Preparing for an audit is always a difficult undertaking with a lot of room for error. Naturally, the purpose is to present the financial statements with accuracy to make confident business decisions.

A financial audit checklist tool can serve as a guide to help you with your year-end financial tasks. In general, an audit checklist tool aids in the inspection or systematic, impartial, and documented evaluation of a company's financial activities or systems.

But, how to ensure that your financial statements are reliable and comply with applicable accounting standards and regulations? SlideTeam brings you content-ready and custom-made Financial Audit Checklist Templates to ensure that the audit is conducted in a comprehensive and systematic manner. Use our ready to use and actionable PPT Slides to identify areas that require further investigation or examination, and to provide a framework for the audit process. Furthermore, these Templates offer several benefits such as,

- Time Saving: Audit checklist Templates save auditors time since they eliminate the need to construct their own checklists from scratch. This permits them to concentrate more on the audit process and analysis.

- Standardization: Using Slideteam's audit checklist Template ensures that all audits are performed to the same standards, regardless of whether they are performed by different auditors or at various periods. This is especially important for businesses that must meet strict regulatory standards.

- Risk reduction: Any of these audit checklist Templates can assist in identifying potential risks and weaknesses in a company's operations. This enables the organization to take corrective action before any severe problems occur, lowering the risk of financial losses or legal penalties.

- Better communication: Audit checklist Templates can help auditors and the company's management team communicate more effectively. All parties can gain a better understanding of the audit process and the criteria used to evaluate the company's operations by employing a standardized checklist. This can lead to improved communication and a better grasp of the company's strengths and shortcomings.

SlideTeam's financial audit Templates are the most powerful approach to expedite accounting procedures. Let’s browse the collection below and take all necessary steps to achieve the audit objectives.

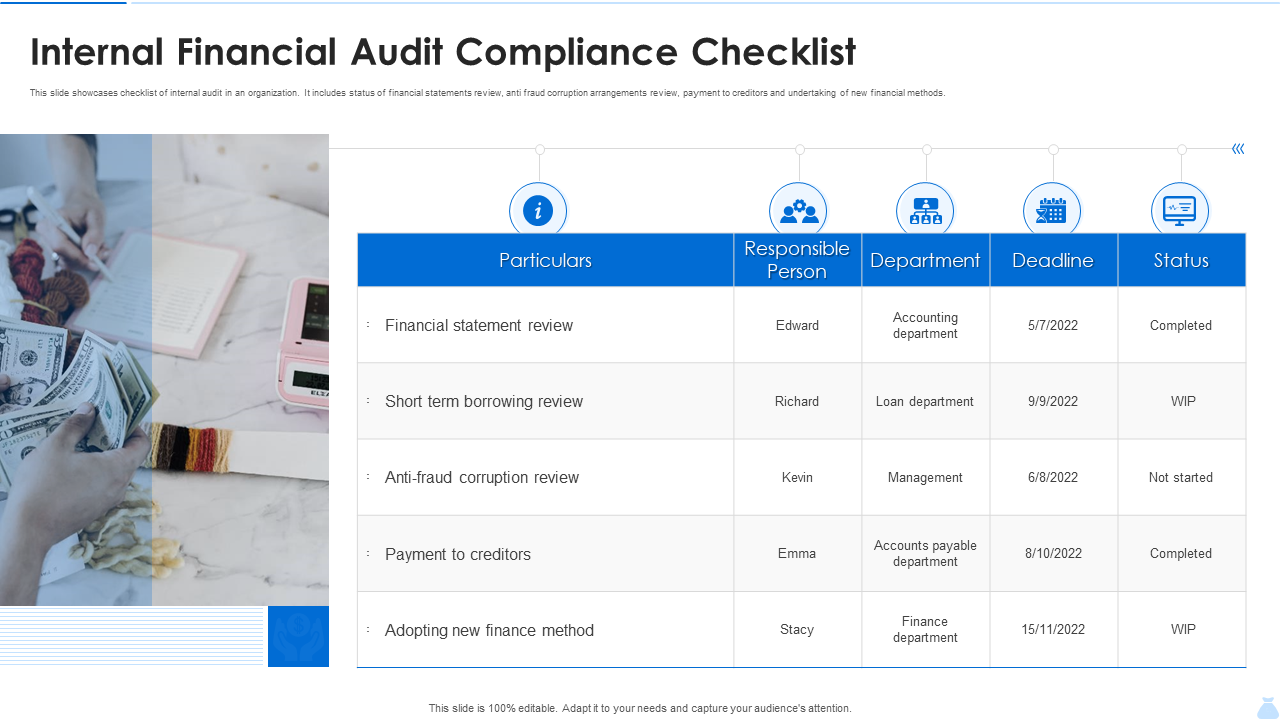

Template 1: Internal Financial Audit Compliance Checklist Template

This template contains an important collection of criteria or standards that a firm must follow to comply with financial rules and internal policies. It includes examining the effectiveness of internal controls to avoid fraud, mistakes, and other financial irregularities, as well as identifying areas for improvement. With this pre-designed Template, monitor the financial audit progress and complete the procedure within a timeframe.

Template 2: Financial Preparation Audit Checklist PPT Template

By following the Template's standardized checklist, you can verify that all financial records are comprehensive and correct, alleviating the possibility of errors. Companies can boost openness in their financial reporting and offer stakeholders with a clear knowledge of their financial status by following a well-structured Financial Audit Checklist.

Template 3: Checklist for Auditing Current Financial Template

This ready-made PPT Template depicts a checklist audit for the current financial scenario. It contains data on current assets, current liabilities, cash flows, insurance plans, risk management, income statements, cash flow statements, financial security, growth, net worth, and more. Deploy this flexible PowerPoint Slide to make your firm in compliance with all applicable regulations and laws.

Template 4: Bank Branch Audit Financial Compliance Checklist Slide

This is a content-ready Bank Branch Audit Financial Template to assess the efficiency of your bank branch's internal control systems as well as the cash management procedures. Use this ready to use PowerPoint Template to monitor handling, reconciliation, and security of the bank financial audit. It is a top-notch PPT Diagram to provide assurance to stakeholders that the bank's financial statements are reliable and that its financial reporting practices are sound.

Conclusion

An audit checklist is a significant document used for the execution of audits. It not only acts as a guide for external and internal auditors to examine every aspect of your organization's compliance with the standard. The above- mentioned financial audit checklist Templates are more than perfectly adequate for any organization in need of assistance in managing their audit process, whether it be in the form of external or internal audit services, training, etc.

FAQs on Financial Audit Checklist

What are the steps to conduct a financial audit?

A financial audit is an essential process that ensures the accuracy and reliability of an organization's financial statements. The audit process involves several steps that are designed to provide reasonable assurance that the financial statements are free from material misstatements.

The steps involved in conducting a financial audit include planning, risk assessment, internal control testing, data collection, substantive testing, report writing, and follow-up.

These steps involve evaluating the organization's financial risks, reviewing its internal control systems, collecting and analyzing financial data, conducting substantive testing procedures, preparing an audit report, and monitoring the implementation of recommendations.

What are the 14 steps of auditing?

The 14 steps of auditing can vary depending on the type of audit, the scope of the audit, and the auditor's approach. However, here is a general outline of the 14 steps:

- Establishing the objective of the audit

- Determining the scope of the audit

- Establishing the audit criteria

- Identifying the auditable entity

- Planning the audit

- Communicating with the auditee

- Conducting an entrance conference

- Gathering evidence through documentation, observation, and inquiry

- Analyzing and evaluating the evidence

- Developing findings and conclusions

- Discussing preliminary findings with management

- Preparing and issuing the audit report

- Following up on recommendations and corrective actions

- Closing the audit

How do I create an audit checklist?

An audit checklist is a tool that helps auditors ensure that they cover all the necessary areas during an audit. To create an audit checklist, follow these steps:

- Define the audit objective and scope: Identify the purpose of the audit and the specific areas to be audited.

- Determine the audit criteria: Identify the criteria or standards that will be used to evaluate the audited entity's performance.

- Identify the audit process: Figure the steps involved in the audit process, including planning, execution, and reporting.

- Develop the checklist: Create a checklist that includes all the areas to be audited, based on the audit criteria and process.

- Review and refine the checklist: Review the checklist to ensure that it covers all the necessary areas and refine it based on feedback from other auditors or subject matter experts.

- Use the checklist during the audit: Use the checklist to guide the audit process, ensuring that all necessary areas are covered and documented.

What is done during a financial audit?

During a financial audit, an independent auditor examines an organization's financial records and statements to ensure they are accurate and comply with accounting principles and applicable laws and regulations. The auditor reviews financial transactions, account balances, and other financial documents. They also evaluate the organization's internal control systems, test the accuracy and completeness of financial data, and prepare an audit report that documents their findings and recommendations for improvement. The ultimate goal of a financial audit is to provide stakeholders with reliable and credible information about an organization's financial performance and position.

Customer Reviews

Customer Reviews