A startup in quest of attracting angel investors or venture capital requires devising a captivating exit strategy.

The exit strategy presents investors with the luxury to bail out anytime and still have good returns for their investment.

The startup exit methods include IPOs, strategic acquisition by third-party, and management buyouts. Each exit method has its set of advantages and shortcomings.

Imagine for a second you are an investor considering putting your money in a venture. Would you go ahead without the prospect of any investor-oriented exit?

Being the Chief Financial Officer, you have to prove the viability of your company’s exit strategy. The presentation of the exit strategy must be well-researched and relevant. In addition, you must have insights from your competitors and the returns their investors have received. It will help your company to gain the trust of your potential investors.

Then formulating an exit strategy for investors can be baffling. Are you running against time to set up your business? Whereas hiring a consultant to draw up an exit plan would put an additional burden on your financial shoulder.

Slide Team has done extensive market research and analysis to propose a winning exit strategy. And then converted all the information into a series of impactful slides. Through this blog post, we provide a brief on essential slides. Scroll down and learn about these slides:-

Template 1

The first crucial slide is the company overview, which comprises the company’s background details — founder, company founded in which year, number of employees, location, and a brief description of the company’s history. The slide also put forth the company’s mission & vision statement, the key to success, and a graph exhibiting the financial highlights. The layout is easy-on-the-eye and engaging to the audience. Plus, the slide is editable — you can add your company’s data.

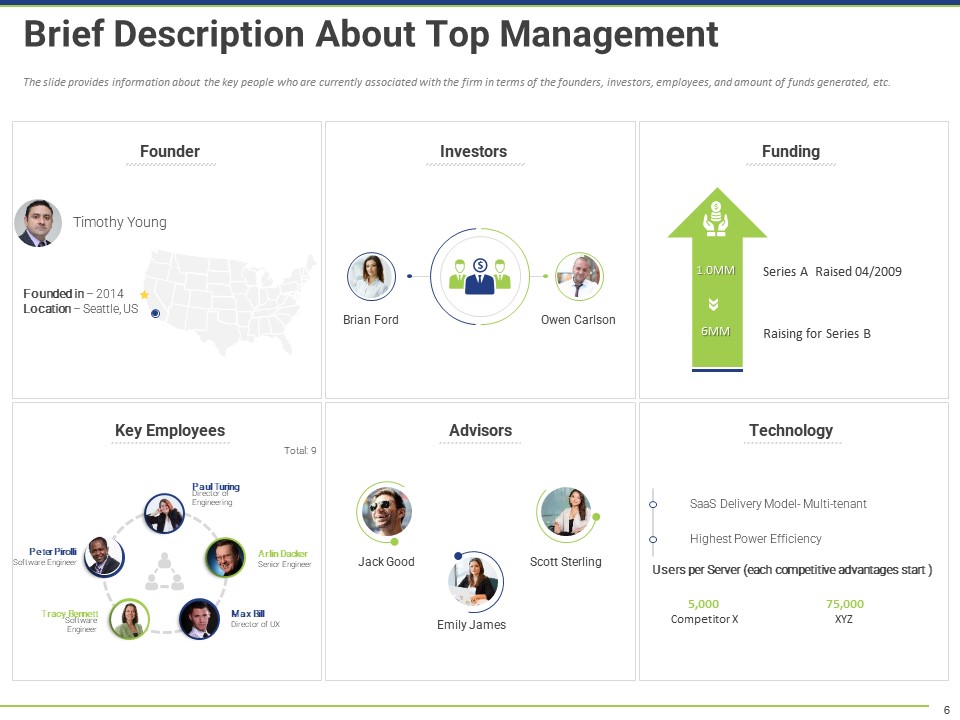

Template 2

The second worth-mentioning slide in this blog post is the brief description of the company’s top management. We have divided the slide into six segments. The first segment introduces the founder. The second one is information about the company’s investors. The other segments include funding, key employees, business advisors, and technology investments. You can easily edit the text in each segment of this slide.

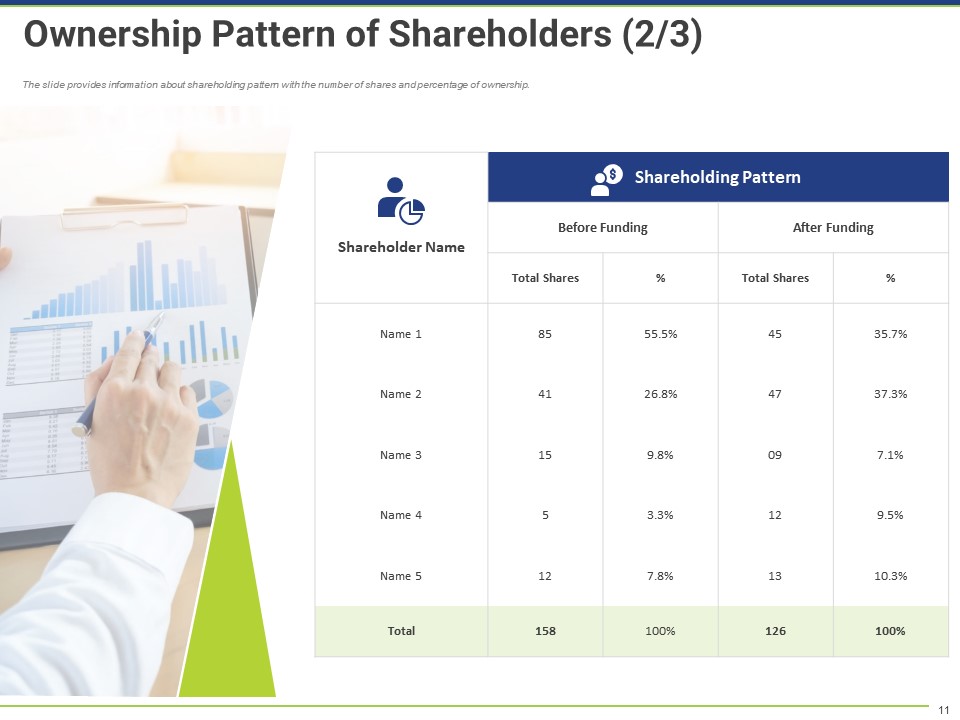

Template 3

We dedicate the slide to the shareholder ownership pattern. It provides information for each shareholder — names and their shareholding pattern before and after funding your startup. The shareholding pattern includes two sections. One is the total shares, and the other is the share percentage. This slide aims to describe how the shareholders have benefited from investing in your company.

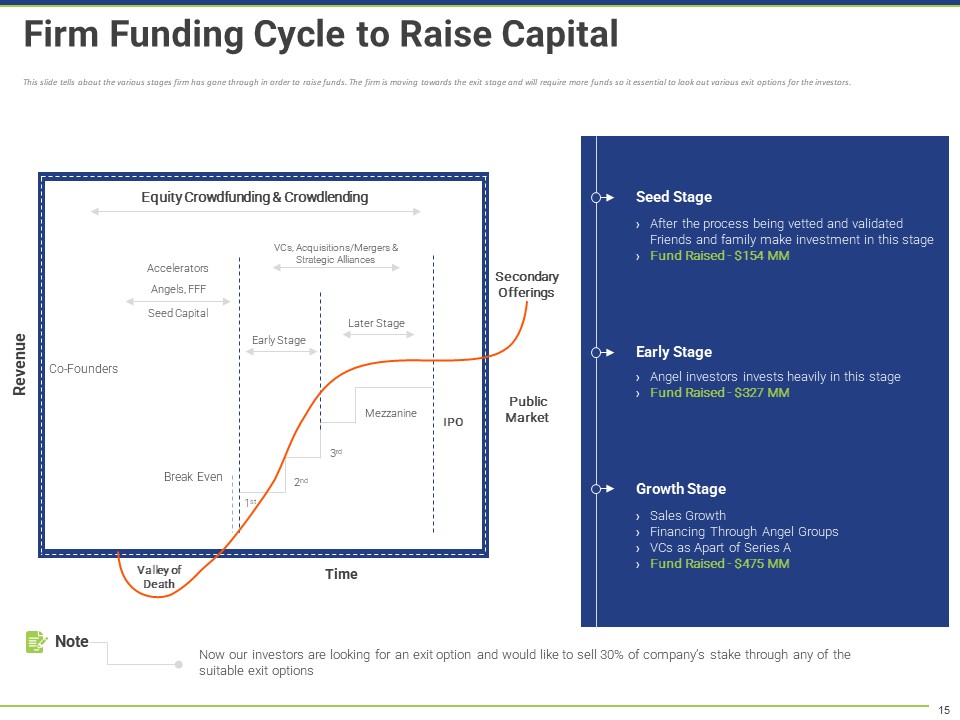

Template 4

The slide demonstrates the various cycles of how a startup raises funds. Typically, there are three cycles of funding. One is the seed stage, the second is the early stage, and the last is the growth stage. The seed stage is when the process is vetted and validated; often, family and friends invest. In the early stage, the startup looks for angel investors. And, finally, the growth stage is when the startup raises funds from sales and financing through angel groups. How much funds are raised during each phase is mentioned in the slide. However, you can edit the numbers. There is a graph that relates crowdfunding and crowdlending to explain the firm’s fund cycle.

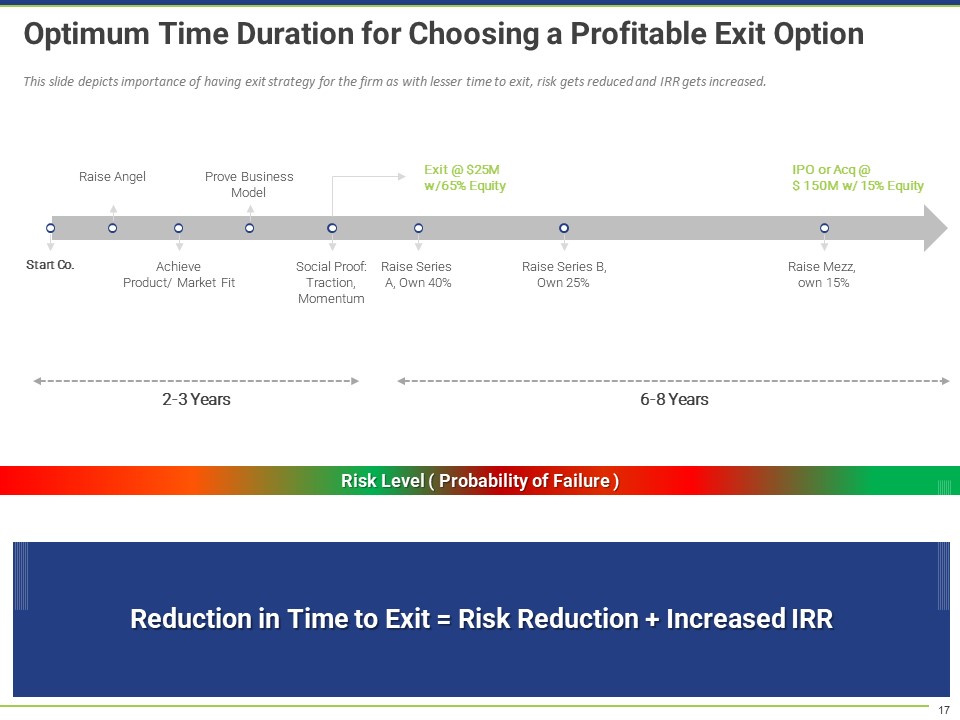

Template 5

Every investor wishes their investment to be rewarding. And, as a startup, it is your ethical responsibility to guide them on how to achieve that during the exit. The slide provides an optimal time duration range when the exit is profitable for an investor. The slide highlights the importance of an exit plan—the lesser time to start the exit, the higher the returns and lower the risks.

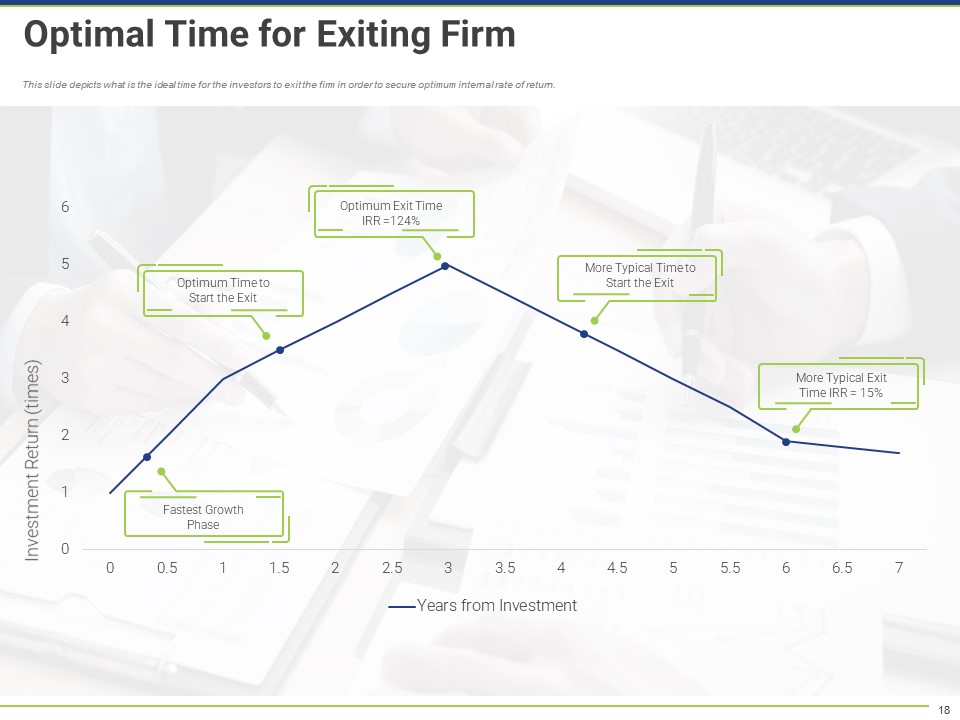

Template 6

This slide aims to depict the best time to exit when the interest rate of the investment is optimum. The best exit time is the third year of the startup, as the IRR is 124%. The optimal time to consider an exit is after the one-and-a-half-year mark. The typical exit time is the sixth year when the IRR is 15%.

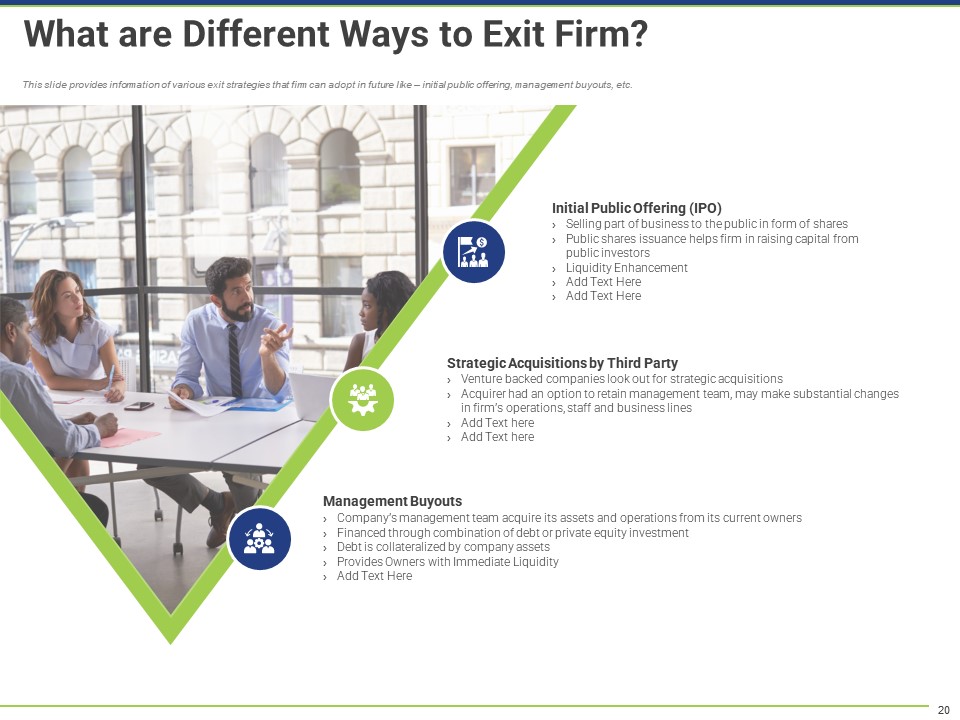

Template 7

The slide put forth the most profitable ways to exit a firm for investors. Three popular ways of exit include IPO, strategic acquisitions by third-party, and management buyouts. Each method will be explained in detail in the upcoming slides.

Template 8

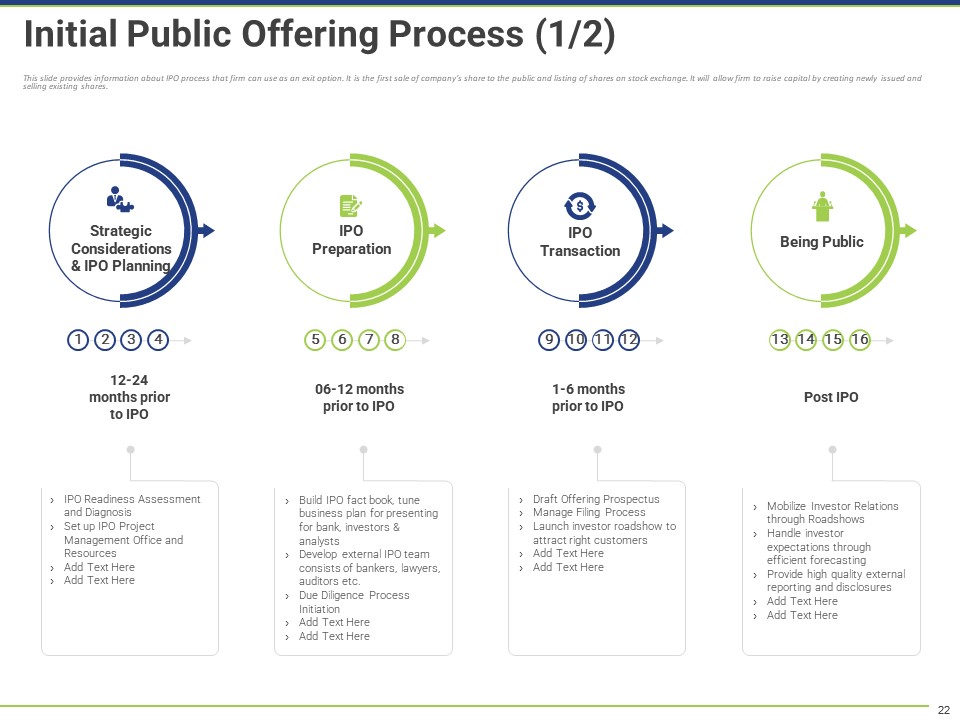

The most suitable way to exit is through the IPO. The IPO or initial public offering allows a company to raise capital by issuing and selling existing shares. An IPO is preferred by investors seeking returns or refunds earlier than expected. It also enables business owners to exit if their company has reached a financial roadblock.

The slide describes four phases of an IPO:-

- The first phase is the strategic considerations, which is the 12-24 months before the launch of the IPO.

- Second is the preparation phase of the IPO, at least six to twelve months before the launch.

- The third phase is IPO translation, six months before making the IPO public.

- The fourth phase defines what to do when the IPO is public.

Template 9

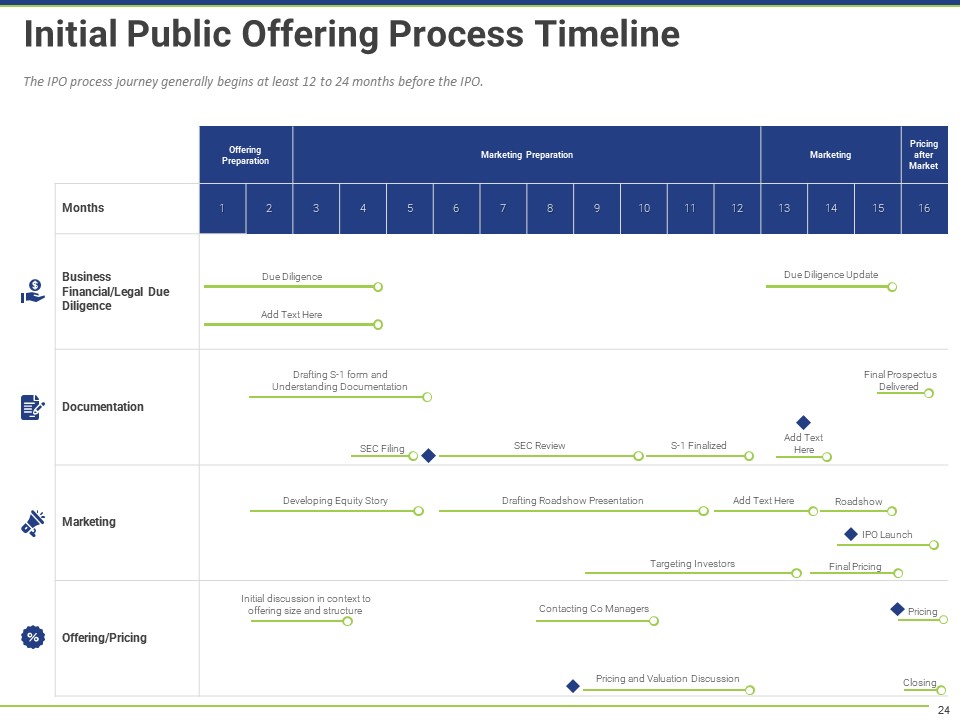

The slide shows the journey of an IPO 12-24 months before its launch. The process is explained month-wise.

The IPO process includes four key aspects:-

- Legal Due Diligence

Legal due diligence is the process of assessing all the legal risks linked with an IPO. This way, the investors are well aware of the possible risks.

- Documentation

The documentation includes the documents required to make an IPO request and when to submit them.

- Marketing

The marketing phase provides details on how your company will be promoting the IPO to attract investors.

- Pricing

And, the last phase is planning out the pricing of your company’s IPO.

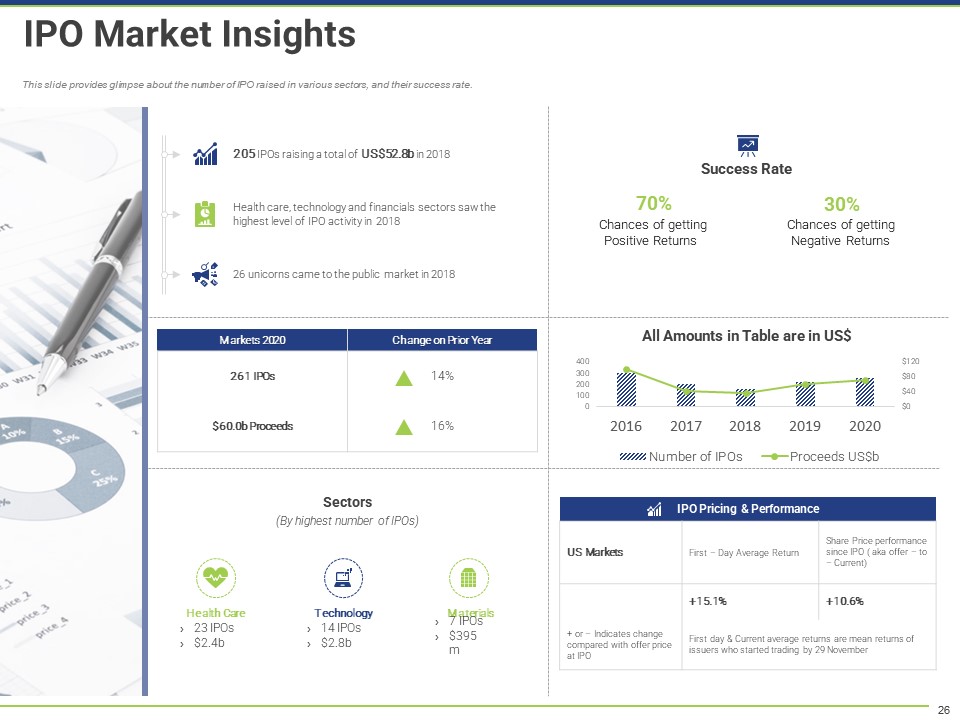

Template 10

The success rate of an IPO and other critical insights for making a well-informed exit decision is in this slide. All the amounts mentioned in the table are $US, but you can update them according to your country's currency.

A few worth-mentioning statistics include:-

- 205 IPOs raising a total of US$52.8b in 2018.

- The highest number of IPOs are in the healthcare sector, 23 IPOs.

- The success rate of an IPO is 70%.

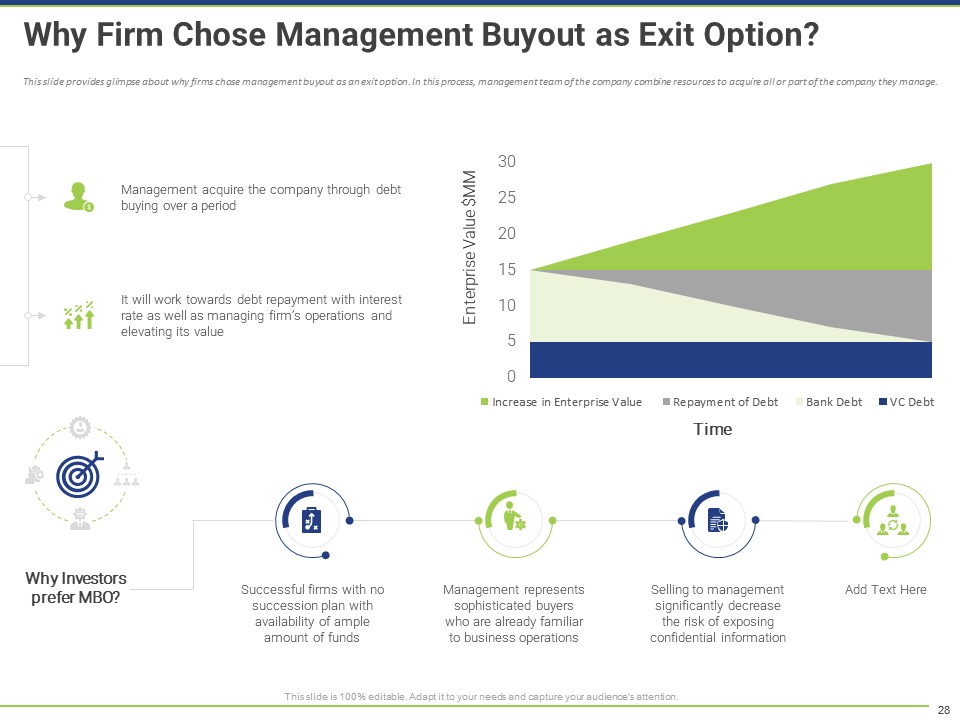

Template 11

The compelling reasons to opt for a management buyout as an exit strategy mentioned in the slide are as follows:-

- Selling the company to the management reduces the risk of leaking the company’s confidential information.

- The management buyers are well-versed with the company’s operations.

- Best suited for a successful startup that has no succession plan but has ample funds.

- You can further add your reasons based on your vast practical industrial experience and knowledge.

The slide also tells how management acquires a company through debt buying over a period with a visually explained Enterprise Value graph.

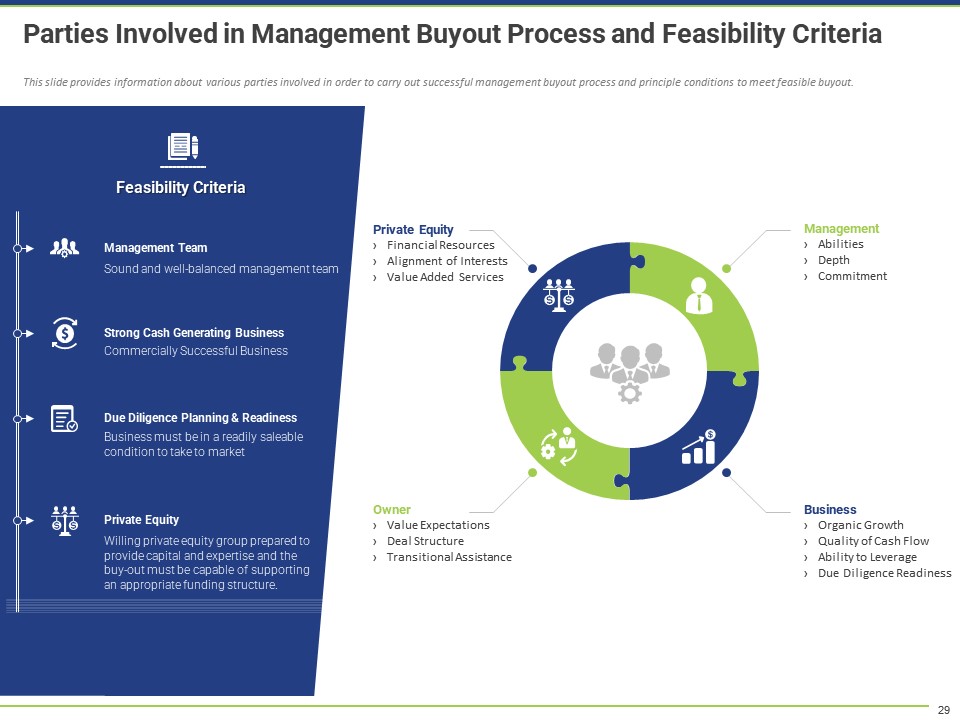

Template 12

Explain to your investors who all are involved in achieving a smooth and successful management buyout. And, what are the feasibility criteria to achieve this? The general management buyout criteria include a qualified management team, strong cash-generating business, due diligence, planning & readiness, and private equity. The slide also sheds light on the principle conditions to meet each feasibility buyout criterion.

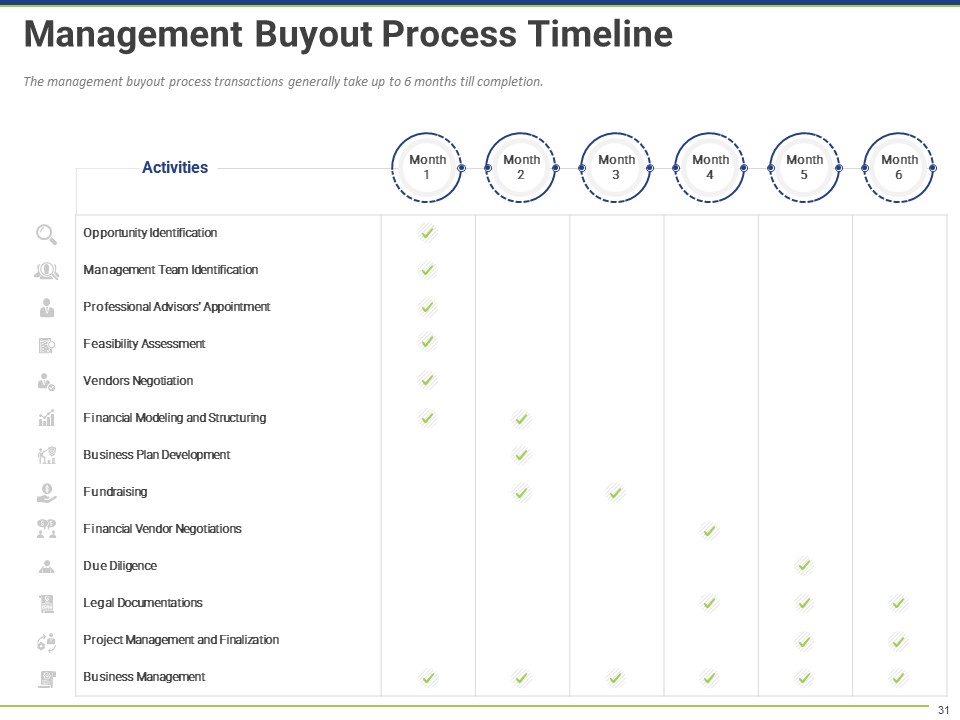

Template 13

A management buyout doesn’t happen overnight; it takes six months for a hassle-free transfer. The slide has a well-defined table that highlights what activities you need to perform corresponding to the appropriate month during the management phase. For instance, opportunity identification, management team identification, and feasibility assessment are involved during the early MBO stage. The later stage covers legal documentation, business management, project management, and finalization.

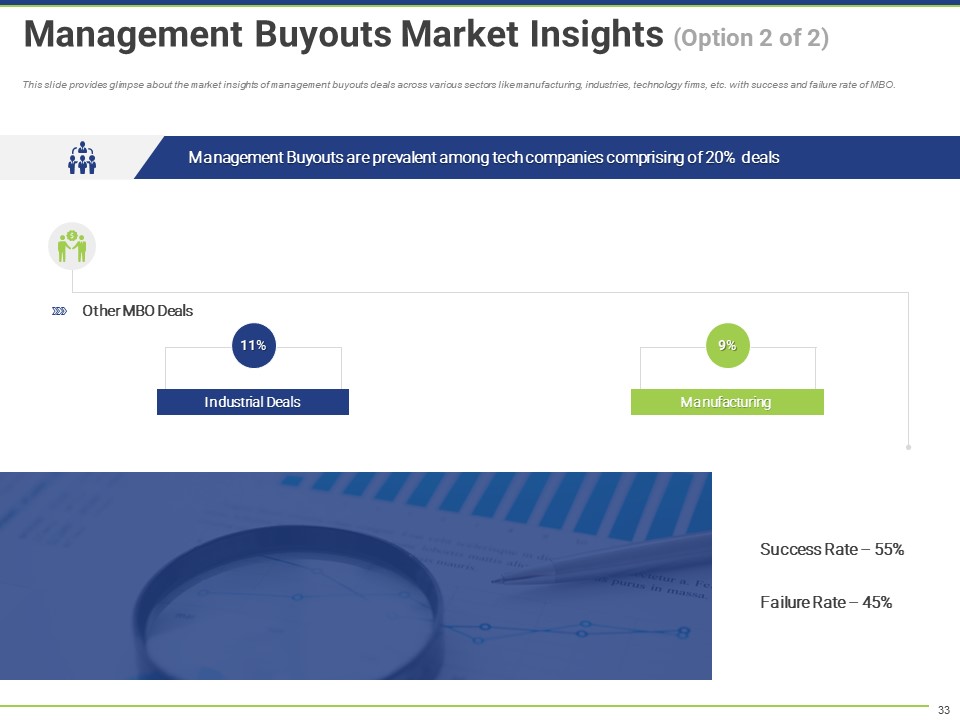

Template 14

Your investors will trust your organization if you show them good stats linked with a management buyout. The success rate of management buyout is 55%. MBO or management buyout is popular among tech companies, and they comprise 20% of all management buyout deals, while 11% in the industrial and 9% for the manufacturing sector. You can add more statistics.

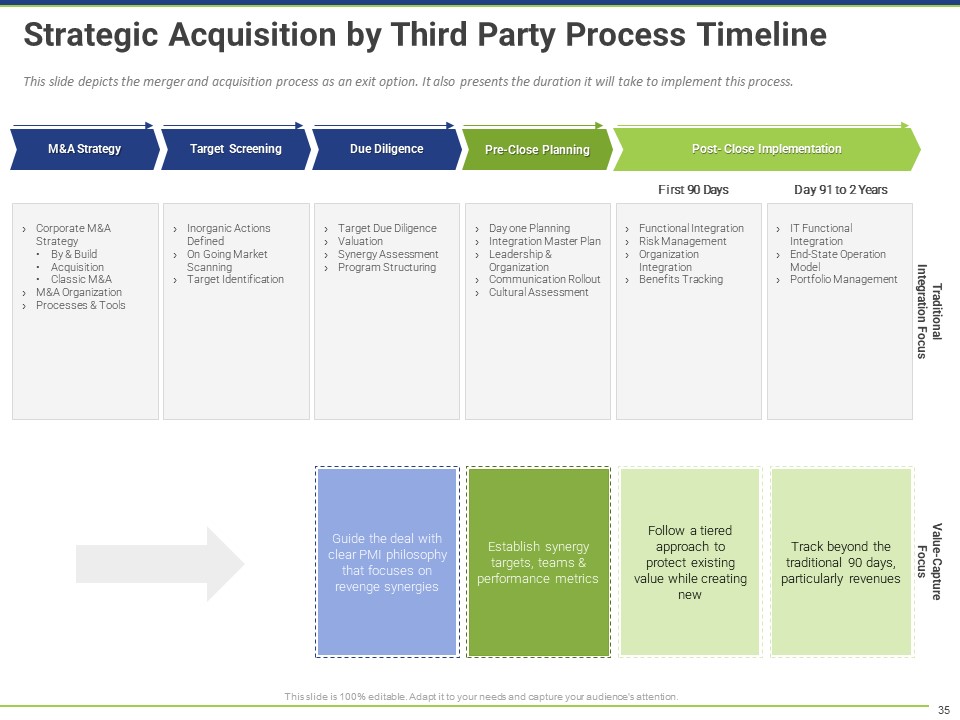

Template 15

The third option for investor exit is through a strategic acquisition by a third party. With an acquisition exit strategy, you give up your business ownership when a third party buys it out. The slide defines how much time is required to implement the third-party strategic acquisition. The strategic acquisition process starts with M&A planning, then comes the target screening followed by due diligence. Post the due diligence we have the pre-closing planning and post-close implementation.

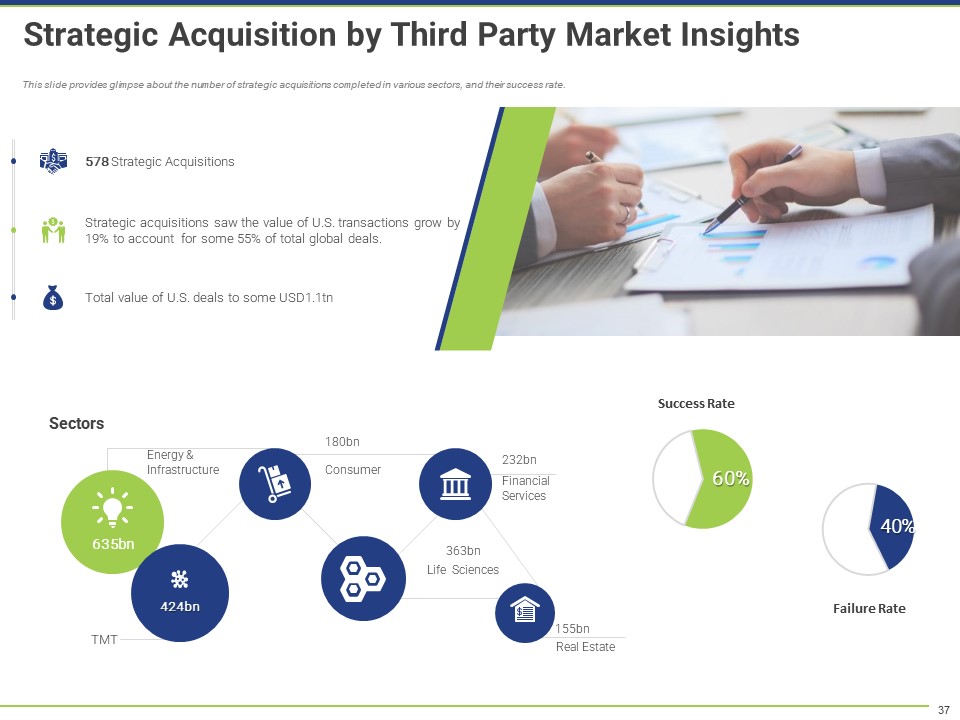

Template 16

Is strategic acquisition by a third party worth it? The slide shares some key insights to answer the most prevalent query of investors. One important stat is that the success rate of strategic acquisition by third-party has a success rate of 60%.

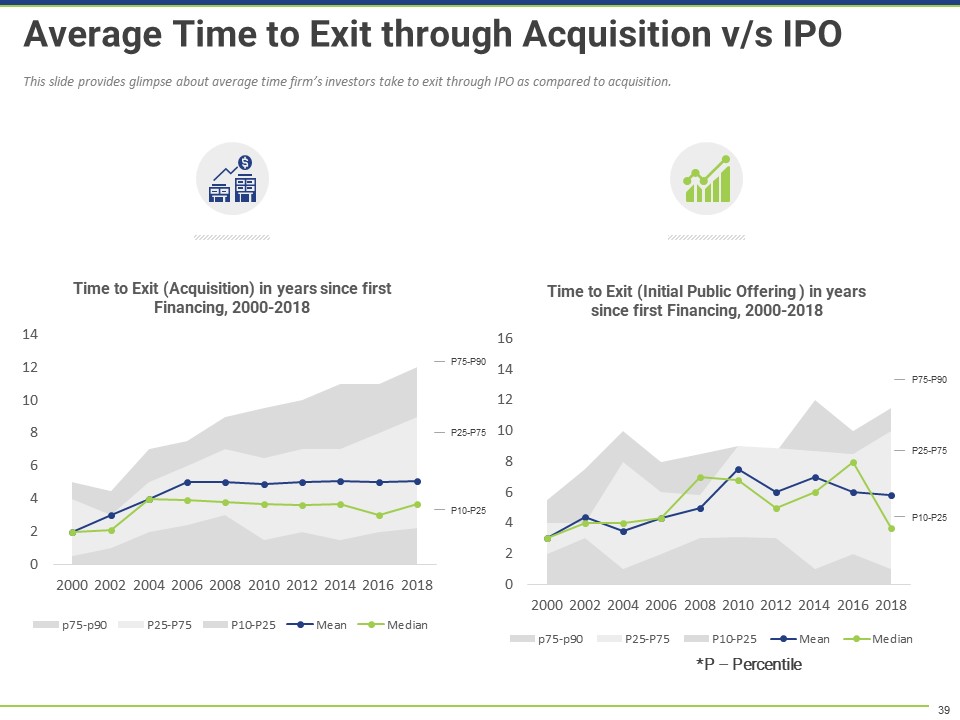

Template 17

The slide has two graphs that put forth the average time an investor takes to exit through IPO compared to acquisition.

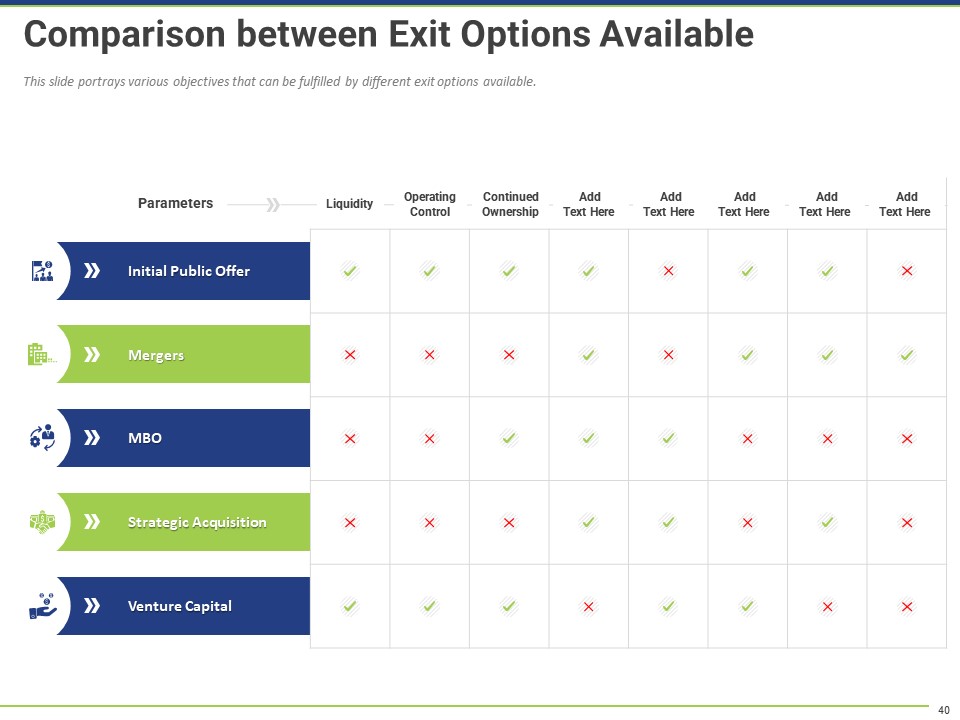

Template 18

The slide provides investors with knowledge for deciding on a suitable exit option with a quick comparison table. For example, an IPO exit has the advantages of liquidity, operating control, and continued ownership. On the other hand, strategic acquisition lacks all these features.

Template 19

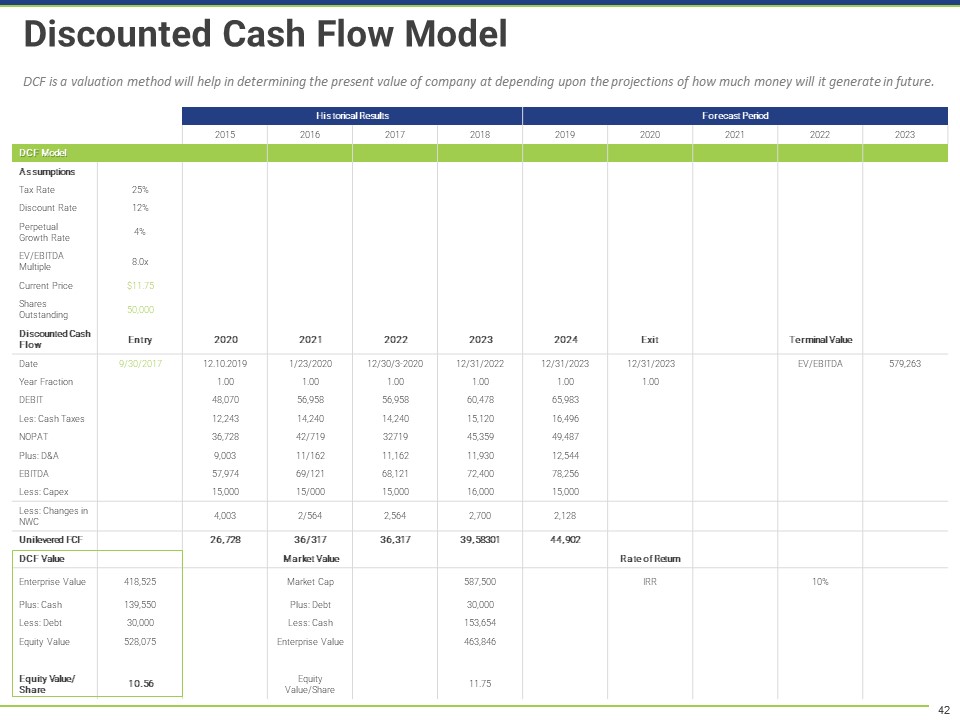

The discounted cash flow model in this slide describes the present value of the company and the future projections. DCF is a globally trusted valuation method to estimate the worth of an investment based on the expected future cash flows. The discounted cash flow formula is created on the concept that the money an individual has at present will have a higher value in the future.

Template 20

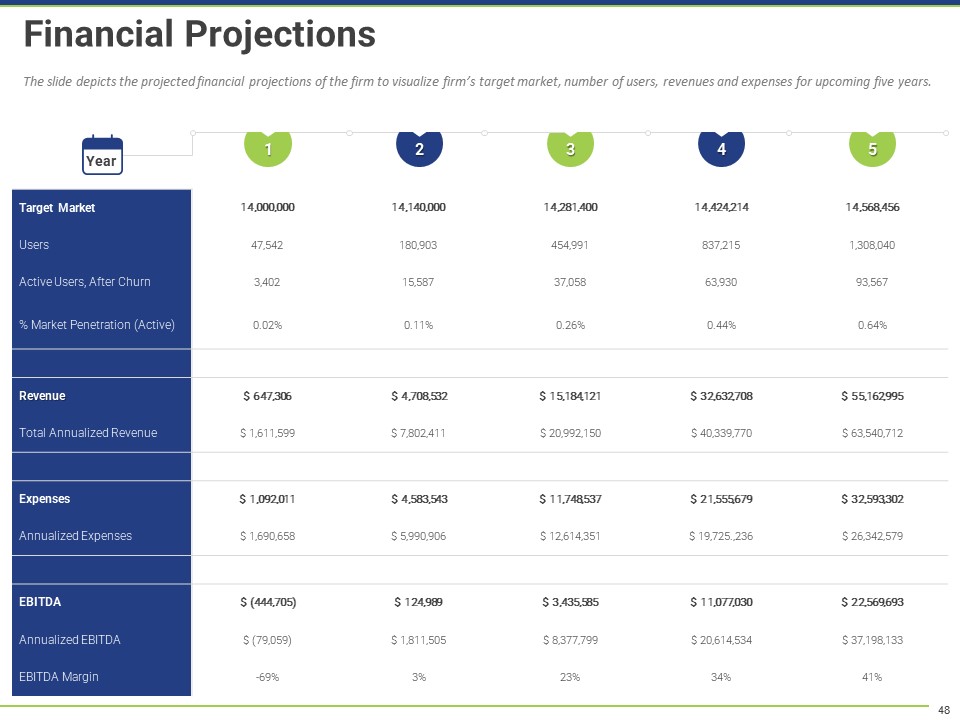

The last slide conveys the expected company’s financial projections to the investors. The projections serve as a means to familiarize your investors with the target market, the number of users, revenues, and expenses for the next five years. These projections are carefully deduced from the existing financial data.

Note: This exit strategy presentation is compatible with Google Slides Text, and the color scheme is editable.

Download this Customizable Exit Strategy Planning For Investors

Whether you are an entrepreneur or a CFO, download this presentation and then customize it to prepare an exit strategy in no time. This well-researched, detailed presentation will help you convince your investors to support your venture.

In case you need assistance, feel free to call us at 408-659-4170 or Inbox at [email protected]. Start a chat with a live technical expert—signup for our PPT membership, starting at $49.99.

Slide Team has an expert panel of finance, design, research & content specialists. They can custom-make a presentation based on your details.

We accept multiple payment options. These include 2CC, Visa, America Express, PayPal, etc.

Customer Reviews

Customer Reviews