“To win in the marketplace, you must first win in the workplace." - Doug Conant, former CEO of Campbell Soup.

Businesses need financial efficiency to stay ahead in the market. And if things are not ok on the home front, it's not possible for them to give a tough fight to the competitors. That's why Doug Conant's above statement seems to perfectly fit in the scenario. We all know, that working capital (read money) is the primary driving force of any organization. but what exactly is working capital?

Well, in simple terms, Working Capital is the net difference between a company's assets and liabilities. It shows what's the volume of liquidity available to the organization to deal with its routine and short-term expenses.

Research suggests that almost 64% of organizations that excel at working capital management can easily stay ahead in the game. The reason is simple: When an organization has proper financial planning and enough current working capital, it can focus on growth. It doesn't have to worry about routine expenses and short-term obligations. Its entire workforce and resources are focused on achieving growth and success.

Benefits of Efficient Working Capital Management

Here are some primary benefits of efficient current working capital management for organizations:

- Organizations can predict future cashflow needs by analyzing trends and patterns in payments and receivable cycles

- Working Capital Management can help pinpoint excesses or shortages in inventory, which allows for more precise stock management.

- Companies can manage their debts better with clear insights into payable and receivable cycles to avoid over-leverage or under-utilization of resources.

In short, managing working capital is critical for any organization’s financial management, irrespective of its size and shape.

But the task is easier said than done! As there are hundreds of moving parts in the process, organizations need a dedicated system to manage their working capital. Organizations have to manage inflows and outflows of cash, accounts receivable, accounts payable, inventory, and cash reserves. Feels a bit tricky, right? But no worries, our experts at Slide Team have got you covered!

We have crafted custom-designed working capital templates. These templates are 100% editable and content-ready. Make minor changes in the templates as per your needs and you are good to present it in front of your leadership.

Let's take a look at them.

Template 1: Working Capital Dashboard PowerPoint PPT Template Bundles

This complete deck offers a clear financial perspective of any organization and offers a holistic view of the company's fiscal operations. Each template covers multiple key aspects like current assets, liabilities, cash flow, and the cash conversion cycle. Result? Your viewers can get detailed clarity on their financial health. In this suite of templates, the leadership can track liquidity through current and quick ratios. They can even monitor operational efficiency with Days Sales Outstanding and Days Inventory Outstanding, which can help them determine the payment needs via Days Payable Outstanding. Finally, it can be used to visualize profit and loss trends for informed decision-making.

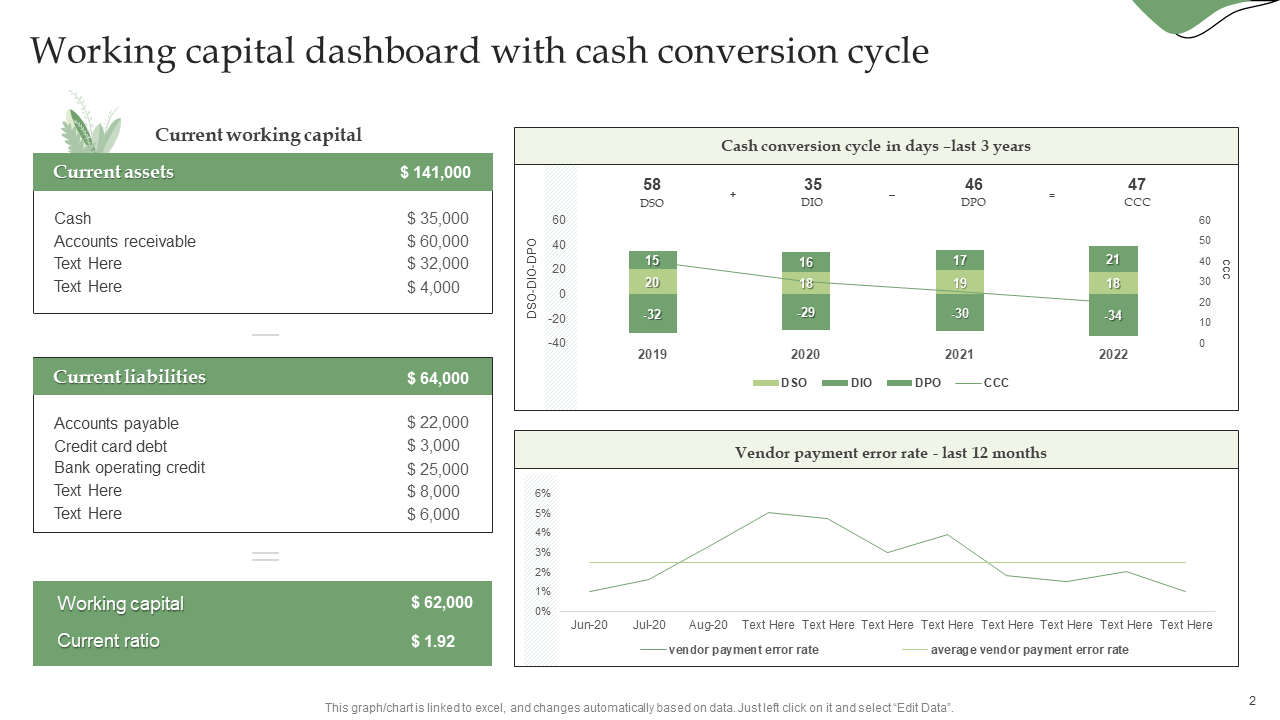

Template 2: Working Capital Dashboard with Cash Conversion Cycle

This template offers a snapshot of a company's financial standing. It addresses the biggest challenge any business faces: effective cash flow management! It displays current assets, liabilities, and current working capital. The template also displays some critical key performance indicators. This includes Days Sales Outstanding (DSO), Days Inventory Outstanding (DIO), Days Payable Outstanding (DPO), and finally, the Cash Conversion Cycle (CCC). Such detailed and crisp financial insight helps leadership monitor liquidity, manage operational efficiency, and identify trends in vendor payment accuracy over time. The design is clutter-free and embedded with graphs to make things even more easier. Download now and put it to the test!

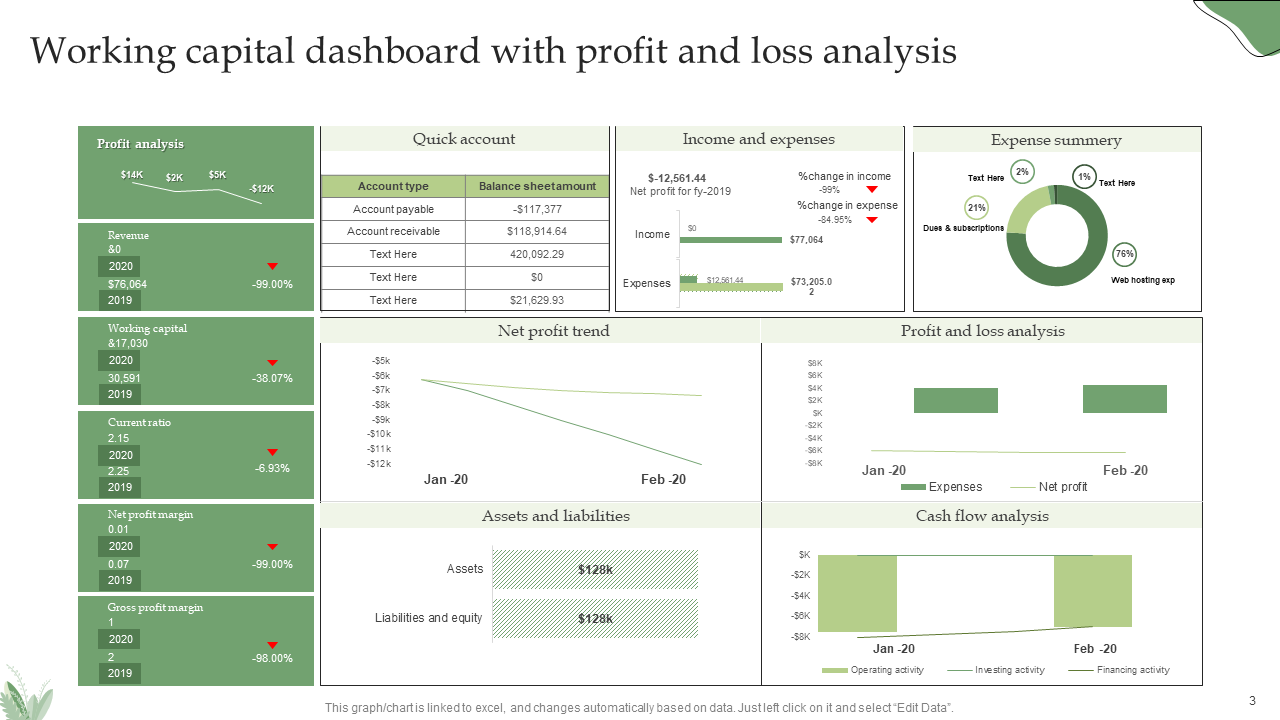

Template 3: Working Capital Dashboard with Profit and Loss Analysis

Looking for something that you can use to present and analyze your organization's financial performance? This template could do the trick. It offers a detailed look into an organization's profits, losses, current working capital trends, and liquidity ratio. It also highlights some critical financial metrics like profit margin and current ratio. These metrics are set alongside a quick account summary that includes account payables and receivables. The best part? The template integrates expense summary and cash flow analysis for an in-depth review of the operational efficiency of your organization. What more do you want to keep track of the financial performance?

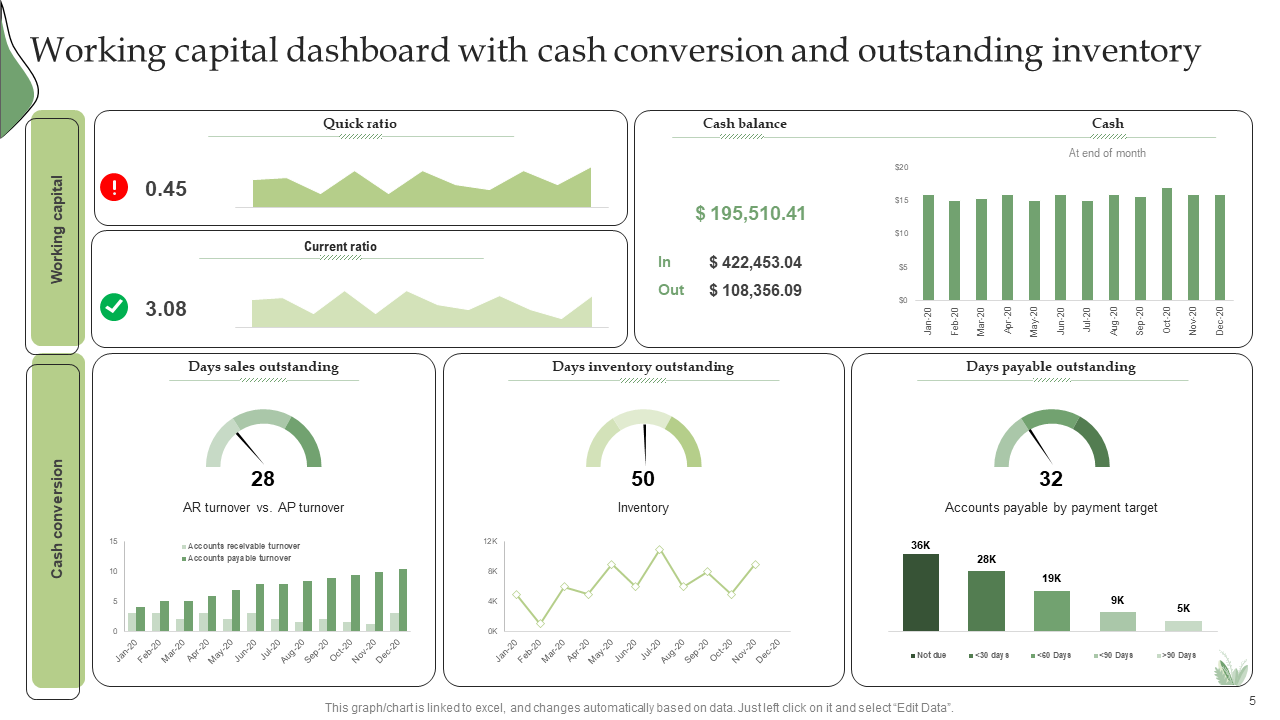

Template 4: Working Capital Dashboard with Cash Conversion and Outstanding Inventory

Struggling with inventory management and cash conversion at your organization? This template can fix that problem. It offers an integrated overview with the help of bar graphs, line graphs, and other visual elements. You can track critical metrics like liquidity and current ratio. You also get a real-time view of cash balances and movements. Remember, these things are vital for cash flow management. The best part? It monitors Days Sales Outstanding at 28 days. Days Inventory Outstanding stands at 50 days, which reflects inventory turnover, and Days Payable Outstanding at 32 suggests a reasonable payment strategy. You can use these insights to better plan your organization's inventory management and cash conversion.

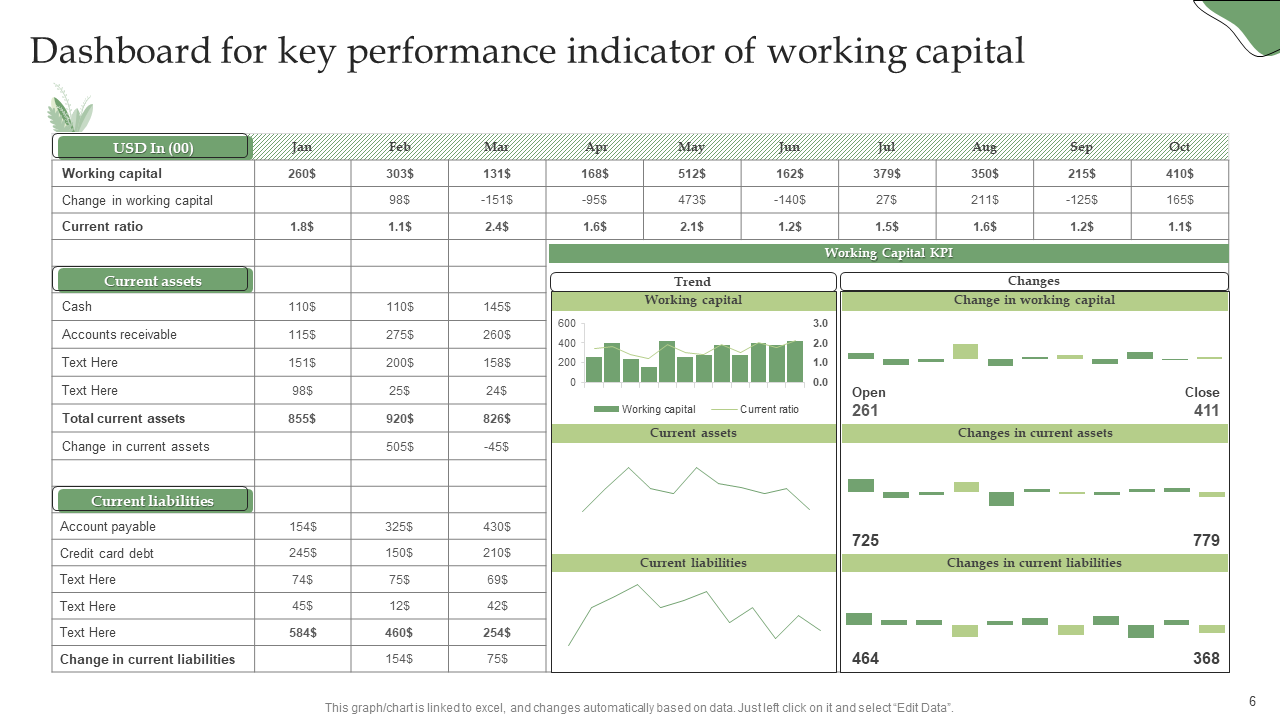

Template 5: Dashboard for Key Performance Indicator Working Capital

Keeping track of certain essential performance indicators is critical for better workflow management. The best way to do so is by using this template. It highlights monthly trends in working capital, current ratio fluctuations, and changes in current assets and liabilities. Apart from that, it also offers a detailed monthly breakdown and reveals how cash and accounts receivable contribute to the fluidity of current assets. This data is placed against the liabilities in terms of account payables. You can also track fluctuations in the current ratio and determine its short-term liquidity status.

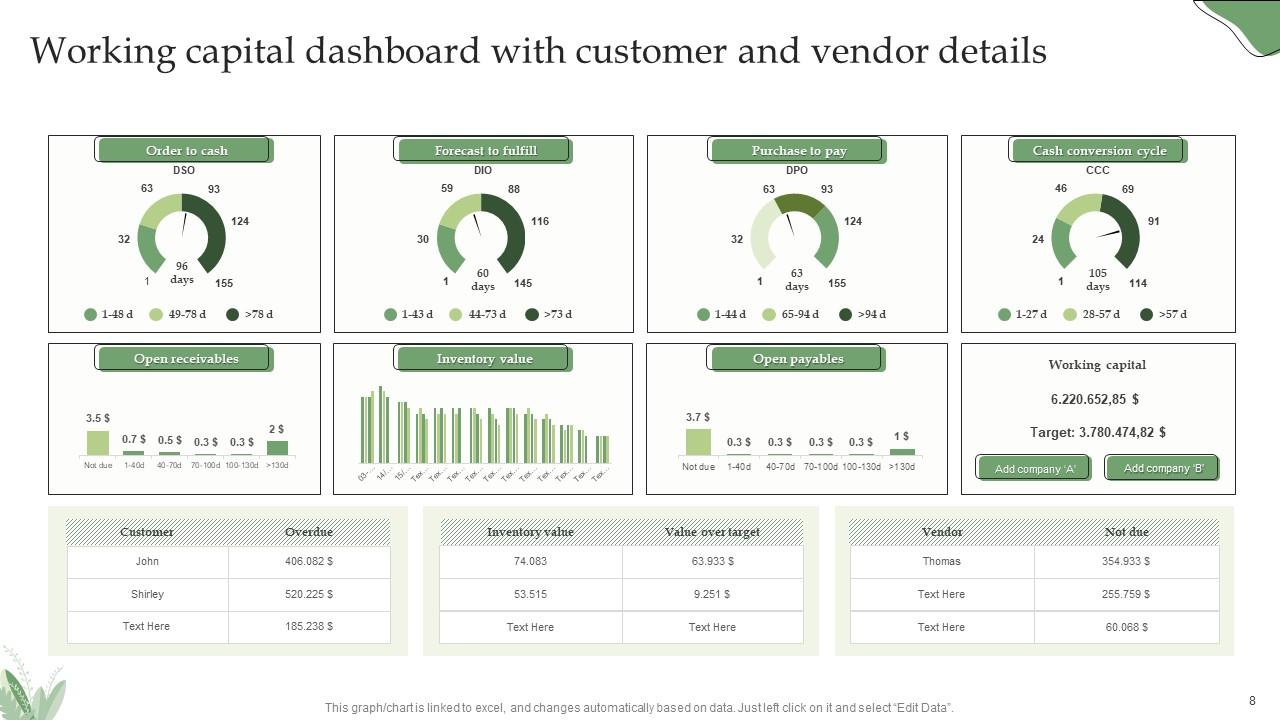

Template 6: Working Capital Dashboard with Customer and Vendor Details

This template presents essential performance indicators, highlighting monthly trends in working capital, current ratio fluctuations, and changes in current assets and liabilities. It gives a detailed monthly breakdown and explains how cash and accounts receivable are contributing to the current liquidity in the organization. This data is positioned against the liabilities and obligations of the organization. So the viewers can get a gist of the company's short-term liquidity status. Such detailed ensures organizations can identify financial patterns and risks. Result? Better financial stability and positive market outlook.

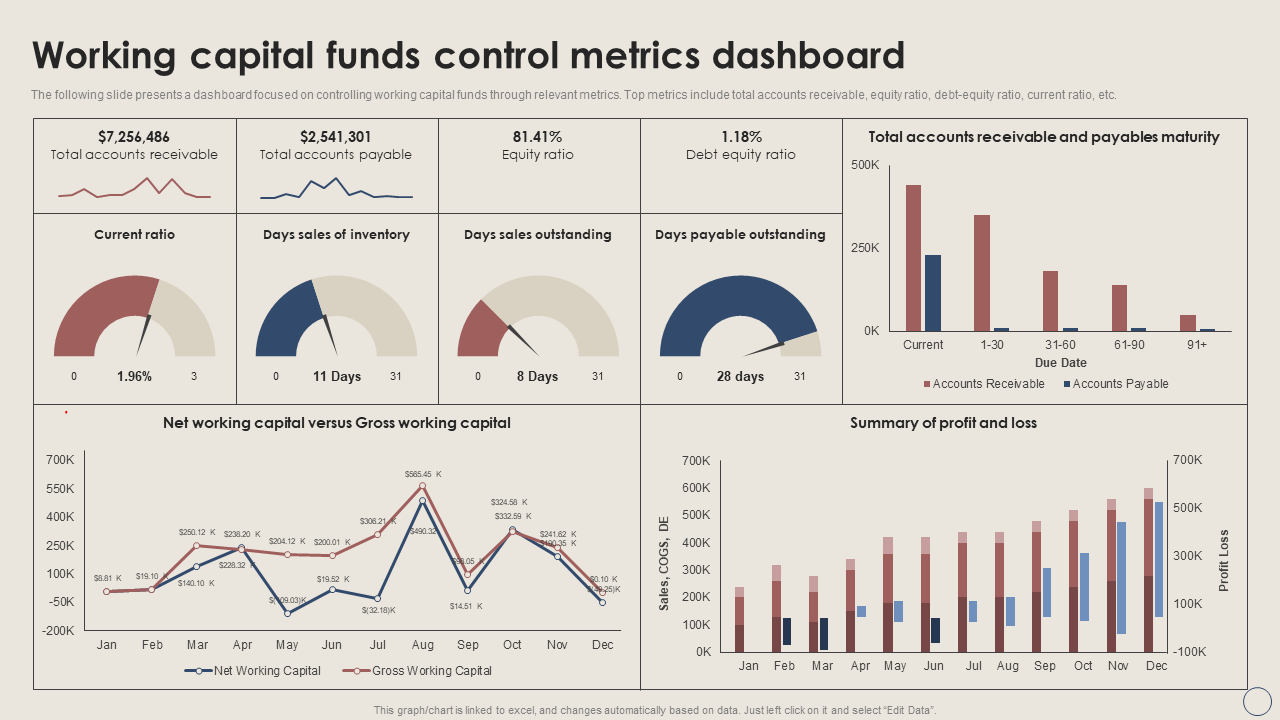

Template 7: Working Metrics Dashboard Working Capital Management Excellence Handbook for Managers Fin SS

This is an excellent template that uses gauges, line charts, and bar graphs to give a clear and visual view of any organization's financial health. You can track the current ratio. Days of inventory and sales and payables using gauges. Then, t uses line graphs to compare net and gross working capital. Such comparison gives a clear overview of cash flow trends and operational funding needs. Similarly, the maturity bar graph of receivables and payables helps in predicting cash requirements. Overall, this template covers all the critical metrics and uses engaging visuals to help financial analysts and team leaders with strategic planning.

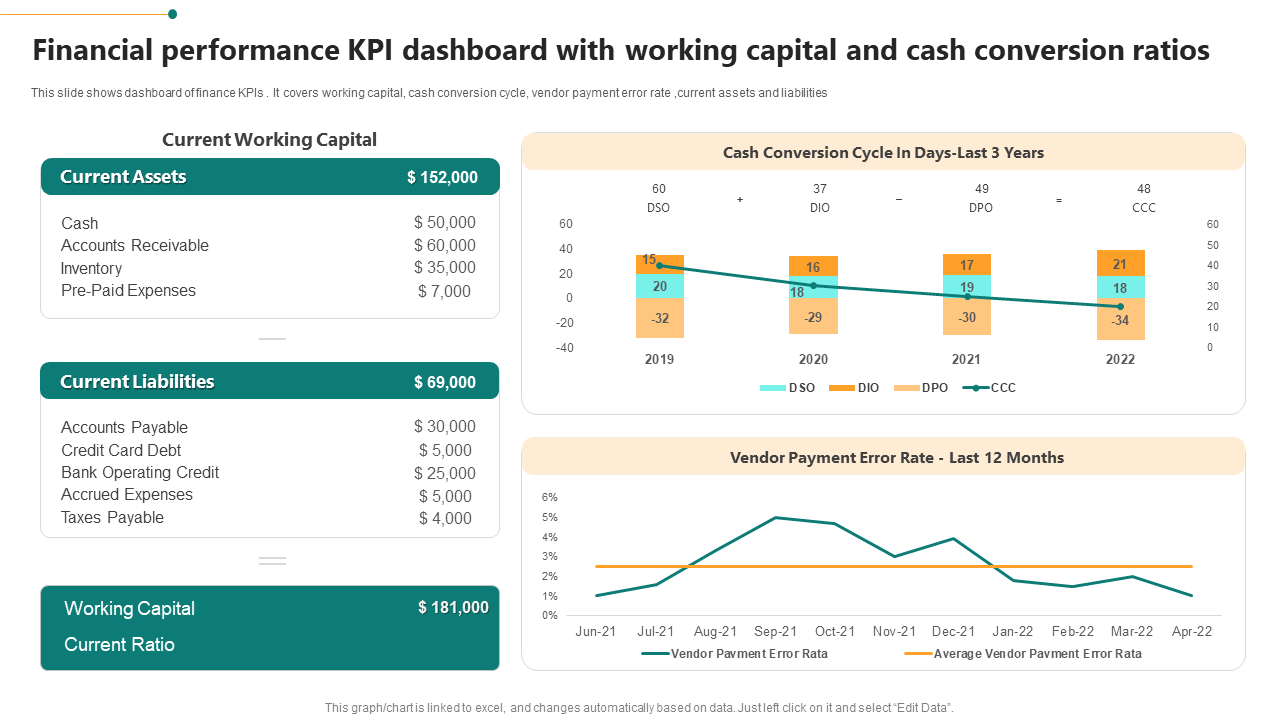

Template 8: Financial Performance KPI Dashboard with Working Capital And Cash Conversion Ratios

This template can help you streamline financial monitoring with a clutter-free and actionable format. The template highlights your organization's current assets and liabilities. It also covers important metrics like the Cash Conversion Cycle (CCC) and breaks down receivables, inventory, and payables into a timeline. This highlights the efficiency of cash flow in business operations. You can also monitor vendor payment error rates and get information on transactional accuracy. Result? You can develop a better payable system that can improve the overall efficiency of the organization. These elements are critical for any business that wants to maintain a solid financial footing and improve decision-making based on accurate, real-time data.

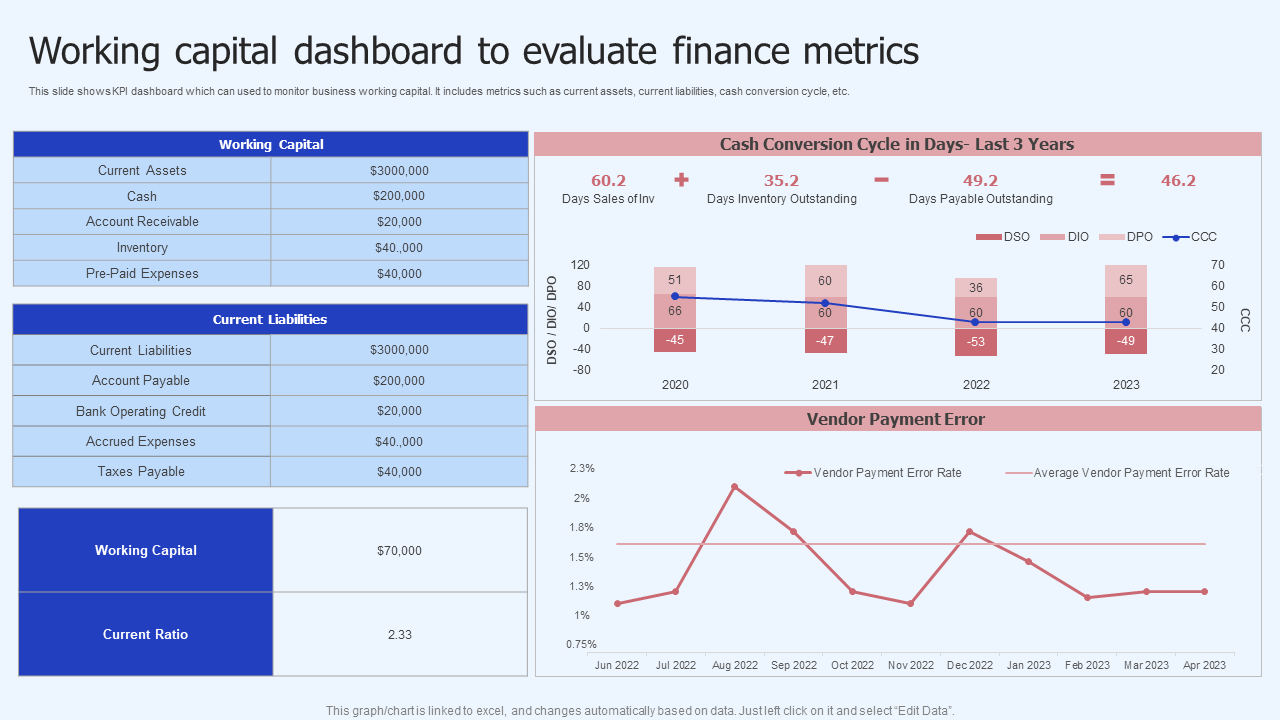

Template 9: Working Capital Dashboard to Evaluate Finance Metrics

Looking for a comprehensive working capital template to evaluate your organization's financial standings? Here's the answer! This template covers all the critical financial metrics and offers a detailed view of them. For example, it covers assets, liabilities, and cash conversion efficiency. It contrasts current assets against liabilities and gives a view of the current ratio, which is a key liquidity indicator. The cash conversion cycle graph displays the duration of receivables, inventory, and payables turnover. Benefit? The viewers can easily understand the speed of cash flow through the business. And finally, the template also has a vendor payment error trend line. This gives an insight into the payment system's accuracy. Remember, an efficient system is critical to maintaining supplier relationships and financial credibility.

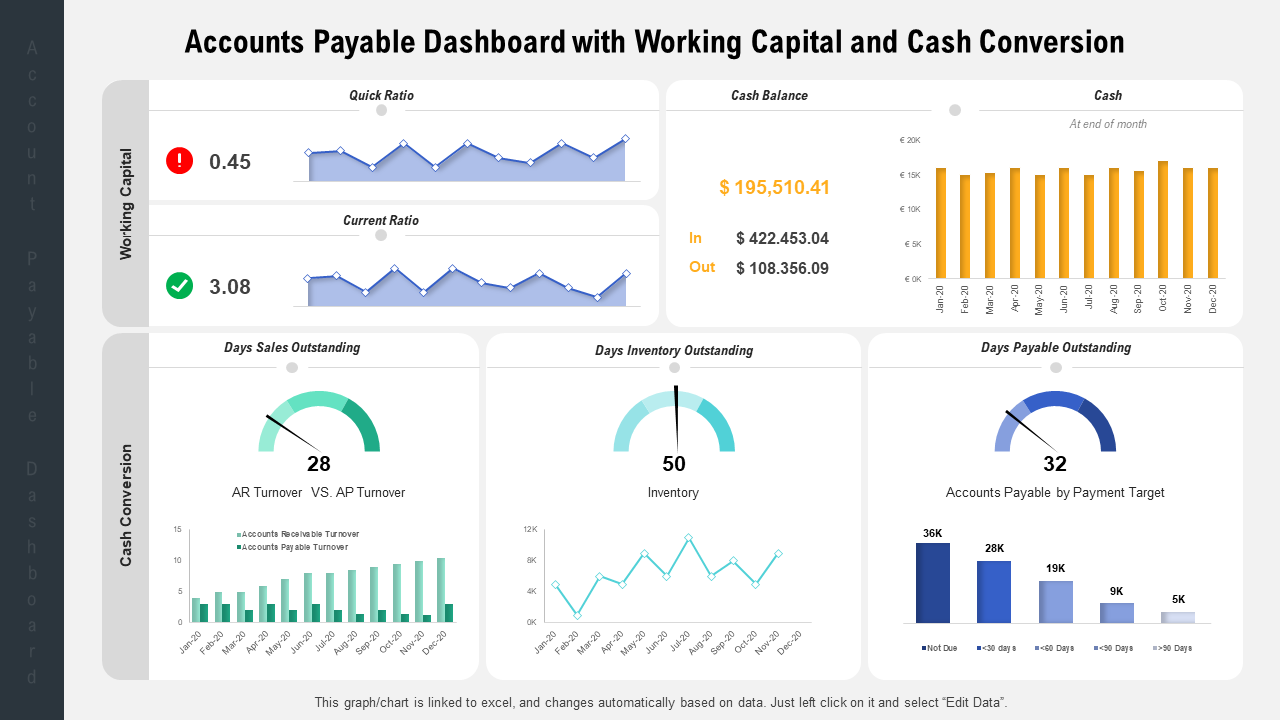

Template 10: Accounts Payable Dashboard with Working Capital and Cash Conversion

This template can help you track liquidity in your organization. It does so by offering a view of quick and current ratios, cash balances, and monthly cash inflows and outflows. All these numbers can be very helpful in understanding any organization's short-term financial stability. The template also assesses operational efficiency by considering Days Sales Outstanding (DSO), Days Inventory Outstanding (DIO), and Days Payable Outstanding (DPO). These metrics are very helpful in managing the cash conversion cycle. On top of that, the template also has an AR versus AP turnover graph and payables by payment target bars. These graphs offer a detailed look at how effectively a company manages its receivables and payables.

Manage Working Capital Like A Pro

If I say working capital is the soul of any business operation, it would be an understatement. Today, no organization can survive for long if they do not keep track of its finances and have inadequate working capital. These working capital templates could prove extremely helpful for financial analysis, team leaders and managers to track the working capital. With regular tracking and efficient working capital management, businesses can take on any challenges thrown at them.

Customer Reviews

Customer Reviews