“It’s important to first understand the financial needs of the borrower and whether they have what’s required to address those needs,” prominent journalist John Reed has said.

The concept of a loan is not new, it has been around for thousands of years. Do you dream of expanding your business, but are still confused about the loan options? One of the best solutions to this dilemma is a MORTGAGE LOAN.

Still stuck on thoughts like, what is a mortgage? Is it different from a loan? Or are both the same? Well, no worries! This blog will help you to understand these terminologies and create templates for your mortgage loan.

To understand the steps involved in the process of the application and closing the mortgage including property appraisal, analysis of application, submission for credit approval, and closing the loan, SlideTeam has curated Top 10 Mortgage Loan Origination Process Flow Templates. Deploy these fully customizable PowerPoint templates to meet customers' expectations.

Are you looking for a well-executed business loan plan to start, expand, or acquire your own set of products? If so, then go through our business loan proposal templates and increase your company's chances of securing funding.

Highlight the significance of a robust mortgage origination process in business.

Let’s explore these templates!

Template 1: Bank Mortgage Procedure PowerPoint Presentation Slides

Do you want to purchase real estate, equipment, inventory, etc.? Deliver an awe-inspiring pitch with our bank mortgage PPT templates. Use this complete deck to showcase your company with its mission, vision, values, products, and services offered, client testimonials, etc. You can describe the features and benefits of the loan including financial flexibility, easy availability, convenient tenure, and tax benefits. Download now!

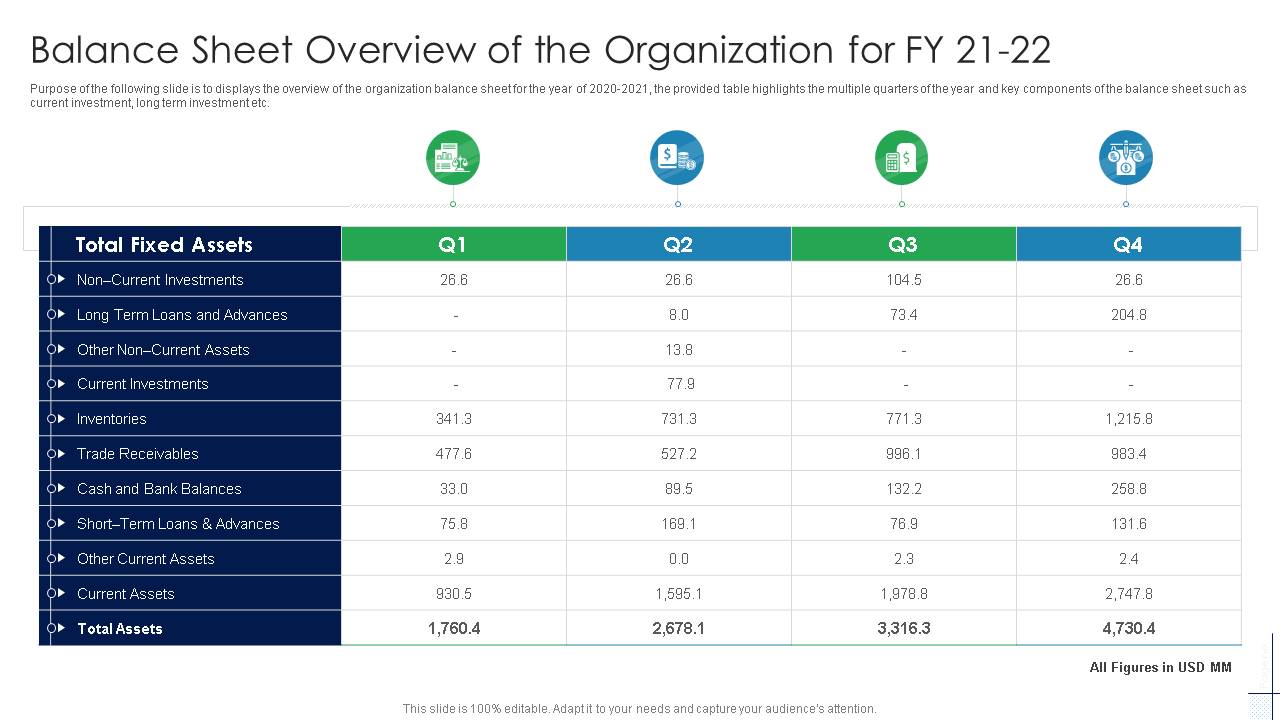

Template 2: Balance Sheet Overview Organization Mortgage Recollection Strategy Template

This template is designed for financial institutions to see balance sheets and firm up a stand on the mortage. Display an overview of your organization’s balance sheet for any financial year with this template. This PPT Slide highlights quarters of the year, showcasing key components such as long-term loans, inventories, short-term and long-term loans, current investment, cash and bank balance, total assets, and so on. Deploy this tabular form of PowerPoint Design now!

Template 3: Mortgage Loan Approved Payday Home Loan Debt Free PPT Slide

Are you dreaming of a perfect house for you and your family, but are baffled about the best loan option? If so, then this mortgage template would be an ideal fit. This PPT graphic design helps you present your ideas with visually appealing finance icons. Instead of boring bullet points, deploy these eye-catching icons to showcase a loan approval analysis.

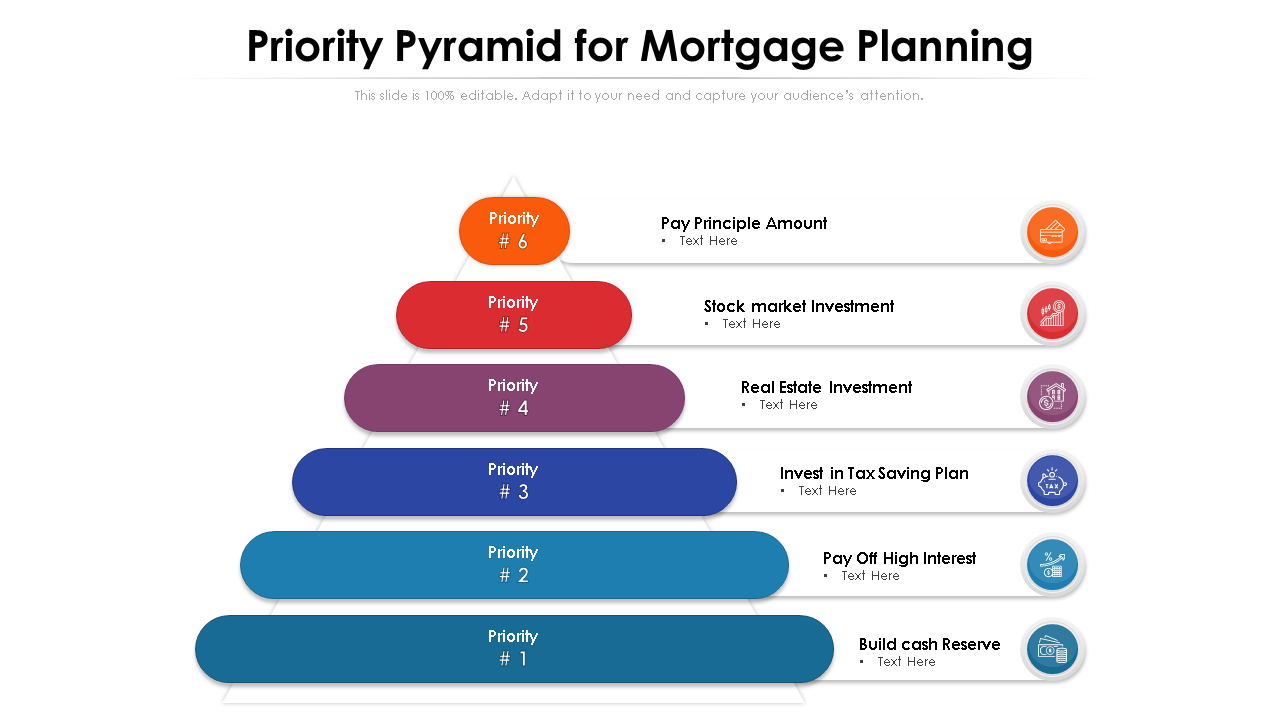

Template 4: Priority Pyramid for Mortgage Planning Template

Use our priority pyramid for mortgage planning template as a visual aid to provide an overview of the steps in in the preparation of a mortgage. This PPT Template presents a six-stage process, which includes the stock market investment, real estate investment, pay principal amount, invest in tax saving plan, pay off high interest, and build cash reverse. Download this design today!

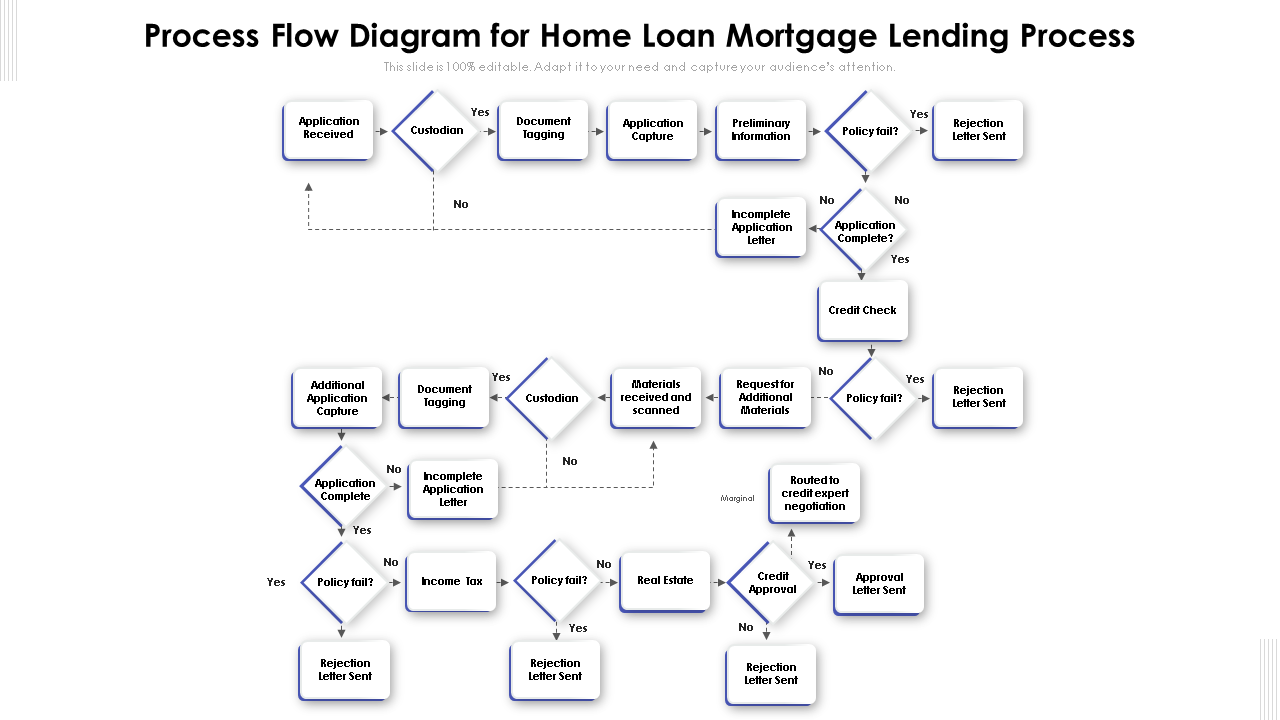

Template 5: Process Flow Diagram for Home Loan Mortgage Lending Process

Here is another ready-to-use PowerPoint Template for the home loan mortgage lending process. Educate your audience on the overall mortgage loan process with this customizable slide. By taking the assistance of this slide, you would be able to cover topics including property appraisal, analysis of application, submission for credit approval, closing the loan, real estate, negotiation, etc. like a pro. Make this PPT Design yours now!

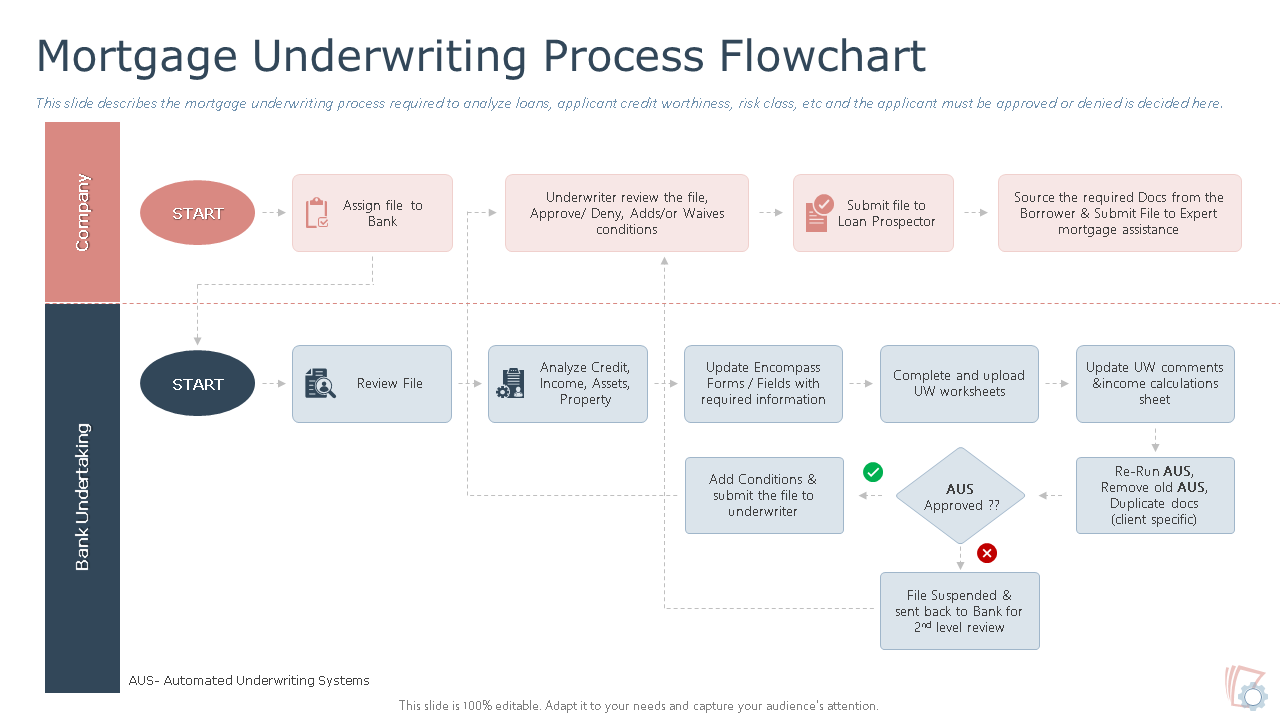

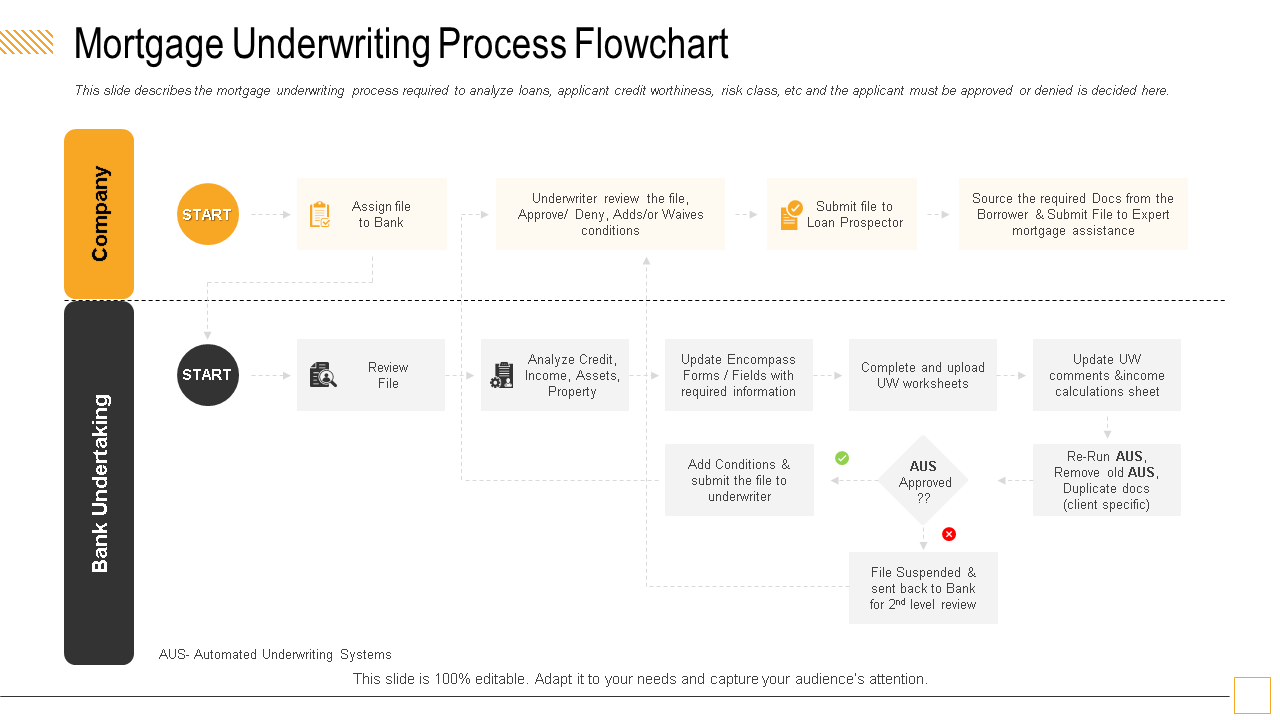

Template 6: Mortgage Underwriting Process Flowchart PowerPoint Presentation

Before getting a mortgage loan, you have to go through the underwriting process. If you are a lender and want to know whether the borrower is a good candidate for a mortgage or not, then our mortgage underwriting process flowchart template is just what you need. This PPT Design is divided into two parts-company and bank undertaking, and is used to analyze the credit-worthiness of the loan applicant. Grab this PPT Template now!

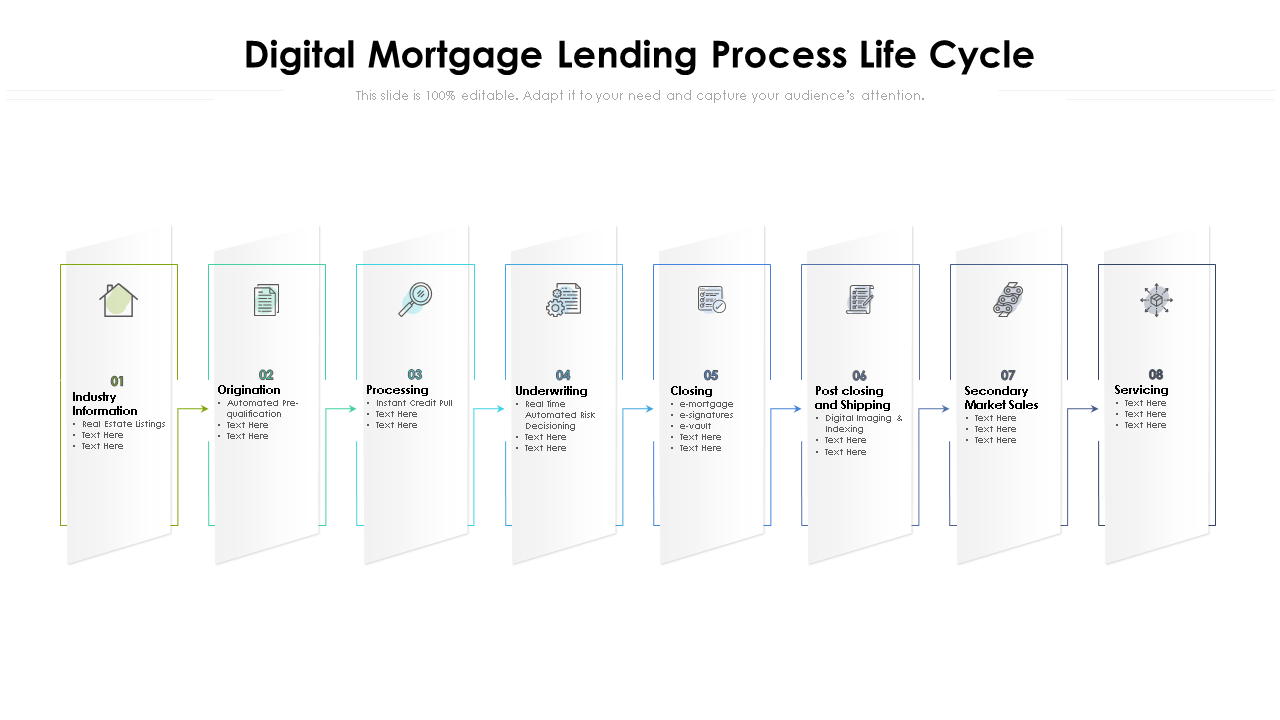

Template 7: Digital Mortgage Lending Process Life Cycle

Lay your hands on our ready-made digital mortgage lending process life cycle PowerPoint Slide. This template is designed for mortgage companies, banks, etc. to showcase the processes and stages through which the borrower has to go once they decide to take out a loan. Highlight key steps such as industry information, origination, underwriting, closing, shipping, market sales, and much more with this eight-stage process design. Download this design now!

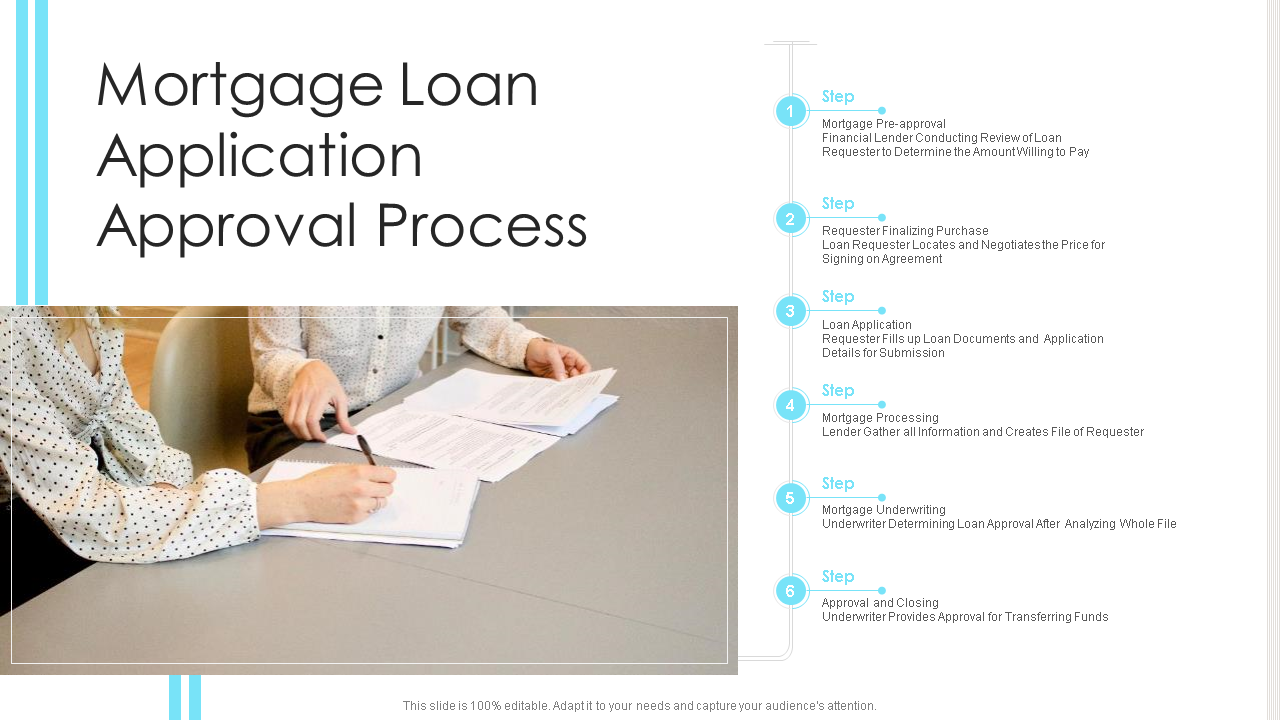

Template 8: Mortgage Loan Application Approval Process PPT Template

Highlight information on the loan application, mortgage processing, mortgage underwriting, approval and closing, etc. with the assistance of our best-in-class mortgage loan application approval process PPT slide. This six-stage template can be used to display the steps in the mortgage loan process, i.e., from the loan application to the closing of the mortgage. Without any pause, download this slide today!

Template 9: Mortgage Analysis Real Estate Growth Drivers PowerPoint Presentation

Are you looking for a real estate investment analysis slide to share your amazing business plan? You, however, need good mortgage planning. Encompassed with seven stages, this template is a great option to present information on laws and regulations, property rates, interest rates, economic growth, and more. Download now!

Template 10: Mortgage Underwriting Process Flowchart PPT Presentation

If you are an underwriter, use this mortgage undertaking process flowchart template. Present this set of slides to decide whether the applicant can be approved or denied. This mortgage underwriting process slide includes the reception of applications from loan officers, desktop underwriting, information correction or additions by loan officers, and final approval or denial. Download it now.

The Bottom Line

Overall, mortgages are a fundamental aspect of the home-buying process for most borrowers who don’t have liquidity. Download our mortgage loan origination process templates to qualify candidates for mortgages and make their dream of homeownership a reality.

In case you want additional PowerPoint Presentation guidance, speak to our experts at SlideTeam and get customized template designs.

PS: Want to prepare your own financial services company profile from scratch? Go through our exclusive blog on best-class slides for comprehensive details related to your company.

FAQs on Mortgage Loan Origination Process

What is a mortgage?

A mortgage is a type of loan from a bank or other financial institutions, used to purchase or maintain a home, land, or other real estate. Here, the property or say, the home itself serves as collateral. If the borrower fails to repay the mortgage, the lender has the right to sell the home and recoup their money. Typically, a mortgage loan is a long-term debt taken out for some 15, 20, or 30 years.

What are the types of mortgage loans?

Mortgages are available in a variety of forms:

1) Fixed rate mortgage: This is the standard type of mortgage, also known as a traditional mortgage. With a fixed-rate mortgage, the interest rate stays the same for the entire term of the loan, which can range up to 30 years.

2) Adjustable-rate mortgage: With this sort of mortgage, the interest rate is fixed for an initial stage, but can be raised or lowered periodically based on changes in prevailing interest rates. Initially, the interest rate is often below the market rate, so the mortgage is more affordable for short-term, but less affordable in the long-term.

3) Balloon mortgage: In this type of mortgage, payments start at a low rate and then “balloon” to a much larger lump sum amount before the maturity of the loan.

4) Reverse mortgage: This is a very different form of mortgage which is designed for homeowners aged 62 or older who want to get monthly income by converting the equity of homes into cash based on their home’s value. Unlike a forward mortgage, where the borrower repays the loan over time and the balance goes down, here in a reverse mortgage, the lender gives money as a lumpsum, fixed monthly payment, or line of credit to the borrower over time, and the balance they owes grows the longer he lives.

What are the steps in the mortgage process?

The mortgage loan process can vary, depending on the lender. But, the following five steps are followed by all lenders:

1) Prequalification: Before applying for a mortgage loan, it is important to get a written estimate of your income and assets for your lender. At this stage, lenders would look for any red flags, i.e., issues with the borrower’s income, assets, debts, or credit record.

2) Loan packet preparation: Once the lender assumes that the borrower is prequalified, the next step is to have a detailed analysis of the borrower’s financial statements (property, investment accounts, cash, and so on). After thorough verification, the lender prepares the loan packet including all the required documents for the transaction.

3) Term Sheet: When the lender is ready with the loan packet, the next step is to disclose the term sheet which includes the amount of loan, duration of the loan, the interest rate, setup fees, prepayment penalties, etc.

4) Negotiation: This is an important step for a borrower because, at this stage, they can ask for changes, such as long-term loans and better interest rates.

5) Loan closing: After negotiation, the borrower accepts the loan terms, and the final step is to sign binding legal agreements that the lender provides.

Customer Reviews

Customer Reviews

![Best Slides to Include In Your Financial Services Company Profile: Template Include [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/10/finance-1013x441.png)