Whether you are an individual taxpayer or a business owner, preparing and submitting accurate and timely tax reports is crucial for staying on top of your tax obligations and avoiding penalties or interest charges.

The objective of generating tax reports is to provide a detailed and precise record of an individual's or a company's financial data to the relevant tax authorities. This information is used to calculate the tax liability and determine the amount of tax due.

Tax reports serve as a record of income and expenses and can assist in discovering potential tax deductions and savings. Hence, creating tax reports is a vital component in the tax compliance procedure, enabling individuals and businesses to fulfil their tax responsibilities and plan their financial future.

The process of creating tax reports, however, is complex, but with the right tools and resources, it is manageable and can provide valuable insights into your financial status.

If you are a finance professional responsible for creating tax reports, we have a helpful resource for you. SlideTeam presents ready-to-use PowerPoint Slides to generate specialized reports that automate tax processing and lessen the complexity of calculations.

These PowerPoint diagrams are simple to use, time-saving, and accessible for downloading.

Let’s explore these content-ready templates!

Template 1: Payroll Management Income Tax Statutory Reports Template

This Payroll Management Income Tax Statutory Report template is an essential tool for any HR or finance department. It helps to streamline the payroll process by automating the calculation of income tax and other statutory deductions, such as social security and health insurance contributions. With this template, you can be confident that your payroll process is compliant with local regulations, and that your employees' tax obligations are being met.

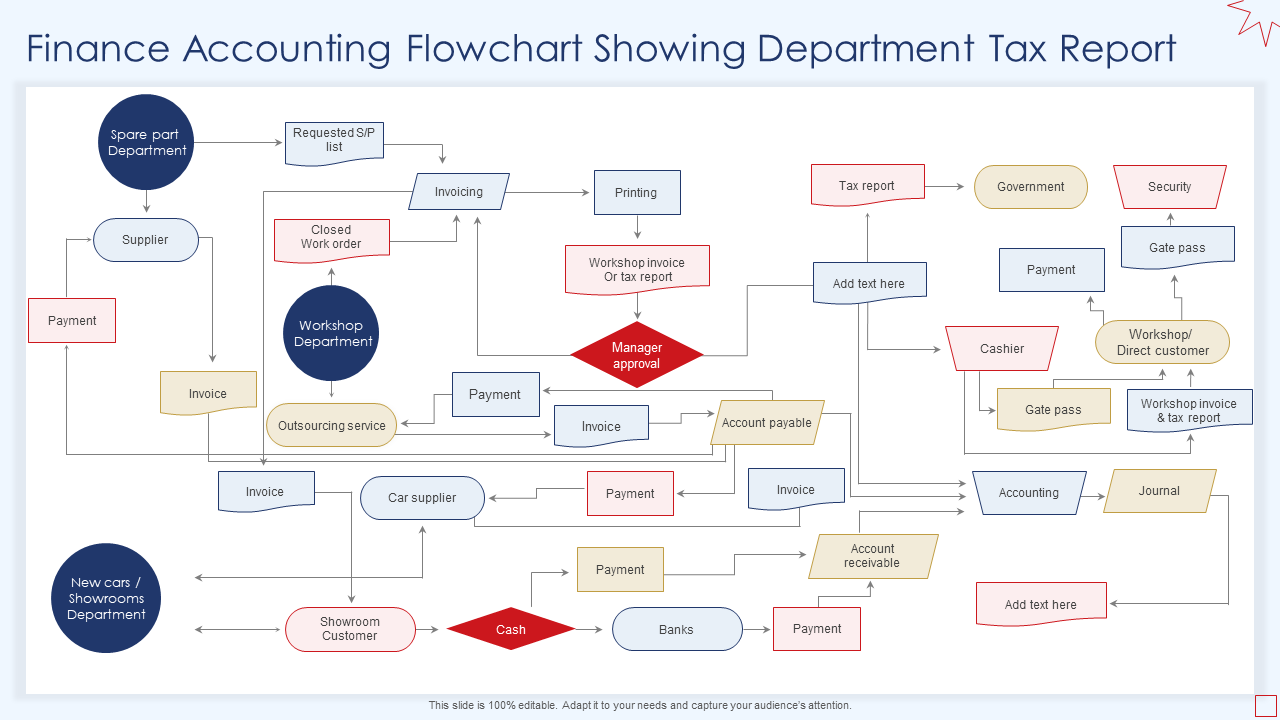

Template 2: Finance Accounting Flowchart Showing Department Tax Report PPT

Introducing our premium collection of slides with a flowchart showing a department tax report and financial accounting. Use this PPT slide to explain the stages and provide information on detailed tax reports. This comprehensive flowchart design and fully customizable PowerPoint template can be used to explain subjects like invoicing, printing, government, security, and payment. Download this template right away and customize it with your creativity!

Template 3: Wealth Tax Proposal Sample Document Report Doc Pdf PPT

This Wealth Tax Proposal Template offers a compelling pitch, including objectives, a road map, and wealth portfolio monitoring. The PowerPoint proposal also shows the several services the business provides to meet client’s needs, like tax planning, cash flow analysis, consulting services, etc. It highlights numerous services provided together with their true costs and taxes and a synopsis of the business, highlighting its history, purpose, basic values, etc.

Template 4: Bi Fold Summary Tax Preparation Document Report PPT

Introducing this Bi Fold Summary Tax Preparation Document Report PDF PPT Template, which with its bi-fold style makes it simple for your visitors to understand your business and area of expertise. This PowerPoint design features vibrant accents to go with any industry. It is useful for organizing and presenting your communication and promotional assets as it is jam-packed with impactful visual information. Thanks to its entirely changeable images, fonts, and themes, you may also utilize it to raise your reporting game. Download this cutting-edge template right away.

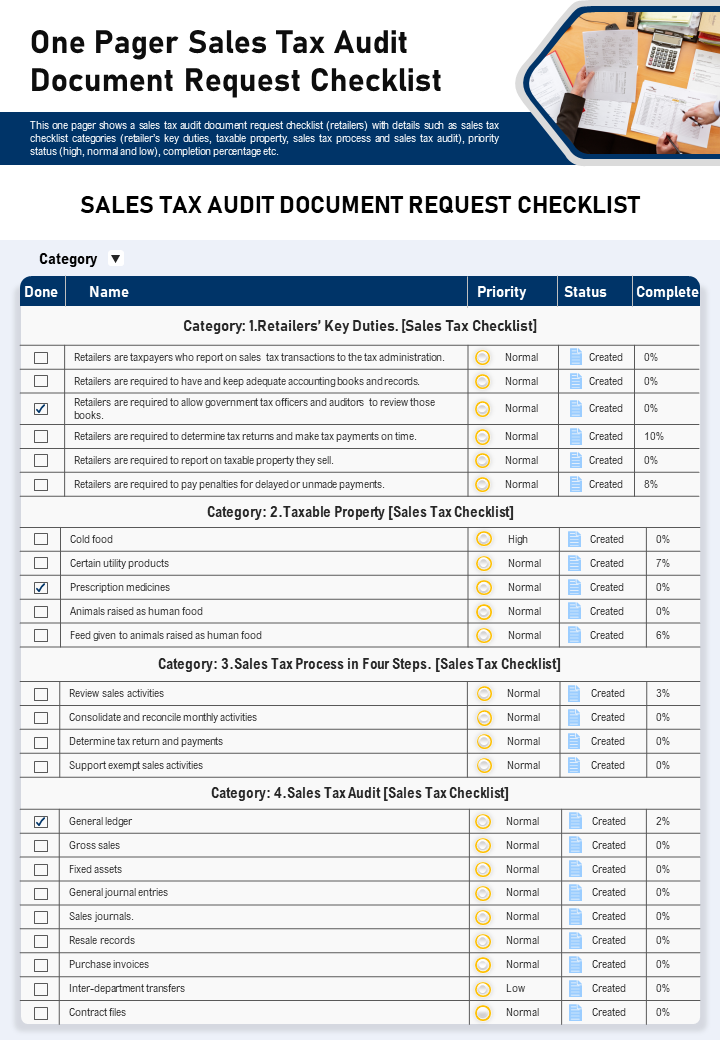

Template 5: One Pager Sales Tax Audit Document Request Checklist Presentation Report PPT

The one-page PowerPoint template includes a pre-made checklist for document requests for sales tax audits. This template has sections for the sales tax checklist, retailers' primary responsibilities, taxable property, the sales tax procedure, and information on sales tax audits. It enables you to classify the various requirements into high, normal, and low priority categories. Download this avant-garde PPT to save time. It can be used for digital or commercial printing.

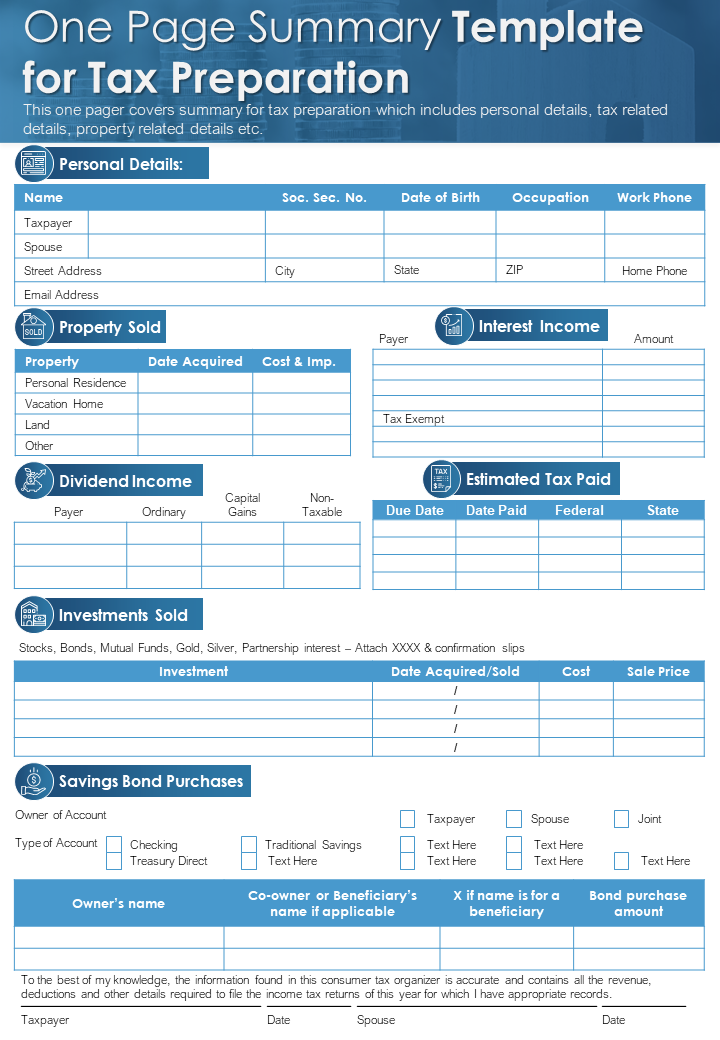

Template 6: One Page Summary Template for Tax Preparation

This one-page summary template on tax preparation is a valuable tool that condenses complex tax information into a concise and easy-to-read format, providing a clear overview of all relevant tax details in one place. With this PPT document, you can quickly reference important information, such as income, expenses, deductions, and tax liabilities, reducing the time and effort required to prepare your taxes. Whether you're a small business owner or an individual, this one page summary template on tax preparation is a great way to keep your finances aligned with your goals.

Template 7: One Page Tax Preparation Checklist Template Presentation Report Infographic PPT

This expertly created one-page tax preparation sheet presentation contains all the pertinent information about the taxpayer, including personal data, dependent information, documents needed for the appointment, estimated tax paid, and deductions. This design is editable, so you are free to make any adjustments or changes you desire. Take advantage of this one-page presentation report infographic template for tax preparation right away.

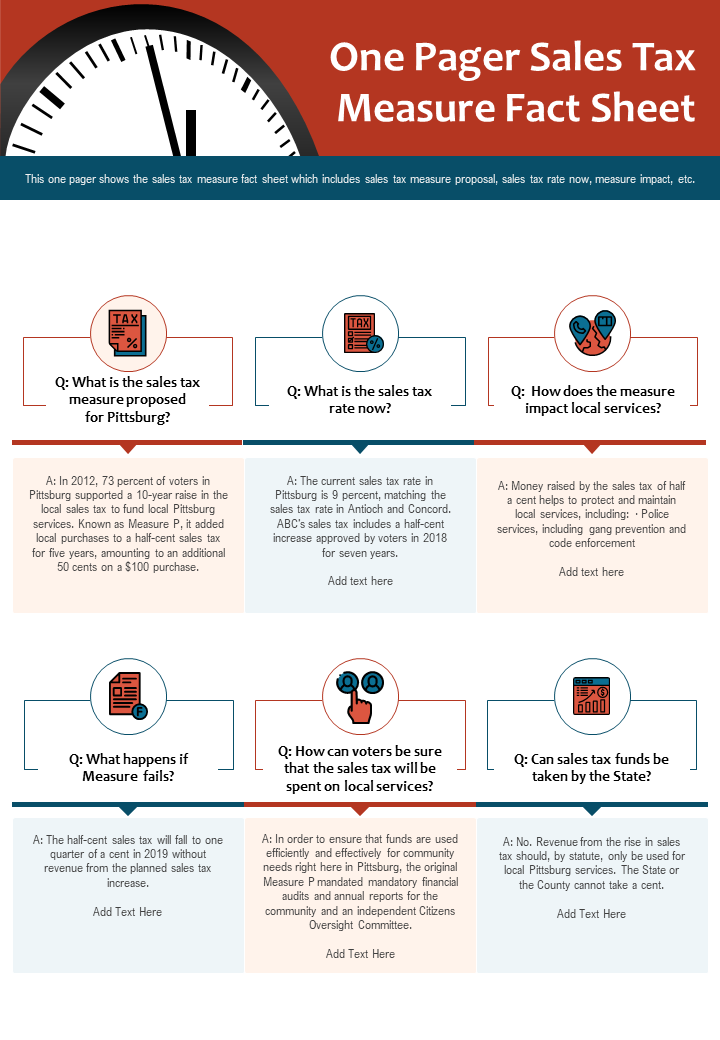

Template 8: One Pager Sales Tax Measure Fact Sheet Template

This PPT Document contains responses to queries about the proposed sales tax measure, the current sales tax rate, and the effect of the measure on local services. This one-page sales tax measure fact file also includes information regarding sales tax funds, voter information about the sales tax, and consequences associated to the initiative's failure. This one-page information packet is also available in different formats for sharing and saving. Get this template right away!

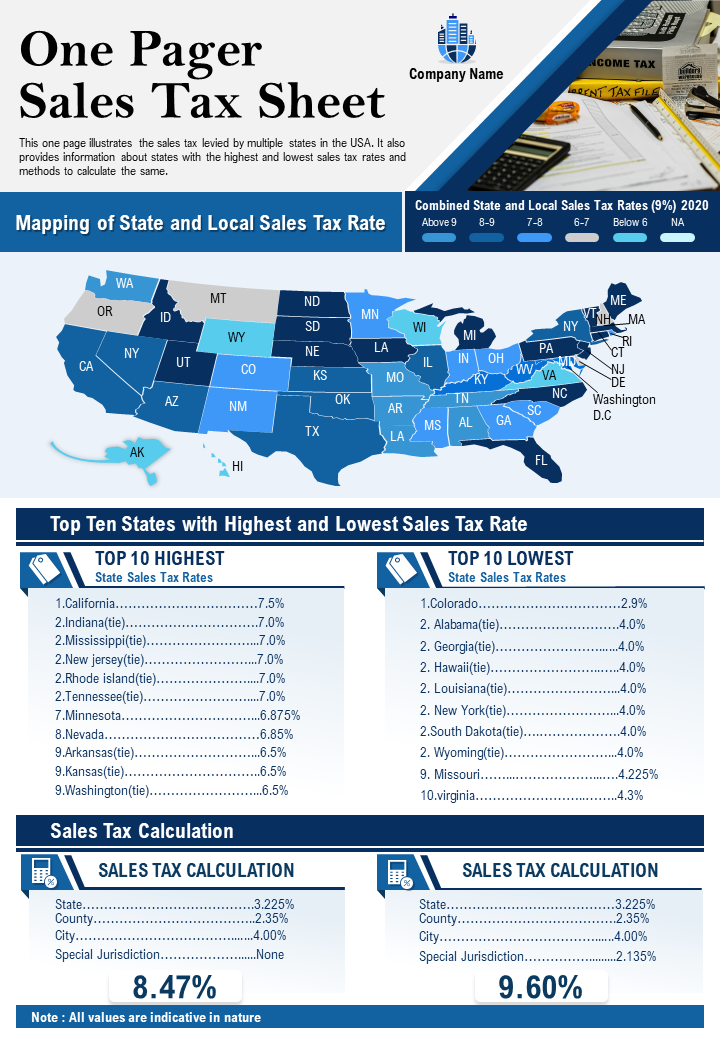

Template 9: One Pager Sales Tax Sheet Presentation Report Infographic PPT

Use this data sheet design to include information on the states with the highest and lowest sales tax rates. Customers can utilize the content-ready parts of the sales tax information sheet format to clarify how sales tax is calculated in addition to this. One of the many marvels of this template is that it gives the user the freedom to alter the text, colors, font type, and font size to suit their particular needs. Customers can therefore modify the sample PPT layout to suit their requirements and tastes. Downloading this template will save you time.

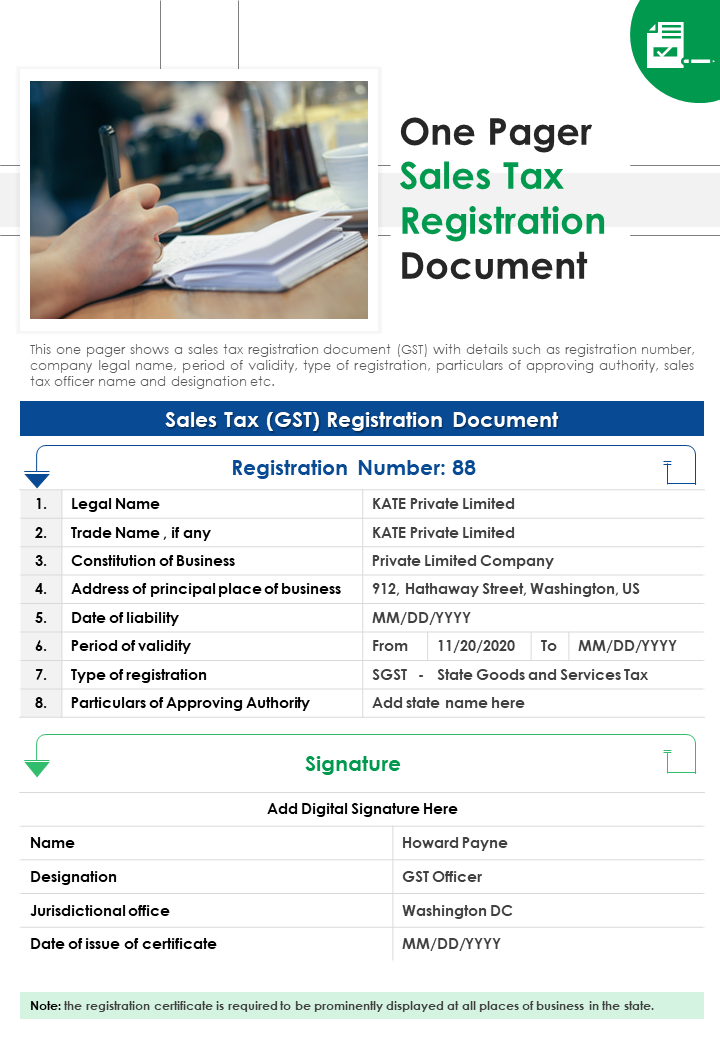

Template 10: One Pager Sales Tax Registration Document Presentation Report Infographic PPT

This sample one-page GST registration form includes information on the registration number, legal name of the firm, validity duration, type of registration, etc. Text portions can also be changed to provide details like the name and title of the sales tax officer and the approving authority. This template allows for complete modification. Customers may easily alter the language and other aspects to make it unique to their needs by investing in this tax registration form slide.

Now that you know why tax reports are crucial and how using a tax report template can help you to a great extent, it’s time to download these Tax Report Templates. Get started with creating a clear, transparent, and useful report for informed decision making.

If you are looking for Budget Proposals, here’s a handy guide with amazing samples and examples.

FAQs on Tax Reports

What is the meaning of a tax report?

Taxation is one of the biggest sources of income for the government. Any return, report, information return, or other document that is filed with or required to be filed with a federal, state, local governmental entity or other authority in connection with the determination, assessment, or collection of any Tax (regardless of whether such Tax is imposed on any of the Seller) or the administration of any laws, regulations, or administrative requirements relating to any Tax is referred to as a "Tax Report." To the best of the Seller's partners' and senior management's knowledge is referred to as "to the knowledge of the Seller."

What is included in a tax report?

A tax return is a document filed with a tax authority that reports income, expenses, and other pertinent tax information. Tax returns allow taxpayers to calculate their tax liability, schedule tax payments, or request refunds for the overpayment of taxes. In most countries, tax returns must be filed annually for an individual or business with reportable income, including wages, interest, dividends, capital gains, or other profits.

On tax returns, taxpayers calculate their tax liability, schedule tax payments, or request refunds for the overpayment of taxes.

Typically, a tax return begins with the taxpayer providing personal information, which includes their filing status, and dependent information.

What are the forms of tax return?

- Form 1040EZ: The Form 1040EZ from the IRS is the simplest one. And more taxpayers can now use the EZ because the IRS boosted the earning cap for filers who use it.

- Form 1040A: The following tax form on the ladder is the 1040A. More taxpayers should be able to use Form 1040A as the earning threshold for filers desiring to use it has increased, similar to what happened with Form 1040EZ.

- The five potential filing statuses for those utilizing the 1040A are single, married filing jointly or separately, qualified widow or widower, and head of household.

- Form 1040: If your income is higher, you itemize deductions, you have more complicated investments and other income to declare, or all of the above, choose Form 1040.

Customer Reviews

Customer Reviews