“Accounts payable for services rendered.”

Your company depends on other businesses to function as part of a supply chain. The products and services these businesses provide allow you to satisfy your customers’ needs. It is then crucial that the money owed to other suppliers be maintained for a healthy business ecosystem.

The accounts payable department maintains these records and ensures that vendors are paid on time. With multiple suppliers and confounding numbers, it can be difficult to streamline the accounts payable process.

SlideTeam is to the rescue!

We present you with 10 content-ready and editable Accounts Payable Process Templates to simplify what your company owes to other businesses in the supply chain. Let’s explore this universe of PowerPoint Designs.

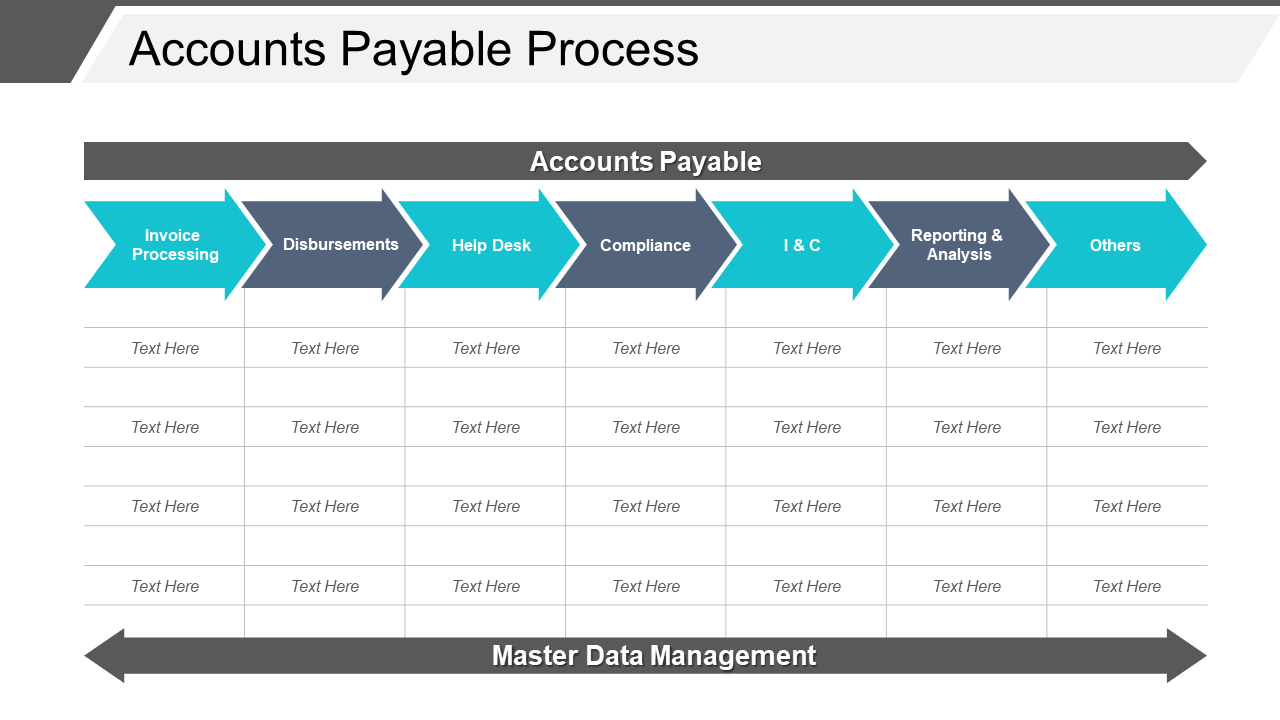

Template 1: Accounts Payable Invoice Processing Disbursements Compliance

This PowerPoint Deck meets the requirement of the accounts payable department to the T. The slides cover bookkeeping, journal entries, ledger, payment process flow, etc. This PPT Bundle provides the accounts payable department with the right tools to help them function. Download now!

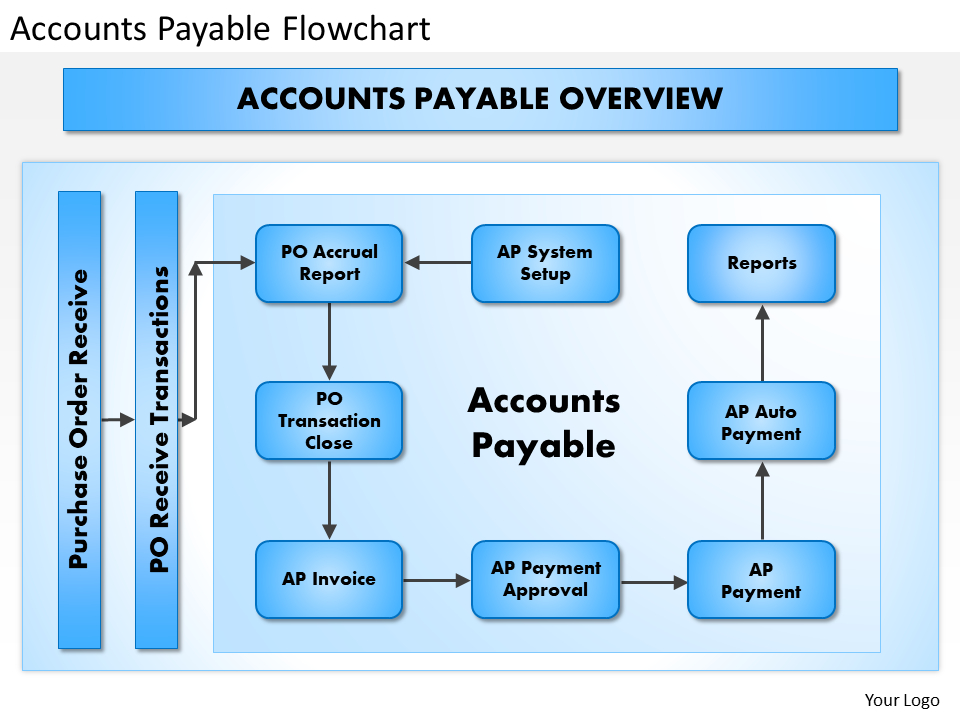

Template 2: Accounts Payable Flowchart PowerPoint Presentation

This PPT Template helps you visualize the accounts payable process. Through this flowchart diagram, walk the audience through the process, starting from the purchase order received to payment to reports. Consolidate tasks and make it easier for them to perform with the use of this presentation template. Download now!

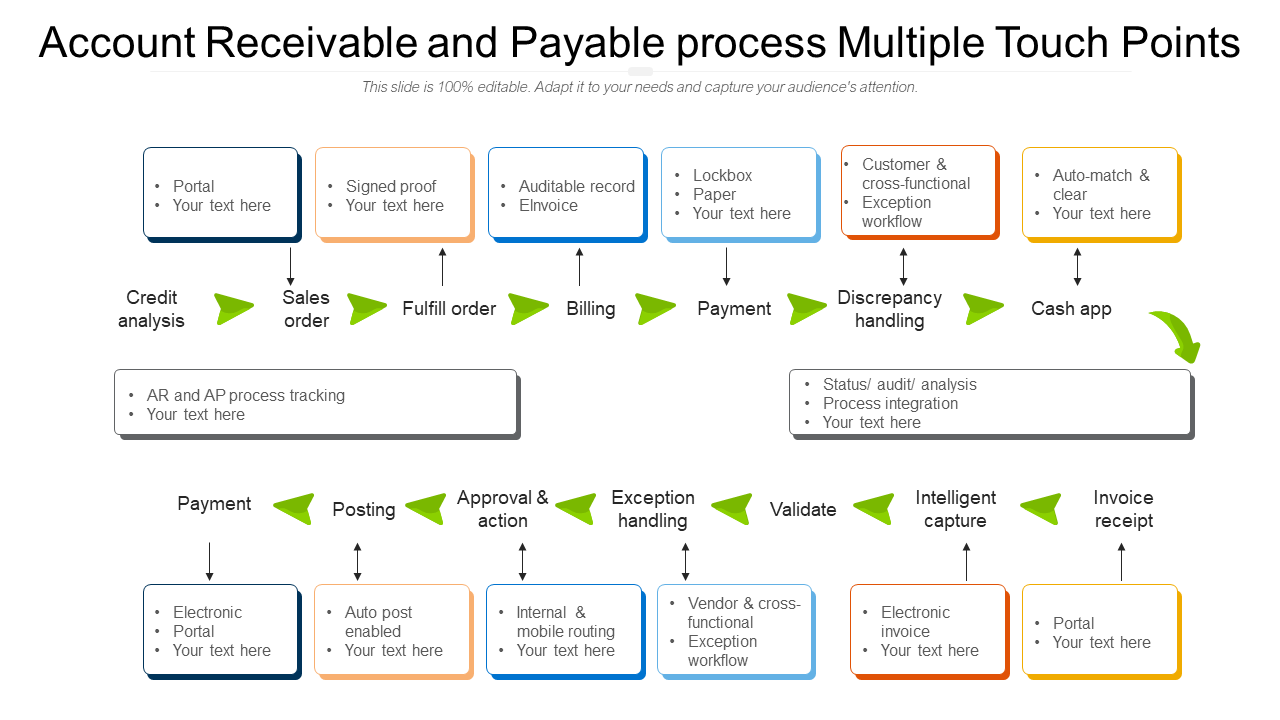

Template 3: Account Receivable and Payable Process Touch Points

Incorporate this PPT Preset to delineate your company’s finances both for accounts payable and receivable. The flowchart is color-coded to improve comprehension and does the work for you when you are presenting to the audience. Get this PowerPoint Template and showcase an excellent working system that streamlines your obligations. Download now!

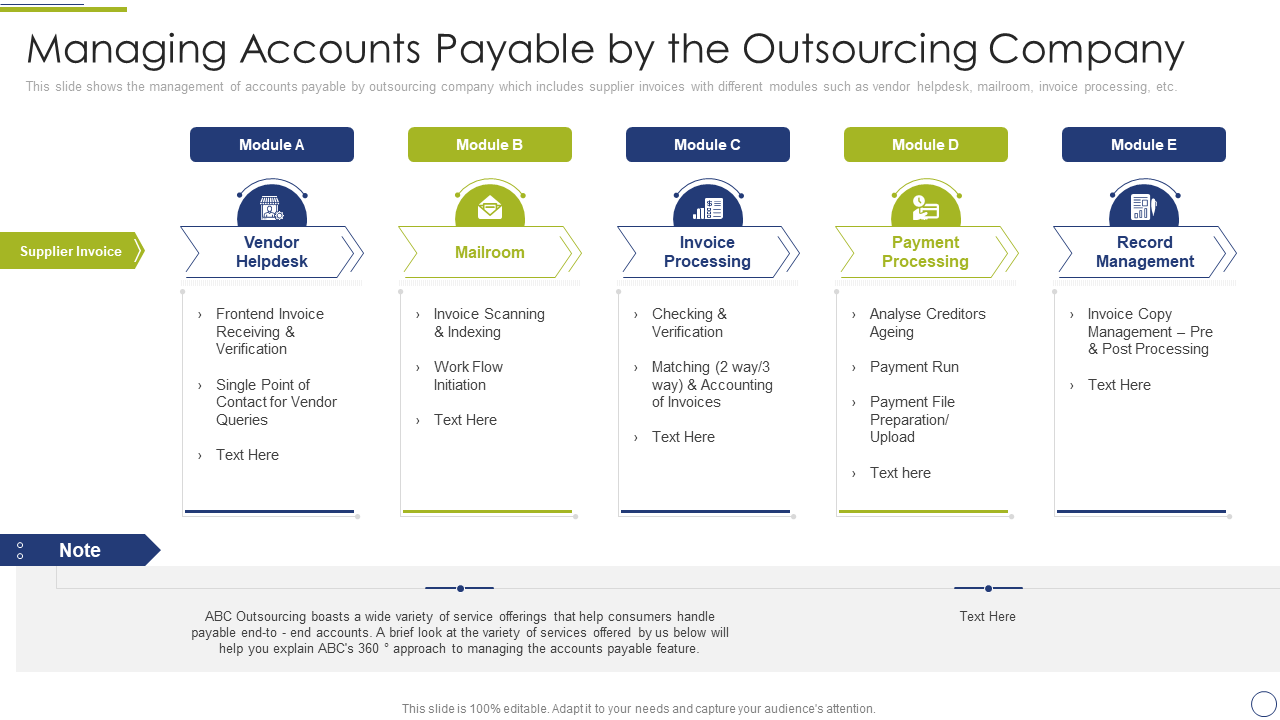

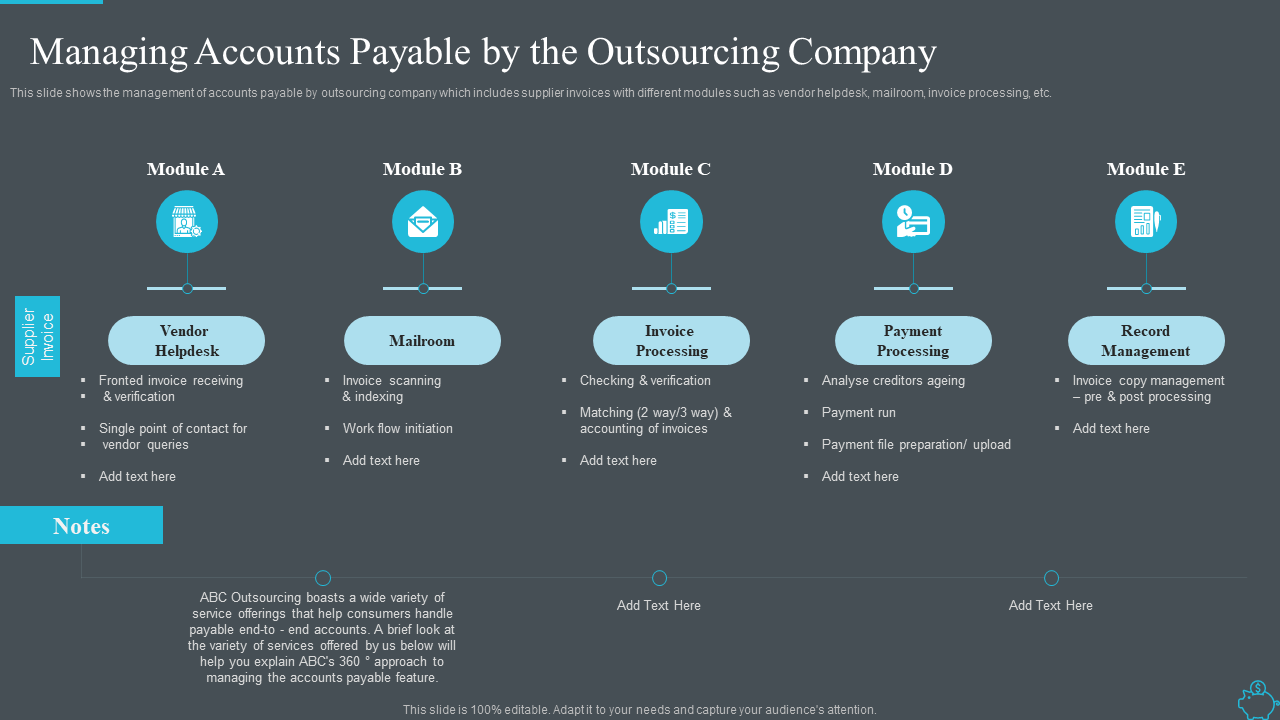

Template 4: Finance and Accounting Process Managing Outsourcing

Make accounts payable easier using this PPT Slide, which tabulates the process into modules, such as vendor helpdesk, mailroom, invoice and payment processing, and record management. Use this presentation template to track the company’s liabilities when outsourcing it to another company. Download now!

Template 5: Accounts Payable Process PowerPoint Slide

Represent and implement the Accounts Payable (AP) process using this PPT Theme, starting with invoice processing, disbursements, reporting and analysis, etc. Allow yourself some breathing room when handling financial data using this color-coded template that makes interpreting it easy and cool. Download it now.

Template 6: Improve Finance and Accounting Function Managing Accounts Payable

Even when you outsource your accounts payable activities, it still remains your baby. Use this PPT Template to keep track of work and ensure that these vendors (see the supply chain dynamics and accounts payable still link) are paid on time. Showcase the outsourcing company how to organize and manage their data in a comprehensive manner using this PowerPoint Layout. Get it now.

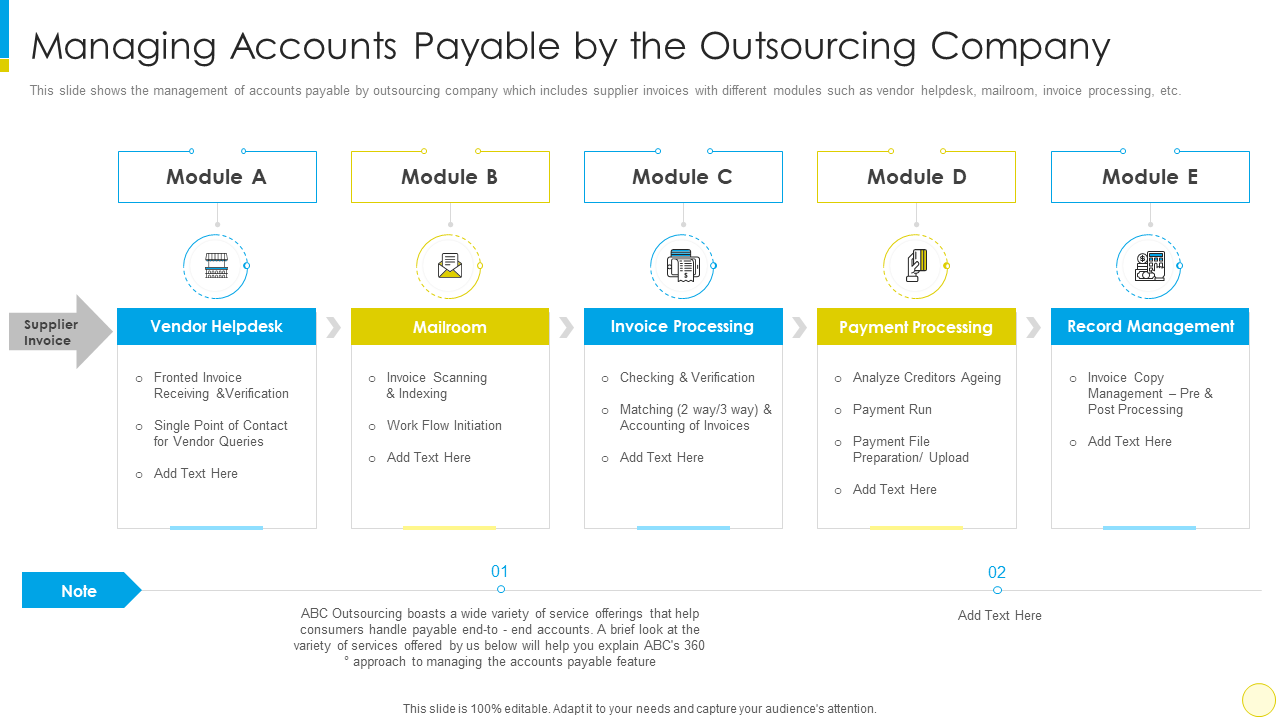

Template 7: Managing Accounts Payable by the Outsourcing Company for Small Businesses and Start-ups

Understandably, a start-up may not necessarily have the manpower or capacity to work on its accounts payable. Their outsourced work can be well-represented on this PPT Layout, which is color-coded and presents data in the tabulated form. Download this template to keep up-to-date and accurate records for your start-up or small company.

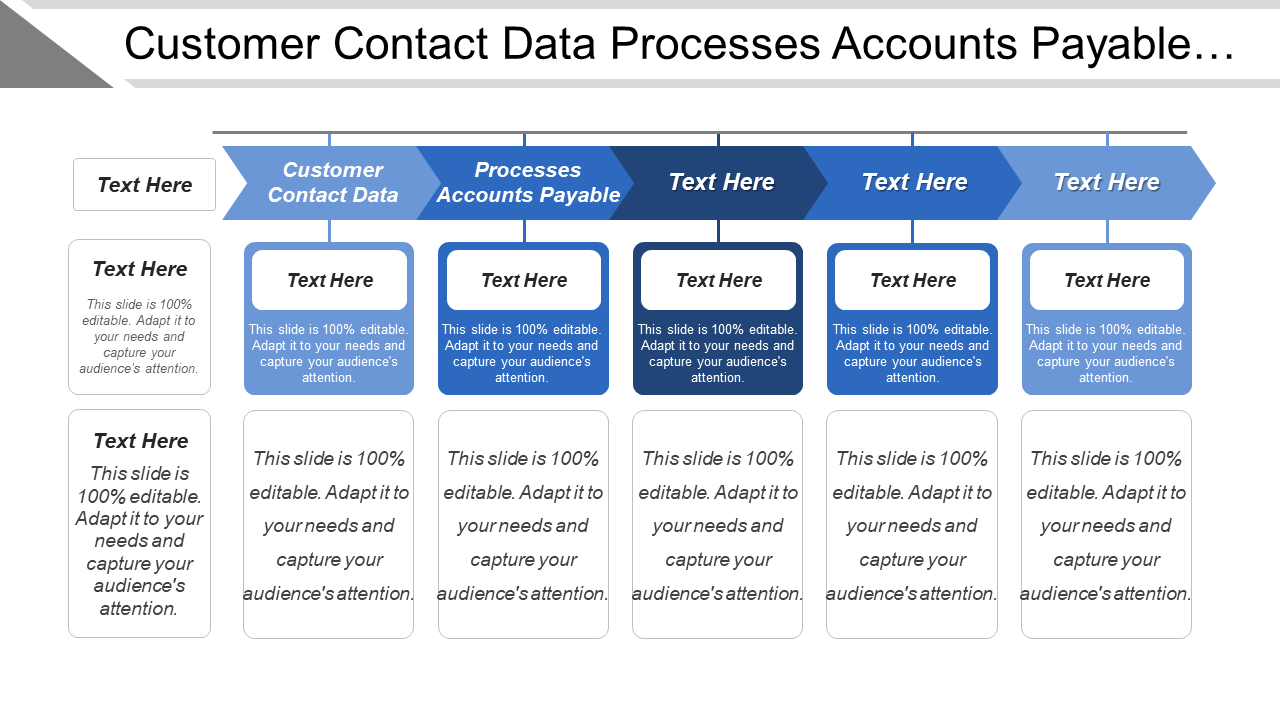

Template 8: Customer Contact Data Processes Accounts Payable Dashboards

Tabulate, organize, and record data for accounts payable and customers using this PPT Theme. The use of this template ensures that you won’t have to go through an unorganized pile of numbers to clear your accounts payable. Download now.

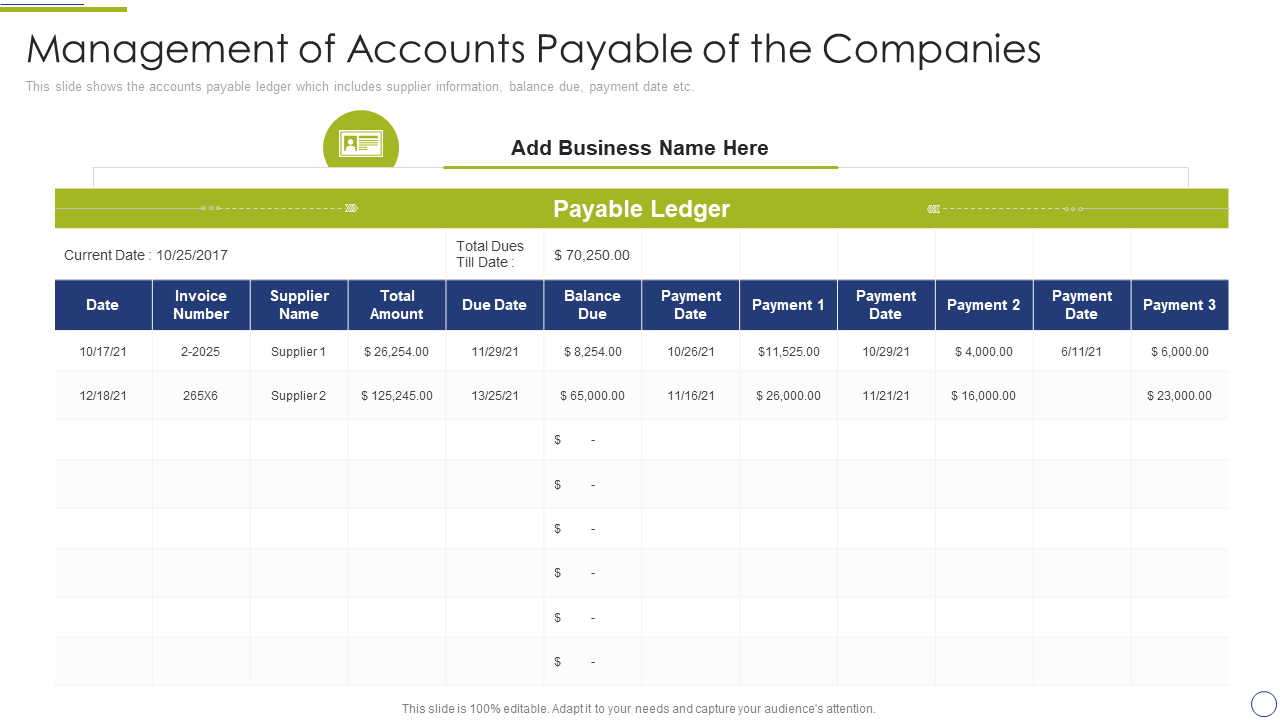

Template 9: Business Process Management of Accounts Payable

This PPT Slide contains a table that acts as the payable accounts ledger that keeps track of your finances. Use this table to track who has been paid, when, and how much, as it happens. Get this PPT Template now.

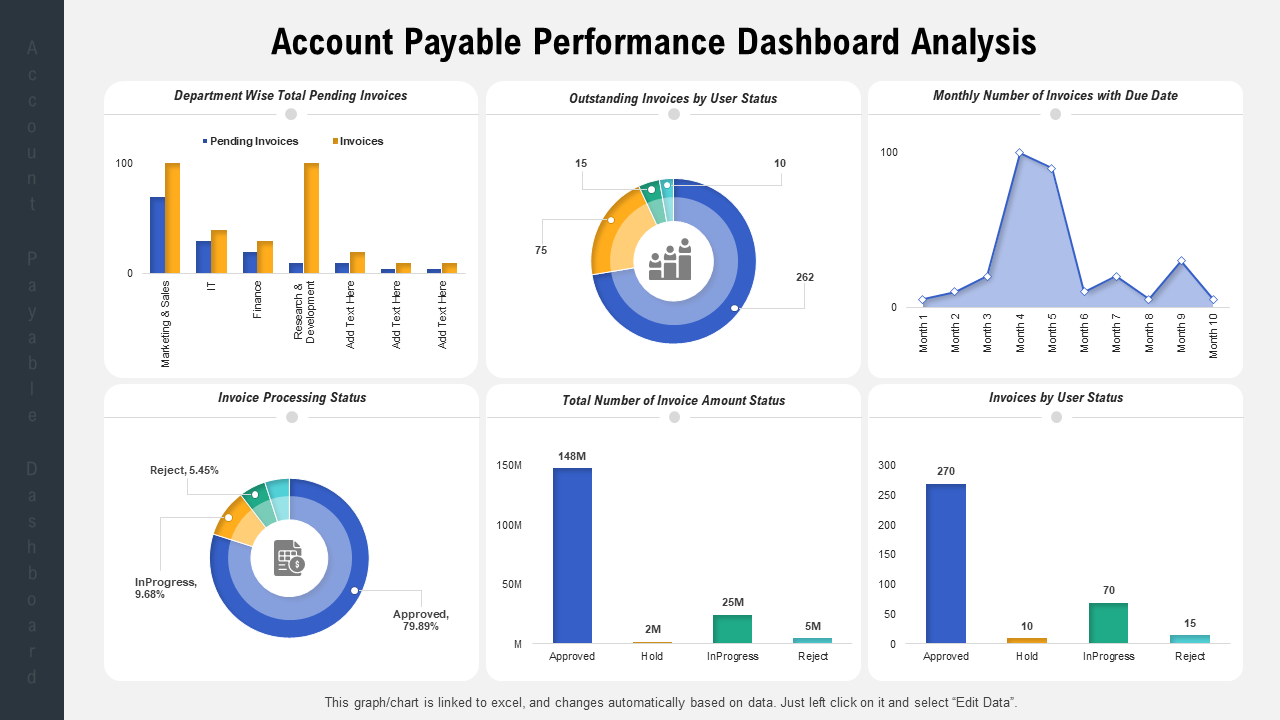

Template 10: Account Payable Performance Dashboard Analysis

This PowerPoint Slide showcases the accounts payable analysis through numbers and graphs. The template is segregated into sections, such as invoices that each department has generated, user status, processing status, etc. Use this template to be aware of the status of the company’s liabilities. Get it now.

He Who Pays the Piper Calls the Tune

For vendors and suppliers, your business is the customer. Once paid for, the products are yours to use, but a healthy supply chain and business ecosystem are created when you act responsibly and are prompt in clearing your debts.

This is not just an issue of reputation or creating a culture of prompt payments but of financial success. Download our Accounts Payable Process Templates to ensure the financial success of your business.

FAQs on Accounts Payable

What are accounts payable?

Accounts payable are transactions in which a business pays its current liabilities using money it has received from customers and other sources. These payments typically involve purchases of goods or services from suppliers and vendors, as well as bills that are due to the government for things like sales tax and payroll taxes.

Businesses need clear procedures and processes to manage their accounts payable transactions. The ability to handle accounts payable can impact a company's liquidity, cash flow, and bottom line. Be aware that sitting on payouts for long also has an impact on your reputation.

What is the difference between accounts payable and accounts receivable?

Accounts payable refers to money that a company owes to its suppliers, typically for merchandise or services that have been received but not yet paid for. Accounts receivable is the amount that a company owes to its customers, usually in exchange for goods or services provided on credit. These two types of accounts are both parts of a company’s balance sheet. Taken together, these make up the current assets section of its financial reports.

What are the four functions of accounts payable?

Accounts payable (AP) is a key function of any business, responsible for recording and processing payments made to vendors and other suppliers. The four major functions of AP are managing vendor accounts, handling incoming invoices, verifying invoice accuracy, and paying bills on time.

Managing vendor accounts involves maintaining up-to-date records of approved vendors, tracking payment due dates, and ensuring dues are clear by the specified date.

Incoming invoices refer to the process of receiving and verifying supplier invoices prior to paying them. This involves checking to ensure that amounts and terms are correct and scanning for any possible errors or fraud. The accounts department has to physically verify that the quantities and prices charged to match the ordered items.

Paying bills on time is essential for maintaining good supplier relationships and avoiding penalties. The accounts payable department uses tools, including automated systems based on payment terms, for efficient handling of the process.

Who is responsible for accounts payable?

Accounts payable is a financial management function responsible for monitoring and recording company expenses. This includes paying bills, managing vendor relationships, and reconciling transactions to maintain accurate records in the accounting system.

The person responsible for accounts payable varies depending on the size of the business and its organizational structure. In smaller organizations, where accounting may be outsourced or managed by a single individual, the accounts payable function will often be assigned to an administrative assistant. In larger organizations with a dedicated accounting and finance department, this responsibility is allocated to one of many positions. The nomenclature and the position may vary; it could be the accounts payable manager, the accounts payable clerk, or the assistant controller.

Customer Reviews

Customer Reviews

![The Superfast Guide to Break-Even Analysis [PPT Templates Included] [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/06/1013x441no-button-1-493x215.gif)

![Top 10 Internal Audit Templates to Establish Propriety [Free PDF Attached]](https://www.slideteam.net/wp/wp-content/uploads/2022/07/1013x441no-button-13-1013x441.jpg)