What should a hedge fund include in its pitch deck to showcase its edge over competitors to potential investors?

In the dynamic world of finance, the art of pitching a hedge fund to potential investors requires the right mix of information and presentation. Investing in a hedge fund is a multi-faceted endeavor involving a journey delivered through an engaging pitch deck that is essential to making a lasting impact.

Whether you are an experienced fund manager or new to finance, it provides a solid foundation to tell the story of your funds and capture financial data. To simplify this complex process, SlideTeam has carefully curated a collection of the top 10 Hedge Fund Pitch Deck Templates with real-world examples and samples. This template is a valuable guide covering essential areas such as performance metrics, investment strategy, risk management, and team expertise.

Want a concise strategic presentation that outlines to potential investors the fund’s investment path, performance history, and unique value proposition? Click here and check out Peter Thiel's Original Venture Capital Pitch Deck Template.

Hedge funds raise capital from accredited or institutional investors and use strategies to generate a dynamic return for investors. They are designed as limited liability companies or limited partnerships. They are managed by professional companies and are not as heavily regulated, allowing them to invest in various asset classes and complex and risky strategies. This section provides an overview of hedge funds, including their strategies, regulations, fees, and considerations for investors.

Discover here 10 Best Private Equity Fund Templates for Judicious Investments and Optimized Returns.

SlideTeam templates combine sophistication with simplicity, providing a glimpse of your fund's primary objectives, history, investment philosophy, and expected returns.

Hedge Fund Pitch Deck Templates

Our templates are structured tutorials for fund managers to communicate their investment strategies, performance history, and valuation to potential investors. These metrics typically have special sections to provide a general overview of the hedge fund's objectives, intentions, and potential investment returns. They are content-ready and 100% editable.

Let’s explore.

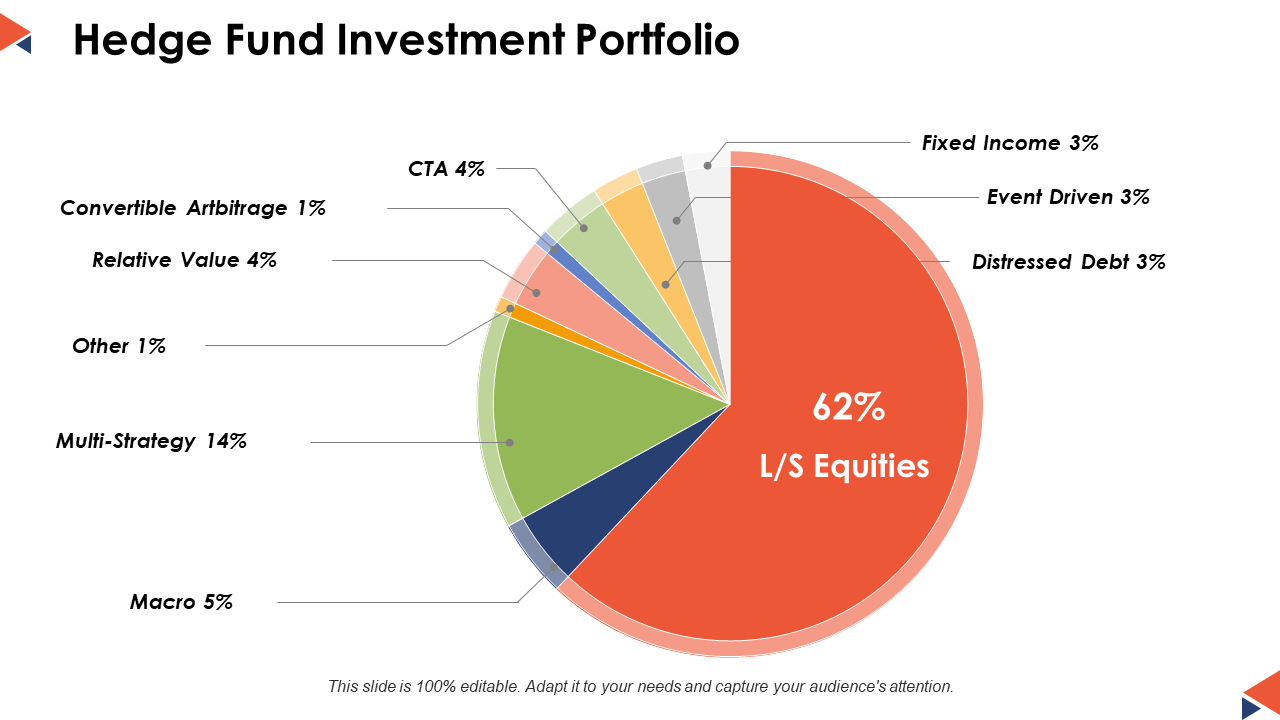

Template 1: Hedge Fund Investment Portfolio PPT Presentation File Deck

This Presentation Deck is designed to present a hedge fund investment strategy, portfolio structure, performance metrics, and market analysis to potential or independent investors aimed at building confidence. The deck allows for dynamic and interactive presentations and provides compelling financial information that is accessible and appealing to its audience. Some hedge funds invest in individual markets, providing capital to start-ups and growth companies. This can be a vital source of investment for businesses that may not have access to the public market. Download this template now.

Template 2: Hedge Fund Risk and Return Analysis PowerPoint Presentation Slides

The PowerPoint Presentation evaluates a hedge fund's overall performance metrics, studying each of its investment techniques' capacity returns and associated risks. This presentation is vital for fund managers to effectively communicate with investors, illustrating the fund's capacity to manipulate and mitigate hazards and maximize returns. By addressing quantitative and qualitative risk control factors, the slides provide a holistic view of the fund's investment method, showcasing its know-how in navigating complex economic markets and its commitment to reaching advanced risk-adjusted returns. Get it now.

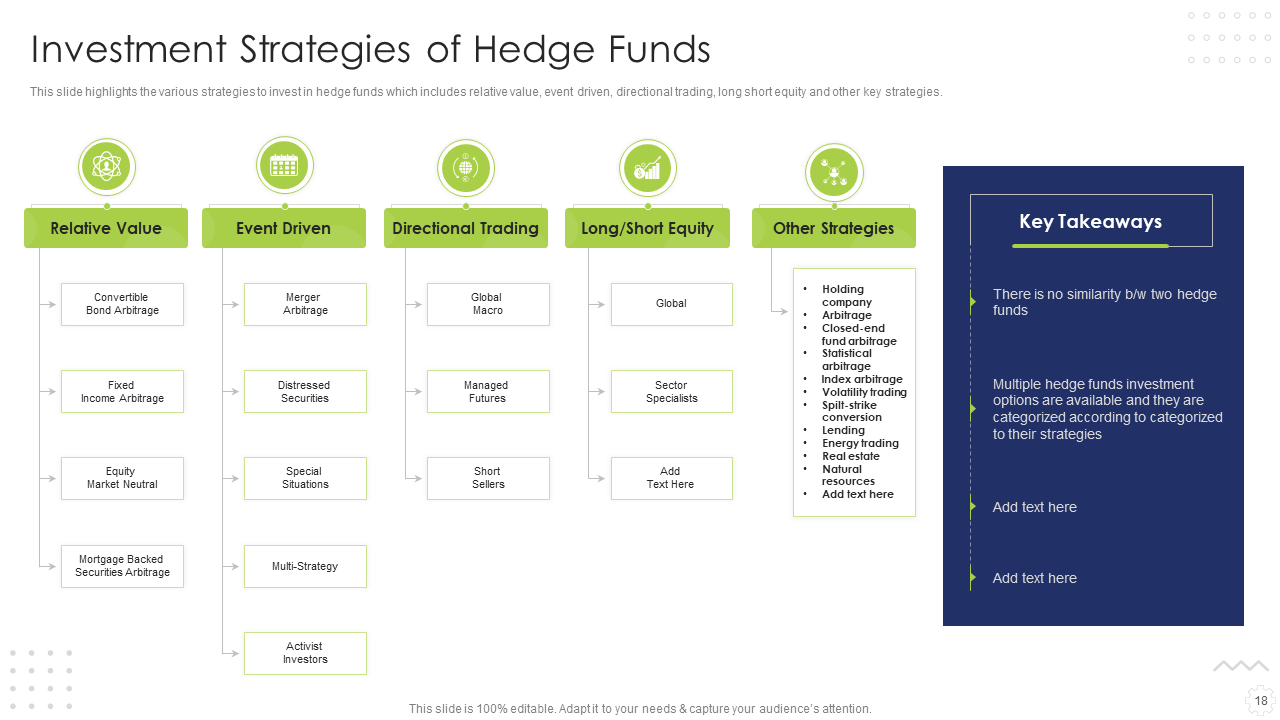

Template 3: Investment Strategies of Hedge Funds

The investment strategies used by the hedge funds are diverse and dynamic, reflecting the flexibility of these financial entities in responding to different market conditions. Hedge funds use a combination of different strategies to achieve their objectives, typically including capital savings, risk management, and higher profitability. Some common investment strategies to invest in hedge funds are Relative Value, Event-Driven, Directional Trading, Long/Short Equity, etc. Hedge funds often use sophisticated investment strategies, including quantitative modeling, arbitrage, and event-based strategies. These techniques can quickly incorporate new information, identify mispricing, and contribute to market efficiency. Grab this template.

Template 4: Long Short Hedge Funds PowerPoint Presentation and Google Slides ICP

The PPT Set is a specialized deck designed to articulate the precise funding strategies employed using lengthy-brief hedge finances. It consists of slides that explain the essential concepts behind the strategies, the risk management techniques employed, and the market scenarios wherein those finances tend to perform first. Graphical representations of overall performance, research of long-term techniques, and specific analyses of profiles make this presentation a helpful resource. Download it now.

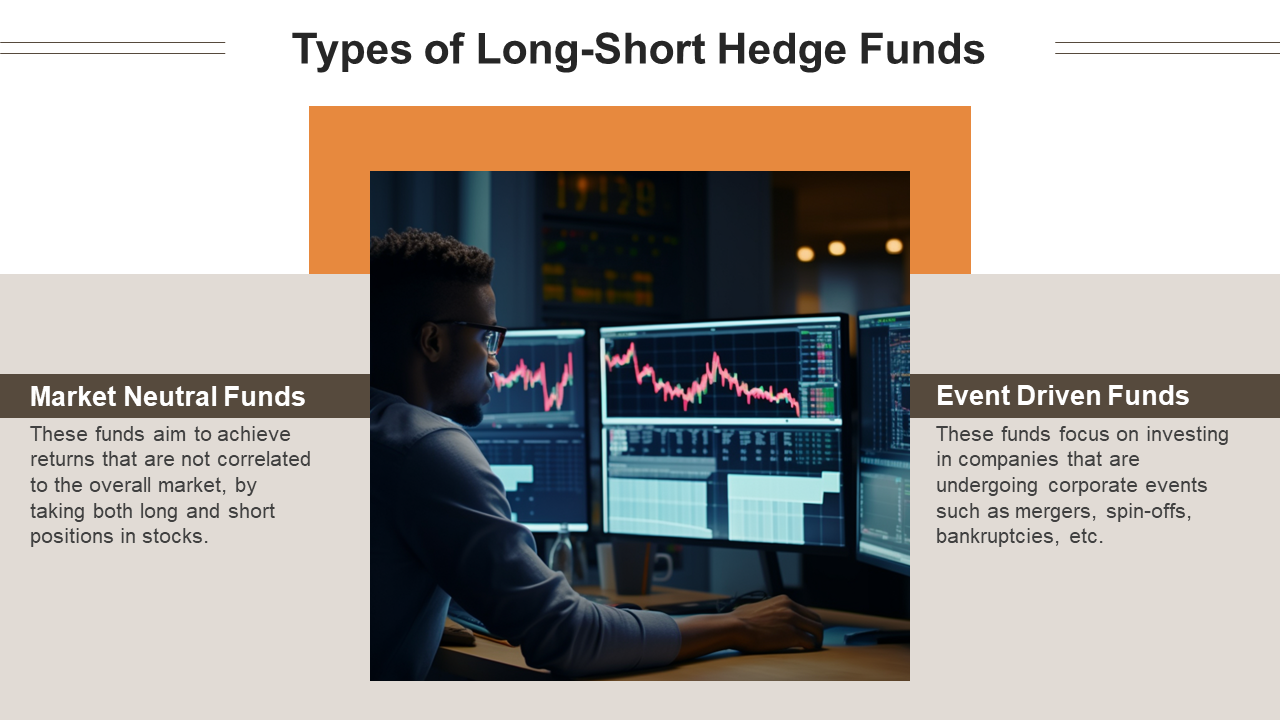

Template 5: Types of Long Short Hedge Funds

Long/short hedge funds represent a versatile investment strategy widely accepted in the industry. By taking long positions in undervalued stocks expected to rise, and short positions in declining stocks, these funds aim to gain from the market of ups and downs, reduce market risk exposure, and appeal to large number of investors by offering volatility and risk-adjusted returns in long/short strategies. The slide showcases main types of long/short hedge funds, each with a specific focus and strategy: Market-neutral and event-driven funds. Get it now.

Template 6: Prime Broker Hedge Fund PowerPoint Presentation and Google Slides ICP

The Template Bundle is a strategic tool designed to clarify the role and importance of prime brokers in hedge fund operations. This presentation outlines the services and support supplied via prime agents to hedge finances, ranging from execution and clearance to financing and custodial offerings. With clear visuals, charts, and infographics, this deck delves into the benefits of utilizing top brokers, emphasizing risk control, operational efficiency, and better liquidity. It is a valuable resource for hedge fund specialists who train stakeholders and potential buyers on the crucial relationship between hedge finances and prime brokers. Download right away!

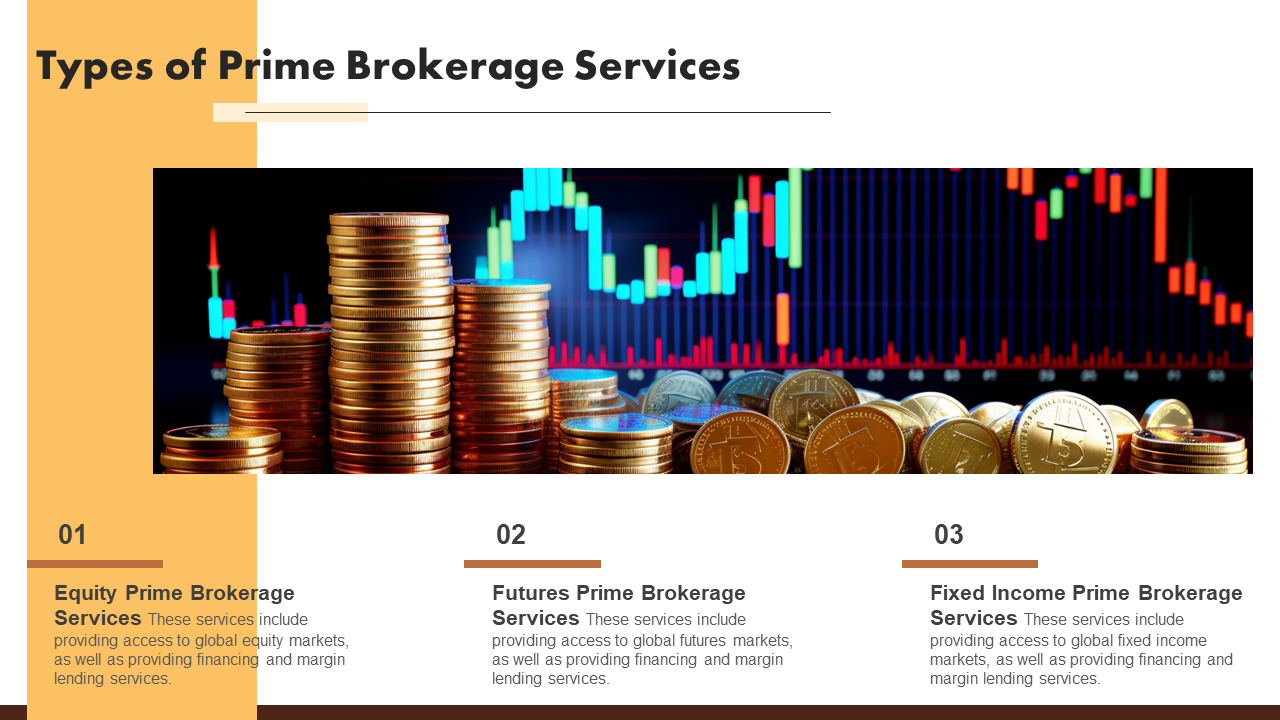

Template 7: Types of Prime Brokerage Services

Prime brokerage services are essential for the financial services industry, catering primarily to hedge funds, institutional investors, and significant investment entities. Prime brokers offer services that allow clients to execute their investment strategies efficiently and effectively. The range of services prime brokers provide is broad and designed to support the diverse needs of their sophisticated clientele. The main types of prime brokerage services shown are: Prime brokerage services, which are essential components of the financial services industry, managing hedge funds, institutional investors, and significant investment banks. The various primary brokerage services: Equity Prime Brokerage Services, Futures Prime Brokerage Services, and Fixed Income Prime Brokerage Services. Download this template now.

Template 8: Hedge Fund Premium PowerPoint Presentation and Google Slides ICP

This PPT Template is a comprehensive resource tailored to clarify the ideas of premium hedge funds. This presentation details premium hedge funds' distinctive features and strategies, offering insights into their investment philosophies, risk management approaches, and performance metrics. Through visually attractive slides, the deck facilitates a deep understanding of how top-class hedge funds seek to deliver superior returns even when navigating complex market dynamics. This PowerPoint and Google Slides ICP are invaluable tools that clearly and precisely shed light on the world of premium hedge fund management. Grab now.

Template 9: Analyzing Hedge Fund Premium Risk and Return

Analyzing hedge funds' premium risk and return is to understand their unique characteristics and strategies, which make them different from traditional investment options like mutual funds, ETFs, etc. Hedge funds aim to be extended/ short equity, global macro, event-driven, and many more. "Premium" refers to the excess return above the risk-free rate or benchmark investors expect to earn in exchange for more investment risk. Investors must evaluate whether the potential returns justify the risks and costs associated with hedge fund investments. Get this template.

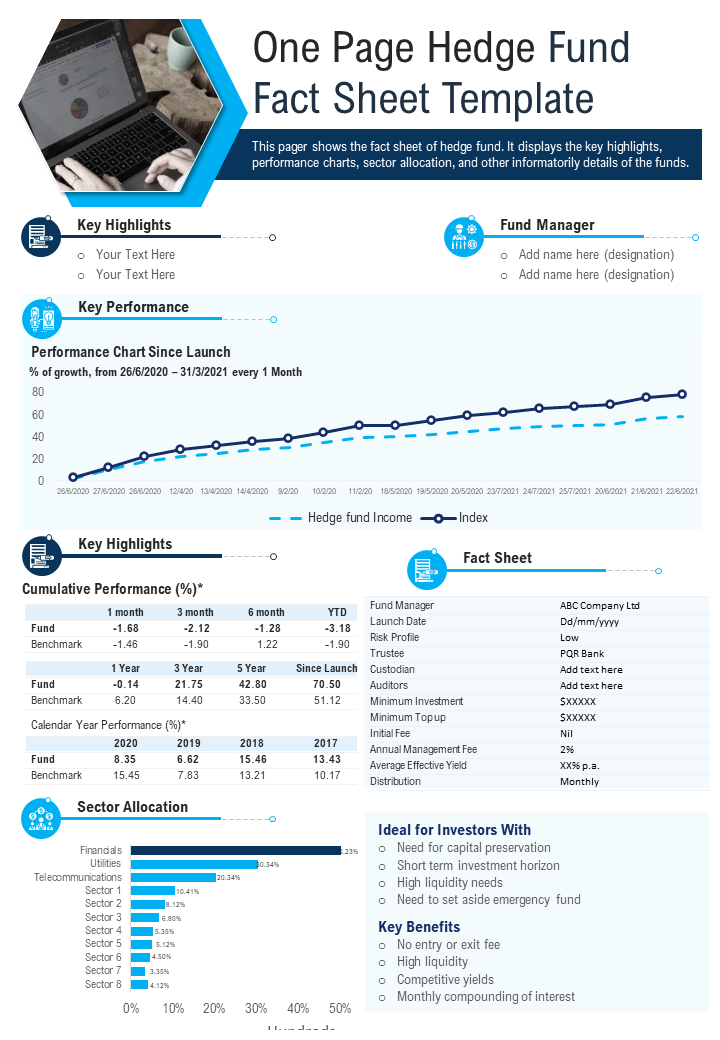

Template 10: One Page Hedge Fund Fact Sheet Template Presentation Report Infographic

This PowerPoint Template is a concise and visually appealing presentation document designed to offer a snapshot of key facts about a hedge fund. This template includes essential details, the fund's funding method, performance highlights, key contributors, and other data, all on a single page. Through a mixture of clear infographics, charts, and textual content, this fact sheet gives a brief overview of the fund's vital attributes, making it a super resource for investor meetings, displays, or distribution. Grab it now.

How Crucial Are Hedge Funds?

Hedge funds play an essential role in financial markets, providing exceptional returns and contributing to market efficiency, liquidity, and innovation. Its goal is to exploit market inefficiencies by aggressively managing stocks to maximize alpha or returns. This focus on achieving positive returns under market conditions can contribute to overall market performance. Through their active management and investment decisions, hedge funds provide capital to companies, businesses, and institutions.

The hedge fund's performance fee structure, in which managers receive 10 percent of profits, aligns investors' interests with their own. This incentive system encourages fund managers to strive for better returns and risk management.

Overall, hedge funds play a strong role in the economy, contributing to market development. Our Hedge Fund Pitch Deck Templates use sophisticated charts and graphs to illustrate the fund's historical performance. From profitability to volatility to benchmark comparisons, it paints a complete picture, instilling confidence in potential investors.

Customer Reviews

Customer Reviews