designs and great customer support can make a happy customer!

Explore and download your favorite templates. 👉🏻 https://t.co/niGQs2AD2V#SlideTeam #PowerPoint #Presentations #PPTTemplates #ClientReview pic.twitter.com/EbvMoVF5xl

— SlideTeam (@Slideteam_net) December 28, 2021

In Case You Have Any Queries, Feel Free to Call at "408-659-417" or Inbox at [email protected] - We'll Respond to You in Less Than Twelve Hours.

Click here to explore the world's largest collection of Pitch decks

Customer Reviews

Customer Reviews