Renowned investor Warren Buffett has emphasized the significance of a term sheet in facilitating successful investments. Buffett states, "The best thing I ever did was to write down my investment criteria so I could see them. That's my term sheet." His endorsement serves as a testament to the importance of having a clear set of terms and conditions that both parties can agree on before proceeding with any business or investment deal.

A term sheet is a tool that enables investors and entrepreneurs to stay aligned and avoid misunderstandings. Without a well-crafted term sheet, negotiations can become a complex and arduous task, causing a breakdown in communication and loss of opportunities. A term sheet provides a map to navigate the labyrinth of negotiations, enabling both parties to proceed with clarity and understanding.

In essence, a term sheet is the foundation of any successful transaction. Its importance cannot be overstated, as it helps to establish a solid foundation for a successful business or investment deal. Failure to recognize its significance could result in missed opportunities and costly mistakes.

If you are struggling to create a fail-proof term sheet for your business deals and agreement, we have a helpful solution for you— Term Sheet Templates

Best Term Sheet Templates to Protect Your Business

SlideTeam presents a unique collection of One-page Term Sheet Templates that will help you streamline your investment deals and easily seal the agreement. These one-pagers are the ultimate secret weapon for every savvy entrepreneur.

The 100% customizable nature of the templates provides you with the desired flexibility to edit your presentations. The content-ready slides give you the much-needed structure.

Let’s begin!

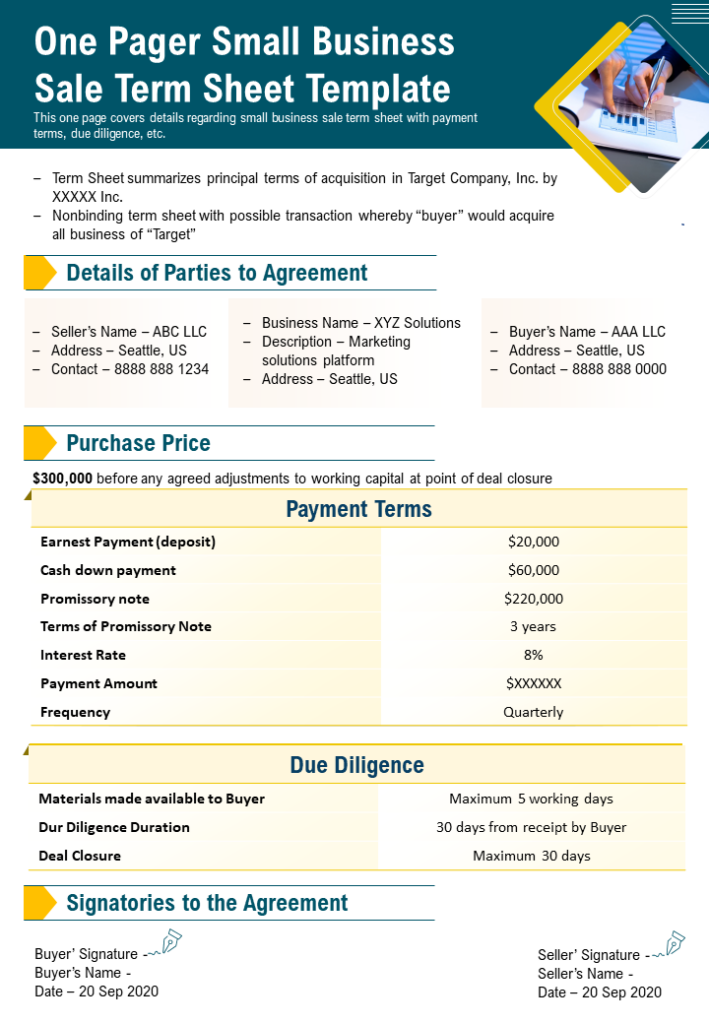

Template 1: One Pager Small Business Sale Term Sheet Template

Looking to sell your small business? Don't let the legal complexities of the sale process bog you down. This Small Business Sale Term Sheet Template is your ultimate solution for a smooth and hassle-free sale. Whether it's the purchase price, closing date, or any other relevant details, this template covers all essential aspects you need to consider for a successful sale. With this PPT Document, you can take charge of your sale negotiations, minimize potential misunderstandings, and secure a lucrative deal for your business. Download now!

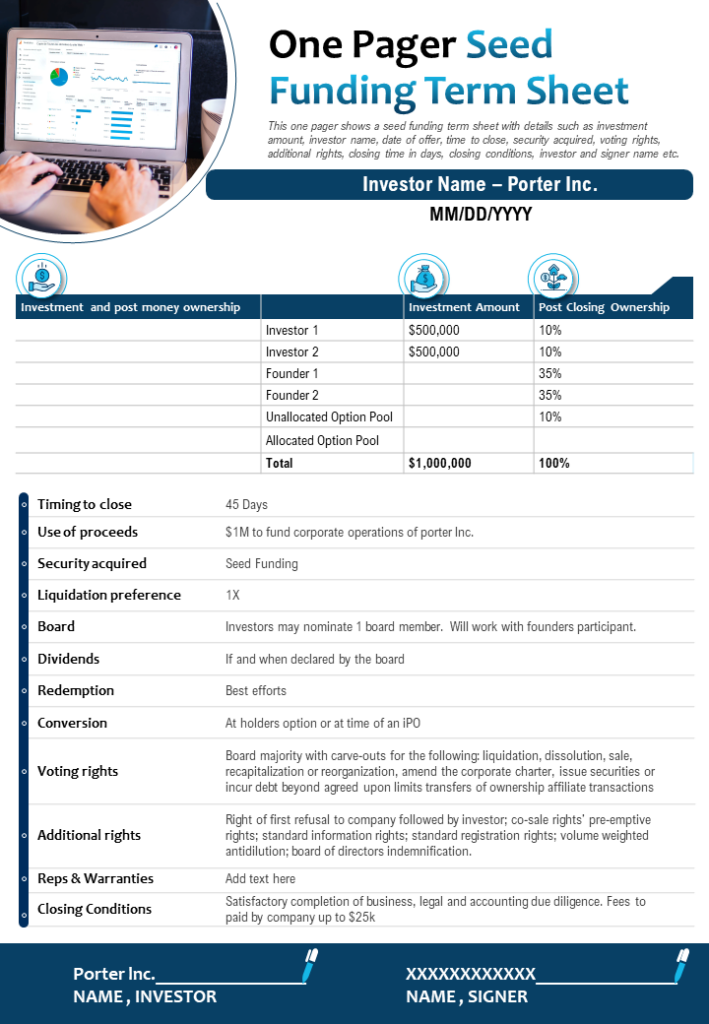

Template 2: One-page Seed Funding Term Sheet Template

With this template, you can easily define the investment amount, valuation, and equity percentage, among other crucial aspects of your funding deal. It also includes twelve crucial elements of a seed funding agreement: Security acquired, liquidation preference, reps, warranties, etc. With this Seed Funding Term Sheet Template, you can streamline the funding process, communicate effectively with potential investors, and secure the capital you need to grow your business. Don't let the funding process intimidate you - take charge of your startup's financial future with the use of our user-friendly and highly effective term sheet template.

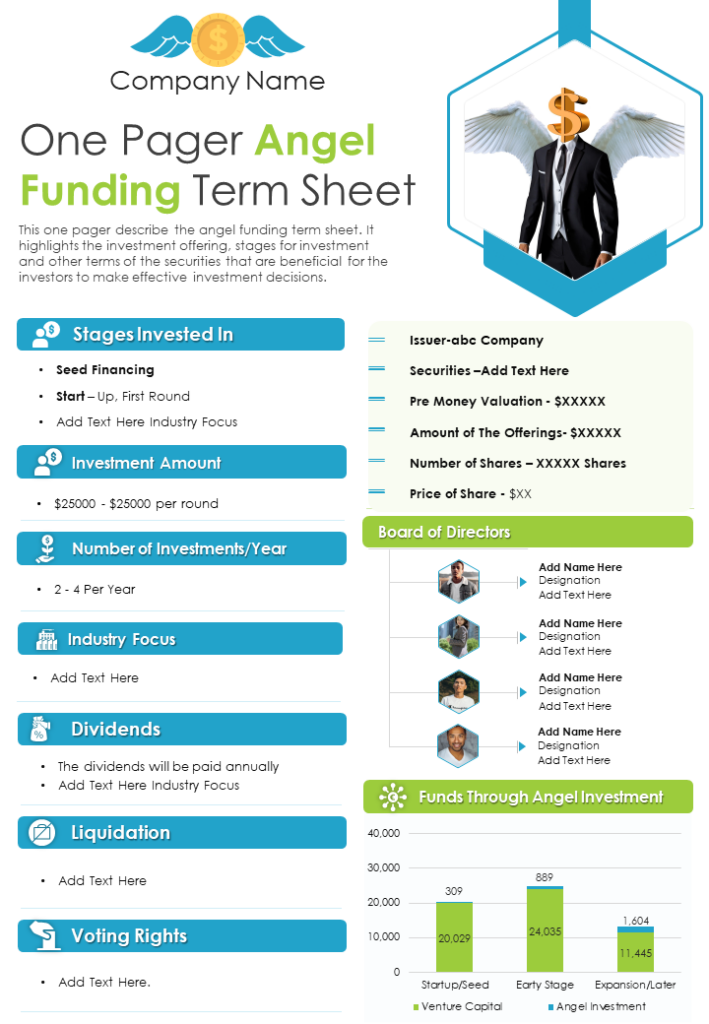

Template 3: One-Pager Angel Funding Term Sheet

This Term Sheet Template is a crucial document for startups seeking funds through angel investment. It outlines essential terms such as investment amount, industry focus, dividends, and liquidation preferences. By defining the investment amount and industry focus, the term sheet template ensures that the investor's funds are directed toward a specific area of interest. The template also defines the dividend payout structure and liquidation preference, which provides clarity on how profits will be distributed. Download it today!

Template 4: One-Pager Fund Formation Term Sheet

This PPT Template is an indispensable tool for promoters looking to raise capital for their investment fund. It provides a concise overview of the fund, including a company snapshot, expected date of closing, use of proceeds, and exit conditions. It enables promoters to communicate their investment strategy and goals, making it easier for investors to understand the fund's potential. It also entails the expected date of closing and use of proceeds and ensures that investors have a clear understanding of the timeline and purpose of the investment. Grab it today!

Template 5: One Pager Term Sheet Template for Venture Fund Investment

This template is a game-changer for startups looking to secure funding from venture funds. It includes the investment structure, dividend payments, and closing conditions, making it easier for entrepreneurs to understand. It also includes the investment structure to make it easier for all to see if the objectives of the investor align with the startup's goals and objectives. The closing conditions outlined in the template help entrepreneurs understand the requirements for sealing the deal, making the investment process hassle-free.

Template 6: One-page Revenue Participation Funding Term Sheet

Here’s a cutting-edge instrument for emerging enterprises seeking financing through revenue participation agreements. This concise and comprehensive document highlights the key provisions of the investment agreement, conveying a compelling case for prospective investors. This term sheet effectively showcases the startup's potential for substantial growth and profitability. Furthermore, it delineates the repayment framework, guaranteeing that investors receive their returns based on the startup's revenue performance.

Final Note

Now that you know how term sheet templates can save you time and effort without delving into the legal jargon, it's time to download these documents that make the investment process and business deal making as free of risk as possible

With our risk-free Term Sheet Template, entrepreneurs can focus on their core business functions and ensure that the terms of the investment are unambiguous and concise. Whether pursuing financing through venture funds, revenue participation agreements, or angel investment, having a dependable and comprehensive term sheet can be the key differentiator.

Download these risk-free Term Sheet Templates and take the first step towards procuring the necessary investment to drive the business toward unprecedented success.

PS. If you are looking for Lease Agreement Templates, here’s a handy guide with stunning templates, samples, and examples.

FAQs on Term Sheet

Is a term sheet legally binding?

A term sheet is usually considered a non-binding agreement, although certain provisions in the term sheet may be binding, depending on the specific language used and the context of the transaction.

For example, some provisions in a term sheet, such as confidentiality agreements, exclusivity provisions, and provisions related to expenses and costs incurred during the negotiation process, may be binding. However, the more significant provisions, such as the purchase price, the representations and warranties, and the closing conditions, are typically considered non-binding until a final, definitive agreement is reached.

What should be included in a term sheet?

A term sheet is a preliminary document that outlines a proposed business transaction's key terms and conditions. The exact contents of a term sheet may vary depending on the nature of the transaction, but generally, it should include the following information:

Transaction structure: The type of transaction being proposed, such as an investment, merger, or acquisition.

Purchase price: The amount of money being offered to buy or invest in the company.

Capitalization table: The company's ownership structure, including the percentage of ownership held by each shareholder and any outstanding debt or other liabilities.

Closing conditions: Any conditions that must be met before the transaction can be completed, such as regulatory approval or due diligence.

Representations and Warranties: A list of statements that the seller makes seller about the company, including its financial condition, legal status, and any other relevant information.

Intellectual property: Any intellectual property that the company owes and how these assets will be transferred or licensed as part of the transaction.

Governance: Any changes to the management or board of directors that will occur as part of the transaction.

Confidentiality: Any obligations of confidentiality or non-disclosure that the parties agree to as part of the transaction.

Termination: The circumstances under which the term sheet or the transaction may be terminated.

Governing law and jurisdiction: The law that will govern the transaction and the jurisdiction where any disputes will be resolved.

Customer Reviews

Customer Reviews

![10 Best Templates to Create a Dynamic Master Action Plan [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/02/1013x441no-button-1-1-1013x441.jpg)

![10 Best Key Learning Templates to Establish Clear Goals [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/02/10-Best-Key-Learning-Templates_1-1-1013x441.png)