For a financial advisor or stock dealer, the scenario of cocktail parties, where everyone seems to seek stock tips and divine predictions, is all too common. Even as people look at them like a crystal-ball gazer who predicts the future, decoding the truth of financial projections is far from any mythical seer's capabilities.

While projections might be mistaken for crystal ball gazing, it is much more than predicting the future – it's about charting a course amidst uncertainty with calculated and data-based confidence. Unlike superstitions, logic, and historical data backs projections.

Business And Financial Projections

Projections play a pivotal role in shaping the future. From predicting economic trends and technological advancements to estimating sales, budget, and operational metrics, the insights gleaned are precious and path-breaking.

In essence, financial projection involves mapping future financial performance, cash flows, and resource needs, enabling stakeholders to make strategic decisions with confidence. It empowers companies to allocate resources well, manage risks, evaluate performance, and attract investors. Whether it's charting a growth trajectory, mitigating uncertainties, or maintaining financial stability, financial projections are indispensable. These help businesses navigate the unpredictable tides of the market and get success.

Five Year Financial Projection Templates

Creating financial projections for the long-term, such as five years, offers businesses benefits.

Long-term projections facilitate strategic planning, enabling organizations to set clear objectives and chart a path for sustainable growth. These aid in resource allocation, ensuring investments align with long-term goals and fostering efficient financial management.

Long-term projections provide a benchmark for performance evaluation, attracting investors, and guiding business valuation; however, challenges arise due to uncertainties, making it difficult to predict market conditions and unforeseen events. Gathering reliable historical data and aligning stakeholders can be complex, while assumptions and external factors impact projections. Navigating the complexities of financial projections with these challenges is a daunting task. That's where our five year financial projection templates became your guiding beacons.

Empowered by comprehensive data analysis, robust models, and flexibility, our templates pave the way for confident decision-making and strategic planning.

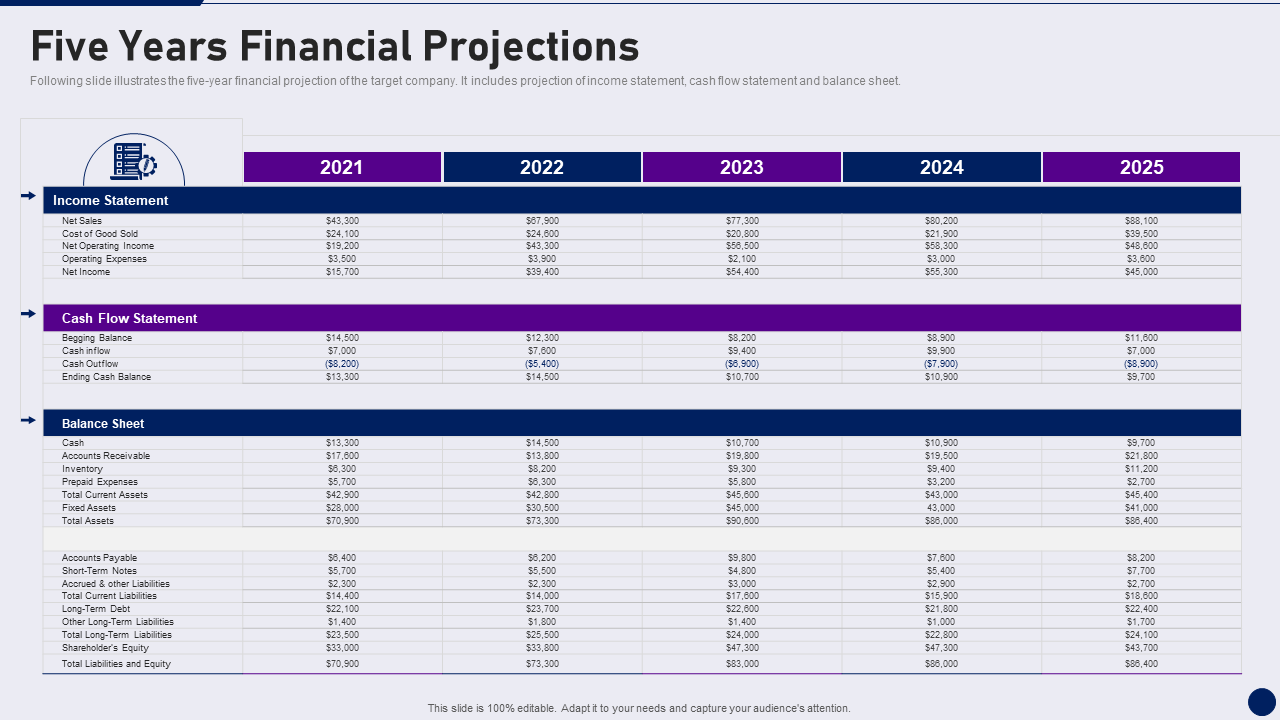

1. Five Year Financial Projections Presentation Template

This comprehensive and user-friendly design provides a clear and detailed view of financial projections for businesses over five years. It encompasses three vital components - income statement, cash flow statement, and balance sheet. The slide breaks down these components into smaller, easy-to-track factors, including operating expenses, cash inflows, cash outflows, accounts receivable, inventory, fixed assets, and more. Whether you are a startup seeking investor confidence, an established business planning for growth, or a financial professional seeking to make informed decisions, this PPT Layout is your ally. Download it now!

2. Five Year Financial Projection Template For Start-Up Fundraising

Ignite investor interest and fuel your start-up's fundraising journey with our dynamic presentation design that empowers you with financial foresight. This PowerPoint Layout enlists components from projecting revenue from new and renewal customers to assessing total revenue and revenue growth. Use this template to showcase your start-up's potential with clarity and precision using expense breakdowns, sales & marketing, R&D, and General & Administrative (G&A) expenses, alongside their percentages. With insights into total expenses, margin Earnings Before Interest, Depreciation, and Tax (EBIDTA), and margin percentage of revenue, you can demonstrate your profitability potential to investors. Get it now!

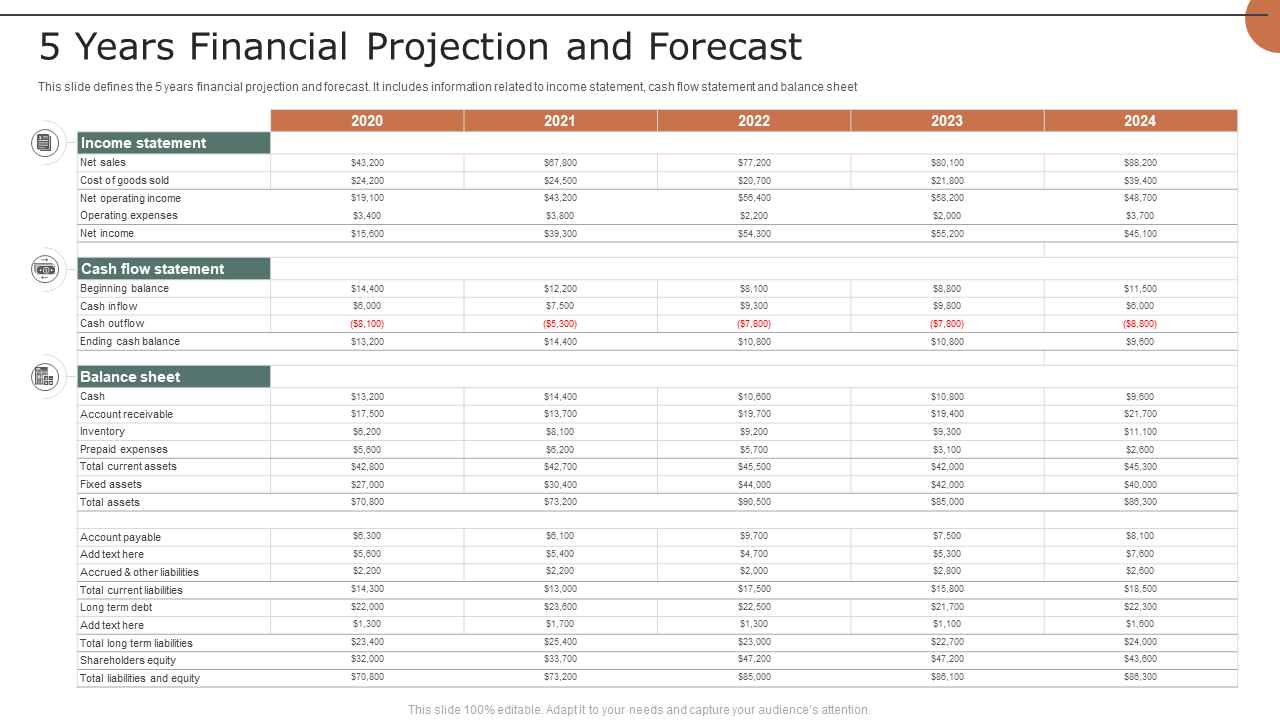

3. Five Year Financial Projection And Forecast PPT Template

Unveil the future of your business with style and precision with this all-in-one financial template showing your five year projections. With crystal-clear components of this PPT Slide, like an income statement, cash flow statement, and balance sheet, you will master the art of forecasting like a pro. Dive into the finer details with easy-to-track factors like net sales, cost of goods sold, cash inflow & outflow, prepaid expenses, current assets, and more - making financial foresight a piece of cake. Grab it today!

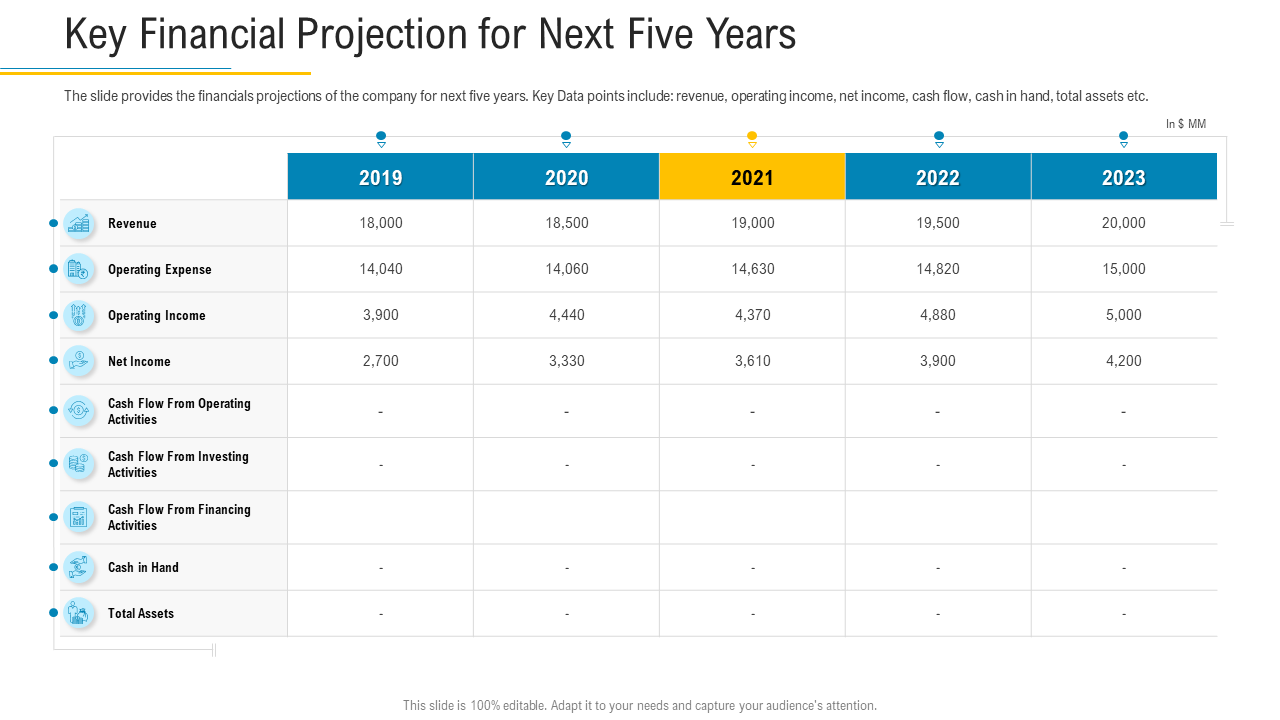

4. Key Financial Projection for Next Five Years PPT Template

Dazzle your audience with a display of financial foresight. This tabular format presentation design is your one-stop-shop for projecting your business financial journey over the next five years. From revenue and operating expenses to net income and cash flows, this template organizes key financial components in an effective way. Whether seeking investor confidence or planning your next big move, this engaging PowerPoint design will help you chart a path to success. Download it now!

Future-Proof Your Finances!

Businesses use financial projections to plan, strategize, and make informed decisions. These are crucial to assessing business financial performance, making strategic decisions, attracting investors, securing loans, and planning for the future. Some basic financial projections businesses use:

- Revenue Projections: Estimate the expected sales and income the business generates over a specific period. It helps companies gauge potential sales and revenue streams.

- Expense Projections: Forecast expected costs and expenditures incurred by the business during a particular time frame. It includes operating expenses, salaries, marketing costs, and other overheads.

- Cash Flow Projections: Provide insights into expected inflows and outflows of cash for the business. It helps manage cash flow and ensure sufficient liquidity for operational needs.

- Profit Projections: Estimate the expected net income or profit for the business after deducting all expenses from the revenue. It helps companies to assess their profitability and financial health.

- Balance Sheet Projections: Balance sheet projections offer a snapshot of the business's financial position at a specific point in the future. It includes assets, liabilities, and equity.

- Growth Projections: Predict the expected expansion or growth rate of the business that aids in setting growth targets and assessing the feasibility of expansion plans.

- Capital Expenditure Projections: Estimate the expected investments in long-term assets, such as equipment, buildings, or technology.

- Debt Projections: Assess the expected borrowing and repayment schedule for loans and other debts the business takes.

- Break-Even Analysis: Determine the level of sales or production at which the business neither makes a profit nor incurs a loss.

- Sensitivity Analysis: This involves assessing the impact of changes in key variables or assumptions on financial projections. It helps understand the sensitivity of forecasts to variables.

These projections offer valuable insights into the financial health and potential growth of the business, enabling proactive management and a clearer path to success.

With our five year financial projection templates, you can transform your vision into a tangible roadmap for success. These PPT Layouts will empower your business to navigate uncertainty and seize opportunities over the next five years with their research-based robust design.

From revenue and expense forecasts to cash flow management and growth projections, these comprehensive and user-friendly designs cover critical aspects of financial projections.

Don't miss this opportunity to secure your financial future - download our five year financial projection templates now and chart your path to prosperity!

FAQs on Financial Projections

What is in a financial projection?

A financial projection is a forecast of a company's financial performance over a period ranging from one year to five years or more. It outlines financial results based on assumptions and historical data. The key components included in a financial projection are:

- Income Statement (Profit and Loss Statement): Show the company's projected revenues, expenses, and profits over the forecast period. It provides insights into the company's ability to generate profits and manage costs.

- Balance Sheet: Projects the company's assets, liabilities, and shareholders' equity at the end of each forecast period. It gives an overview of the company's financial position and ability to meet its financial obligations.

- Cash Flow Statement: The cash flow projection demonstrates the expected cash inflows and outflows during the forecast period. It is crucial to assess the company's cash liquidity and capacity to handle financial commitments.

How do you calculate financial projections?

Calculating financial projections involves a combination of historical data, market research, and assumptions about future performance. Here's a step-by-step process:

- Start by collecting historical financial statements, including income statements, balance sheets, and cash flow statements.

- Based on market research and expert insights, make assumptions about factors that will impact the company's performance, such as revenue growth rate, cost of goods sold, operating expenses, etc.

- Project the revenue by applying the growth rate assumption, calculating costs, and estimating gross profit and net income.

- Project balance sheet items by considering expected changes in assets and liabilities. Ensure that the balance sheet remains proportional.

- Use the income statement and balance sheet data to determine cash flows from operating, investing, and financing activities.

- Analyze the projections for reasonableness and adjust the assumptions if necessary. Consider potential risks and market uncertainties.

- Develop scenarios to understand how changes in assumptions impact the projections.

What are 3-way financial projections?

Three-way financial projections go beyond a traditional income statement and balance sheet projections by incorporating the cash flow statement. These projections include three key financial statements — Income Statement (Profit and Loss Statement), Balance Sheet, and Cash Flow Statement.

By combining these three financial statements, three-way financial projections provide a more comprehensive and accurate representation of a company's financial health. These help businesses and investors gain a deeper understanding of the company's ability to generate cash, manage working capital, and meet financial obligations. These projections are valuable tools for strategic planning, identifying potential funding gaps, and making informed business decisions.

Customer Reviews

Customer Reviews