The now much taken-for-granted EBITDA valuation metric is the brainchild of John Malone, famously regarded as the cable cowboy. In the early 1970s, when Malone became the CEO of TCI, he came up with this unconventional solution of funding internal company growth and its acquisitions with the pretax flow.

The solution of moving away from the then wall street game of ‘cash per share’ proved to be the greatest competitive advantage for TCI.

But how is Ebitda still relevant?

Well, for starters, Ebitda, which we denote as equal to net income + interest + taxes + depreciation + amortization, measures your company’s profitability from revenue, excluding direct and indirect expenses.

And like every other company, your primary objective must be to maximize the wealth of your shareholders. So Ebitda helps you analyze the company’s operating performance before giving weightage to any financial decision, leading to effective due diligence.

Related read: Top 10 Business Due Diligence Templates to Predict and Eliminate Risks

Besides these, let’s delve into the six main reasons why you should calculate your Ebitda periodically.

- It’s responsible for the success of your liquidity event. A positive Ebitda result, for now, indicates profitability in the future.

- It helps present the level of your company’s operative viability before banks and investors by capturing its maximum value.

- It proves to be a north star metric for your company through which you can tell your company’s growth rate, potential, and stability.

- It assists you in making an informed decision on whether to keep the company running or dissolve it completely.

- It directs your decision on shareholders’ dividends and your retained earnings. It is the most crucial feature where you decide on the share value and the value you must retain for the upcoming year or expenses.

- It aids and abets your findings to set future targets for your company accordingly. You can choose to either increase your sales or reduce your costs based on the results.

Thus, Ebitda is the key to focus on your business fundamentals, operational profitability, and cash flows.

Ebitda templates to download and deploy

Collecting and consolidating each statistic in an organized and comprehensive manner can be difficult and time-taking. Therefore, we present our 10 best templates to help you calculate your company’s Ebitda margin or profitability effortlessly. Let’s explore them below to find the right pick for your unique requirements.

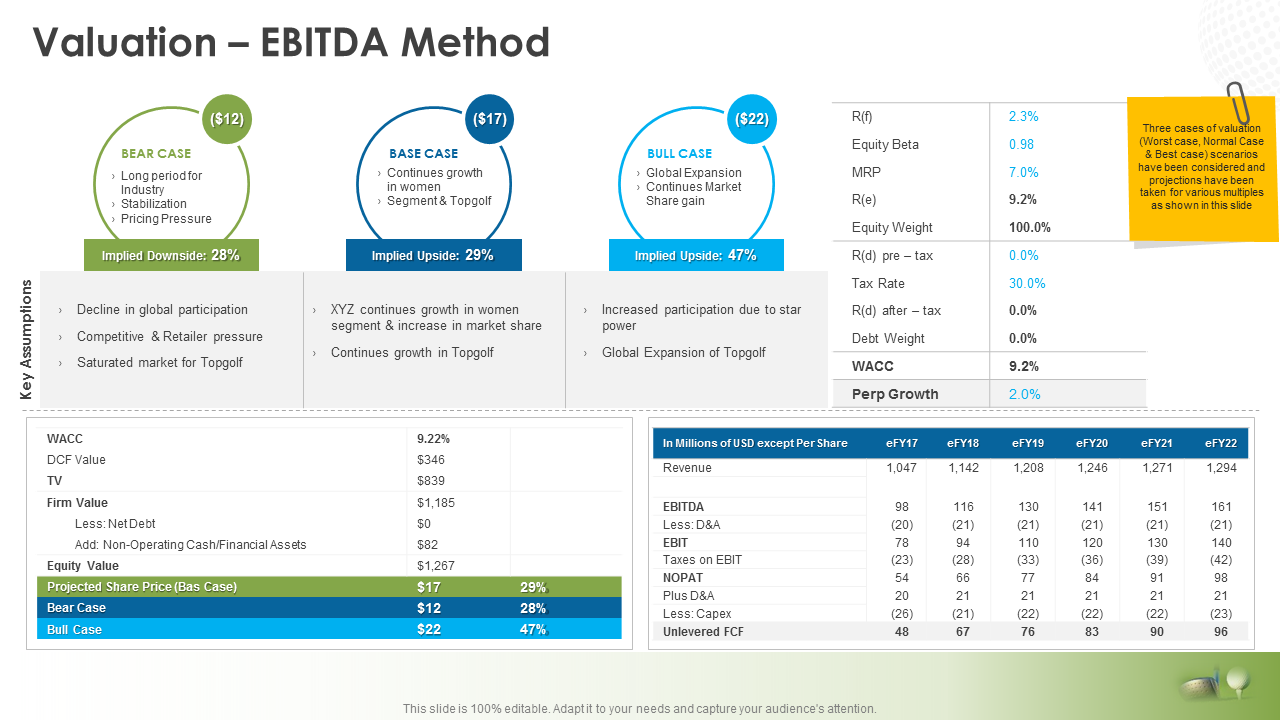

Template 1

Evaluate your company’s operating profitability by taking the aid of this PowerPoint template. Using this template, you can create a snapshot of your company’s net income before considering any other influencing factors. So go ahead and download the template now!

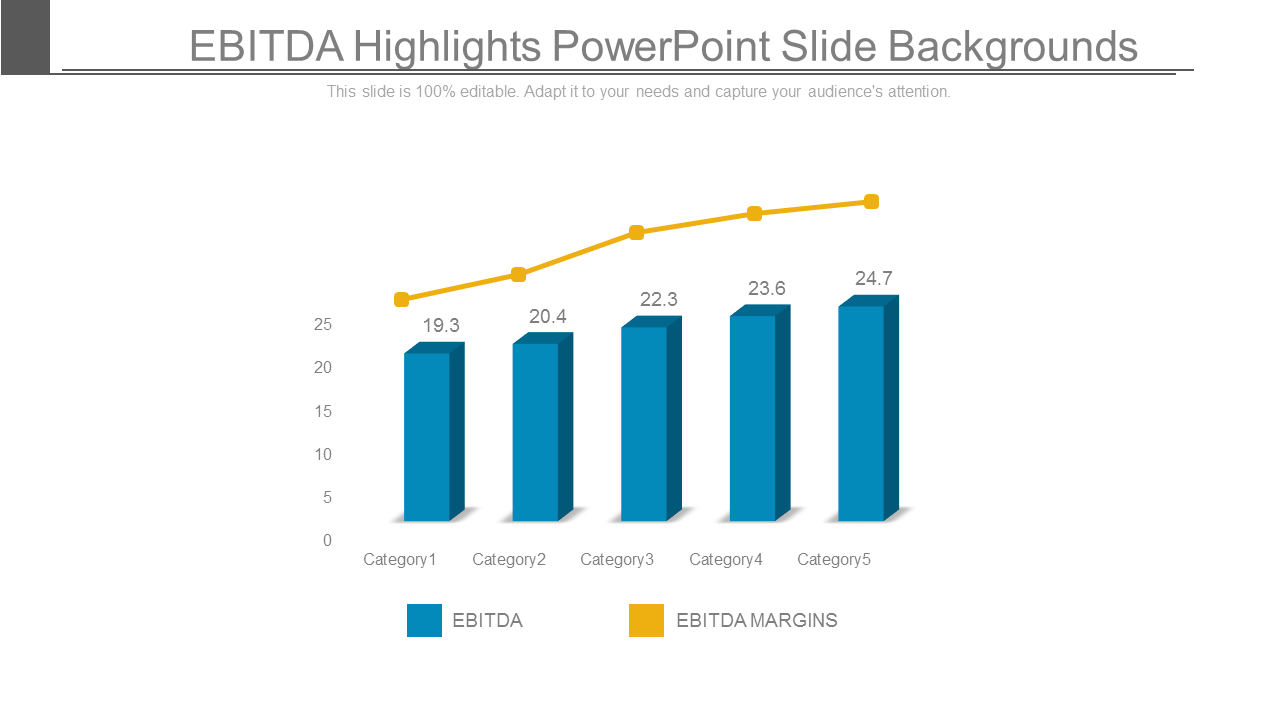

Template 2

Keep the company’s cash flow in check with the assistance of this PowerPoint template. With this PPT template, you can highlight the margins for each category in a color-coded and accessible manner. Download and utilize it now!

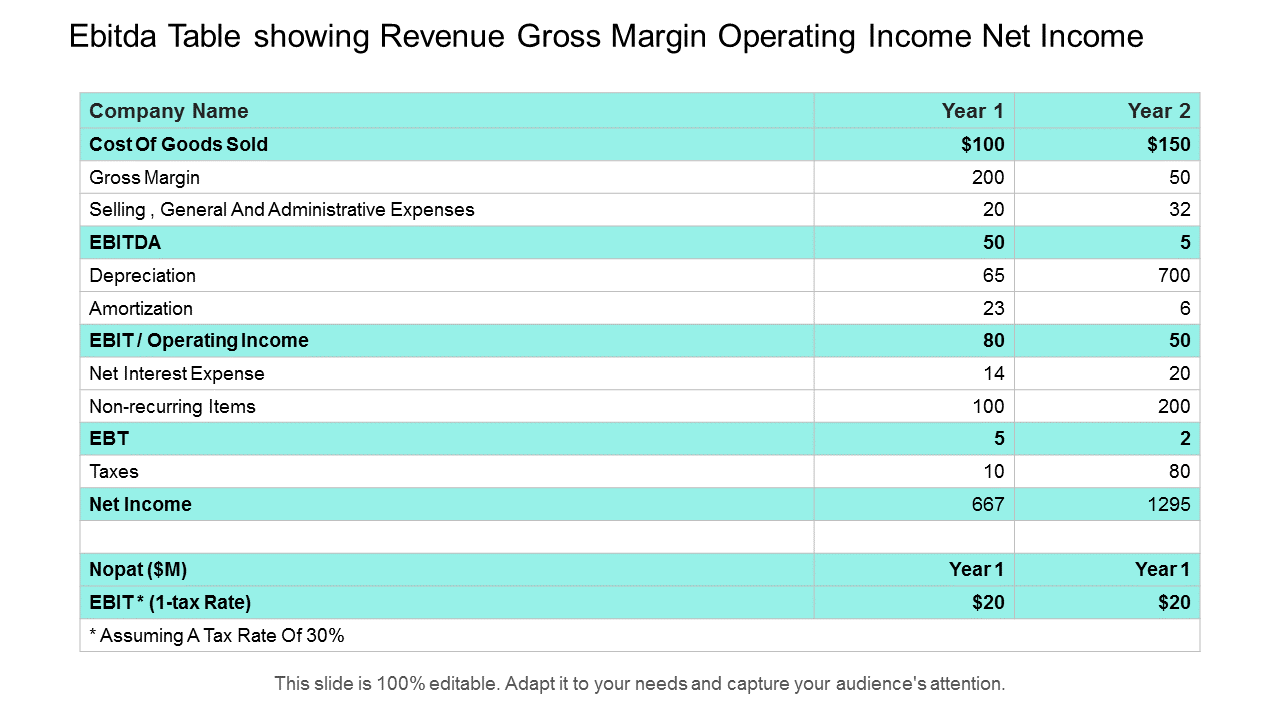

Template 3

You can easily measure your company’s net income and operating income for the past and current year by deploying this well-structured and organized PPT template. Display the costs of each good sold through this editable template. Click on the download link now!

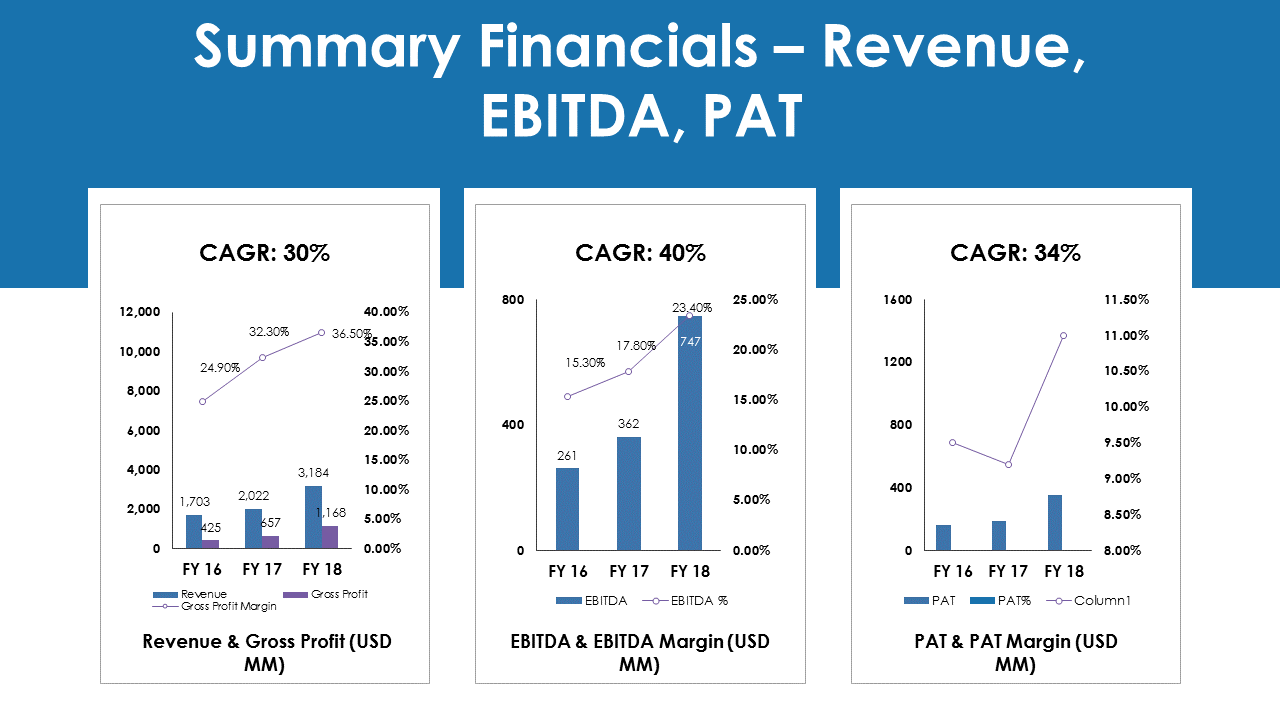

Template 4

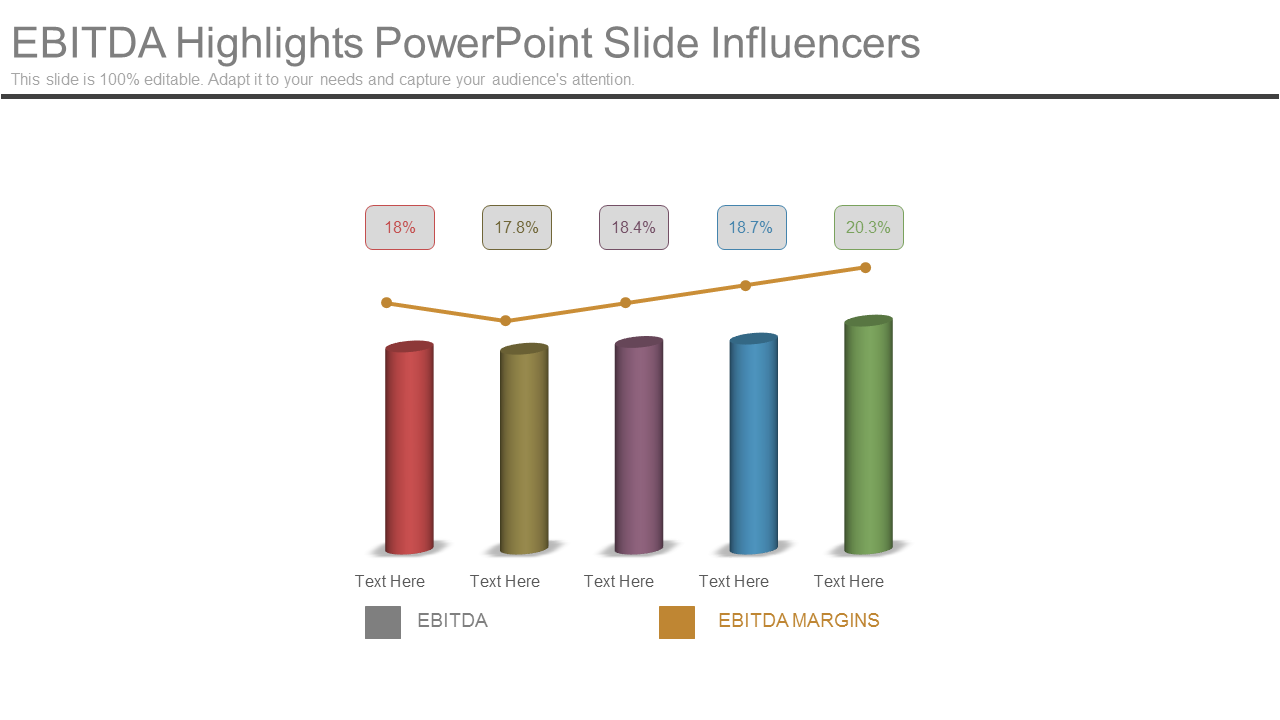

Visual representation of data, such as through bar charts, tends to capture the attention of the audience effortlessly. Therefore, employ this content-ready PowerPoint template to present your logistics and statistics clearly and concisely. Just click on the link below!

Template 5

This is another PowerPoint template that is well-equipped to showcase your financial activities, annual expenses, innovation spending, and customer acquisition cost-efficiently. So download this completely customizable template and add or edit your information with ease.

Template 6

Pick this PPT template to draw comparisons between your company and its competitors. You can take advantage of this readily available template when deciding on your capital investment. So download this completely adaptable template and get going!

Template 7

Choose this template and identify the cash generated for revenue earned. Utilize this PowerPoint template to adapt to the ever-growing economic environment. Without waiting any further, click the download link!

Template 8

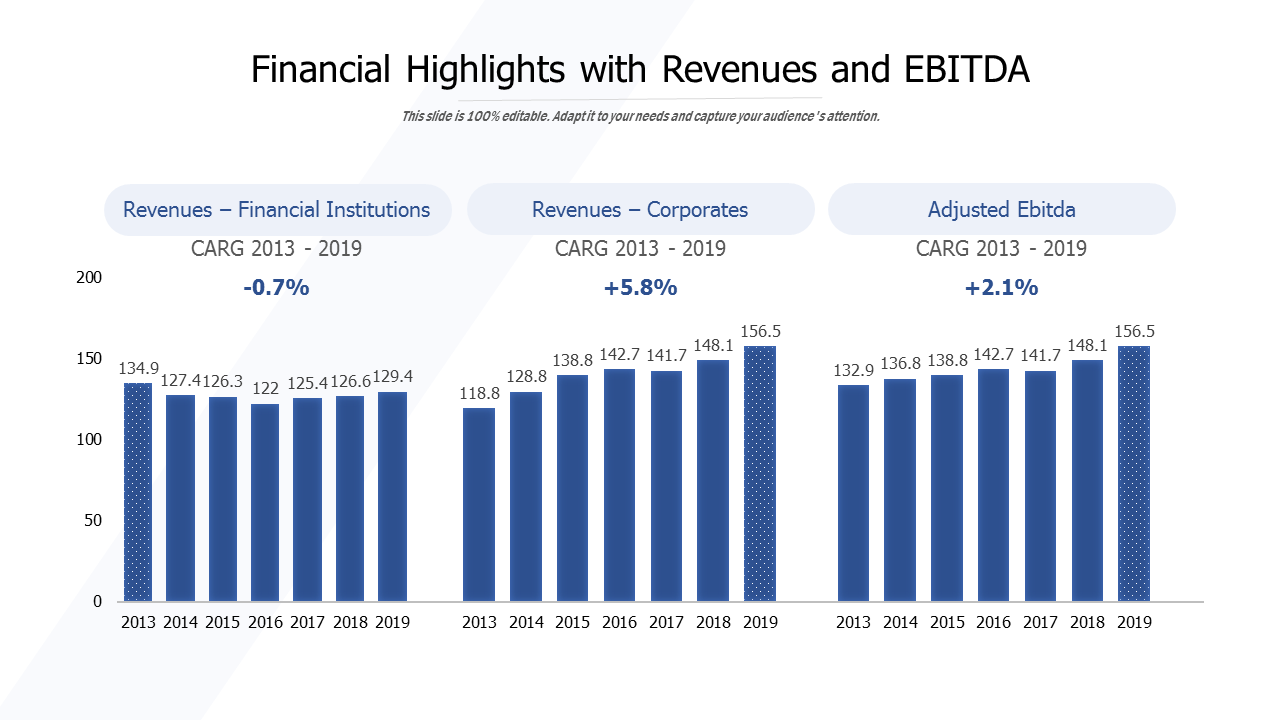

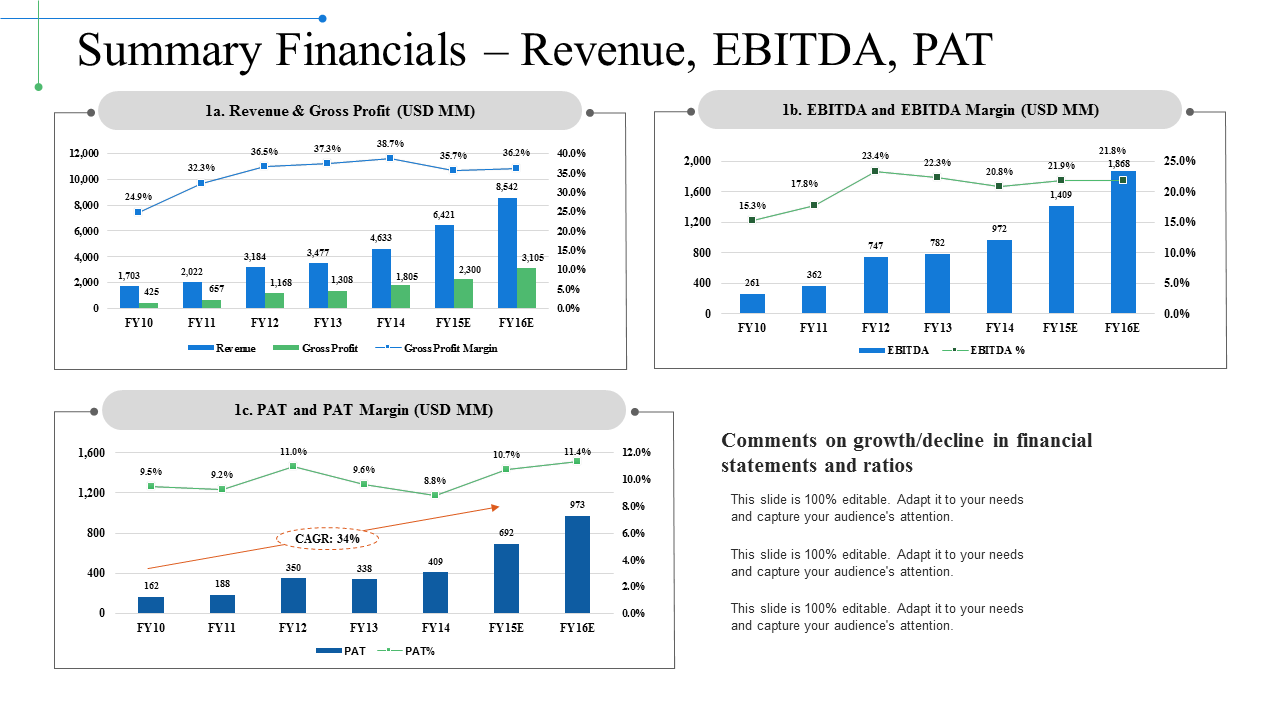

Consolidate your revenue data for financial institutions, corporations, and Ebitda distinctly with the help of this PowerPoint template. The systematic arrangement of bar graphs in this template makes it easily accessible and retains the attention of your viewers. Go ahead and download the template now!

Template 9

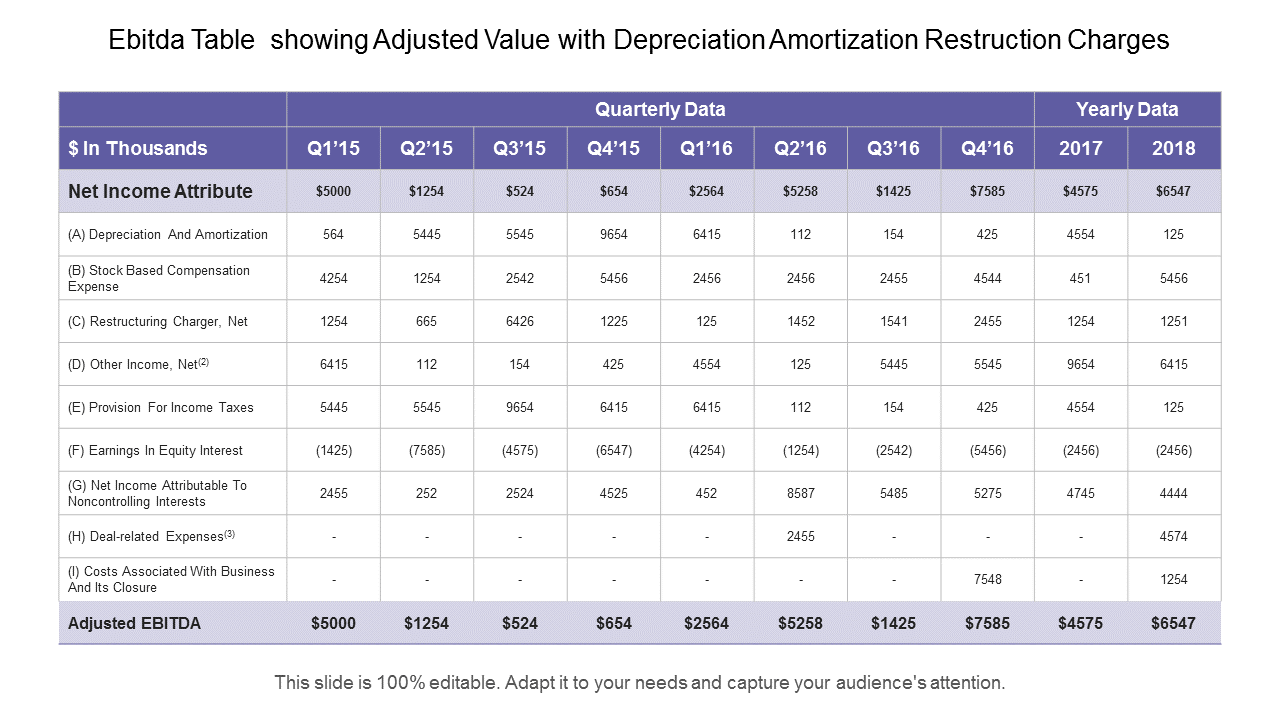

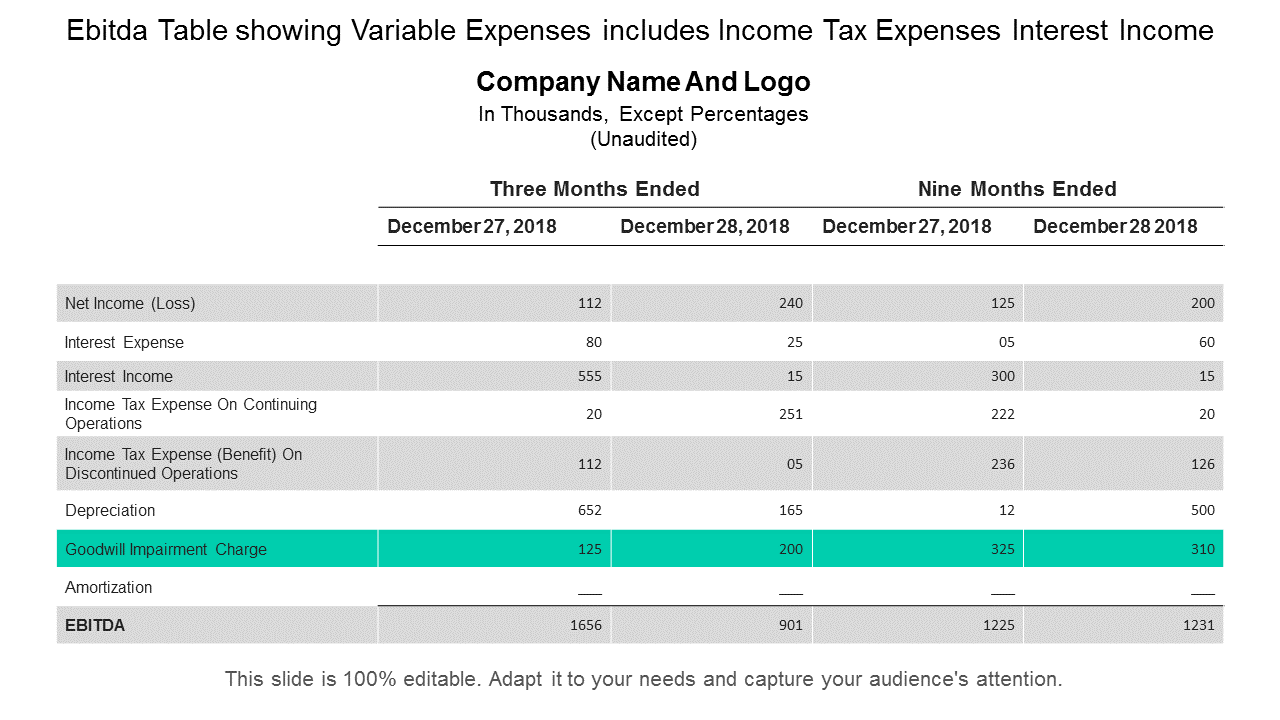

This is another template that illustrates the variable expenses of your company in an organized tabular format. Share every essential element like net income, interest expense, depreciation, etc, by downloading this professionally curated PowerPoint template.

Template 10

This PowerPoint template explicitly highlights your data through line charts and graph charts. We have curated this template to provide a detailed account of a company’s financials in an attractive yet informative manner. Grab the template now to save valuable time and effort.

Final thoughts

Much like the first wave, the second wave of the ongoing pandemic rendered businesses unable to predict the market conditions. But with some relief in restrictions in and outside the nations, companies expect to see improved Ebitda margins.

Therefore, you need to timely and efficiently deduce your company’s earnings to thrive in changing situations. And our PowerPoint templates will let you arrange and comprehend your data smartly.

P.S: You can decode your entity’s progress and monitor its market position with our suitably designed annual performance report templates here!

Customer Reviews

Customer Reviews